EXECUTIVE SUMMARY

Refineries can look forward to an improving business environment over 2024 to 2026. Domestic demand for refinery products will be boosted by an uptick in economic activity, particularly in e-commerce sales and the tourism sector. The industry will also benefit from increasing connectivity in trade and investment across the ASEAN region that will then lift demand from the transport sector and related parts of the economy. On the supply side, major producers will likely restrict expansion in output to keep in check with growth in demand, and so global crude prices will remain elevated. As such, gross refinery margins will run in the range of USD 6.0-7.0/bbl, up slightly from 2023’s average of USD 6.3/bbl.

However, ongoing geopolitical tensions and possible cuts to production quotas will stoke periodic volatility in global crude markets, and this will then expose refineries to the risk of stock losses.

Krungsri Research view

Krungsri Research view: An improving economic outlook will feed a sustained rise in domestic demand for refinery products, while OPEC+ restricting supply will keep oil prices elevated. Refineries and associated businesses can therefore look forward to growth in turnover from 2024 to 2026.

-

Refineries: Expansion of overall demand for refinery products from ongoing economic expansion, high level of capacity utilization and wide GRMs will help refineries to look forward to steady profit growth in the coming period. Additionally, corporations will step up their investments, especially in clean energy projects that will allow them to produce a greater range of high-value products and so to expand their revenue base over the long term. Nevertheless, volatile crude markets will expose companies to an increased risk of having to shoulder stock losses.

-

Wholesalers of refinery products and liquid fuels: Players in this group will benefit from increasing domestic demand for refinery products. Most of these companies are also members of commercial groups that include refineries and so these face relatively low levels of commercial risk.

-

Petrol stations/service stations: Steadily increasing domestic demand for refined oil products will support a positive outlook for petrol stations. Moreover, to increase competitiveness and build income, players are also increasingly expanding their investments in ‘green’ fuels and in business activities that are not connected directly to the sale of oil products, such as the rental of retail space in forecourts and the installation of EV charging stations.

Overview

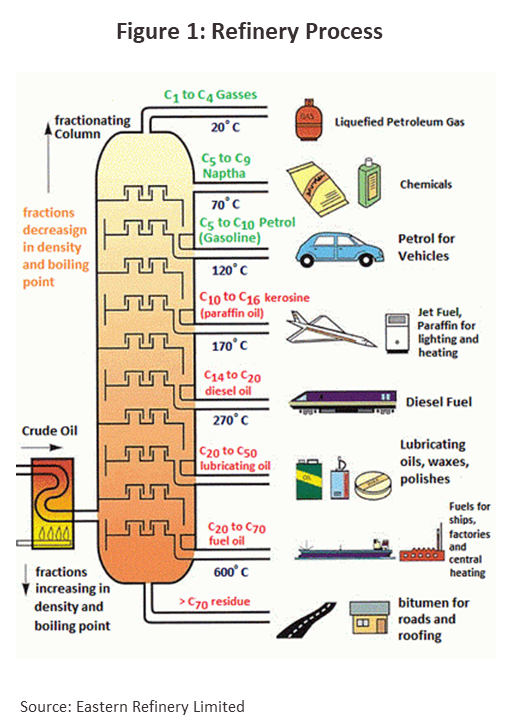

Oil refining is a large-scale, technology-dependent and capital-intensive industry within which corporations leverage their significant investments to generate economies of scale. Given this, returns on investment are typically made over only an extended period, and this constitutes a significant barrier to entry. The refining process involves the fractionation or transformation of crude oil into a variety of petroleum products (Figure 1), including liquified petroleum gas (LPG), naphtha, gasoline, kerosene, diesel, bunker oil, and asphalt. These are used in different applications according to their qualities and properties, though the exact proportions of these different products in refinery output is dependent on the source and profile of the crude oil used as an input.

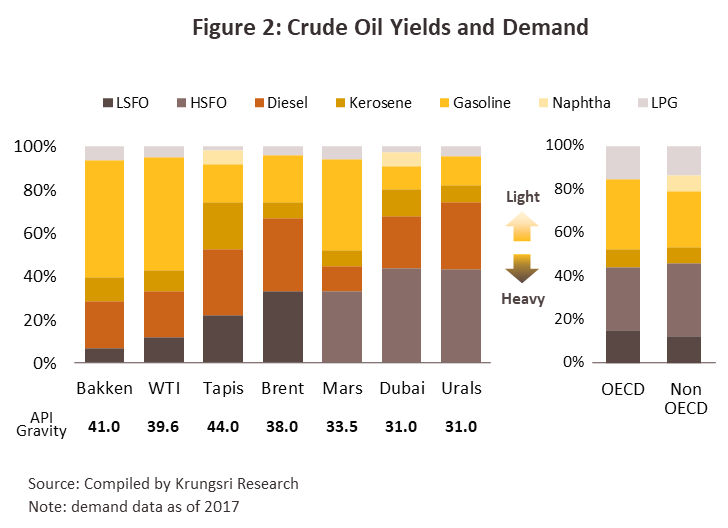

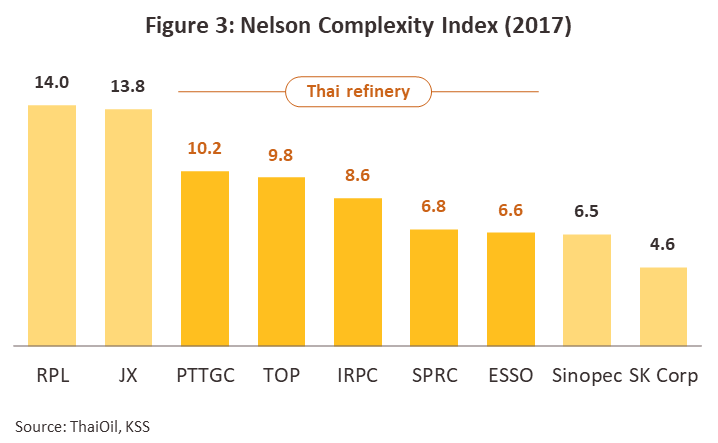

Refineries can be divided into the two broad categories of simple refineries, which distill crude oil to separate this out into its components, though these will vary according to the properties of the crude that is refined, and complex refineries, which add so-called ‘cracking units’ to the process. Complex refineries are more expensive to build and to operate, but in addition to simply distilling crude, these are able to transform heavy, low-value oil products into light, higher-value ones. The extent to which complex refineries are able to transform oil products varies and is measured by the Nelson Complexity Index (NCI). A high NCI indicates that a refinery is able to convert a wider range of products into high-value outputs and so has a greater level of flexibility with regard to the sources of crude that can be used as inputs. Refineries with a high NCI are therefore able to process crude from suppliers in different regions and that thus have different properties1/(Figure 3).

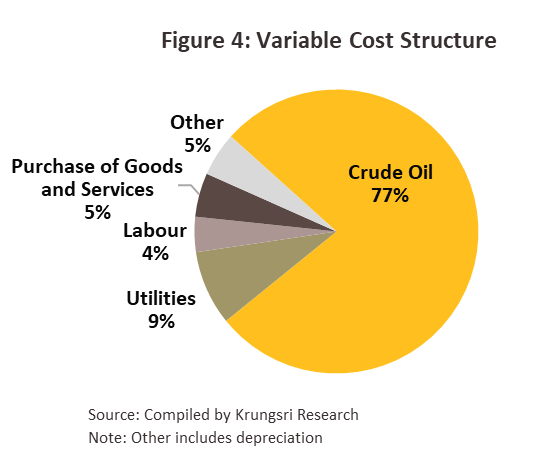

Although refining is a highly capital-intensive industry, refineries themselves have a fairly long lifespan of 30-50 years and so fixed costs per unit are relatively low. Instead, around 95% of costs are variable, and of this, 75-80% is attributable to inputs of crude oil. A further 10% of costs is attributable to the energy used in the refining process, and the remaining 10-15% goes to other areas, such as depreciation (Figure 4).

In addition to the cost of crude, the price of petroleum products is also determined by the interaction of supply and demand, and the latter in turn depends on the level of economic activity since some 70% of all petroleum products are used as transport fuels. The difference between the price of petroleum products and the cost of crude (which is also called the ‘spread’) is used to measure the profitability or margin of each refined product.

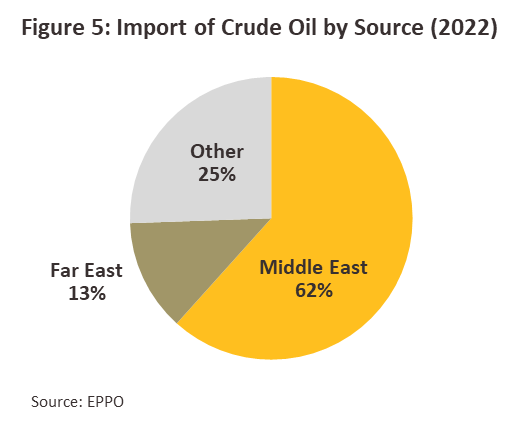

The ability of a refinery to turn a profit can be assessed from an examination of its gross refinery margins (GRMs), which are calculated per barrel by subtracting the total refining costs from the combined value of the petroleum products produced from the refining process. In detail, the following factors determine the GRM of a refinery: (i) The cost of crude oil. Changes in the cost of crude will increase the GRM in two situations. These are if increasing demand for petroleum products pushes up the price of crude but refined products increase in price by a greater degree than does crude, or if the supply of crude oil expands and this helps to depress prices for crude and the effect of this is greater on crude than on refined products; (ii) the price of petroleum products; (iii) capacity utilization. If capacity utilization is high, the GRM will likewise be high, and generally, efficiently run refineries will operate with a capacity utilization over 80%2/; (iv) the extent to which a refinery is able to convert inputs into higher-value outputs. An examination of the NCIs of Thai refineries indicates that these are fairly high; and (v) the ability to control costs and to source more desirable crude. Refineries which process heavier crude will usually have a lower GRM than those that are able to use lighter crude; around 62% of the crude processed by Thai refineries is heavy Middle Eastern crude and this means that output tends to be of heavier products, such as diesel and fuel oil (Figure 5).

In addition, the profitability of individual refineries also depends on: (i) the extent to which business operations are vertically integrated through to downstream activities and on to related areas, since this will help to reduce costs and improve production planning; and (ii) the physical location of the refinery since there will be consequent cuts to transportation costs and improvements to profitability if resources and/or markets are easily accessible.

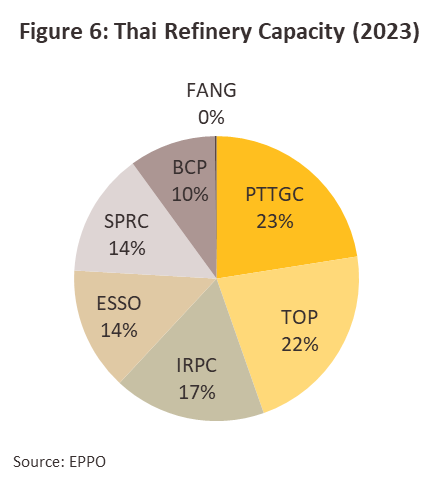

With a refining capacity of 1.243 million barrels per day, the Thai refining sector is second only to Singapore in size within the ASEAN region. Seven operators are active in the sector, and all production from these comes from complex refineries. These seven players are: PTT Global Chemical (PTTGC), ThaiOil (TOP), IRPC Public Company Limited (IRPC), ESSO3/, Star Petroleum Refining Public Company (SPRC), Bangchak Petroleum (BCP), and FANG. PTT is the largest of these since it is a major shareholder in PTTGC, TOP and IRPC (Figure 6).

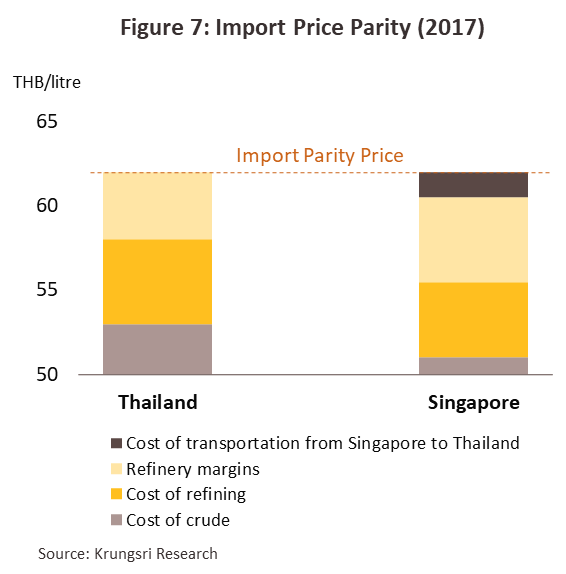

As their reference price, Thai ex-refinery prices use those quoted on the Singapore exchange (SIMEX), specifically the Mean of Platts Singapore (MOPS) while the import price parity principle, which is calculated from Singapore prices FOB combined with transportation costs, is used to specify the Thai price ceiling. Singaporean GRMs therefore clearly have a heavy influence on those of Thai refineries (Figure 7).

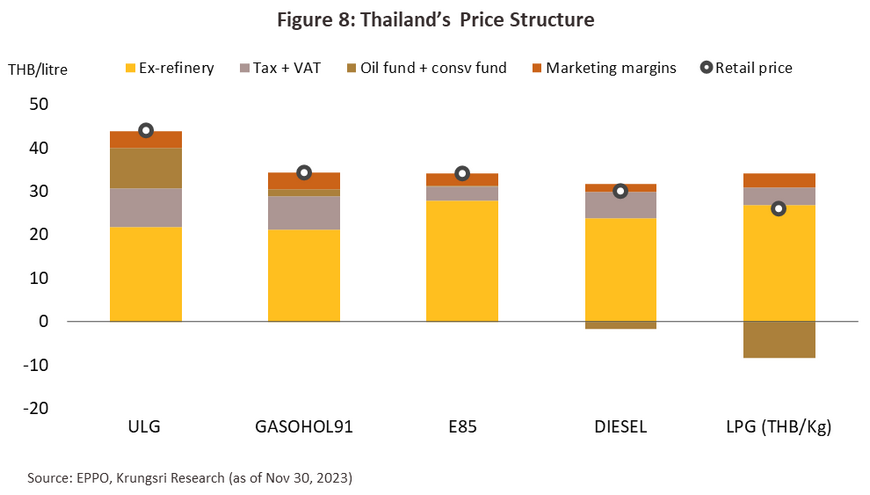

The retail price of Thai oil products is not determined simply by market forces, which in this case would be a combination of the refining costs, the GRM, the distributors’ marketing margins, and the cost of the crude itself. Rather, the Thai government plays a significant role in determining the movement of prices through the collection of excise duties on refined products and contributions from distributors of oil products to the Oil Fund (Figure 8). The Oil Fund exists to smooth out variability in domestic prices for refined oil products when prices on world oil markets are high or particularly volatile. Subsidies from the Oil Fund are also used by the government to promote consumption of particular fuels, such as E20 and B7.

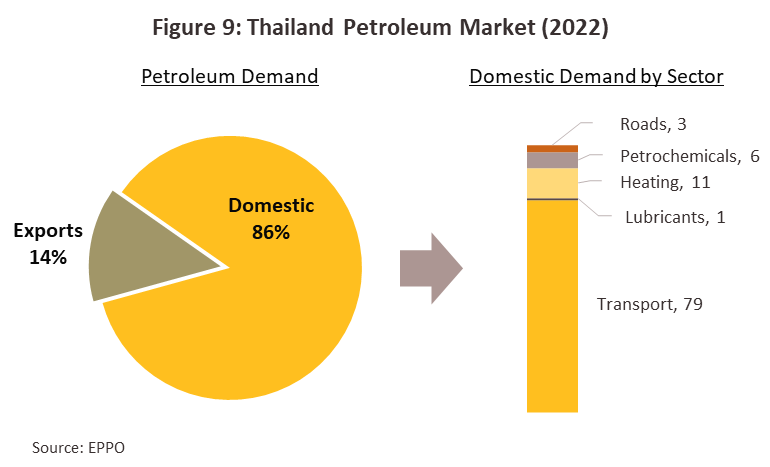

About 86% of the refined products output by Thai refineries is consumed on the domestic market. Of this, 79% is used as transportation fuel (i.e., gasoline, kerosene, and diesel), 11% is used as industrial fuels or in the production of electricity (i.e., diesel and bunker fuel), 6% is used by the petrochemical industry (i.e., LPG and naphtha), and 3% (asphalt) is used in road construction. The 14% that is exported goes largely to the ASEAN zone, which takes approximately 75% of this, and East Asia (Figure 9).

Situation

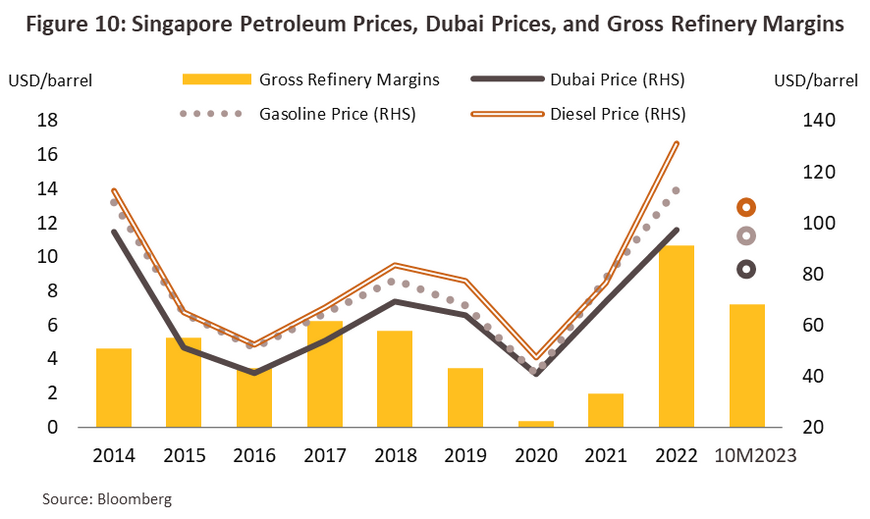

The outlook for oil refiners improved markedly in 2022 with the successful global rollout of vaccines and the effective ending of the Covid-19 pandemic, allowing countries to relax restrictions on international travel and opening the way for economic activity to return to normal. Given this, consumption of goods and services rebounded, lifting demand for transport fuels, especially for aviation fuel as demand for travel and tourism that had been bottled up through the pandemic was released. The effects on oil markets of these shifts in demand were then amplified by Russia’s invasion of Ukraine, and against this backdrop, at an average of USD 97.4/bbl, 2022 Dubai crude prices were up 40.5% from their 2021 level and almost 75.0% from their 2015-2019 average of USD 55.8/bbl. However, elevated prices undercut demand, especially in the latter half of the year, though alongside this, average gross refinery margins expanded to a historic high of USD 20.7/bbl, a huge leap from the pre-Covid average of USD 3-5/bbl (Figure 10).

Prices for Dubai crude retrenched through the first 10 months of 2023, dropping -17.9% YoY to an average of USD 82.2/bbl. Through the year, central banks responded to a rapid buildup in inflationary pressures by hiking rates aggressively, and this then weighed on global growth. In addition, China’s emergence from the shadow cast by its zero-Covid policy was much weaker than expected, and as the recovery stumbled, global demand for oil softened. In response, producers trimmed output, and in particular, the OPEC+ group agreed to combined cuts in production quotas that have taken more than 2.5 million barrels per day offline since the start of the year. Supply to global oil markets was then further affected by the imposition of embargos on imports of Russian oil and refinery products to the western economies. Market sentiment was also undercut by the continuation of the war in Ukraine and the sudden outbreak of fighting between Israel and Hamas at the start of October. This added to volatility in global markets, and so although demand has weakened, crude prices have remained elevated.

Softening demand for refinery products added to downward pressure on prices on the Singapore market, but declines were limited by the entry to the Asian market of buyers from the EU trying to replace lost imports from Russia, especially of diesel. Domestic demand in Asia also rallied as the tourism sector bounced back across the region, and with international travel surging, demand for transport fuels naturally tracked upwards. Over the first 10 months of 2023, Singapore diesel prices thus slid -20.8% YoY to an average of USD 105.8/bbl, while benzene prices dropped -19.4% YoY to USD 94.9/bbl. 9M23 gross refinery margins also narrowed, closing to USD 7.2/bbl from the 2022 average of USD 12.2/bbl.

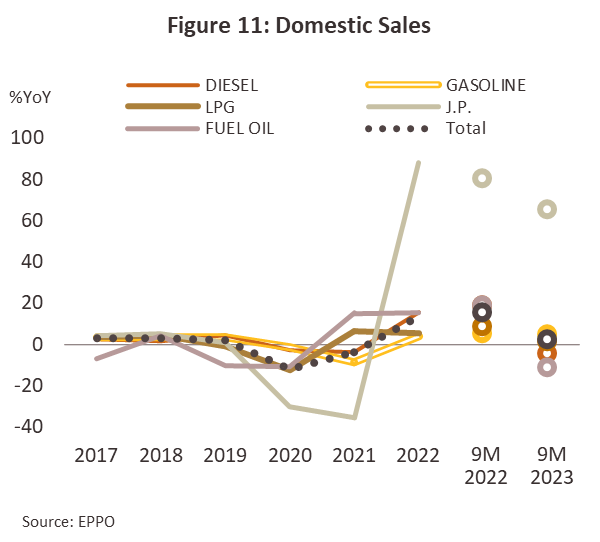

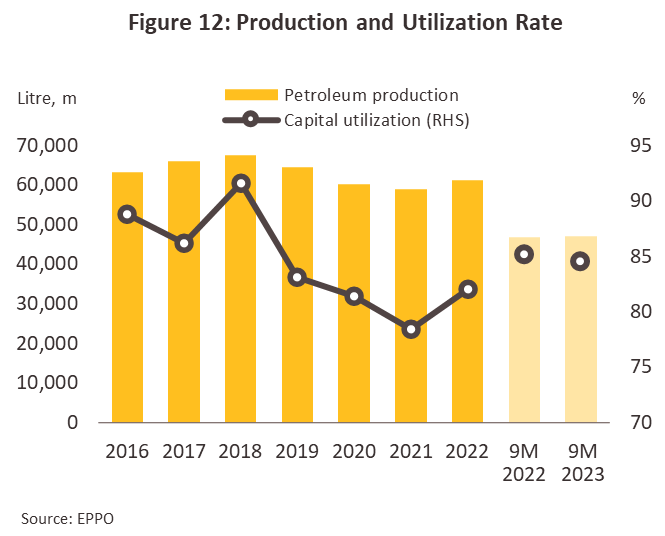

Thai refineries benefited from steady growth in the economy through 9M23, in particular from the rapid rebound in the tourism sector. This boosted income from wages, supported an improving outlook in related industries and added to demand for air travel, and thus overall consumption of refinery products (i.e., benzene, diesel, aviation fuel, and bunker fuel) rose 2.4% YoY (Figure 11) while capacity utilization remained high (Figure 12). However, softening crude markets undercut prices, and thus average Thai gross refinery margins contracted -32.1% YoY to THB 8.2/liter.

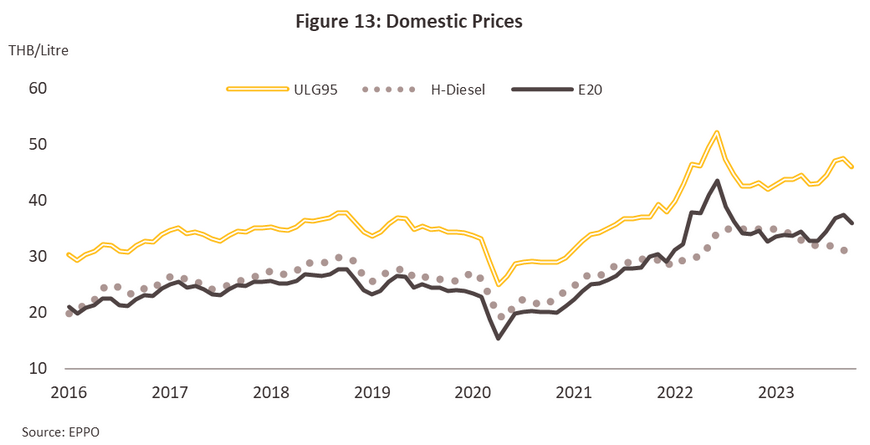

Having surged in 2022, 2023 GRMs have returned to a more normal level of USD 6-10/bbl. This has been due to a rebalancing of supply and demand and the fall in the prices of many refinery products (Figure 13), which in turn has been driven by expanding supply. In detail, benzene prices have fallen on an increase in Chinese exports, prices for diesel and aviation fuel have dropped with growth in Russian supply, which has been diverted from Europe to Asia, and the opening of new refineries in Kuwait has increased global production of bunker oil, undercutting prices for the latter. Krungsri Research thus expects that for the year, the market for Thai refinery products will be as follows.

-

Ex-refinery prices have steadily weakened, most notably for diesel (down -21% YoY), and although prices for Dubai crude have also softened, this has been less pronounced (down -15% YoY). The spread between the two has therefore narrowed from THB 9.5/liter in 2022 to THB 6/liter in 2023. Likewise, the spread between ex-refinery benzene prices and Dubai crude has contracted, though this has been at a much slower rate and between 2022 and 2023, the spread has tightened from THB 4.4/liter to THB 4.2/liter.

-

Softening ex-refinery prices have pulled down pump prices through the year. The cost of diesel thus ticked down -2.3% YoY to an average of THB 32/liter across 2023, though this decline also reflects the impact of the government’s decision to use money from the Oil Fund to subsidize price cuts. The authorities have now decided that between 20 September and 31 December, 2023, these subsidies will continue and so pump prices will be kept below THB 30/liter. Average 2023 prices for benzene also inched down -0.3% YoY to THB 45/liter.

-

Consumption of refinery products expanded 2.2% YoY on an overall increase in economic activity, though an uptick in the transport sector has naturally been most important in stimulating additional demand. (i) Weakness in the export sector undercut growth in demand from industry and so consumption of diesel and bunker fuel rose just 0.5% in the year. (ii) The return of social and economic life to normal has lifted overall levels of domestic travel and so demand for benzene is up 5.0% YoY. (iii) The number of flights has surged 36.8% from its level in 2022 and thus consumption of jet fuel has jumped 60%. (iv) Demand for LPG has risen 2.5% from a year earlier thanks to the higher cost of benzene, which has diverted demand to LPG instead.

-

Exports inched up 1.5% YoY on a 30% YoY increase in overseas sales of diesel. However, this was largely offset by declines in exports of -6.0% YoY for benzene, -22% YoY for jet fuel, and -32% YoY for LPG, and so the overall increase was relatively minor.

-

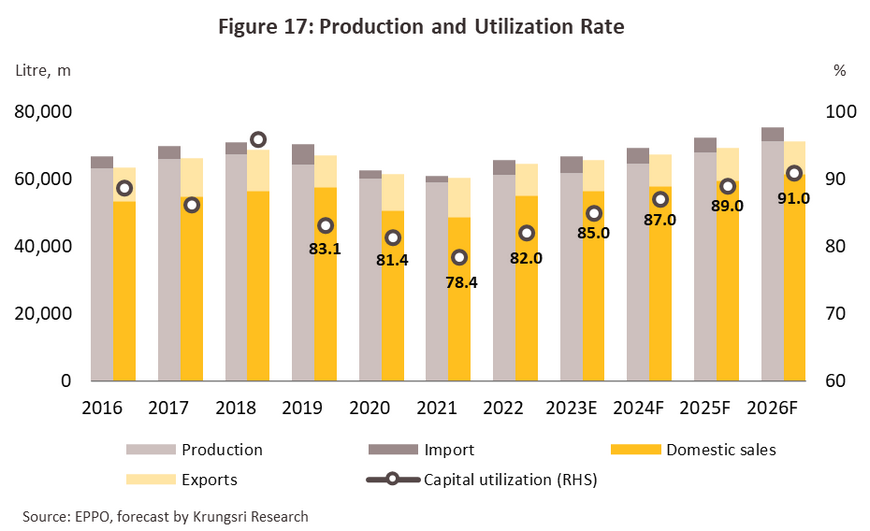

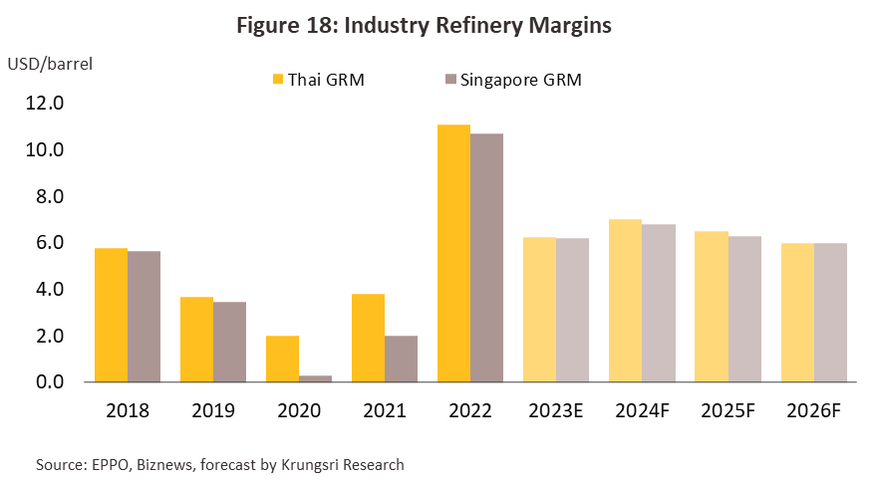

Production and capacity utilization have both risen in line with stronger demand. Overall output of refined products is up 1.0% YoY, split between increases of 2.7% YoY for benzene, 47% YoY for jet fuel, and 0.5% YoY for diesel. Likewise, at 85%, capacity utilization has returned to close to its pre-pandemic level, and so for all of 2023, gross refinery margins are expected to average USD 6.25/bbl, down sharply from 2022’s USD 11.3/bbl

Outlook

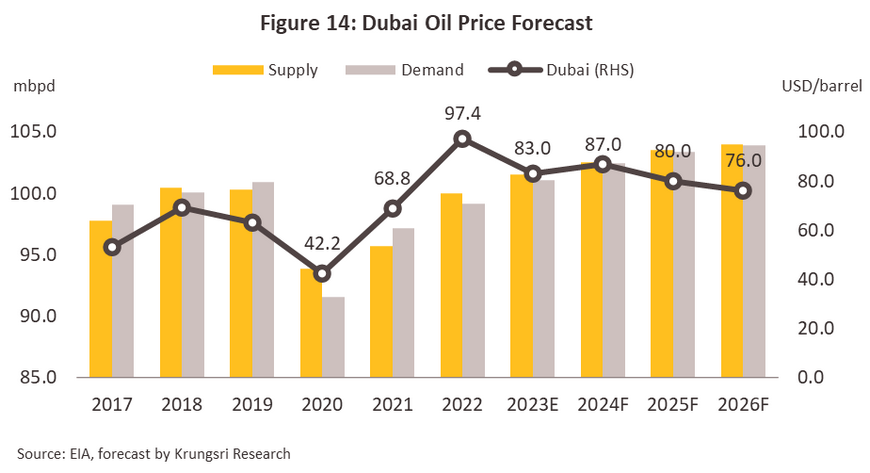

Prices for Dubai crude are likely to remain in the range USD 80-85/bbl over 2024 to 2026, helped by slow growth in the world economy that will then support a gradual strengthening of demand. Alongside this, markets will be constrained by cuts to production quotas by the OPEC+ group (the organization controls around 40% of crude production capacity globally), which will try to keep prices in its target range by more closely matching supply and demand. Indeed, Russia and Saudi Arabia have announced voluntary production cuts that will take 1.66 million barrels per day off global markets between May 2023 and December 2024, and the Energy Information Agency (EIA) therefore expects that in 2024, demand will come to 102.4 million barrels per day, closely aligned with production of 102.6 million barrels per day. Krungsri Research expects that over 2024 and 2025, demand will rise with global economic growth, while easing geopolitical tensions will free up supply and with the latter expanding more rapidly than the former, prices for Dubai crude will slip from an expected USD 87/bbl in 2024 to USD 80/bbl and USD 76/bbl in each of 2024 and 2025. Refineries will therefore likely enjoy a rise in turnover through the coming period (Figure 14).

The softening cost of Dubai crude will undercut Singapore prices for refined products. Prices will be further affected by an increase in regional production capacity, especially in China and India, and the expansion in supply that this will bring. However, this will be balanced by stronger demand that will be stoked by economic growth and acceleration in the tourism sector, particularly in Asia (the IMF sees emerging and developing Asian countries enjoying growth of 4.5-5.5% over 2024-2026). This will thus hold back declines in the prices of refined products, while the spread between prices for Dubai crude and refined products will pull back, falling to its pre-pandemic level. Singapore GRMs will therefore average USD 6.0-7.0/bbl over the next 3 years.

Domestic prices for refined products will track those set on global markets, and so for benzene and diesel, these are forecast to average respectively THB 42.0-46.0/liter and THB 31.5-33.5/liter. The spread between ex-refinery prices and Dubai crude is also expected to average THB 3.5-4.5/liter (Figure 15).

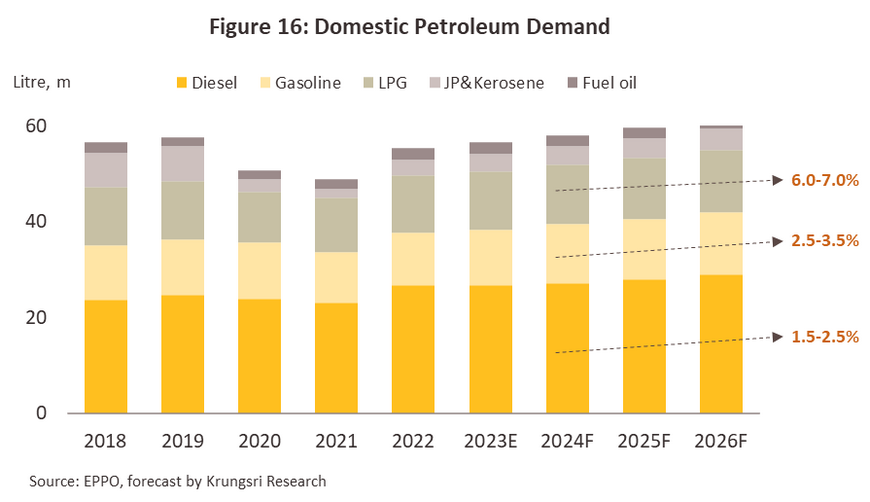

Domestic demand for refinery products will expand by 2.5-3.5% per year. (i) Recovery in the export sector and the ongoing rebound in tourist arrivals will support continuing growth in the domestic economy, and this will in turn drive greater demand for oil products from the industrial and transport sectors. (ii) The value of e-commerce sales is forecast to expand by some 15% per year, and this will translate into increased consumption of transport fuels. (iii) Greater integration of trade and investment across the ASEAN zone will boost use of diesel-powered commercial vehicles. Combined, these factors will help to lift demand for diesel by an average of 1.5-2.5% per year, while for benzene, demand will be up by 2.5-3.5% annually. Continuing growth in tourist arrivals, which is now forecast to hit 40 million annually by 2025, will also feed a 10.0-20.0% expansion in yearly consumption of jet fuel (Figure 16).

Heavier consumption of oil will naturally bring with it an expansion in output of refinery products, and the latter will therefore increase by 4.0-5.0% per year. At the same time, capacity utilization will edge up to 87-91% (Figure 17). With global crude prices likely remaining elevated, gross refinery margins will run in the range of USD 6.0-7.0/bbl, somewhat above the USD 5.0/bbl averaged over 2012 to 2019 (Figure 18).

To respond to future increases in demand and to open up new business opportunities, some refinery operators plan to expand their production capacity. This will allow players to adopt a more flexible approach to sourcing inputs and because this will help to generate additional economies of scale, marginal production costs will fall. Investments will also facilitate the move into clean energy projects, for example, converting low value products such as bunker fuel into higher value, more environmentally friendly goods such as diesel and low-sulfur jet fuel. Refineries may also increase output of ‘sustainable aviation fuel’ (SAF) since the Oil Plan and the revised AEDP are expected to stipulate that by 2027, this should comprise at least 1% of all aviation fuel used. This would not only contribute towards implementing cuts to greenhouse gas emissions but would also match the actions of refineries worldwide.

1/ The major components of crude oil are alkane and cycloalkane hydrocarbons, but crude oil usually also contains small quantities of sulfur, nitrogen, and a variety of metals. Crude from different formations typically has its own profile so crude from the Bakken reserves in North Dakota is more than 60% light oil, whereas that from the Urals in Russia is just 30% light oil. This difference is significant since light oil is less dense than heavy oil. This is due to the lower number of carbon atoms that light oil contains, which makes it more combustible and thus more energetic than heavy oil.

2/ Usually, refineries run non-stop since stopping and starting operations incurs heavy costs. Refineries will, however, periodically cease operations for annual planned maintenance. This will normally be for a period of 1-2 months.

3/ In 2023, Bangchak bought a 65.99% share of Esso from ExxonMobil and announced its intention to buy the remaining shares. This purchase should be completed in 2024.

.webp.aspx)