Executive Summary

Demand for beverages on the domestic market, which absorbs some 90% of all output, continued to soften in 2021 on fragile consumer spending power that was undercut by the weak economy and the year’s intense wave of COVID-19 infections. Over 2022-2024, the domestic market should return to growth, but the wider economic recovery will be only gradual and this will limit how fast the market rebounds. In addition to the impacts of COVID-19, sales in the major product categories (carbonated drinks, beer, and spirits) will also struggle against government measures to reduce consumption of drinks that may cause harm, principally high-sugar drinks and alcoholic beverages. The weak purchasing power of low-income earners will also drag on sales through the coming period.

Overall, exports will not perform well over 2021-2024. Overseas sales of non-alcoholic drinks will likely weaken given the decision by the authorities in Myanmar (Thailand’s most important export market) to block imports made by land and so close Thailand’s most important export channel. For their part, sales of alcoholic drinks will improve only slowly, moving in step with economic recovery in export markets, but at the same time, Thai producers are investing in production facilities overseas and so the importance of exports from Thailand-based breweries and distilleries is likely to diminish.

Krungsri Research view

Over 2022 to 2024, overall income for the Thai beverage industry will rise in step with the improving outlook for the domestic market since this is the industry’s main source of income. The continuing impact of COVID-19 on domestic consumer spending power meant that the value of goods distributed to the market in 2021 continued the decline that began in 2020, but over the next 3 years, domestic sales will rebound to growth on the back of economic recovery and a revival in the tourism sector. However, exports will see at best only slight growth, though they may in fact continue to decline, given increasing investment in production facilities across the ASEAN zone, Thailand’s most important export market. Increases to the sugar tax will also add to the manufacturing costs of players producing carbonated drinks, and this may eat into profits.

- Bottled water producers: Overall income is likely to have remained relatively flat for 2021, given the temporary imposition of controls on restaurants and the depressed state of the tourism sector, but over 2022-2024, this will improve in line with economic growth. However, competition will remain stiff, both from other players in the same segment and from alternative products, in particular from drinks that are fortified with vitamins that are gaining in popularity as consumers become more health conscious.

- Carbonated drinks producers: Income will likely be somewhat volatile over the next 3 years. In 2021, turnover fell with weak consumer spending power and the poor economic conditions, but the economy will recover in the coming period, purchasing power will firm up, and demand will be boosted by the desire to stock goods ahead of the introduction of phase 3 of the sugar tax (due at the end of 2022), which will bring a sharp rise in tax rates and with this, price rises. The market will likely shrink again in 2023, before expanding in 2024 in step with a stronger economy and the need to stock carbonated drinks in anticipation of phase 4 of the sugar tax and the even higher taxes that will be imposed at the end of that year. Exports will tend to weaken through the period, undercut by the ban on imports through the Thai-Myanmar land border crossings and rising production by Thai players in export markets. Players will also have to face costs that will be driven up by steeper taxes (determined with reference to sugar content) and the need to spend on marketing to compete with alternative products.

- Breweries: Income will gradually strengthen, lifted by an improving domestic market that is benefiting from the rollout of vaccines and the steady abating of the COVID-19 pandemic, which is then allowing economic activities to return to normal and the public to meet, drink and socialize. Thanks to this, having shrunk in 2021, the domestic market should return to growth over 2022-2024. However, any improvement in income from exports will be limited by growing competition, especially from beer brewed in export markets themselves because in these countries, local brands generally enjoy a high market share.

- Distilleries: Income will gradually rise with an improving economic outlook and strengthening consumer spending power, and this will then feed into recovery in the domestic market. In addition, players will use a range of marketing strategies to appeal to customers and to stimulate sales that will include releasing new products and increasing the range of purchasing options and bottle sizes that are available. This will then allow producers to appeal to a wider range of customers, in particular, by offering drinks in smaller bottles, they will be able to increase sales to lower-income groups with limited spending power.

OVERVIEW

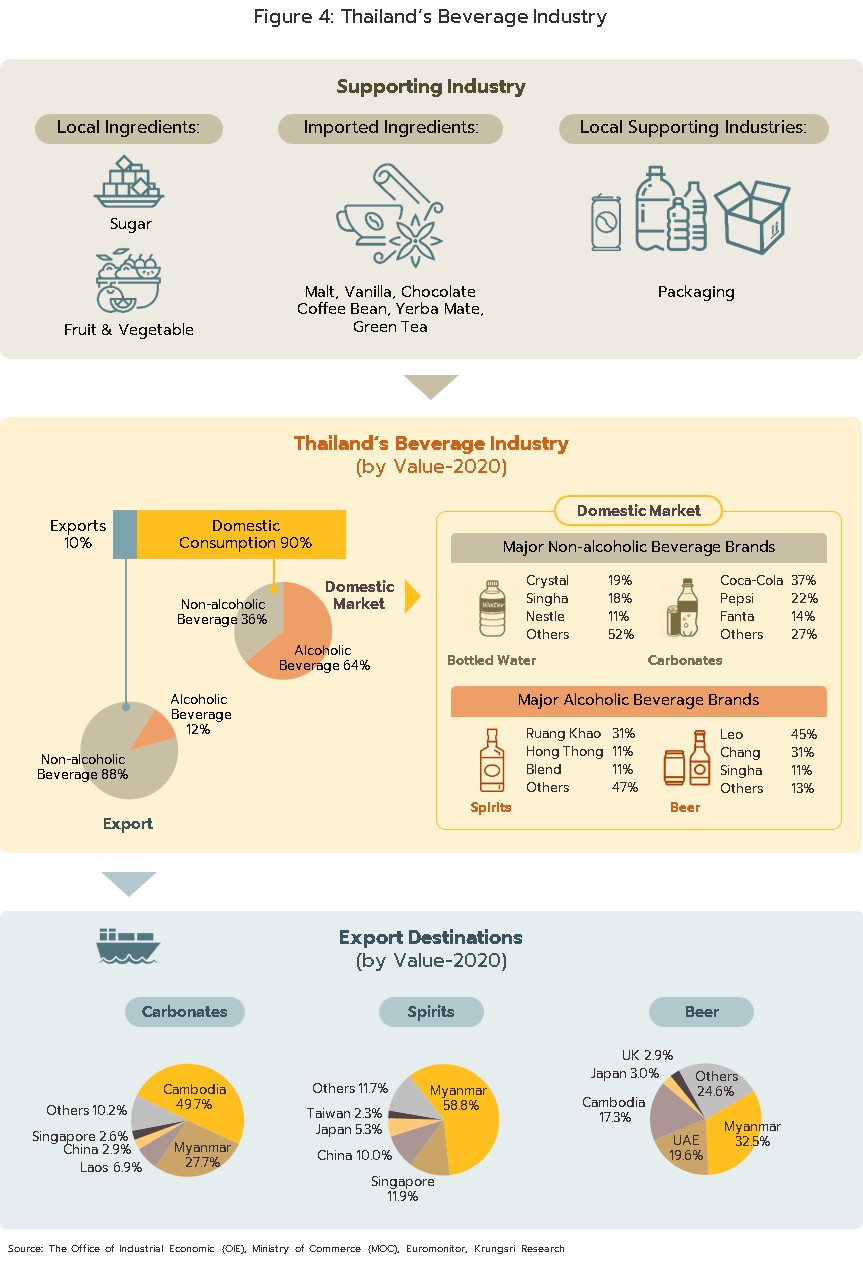

The domestic Thai beverage industry outputs a comprehensive range of product lines and this is sufficient to meet much of domestic demand (around 90% of output is distributed to the domestic market), with imports mostly restricted to expensive goods at the top end of the market, such as whiskey and wine. Thailand is also able to export some domestically produced drinks, with around 10% of production going abroad. In 2020, a total of 420 sites producing beverages were registered with the Department of Industrial Works. These were split between:

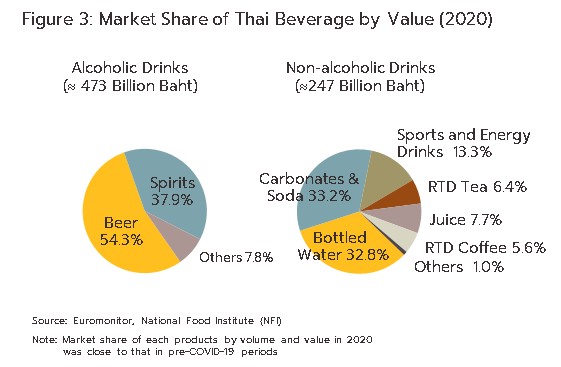

(i) 340 sites (81% of the total) producing non-alcoholic drinks, of which 60% were SMEs, and

(ii) 80 sites producing alcoholic drinks (19% of the total). 49% of these were large-scale operations producing spirits (classified as 28-degree or over) and beers under the market-leading brands. The remaining 51% were SMEs outputting white spirit, local types of spirits and wines; these latter types of alcoholic drink are less tightly regulated by the authorities and so are more often produced by small-scale operations (see the illustration on page 7, ‘Regulations Governing Thai Brewers and Distillers’).

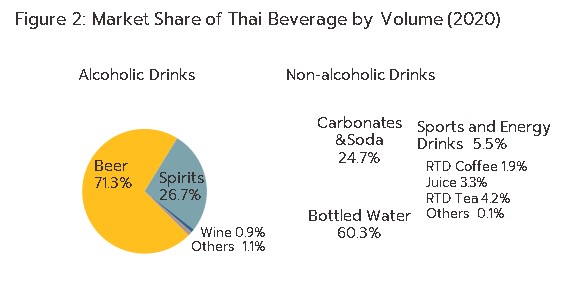

In 2020, the domestic market for beverages soaked up 13 billion liters of drinks, these having a value of THB 720 billion. By quantity, the market was divided between the non-alcoholic and alcoholic segments in the ratio 79:21 but by value, the relative importance of the two segments flipped to a ratio of 36:64. Details are as follows (figures 1-3).

- Non-alcoholic drinks: The most important non-alcoholic segment was bottled water, which had a 60.3% share of the soft drinks market by volume and a 32.8% share by value. The second most important category was carbonated drinks, with a 24.7% and 33.2% share by volume and value, respectively.

- Alcoholic drinks: Beer was the most important product, having a 71.3% market share by volume and a 54.3% share by value. Beer was followed in importance by spirits, which had a 26.7% and 37.9% share by volume and value.

The overwhelming majority of exports of drinks (88% by value) are of non-alcoholic varieties, with Thailand performing best in the export of carbonated drinks and ready-to-drink tea and coffee. The ASEAN zone comprises the most important export target (with about 64% by value of exports of Thai non-alcoholic drinks), followed by the United States (12%). Alcoholic products account for only 12% of the value of exports, though again, the ASEAN zone is the main market for these, with the region accounting for 69% of exports of Thai alcoholic drinks. The United Arab Emirates, Japan and China occupied 6%, 5% and 4% share respectively.

SITUATION

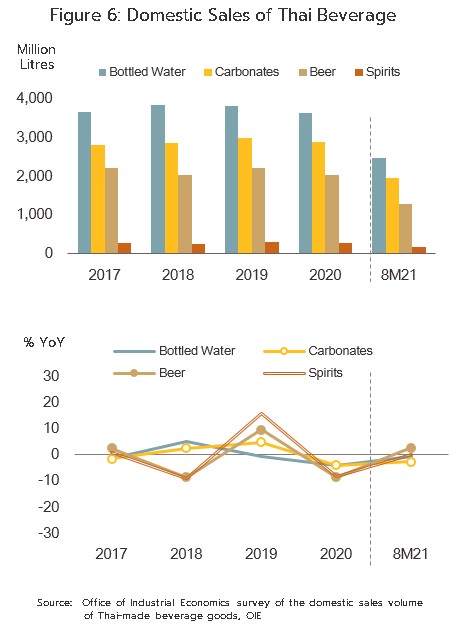

Domestic market conditions: The major segments of the Thai beverage market, include bottled water, carbonated drinks, spirits and beer (which account for around 80% of the value of domestic beverage sales). Conditions were turbulent through all of 2020 and the first 8 months of 2021. As elsewhere in the economy, the prolonged COVID-19 crisis undercut demand, while the market also struggled under the impact of the new sugar tax, through which the government is ratcheting up rates every 2 years over the period between 2017 and 2024.

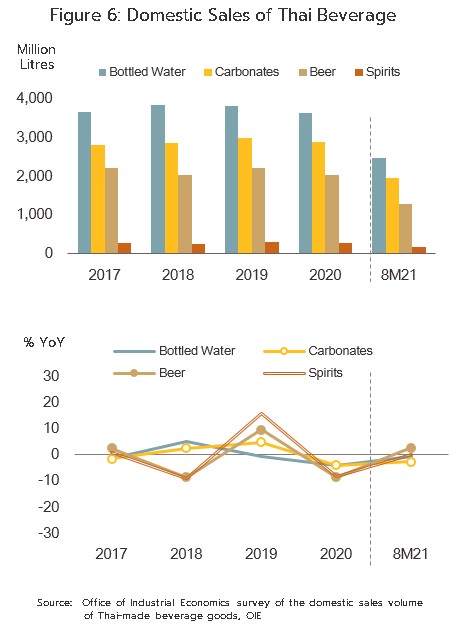

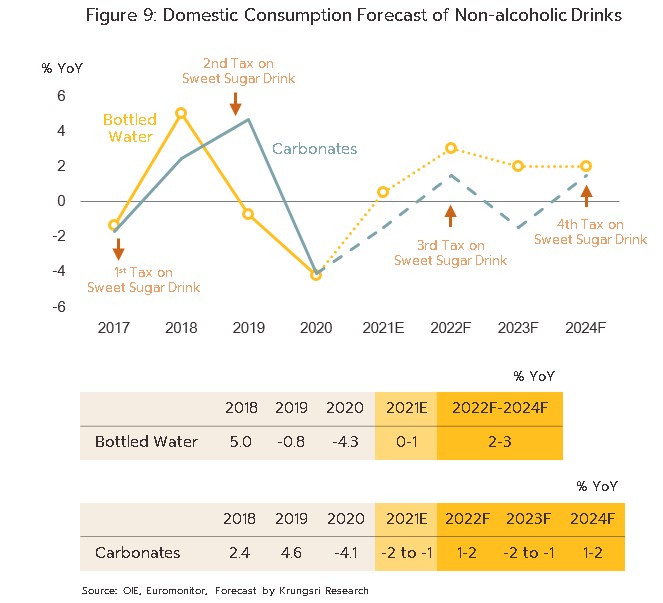

Non-alcoholic drinks: The market for non-alcoholic drinks weakened over 2020 and then remained depressed over 8M21. Through the period, weakening consumer spending power meant that demand for carbonated drinks slipped at a faster rate than it did for bottled water.

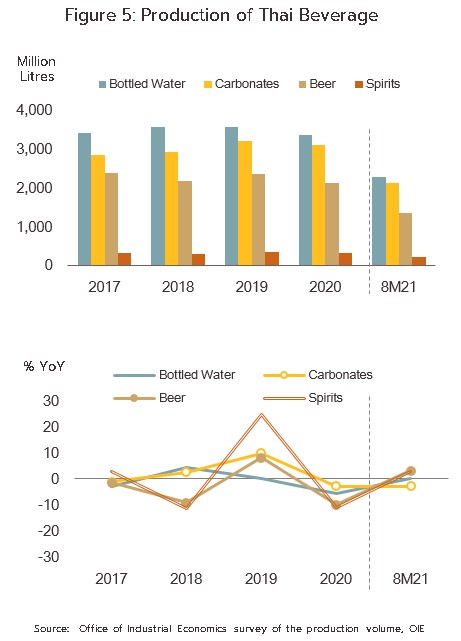

Bottled water: In 2020, the market was sluggish, with sales volume shrinking 4.3%. This was due to: (i) the government’s imposition of the lockdown as it tried to slow the spread of COVID-19, which then resulted in the suspension of eat-in services in restaurants between 22 March and 17 May (sales to eat-in customers in restaurants account for 45-55% of the value of all sales of bottled water); and (ii) extreme sluggishness in the tourism sector in both the domestic and international segments. As a result of these factors, output from water bottling plants slipped 5.4% as distributors tried to run down existing stocks.

- 2020 bottled water market share: Crystal was the most important brand with a 19% market share worth THB 81 billion. This was followed by Singha (18% market share), Nestlé (11%), and Namthip (4%) (source: Euromonitor).

- Over 8M21, output of bottled water edged up just 0.3% YoY but distribution slipped by another 0.8% YoY on: (i) the need to reintroduce strict control measures that included the temporary closure of restaurants to eat-in diners; (ii) the switch to working at home by many private- and public-sector staff, which then undercut demand for bottled water in workplaces; (iii) the continuing depressed state of the tourism sector, with demand from both the domestic and international segments down across the year; and (iv) increasing consumer wariness about spending. In addition, some consumers switched to buying water from coin-operated vending machines, while others cut the risk of infection by installing water filters in their homes. Nevertheless, as 2021 drew to a close, demand for bottled water should have returned to growth, helped by the boost to the economy given by the relaxation of pandemic control measures and, from 1 November, the reopening of the country, which will help to lift domestic tourism alongside the international market. For all of 2021, demand for bottled water in Thailand should thus grow by 0-1%.

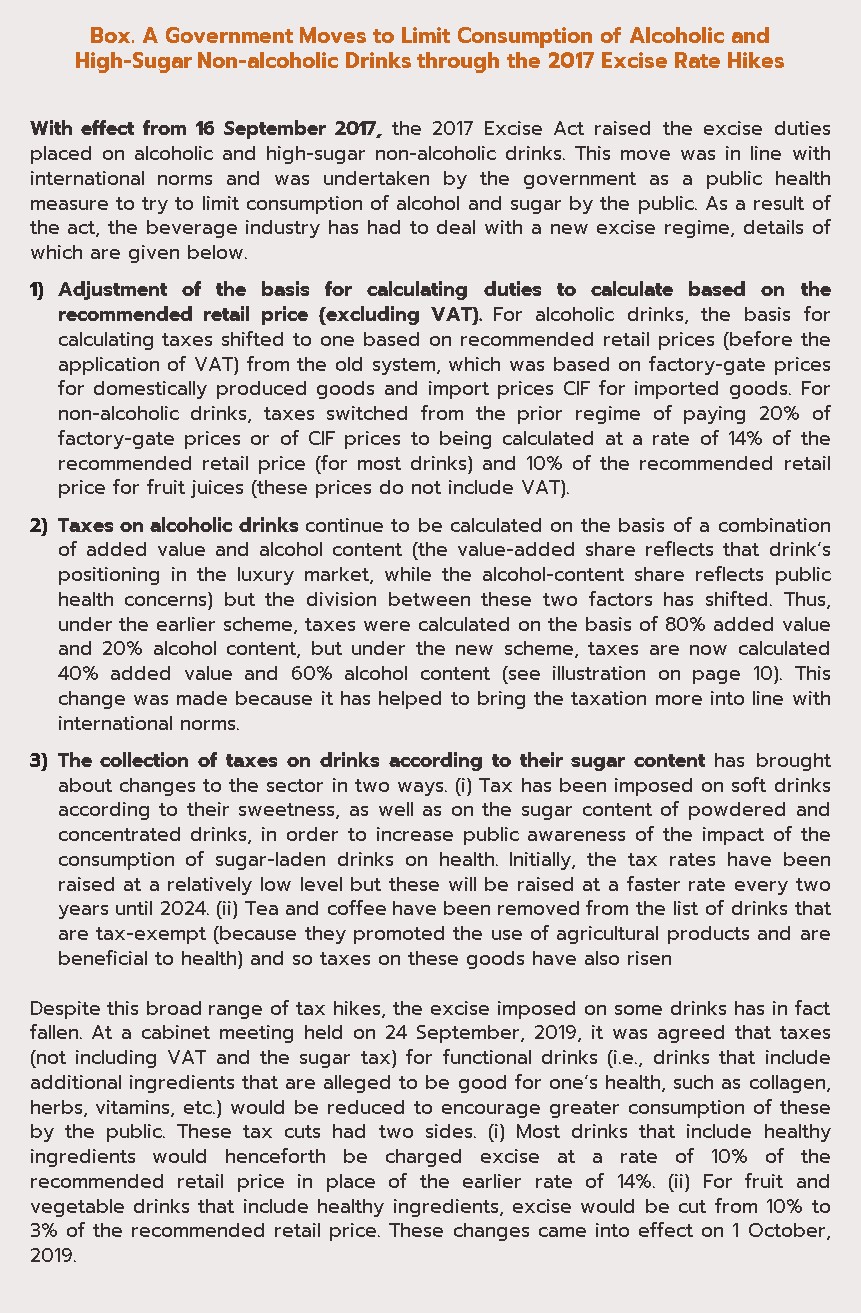

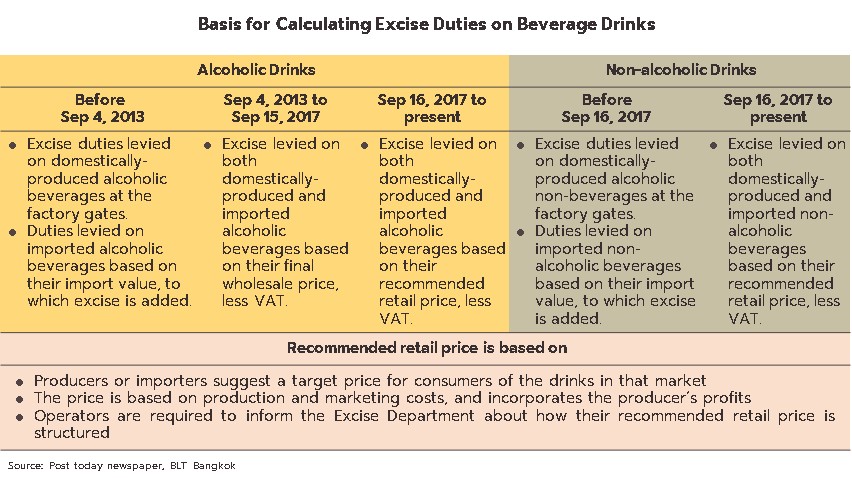

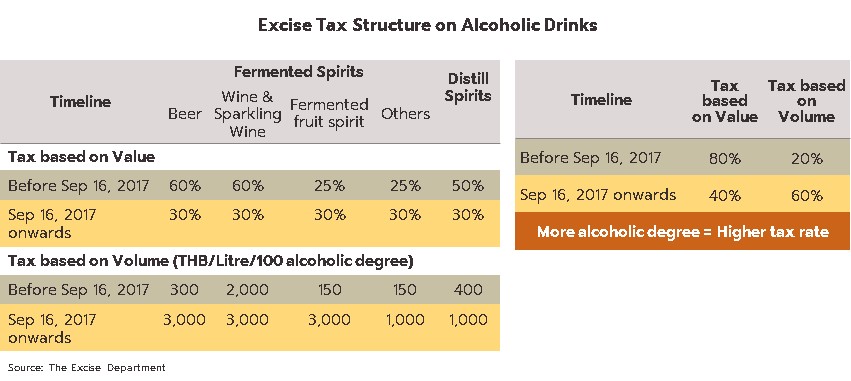

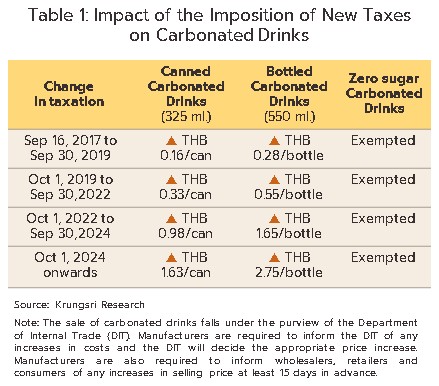

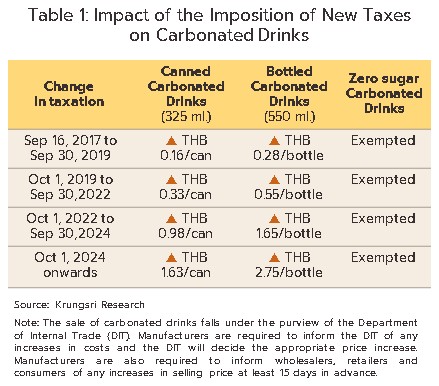

Carbonated drinks: The volume of carbonated drinks distributed to the domestic market dropped 4.1% in 2020, thus moving slightly ahead of the 2.8% decline in output. The market weakened on: (i) the drop off in economic activity in 2020 and the subsequent move by consumers to reduce or eliminate unnecessary spending, including that on carbonated drinks; (ii) the temporary closure of nightspots and the limitation on opening hours for restaurants, which were also banned from serving food to eat-in diners for several months (sales to the latter segment generates around 20-30% of all income from domestic sales of carbonated drinks); and (iii) the continuing impacts of the sugar tax, which is being collected on all types of sweetened drinks (see Box A on page 4 for details). The tax will be increased every 2 years through to 2024, with a total of 4 increments. The first stage of this ran from 16 September, 2017, to 30 September, 2019, with stage 2 running from 1 October, 2019, to 30 September, 2022[1], during which tax rates have doubled from those set for the initial period. In response to the sugar tax, manufacturers of carbonated drinks have had to raise their prices, with this especially clear for older style drinks that have a sugar content that is greater than 10 grams per 100 milliliters (Table 1).

- 2020 carbonated drinks market share: The market was dominated by Coca-Cola (Thailand), which enjoyed a 58.4% market share and income of THB 82 billion from sales of carbonated drinks. Coca Cola was followed by Pepsi-Cola (Thailand) (24.2%), ThaiBev (9.0%), and RJ Group (7.6%), leaving just a 0.8% share for other players. In terms of brands, Coke is the market leader, with a 37% market share, followed by Pepsi (22.1%), Fanta (14.3%) and Est (8.8%) (source: Euromonitor).

- Over 8M21, output and demand for carbonated drinks both slipped further, weakening by respectively 2.8% YoY and 2.9% YoY on depressed spending power and weak consumer confidence. The year’s severe outbreak of COVID-19 forced the government to reintroduce strict controls that mandated opening hours for restaurants, and either banned eat-in dining (1-16 May and 25 June-31 August) and limited numbers (17 May-24 June and 1 September through to the present). Given this, having grown 3.2% YoY over 4M21, demand for carbonated drinks dropped 9.0% YoY over May to August. Nevertheless, the abating of the COVID-19 crisis and the relaxation of controls has meant that eat-in dining has been allowed since 1 September, while foreign tourists have been readmitted to the country from 1 November. This will then help to stiffen domestic sales of carbonated drinks, and so for all of 2021, the decline in demand should slow to between -1% and -2%.

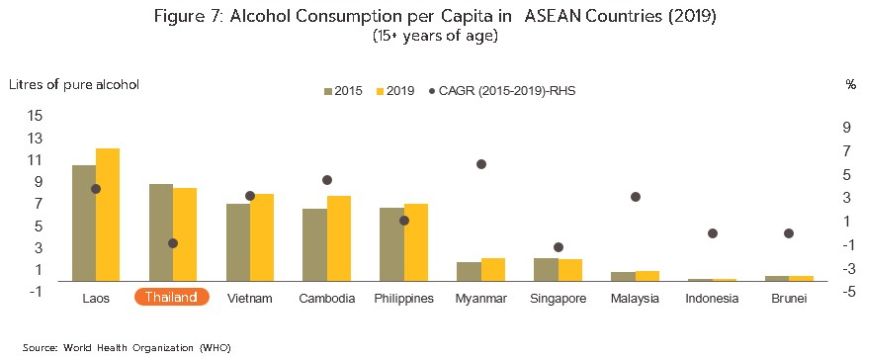

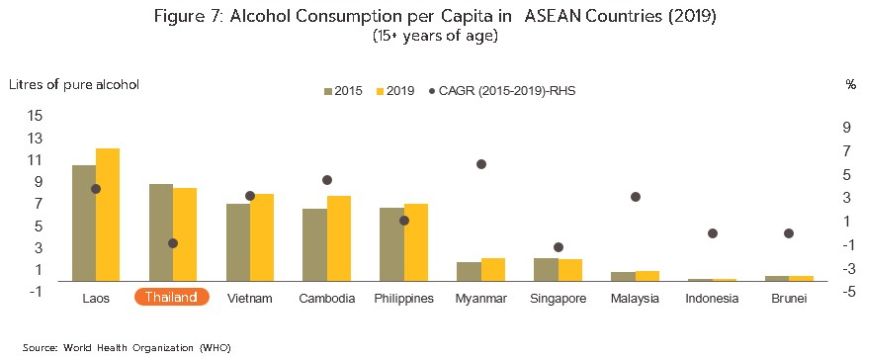

Alcoholic drinks: Although Thailand’s per capita consumption of alcoholic drinks is among the highest in the ASEAN zone, average growth rates are low (Figure 7), and as with the non-alcoholic segment, sales of alcoholic drinks contracted in 2020 and then remained weak through 8M21.

- In 2020, domestic sales of beer and spirits shrank by volume by 8.8% and 8.5% respectively on: (i) the spread of COVID-19 and the huge impact of this on the tourism sector; (ii) the imposition of pandemic control measures that then closed many distribution channels, including nightclubs, pubs, bars, and in-restaurant drinking (the latter accounts for around 40-50% of beer sales and 35-45% of sales of spirits, by value); (iii) convenience stores’ restricted opening hours; and (iv) the cancellation of major festivals including Songkran and New Year, which count as the industry’s high season. Because of this, output of beer and spirits slumped by 9.8% and 10.4% respectively in 2020.

- 2020 beer market share: The market leader in Thailand is Boon Rawd Brewery, which has a 57.9% market share and total income from beer sales of THB 260 billion. This is followed by ThaiBev (34.3%) and Thai Asia Pacific Brewery (4.7%). In terms of brands, Leo is the market leader (44.8% share), followed by Chang (31.2%), Singha (11.2%), Heineken (3.8%), and Archa (2.4%) (source: Euromonitor).

- 2020 spirits market share: With a 59.5% market share and income from domestic sales of spirits that totaled THB 180 billion, ThaiBev was the segment’s market leader in 2020. ThaiBev was followed in importance by Diageo Moet Hennessy (Thailand) (8.0%), and Regency Brandy Thailand (4.4%), with the remaining 28.1% of the market taken by smaller companies. By brand, Ruang Khao (a community distilled spirit) had the greatest market share (30.9%), followed by the distilled brown spirits Hong Thong (11.4%), Blend 285 (11.2%), Regency (3.6%), Sang Som (3.0%), and Mekhong (2.5%) (source: Euromonitor).

- Over 8M21, sales of beer returned to growth, though only at the relatively low level of 2.6% YoY, while sales of spirits edged down another 0.1% YoY. Sales remained soft in the face of continuing weakness in consumer spending power and the ongoing closure of the country, which then ensured that the tourism sector remained severely depressed. However, a repeat of the 2020 market contraction was avoided by the relaxation of control measures during the earlier part of the year. Thus, in April, the quantity of beer and spirits distributed domestically surged by respectively 395.4% YoY and 210.0% YoY, and for 4M21 in total, sales of these were up by 17.3% YoY and 19.4% YoY. However, following the reimposition of controls, sales growth went into reverse and over May to August, sales of beer fell back 15.6% YoY, while sales of spirits crashed 32.3% YoY. For the last 4 months of the year, demand is expected to have returned with the loosening of restrictions on the consumption of alcohol in the tourism pilot provinces of Bangkok, Krabi, Phuket and Phang Nga (from 1 November, 2021)[2] and the opening of many parts of the country to tourist arrivals. For the year as a whole, the prediction is therefore that demand for beer will be down by 2-3%, while for spirits, demand will decline by between 3-4%.

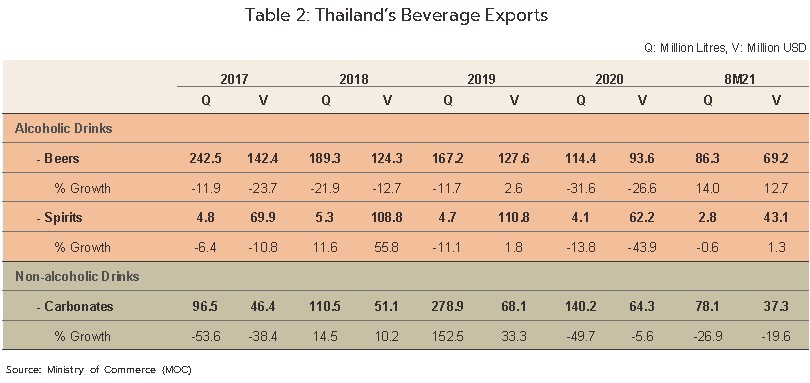

Export markets: Exports of beverages weakened sharply in 2020, but for 8M21, the overall situation improved. This was with the exception of exports of carbonated drinks, which continued the decline in sales that began a year earlier.

2020 exports of overall beverages declined in terms of both volume and value. In detail, overseas sales of beer were down 31.6% by volume and 21.6% by value, spirits were down by respectively 13.8% and 43.9%, and for carbonated drinks, the declines came in at 9.7% and 5.6%. This poor performance is explained by: (i) the economic slowdown and consequent weakening of consumer spending power in the main export markets of Cambodia (responsible for 25.4% of 2020 exports of Thai beverages, by value), Vietnam (20.4% of exports), Myanmar (17.8%), China (10.0%) and Lao PDR (5.1%); (ii) the widespread closing of border checkpoints with Cambodia, Myanmar, and Lao PDR (responsible for a combined 48.3% of exports), and instead of the usual 97 border checkpoints, only 35 operated through the year, a situation that was then made worse by the more onerous safety checks that were made on cross-border shipments; and (iii) the trend by both Thai and overseas operators to increase investment in beverage production facilities in Thailand’s main export markets. In 2020, the ASEAN zone accounted for around 70% of the value of exports of Thai alcoholic drinks and 90% of those of carbonated drinks. These strong sales have therefore attracted greater investment and with output rising in these countries, income is now starting to come from this. Companies investing in the region include Carlsberg Thailand (investments have been made in Lao PDR), ThaiBev (Vietnam), Coca Cola Thailand (Myanmar and Cambodia), and Pepsi Cola Thailand (Myanmar and Vietnam).

Over 8M21, exports of alcoholic drinks recovered, but for carbonated drinks, the situation remained depressed.

- Overseas sales of alcoholic drinks recovered in 8M21, and by volume and value, exports of beer were up 14.0% YoY and 12.7% YoY, and although sales of spirits fell 0.6% YoY by volume, by value they rose 1.3% YoY. Sales figures were boosted by comparison with the low baseline set in 2020, and by progress on vaccinations and the subsequent economic revival in Thailand’s main export target of the ASEAN zone (in 8M21, ASEAN countries absorbed 57.2% of beer exports and 80.2% of spirit exports, by value). As such, the value of exports of beer and spirits to ASEAN jumped 17.3% YoY and 18.3% YoY respectively, though expansion in the Myanmar market was especially noticeable. By value, the country has a 43.3% and 58.8% share of all Thailand’s beer and spirit exports, and in the period, these jumped by respectively 44.0% YoY and 6.3% YoY. Growth was driven by civilian opposition to the military coup in February 2021, with opponents of the military government boycotting purchases of Myanmar-produced beer, which is under the control of the government, and instead buying imported beers, especially beer from Thailand (source: frontiermyanmar.net and posttoday.com). However, through the end of 2021, growth in exports to Myanmar is likely to slow since having banned the import of non-alcoholic drinks by land, the government is further tightening controls on land border crossings, while uncertainty persists over the rules governing cross-border trade. Given this, exports of alcoholic drinks are forecast to see only limited growth for 2021 overall.

- Exports of carbonated drinks continued to weaken through 8M21, crashing 26.9% YoY by volume and 19.6% YoY by value. Sales were badly affected by the decision by the Myanmar authorities to block the import of non-alcoholic drinks by land. This rule came into effect on 1 May, 2021[3], leaving Thai exporters able to use only sea and air routes when shipping soft drinks into the country; Myanmar has a 29.8% share of exports of carbonated drinks, making it second only to Cambodia (which has a 36.7% share) in importance to Thai exporters and so this was a significant blow to the industry. To make matters worse, the value of exports to Cambodia slumped 45.2% YoY over 8M21 on the impacts of periodic lockdowns, in particular in border regions, that then made it difficult to distribute goods. Against the backdrop of Myanmar’s block on cross-border trade and the tight regulation of imports by other countries in the region, the expectation is that for all of 2021, the value of exports of carbonated drinks will have continued the decline that began in 2020.

OUTLOOK

Domestic market: Growth will return over 2022-2024 but expansion will be limited and will tend to move with what is expected to be an only gradual recovery in the broader economy. The most important market segments (carbonated drinks, beer and spirits) will also be affected by rising consumer concern with personal health and wellbeing and with official moves to discourage consumption of drinks that have negative impacts on health (e.g., alcoholic drinks and soft drinks with a high sugar content).

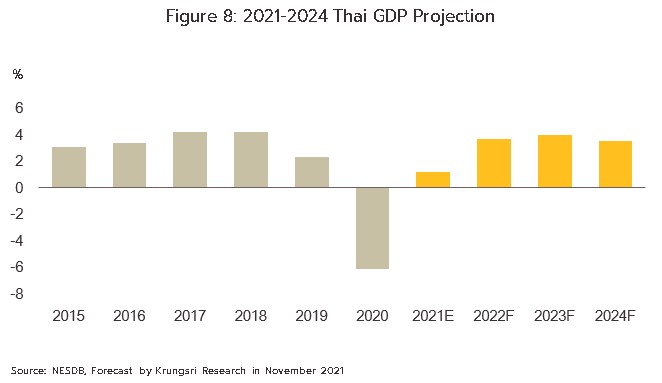

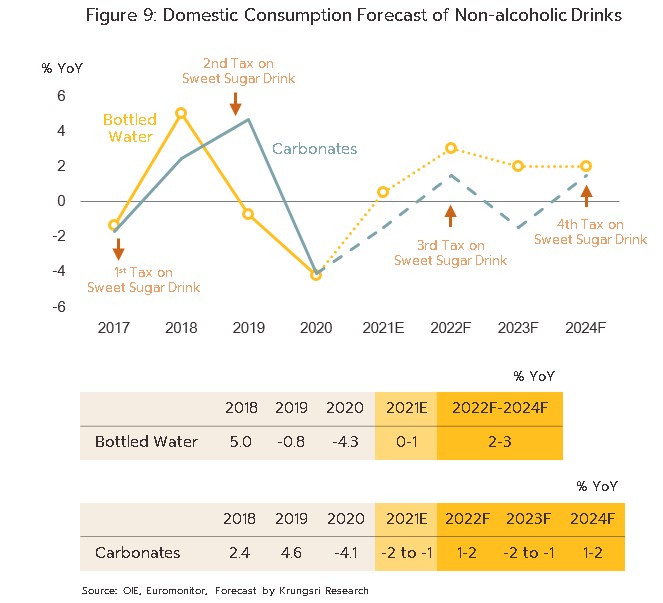

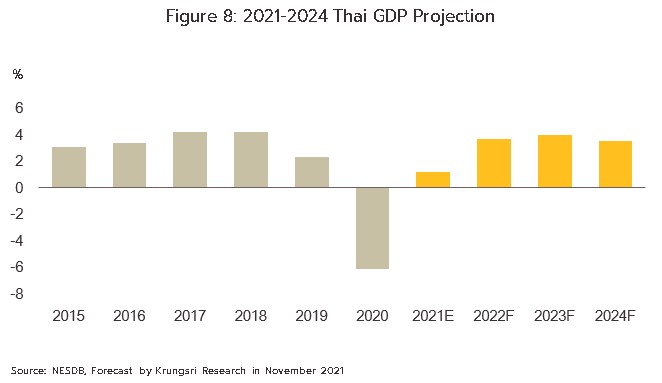

Demand for non-alcoholic drinks will tend to rebound following the 2021 contraction in sales. The market will be boosted by ongoing urbanization and, thanks to economic recovery (Figure 8), rising consumer spending power.

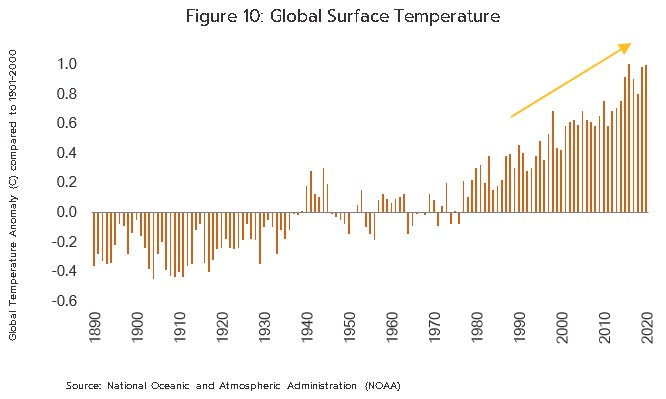

- Bottled water: Domestic demand for bottled water is expected to grow by 2-3% annually. Sales will be helped by the fact that the product is both a necessity and a good that fits in with and supports modern lifestyles and rising concerns over the health and safety of food and drinks, though this is especially the case for bottled water that meets the ISO 9001 and HACCP standards. In terms of products, sales of both smaller bottles (sold to general consumer groups) and larger gallon-sized bottles (distributed to homes and offices) should see growth. Sales will also be boosted by climate change and rising sea levels, which is impacting supplies of drinking water in the Chao Phraya basin; during the hot season (January-April), infiltration by sea water is making drinking water saltier and this is then encouraging consumers to buy bottled water instead. However, competition will tend to stiffen in the coming period, and with consumers faced with a greater range of choices (e.g., health drinks and vitamin-fortified waters), players will look to expand their distribution channels through the use of more aggressive marketing strategies, and this will drive up business costs.

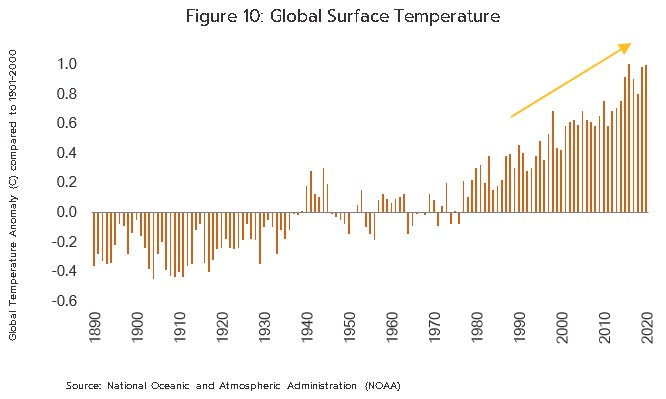

- Carbonated drinks: Demand for carbonated drinks will tend to fluctuate over the next 3 years. In 2022, demand should strengthen by 1-2% with the success of the vaccination program, the rebound in the economy and the reopening of restaurants, while consumers, retailers and wholesalers will also all tend to stock up on carbonated drinks ahead of the introduction of phase 3 of the sugar tax (in October 2022, the sugar tax rate will increase to 3-times its level during phase 2). The consequence of the latter will, though, be to weaken demand in 2023, and this will fall by 1-2% before returning to growth of 1-2% in 2024 as inventories are again built up in anticipation of phase 4 of the sugar tax, when the rate will increase to 3 times its phase-3 level. Stronger demand will also be supported by economic growth, more reopening of restaurants and nightspots, and the impacts of climate change on rising temperatures (Figure 10). Against this, competition will tend to stiffen as operators respond to the ratcheting up of the sugar tax by attempting to expand their market share. This will include the introduction of new product lines (e.g., lime Pepsi, cream soda and raspberry scented Pepsi Max, Coke Plus Coffee, orange scented Coke Zero, and Est Play fortified with B6 and B12) and the sale of a growing range of alternative goods that will include carbonated functional drinks[4], sparkling drinks [5], ready-to-drink teas, and health beverages, such as low-sugar drinks or drinks that use alternative sweeteners.

Having contracted in 2020 and 2021, the market for alcoholic drinks will see only weak growth over 2022-2024 (Figure 11). The success of the vaccination program and the return to more normal economic conditions will help to gradually lift consumer spending power, but the market is tightly controlled by the government, which limits marketing and advertising, sets zoning rules on where alcohol can be sold, and runs public awareness campaigns to discourage consumption of alcohol. Wider trends in society are also increasing concerns over the impact of drinking on personal health, and this will tend to limit expansion in the industry.

- Beer: Demand is forecast to expand by 3-4% annually on the economic recovery and the marketing opportunities that will be made available by major sporting events, most notably the football World Cup in 2022 and the Euros and the Olympics, both of which will take place in 2024. These will help to boost sales through restaurants and nightspots, especially for craft beers [6], which are rapidly growing in popularity. Producers are also trying to increase income by adapting their marketing strategies, for example by reducing the alcohol content in some products and by cutting back on packaging, which then helps to reduce the sale price. However, market share may come under greater threat from the growing interest in alcohol-free beer[7] among health-conscious consumers.

- Spirits: Domestic consumption of spirits is predicted to rise by 2-3% per year over the next 3 years. Sales will be lifted by the release of new product lines that have included ThaiBev’s Niyom Thai, a rice wine made from fragrant rice, Phraya Nak, which is infused with herbs, and the rice wine Grand Royal Super Smooth (the first two were released in 2020, while the latter came onto the market in January 2021). In 2020, Tawadang 1999 also released the colored blended spirit GALAXY. In addition, companies are overhauling design, packaging and bottle sizing as they try to differentiate their products and attract greater interest from different consumer groups. Thus, Blend 285 Signature (a brand operated by Blend 285) joined with a fashion designer to release a range of specially designed boxes at the end of 2020, while Hong Thong began to be sold in 700 milliliter bottles in February 2021, and then in July, this became available in 350 milliliter bottles.

Exports: Through 2022 to 2024, the value of non-alcoholic drinks (i.e., of carbonated drinks) will continue to weaken, but overseas sales of alcoholic beverages (beer and spirits) will tend to recover, though only weakly.

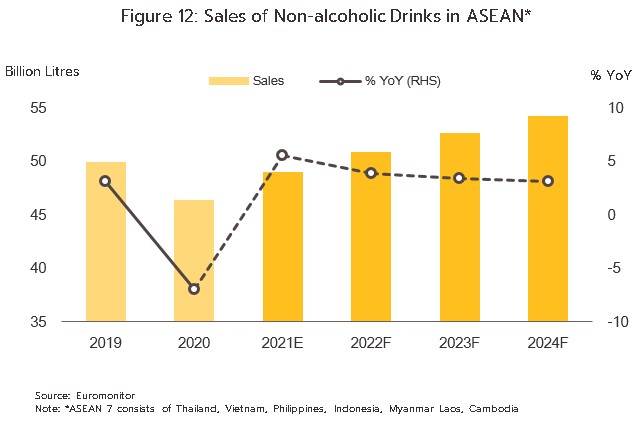

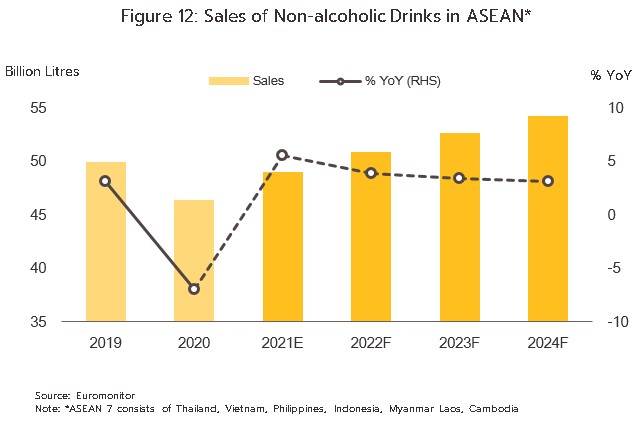

- Carbonated drinks: Income from the export of carbonated drinks from Thailand will continue to decline for two main reasons. (i) Exports to Myanmar (Thailand’s second biggest export market) have been badly hit by the closure of land crossings to imports of soft drinks from Thailand, and instead of the 1-day road journey to Yangon and many other provinces, since 1 May, 2021, exporters have had no option but to make do with the 1-week sea journey. This has then driven up costs, with knock-on effects for retail prices in Myanmar. (ii) Thai players have been increasing their investments in the rest of the ASEAN zone. For example, Coca Cola Thailand is investing in facilities in Myanmar, Cambodia, Malaysia and the Philippines, while Pepsi Cola Thailand is putting money into Myanmar and Vietnam. Funds are being pulled in by the rising consumption of carbonated drinks in these countries (Figure 12), itself a result of higher incomes, ongoing urbanization, and the popularity of Thai-made non-alcoholic drinks. Producing drinks in these countries also has the advantage of cutting labor and transport costs, but although exports from Thailand are falling, this lost income will be made up for by income generated locally in these countries.

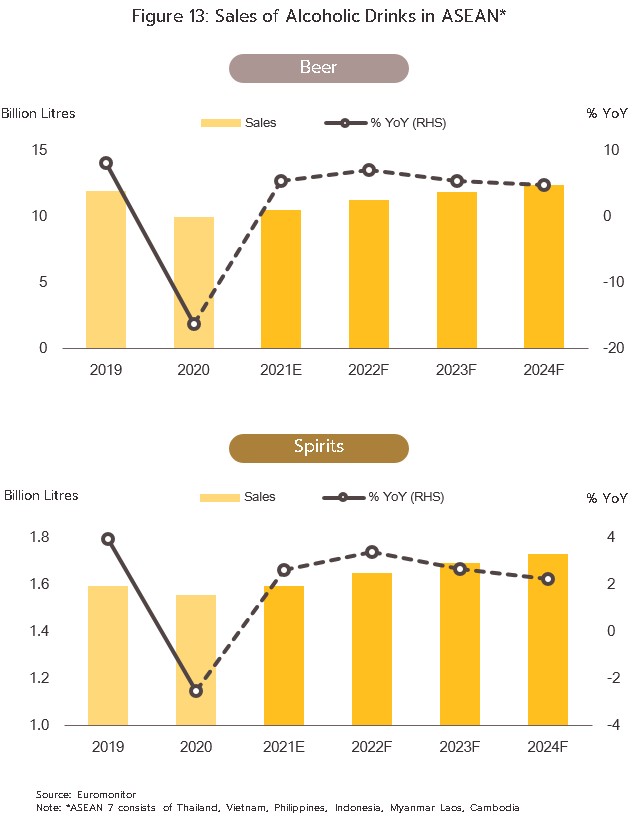

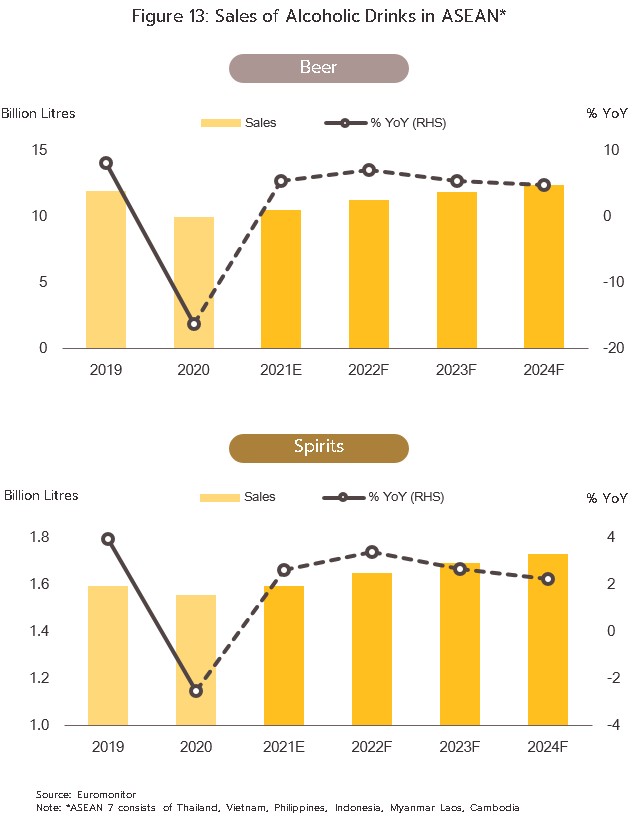

- Beer and spirits: Over the next few years, exports of alcoholic drinks will grow, but the rate of expansion in the market will likely be somewhat limited. Demand will strengthen in the ASEAN zone (Figure 13), an area that is responsible for over 80% of the value of exports of Thai alcoholic beverages and that is thus Thailand’s main export target, and the effects of this will be amplified by the release of new product lines by Thai brewers and distillers. Thai players are also expanding their distribution networks across ASEAN countries, with ThaiBev entering into a joint venture with Asia Euro Wines and Spirits, a major distributor of drinks that operates a distribution network that extends across China, Singapore, and Malaysia. However, growth in exports into the ASEAN market will face challenges. (i) The ASEAN market is marked by high levels of competition, and across the region, local players generally enjoy a significant market share. Thai operators looking to invest in these markets will therefore need to consider forming partnerships with local operators. Examples of partnerships that have already been made are ThaiBev’s joint venture with Saigon Beer Alcohol Beverage Joint Stock Corporation (Sabeco), Vietnam’s biggest brewery (as of 2017), and their partnership with Myanmar Supply Chain and Service Company (MSC) and Myanmar Distillery Company (MDC), Myanmar’s biggest distillery, under the Grand Royal brand. (ii) Ongoing political conflict in Myanmar and uncertainty over the rules governing cross-border trade present a significant obstacle to increasing exports of beer, especially so given the fact that with a respectively 32.5% and 58.8% share of exports of beer and spirits, Myanmar is Thailand’s most important market for the export of alcoholic drinks.

[1] In May 2021, the Excise Department announced that to help both producers and consumers through the COVID-19 crisis, it would postpone the ending of phase 2 of the sugar tax by 1 year. Thus, instead of finishing on 30 September, 2021, phase 2 will now terminate on 30 September, 2022. Phase 3 of the sugar tax will therefore run from 1 October, 2022, to 30 September, 2024. During this period, the sugar tax will be 3-times higher than it was in phase 2.

[2] With effect from 1 November, 2021, the government has relaxed the rules on consuming alcohol, and this is now allowed in SHA accredited restaurants in the 4 pilot provinces (Bangkok, Krabi, Phuket, and Phang Nga). Initially, sales of alcohol were permitted until 9pm, but as of 1 December, this has been extended to 11pm. Sales of alcohol were also allowed nationwide on New Year’s Eve in open air restaurants, with sales permitted until 1am on the morning of 1 January, 2022.

[3] Myanmar banned the import by land from Thailand of non-alcoholic drinks from 1 May, 2021, onwards. This ban covers carbonated drinks, energy drinks, drinks that include tea and coffee, ready-to-drink coffee, fruit juices, and milk products.

[4] Functional drinks are non-alcoholic drinks that include added ingredients that are beneficial for one’s health, e.g., vitamins, herbs, and fruit and vegetables.

[5] Sparkling drinks are fizzy non-alcoholic drinks. These are carbonated, and generally have added flavors, odors, or vitamins.

[6] Boon Rawd Brewery has introduced several craft beers: Snowy Weizen by EST.33 in 2017, EST.33 Copper Craft Beer in June 2018, and Corn Craft Beer in February 2019. At the end of 2018, ThaiBev began selling the ‘HUNTSMAN’ and ‘Black Dragon’ brands, and over 50 imported craft beers are also on sale in Thailand.

[7] Alcohol-free beer is beer that is brewed in the normal way but which is then passed through an additional process that removes the alcohol (the alcohol content should be no more than 0.5%) but retains the beer’s taste, odor and color. In Thailand, the market for this remains somewhat small and specialist because Thai manufacturers have not yet begun to distribute their own alcohol-free beer and so sales are only of imports, but in Europe and the US, concerns about health mean that sales are rising and over 2010-2015, global sales strengthened by an average of 5% annually. Some of the more important brands include Heineken 0.0, Asahi Style Free, and Carlsberg 0.0%.

.webp.aspx)