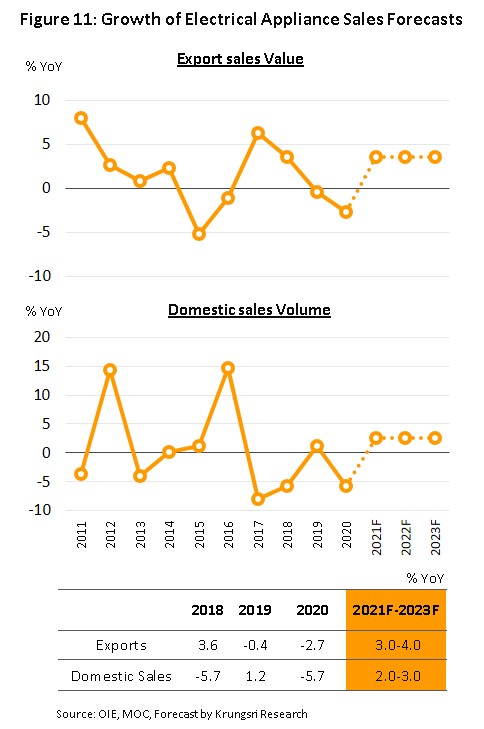

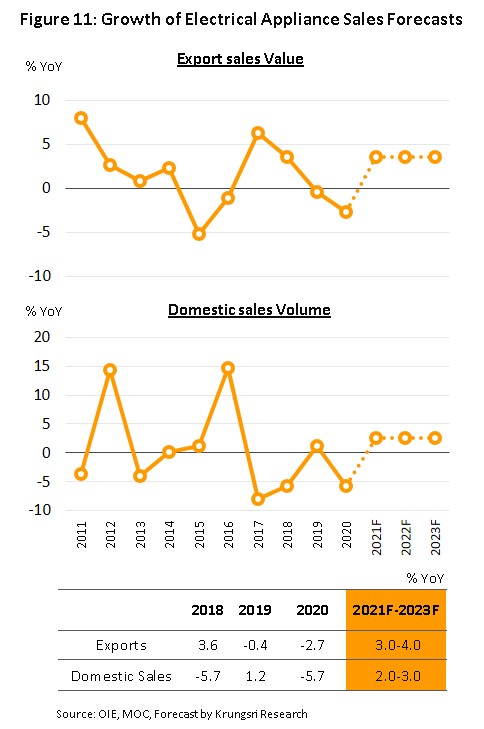

The Thai electrical appliances industry is predicted to see average annual growth of 2.0-3.0% over the three years from 2021 to 2023. This outlook is supported by: (i) recovery in the market for residential housing and in the economy more generally; (ii) steadily strengthening demand for air conditioners that will be driven by the impact of climate change on average temperatures; (iii) an increased focus by manufacturers on new appliances that are targeted at personal health (e.g., air purifiers that restrict the spread of bacteria and viruses and that filter out PM2.5 pollution); and (iv) a shift to a greater emphasis on online distribution by sellers as they look to broaden the range of communication channels that they use and increase the number of positive purchasing decisions.

Over the same period, exports of electrical appliances from Thailand are expected to strengthen at the slightly faster rate of 3.0-4.0% thanks to: (i) expansion in the world economy; (ii) ongoing trade conflicts between the US and China that will open the way for Thai manufacturers to increase sales of some goods (e.g., of air conditioners and refrigerators) into US markets; (iii) the impetus given to exports of washing machines to the US by the ending in 2021 of anti-dumping measures; and (iv) greater demand for electrical appliances in the ASEAN zone that will be driven by increasing urbanization and the expansion in the size of the middle class across the region.

Overview

The Thai electrical appliances sector has a history going back more than sixty years, though throughout this time, the government has actively supported the sector by attracting foreign capital inflows through the implementation of a range of investment promotion strategies (administered via the Board of Investment, or BOI). The result of this has been the steady investment in and development of domestic capacity to manufacture electrical goods and parts.

During the sector’s early history (1960-1971), the government promoted the electrical appliance industry as an import-substitution strategy and at this first stage, components were imported for use in the domestic assembly of relatively straightforward products, such as radios, televisions, and fans.

However, from 1972 onwards, official policy has switched to supporting the sector as an exporter, a move aided by the 1987 Plaza Accord[1]. The latter led to a rise in the value of the yen and, in the wake of this, many Japanese manufacturers relocated their production facilities overseas, including to Thailand, which partly because it was viewed as being a market with high-potential for growth then became an important production center for transnational players. Thailand also benefited from its geographical location at the center of the ASEAN zone and the increase in the economic potential of this that followed from the establishment of the ASEAN Free Trade Area (AFTA) in 2004, and, at least originally, from its low manufacturing costs. Given these advantages, the country has been able to attract international manufacturers and over time, these have steadily increased investment in production facilities in the country. Manufacturers attracted to Thailand have included those producing electrical appliances, electrical components (e.g., compressors, motors, diodes, television displays, speakers, etc.) and electronics parts (e.g., printed circuit boards, integrated circuits, capacitors, etc.) These developments have thus all fed into the on-going development of Thai electrical appliance supply chains.

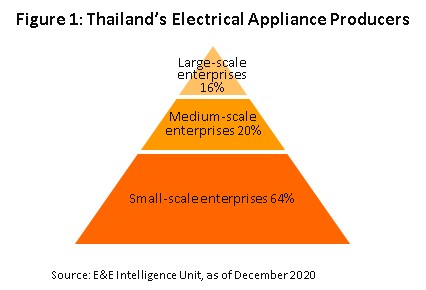

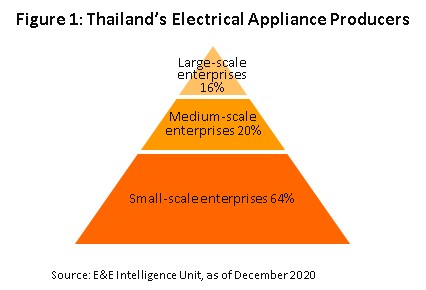

As of 2020, there were 468 manufacturers operating in the Thai electrical appliances sector. These players may be split into two groups. (i) 16% are classed as large manufacturers, which have access to both advanced technology and significant sources of capital. These can then be divided into the two subgroups of (a) international manufacturers that sell world-leading brands (e.g., Mitsubishi, Sony, LG, Samsung, and Toshiba) and (b) Thai manufacturers, a group that includes both those producing to supply other brands (and which are therefore ‘original equipment manufacturers’, or OEMs) and those that sell under their own brands (e.g., Tasaki, Saijo-Denki, Uni-aire, and Central Air, all Thai brands in the air-conditioning market, and the fan manufacturers Hatari, Accord, and MasterKool). (ii) 84% are SMEs, most of which manufacture parts and components for major producers. These companies are generally limited in their ability to develop their own technology and have only a weak negotiating position within the market (Figure 1).

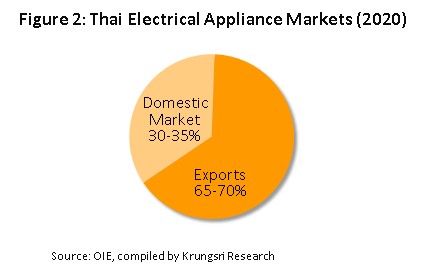

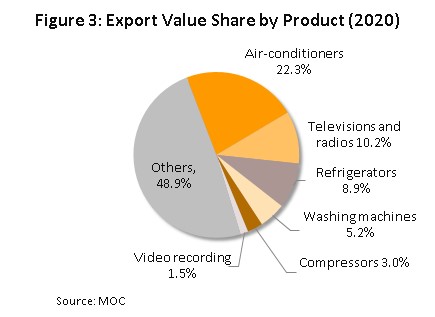

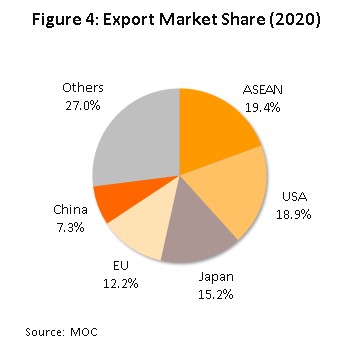

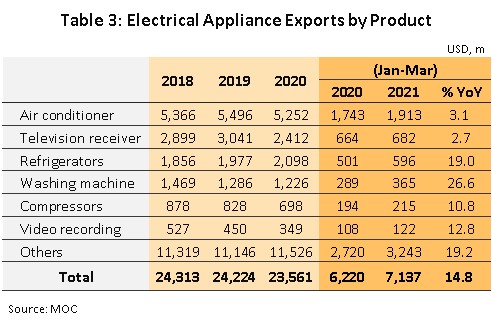

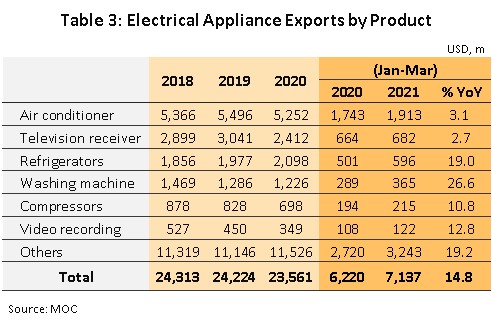

Data from The Office of Industrial Economics indicate that in 2020, some 65-70% of all output from the Thai electrical appliances sector was bound for export markets and distribution abroad (Figure 2). In terms of product groups, the most important category of goods is air conditioners (22.3% by value of all electrical goods exported), followed by televisions and radios (10.2%), refrigerators (8.9%), washing machines (5.2%), compressors (3.0%), video equipment (1.5%), and ‘other’ goods (48.9%) (Figure 3). The ASEAN zone is the most important market, accounting for 19.4% of total Thai electrical goods exports in the year. This is followed by the United States (18.9%), Japan (15.2%), the European Union (12.2%) and China (7.3%) (Figure 4).

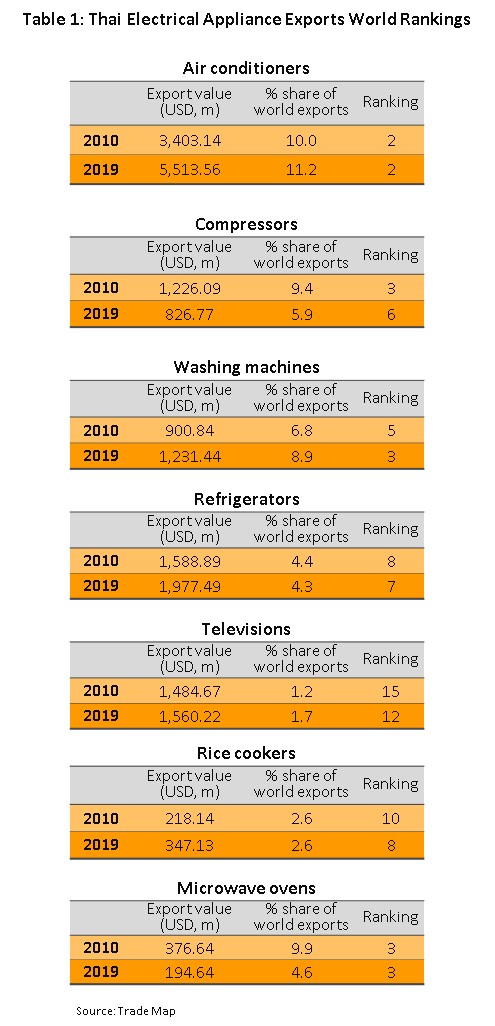

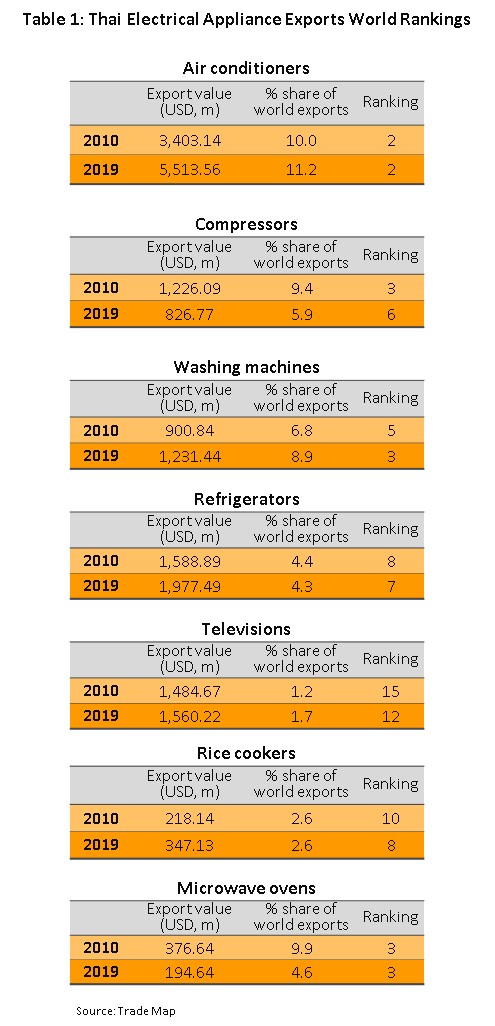

However, although the industry has expanded enormously over the past few decades, the development of supply chains within each segment has moved forward at varying speeds, and because of this, the potential of Thai exports to compete on world markets varies substantially from one segment to the next (Table 1). These differences are described below.

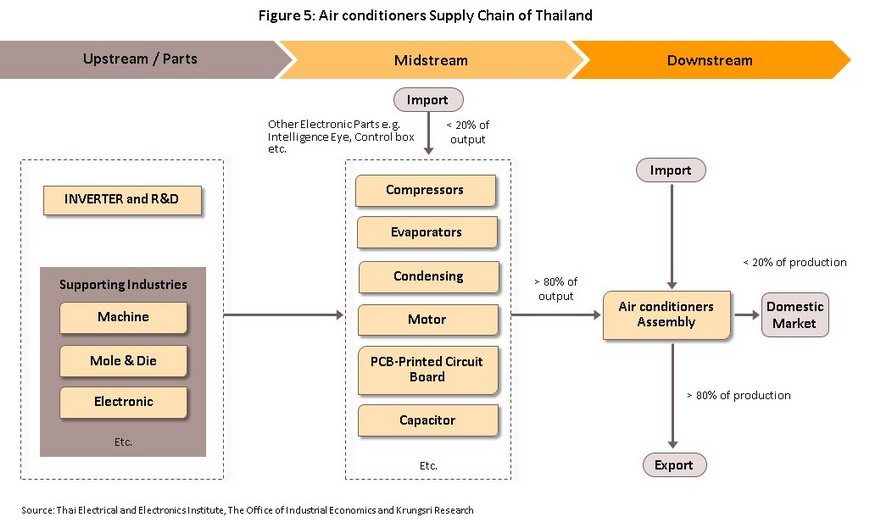

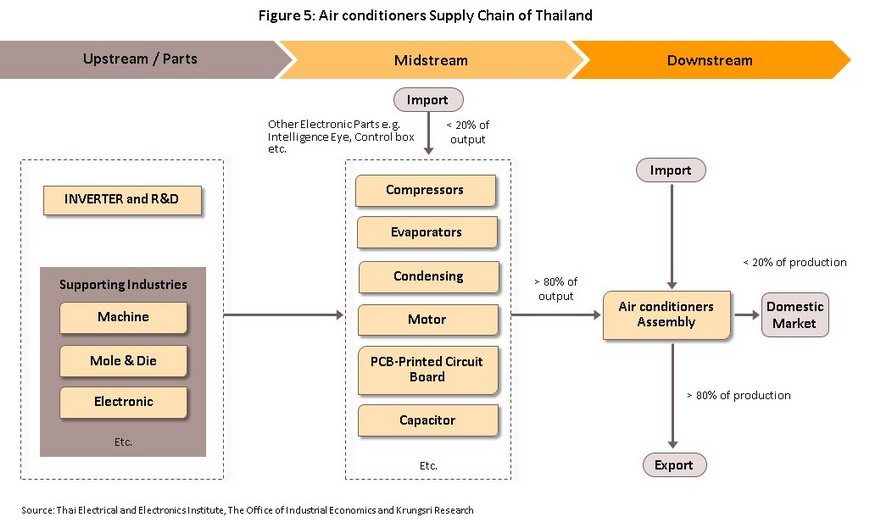

- The cooling devices segment, a category that includes air-conditioners and compressors, is relatively mature through the whole supply chain and compressors, evaporators, condensers and motors can all be sourced domestically. As such, by value, over 80% of the parts used in the production of finished cooling devices are now supplied by Thai manufacturers (Figure 5) and Thailand is host to a large number of world-leading air conditioner manufacturers, as well as supporting its own native air-conditioning manufacturing sector. The former group is dominated by Japanese players, including Mitsubishi Electric, Mitsubishi Heavy Duty, Sharp, Hitachi, Toshiba, Daikin, and Fujitsu, though it also includes players from South Korea (Samsung and LG), China (Haier and Midea) and the US (Carrier and Trane). Thai brands active in the segment include Saijo-denki, Tasaki, Central Air, Star Aire, Eminent, Amina and UNI-Aire. The production of cooling appliances in Thailand has developed steadily and Thailand is now one of the world’s leading exporters of these goods; in 2019, with a market share of 11.2%, the country was in fact the world’s second most important exporter of air-conditioning units (after only China, which has a 32.9% share) and with a 5.9% market share, the sixth most important exporter of compressors[2].

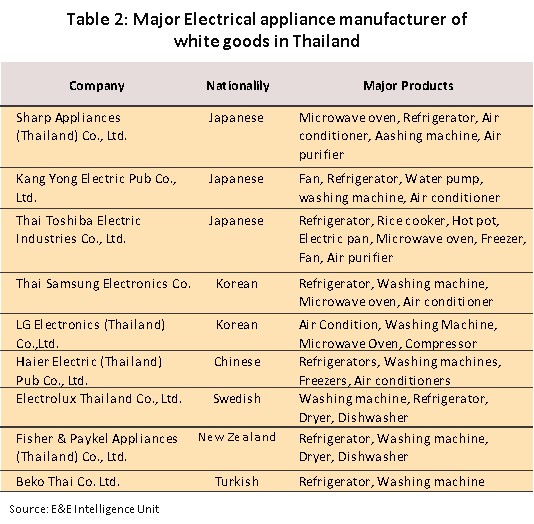

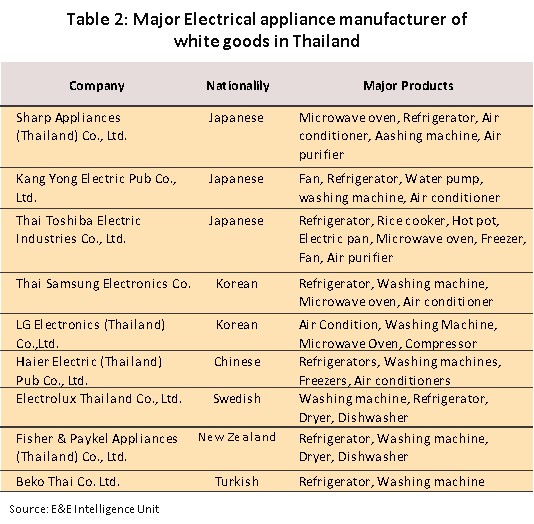

- Thai production of white goods is also strong in its parts production and supporting industries. Thai white goods supply chains have benefited from technology transfer from international companies investing in Thailand and from the experience Thai players have gained when subcontracting for these, and Thai manufacturing capabilities have risen accordingly, allowing the country to become a major exporter of white goods. Thus, in 2019, Thailand had an 8.9% share of the global market for washing machines, putting it in third place globally, a 4.3% share of the market for refrigerators (7th in the world), a 2.6% share of the market for rice cookers (8th in the world), and a 4.6% share of that for microwaves (3rd in the world). However, despite these advantages, Thailand is hindered by a lack of expertise in embedded systems, a shortage of designers and developers, and limitations on the use of testing laboratories. In addition, uptake of international standards may lag and these are not yet enforced across the production of all goods categories, especially for innovative new products manufactured by world-leading brands including Sharp, Mitsubishi, Toshiba, Samsung, LG, Haier, Electrolux, Fisher & Paykel and Beko (Table 2).

- Thai participation in the audio visual (AV) segment has weakened and Thai output of AV goods has been dropping, especially for televisions, for which production has fallen from 5.2 million in 2000 to just 0.63 million in 2017 (the most recent date for which information is available). Several factors lie behind this decline. (i) In 2012, competition from low-cost televisions from China (e.g., from Haier, TCL, and Hisense) began to increase. (ii) In 2015, the major manufacturers LG, Samsung and Toshiba moved production facilities from Thailand to other countries in the ASEAN zone, including Vietnam and Malaysia, as their head offices attempted to exploit economies of scale. (iii) Rapid developments in the technology behind television screens[3] meant that overseas companies that were still producing TVs in Thailand increasingly switched to importing screens (the major component in TV production) from the brand’s parent company. Unfortunately, the majority of Thai producers were unable to respond rapidly to these changing market conditions and to master the new technology, and only a few major Thai players have been able to develop and manufacture their own high-definition LED TVs throughout the whole of the production process[4]. (iv) Competition on production costs has intensified and this has forced some Japanese players to reduce their production runs, and with this, they have cut back on Thai-based output. Some Japanese companies have instead switched to generating income from the licensing of brand names to lower-cost manufacturers from other countries, which has then allowed Japanese brands to be distributed at lower price points. For example, in 2018, Toshiba agreed to a forty-year lease of its technology and the rights to distribute televisions under the Toshiba brand name to Hisense, a Chinese manufacturer that has also bought licensing rights for the Hitachi, Lucent, Matsushita, NEC, Sanyo and Qualcomm brands. Given these changes in the market, in 2019, Thailand slipped to twelfth place in the world rankings of television exports, mustering only a 1.7% market share.

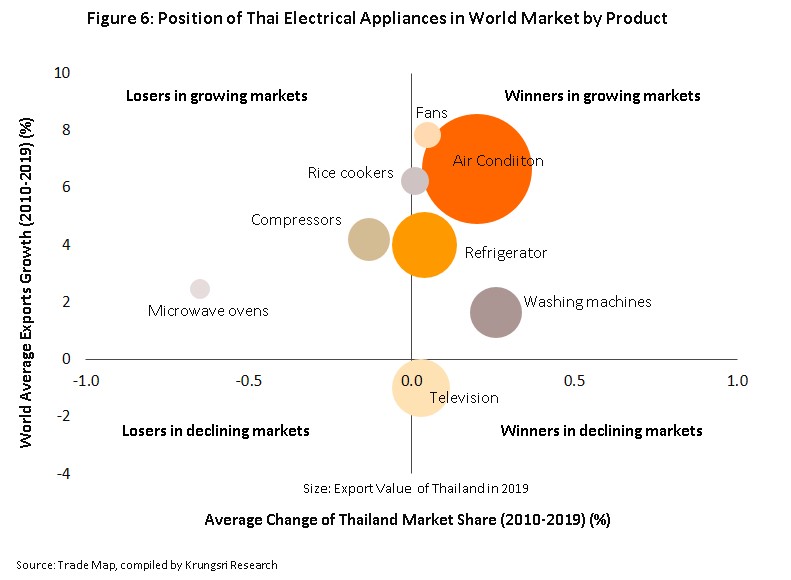

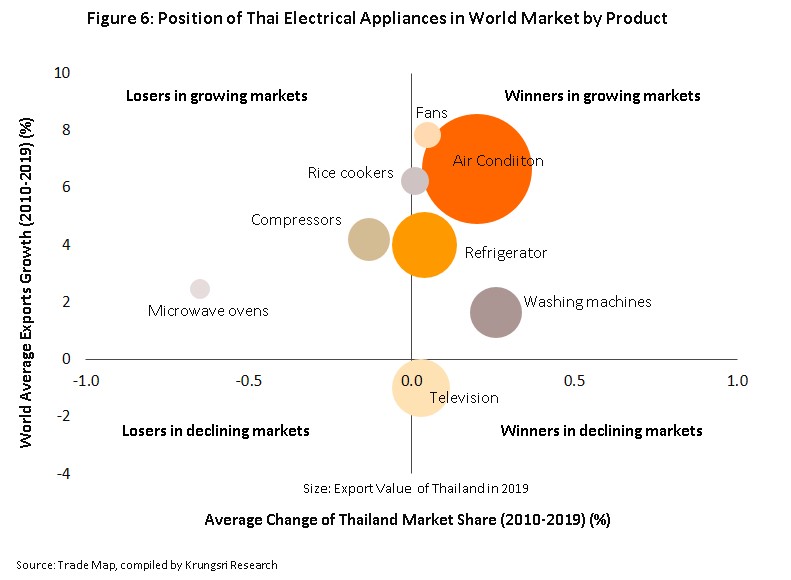

This situation is consistent with research into the competitiveness in world markets of the Thai electrical goods sector between 2010 and 2019. This research considered changes in Thai goods’ market share and the direction of growth in global markets, with the results divided into three categories. (i) Product categories in which Thailand is highly competitive and for which the market is growing (i.e., winners in growing markets) include air-conditioning units, refrigerators, washing machines, rice cookers and fans. (ii) Losers in growing markets (i.e., categories in which Thailand has a declining share of a growing market) include microwaves and compressors. (iii) For Thailand, losers in declining markets include televisions (Figure 6).

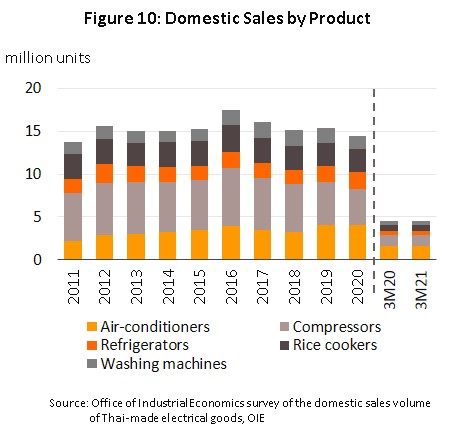

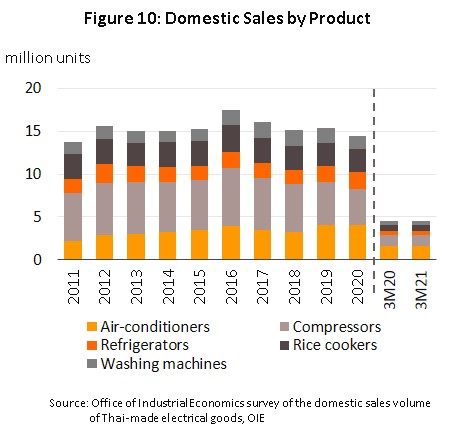

As for the domestic market for electrical goods, this takes 30-35% of the output of the industry by volume. Electrical goods that are widely owned (defined as being owned by more than 30% of Thai households) include refrigerators, air-conditioners, washing machines, fans, televisions, irons and electric cookers. A Euromonitor survey of the domestic market for electrical goods in Thailand (conducted in January 2021) revealed that in terms of the 2020 domestic market, the most valuable product category was refrigerators and freezers (25% by value of all goods), followed by washing machines (24%), air-conditioners (17%), small household electrical appliances such as irons, vacuum cleaners, kitchen appliances and fans (22%), and others (12%). Most items (60-70% by value) are distributed through shops retailing electrical goods, of which there are over 3,000 spread across the country, a further 25-35% of goods are sold from modern trade outlets, including discount stores, department stores, and home improvement centers, while the remaining 5% are sold directly or through the internet.

Situation

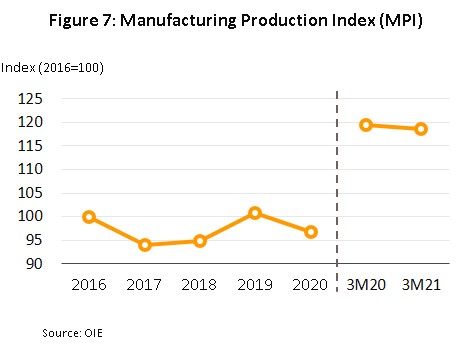

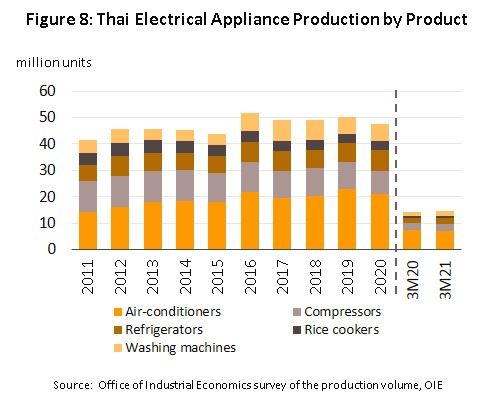

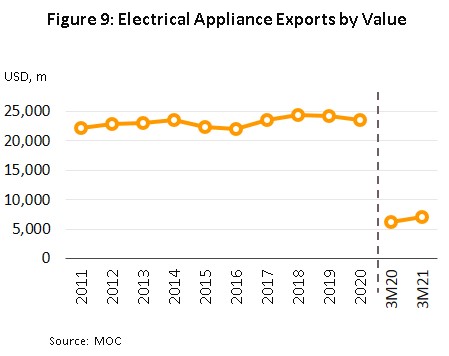

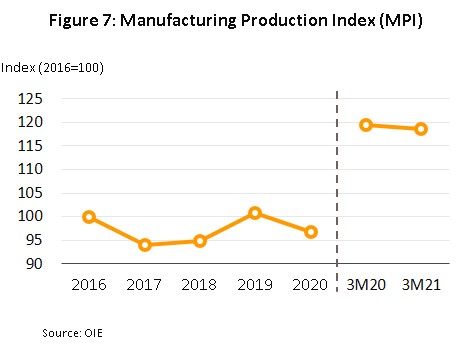

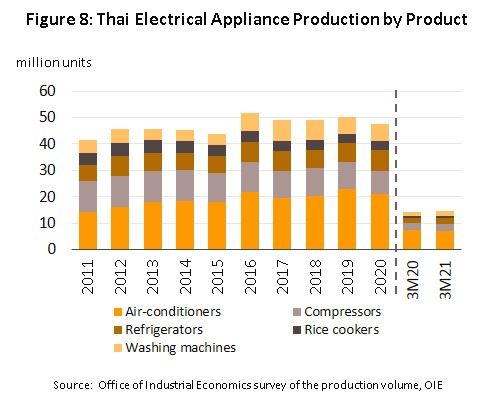

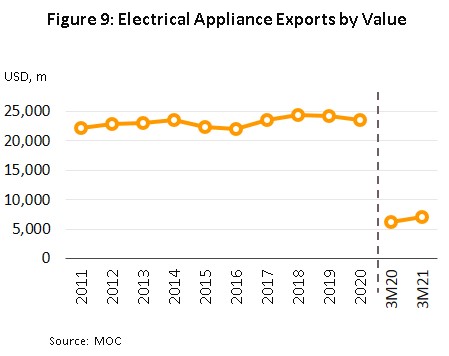

Between 2016 and 2020, the quantity of electrical goods produced in Thailand grew at the somewhat slow rate of 1.9% per year. By volume, the domestic market actually contracted slightly in this period, shrinking at the rate of 0.7% annually, though this was offset by a 1.1% annual expansion in exports. Details of these changes are given below.

- Domestic distribution of electrical appliances: In 2016, sales of the major electrical goods[5] jumped 14.7% to an all-time high of 17.5 million items, setting a new record. The year saw the most intense El Niño in 20 years, and the resulting extreme heat boosted the market for air-conditioning devices and compressors. Demand for other household electrical goods was also helped by a healthy property market, but over 2017-2019, demand weakened as the real estate market softened, while the earlier surge in purchases meant that sales naturally fell in the following years as goods worked through replacement cycles[6] that typically last for 8-12 years. As such, the volume of goods distributed domestically shrank 7.9% in 2017 and by another 5.7% in 2018, before returning to growth of 1.2% in 2019. However, despite this weakness, continuing hot weather and the longer than normal summer in 2019 (February to May 2019) meant that the number of air-conditioning units and refrigerators that were sold rose by 25.7% and 14.8%, respectively.

In 2020, the domestic market shrank again, falling in value by 5.7% under the impact of the COVID-19 pandemic and the consequences of this on consumer spending power and the broader economy. Nevertheless, despite overall falls, sales of refrigerators and air conditioners rose by respectively 5.3% and 0.2% as consumers and students switched to working and studying at home.

- Exports of electrical appliances: Over the period 2016-2019, the value of exports of electrical appliances rose by an average of 2.1% per year, though this obscures the sharp changes in fortune that some segments saw over these years. In 2016 and 2017, exports of Thai washing machines jumped by an average of 22.9%, but exports to the US surged by an annual average of 356.8% thanks to the decision by the Korean manufacturers Samsung and LG to move production facilities to Thailand (in 2017, washing machines accounted for some 7% of the value of all exports of electrical appliances). However, following this, US authorities instituted anti-dumping measures[7] that ran from February 7, 2018 to February 6, 2021 and these cut exports from Thailand to the US by 51.1% in 2018 and 19.8% in 2019. As a result, the contribution of the US market to export sales of washing machines slipped from 33.3% in 2017 to 18% in 2018 and 16% in 2019. More positively, though, investment by Toshiba, LG, and Saijo-Denki in the production of air conditioners continued, and rising temperatures helped to support a 4.7% increase in exports over the period 2016-2019.

In 2020, the total value of exports of the main electrical appliances dropped 2.7%, moving in line with a weaker global economy. Exports of compressors were particularly hard hit in the year, falling 15.6% following the expansion in domestic production capacity in India[8], Thailand’s fourth biggest export market for compressors (exports to India of compressors fell from 9.1% of the total value of exports of these in 2019 to just 5.2% in 2020). In addition, the value of exports of washing machines also declined by 4.7% on the move by the US (Thailand’s most important market for washing machine exports) to protect against alleged stock dumping by Thai-based manufacturers. However, despite these setbacks, sales in overseas markets of some goods rose as COVID-19 forced people around the world to spend more time at home. Product categories benefiting from this included refrigerators (exports rose 6.1% by value), microwaves (+27.1%), cookers (+23.3%) and fans (+5.8%), and combined, these product categories accounted for 13.2% of the value of all exports of electrical appliances.

In the first quarter of 2021, output of electrical appliances increased 2.1% YoY on a return to growth in the world economy and stronger performance in export markets. Details of this are given below.

- In 1Q21, the number of electrical appliances distributed to the domestic market edged up 0.02% YoY to 4.5 million items. Sales of washing machines have performed well, jumping 15.7% YoY on the increasing popularity of launderettes and of new smart-phone operated models that include health functions that help protect against the spread of disease. The impact of the recent waves of COVID-19 on consumer activity and the greater need to avoid unnecessary outdoor activities and instead spend more time at home also helped to boost sales of refrigerators by 4.2% YoY. However, a colder, longer winter in 1Q21 compared to 1Q20 cut sales of air conditioners and compressors by 2.0% and 2.9% YoY, respectively.

- Exports did better in 1Q21, surging 14.8% YoY to a value of USD 7.14 billion. Growth was seen in all the main product groups, though at 26.6% YoY, this was especially strong for washing machines. Growth was led by the US market (the source of 21.7% of all receipts from the export of washing machines), where this hit 202.6% with the ending of the anti-dumping measures described above. In terms of product groups, next in importance after washing machines were refrigerators (+19.0% YoY), compressors (+10.8% YoY) and air conditioners (+3.1% YoY), while by area, the US and the EU were the strongest performers, these accounting for 22.8%, 20.2% and 39.7% of the value of all exports of refrigerators, compressors and air conditioners. Growth rates for sales into the US and the EU for the same three product groups were also impressive in 1Q21, reaching 113.5% YoY, 17.3% YoY and 39.0% YoY for these respectively. These strong performances were the result of economic recovery that is being supported by the rapid rollout of COVID-19 vaccines. Repeat waves of the COVID-19 pandemic have also helped underpin greater demand for home entertainment, and so sales of AV equipment rose 4.5% YoY in the quarter.

Outlook

Over the three years from 2021 to 2023, output by Thai electrical appliance manufacturers is forecast to rise by an average of 2.0-4.0% per year. Domestically, stronger property markets and a recovery in the economy will help to boost demand, while internationally, a rebound in the global economy and within the ASEAN zone, higher rates of urbanization and an expansion in the size of the regional middle class will help to lift exports. In addition, a continuation of the US-China trade conflict should pave the way for some Thai manufacturers (especially of air conditioners and refrigerators) to increase sales by taking the place of Chinese suppliers that are being locked out of US markets.

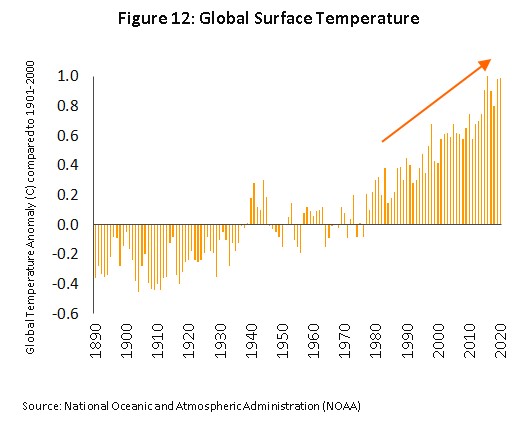

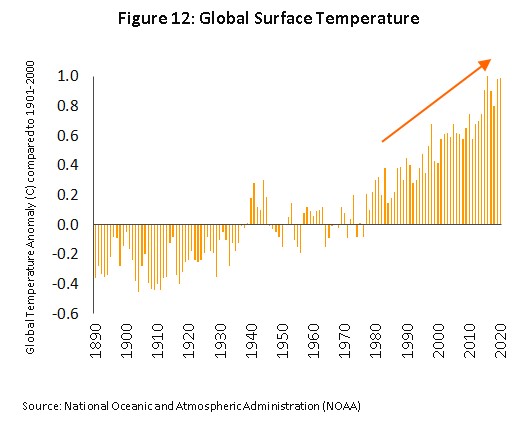

- Domestic demand for electrical appliances is expected to rise by 2.0-3.0% annually over the next three years, with tailwinds blowing from several different sources. (i) The market for residential accommodation should come back to life in 2022-2023 on an anticipated rebound in the economy. (ii) Manufacturers will market new air conditioners, air purifiers, and washing machines that will provide greater health-related benefits to consumers (e.g., by protecting against problems with PM2.5 pollution and the spread of illness by filtering air and removing bacteria and viruses). In addition, the market will also be buoyed by the release of a new generation of internet-enabled appliances that can be controlled remotely. (iii) Over 2022-2023, climate change will likely force average temperatures ever higher (Figure 12), helping sales of air conditioners. (iv) Manufacturers and distributors will increasingly exploit online sales channels that provide consumers with ready access to product information and make it easier for them to make positive purchasing decisions.

- From 2021 to 2023, exports of electrical appliances are predicted to rise by an annual average of 3.0-4.0% per year. (i) Any continuation of the long-running US-China trade conflict[9] will open the possibility of Thai players stepping in to replace lost exports from China. This will be especially true for manufacturers of air conditioners and refrigerators (in 2020, exports to the US of these two comprised respectively 11.5% and 15.4% of the value of total exports, up from 5.5% and 4.1% in 2017). (ii) The ending of US anti-dumping measures targeted at imports of Thai washing machines in 2021 will provide the conditions for a rebound in exports of these. (iii) Demand for electrical appliances in Asia (responsible for 19.4% of the value of exports of Thai electrical appliances) has high growth-potential, especially given current low ownership rates, in particular for air conditioners; in many Asian countries, including India, Indonesia, the Philippines, Myanmar, Cambodia and Lao PDR, ownership rates are under 20% (source: The Japan Refrigeration and Air Conditioning Industry Association (JRAIA)). Furthermore, exports will be boosted by ongoing urbanization and rising membership of the middle class[10] across the ASEAN zone.

- Over the long term, Thai electrical appliance manufacturers have the opportunity to enjoy ongoing growth, given rising demand for high-tech goods that can be connected to the internet through steadily expanding 5G networks. The industry should also be helped by progress on the development of the Eastern Economic Corridor (EEC), which will be the site of pilot projects to encourage investment in future high-tech industries under the aegis of the government’s ‘Thailand 4.0’ industrial policy. It is expected that this will then help to attract an increase in inflows of investment funds to Thai electrical appliance manufacturers for the development of new products, especially in areas where Thailand has the advantage of already being highly competitive, for example in the manufacture of cooling devices and household appliances.

Problems with a shortage of integrated circuits and semiconductor chips began to emerge worldwide at the end of 2020 as a result of supply being insufficient to meet the sudden increase in demand that the COVID-19 pandemic precipitated. When the pandemic first struck, governments were quick to enforce social distancing measures and this meant that large sections of the public in many countries were restricted to living much of their lives at home, carrying on education and work through the internet.

This then had knock-on effects in many manufacturing industries, pushing up demand from consumers for products from auto assemblers and producers of smartphones, personal computers, notebooks, tablets, game consoles and new high-tech internet-enabled electrical appliances, though as a consequence of this, demand then outran supply. For example, a report by New Delhi Television (NDTV) reveals that Whirlpool, a Chinese manufacturer of electrical appliances, has been badly affected by a shortage of microcontrollers (MCUs) and power management integrated circuits (PMICs)[11] and that in March 2021, the company received less than 10% of the MCUs and PMICs that it had ordered, impacting production of microwaves, refrigerators and washing machines, cutting exports to Europe and the US by some 25%, and forcing the company to postpone the release of a new smoke extractor by at least 4 months.

Companies have also experienced problems with shortages of display driver chips[12]

, which has led to a supply shortfall of LCDs and hindered production of goods that use these, including televisions and some high-end consumer goods that have LCD displays, such as some more expensive refrigerators. Naturally, these shortages have also pushed up prices for ICs and LCD screens and adversely affected production costs. Nevertheless, Krungsri Research expects that IC shortages will begin to resolve themselves in the latter half of 2021, given the efforts by IC manufacturers to ramp up production and the moves at the start of 2021 by the governments of many countries with advanced technology sectors (including China, Taiwan, the US and Japan) to accelerate investment in their indigenous chip industries and to expand domestic production of semiconductors and ICs[13].

Krungsri Research’s view

Through the years 2021 to 2023, manufacturers of electrical appliances will enjoy rising income. The value of exports will increase in step with the recovery in the global economy, helped additionally by the creation of trade barriers between China and America that will then widen opportunities for Thai players to sell into the US market. Domestically, strengthening consumer spending power will support higher sales volumes, while distributors will stimulate the market through the release of new models and a greater reliance on online marketing channels.

- Manufacturers of cooling appliances: Business conditions should continue to improve for this group and income will tend to rise with a recovery in the overall level of economic activity and a strengthening in demand for electrical appliances. The cooling devices segment will also benefit from the likely continuation of US-China trade tensions, and thanks to this segment’s high levels of competitiveness, the fact that it is one of the most important suppliers to world markets, and its ability to manufacture the large refrigerators that are favored on the US market, Thai producers of air conditioners and refrigerators will be able to replace lost Chinese imports in the American market (already a major source of receipts for Thai producers). In addition, temperatures are continuing to trend upwards under the influence of climate change and this too will support heavier demand for cooling devices.

- Manufacturers of other household electrical appliances: Within this group, income will tend to strengthen. Exports of washing machines to the US (Thai manufacturers’ most important export market) will tend to recover following the expiry of anti-dumping measures in 2021, but unfortunately, exports of other types of electrical goods will have to contend with increasing competition, particularly from Chinese goods that are both cheaper and of increasingly higher quality. Meanwhile, demand from the domestic market will tend to increase, especially for sales of washing machines and air purifiers, the latter a result of nationwide problems with air pollution that are becoming more common and more extended and which are increasingly having health consequences for consumers’ respiratory systems. In addition, sales of smaller household appliances, such as rice cookers, vacuum cleaners and microwaves, will also benefit from a stronger economy and a healthier property market. However, the audiovisual segment will tend to suffer as a result of increased usage of portable electronic devices, such as smartphones, tablets and notebooks, which are increasingly replacing dedicated AV equipment.

- Distributors/retailers of electrical appliances: The domestic market for electrical appliances will continue to grow in the coming years but the benefits arising from this will largely accrue to the big, modern trade operations selling these goods (e.g., Power Buy and Power Mall) since these enjoy advantages in terms of their financial stability, the range of stock that they are able to carry, the number of branches that they operate, and their ability to put in place effective marketing and pricing strategies. For their part, the many traditional general retailers of electrical goods are at risk of seeing their turnover squeezed by competition with on the one hand, the big retailers of electrical appliances and other modern trade retailers that distribute electrical goods, such as HomePro, HomeWorks, Tesco Lotus and Big C, and on the other, growing use of internet-based sales channels by both domestic manufacturers and importers of cheap, high-tech goods from China. Modern trade outlets are also starting to play an increasingly important role in online markets and they too are now steadily taking market share from traditional sellers.

[1]The Plaza Accord was agreed in 1985 and came about as a result of the global consequences of the Japanese government’s depreciation of the yen, which had led to a significant rise in Japanese exports and thus to trade imbalances worldwide. In response to this, the other G5 members (the United States, the United Kingdom, Germany, and France) pushed for an increase in the value of the yen. This, though, raised production costs for Japanese manufacturers and incentivized them to relocate outside the country as they looked to reduce their overheads and retain their competitive advantages.

[2]Thailand’s share of the market for cooling devices, and in particular for compressors, shrank over 2017-2019 because Germany and South Korea, both of which have a 6-8% share of the global market for compressors, expanded their domestic production facilities and this then boosted their export capabilities. However, within Thailand, some compressor manufacturers (e.g., Siam Daikin and Emerson Commercial and Solutions (Thailand)) have also increased their investments and are ramping up production and exports over 2020 and 2021, when Thailand’s market share should start to increase again.

[3]The evolution of television technology has moved from CRTs (cathode ray tubes), through CLDs (color layout descriptors) to the current use of LEDs (light-emitting diodes), which allow 4K or even 8K resolution

[4]Cybo is a Thai manufacturer of TV displays that is able to produce LCD and LED screens that have 4K and 8K resolution, as well as curved screens. The company distributes TVs under the ‘PrismaPro’ brand.

[5]Comprises air conditioners, compressors, refrigerators, washing machines and rice cookers. Data from a survey by the Office of Industrial Economics.

[6]Euromonitor estimates that the replacement cycle for electrical appliances is 5-8 years for air conditioners, 12-15 years for refrigerators and freezers, 10-15 years for washing machines and dryers, 5 years for rice cookers and 4 years for microwaves.

[7]Anti-dumping safeguards introduced by US authorities came into effect on February 7, 2018 and applied tariff codes 845020, 845090 and 845011 to imports of washing machines. An annual quota of imports of 1.2 million machines was imposed and for these, import duties of 20%, 18% and 16% were imposed over the following 3 years. For over-quota imports, duties were raised to 50%, 45% and 40% for each of these years. This was in marked contrast to earlier rates, which had been set at just 1.4%.

[8]In 2020, Highly, a Chinese joint venture with the Japanese electronics giant Hitachi, expanded its Indian-based production capacity of compressors from 2 million to 3 million units per year. Output will be directed both to the domestic Indian market and to overseas sales, including to West Asia, Malaysia and Vietnam. In addition, the Indian compressor manufacturer Honon Systems also increased its annual production capacity by more than 2 million units in 2020, with this again likely to go to both domestic and export markets.

[9]The US and China have agreed to the first phase of a trade agreement. This specifies that from February 14, 2020, the US was to reduce tariffs from 15% to 7.5% on imports of Chinese goods worth a total of USD 120 billion. Product categories that will benefit from this include dishwashers, washing machines with a capacity of over 15 kilos, ovens, bakery ovens, televisions and video players.

[10]As of the third quarter of 2018, the Asian Development Bank estimates that by 2030, 65% of the population of the ASEAN region will qualify as middle class, compared to just 29% in 2010.

[11]These are types of integrated circuit. MCUs monitor and control automated systems, while PMICs are responsible for power management.

[12]These are responsible for managing displays.

[13]Additional details can be found in the Krungsri Research’s 2021- 2023 electronics industry outlook

.webp.aspx)