EXECUTIVE SUMMARY

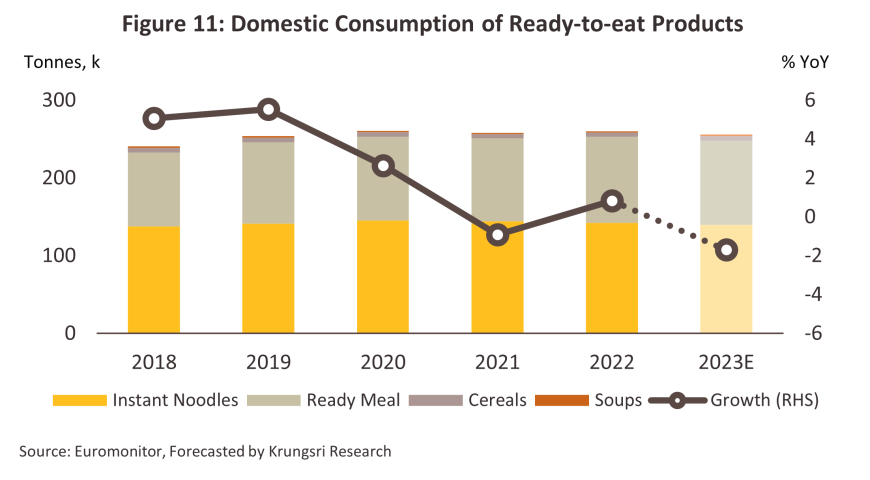

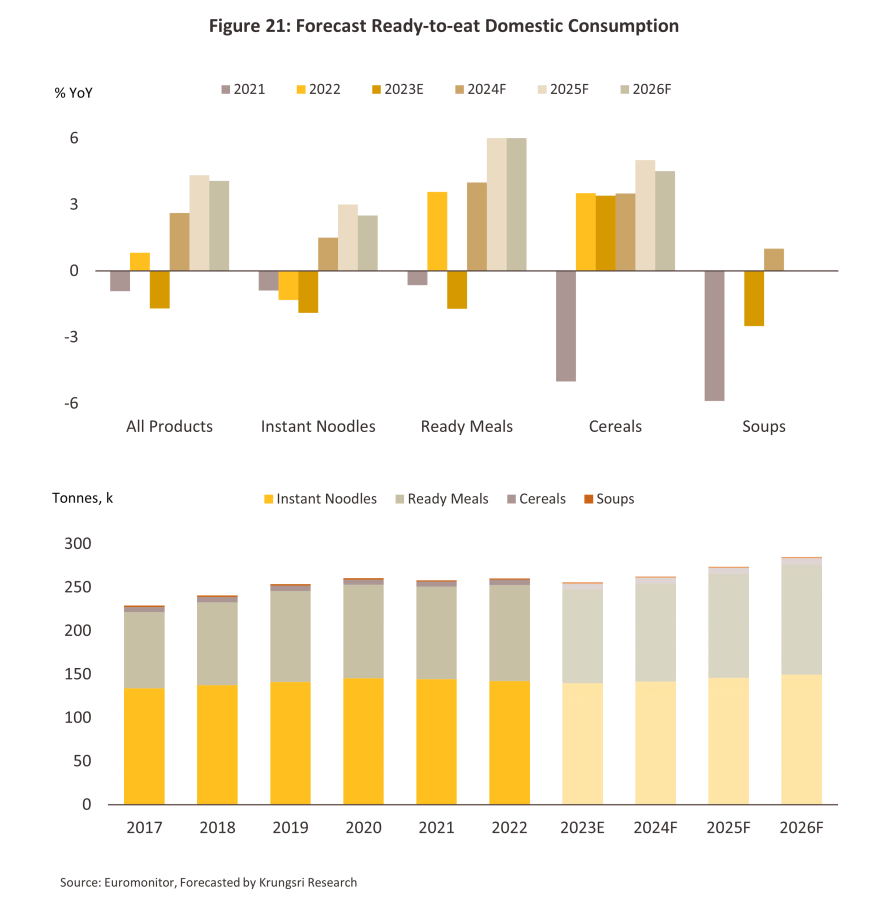

The market for Thai-made ready-to-eat food is fairly evenly balanced between domestic and export sales, with these absorbing respectively 53.9% and 46.1% of industry output. The abating of the COVID-19 pandemic and the return of consumption patterns to normal (including an increase in eating out) has resulted in a contraction of between -1.0% and -2.0% in the quantity of goods consumed domestically in 2023. However, the market should bounce back to growth over 2024 to 2026 and the forecast is thus for sales to the domestic market to expand by 3.0-4.0% annually on (i) general economic growth and the positive impacts of this on consumer purchasing power; (ii) an expansion in sales made through modern trade outlets; (iii) the development of new product lines, with healthier options likely to be especially important; and (iv) an uptick in economic activity that will boost sales of goods that are easy to consume. For exports, sales increased at 2.7% in 2023. Due to the persisting geopolitical conflicts, coupled with Thailand's competitive export prices in the global market, trading partners have increasingly turned to importing products from Thailand. Nevertheless, from 2024 to 2026, export volume is expected to jump by an average of 5.0-6.0% per year, helped by: (i) gradually recovery of economic activities amid still-high cost of living in export markets that make these low-price products attractive to consumers; and (ii) increasing urbanization and an expansion in the sales channels (both offline and online) through which consumers can access these products; and (iii) the changes in population structure, with smaller family sizes, which have led to a decrease in the quantity of food demand per household consumption each time. Players will nevertheless have to contend with some challenges over the next few years, including (i) the effects of increasingly unpredictable weather on agricultural supply lines and the impacts of this on the cost of and access to inputs; (ii) the move by the authorities in many countries to control consumption of high salt content products through the use of tax; (iii) consumers prioritize food products with quality certification, which will put upward pressure on production costs of producers in elevating their products to meet standards. (iv) the imposition of environmental non-tariff barriers to trade, potentially increasing production and packaging costs; and (v) the risk of worsening geopolitical tensions and an extension to armed conflict, which would add to overheads related to transportation and packaging.

Krungsri Research view

-

Manufacturers of instant noodles: Manufacturers have benefitted from the development of new higher value-added product lines and from being able to pass higher costs on to consumers, while with the economy growing, consumers with improving purchasing power will be able to afford more expensive premium products. The popularity of Thai goods overseas will also likely continue to increase, and so manufacturers’ overall income will track upwards. However, the cost of inputs is also expected to rise. In particular, unpredictable weather and especially drought in major wheat-producing countries such as Australia and Canada, will add to production costs and effect profitability.

-

Manufacturers of ready meals: Continuing urbanization is increasingly connecting consumers to the channels through which ready meals are distributed, though most important among these are convenience stores and hypermarkets. In addition, the recovery in the economy has shifted shoppers back to favoring products that are easy and quick to prepare and consume, and so sales are expected to increase to both the domestic and export markets.

-

Manufacturers of ready-to-eat cereals: Increasing consumer concerns over personal health, which have added to the appeal of cereal-based foods, and the development of new products suitable for modern fast-paced lifestyles will support industry income to continue to grow. However, the return of Ukrainian supply to world markets will add to the competition faced by Thai manufacturers in international markets, most notably in Europe. Drought in Australia will also affect the supply of inputs, and so manufacturers will need to source goods elsewhere, adding to costs and undercutting profits.

-

Manufacturers of instant/long-life soup: Due to its high cost relative to soup bought from restaurants or made at home, the target market for instant and long-life soup is somewhat limited. This is especially so now that the pandemic has subsided, and consumers no longer need to stock food at home, and this will further negatively impact manufacturers’ income.

Overview

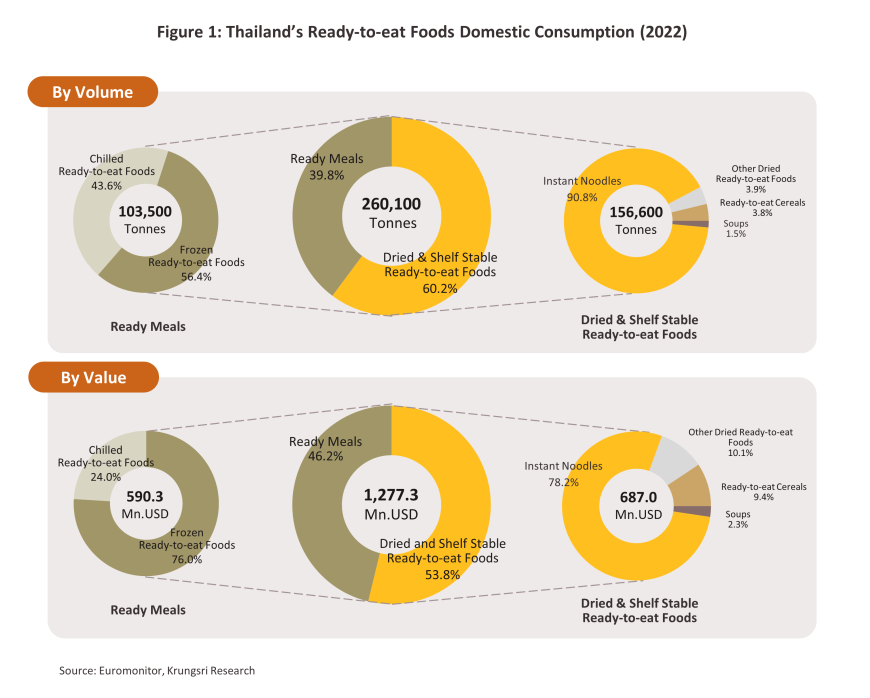

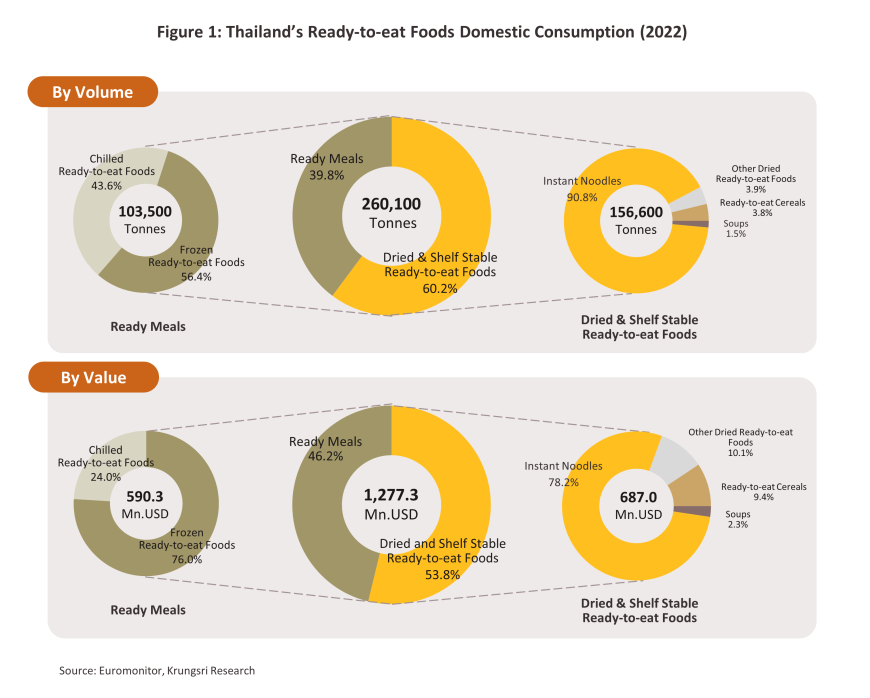

Ready-to-eat food is food that has been prepared or pre-cooked so that it is almost ready for consumption as soon as it is purchased, generally needing only to be reheated before it is eaten. It is thus much more convenient than cooking from scratch. In 2022, the ready-to-eat food industry had a total domestic and export sales volume of 482.4 thousand tonnes, with a value of USD 2.0 billion. Relying on the domestic market, there were sales of 260.1 thousand tons, accounting for 53.9% of the total ready-to-eat food sales volume, with a total value of USD 1.3 billion, representing 64.5% of the total value of ready-to-eat food sales. Ready-to-eat foods can be split into two main groups (Figure 1):

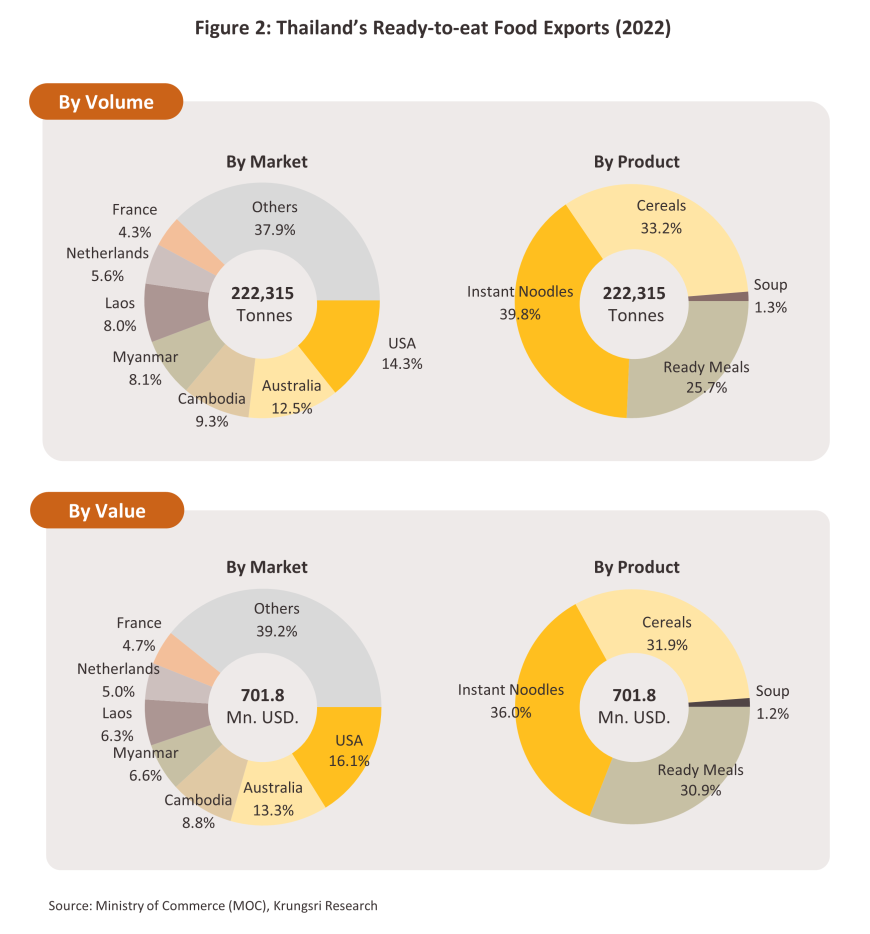

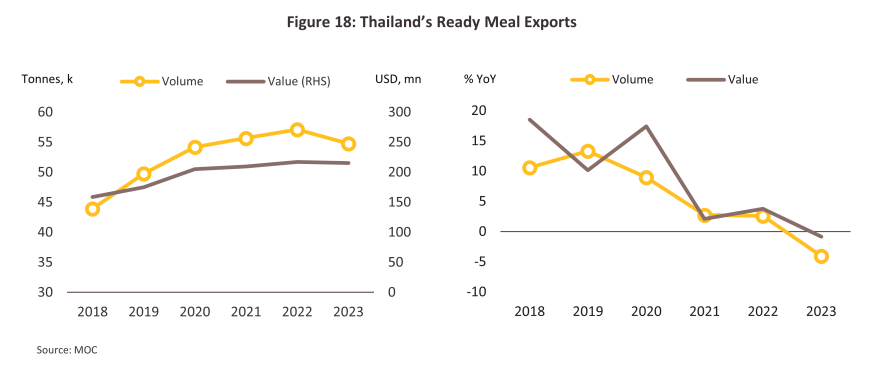

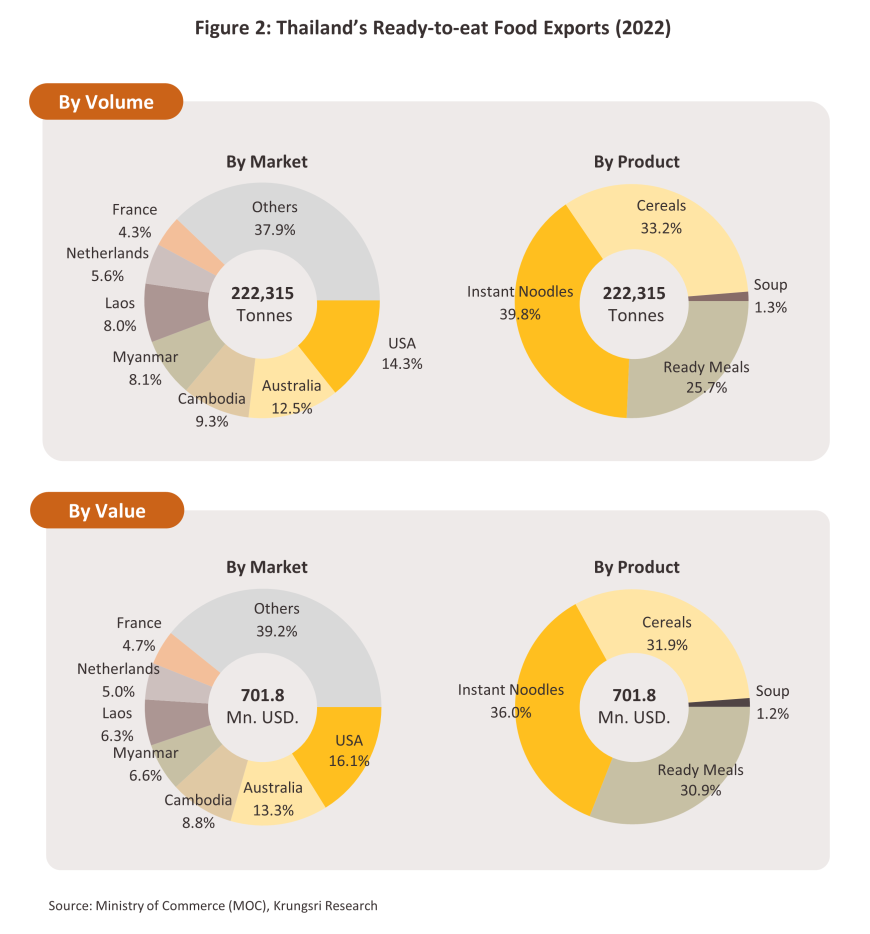

A total of 482.4 thousand tonnes of Thai-made ready-to-eat food products were distributed to domestic and international markets in 2022, and this then generated receipts worth USD 2.0 billion. The domestic market absorbed 53.9% of total ready-to-eat food sales volume, or 260.1 thousand tonnes, though by value this absorbed 64.5%, or USD 1.3 billion. By volume, exports came to 222.3 thousand tonnes (46.1% of the total), while this brought in income worth USD 701.8 million, or 35.5% of all earnings from the sale of ready-to-eat food (Figure 2). The most important overseas market was the US, which absorbed 14.3% of exports by volume, followed in importance by Australia (12.5% of export volume), Cambodia (9.3%), Myanmar (8.1%), and Lao PDR (8.0%). Details on exports of different product categories are given below.

-

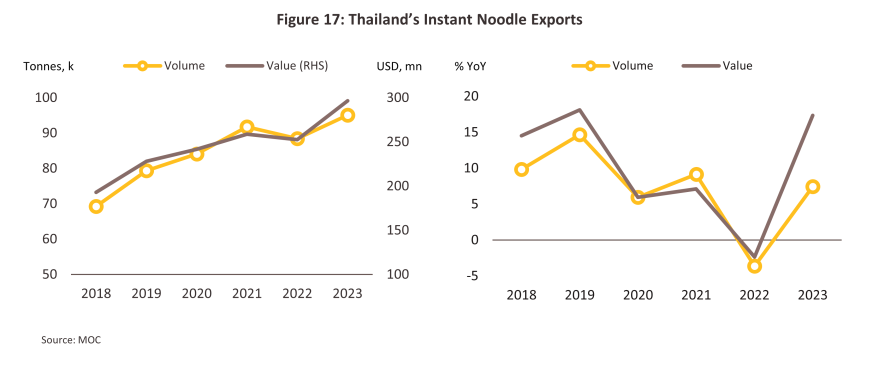

Instant noodles6/: These accounted for 39.8% of total exports of ready-to-eat foods by volume and 36.0% by value. The most important export market was Cambodia, which took 20.3% of all exports of instant noodles by volume, followed by the Netherlands (12.8%), Myanmar (12.6%), Lao PDR (10.5%) and the US (6.6%).

-

Cereals7/: By volume and value, these represented 33.2% and 31.9% of all exports ready-to-eat foods. Australia was responsible for 24.2% of all exports by volume, followed by the US (18.5%), the Philippines (14.3%), Germany (5.8%) and China (5.7%).

-

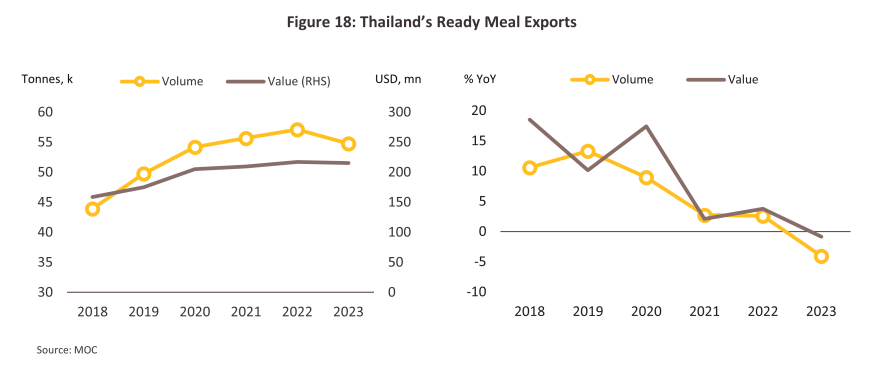

Ready meals8/: Ready-to-eat meals represented 25.7% of all exports ready-to-eat foods by volume, but this rose to 30.9% when considered by value. The US was the most important market for these goods, taking 21.2% of all exports (by volume), followed by Australia (10.2%), Lao PDR (9.8%), Myanmar (9.4%), and France (9.0%).

-

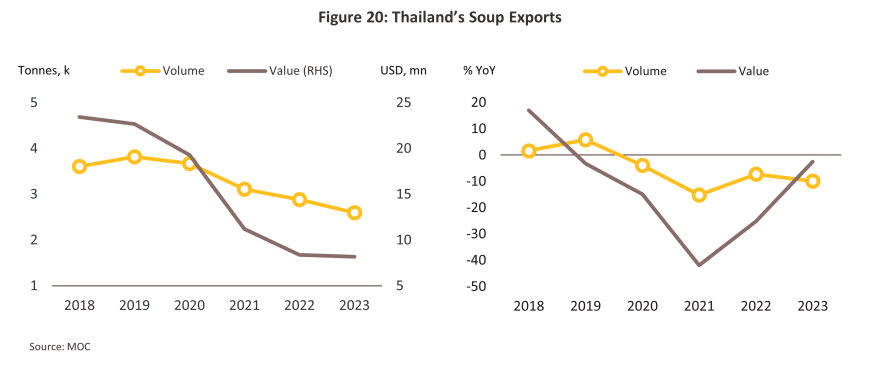

Instant/long-life soups9/: This is a relatively minor category, contributing just 1.3% and 1.2% of all exports of ready-to-eat foods by volume and value. 17.0% of exports volume were sold into markets in the Philippines, which was followed in importance by Hong Kong (15.5%), South Korea (12.9%), Australia (8.9%) and the US (6.7%).

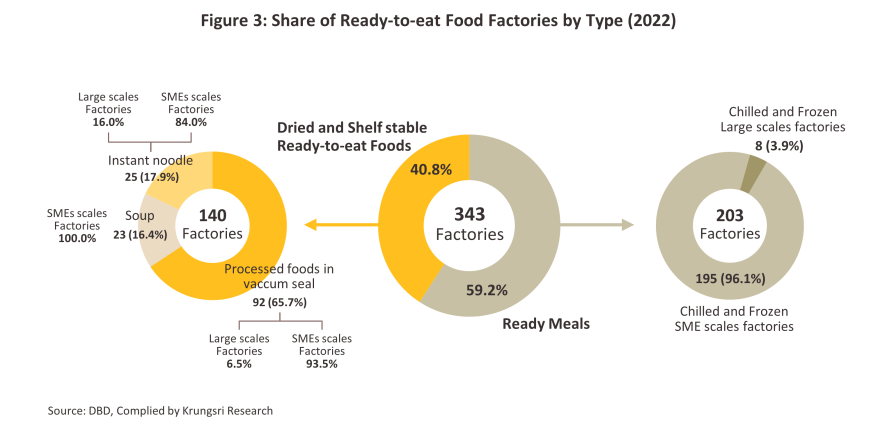

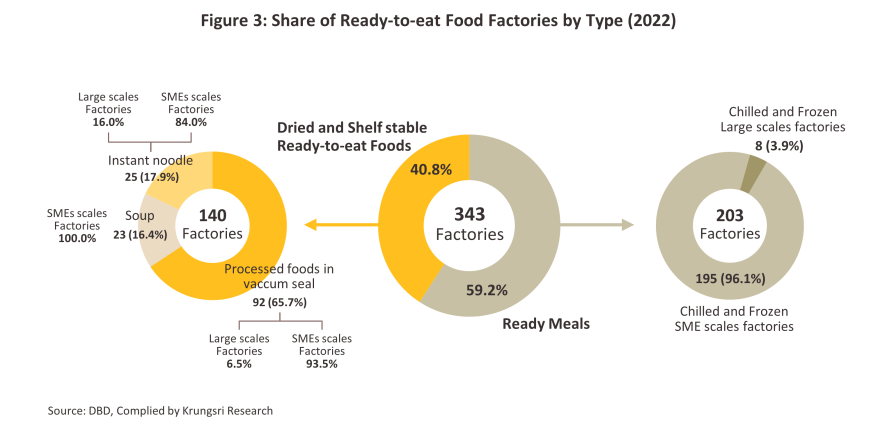

As of 2022, there were 343 sites processing ready-to-eat food10/ in Thailand that were active and registered with the Department of Business Development, though almost all of these (324) were SMEs. (i) 140 sites produced dried and shelf stable ready-to-eat foods (40.8% of the total), split between 129 SMEs and 11 large-scale operations. Considered by product, 92 sites produced ready-to-eat food distributed in vacuum-packed containers, 25 produced instant or fully prepared starch-based products, and 23 manufactured soups or specialty products. (ii) 203 sites, or 59.2% of the total, produced chilled and frozen ready-to-eat foods. Of this total, 195 were SMEs and 8 were large companies (Figure 3).

Through 2022, the overall situation for manufacturers of different product categories within the market for ready-to-eat food was as follows.

Instant Noodles

-

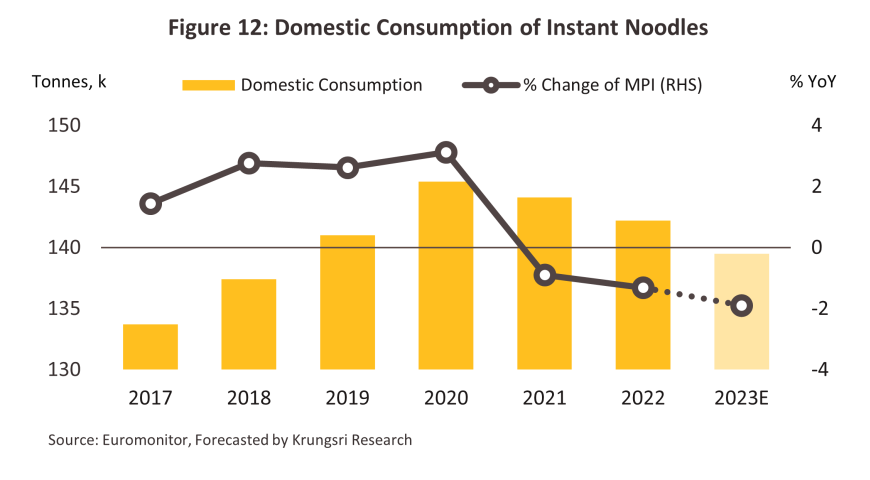

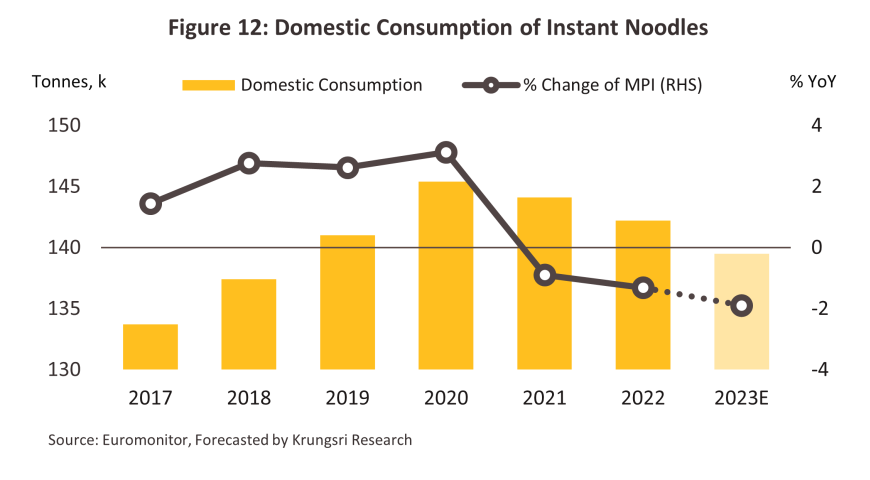

Domestic sales of instant noodles had a combined value of USD 537.2 million. The major players in the market are Saha Pathana Inter-Holding PCL. (Mama brand), Thai Preserved Food Factory Co.,Ltd. (Waiwai brand), Ajinomoto Co.,Ltd. (Yum Yum brand), Nongshim Co.,Ltd. (Nongshim brand) and Nissin Foods (Thailand) Co.,Ltd. (Nissin brand), and combined, these producers control in excess of 90% of the total Thai market for instant noodles. Over 2017 to 2022, consumption has expanded at an average rate of 1.3% annually, though because these products are priced attractively and thus represent a ready alternative when access to fresh food is limited, growth has been especially strong when purchasing power is weak. In addition, the wide and steadily expanding range of flavors that is available means that instant noodles appeal across consumer groups, without regard to gender or age.

-

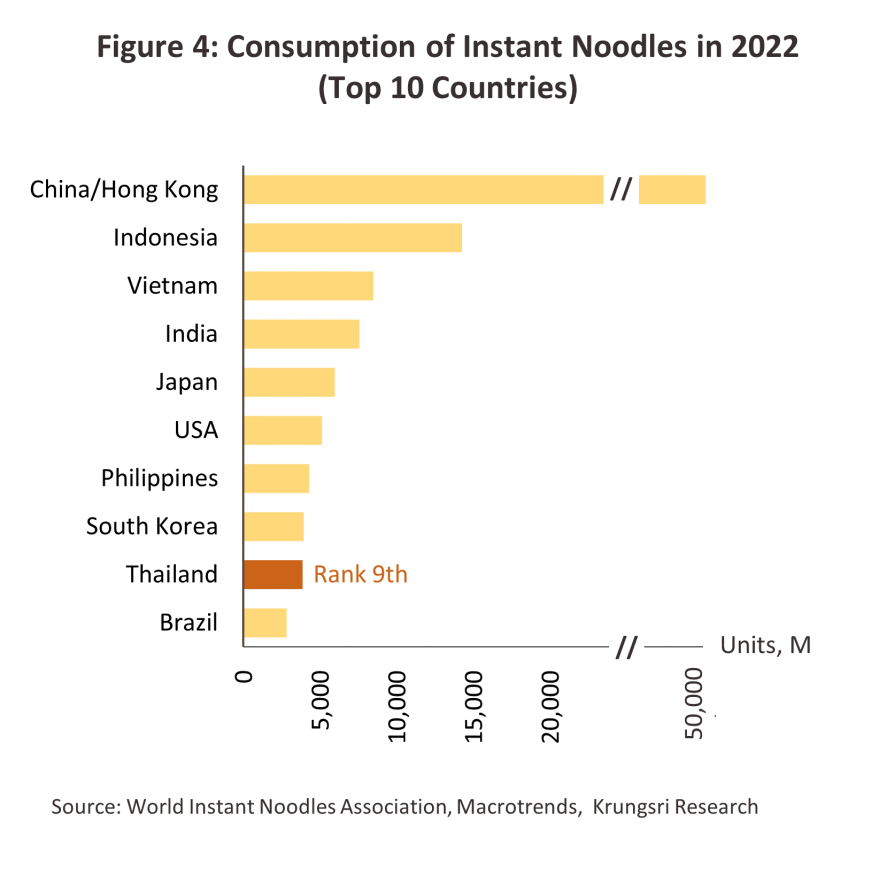

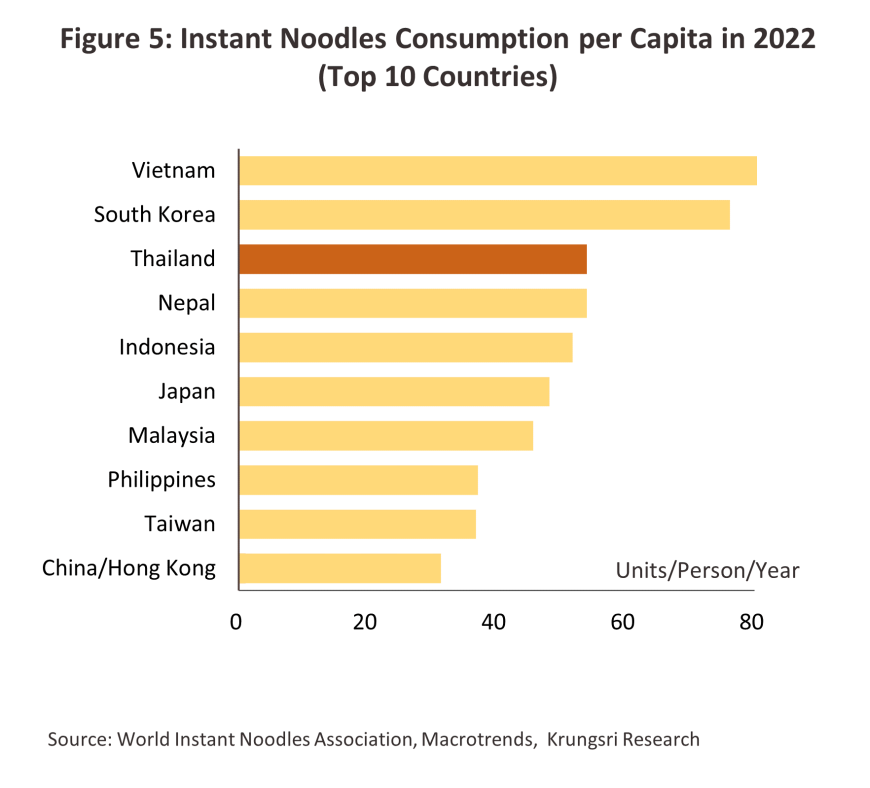

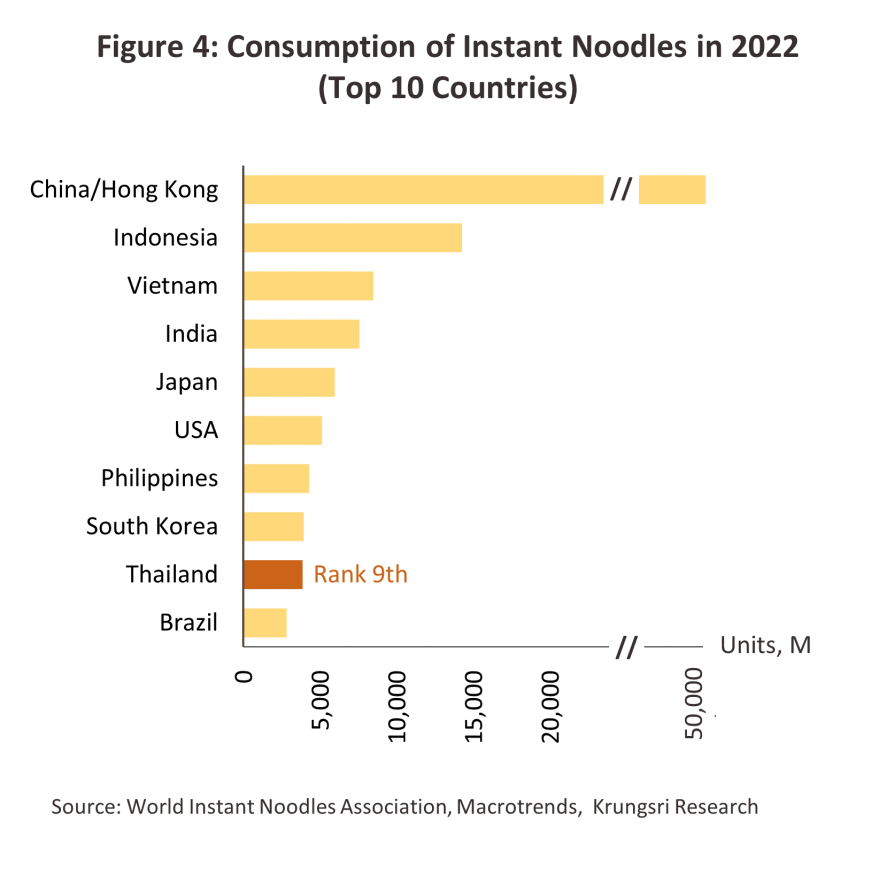

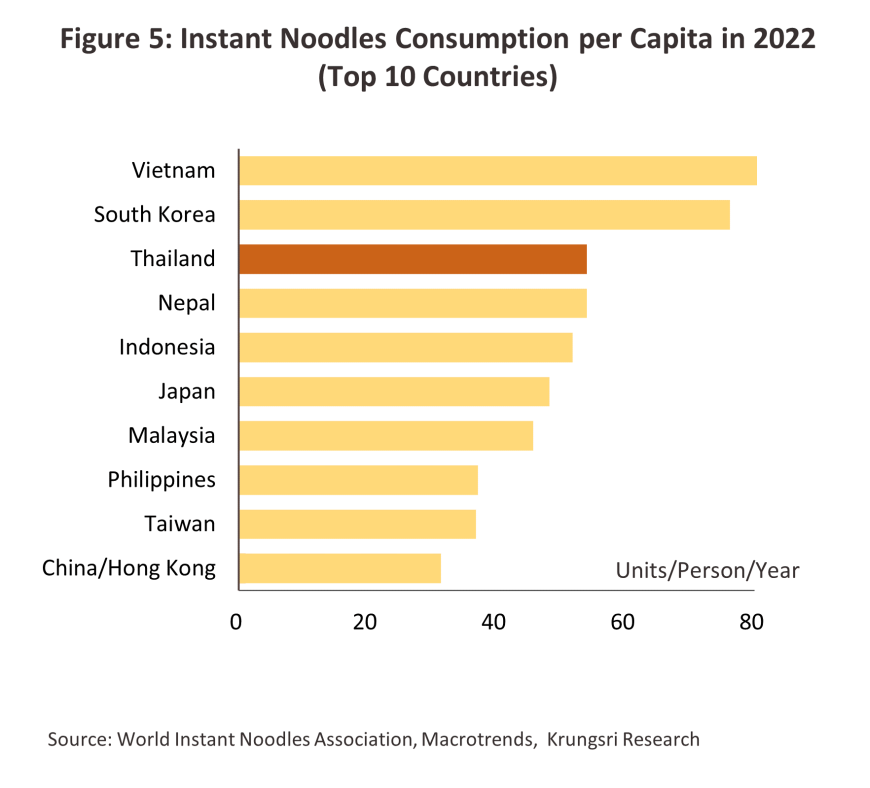

Domestic distribution accounted for 61.6% of sales volume, or a total of 142.2 thousand tonnes. This reflects the importance of Thailand to world markets, with the country’s total consumption of 3.87 billion servings sufficient to place it 9th in the overall world rankings. However, per capita consumption of 54.0 servings per person per year raises Thailand to 3rd place in the world, equal with Nepal and behind only Vietnam (86.4 servings per person per year) and South Korea (76.2 servings per person per year). This compares to average annual global consumption of 15.2 servings per person (Figure 4 and Figure 5).

-

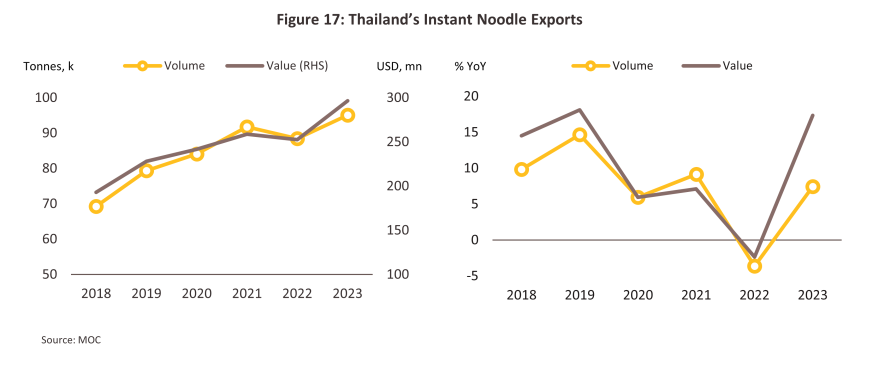

Exports totaled 88.5 thousand tonnes, or 38.4% of sales volume, and this then brought in income of USD 252.5 million, or 32.0% of all receipts from the sale of instant noodles. In 2022, economic weakness in the important export markets of Cambodia and Myanmar undercut consumer spending power and so in the year, exports contracted -3.6% by volume and -2.4% by value.

-

Domestic competition on both price and serving size was intense in the period, especially for products sold in pouches since these are best considered a fast-food product, which manufacturers market through a combination of pricing strategies and the rolling development of new product lines. These goods are targeted at low to mid-income earners that have limited purchasing power, though as they shift their focus to younger consumers with higher spending power, producers are increasingly developing higher priced premium instant noodles that trade on the novelty of their flavors and the quality of their ingredients and packaging.

-

Production costs have moved with fluctuations in the price of wheat because the latter accounts for some 50-80% of the cost of inputs (the wheat has to be imported). As a determinant of overall costs, wheat is followed in importance by palm oil and flavorings. Moreover, prices for instant noodles are controlled by the Department of Internal Trade and so manufacturers have only limited room within which to pass higher costs on to end consumers, and so the rising cost of wheat put downward pressure on manufacturers’ profitability through 2022.

Ready-to-eat Cereals

-

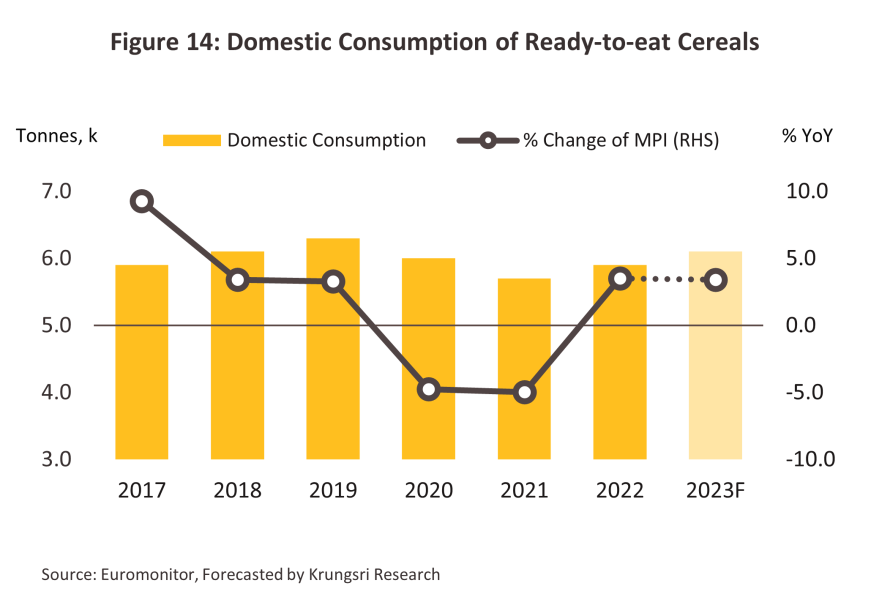

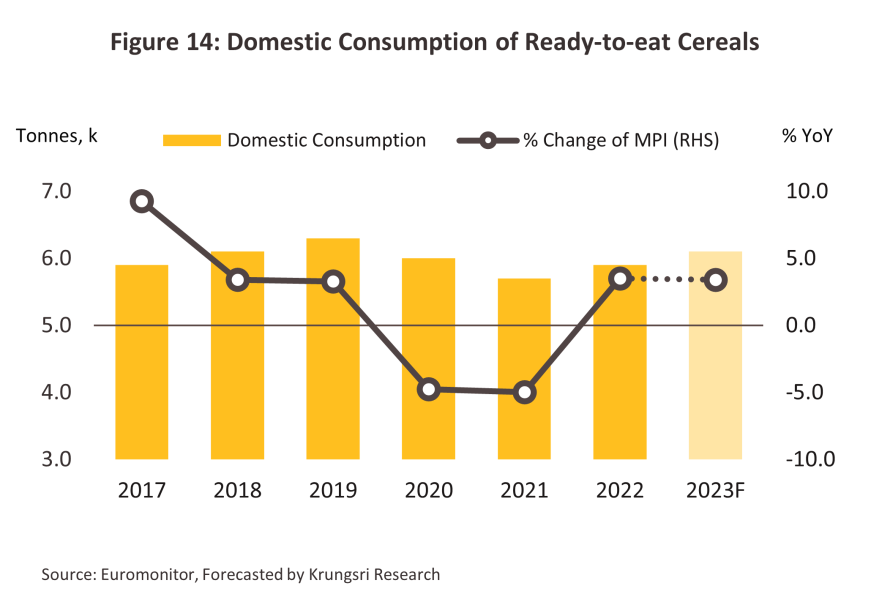

Domestic sales of cereals generated USD 69.4 million in receipts. The market is dominated by a small number of companies, with Nestle’ (Thai) Co.,Ltd. (Koko Crunch, Honey Stars, Fitnesse, and Milo brand), European Snack Food Co.,Ltd. (Copp brand), Brunchtime Co.,Ltd. (Diamond Grains brand), and Kellogg’s (Thailand) Co.,Ltd. (Kellogg’s brand) holding a 69.5% share by value of the domestic market for cereals. These companies manufacture products from a range of raw materials, including corn (cornflakes), wheat (wheat flakes), oats (oatmeal), rice and granola. Overall consumption of these products increased by an average of 1.5% per year over 2017-2022, with demand growth driven by the accelerating pace of life and consumers’ preference for foods that are quick and easy to prepare, especially for breakfast.

-

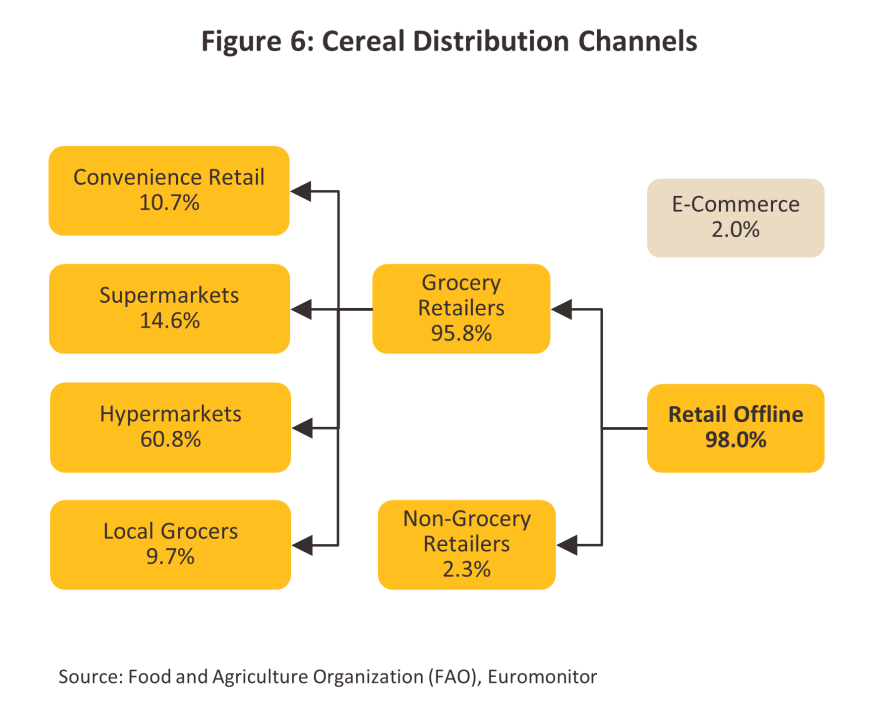

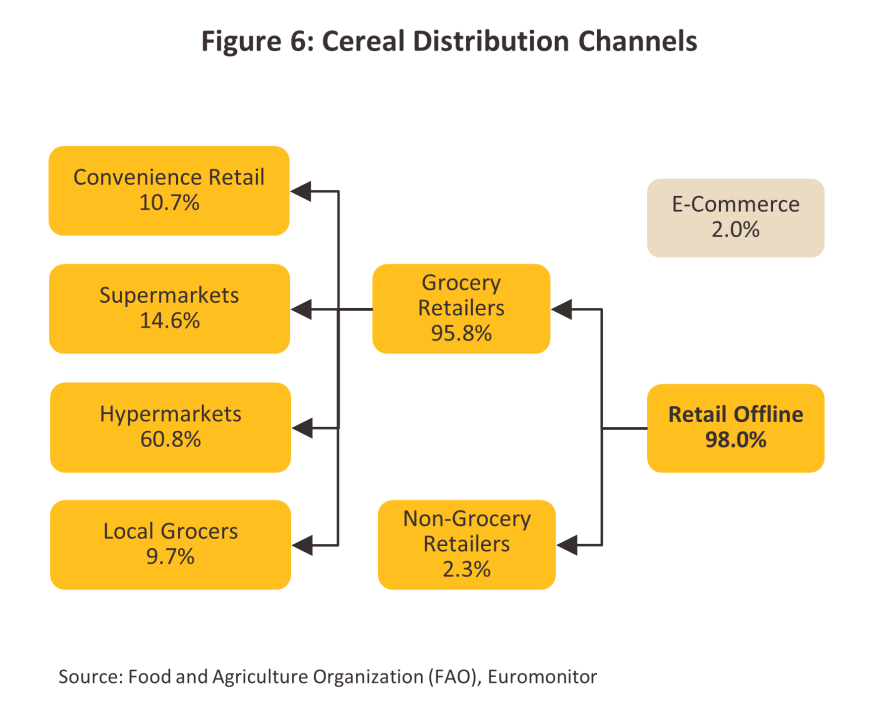

The quantity of cereals distributed domestically is relatively slight, and so the Thai market accounted for just 7.4% of total sales, or some 5.9 thousand tonnes. Rising consumer concerns with personal health have shaped the local market, and manufacturers have responded to this by developing a steady stream of new products, some of which are sold in small easy-to-carry serving sizes that are suitable for snacks or single meals. In the year, 75.4% of cereals sold to the domestic market were distributed through modern trade outlets, making these substantially more important than distribution through either convenience stores (10.7%) or local grocers (9.7%) (Figure 6).

-

Export markets absorbed 73.9 thousand tonnes of Thai cereals, or a full 92.6% of total sales volume, which then provided manufacturers with income worth USD 223.7 million, or 76.3% of all receipts from the sale of cereals. By volume and value, exports jumped by respectively 11.5% and 8.0% in 2022 on growth in the major markets of Australia and the US. Sales into these countries benefited from high inflation, which undercut spending power and encouraged consumers to switch to lower-priced goods.

-

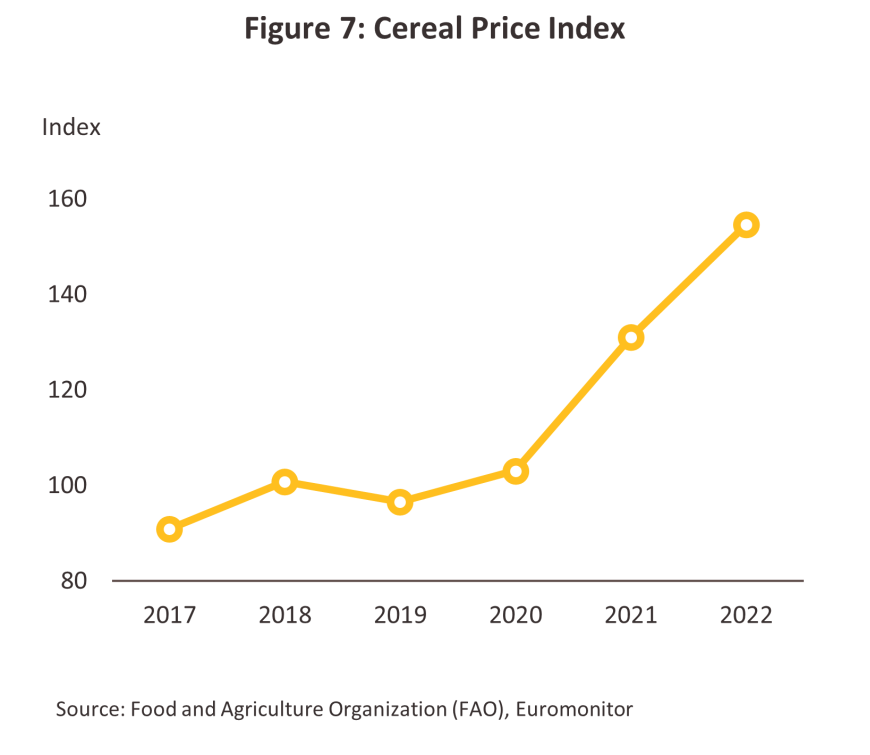

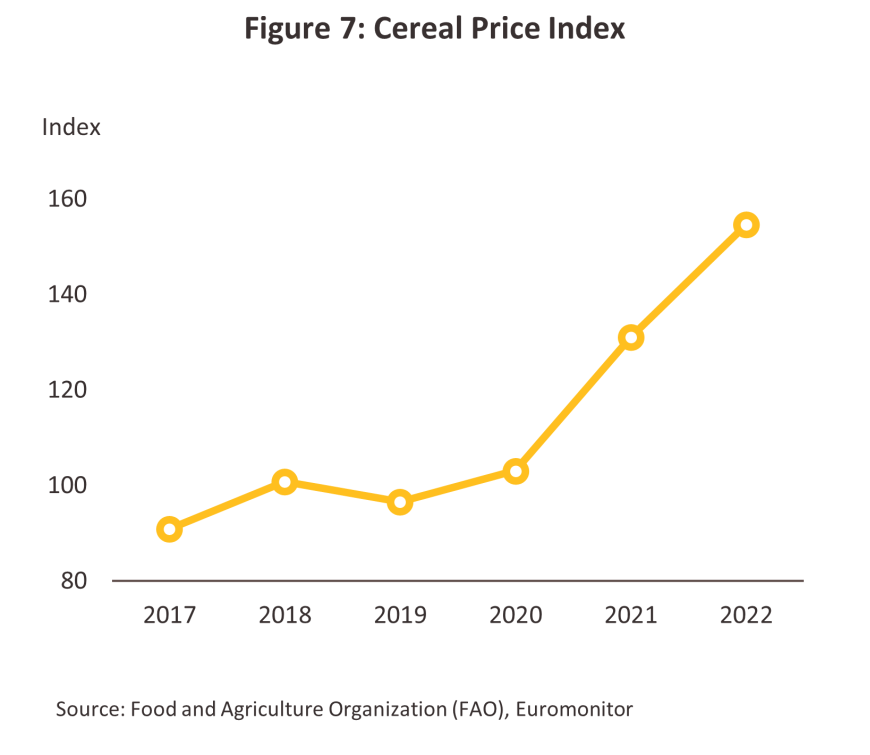

Production costs for manufacturers of ready-to-eat cereals are determined by the cost of their primary input, i.e., cereal crops such as wheat or barley, most of which are imported into Thailand. With a 48.6% market share, Australia is the main source of these, but thanks to the creation of the ASEAN-Australia-New Zealand Free Trade Area (AANZFTA)11/, these may be brought into the country with zero tariffs. Nevertheless, over 2021 and 2022, global cereal costs surged 22.5% annually (Figure 7), adding to production costs and pushing up prices for ready-to-eat cereal products.

Ready Meals

-

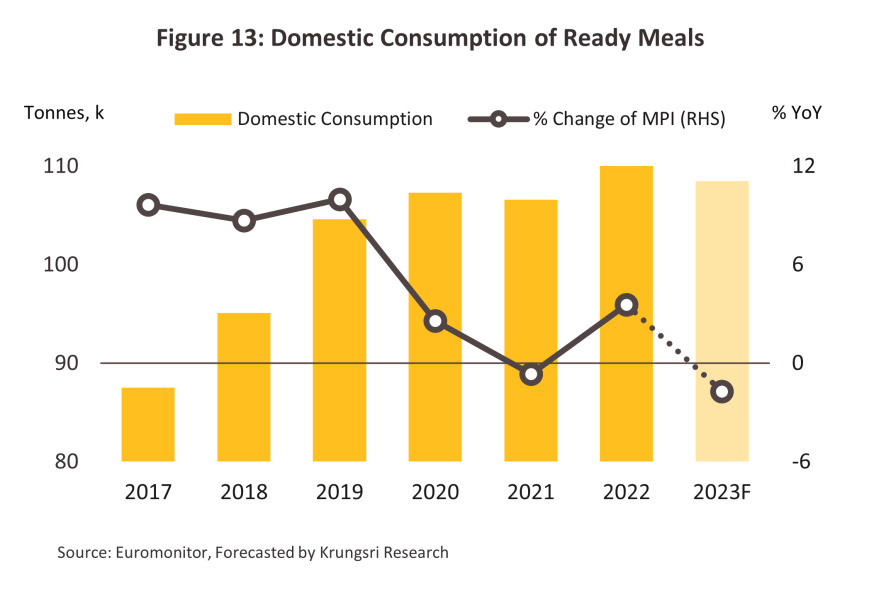

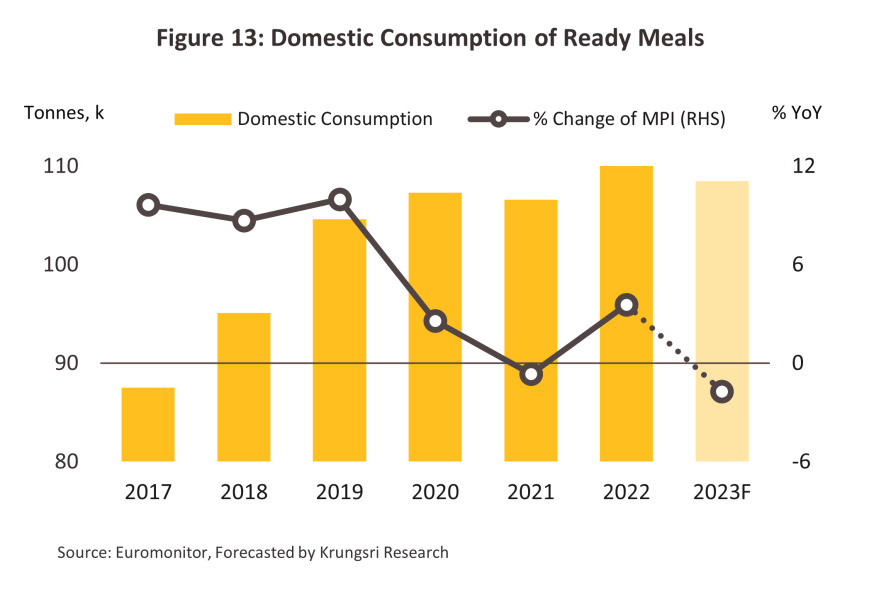

Domestic sales of ready meals were worth USD 660.2 million, most of which went to five major producers: Charoen Pokphand Group (Ezygo, 7Fresh, EzyChoice, CP, and Jade Dragon brand), Surapon Foods PCL.(Surapon brand), Unilever Thailand Group (Knorr brand), S&P Syndicate PCL. (Quick Meal brand) and Thai Agri Foods PCL.(Little Chef brand), which together have an 87.5% market share by value. Ongoing urbanization and the increased preference shown by urban consumers for easy to prepare foods drove a 5.6% annual increase in consumption of ready meals over 2017-2022, and this process will likely be accelerated by the post-pandemic rebound in economic activity. In addition, these goods are distributed through convenience stores that operate extremely extensive national branch networks, making ready meals very easy to buy, while manufacturers have also developed a broad range of dishes covering Thai, Chinese, Japanese and Italian cuisines.

-

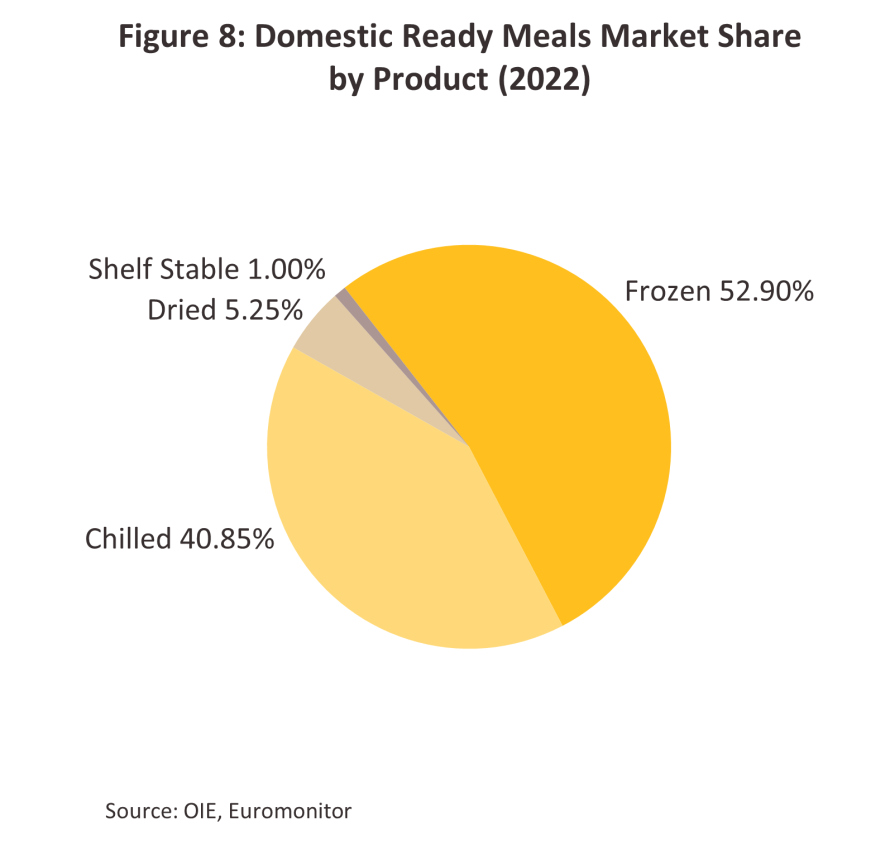

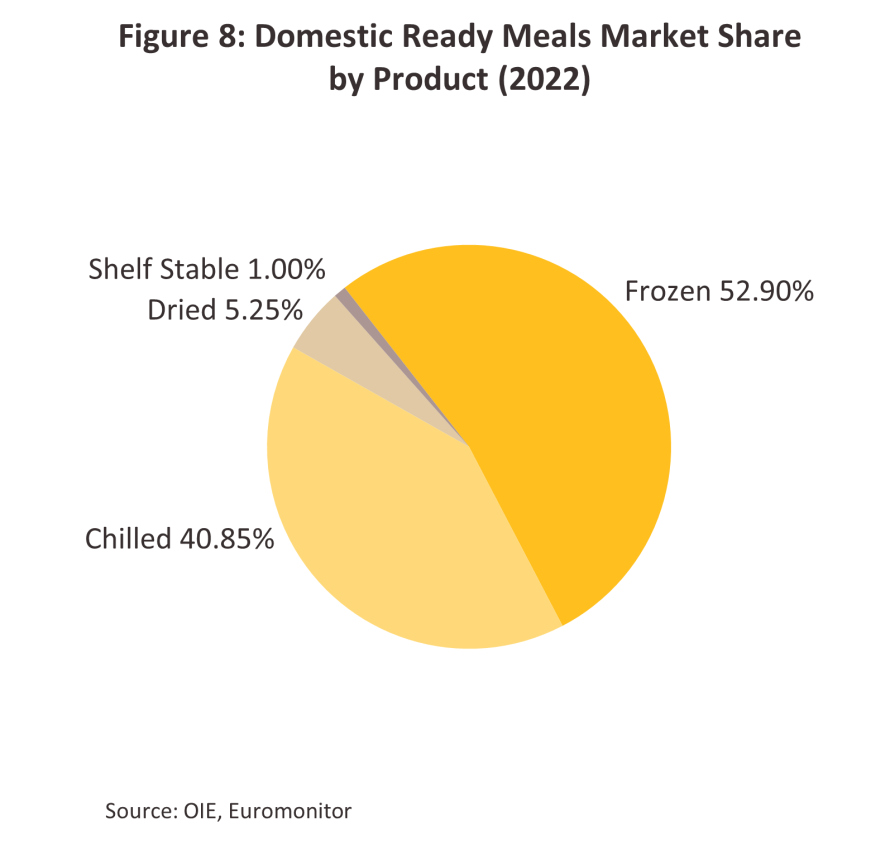

The domestic market accounted for 65.9% of sales volume, or 110.4 thousand tonnes of products. The market leaders generally operate their own distribution networks, which makes it relatively easy for them to get their products in front of the public. This also helps manufacturers to generate economies of scale, which in turn allows producers to sell goods at price points that are close to those set in markets generally, though they also periodically run additional promotions to further attract consumers. Sales are overwhelmingly of chilled and frozen meals, which represent 93.8% of all ready meals distributed to the market (Figure 8).

-

34.1% of all ready meals (or 57.1 thousand tonnes) were distributed to overseas markets, and this generated receipts worth USD 217.2 million, or 24.8% of all income from the sale of ready meals. Exports were thus up by respectively 2.6% and 3.7% from their 2021 level, helped by stronger sales into Europe, where consumers looked for foods that could be stored at home during the pandemic but that were also convenient to prepare.

-

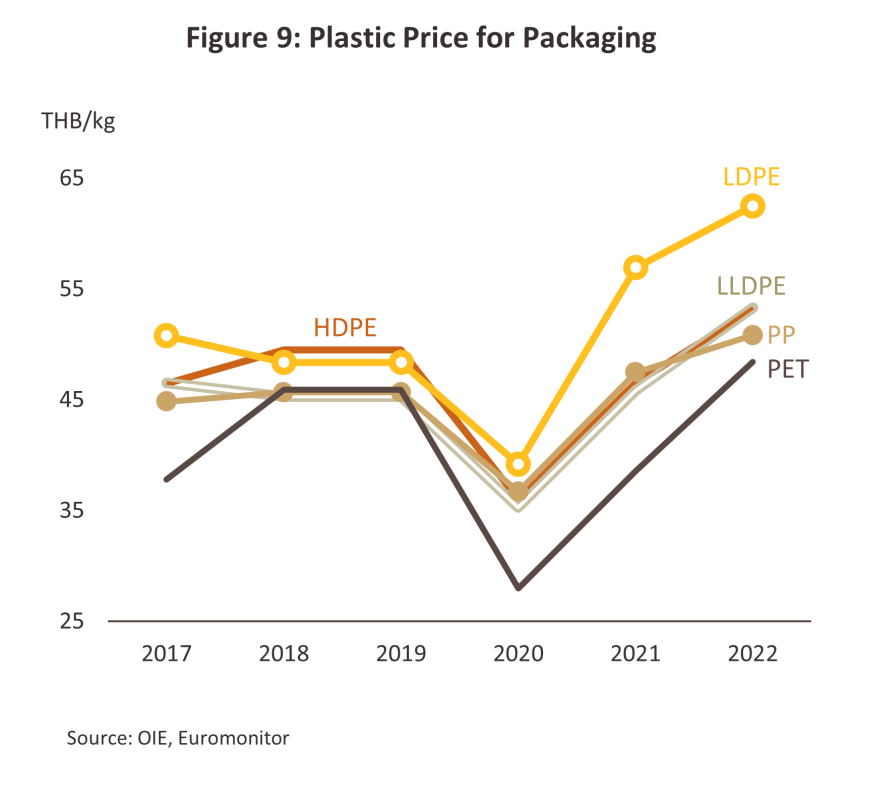

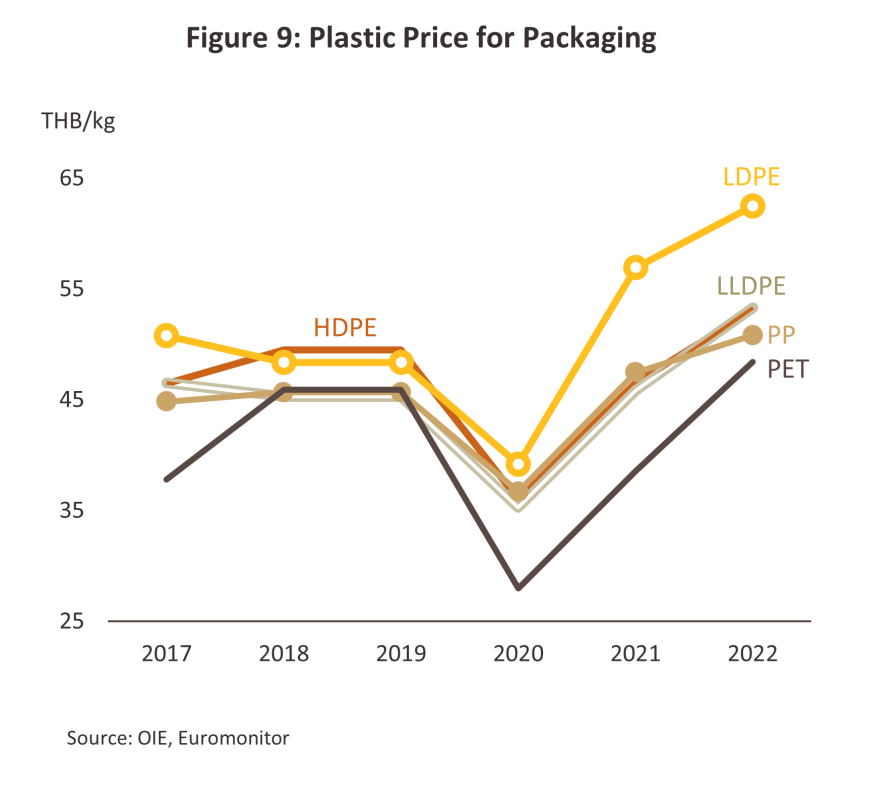

Production costs are largely determined by the prices of the wide range of agricultural inputs and flavorings used in production, though because these tend to be sourced domestically, manufacturers are exposed to only a limited risk that prices for these will become volatile or that supply shortages will emerge. Moreover, manufacturers can adjust output across the year to take account of seasonal changes in the crops that are available on the market. However, ready meals are generally packaged in plastic, and so producers may see costs for the latter move with volatility in global oil markets (Figure 9).

Instant and shelf-stable soups

-

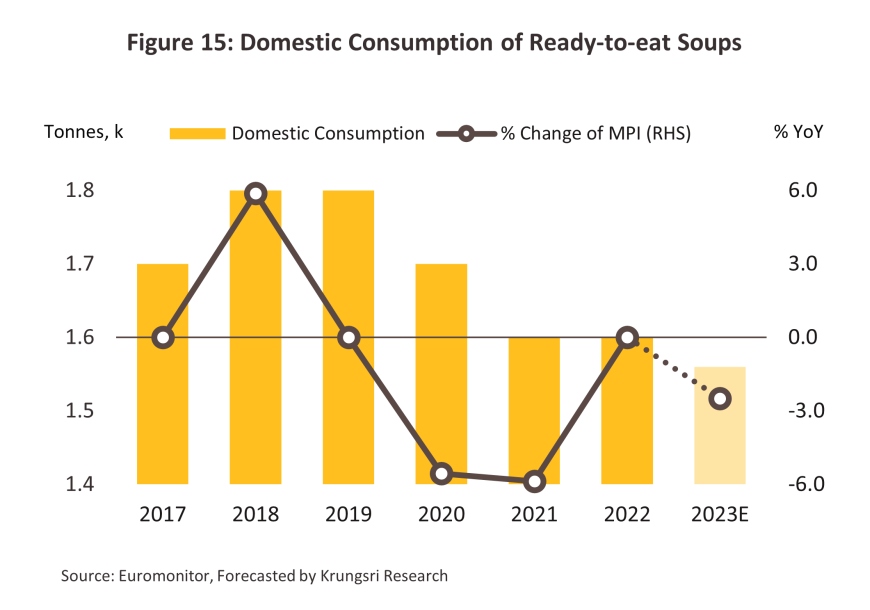

The domestic market for instant and long-life soups was worth USD 10.5 million in 2022, and this is dominated by a combination of Sino-Pacific Trading (Thailand) Co.,Ltd. (Campbell’s brand), Jim’s Group Co.,Ltd. (Lady Anna brand), and River Kwai International Food Industry Co.,Ltd. (River Kwai brand), which together account for 76.1% of the market. However, overall consumption contracted by an average of -1.0% annually over 2017 to 2022 as domestic buyers shifted to a preference for soups that are clear, prepared from fresh ingredients and/or promise greater health benefits. This contrasts with ready-to-eat soups, most of which are creamed products that are preferred by only a small number of shoppers looking for convenient, easy to prepare foods.

-

1.6 thousand tonnes of instant and long-life soups were distributed domestically in 2022, or 35.7% of all sales volume. These are relatively high-priced premium products and so the domestic market remains somewhat limited. Sales are thus dependent on a fairly narrow consumer base.

-

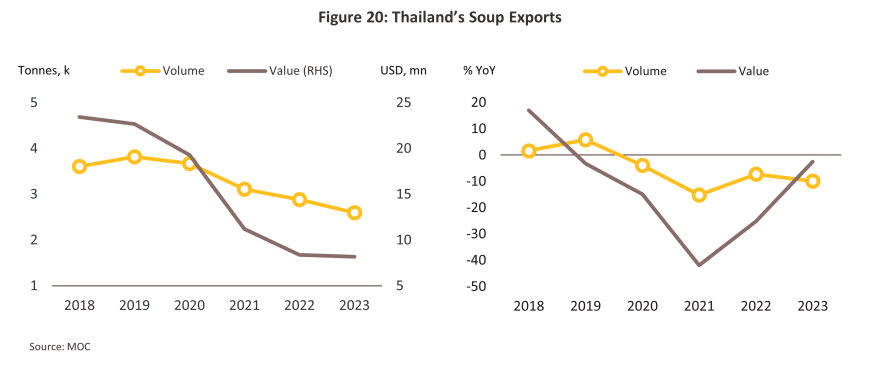

Exports totaled 2.9 thousand tonnes in 2022, or 64.3% of total sales instant and long-life soups, and this then generated receipts worth USD 8.4 million, or 44.4% of all income from the distribution of instant and long-life soups. However, in 2022, exports slumped -7.3% by volume and -25.2% by value following a campaign in South Korea (Thai players’ main export market) encouraging consumers to cut back on their consumption of high-sodium foods.

-

Production costs have risen. These are largely attributable to: (i) the ingredients used in the preparation of the soup, including artificial cream and flavorings, prices of which have risen; and (ii) packaging, for which prices have tracked increases in the cost of energy.

Situation

The domestic market for ready-to-eat food products

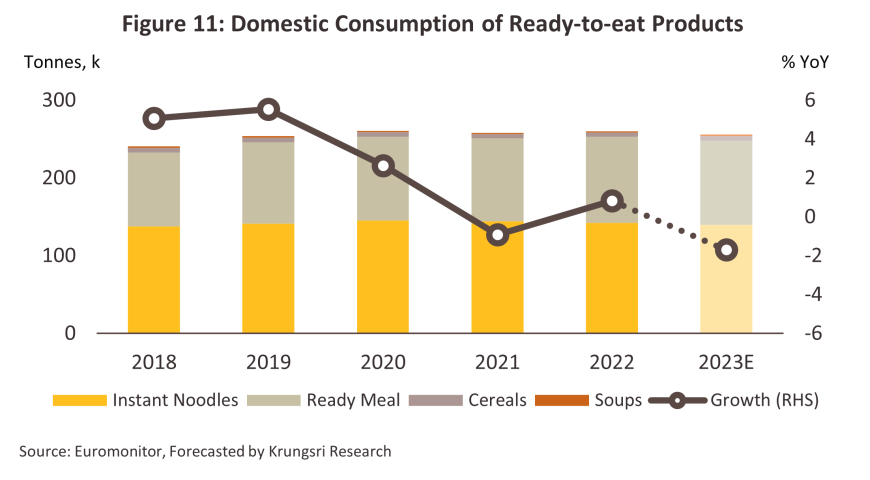

The volume and value of ready-to-eat foods distributed to the domestic market increased by respectively 0.8% and 7.5% in 2022. Consumption patterns were influenced by a range of factors including long-term trends that are increasing rates of urbanization, which pushes consumers to shop for foods that are quick and easy to consume, while over the shorter term, the ongoing spread of COVID-19 encouraged individuals to avoid crowded spaces such as markets and shopping centers and instead to buy ready-to-eat food distributed through convenience stores. Consumers also responded to the pandemic by stepping up their purchases of foods with a long shelf life. However, the abating of the crisis in 2023 precipitated another change in behavior, and as consumers returned to eating out in restaurants and spending as normal, demand for ready-to-eat foods softened. Thus, overall domestic consumption of ready-to-eat products is expected to have shrunk by between -1.0% and -2.0% through 2023. The situation with individual product groups is given below.

-

Instant noodles: By volume, distribution to the domestic market contracted -1.3% in 2022, but by value, this rose 7.5%. Sales were troubled by the rise in the price of key inputs, and in particular by the combination of the outbreak of war in Ukraine, which stoked fears over food security, and problems with global supply chains, and these factors then triggered a 24.3% increase in the cost of wheat flour and a 38.5% jump in that of wheat. This then forced manufacturers to raise their prices, eroding demand from the core market of lower- to middle-income earners. Sales have continued to slide through 2023, and as a result of the ending of the pandemic, the rebound in economic life, and the reopening of restaurants to normal service, consumers have returned to their pre-pandemic eating out habits. Given this, domestic distribution is forecast to have contracted by another -1.5% to -2.5% in 2023. Manufacturers also have to contend with the fact that prices for their goods are controlled by the government and so it is not possible for companies to respond to continuing increases in the cost of inputs by immediately hiking their prices. Instead, producers will tend to respond to rising costs by diverting output away from domestic consumption and towards export markets.

-

Ready meals: Domestic distribution rose 3.6% by volume and 7.6% by value in 2022 thanks to two primary factors. (i) The continuation of the COVID-19 pandemic forced consumers to spend much longer at home than normal. At the same time, access to food was restricted, and in response, households tended to stock up on ready meals since these are sold through convenience stores and so can be bought easily across the country. (ii) Manufacturers have responded to increased worries about personal health and wellness by developing new plant-based products. However, despite continuing urbanization, the acceleration in the pace of life, and greater access to ready meals, domestic consumption is expected to have shrunk by between -1.0% and -2.0% in 2023. This is because post-pandemic life has largely returned to normal and consumers now have a wider range of food choices, including dining-in in restaurants or utilizing food delivery application services, and given this, demand for ready meals has weakened.

-

Ready-to-eat cereals: By volume and value, domestic distribution expanded by respectively 3.5% and 7.5% in 2022. As with other segments of the market, demand benefited from both the continuation of the pandemic and the need to store food at home, and from increasing concerns with personal health, which is encouraging consumers to buy foods with a healthier brand appeal. Sales growth has continued into 2023 and for the year, consumption is expected to be up by another 3.0-4.0%. Worries about personal health continue to buoy the market, while manufacturers have sharpened the impact of their products’ appeal through more health-conscious marketing, for example by releasing low sodium, reduced sugar, and high fiber products (the latter increases feelings of fullness). Cereals also serve as favored foods for snacks or when individuals are in a rush, and this aspect of their appeal has benefited especially from the return to school of children, with the move to sell products in small, single-serving sizes amplifying their appeal to the student demographic.

-

Instant/long-life soups: By volume, sales were unchanged in 2022, but by value they edged up 4.7%. Sales growth is limited by the narrow appeal of these products and their high cost relative to making soup oneself or buying it from a restaurant, and so by volume, sales were unchanged in the year, although the higher cost of raw materials and packaging pushed up prices. For 2023, the return to dining-in in restaurants and rising interest in freshly prepared food will drag on sales, and so these are expected to have fallen by between -2.0% and -3.0% in the year.

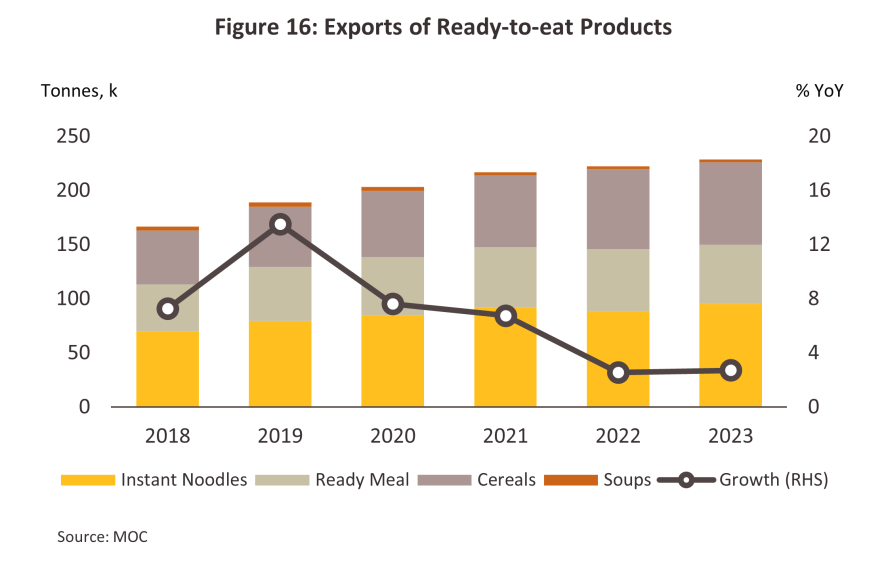

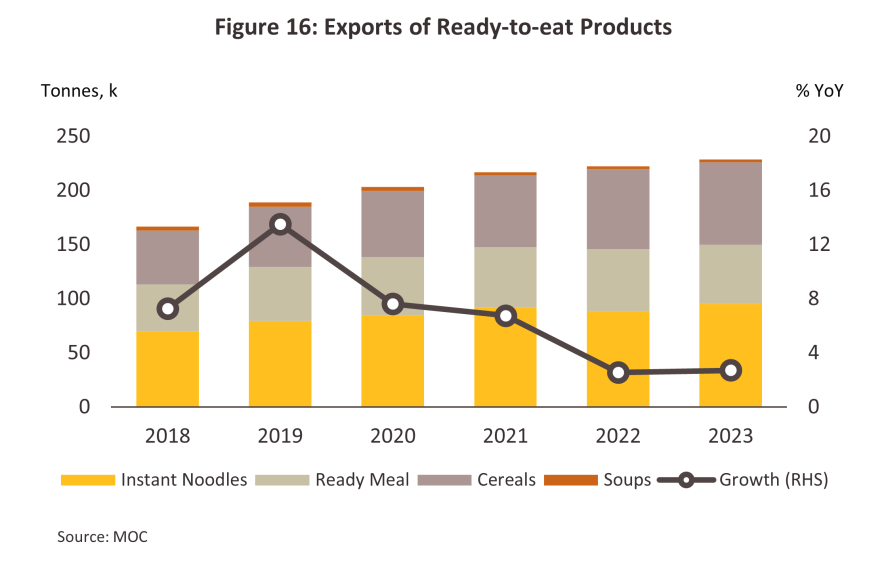

Exports of ready-to-eat food

Exports of ready-to-eat food products grew 2.5% by volume in 2022, with growth in value falling slightly behind at 2.3%. The extension of the war in Ukraine restricted the supply of grain to world markets and because of this, global worries over food security deepened. In response, trade partners stepped up imports of ready-to-eat products from Thailand, which, because manufacturers are able to source the majority of inputs from domestic suppliers, enjoy relatively low prices and this then gives them a competitive advantage on global markets. Thai players further benefit from the free trade agreement signed with Australia and New Zealand. These countries contribute a significant share of the raw materials that Thai manufacturers rely on, and under the agreement, these materials can now enter the country with zero tariffs, further lowering production costs. Those factors continued to support the export volume of ready-to-eat food to increased at 2.7% by volume and 8.4% by value for all of 2023. The situation for individual product groups is described below.

-

Instant noodles: Exports softened through 2022, slipping -3.6% by volume and -2.4% by value, though this was largely explained by the -17.1% slump in sales to Cambodia, where buyers switched to sourcing low-cost goods from Indonesia12/. However, in 2023, exports expanded by 7.4% by volume and 17.3% by value. Growth was especially strong in the important market of the Netherlands (+29.7%), where Thai food is becoming increasingly popular13/, though this trend has also been accelerated by the rising cost of living and the need to switch to cheaper foods, such as instant noodles14/.

-

Ready meals: Exports of ready meals strengthened in 2022, ticking up 2.6% and 3.7% by volume and value respectively. Sales received a major boost from the 124.0% surge in orders from Japan, where the continuation of the COVID-19 pandemic added to demand for ready meals to eat at home. For all of 2023, ready meals export contracted -4.1% by volume and -0.9% by value. Sales have been hampered by a variety of factors, including the high price of ready meals compared to other ready-to-eat products, creating a disadvantage in competition, particularly during a high-cost-of-living situation. In addition, consumer life has returned to normal, and consumers are increasingly eating out again, undercutting demand.

-

Ready-to-eat cereals: Overseas sales of cereals rose 11.5% by volume and 8.0% by value in 2022 thanks to increased demand in the major markets of Australia (+19.0%) and the US (+60.7%). Higher sales were driven by rising inflation, which eroded spending power and encouraged consumers to increase purchases of cheaper foods, such as cereals. In addition, Prices of Thai products are attractive to consumers and thus remain competitive on world markets, despite prices increasing 4.8% to an average of USD 3,173 per tonne through the whole year of 2023. Exports thus slightly increased 2.7% by volume and 7.7% by value during that period. Growth was particularly strong in the US market (+11.3%) due to the ongoing cost-of-living crisis and continuing demand for cheaper food. Consumers are also increasingly more health-conscious, driving more demand for grains and cereal. However, Thai exporters are having to contend with tougher market conditions now that shipments of grain from Ukraine have resumed15/, and with this entering markets in the EU, exports of Thai products to Europe have dropped -11.2%.

-

Instant/long-life soups: Exports performed poorly in 2022, slumping -7.3% by volume and -25.2% by value. Declines were driven by the crash in exports to Hong Kong (-56.8%) and South Korea (-13.4%), where public health campaigns have encouraged consumers to cut back on the consumption of high-sodium foods such as instant noodles and ready-made soup. The increased concern with personal health also caused shoppers to turn to low-sodium and low-sugar foods16/. These factors continued to affect sales through all of 2023, and so exports dropped -9.9% by volume and -2.5% by value in the period. In addition to worries over sodium consumption, households have also turned back to freshly cooked food, further undercutting sales of instant and long-life soups.

Outlook

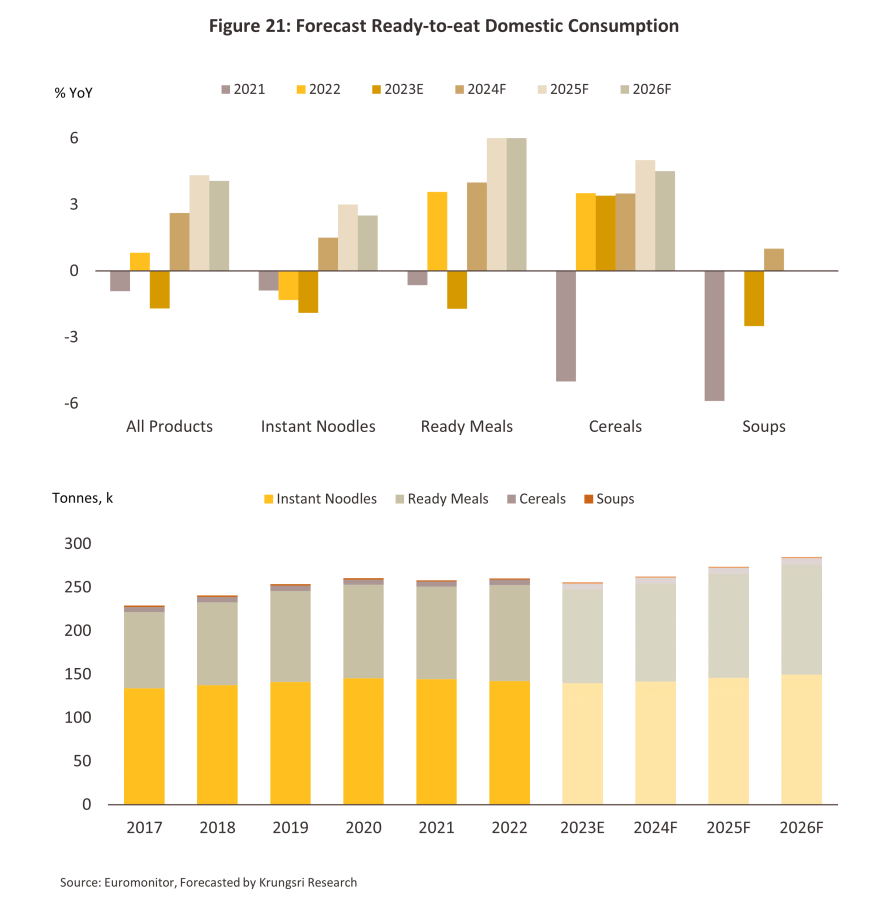

The domestic market for ready-to-eat food, the sales volume is forecasted to grow at an average rate of 3.0-4.0% annually. By product group, annual growth will come in at: (i) 2.0-3.0% for instant noodles; (ii) 5.0-6.0% for ready meals; (iii) 4.0-5.0% for cereals; and (iv) 0.0-1.0% for instant and long-life soups. This outlook will be supported by several factors. (i) A steady uptick in economic activity is lifting consumer spending power. (ii) Rates of urbanization are increasing, and this is then bringing consumers within the reach of ready-to-eat foods’ primary distribution channels of convenience and department stores, while the role of the internet in marketing and selling goods is also rising. (iii) Manufacturers are responding to changing consumer preferences by developing new health products, including plant-based proteins, low-sodium foods, MSG-free products, and products made from healthier ingredients. (iv) Ready-to-eat foods are easy to prepare and consume, are viewed as being both tasty and well-made, and are priced at a level that makes them competitive with food from general restaurants, though periodic promotions lower prices even further, and this makes them a good match for contemporary, fast-paced, and time-poor lifestyles.

,

split between annual increases of: (i) 6.5-7.5% for instant noodles; (ii) 4.0-5.0% for ready meals; (iii) 3.5-4.5% for cereals; and (iv) 0.5-1.5% for instant and long-life soups. Growth will be driven by: (i) the combination of only slow economic growth and high levels of inflation in the main overseas markets, which will add to demand for cheaper ready-to-eat foods; (ii) the fast pace of modern life and better access to both online and offline distribution channels; (iii) demographic change in the main export markets (i.e., the US and the EU) that is reducing household sizes and increasing the number of people living alone, which in addition to the aging of society17/ is shifting consumer behavior away from buying raw ingredients and preparing food oneself and towards purchasing food in single serving sizes. However, drought in Thailand and other countries may impact the cost and supply of agricultural products as raw materials, and with manufacturing supply chains potentially disrupted, sales growth may be limited.

Challenges

-

More extreme weather will likely: (i) trigger drought in Thailand and in other major agricultural producing regions, which will then cut yields and push up costs of raw materials; and (ii) raise sea surface temperatures, cutting yields from aquaculture and fishing. Those factors will negatively impact outputs and prices of raw materials along the industry supply chain.

-

Governments in Thailand and overseas are encouraging the public to reduce their sodium intake. This is partly in response to the campaign by the World Health Organization (WHO) to cut mortality from excess sodium. The WHO hopes to bring this down to the recommended maximum of 2,000 milligrams (or 5 grams of salt) per day (consumption of Thai population currently averages 10.8 grams per day per person)18/. To accelerate the impacts of this, a salt tax may be introduced by Thai government in the future19/, and as pressure on growth in the market for ready-to-eat food rises, manufacturers will need to adapt.

-

The global health and wellness trend has led consumers to increasingly choose nutritious foods. Consumers now consider the nutritional content when purchasing food, emphasizing products with quality certifications. This is a cost for producers in elevating their products to meet standards.

-

Increasing concerns over environmental and sustainability factors20/, especially for The European Union that has implemented measures to promote recycling in packaging, aiming to achieve a minimum of 75% recyclable packaging by 2030, are pushing pressure on some products in the European market to carry recyclable labels, aiming to attract environmentally conscious customers and comply with EU regulations.21/

-

The risk of worsening geopolitical tensions and an extension to armed conflict, would add to overheads related to transportation and packaging.

1/ Sterilization involves heating a product to hotter than 100 degrees Celsius. This eliminates all bacteria in the food, thereby extending the shelf-life of the product and allowing it to be stored at room temperature (source: technosoft.eu).

2/ Pasteurization involves heating a product to lower than 100 degrees Celsius. This eliminates some bacteria in the food, This results in a shorter shelf life compared to sterilization methods, and the product needs to be stored at lower temperatures (source: technosoft.eu).

3/ Ready-to-eat meals and instant soup with a long shelf life.

4/ A retort pouch is a kind of soft, flexible packaging that is resistant to heat, light, and water, but which can be placed in a microwave or in boiling water to allow consumers to easily reheat its contents (source: Office of Industrial Economics).

5/ Manufacturers typically use packaging made from crystallized polyethylene terephthalate (CPET). This is made from PET and has the advantage of being cheap to produce but of tolerating temperatures between -40 and 220 degrees Celsius (source: Office of Industrial Economics).

6/ HS Code: 19023040

7/ HS Code: 1904

8/ HS Code: 190220,19023020, 19023030, 19023090, 190240

9/ HS Code: 21042019, 21042099

10/ Manufacturers of ready-to-eat food are defined as those that produce: (i) frozen pre-cooked foods; (ii) vacuum-packed ready-to-eat foods; (iii) soups and specialty foods; or (iv) instant and fully-prepared starch-based foods (source: Department of Business Development).

11/ As a result of signing the ASEAN-Australia-New Zealand Free Trade Agreement, since 2012, Thai companies have been able to import cereal crops from Australia and New Zealand without having to pay import duties (Source: Department of Foreign Trade).

12/ In 2022, export prices for Thai instant noodles averaged USD 2,856/tonne, compared to just USD 1,910/tonne for Indonesian products (source: MOC, Trademap).

13/ Source: Department for International Trade Promotion

14/ Source: USDA

15/ Ukraine is able to export grains by coasting along through Romanian and Bulgarian territorial waters, which because they are NATO members ensures that the ships are safe. In addition, goods are being shipped through the Danube and overland by rail (source: https://kyivindependent.com/).

16/ Source: foodnavigator-asia.com

17/ Source: Eurostat, United States Census Bureau, WHO

18/ Source: https://worldpopulationreview.com/

19/ Source: National Health Foundation, Excise Department

20/ Source: Department for International Trade Promotion

21/ Source: Ministry of Foreign Affairs (Department of European Affairs)

.webp.aspx)