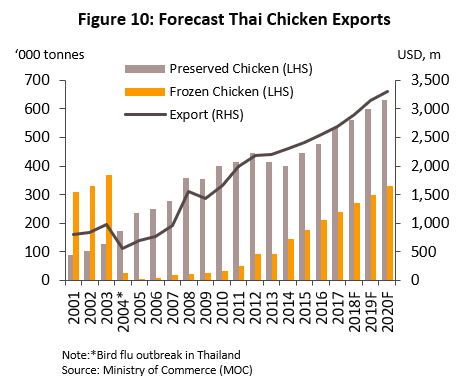

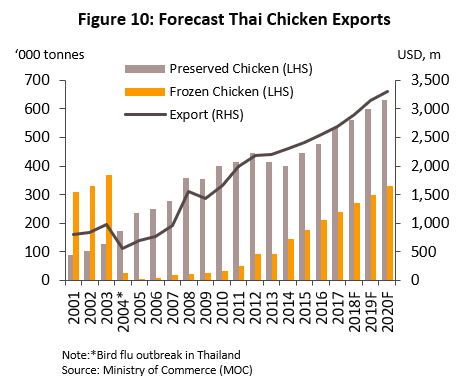

Between 2018 and 2020, the Thai frozen and processed chicken sector is expected to grow on rising demand from international markets. Exports will benefit from (i) the ongoing relaxation of restrictions from trading partners on the import of Thai frozen chicken, (ii) the opening of new markets in Asia and the Middle East, and (iii) the spread of bird flu in flocks in other countries, which will present an opportunity for Thailand to increase its exports of frozen and processed chicken.

Overview

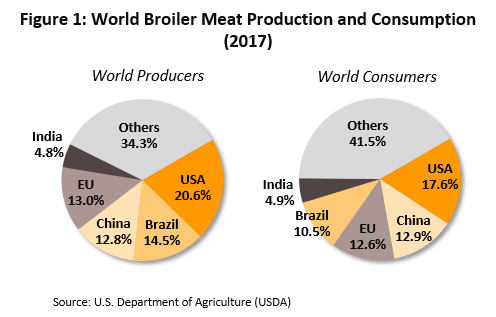

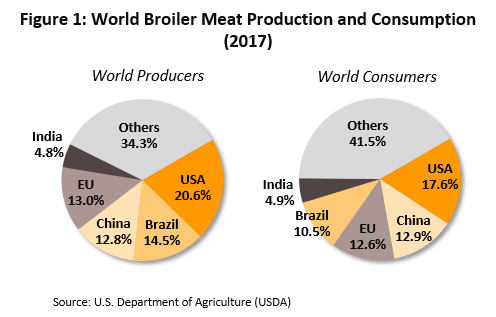

Worldwide, approximately 85-90 million tonnes of chicken is produced annually, with the main suppliers (the United States, Brazil and China) accounting for around half of this output. However, domestic markets consume the overwhelming majority of global production, leaving only 10-15% to be traded in export markets. These exports fall into two main classes: (i) frozen chicken, which includes whole, boned and prepared, and salted chicken; and (ii) processed chicken, which has been cooked or flavored in some way before being chilled or frozen. Products in this second group have greater added value and examples include items such as chicken that has been coated and fried, marinated, or prepared as chicken nuggets or chicken steaks.

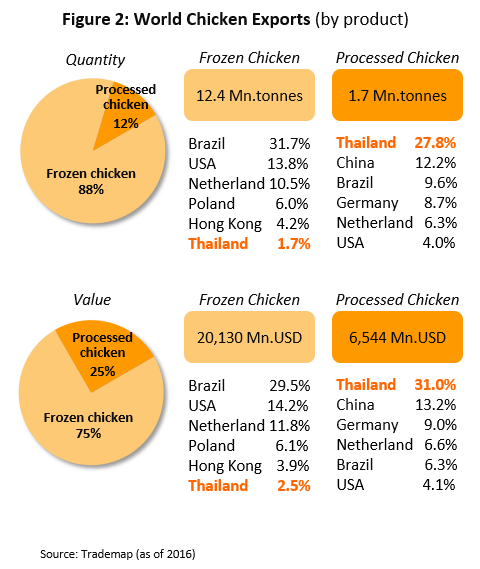

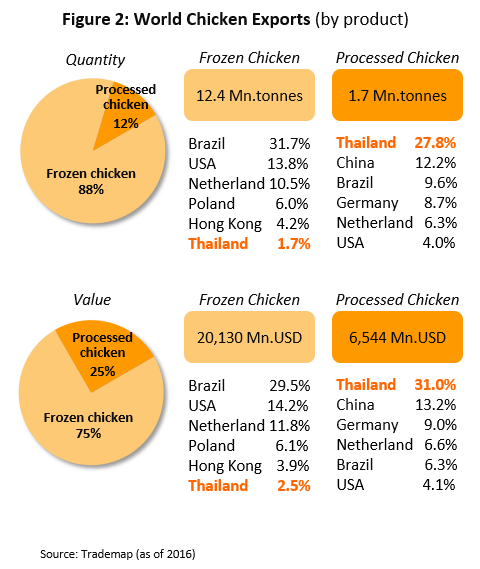

International trade in chicken meat is largely of chilled and frozen goods, which account for 88% of all exported chicken products by weight and 75% by value. The biggest exporter of frozen chicken is Brazil, which exports boned and prepared broilers, accounting for 31.7% of supply to the world market and is followed in importance by the United States and the Netherlands, which tend to focus more on the export of whole frozen items (in western countries, whole chickens tend to be preferred over those which have been boned or prepared). These two countries contribute 13.8% and 10.5% of world exports, respectively. Thailand, which like Brazil exports boned and prepared broilers, is responsible for just 1.7% of global frozen chicken exports. With regard to the market for higher value processed chicken products, these contribute a 12% share of world exports in terms of weight and 25% in terms of value. Here, Thailand is the market leader, providing 27.8% of all global exports of processed chicken by weight. Thailand is followed by China, Brazil, Germany, and the Netherlands, which have a market share of 12.2%, 9.6%, 8.7% and 6.3%, respectively.

As regards imports, no country dominates and even the largest importers contribute only a relatively small share to overall imports. Information from Trademap for 2017 thus shows that Japan was the biggest importer (by weight), taking 7.1% of global chicken imports, followed by Hong Kong (6.0%), Mexico (5.4%), the United Kingdom (5.1%), Saudi Arabia (4.8%), Germany (4.3%), the Netherlands (4.1%), South Africa (3.5%), Iraq (3.1%), China (3.0%), and the United Arab Emirates (2.9%).

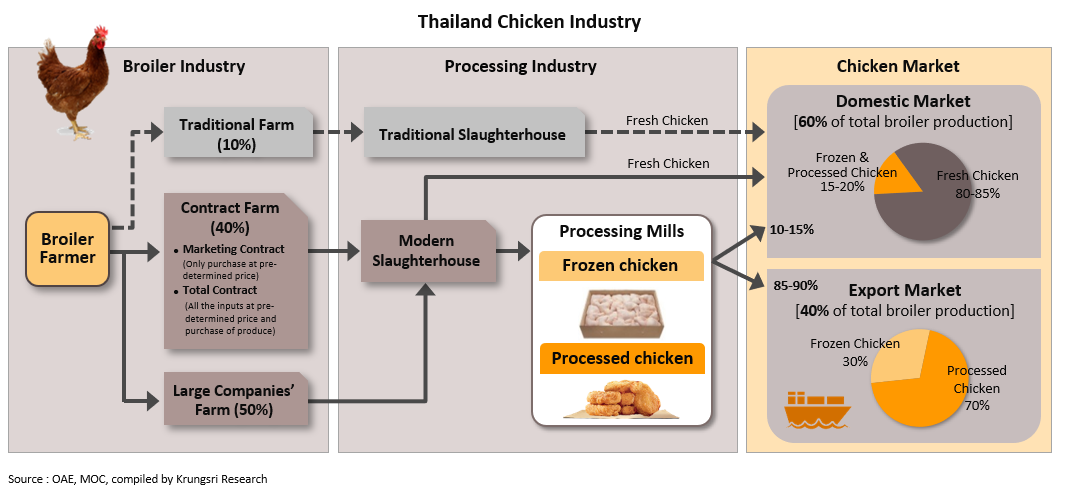

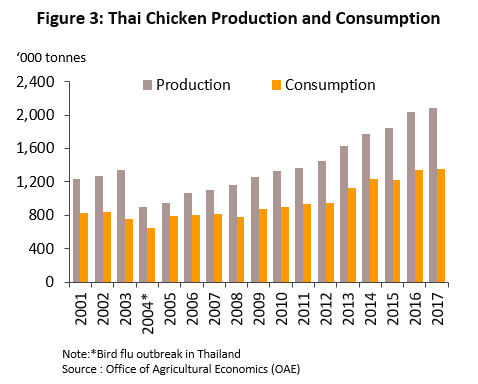

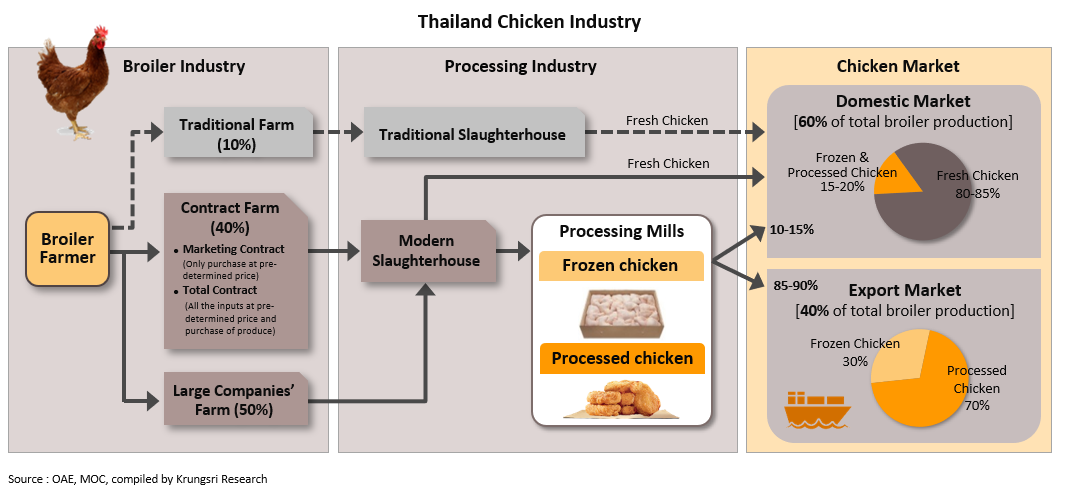

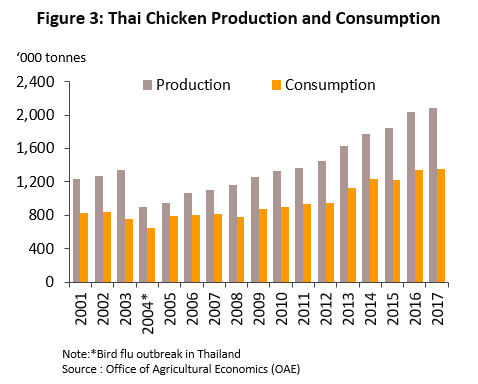

Overall, Thailand sits in 10th place in the rankings of global broiler producers, outputting 2.0-2.1 million tonnes annually, which represents 2% of world output. The domestic market consumes 1.2-1.3 million tonnes of this (around 60% of the total), the majority of which is in the form of raw fresh chicken meat. The remaining 40% of Thai output is used as inputs to frozen and processed chicken industries, the lion’s share is exported and some of the output of these businesses is distributed via modern trade outlets in domestic market.

The structure of the Thai chicken sector

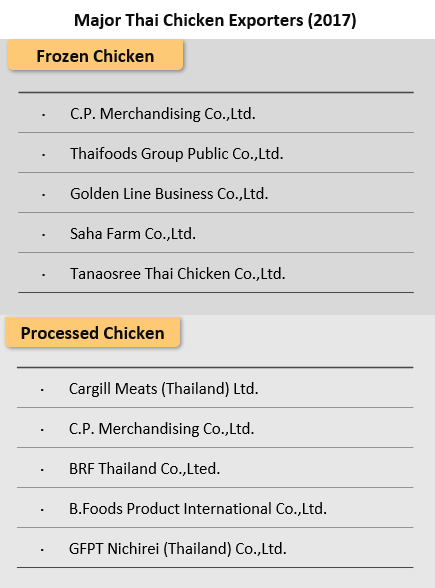

The domestic Thai chicken sector is dominated by seven operators: Charoen Pokphand Foods, Betagro, Sahafarms, Cargill, Thaifoods, GFPT, and Laemthong Industries. These have all invested in operations through the length of the production chain, from animal feed, through farming (both operating their own farms and running contract farming operations with independent farmers) to processing. This enables these players to control costs, to take advantage of economies of scale and to process inputs into value-added products for export.

Farms operated by the major players in the frozen and processed chicken sector account for around 50% of all domestic production and this output is slaughtered and processed for export as boned and prepared, frozen, and processed chicken. On top of this, production by contract farmers1/ (who are on contract to the major frozen and processed chicken producers) contributes another 40%. The bulk of this output is purchased by domestic consumers, whether that be hotels, restaurants, or households, with a smaller proportion going to processing for value-added products. The remaining 10% of national production comes from independent farms which are outside the frozen and processed chicken supply chain. All of their output is therefore sent to smaller slaughterhouses and then on to the domestic market.

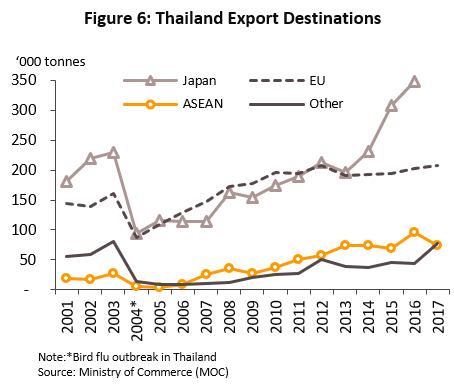

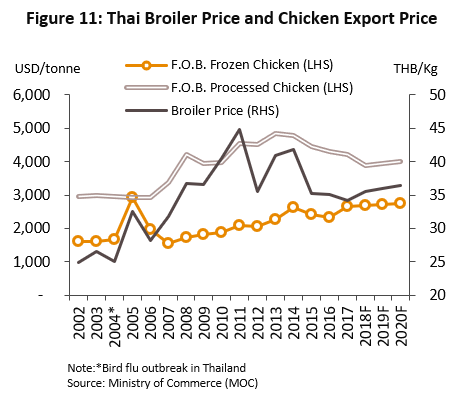

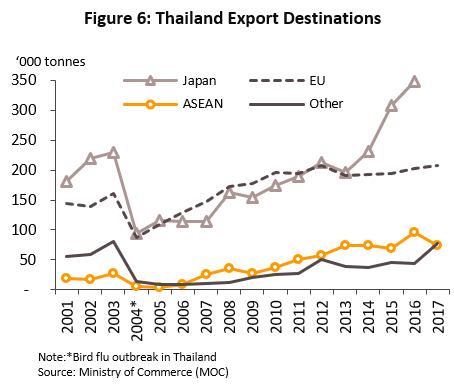

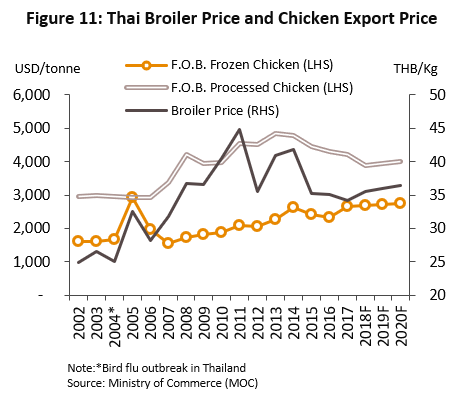

The sector has undergone significant changes since 2004, when Thailand was affected by a major outbreak of bird flu[2]. As a result of concerns over possible infection and thus of the safety of raw chicken originating in Thailand, authorities in some countries placed restrictions on the import of Thai frozen chicken and this had a significant effect of businesses since at the time of the outbreak, frozen chicken represented 75% of all exports of chicken from Thailand by weight. In response to this, Thai producers overhauled their operations to place greater emphasis on the production and output of processed and cooked chicken, the import of which was still permitted[3]. This shift has led to continuing growth in exports and the establishment of processed chicken as the sector’s primary product, which it has remained to the present day.

The situation for exports of frozen chicken from Thailand returned to a more positive state following the abating of the bird flu outbreak. In addition, the development of evaporative air cooling systems (EVAPs)[4]on Thai chicken farms, especially on the farms of the major players and on contract farms which form part of the Thai frozen and processed chicken supply chain, helped to steadily rebuild consumer confidence in Thai products in export markets.

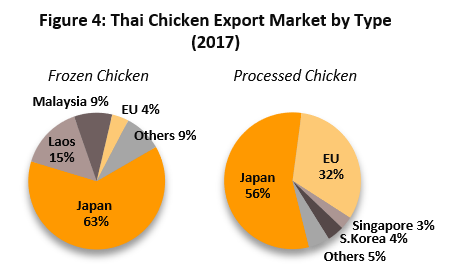

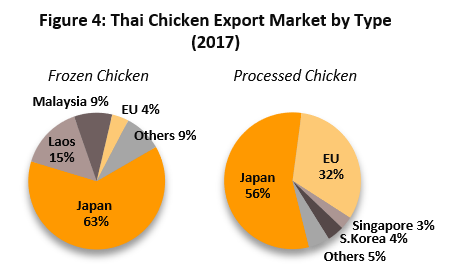

In 2017, exports of chicken from Thailand were split approximately 70:30 between processed and frozen chicken. Japan is the most important export market for both groups; measured by value, Japanese consumers purchase 63% and 56% of all Thai exports of frozen and processed chicken, respectively. Japan is followed in importance by the European Union, which takes mostly processed chicken (the EU buys 32% of all Thai exported processed broilers). Other significant export markets include Singapore, South Korea, Laos PDR and Malaysia. As for competitors in world markets, the main threat comes from Brazil, which is currently expanding into Asian markets (Figure 4).

Situation

Over the past decade, the frozen and processed chicken industry worldwide has suffered from intermittent outbreaks of bird flu and this has caused periodic losses to the industry (Figure 5). However, Thailand has been free of incidences since 2007 and this has presented an opportunity for Thai exporters to steadily expand their markets. As such, exports of frozen chicken returned to a state of growth in 2013, following the relaxation of restrictions by its trade partners on the import of frozen chicken from Thailand. Between 2014 and 2016, exports of Thai frozen chicken grew at an annual rate of 28.7%, while exports of processed chicken have grown by an average of 7.2% per year over this time frame. The most rapid growth being recorded in Japan and the ASEAN zone. By contrast, for a number of reasons, the situation with the EU has not been quite so favorable for Thai businesses and exports to the EU have only grown slowly. Among factors behind this, the EU has awarded Thailand only the relatively small import quota of 252,000 tonnes per year[5], which compares somewhat badly with Brazil’s quota of 500,000 tonnes/year. In addition, the EU has strict policies on enforcing random inspections of imports and it is also implementing stricter measures governing the regulation of labor and labor rights for imports to the EU, and these are increasing the costs of production for Thai exporters.

The generally positive business conditions and steadily expanding export markets described above, together with the growth in demand for chicken products that the domestic market has seen in the past five years (spurred by growth in sales of fast-food and in purchases for household consumption), have supported solid growth for the sector and broiler farms connected to the frozen and processed chicken supply chain have grown in step with this sectoral expansion.

In 2017, the sector continued to experience growth. Domestic consumption rose by approximately 2% YoY following strengthening demand from fast-food businesses, while exports were buoyed by increasing demand for chicken products worldwide. Thailand’s trade partners continued to remove bans on the import of Thai frozen chicken, while outbreaks of bird flu in a number of countries, including China, Myanmar, South Korea, Saudi Arabia, Iran, Russia, the United States, and several African nations, boosted the level of replacement imports sourced from Thailand. This was to lift exports of Thai chickens by 11.0% YoY by quantity and 18.4% YoY by value. For individual product categories, the situation was as follows:

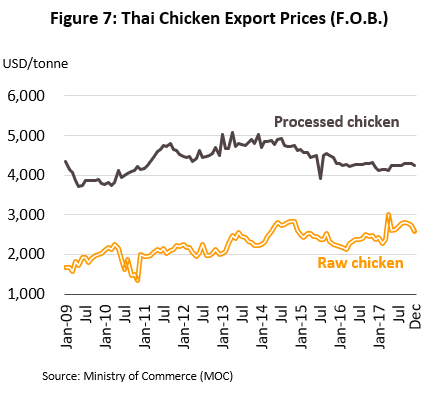

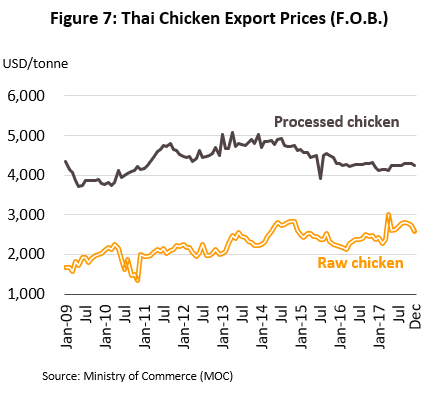

- Frozen chicken: A total of 225,000 tonnes of frozen chicken was exported last year (2017), up 5.6% YoY. This had a value of USD 597.0 mn, a jump of 18.9% YoY, and especially large increases were seen in the amount imported by Japan (which rose 27.5% YoY by value) and Hong Kong (up 40.8% YoY). This sharp expansion in demand was caused by the outbreak of bird flu in China and in many countries in Asia, the Middle East and Africa, and as imports from infected flocks in these countries fell, demand for compensatory replacements sourced from Thai exporters rose. With this spur in demand, the price of exported frozen chicken also rose, increasing 13.1% YoY.

- Processed chicken: 532,000 tonnes of processed chicken was exported in 2017 with a value of USD 2.25 bn, figures that indicate growth of 11.3% YoY and 3.0% YoY, respectively. An impressive level of growth was seen in exports to Japan, South Korea, Hong Kong and Singapore (exports to which rose by 15.1% YoY, 101.6% YoY, 17.7% YoY and 9.9% YoY by value, respectively). However, a steep increase in Brazilian output and subsequent rising exports of processed chicken to Asia signal stiffening competition in world markets and with that, softening prices. As such, the prices realized for processed chicken on global exchanges slipped 1.0% YoY.

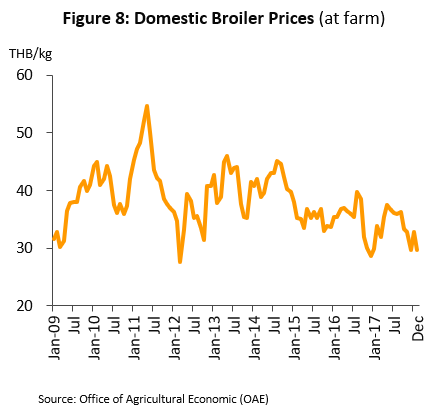

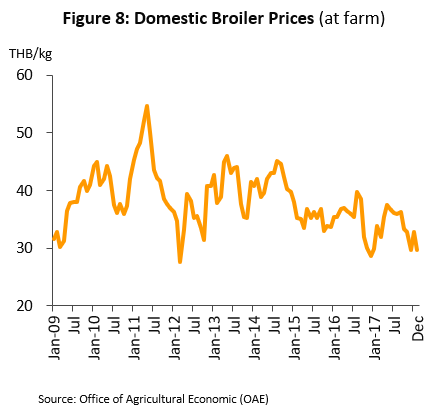

Overall, as regards players’ turnover in the sector, 2017 saw profits continue at a good level due to rising income and falling production costs, attributable to a decline in the price of broilers of 3.4% YoY (Figure 8).

Outlook

Looking out over the next three years, the sector is expected to continue enjoying favorable business conditions, and steadily rising demand will feed ongoing growth for players in the frozen and processed chicken sector. The domestic market is forecast to grow at 2-3% per year, a rate close to that recorded for last year, with demand for household consumption anticipated to expand by 1-2% annually and that for use by fast-food restaurants expected to rise at the higher rate of 3-4% per year on rising consumer demand and consequent plans to expand the number of chicken-based fast-food outlets. Exports will also likely continue to grow but the high level of annual expansion recorded in 2017, as exports rebounded in the major markets of Japan, the European Union, South Korea, and Singapore on the relaxing of the ban on imports of Thai frozen chicken, will mean that by comparison, annual growth in 2018-2020 will be at a lower rate. This is therefore expected to run to a yearly average of 5-8%. This outlook is based on the following factors.

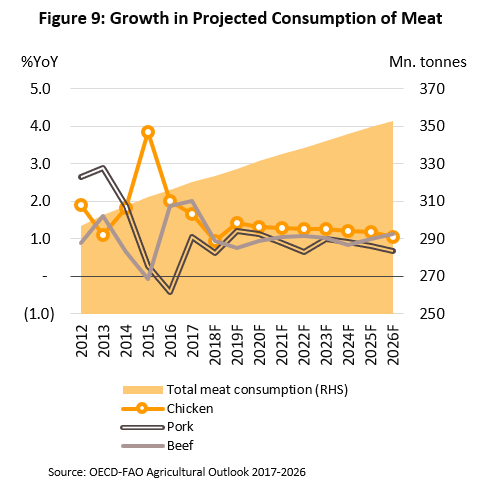

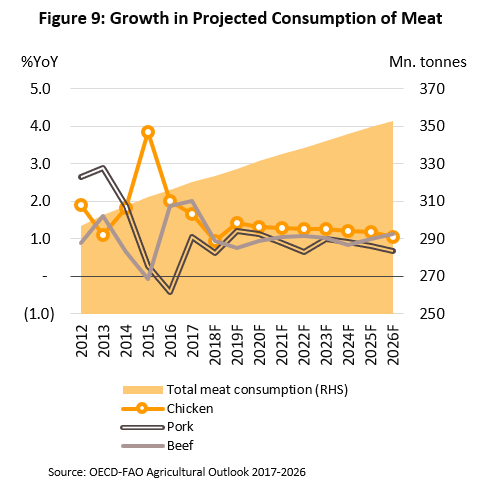

- The forecast is that chicken meat consumption on world markets will grow by 1.5-2% per year, exceed demand for other meats. (source: OECD-FAO Agricultural Outlook 2017-2026)

- Outbreaks of bird flu continue to be reported in many countries but the serious incidences have not yet returned to Thailand as 90% of Thai chicken output is contributed by large operators whose farms are provided EVAP system and standardized procedure of chicken processing. This is therefore an opportunity for Thai exporters. Thus, the United States Department of Agriculture (USDA) states that at present bird flu is widespread in many countries in Asia and Europe which are net importers of chicken. So, this will tend to increase exports to these markets.

- Exports should increase from Thailand to new markets in the Middle East, Africa and China. In the case of the latter, imports of Thai frozen chicken are forecast to grow following (as of March 2018) the certification of seven Thai chicken processing facilities by the Certification and Accreditation Administration of the People's Republic of China (CNCA).

- Exports of processed chicken to Japan are also likely to expand further on growing health concerns6/, and Japanese food companies are in addition investing in sites within Thailand for processing chicken to be used as inputs to the food sector in Japan.

Despite this positive outlook, though, players in the sector face the possibility of rising production costs (principally of broiler), which may rise on higher prices for animal feed, both for soybean meal and for corn. Competition is also increasing from suppliers in Brazil, China, Ukraine and Vietnam, which are developing chicken products for export markets. The effect of this will then be to increase the market strength of importers when it comes to negotiating prices and, although they should remain at respectable levels, profits may be put under pressure because of these developments.

Over the next 5-10 years, Thailand may lose the competitive advantages that it currently enjoys in export markets if, as is likely, the costs of labor and other factors of production rise. Meanwhile, because production there operates on a larger scale and is more advanced and less labor-intensive, marginal production costs in Brazil are significantly lower than they are in Thailand. Beyond this, the Thai chicken industry is also overly reliant on the supply of chicken breeds from outside the country (the majority in fact come from Europe and the United States). Because of this, in the event of an extended outbreak of bird flu in a country that supplies breeds to Thailand, the country might have difficulties in expanding production.

[1] Contract farming is an arrangement under which farms are contracted to produce chickens for large agribusinesses. The latter supply the smaller contracting farm with technology and support, and agree to buy a fixed quantity of chickens at a pre-determined price.

[2] Bird flu is a form of influenza the severity of which depends on the particular strain of the virus spread in any given outbreak. Recent cases have involved the more dangerous H5N1and H7N1 strains, which can be spread from birds to humans who are in close contact with infected animals.

[3] Research shows that the bird flu virus cannot survive temperatures above 70 degrees Celsius so cooking chicken through frying, boiling, steaming, baking or grilling will kill the virus and render the meat safe for human consumption (source: Department of Disease Control, Ministry of Public Health).

[4] EVAP systems are used on farms to provide a temperature- and humidity-controlled environment for the raising of commercial livestock. The use of these systems helps to reduce the risk of infection and death from communicable illnesses and they also have the advantage of allowing for higher stocking ratios, raising average animal weight and providing protection against infestation by animals and insects that can act as disease vectors.

[5] The EU quota for imports of Thai chicken has two components. Imports are permitted up to: (i) 160,000 tonnes of processed chicken, with duties charged at 8% of the imported value and EUR 1,024/tonne for imports in excess of the quota; and (ii) 92,610 tonnes of salted frozen chicken, for which duty is charged at a rate of 15.4% of the imported value and EUR 1,300/tonne on over-quota imports. In 2017, total exports from Thailand to the EU came to 500,000 tonnes over the set quota, so high levels of duties had to be paid on this.

[6] Research by the National Cancer Institute in Maryland in the United States shows that compared to other types of meat, consuming chicken can lead to better health outcomes, a longer life and reduced risk of cancer and heart disease. This is due to chicken’s low levels of cholesterol and saturated fats relative to those found in red meats such as pork, beef and lamb. In addition, chicken is a source of the amino acid leucine, protein, vitamins and minerals, including iron and zinc.

.webp.aspx)