Through the period 2020-2022, the auto-finance sector will see a slowing rate of expansion due to what is likely to be only sluggish growth in the wider economy, and this will weigh on consumer purchasing power. In addition, demand for new cars to replace those bought under the First-Car Buyer scheme will steadily be exhausted over the next few years, while increasingly strict government regulation of consumer lending will help to stoke competition from captive finance operations, and these will then begin to play a more prominent role within the sector. Against this background, financial institutions will need to build new markets by exploiting a range of different strategies, in particular by expanding their customer base and reaching a more diverse range of potential consumers through the adept use of digital platforms. This will therefore be an important factor in maintaining and strengthening competitiveness in the coming period.

Overview

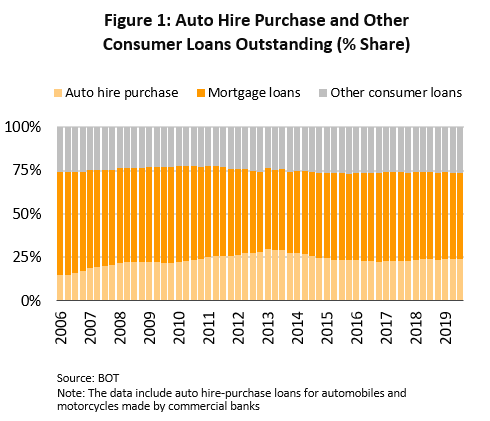

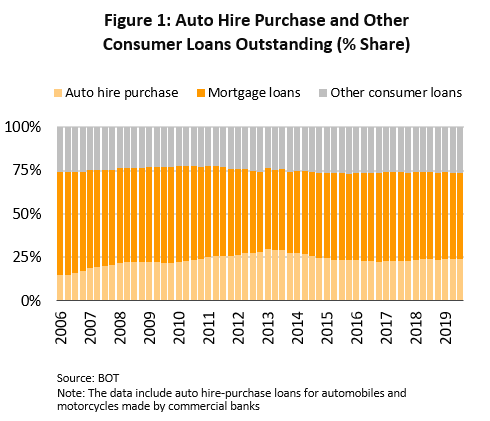

The auto finance or auto hire-purchase sector has played an important role in the Thai economy for some time and this business has developed alongside the domestic market for automobiles. Thus, as of the third quarter of 2019, outstanding debts on hire purchases of automobiles had a total value of THB 1.1 trillion, or 24.0% of all consumer loans issued by the commercial banking sector (Figure 1).

Auto hire-purchase businesses provide credit to buyers of automobiles and motorcycles. Under these agreements, lenders retain the ownership rights to vehicles bought on hire purchase until all payments have been made in full and in the period of time specified in the loan agreement, at which point, ownership is transferred to the buyer. This is one way in which hire purchase differs from leasing, because in leasing agreements, the leasee (i.e. the person or organization which takes out the lease) may either extend the period of the lease or return the vehicle when the contract expires. Leases are thus much more popular with corporate organizations, which need to acquire the use of vehicles in large numbers.

Hire purchase is also a form of secured debt and normally, interest rates are specified in the hire-purchase agreement, these being set at a flat rate for the duration of the loan, and when calculating the monthly repayments, this interest is then charged on the basis that the principle is fixed for the life of the agreement; borrowers thus pay interest at the same rate in each of their repayments. Hire-purchase agreements normally run for 1-5 years, and down-payments worth 20-30% of the value of the vehicle being purchased are usually required.

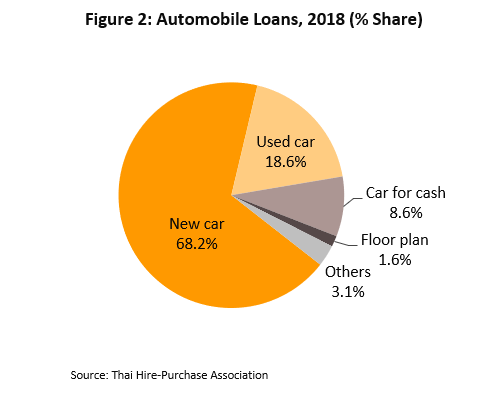

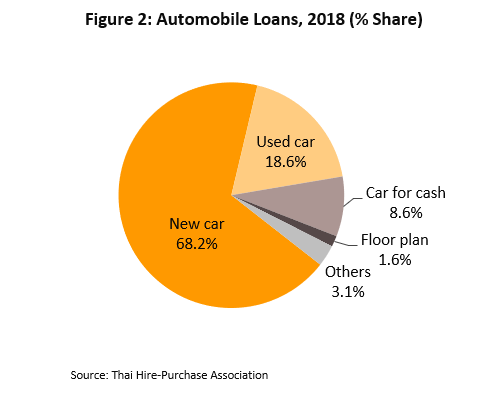

As a result of the after-effects of high growth of the First-Car Buyer scheme, which ran from 2011-2012, the auto finance sector has experienced periods of only sluggish growth over the recent past and in response, lenders have expanded the range of financial products on offer. These have included ‘car for cash’ programs, which are essentially loans secured against a vehicle, and ‘floorplan’ arrangements, which provide financing to auto dealers for orders and purchases of vehicles and for working capital. Data from the Thai Hire-Purchase Association[1] show that in 2018, despite falling a proportion of all auto financing from 77.1% to 68.2% over the past 5 years, credit for new vehicles remains the most important segment of the auto finance sector. This was followed by credit for second-hand vehicles (18.6%), loans secured on vehicles (8.6%), and credit for auto dealers (1.6%) (Figure 2).

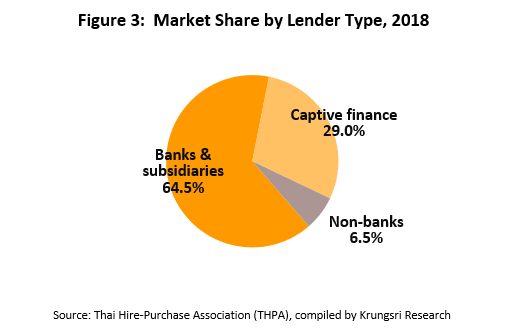

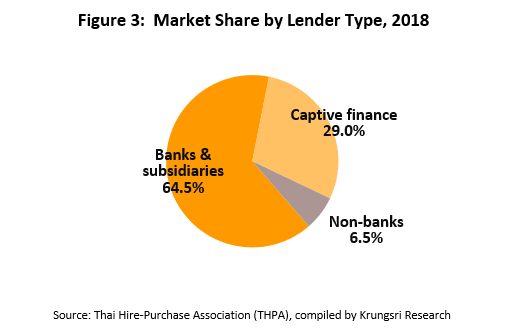

At present, the Thai market is structured such that lenders providing hire-purchase financing may be divided into three groups: (i) Financial institutions are mostly Thai commercial/high-street banks, branches of foreign banks, or subsidiaries of banks, and so this group has lower costs of financing than do other players. (ii) Captive finance refers to financing offered by auto manufacturers or distributors. This group has been playing an increasingly important role in the market in recent years and benefits from being able to draw on parent companies’ (i.e. large vehicle manufacturers) financial resources and on the strategic advantage of being part of a distribution network and of therefore being able to market in cooperation with dealers. (iii) Non-bank lenders are typically smaller leasing operations that offer lower value hire-purchase arrangements, and at present, there are around 300 of these registered in the country[2]. Members of this group are usually SMEs focusing on supplying financing for motorcycles and are thus at a financial disadvantage when compared to other lenders. This group also tends to serve the low-income market and so faces a higher risk of default on its debts.

In terms of market share, in 2018, financial institutes continued to dominate, with a 64.5% share of all outstanding auto debts. Captive finance was in second place, with a 29.0% share, and non-banks were left with just the remaining 6.5% [3] (Figure 3).

Situation

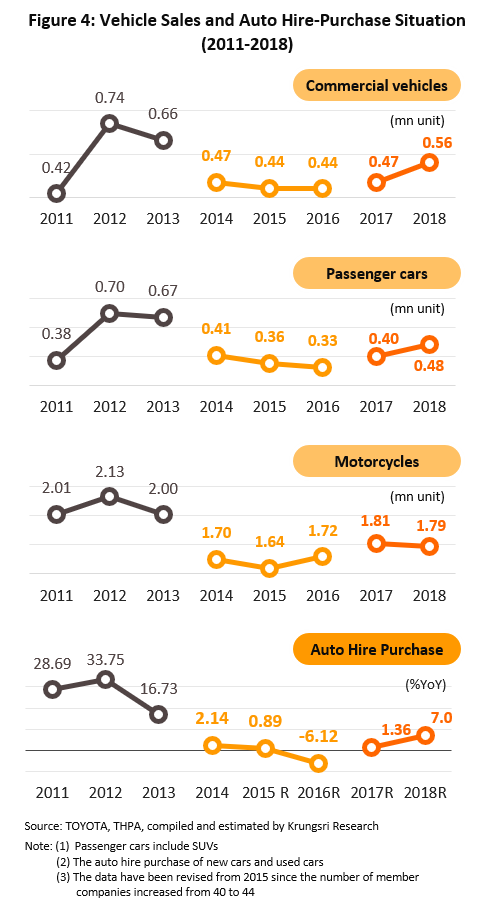

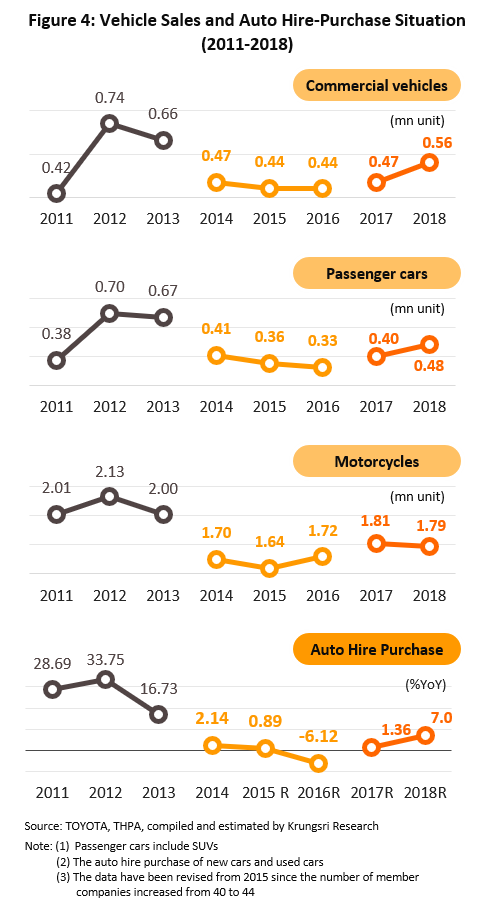

In the years 2011-2015, fluctuating demand for automobiles and motorcycles fed into a considerable degree of slowdown in the domestic market for auto finance, though this came to an end as 2016 drew to a close and the auto finance sector began to recover. In the following analysis, three periods are thus identified: the boom years (2011-2013), the bust years (2014-the first half of 2016) and the recovery (the second half of 2016-2018) (Figure 4).

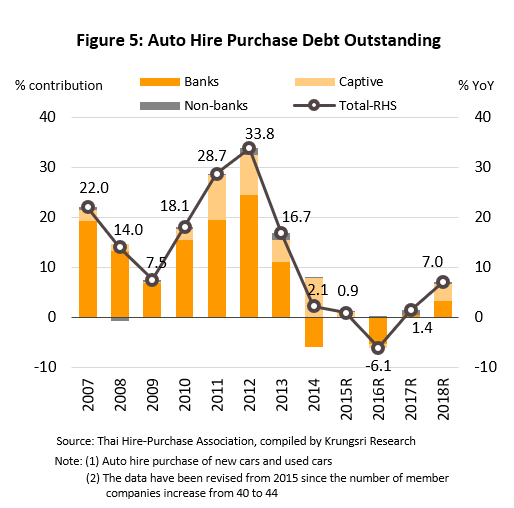

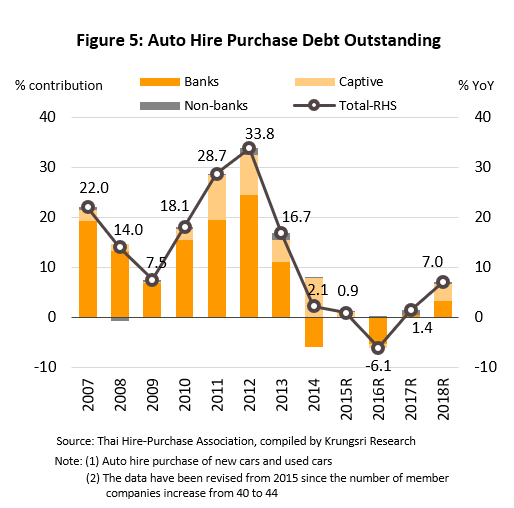

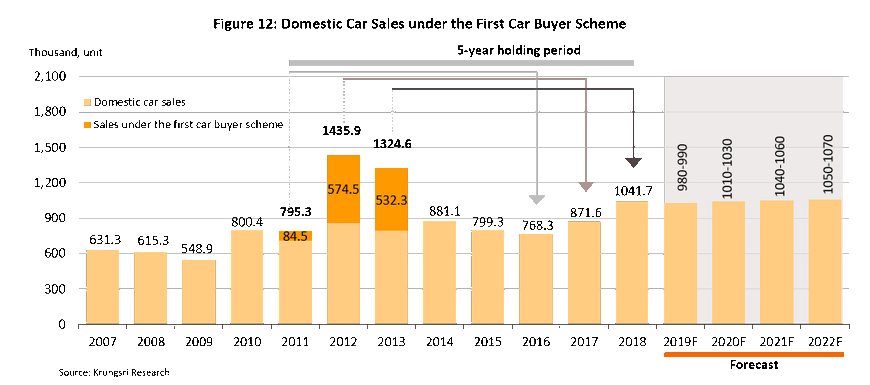

- Boom: Between 2011 and 2013, the sector experienced high levels of growth thanks to the stimulus provided by the First-Car Buyer scheme, which lifted car sales from 0.79 million in 2011 to 1.4 million in 2012 and 1.3 million in 2013, and with this, the value of auto hire purchases likewise grew, rising by 33.8% YoY in 2012 and then by 16.7% YoY in 2013. Sales of motorcycles were also healthy in this period (2 million were sold in 2012), being buoyed by the high price of agricultural products that was caused partly by the rice pledging scheme and partly by high oil prices, which averaged USD 106.8/barrel during the period 2011-2013. The latter then helped to push up the prices that farmers were able to achieve for crops used in the production of alternative energy, including palm oil for use in biodiesel and cassava for use in the manufacture of ethanol. The majority of the expansion in hire-purchase loans in these years came from financial institutions and from captive finance, with the second playing an increasingly important role in the sector after 2011.

- Bust: Following the boom period, the two years of 2014 and 2015 saw a rapid slowdown in growth in the auto hire-purchase market; in 2014, the market for auto finance shrank sharply because demand carried forward by the First-Car Buyer scheme had already been met, leaving worsening market conditions in the policy’s wake and so sales of vehicles (including both private passenger automobiles and commercial vehicles) shrank back to a more normal rate of 0.7-0.8 million units/year. At the same time, sales of motorcycles also fell, declining to around 1.7 million units as the effects of the intense drought took hold and concurrently, farm incomes fell, dragged down by sliding oil prices that helped to reduce the price of crops that are used as inputs to alternative energy production. The net effect was then to undercut growth in outstanding auto loans, which at their worst point in 2016, shrank by

-6.1% (Figure 5).

This contraction of the automobile market also had important implications for the structure of the auto hire-purchase sector as a whole:

- Competition in the sector stiffened, and captive finance companies began to play a more important role in the market. Working in association with dealers, these companies used a variety of strategies to promote sales and so reduce large stock holdings, which following the earlier period of expanded output by manufacturers had grown to high levels. Among these strategies, they introduced ‘balloon loans’. These loans are a way of extending financing to low-income groups and are structured so that payments for each installment are low, with the outstanding balance paid off by a large lump-sum payment in the final period. In addition, installment periods were extended to 3-6 months each so that individuals who have seasonal incomes, such as many of those who work in the agricultural sector, could gain easier access to credit. Payments to dealers were also sped up so that it would be possible for them to be paid within a single working day and this then helped dealers close sales more easily. Through 2015, these moves helped captive finance players to expand their operations, while at the same time, that of commercial banks suffered (Figure 5). Hire-purchase companies also tried to deal with more challenging market conditions by relaxing the terms of their financing, for example by extending repayment periods to 7-8 years and by reducing the size of the down-payments that are required from buyers.

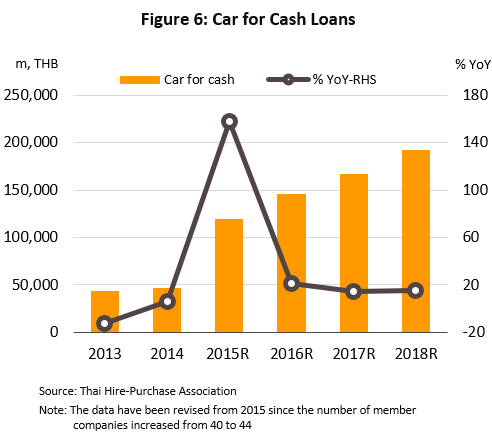

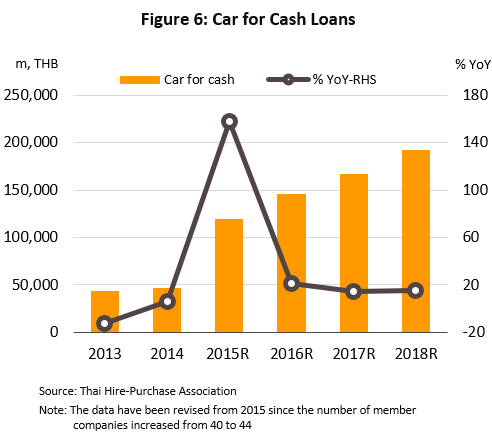

- Players also changed their tactics to exploit markets which had the potential to offset losses in the main auto hire-purchase market. These changes included extending ‘floorplan’ financing to dealers (to allow them to expand their businesses and to launch marketing campaigns to sell-off stock) and refinancing privately-owned automobiles. This latter proved to be popular and the market for this grew steadily while the economy remained sluggish in the period from 2013 to 2015 (Figure 6).

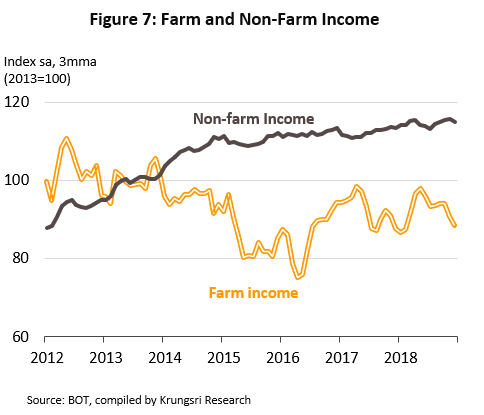

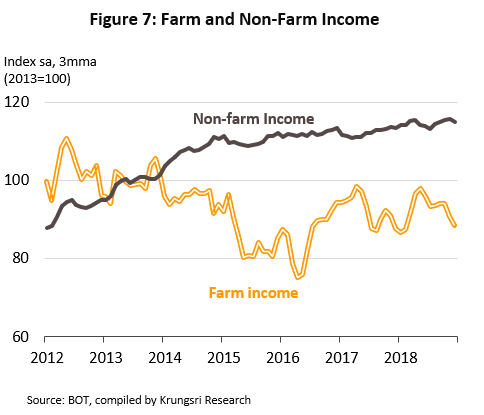

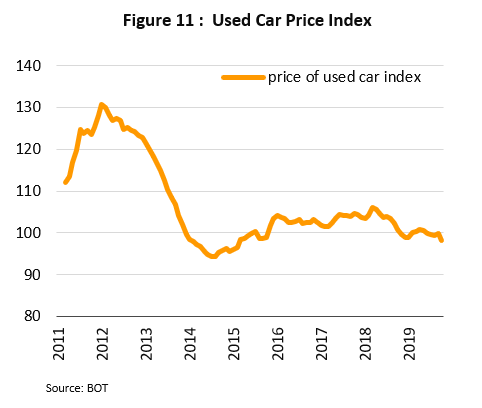

- Recovery: In 2016, the value of all outstanding auto loans contracted by -6.1% YoY in 2016. On 1H16 household purchasing power that was undercut by a variety of factors. However, despite the difficulties in the previous years, the auto finance sector saw signs of recovery in the latter half of 2016. In the first half of 2016, farm incomes were hurt by the impacts of the drought, while growth in non-farm income stalled in the face of continuing sluggishness in the economy and high levels of household debt (Figure 7), although in addition, purchases of new vehicles were rushed through at the end of 2015 in anticipation of rising duties on vehicles with engines over 1,500 cc and this then naturally led to a softening of demand in 2016. In 2019 H2, the abating of the drought helped to boost farm incomes and this then benefited sales of commercial vehicles and motorcycles. Growth in sales of new vehicles was also underpinned by strong demand for trucks and buses, luxury and imported automobiles, and ‘big bikes’. The market for second-hand vehicles also improved following an earlier period of loss-making, when prices had fallen by up to 25-30%. These cuts had been triggered by customers who had bought vehicles on the First-Car Buyer scheme failing to meet their payment schedule, thus causing their cars to be repossessed by lenders; the resulting flood of second-hand vehicles then pulled down prices substantially.

- Recovery continued through the following 2 years, and in 2017, the value of auto hire-purchase loans increased by 1.4% YoY. The most important factors positively affecting the market included a better economic outlook, which then strengthened consumer purchasing power, and the beginning of the expiry of the 5-year period during which the sale of cars bought under the First-Car Buyer scheme was prohibited, thus allowing these vehicles to gradually be replaced (for all purchases of vehicles made under the First-Car Buyer scheme, this prohibition expired between the end of 2016 and the first half of 2018). Beyond this, auto finance lenders benefited from sales promotions in market segments where consumers had stronger purchasing power, (e.g. for imported and luxury vehicles), the release of new models, pricing strategies to stimulate demand, and the relaxation of loan conditions by captive finance operations that were made to help dealers clear their forecourts of excess stock. In 2018, the recovery continued and the market grew by another 7.0% YoY as economic growth extended and some consumers changed or upgraded their vehicles. Captive finance operations have also been competing strongly on price and used a number of different sales strategies to expand their market share, including extending loan repayments over a longer period than usual (up to 84 months), offering balloon loans, which have a sizeable portion of the total loan repayments shifted to the last payment, and by offering special low-interest deals through dealers that have allied with financial institutions.

However, despite these generally positive business conditions, negative headwinds came in the form of government moves to more tightly regulate lending by introducing new regulation on hire-purchase loans contracts, which simultaneously cut income from interest payments and increased administrative costs.

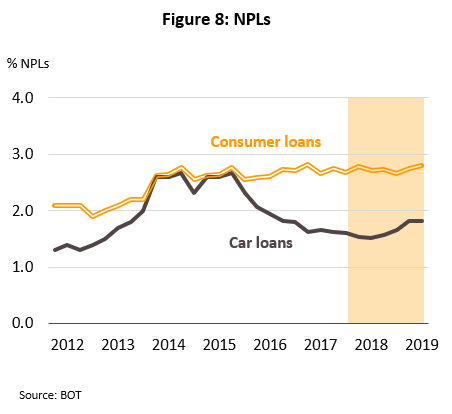

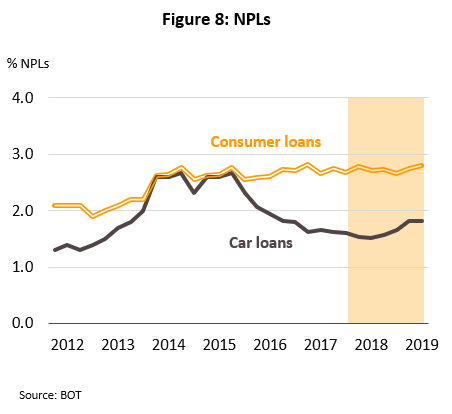

- Non-performing auto finance loans, or NPLs, rose steadily through this period, hitting a high of 2.76% of all outstanding auto loans in the 3rd quarter of 2015 (Figure 8). The situation with NPLs deteriorated because the First-Car Buyer scheme had encouraged consumers to take on significant debts at a time when some lacked the financial security to do so and as such some buyers failed to meet their repayment schedules, forcing lenders to repossess their vehicles. However, creditors moved to remedy this situation by restructuring lenders’ debts, extending repayment schedules and reducing interest payments, and the upshot of this was then that fewer debts turned bad and the proportion of NPLs in the system gradually fell, while at the same time, the auto market entered a period of recovery. Thus, by the final quarter of 2017, NPLs accounted for just 1.6 % of total auto debt, although this then increased slightly to 1.66% in 2018.

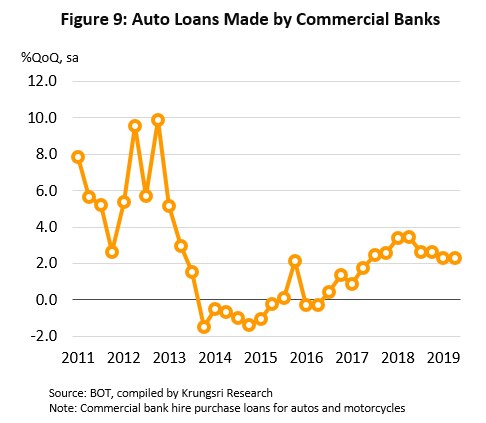

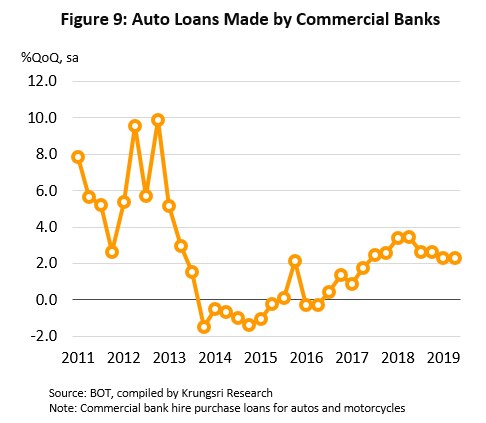

- In 2019, business conditions remained on a positive trajectory for auto finance lenders, as was reflected in the strong increase in the value of auto loans approved by commercial banks (Figure 9). Through the year, tailwinds continued to blow from 2018, and these included sales promotions undertaken by major manufacturers and the ongoing release of new models, but the situation for the second-hand market weakened somewhat in the year as prices softened on an increase in the supply of second-hand vehicles that was precipitated by owners of autos bought under the First-Car Buyer scheme changing their vehicles. In addition, by easing access to credit, sellers have encouraged purchases by individuals who are unable to keep up with their payments and as these vehicles are repossessed they have entered the second-hand market. As such, NPLs have started to rise again within the auto finance sector and as of the 2nd quarter of 2019, these accounted for 1.82% of all auto debt (Figure 8).

Outlook

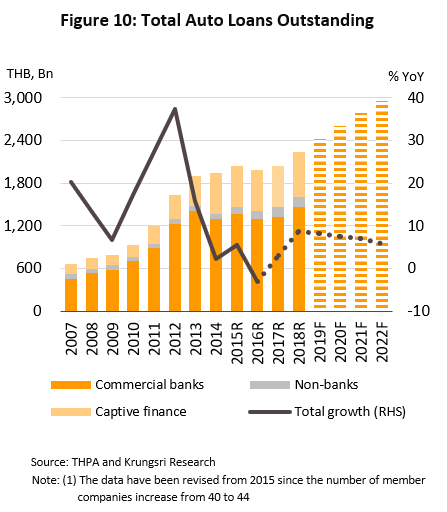

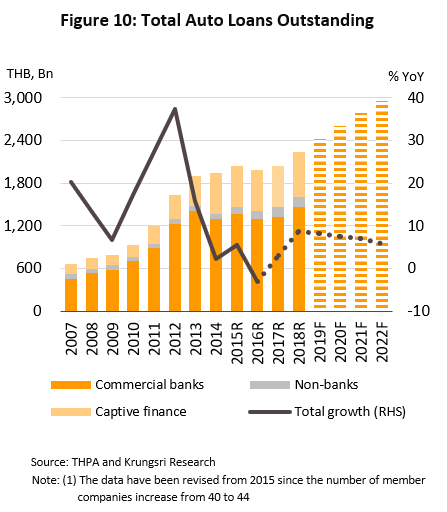

Over the next few years, annual growth in the auto finance sector is forecast to slow to an average rate of 6.7-7.0% during 2020-2022 (Figure 10). Positive factors that may boost turnover within the sector in the near future will include the likelihood of interest rates remaining low, increasing sales of some types of vehicles (in particular commercial passenger vehicles, trucks and electric vehicles), strengthening demand in the second-hand market, and moves to use digital platforms to extend markets to potential new customer groups. However, the temporary stimulus to the market that was provided by the need of First-Car buyers to purchase new vehicles will rapidly be exhausted, consumer confidence and household spending power are being undermined by what are expected to be only anemic levels of economic growth, and many households continue to be saddled with high levels of debt. At the same time, increased efforts by the government to manage the release of smaller consumer loans are also forecast to have an impact on players’ ability to approve new credit. Details of these positive and negative factors are given below.

Positive factors affecting the sector

- Domestic interest rates will tend to fall in the coming period and this will reduce the cost of borrowing but because income from interest is fixed when auto loan contracts are agreed, this will then translate into higher profits for lenders.

- Some segments of the auto market will see solid rates of growth.

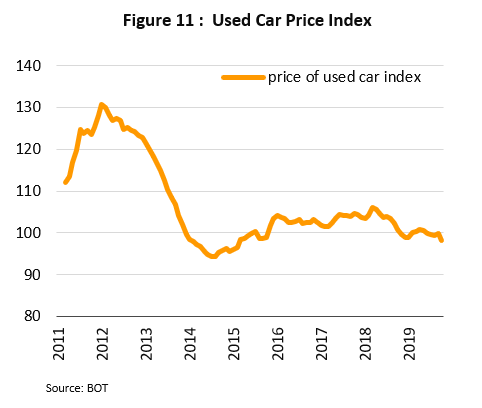

(i) Sales of commercial vehicles are forecast to rise in step with growth in demand for transport and logistic services and as a result of government investment in national infrastructure. (ii) Relative to that for new cars, the market for second-hand vehicles will be less affected by government regulation of consumer finance since second-hand dealers will be able to run promotions to stimulate sales, and because loans are assessed relative to average market prices, these may include offering loans for more than the actual value of the vehicle being sold or arranging loans that include cash-back payments to borrowers. In addition, the market for second-hand autos will also be boosted by continuing low prices (Figure 11) that will be caused by a combination of First-Car buyers purchasing new vehicles, now that the 5-year prohibition on selling their cars has fully expired, and earlier efforts to stimulate sales that have encouraged consumers to take on car debts that they cannot service, and so these vehicles are now being repossessed and released to the second-hand market. (iii) Demand will strengthen for environmentally-friendly vehicles, especially for electric vehicles (EVs), which are expected to fall in price thanks to government efforts to increase domestic production. These measures have included BOI support for investment in the production of hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs) and battery electric vehicles (BEVs), together with moves to encourage the construction of EV charging stations, an important step in building out the infrastructure required to underpin more widespread usage of EVs in the future. In addition, the government has also overhauled auto excise rates and rates for EVs have now been set at a low level, which should naturally act as another incentive to consumers to switch to higher tech vehicles that are more fuel efficient.

- By using new digital platforms, lenders will be able to extend the market for auto finance to potential new customer groups, though moving in this direction will be particularly attractive to large financial institutions, which will then be able to exploit their strengths in having access to a sizeable customer base by working with dealers to market their financial services. By using data analytics to analyze data in depth, operators will be able to better understand actual consumer needs their searching through online marketplace to compare price of cars. The financial institutions can provide auto lending to those customers, based on individual risk from their financial transaction data and other behavioral data from relevant platforms. Then to offer appropriate loans proactively, without having to wait for potential borrowers to submit a formal application.

Negative factors affecting the sector

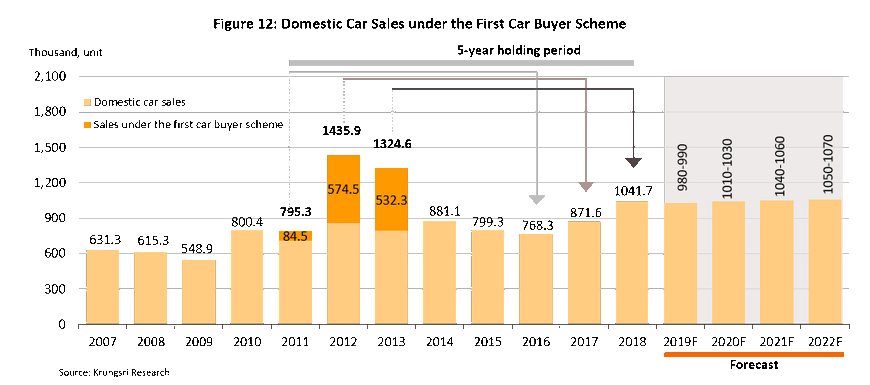

- Demand from buyers who purchased a vehicle under the First-Car Buyer scheme[4] will steadily dissipate because the 5-year ban on sales fully expired in the period 2016-2018. Indeed, in 2018, when the moratorium on transferring ownership for the last group of purchases made under the scheme terminated, it became possible to sell on a further 530,000 vehicles (Figure 12), or 44.7% of all the vehicles sold under the program, and owners have in fact steadily been upgrading these, but the effects of this process on the auto finance sector will steadily lessen as time goes by and will eventually end.

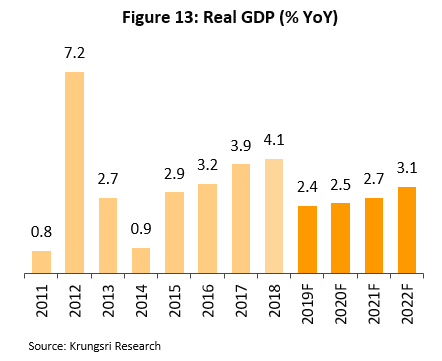

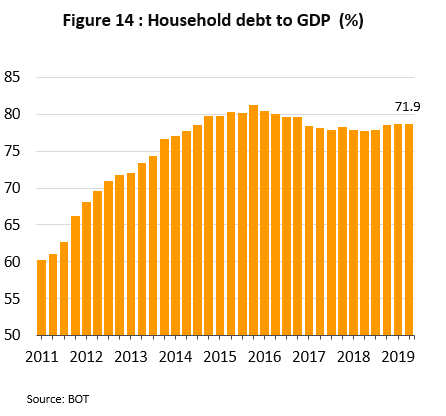

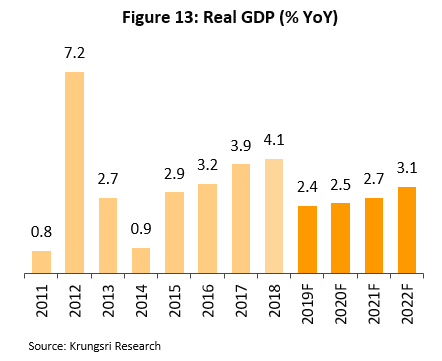

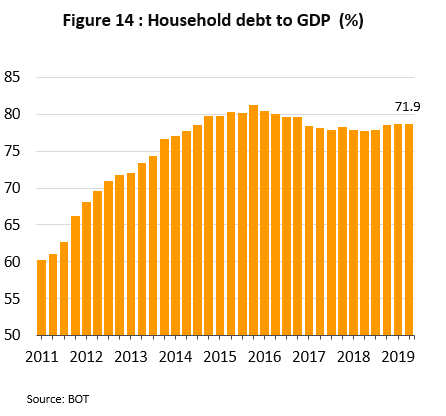

- Consumer spending power will soften under the twin impacts of the high levels of debt that are affecting most Thai households and only low levels of growth in the domestic economy. Thus, Krungsri Research estimates that the Thai economy will see average growth of just 2.8% YoY in the period 2020-2022 (Figure 13), and as of the 3rd quarter of 2019, household debt stood at 71.9% of GDP (Figure 14). This is acting as a significant brake on consumers’ willingness to take on new debt, especially for items such as automobiles, which are seen as luxury goods and so purchases of these are more responsive to changes in income than are household necessities.

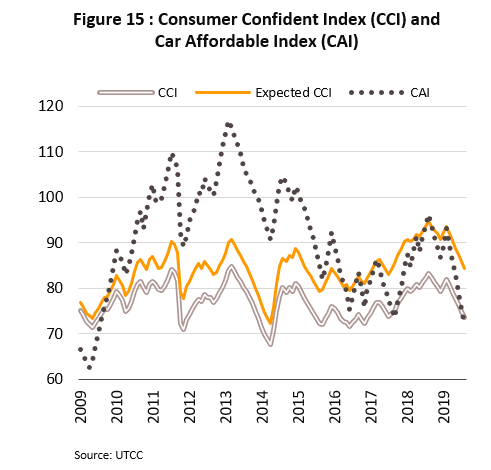

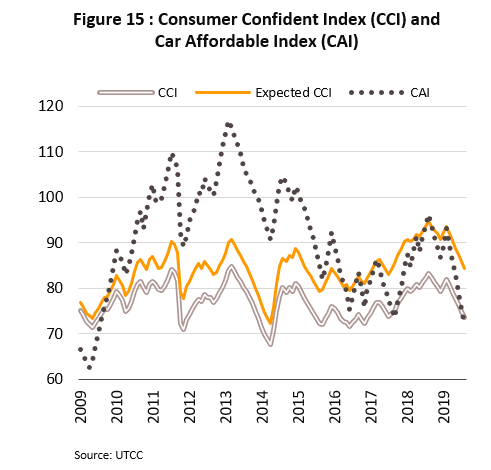

- Consumer confidence is tending to worsen and because of this, buyers may postpone purchases of new vehicles. The new car affordability index, which indicates consumer willingness to buy new vehicles, typically moves in parallel with the consumer confidence index, and data from the 3rd quarter of 2019 shows that the latter has been falling steadily on fears over uncertainty in the world economy and the lack of clear signs of economic growth domestically. At the same time, the car affordability index also weakened and touched its lowest level since 2009, while the majority of respondents to a survey believed that now was not an appropriate time to purchase a new car (Figure 15).

- Tighter government regulation of auto finance loans will limit the ability of lenders to release credit in several ways:

- The Bank of Thailand is now responsible for regulating ‘car for cash’ loans (i.e. pawning vehicles) alongside operators offering other personal loans secured against vehicles and this means that these operators now need to register with the BOT when operating nationally. To do so, they need to have registered capital of no less than THB 50 m and to charge interest rates of no more than 28% per year.

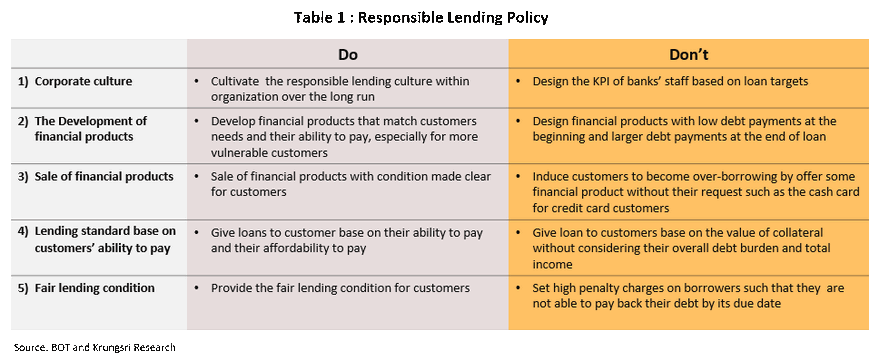

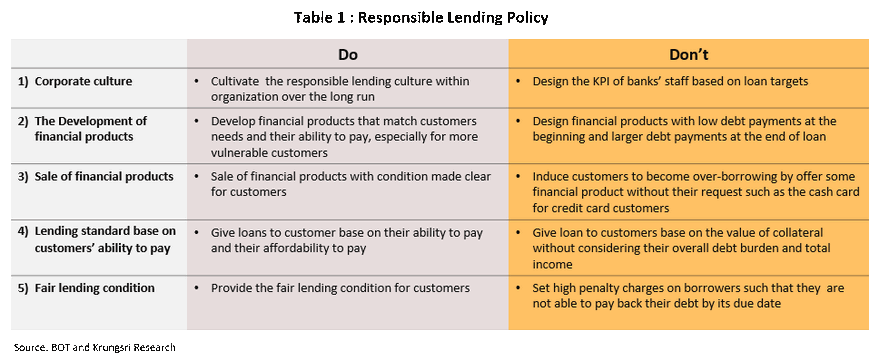

- In August 2019, financial institutions put their names to the principles of the ‘responsible lending’ agreement, which, to allow borrowers to retain enough income to cover their living expenses, urges lenders to consider a range of factors connected to borrowers’ circumstances, rather than simply ensuring that there is sufficient collateral secured against their loans. These factors include the borrower’s financial status and their ability to meet the repayment schedule, and are particularly important for the most at-risk groups. Lenders should also now ensure that loans meet borrowers’ needs and should not attempt to sell financial products that cause borrowers to take on more debt than they need to. These requirements will likely have an impact on all stages of the loan-making process, including stopping lenders from offering loans without considering customer needs, not selling balloon loans (loans that have low initial repayments and a large final payment, which may be beyond the ability of borrowers to repay), not making loan decisions based primarily on the value of the collateral against which the loan is secured while ignoring the borrower’s current debt obligations and sources of income, and not approving loans on the spot, such as car for cash- or house for cash-type deals (Table 1).

Krungsri Research View

The auto finance sector is forecast to see slightly slower rates of growth over the 3 years from 2020 to 2022, although these should still average 6.6-7.0% YoY (Figure 10). The sector will benefit from falling interest rates, growth in demand for some vehicle categories, and the increasing ability of businesses to use new technology to expand their customer base. However, at the same time, only low levels of economic growth and with this, weaker household spending power and consumer confidence, the end of the stimulus effect of upgrading autos bought under the First-Car Buyer scheme, and the greater government regulation of small loans will all weigh on growth. These factors will then put operators’ profitability under pressure and restrict growth in the market, which will in turn have a number of consequences.

- Competition from captive finance operations is expected to rise in the future since the increase in government regulations of the auto finance sector is forecast to have a greater direct impact on financial institutions than on non-bank lenders, and in particular on auto manufacturers that run their own captive finance operations and which in the future may depend on captive finance in marketing some vehicle models. The result of these new government measures may thus be encourage these players to switch to more proactive strategies by increasingly marketing through their own captive finance operations, which would also allow them to maintain their share of auto loans market.

- Operators will increasingly compete for access to customers with higher spending power as a way of compensating for the impact of the new BOT lending regulations on consumer groups that are more at risk (e.g. those who have only recently entered the labor market, low-income earners and the elderly), since these will be more heavily affected by the BOT rules. At the same time, though, over the longer term, these new rules should help to raise the quality of the loans made by auto finance lenders.

- Marketing through digital platforms will play a greater role in helping lenders better connect to customer groups in the future and by using digital channels, players will be able to understand and access to the range of consumer needs more fully, as well as being able to appeal to a wider range of potential new borrowers. These new tools also offer the advantages of lowering costs by allowing lenders to use data analytics to investigate the huge quantity of alternative data. The financial institutions will better assess customer risk and can provide loan in advance to customers who have a tendency to buy car by comparing car price from bank alliances’ e-marketplace. In light of this, since growth in the market will tend to slow, lenders that successfully invest in and apply the technology required to develop digital platforms will be best placed to maintain their competitiveness and to grow their business in the future.

[1] www.thpa.or.th

[2] Data from the Department of Business Development.

[3] Data from the 44 members of the Thai Hire-Purchase Association that are auto hire-purchase lenders. This data represents approximately 85% of auto hire-purchase loans

[4] The First-Car Buyer scheme ran from September 16, 2011 to December 31, 2012 so customers who bought a vehicle under the scheme in 2011 passed the 5-year ownership mark in 2016, and at this point they were then free to sell their cars or otherwise transfer ownership.

.webp.aspx)