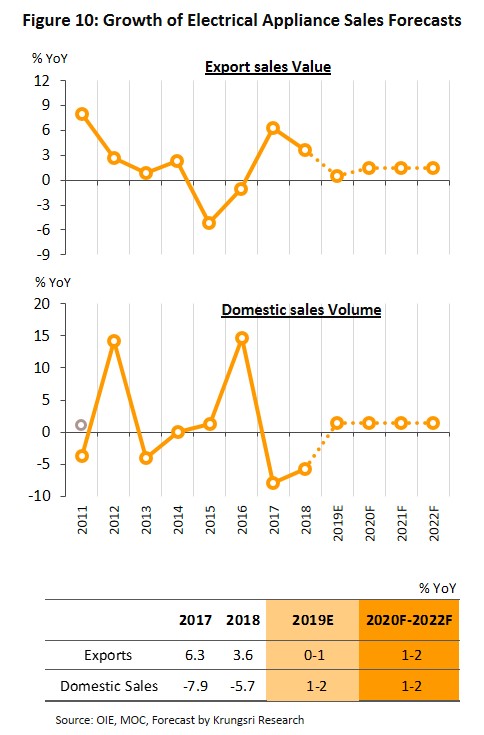

The electrical appliances industry is expected to register mild growth in 2020-2022. Domestic demand is projected to rise by 1-2% per year supported by: (i) strong demand for cooling appliances driven by climate change; (ii) a more buoyant housing market, that is expected to pick up in 2021-2022; (iii) replacement demand; and (iv) marketing strategies by manufacturers and distributors, such as releasing new models and exploiting online channels to engage customers by supplying more comprehensive information to solicit purchasing decisions.

Overall exports of electrical appliances could see zero or limited growth in anticipation of a slow recovery of the world economy over the next few years. Although US-China trade tensions are easing, there are lingering uncertainties. However, for some product groups, notably air conditioners and refrigerators, the recent trade spat has paved the way for Thai manufacturers to increase exports to the US, while exports to the rest of the ASEAN zone would also increase in line with continued economic growth and rising household income in the region.

Overview

Thailand’s electrical appliances sector goes back more than 50 years. Throughout this period, the government has actively supported the sector by attracting foreign capital inflows through a range of investment promotion strategies (administered by the BOI). During 1960-1971, the government promoted investment in the industry as an import-substitution strategy. During this stage, Thailand imported components for the assembly of relatively basic products such as radios, televisions, and fans. Between 1972 and 1992, the official policy switched to supporting the industry as an exporter. This was helped by the 1987 Plaza Accord[1] which had led to a stronger yen which subsequently encouraged many Japanese manufacturers to relocate production facilities overseas, including in Thailand to exploit the low manufacturing costs and geographical location at the center of the ASEAN zone. The establishment of the ASEAN Free Trade Area (AFTA) in 2004 also increased the economic potential of the ASEAN zone, and Thailand attracted many international manufacturers, especially Japanese corporations which had steadily increased investment in Thailand to manufacture for export. Manufacturers attracted to Thailand included both those producing electrical appliances and components (compressors, motors, diodes, television displays, speakers, etc.) and electronic parts (such as printed circuit boards, integrated circuits and capacitors). These developments fed into the ongoing development of Thailand’s electrical appliances supply chain.

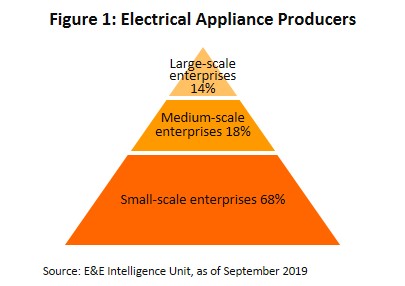

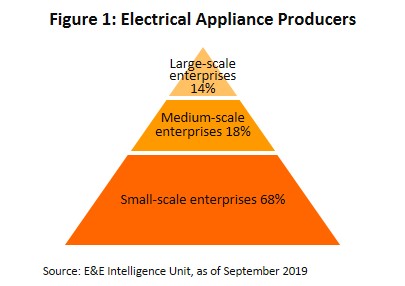

At end-2019, there were about 440 manufacturers operating in the Thai electrical appliances sector (Figure 1). These are split into two groups: (i) 14% are large manufacturers, which have access to both the latest technology and large funding sources. They can be sub-divided into two sub-groups: international manufacturers of leading global brands (e.g. Mitsubishi, Sony, LG, Samsung, and Toshiba), and Thai component manufacturers (OEM) that supply to independent brands and those that supply to their own brands (e.g. Tasaki, Saijo-Denki, Uni-aire, and Central Air in the air-conditioning market, and fan manufacturers Hatari, Accord Air, and MasterKool); and (ii) 86% of the companies manufacture parts and components for major producers. Most of these are SMEs, which have limited ability to develop their own technology and have weak negotiating power in the market.

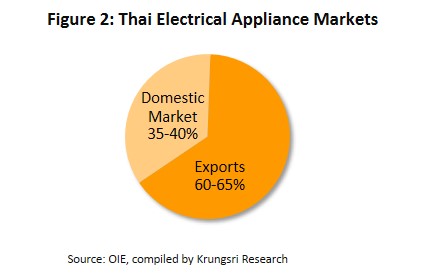

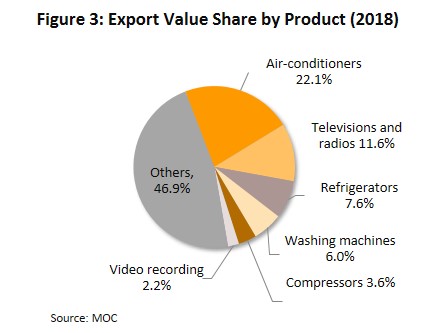

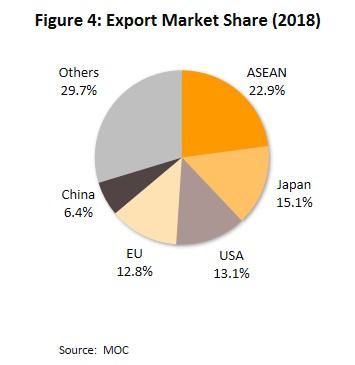

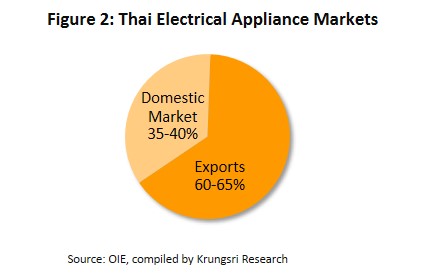

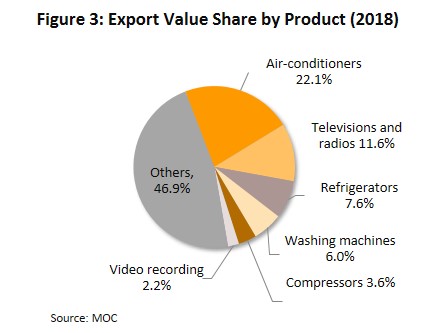

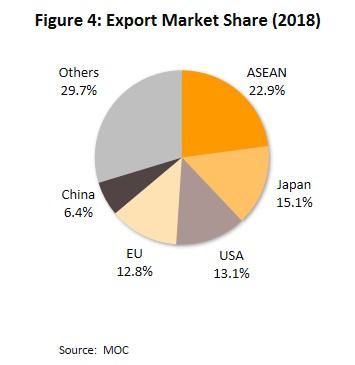

Data from the Office of Industrial Economics indicate that in 2018, 60-65% of output from Thailand’s electrical appliances sector was bound for export markets and distribution abroad (Figure 2). The most important market is the ASEAN zone, which absorbed 22.9% of the total export value of Thai electrical goods in the year. This was followed by Japan (15.1%), the United States (13.1%), the European Union (12.8%) and China (6.4%). By product, the most important category was air conditioners (22.1% of the value of all electrical goods exported), followed by television & radio (11.6%), refrigerator (7.6%), washing machine (6.0%), compressor (3.6%), video equipment (2.2%), and others (46.9%) (Figure 3 and 4).

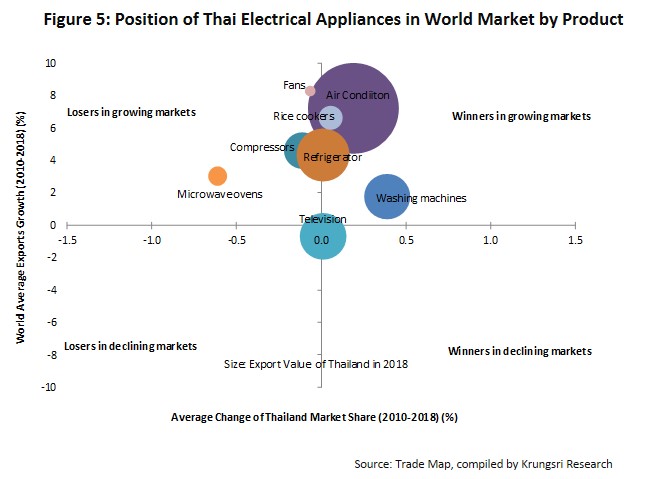

However, the development of the domestic electrical appliances supply chain has been uneven over the past 50 years. As a result, different parts of the chain have different production capability and standing in their respective world markets (Table 1). The cooling appliances segment, which includes air-conditioning units and compressors, is relatively mature with over 80% of the parts sourced domestically. Hence, this segment has continued to develop and Thailand is now one of the world’s leading exporters of these goods. In 2018, Thailand was the world’s second largest exporter of air-conditioning units (10.9% market share) and sixth largest exporter of compressors[2/] with 6.2% market share. Thailand is also a major exporter of white goods, including washing machines (second largest with 9.8% global market share), refrigerators (eighth largest with 4.0% share), rice cookers (seventh largest with 3.0% share), and microwaves (third largest with 5.6% share).

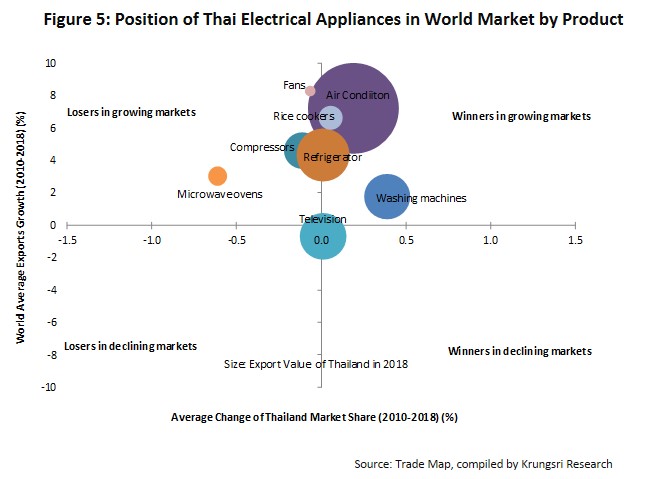

This is consistent with research on Thailand’s electrical appliances sector between 2010 and 2018 which showed air-conditioning units, refrigerators, washing machines and rice cookers made in Thailand are competitive in the global market. This helped the domestic industry to increase market share in the growing markets. However, Thai-made microwaves, compressors and fans are losing market share although the markets for these goods are growing (Figure 5).

In contrast with the situation for cooling appliances and white goods, the Thai audio-visual segment has developed more slowly. Specifically, television output has declined steadily since 2012 with rising imports of Chinese goods (produced by companies such as Haier, TCL and Hisense). And since 2015, major manufacturers such as LG, Samsung and Toshiba have been relocating production facilities to other countries within the ASEAN zone such as Vietnam and Malaysia. At the same time, television technology has been evolving rapidly[3], and foreign manufacturers would import screens into Thailand from their parent countries to assemble into finished goods for distribution in Thailand and for export. This has hindered the ability of Thai manufacturers to develop their production processes and keep abreast of changes in technology, although some large Thai players have been able to overcome these obstacles and developed the parts and processes needed to assemble new, high-definition LED TV [4].

Competition has also been rising in the world market for televisions. Most recently, Japanese electrical appliances producers have started to increase revenue by selling their technology and licensing the use of their brand names to foreign manufacturers due to their lower production costs5/. For example, Toshiba sold its technology and licensed the use of its name to Hisense (a Chinese manufacturer of electrical goods) to produce and sell Toshiba TVs for 40 years starting from 2018. Hisense has also secured licensed rights from other large brands including Hitachi, Lucent, Matsushita, NEC, Sanyo and Qualcomm.

The domestic market for electrical goods absorbs 30%-40% of output. More than 30% of Thai households have refrigerators, air-conditioners, washing machines, fans, televisions and irons. A Euromonitor survey of market for electrical goods in Thailand (conducted in February 2019) revealed the most popular product categories were air-conditioners and air-purifiers (39% by value of all goods), followed by washing machines (16%), refrigerators and freezers (15%), small appliances such as irons, vacuum cleaners, kitchen appliances and fans (20%), and others (10%). Most items (60-70% by value) are distributed through about 3,000 retail shops across the country, 20-30% are sold through modern trade outlets including discount stores, department stores, and home improvements centers, and the remaining 5% is sold directly or through online platforms.

Situation

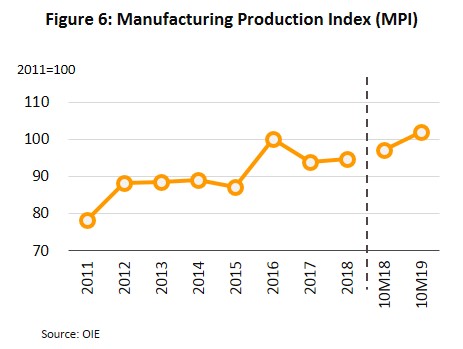

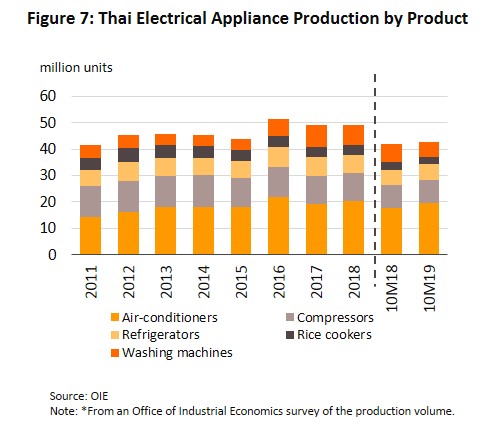

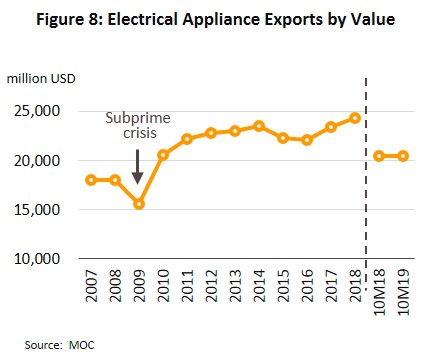

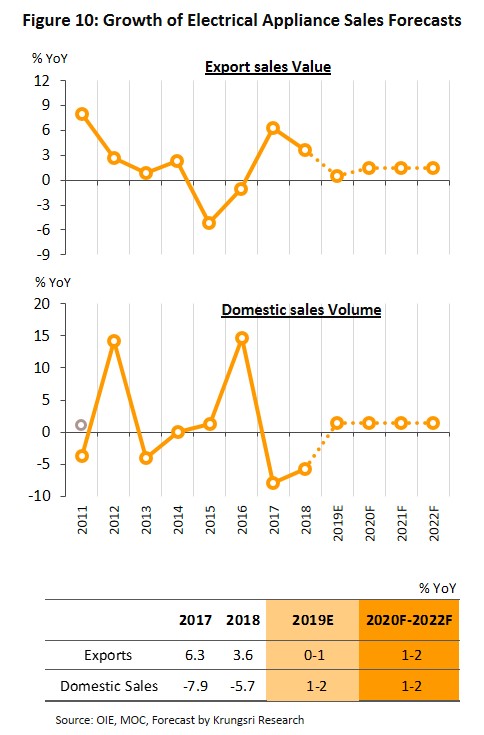

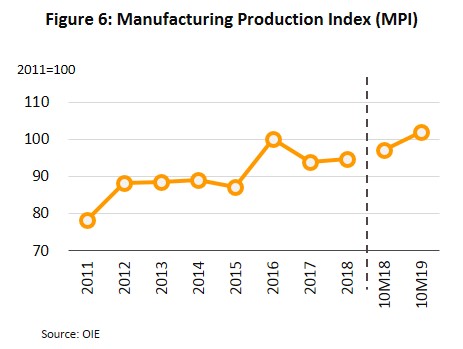

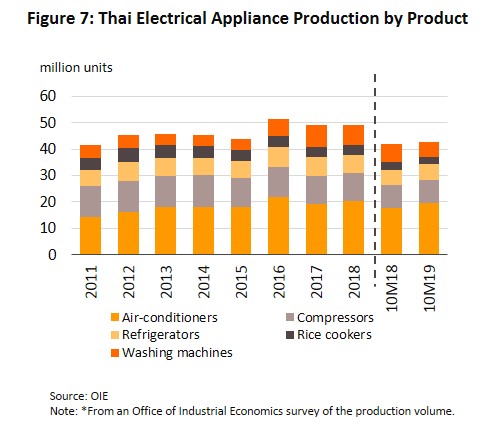

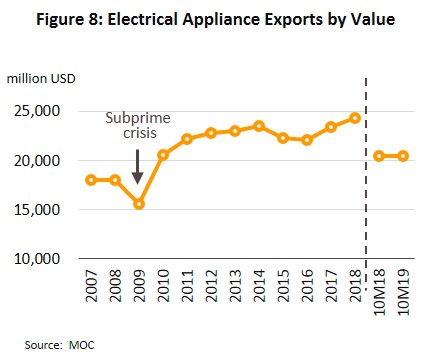

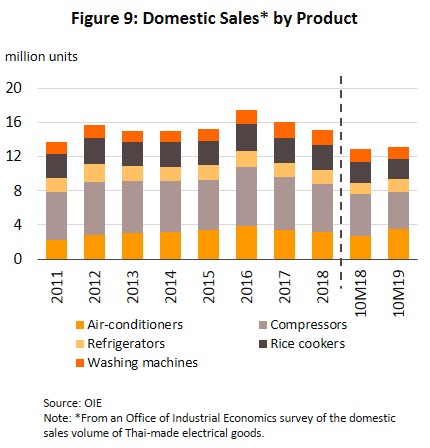

Between 2012 and 2018, the volume of electrical goods produced in Thailand registered relatively slow growth of 1.3% per year (CAGR). Meanwhile, the domestic market (by volume) shrank by 0.6% annually (CAGR) while export value expanded by 1.1% per year (CAGR). The details are given below.

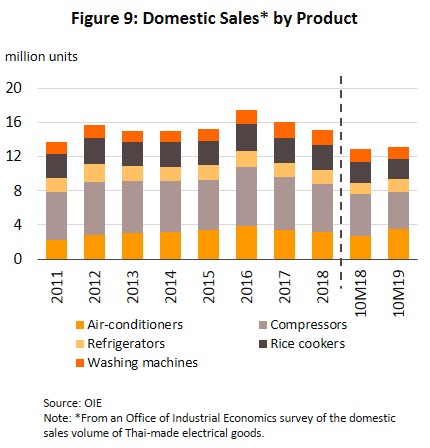

- The domestic market for electrical goods was mixed during 2012-2018. In 2012, sale of main product categories (air conditioners, compressors, refrigerators, washing machines and rice cookers)[6] reached 15.7 million units, rising 14.3% from the previous year, partly driven by replacement demand after severe flooding 2011. From 2013 to 2015, the strong condominium market, recovering domestic housing market, and repairs to properties damaged in the 2011 floods, helped to sustain demand for electrical goods, although growth was flat. In 2016, Thailand experienced excessively hot weather caused by the strongest El Niño in 20 years; this supported additional demand for air conditioners and compressors. Demand for other household electrical goods moved in tandem with the housing market.

But in 2017 and 2018, a sluggish housing market reduced demand for household appliances. The situation was made worse by strong demand in prior years and that most electrical goods have a replacement cycle of 8-12 years, which meant many goods were still at the early stage of their lifecycle. Thus, sale of electrical goods shrank by 7.9% and 5.7% in these two years. However, research by Euromonitor shows that the release of new models and/or electrical appliances that employ new technology could lift retail prices. This boosted the value of the market for electrical goods by an average of 5.8% per year between 2012 and 2018.

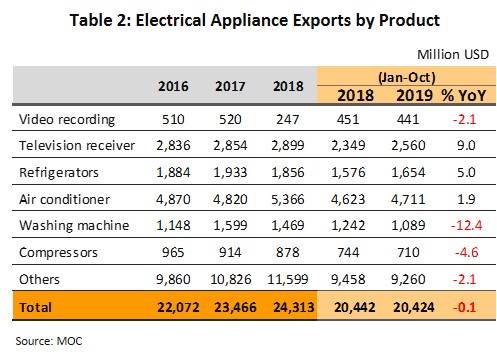

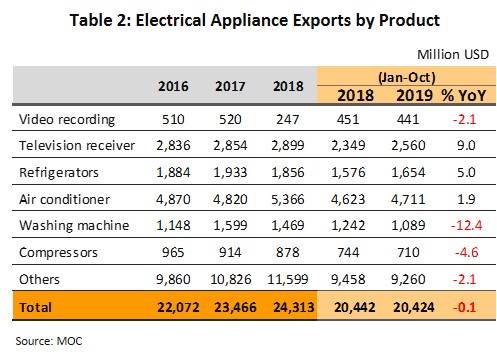

- Over the 7-year horizon, exports of electrical goods have been held back by a number of factors. (i) The world economy has experienced only anemic growth. (ii) The competitiveness of some Thai manufacturers has weakened, although this has been especially noticeable within the audio-visual segment. (iii) The extensive flooding at the end of 2011 caused significant damage to factories based in central Thailand. (iv) The increase in the national minimum wage to THB 300/day in 2012 prompted some international manufacturers of electrical goods (of both components and finished products) to relocate their production facilities to sites outside Thailand. In 2016-2017, however, exports of Thai-made washing machines increased substantially, with the US market doing particularly well following increased investment by Samsung and LG in their Thai washing machine factories (washing machines accounted for around 7% of the value of all exports of electrical appliances in 2017). At the same time, a combination of continuing investment in the Thai-based production of air conditioners by companies including Toshiba, LG, Daikin and Saijo Denki, and the heat wave of 2016 helped to support a 6.0% increase in exports. The following year, though, exports of air conditioners fell back again, shrinking by 1.0% as temperatures cooled and the effects were felt of 2016’s brought-forward demand. In 2018, overall exports of electrical goods had a value of USD24.31bn (a 3.6% growth) and growth was strongest for air conditioners, televisions, radios, and ‘other types’ of electrical goods (e.g. fans, microwaves, electric showers, etc.). On a negative note, exports of washing machines crashed in 2018 due to the move by US authorities to institute anti-dumping measures7/ (effective February 7, 2018 to February 6, 2021); for the year, exports tumbled 51.1% (in 2018 the US had an 18% share of exports of washing machines by value). As a result, the total value of all exports of electrical goods grew only slightly in 2018.

Between January and October 2019, production of electrical appliances grew only slowly, rising 1.7% YoY to a total of 42.6 million units. As such, the sector’s manufacturing production index expanded only mildly; in the period, distribution to the domestic market rose slightly but the value of exports contracted fractionally. Details of this are given below.

- In 10M19, 13.1 million electrical appliances were distributed to the domestic market (+1.6% YoY). This was supported by strong sales of air conditioners and refrigerators, which rose by 29% YoY and 14.3% YoY, respectively, due to last year’s unusually hot and extended summer (the 2019 summer ran from February to May). But widespread weakness in the economy and continuing sluggishness in the real estate market dragged on demand for other electrical goods, such as washing machines and rice cookers, which saw sales drop by 8.5% YoY and 5.3% YoY each. For all of 2019, the expectation is thus that domestic sales growth will come to just 1-2%.

- For the same 10-month period, exports slipped by 0.1% YoY to a value of USD20.42bn following a slowing global economy, which then pulled down exports of Thai electrical appliances in almost all product categories. In contrast to this general trend, exports of air conditioners and refrigerators benefited from the ongoing US-China trade dispute and Thai manufacturers were able to fill the gap left by declining Chinese exports of these goods. In 10M19, imports to the US from China of air conditioners and refrigerators shrank by 7.7% YoY and 23.9% YoY, respectively. This then squeezed China’s market share for these two product groups and these fell to 30.5% and 20.4% from 41.4% and 26.4% in 2018. Thai exports to the US jumped by respectively 45.6% YoY and 127.1% YoY, lifting Thailand’s share of the US market from 3.7% to 5.0% for air conditioners and from 1.3% to 2.7% for refrigerators (comparing 2018 and 10M19 figures). Given this, for full-year 2019, the value of exports of electrical appliances from Thailand is forecast to either remain flat or to rise by up to 1%.

Outlook

Between 2020 and 2022, production of electrical appliances is expected to grow at a slow rate of 1-2% per year. Domestic demand would be driven by climate change which would drive demand for cooling appliances, the anticipated recovery in the real estate market in 2021-2022, and replacement demand [8]. Exports should be stable or rise only slightly. It is unclear how the US-China trade dispute will evolve but Thai manufacturers of air conditioners and refrigerators may be able to continue to increase exports to the US, while exports to the ASEAN market will strengthen in line with the growth of the regional economies.

- Over the next 3 years, domestic demand for electrical appliances is expected to grow by an average of 1-2% p.a. This would be driven by the following: (i) anticipated recovery in the residential housing market in 2021-2022 spurred by accelerating public infrastructure spending and recovering private sector investment; (ii) replacement demand – severe flooding in 2011 had caused a spike in purchases of consumer electrical goods and these are now reaching the end of their lifecycle (especially washing machines, refrigerators and air conditioners); (iii) climate change and generally rising temperatures, which will feed demand for air-conditioning; (iv) release of new products that are internet-enabled, and ongoing marketing campaigns to stimulate sales; and (v) use of online sales channels to better inform consumers to make purchasing decisions easier and more convenient.

- In the same time period, export value is expected to rise by 1-2% p.a. Although the US-China trade war appears to be easing[9], it remains unclear how that will pan out. This could be an opportunity for Thai manufacturers to continue to increase exports to the US to replace China goods that are affected, particularly air conditioners and refrigerators. In 10M19, Thai exports of these two product categories to the US represented 7.3% and 9.8% share of the US market, respectively, up from 5.5% and 4.1% in 2017. Meanwhile, demand from Asia (which accounts for 23% of Thai exports of electrical appliances by value) continued to grow as ownership rates remain low for many consumer goods. For example, according to the Japan Refrigeration & Air Conditioning Industry Association (JRAIR), ownership rates for air conditioners remained below 20% in many Asian countries, including India, Indonesia, the Philippines, Myanmar, Cambodia and Lao PDR. However, these countries have a rapidly-rising middle-income population[10] that will drive consumer demand.

- Over the mid- to long-term, Thailand’s electrical appliances sector should continue to see healthy growth. Demand for internet-enabled and high-tech household goods will continue to grow, especially with the impending rollout of 5G networks. And this could happen sooner than planned (bidding for 5G spectrum started in November 2019 and commercial could start in 2020[11]). In addition, the government is encouraging the growth of high-tech ‘future industries’ through its support for the development of the Eastern Economic Corridor (EEC). The government hopes this will help to attract investments to develop innovative new technologies within Thailand’s electrical appliances sector, especially in areas where the country already has a competitive advantage such as cooling appliances and household goods.

Krungsri Research’s view:

For operators in the Thai electrical appliances sector, earnings should grow slightly over 2020-2022 as climate change (hotter weather) would drive demand for air conditioners. Meanwhile, manufacturers and distributors will try to stimulate the market, by employing a range of marketing strategies, releasing new models, or expanding their online presence. This would help to expand the domestic market. However, exports would be flat as the US-Chinese trade spat would continue to dampen global economic growth and in turn, demand for electrical appliances.

- Manufacturers of cooling appliances: Business conditions and earnings should continue to improve. Although the segment will be hurt by weakness in the global economy, Thailand’s strong competitiveness means local producers will be able to exploit the unresolved US-China trade tension by replacing lost Chinese imports in the American market. In addition, several multinational manufacturers of cooling appliances plan to move to Thailand or expand existing production facilities in the country to turn Thailand into their regional production center. Finally, rising temperatures induced by climate change will continue to support additional demand for cooling appliances.

- Manufacturers of other household electrical appliances: Earnings should remain flat or shrink slightly because of ongoing US anti-dumping measures on imported washing machines. The measure would be in force for 3 years from February 7, 2018, with tariffs being dropped gradually. Following the expiry in 2021, exports of washing machines to the US should recover. Although the US-China trade war appears to be abating, it is unclear how the situation will evolve. And because Thailand is one of the world’s largest producers of refrigerators and Thai manufactures are able to assemble the large models popular in the American market, this might allow them to continue to increase exports of refrigerators to the US. In 2018, 1.3% (by value) of refrigerators imported into the US originated from Thailand, up from 0.6% in 2016. Thai exports of washing machines and refrigerators to the US account for 11% of the kingdom’s total export value of these two products, and 5% of the value of imports of the same to the US. Unfortunately, exports of other types of electrical goods will face rising competition in the market, particularly from Chinese goods which are cheaper and increasingly better quality. Meanwhile, domestic demand should grow slightly, especially for washing machines, air purifiers (following regular air pollution episodes nationwide that are considered a health hazard), and smaller household appliances such as rice cookers, vacuum cleaners and microwaves. However, sale of audio-visual appliances would drop because of the rising popularity of portable electronic devices such as smartphones, tablets and notebooks.

- Distributors/retailers of electrical appliances: Domestic market for electrical appliances will continue to grow. But the benefits arising from this will largely accrue to the big, modern trade operations that sell these goods (e.g. Power Buy and Power Mall). They enjoy several advantages, including financial stability, large product range, large branch network, and the ability to implement effective marketing and pricing strategies. Meanwhile, conventional general retailers of electrical goods will see their earnings squeezed by competition from big retailers of electrical appliances and other modern trade retailers which distribute electrical goods, such as HomePro, HomeWorks, TESCO Lotus and Big C. There is also competition from the growing number of online sales channels employed by both manufacturers and modern trade outlets, which are starting to play an increasingly important role in the market and are steadily taking market share from the conventional retailers.

[1] The Plaza Accord was agreed in 1985 and came about as a result of the global consequences of the Japanese government’s depreciation of the yen, which had led to a significant rise in Japanese exports and thus to trade imbalances worldwide. In response to this, the G5 (the US, the United Kingdom, Germany, and France) pushed for an increase in the value of the yen. This, though, raised production costs for Japanese manufacturers and incentivized them to relocate outside the country in order to reduce their overheads and so retain their competitive advantages.

[2] Thailand’s share of the market for compressors shrank in 2017-2018 because Germany and South Korea, both of which have a 6-8% share of the global market for compressors, expanded their domestic production facilities and thus boosted their export capabilities. However, within Thailand, some compressor manufacturers (e.g. Siam Daikin and Emerson Commercial and Solutions (Thailand)) have also been increasing their investments and rising production for export will start to have an impact on the market within the next 1-2 years, when Thailand’s market share should start to increase again.

[3] The evolution of television technology has moved from CRTs (cathode ray tubes), through CLDs (color layout descriptors) to the current use of LEDs (light-emitting diodes), which allow 4K or even 8K resolution.

[4] Cybo is a Thai manufacturer of TV displays that is able to produce LCD and LED screens that have 4K and 8K resolution, as well as curved screens. The company distributes TVs under the ‘PrismaPro’ brand.

[5] From a report by the Japanese Ministry of Economy, Trade and Industry released in 2014, which revealed that the competitiveness of Japanese electrical manufacturers was under threat from Chinese and South Korean goods, which were increasingly competing for market share.

[6] Data from a survey conducted by the Office of Industrial Economics.

[7] Anti-dumping safeguards introduced by US authorities came into effect on February 7, 2018 and applied tariff codes 845020, 845090 and 845011 to washing machines. An annual quota of imports of 1.2 million machines was imposed and for these, import duties of 20%, 18% and 16% were imposed over the following 3 years. For over-quota imports, duties were raised to 50%, 45% and 40% for each of these years. This was in marked contrast to earlier rates, which had been set at just 1.4%.

[8] Euromonitor estimates that the replacement cycle for electrical appliances is 5-8 years for air conditioners, 12-15 years for refrigerators and freezers, 10-15 years for washing machines and dryers, 5 years for rice cookers and 4 years for microwaves.

[9] The US and China have agreed to the first phase of a trade agreement, and this specifies that from February 14, 2020, the US will reduce tariffs on imports of Chinese goods worth a total of USD 120 bn from 15% to 7.5%. Product categories that will benefit from this include dishwashers, washing machines with a capacity of over 15 kilos, ovens, bakery ovens, televisions and video players.

[10] As of the 3rd quarter of 2018, the Asian Development Bank estimates that by 2030, 65% of the population of the ASEAN region will qualify as middle class, compared to just 29% in 2010.

[11] In November 2019, the National Broadcasting and Telecommunication Commission (NBTC) set out a schedule for auctioning the 5G frequencies (700 MHz, 1,800 MHz, 2,600 MHz and 26 GHz). Between November 13 and December 12, 2019, the NBTC consulted with the public and heard opinions on the proposed terms and conditions of the 5G auction. The auction was then announced in the Government Gazette on December 17, 2019, and interested parties were invited to participate in the bidding on January 2, 2020. It is expected that the actual bidding will take place on February 16, 2020 and operations will begin in July 2020.

.webp.aspx)