EXECUTIVE SUMMARY

Over 2024 to 2026, the ethanol industry will enjoy ongoing expansion and improving business conditions thanks to: (i) growth in the tourism industry and an overall strengthening in economic activity; (ii) an increase in the number of vehicles on Thai roads that are able to run on gasohol; (iii) the rising popularity of e-commerce, which will underpin further growth in the transport industry; (iv) government support for biofuels and for increased use of E20 gasohol; and (v) greater demand for ethanol from other industries, for example, for use in the production of sustainable aviation fuels, pharmaceuticals, cosmetics, and bio-plastics.

However, challenges facing players will include the impact of the drought on access to raw materials and the likely volatile but increasing price of these, which will put pressure on production costs and margins. Over the long term, there is also a risk that the increasing popularity of EVs will undercut demand for ethanol.

Krungsri Research view

Players that operate supply chains that are integrated from upstream production through to downstream distribution will enjoy competitive advantages, but problems securing supplies of inputs and the rising cost of these may nevertheless put pressure on profits.

-

Manufacturers producing ethanol from molasses: Income will remain flat or possibly inch down slightly on the impacts of the drought on sugarcane yields and thus on the amount of molasses available, which will then keep the cost of inputs elevated. However, while smaller independent operations will have to contend with uncertainty over access to raw materials, ethanol distillers that operate their own sugar mills will have more secure access to inputs and will face lower production costs, thus putting them at a relative advantage.

-

Manufacturers producing ethanol from cassava: Income will remain unchanged or weaken slightly. Again, this will be a result of the effects of the drought on prices, though the latter will also be pushed up by a combination of demand from other industries (e.g., producers of food and beverages, alcohol and animal feed) and stronger exports of cassava products. As such, demand may exceed supply, and this will push up prices and eat into ethanol manufacturers’ margins.

Overview

Ethanol, or ethyl alcohol, is produced either from sugary or carbohydrate-rich plants grown specifically for the purpose, or from cellulose or hemicellulose-rich plant waste that is left over from other agricultural processes. These inputs, the most common of which are sugarcane, rice, straw, corn and cassava, are fermented to produce 99.5% pure ethanol. This is then used either as a liquid fuel (directly or mixed with gasoline) or subjected to further industrial processing, for example in the manufacture of beverages or pharmaceutical products.

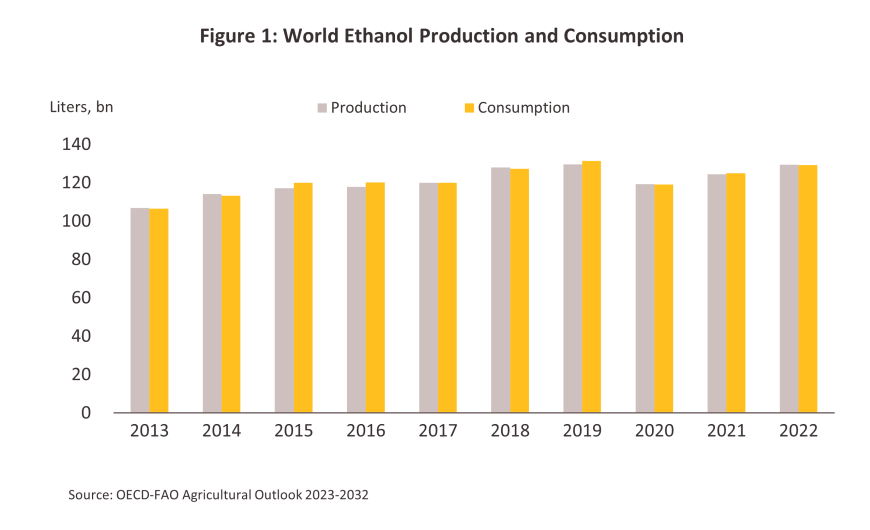

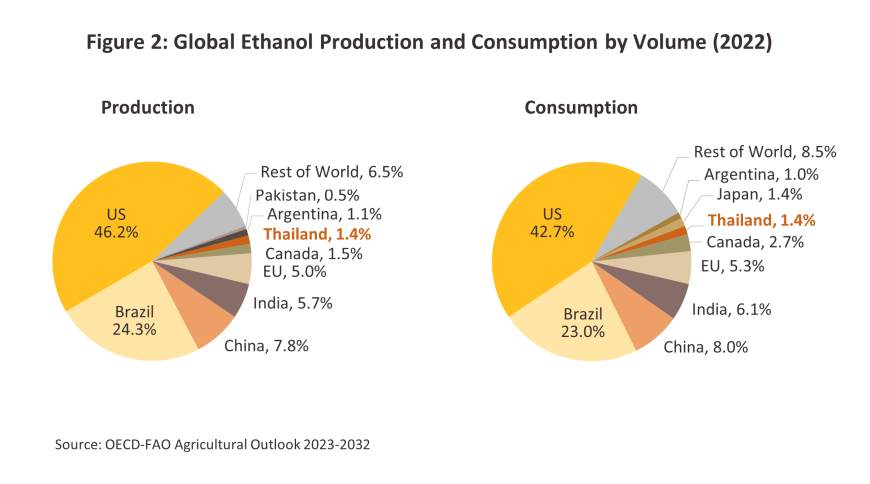

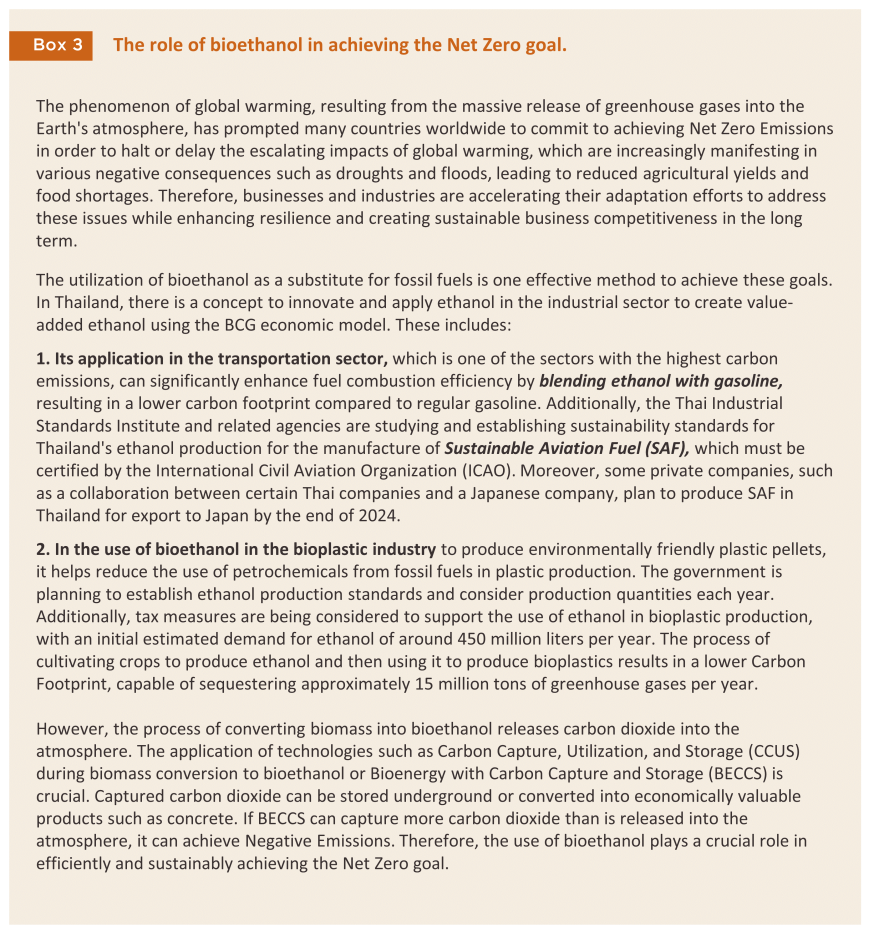

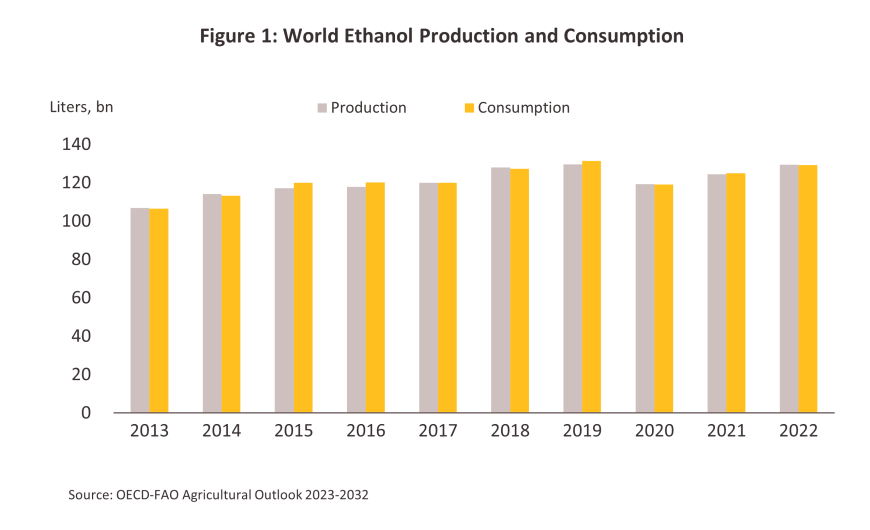

Worldwide demand for ethanol has been rising steadily in recent years, and with the post-pandemic global economy recovering, demand for sterilizing alcohol ongoing, and domestic and international travel and tourism rebounding, annual global demand totaled 129.2 billion liters in 2022, only slightly below its pre-Covid level (Figure 1). The largest consumers and producers of ethanol are the US, Brazil and China, which account for around 78.3% of global production and consumption (Figure 2). These countries generally use corn and sugarcane as their primary inputs.

Thailand sits in 7th place in the world rankings of both ethanol producers and consumers. The majority of domestically produced ethanol is used as a transport fuel, and because it is mixed with benzene1/ to sell as gasohol, movements in the ethanol market are naturally tightly correlated with domestic demand for liquid fuels. However, government policy also exerts a strong influence over the industry because since 2001, the authorities have required that regular petrol is mixed with 10% ethanol when sold to the public, and this then yields the gasohol 912/ and 95 that is sold on Thai forecourts. From 2008, 20% (E20) and 85% (E85) ethanol mixes have also been available, and this has helped to stoke steadily stronger demand. However, set against this is the fact that the domestic market for ethanol is tightly regulated and sales to distributors of transport fuels are subject to the provisions of the 2000 Act on Sales of Oil Fuels, while using ethanol in industrial processes is also only possible with the permission of the Liquor Distillery Organization (operating under the oversight of the Excise Department).

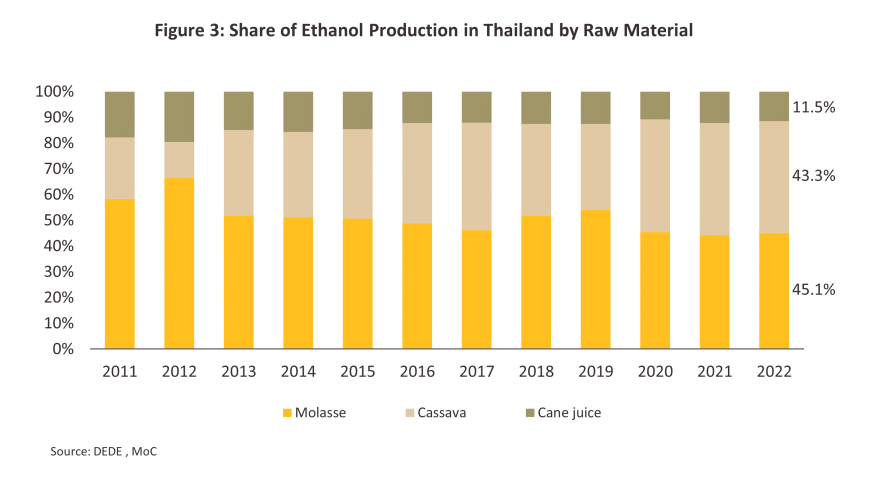

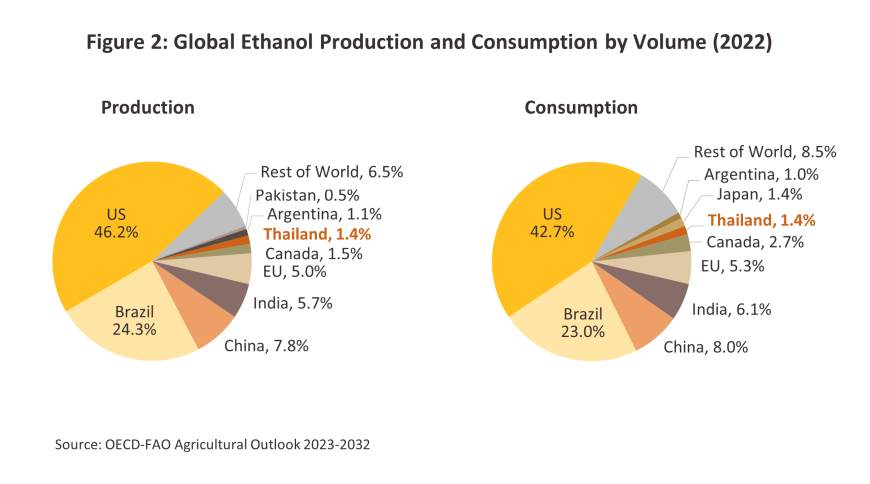

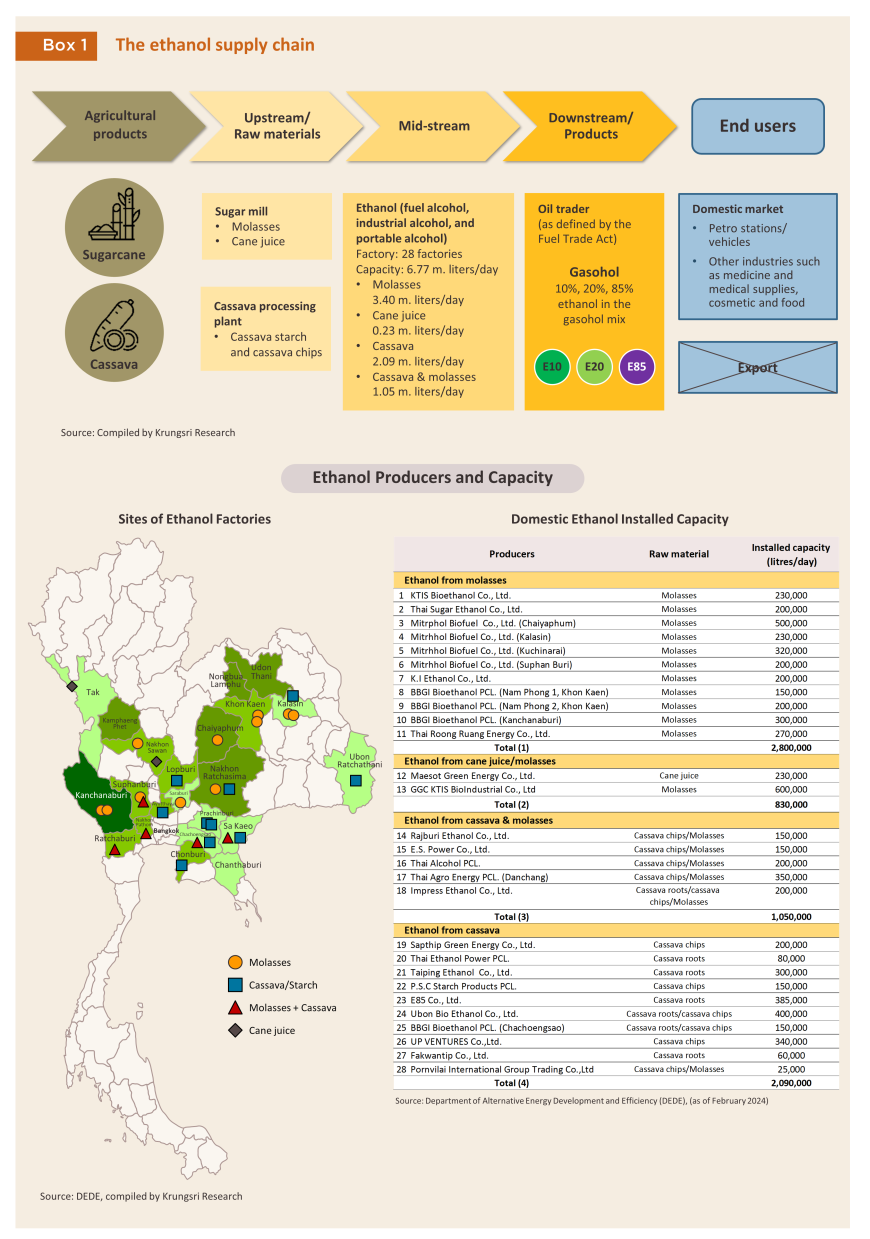

The most important inputs into Thai ethanol production are molasses, cassava and sugarcane, and in 2022, these three accounted for respectively 45%, 43% and 12% of domestic ethanol production (Figure 3), though the exact proportions of the different inputs used will vary according to their relative costs at any given moment in time. Thus, as molasses prices rise, consumption by the ethanol industry will generally decline. However, use of molasses as a raw material typically outpaces that of cassava given the relative ease of accessing supplies of this, though this is partly because some ethanol producers are major players in the sugar market that have expanded downstream from sugar processing into the production of ethanol. By contrast, using cassava as an input may entail enduring stiffer competition with players from other industries that are also trying to secure raw materials, while government interventions in the market in support of farmers can also add to uncertainty over prices.

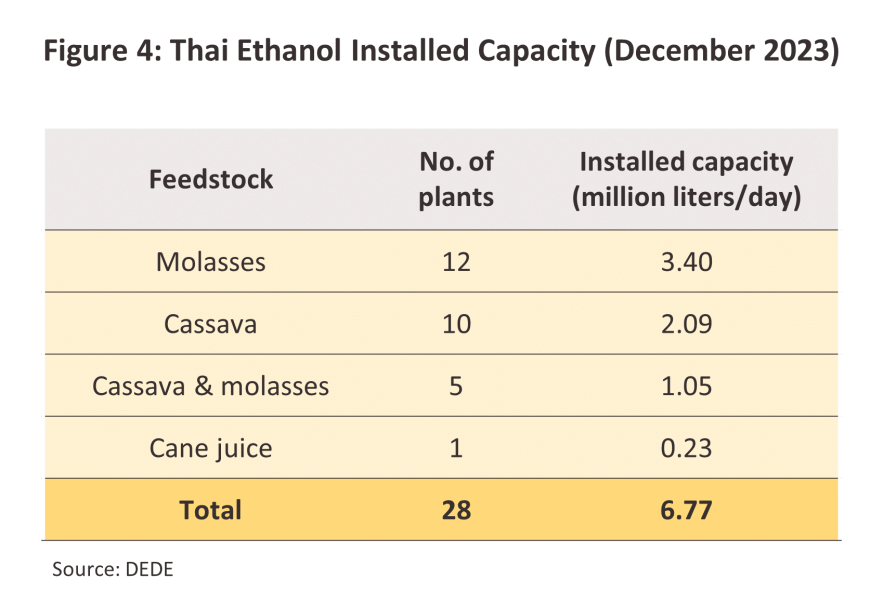

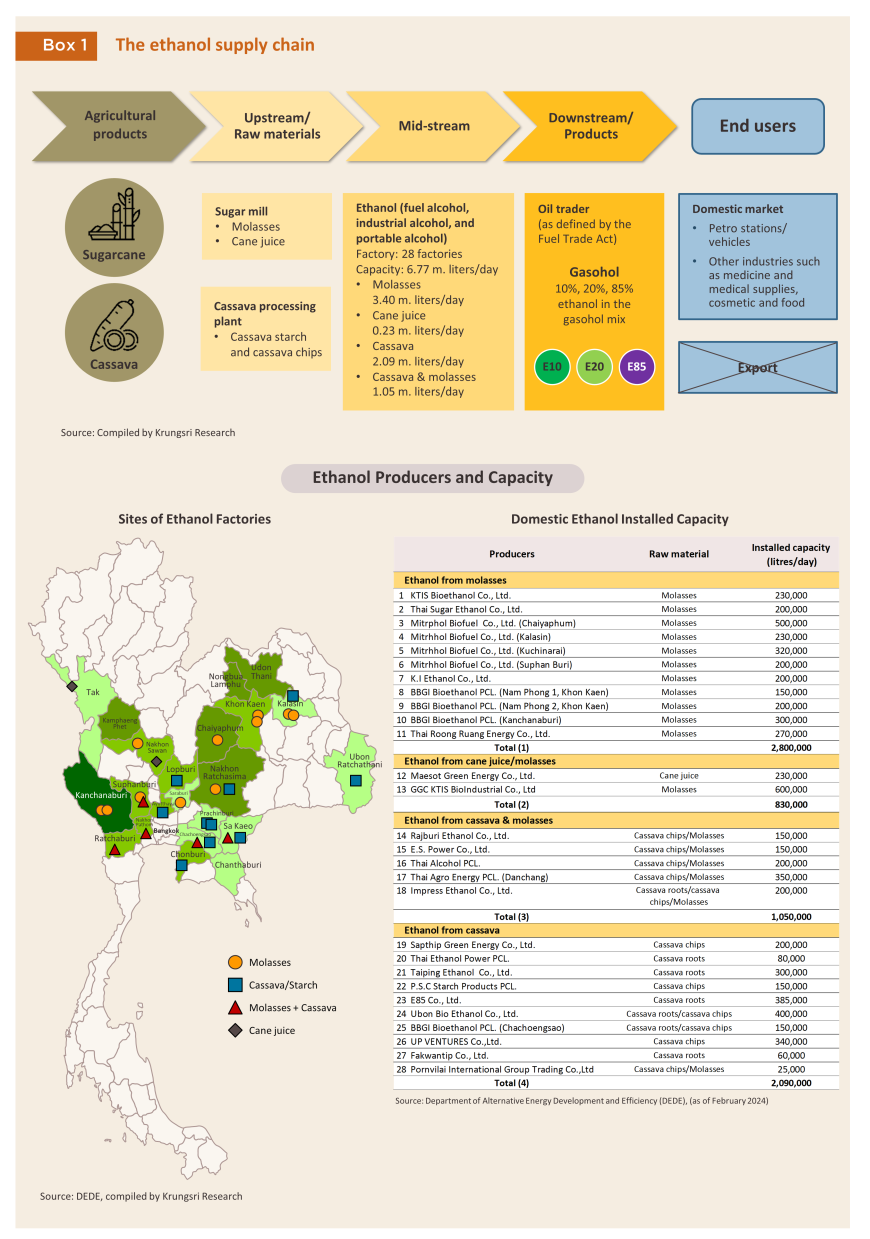

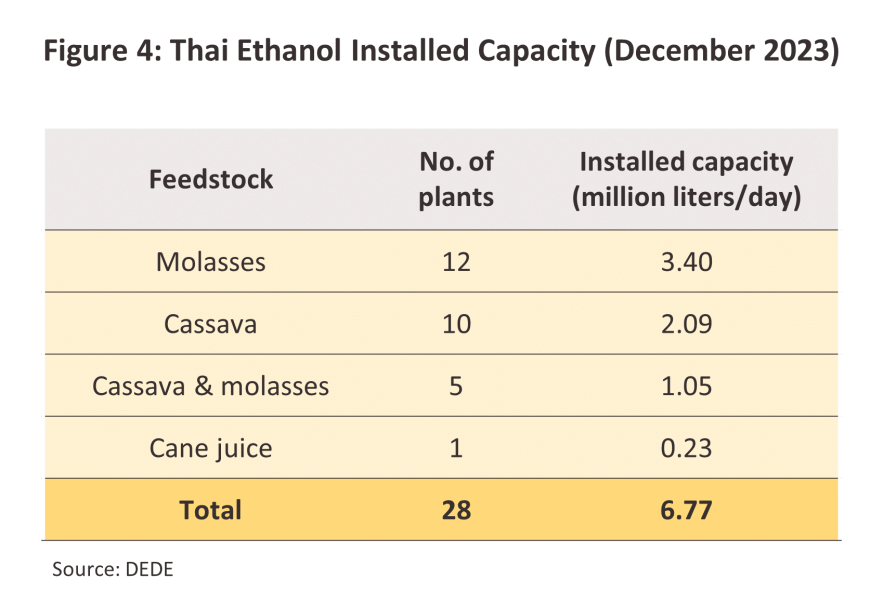

At present (as of February 2024), there are 28 ethanol distilleries operating in Thailand, most of which are downstream operations that are part of major players in the sugar or cassava markets (Box 1). These have a combined production capacity of 6.8 million liters per day, up from an average of 6.6 million liters in 2022. Of this, 3.4 million liters is for molasses-based production, 2.1 million liters for cassava-based production, 1.1 million liters for a mixture of the two, and 0.2 million liters for production from sugarcane juice (Figure 4). The majority of distilleries are located in the central and northeastern parts of the country.

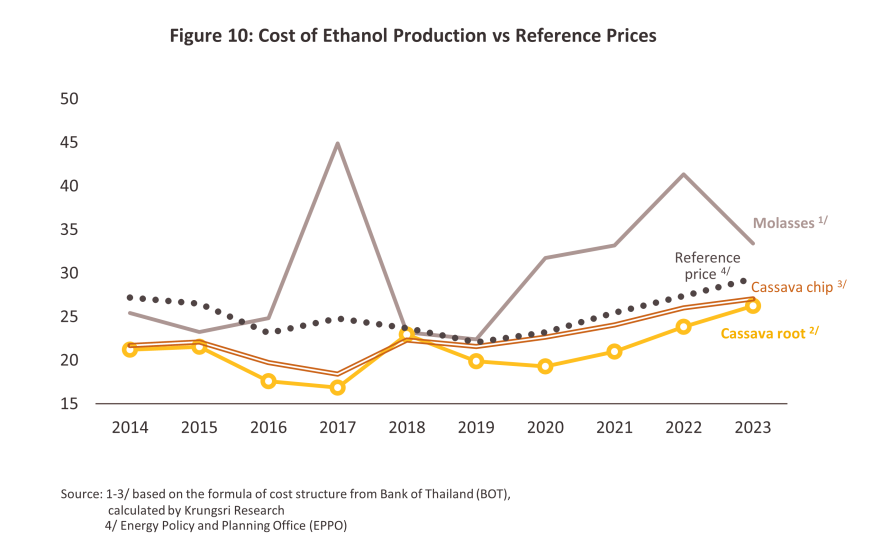

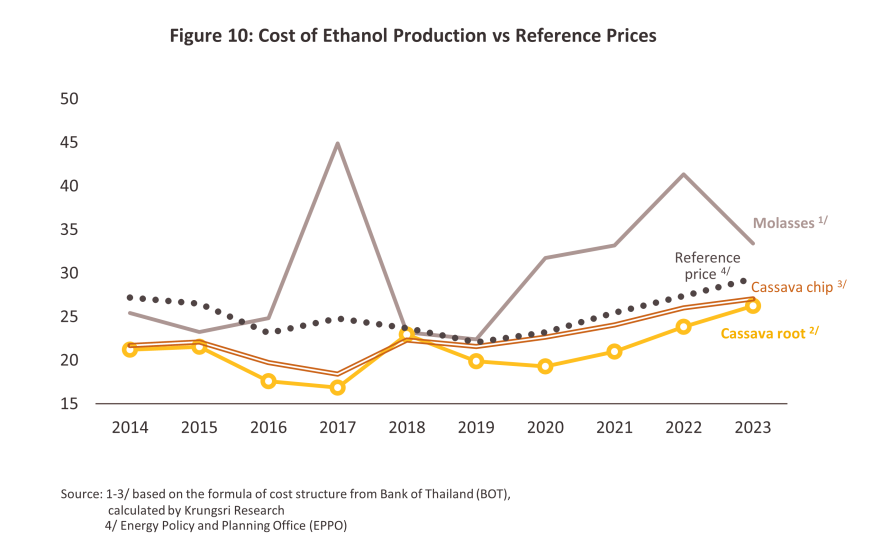

The cost structure of the industry depends on the inputs that are used.

1) For molasses-based production, inputs account for 60-70% of production costs, operating costs take up a further 25-35%, and 5% goes towards fixed costs.

2) For cassava-based production, at 55-60%, raw materials contribute a lower share of overall production costs but operating costs are higher (35-40% of the total), while at 5%, fixed costs are the same. Compared to molasses, using cassava as an input imposes higher overheads due to the more complex processing required to convert cassava starch into the sugars that are needed to produce ethanol.

The ethanol market is guided by a reference price, and this is determined by data collected by the Excise Department on sales of ethanol on the domestic market. An average price, weighted according to the volume of actual sales, is thus announced on the 1st day of the month, and since 1 January, 2012, this has been used as the ethanol reference price. Producers’ margins (i.e., the gap between sale prices and production costs) are determined by: (i) the cost of inputs; (ii) changes in the reference price, which may be driven by shifts in the proportion of the total output coming from molasses and cassava; and (iii) marketing costs of around THB 1-2 per liter.

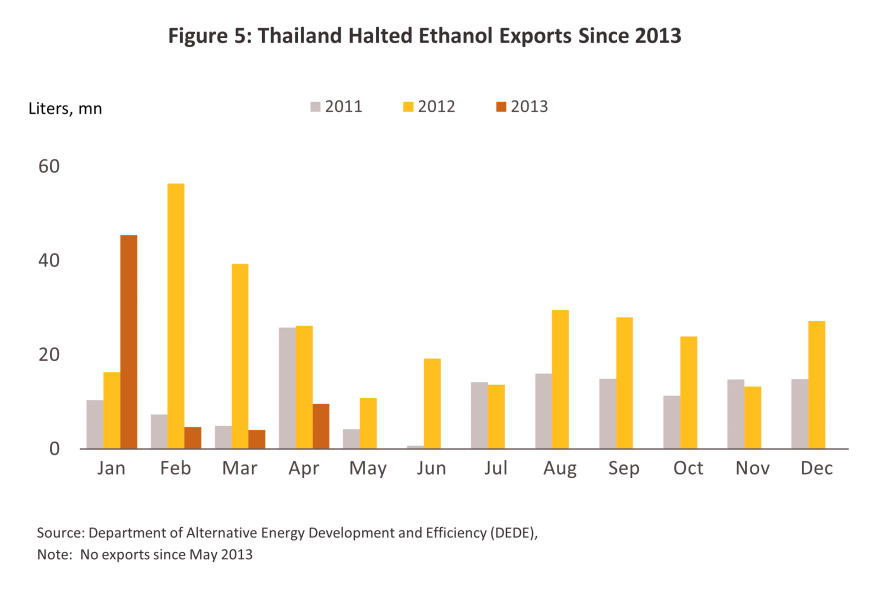

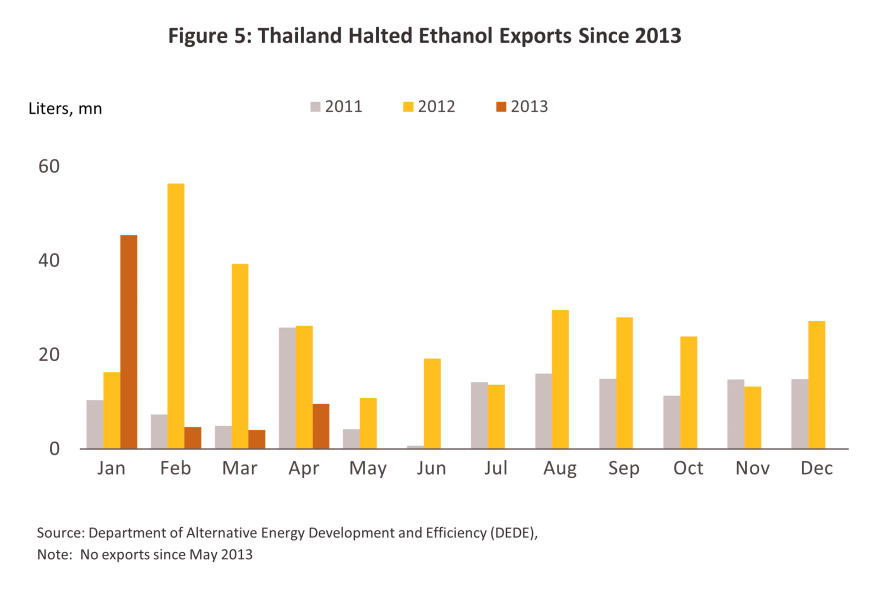

The ethanol market presents a slight peculiarity: typically, there are no exports at all. This can be attributed to a government having ordered a halt to these in May 2013 (Figure 5), prompted by officials' concerns about maintaining adequate ethanol stocks following the cessation of sales of 91 and 95 octane petrol on January 1, 2013. Despite this overarching prohibition, there are exceptions. For instance, in March 2014, 4 million liters were exported, and again in December 2020, the export of 54,000 liters of ethanol was approved. (Before the ban, exports were permitted since 2007, albeit subject to individual approval by the Director-General of the Excise Department. During this period, the primary export markets were the Philippines, Japan, and the UK).

Government policy and support for the ethanol industry is laid out in the Alternative Energy Development Plan (AEDP), and this includes: (i) setting goals for production with reference to demand from the transport sector and the promotion of gasohol consumption; (ii) promoting the development of vehicles that are able to run on E85 gasohol; (iii) encouraging the wider and more comprehensive distribution of biofuels (E20 and E85) on forecourts across the country; and (iv) providing price subsidies via the Oil Fund. These policies have helped to underpin expansion in the ethanol market, but the government has now moved from relying on the price mechanism to stimulate demand towards making E20 gasohol the default option, with other fuel types relegated to alternative status. This is expected to positively influence demand in the coming period.

Situation

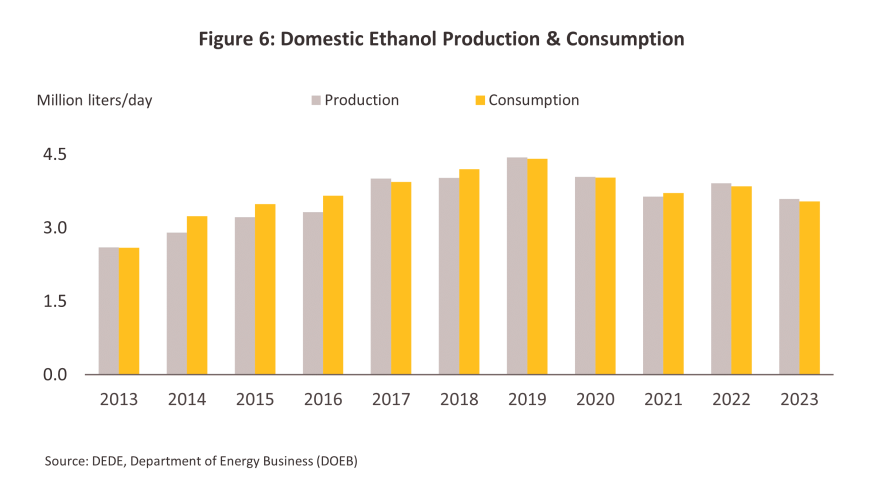

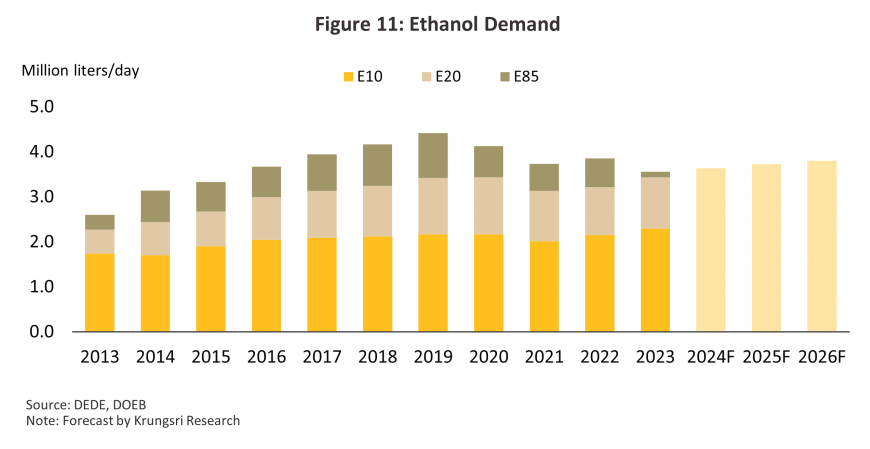

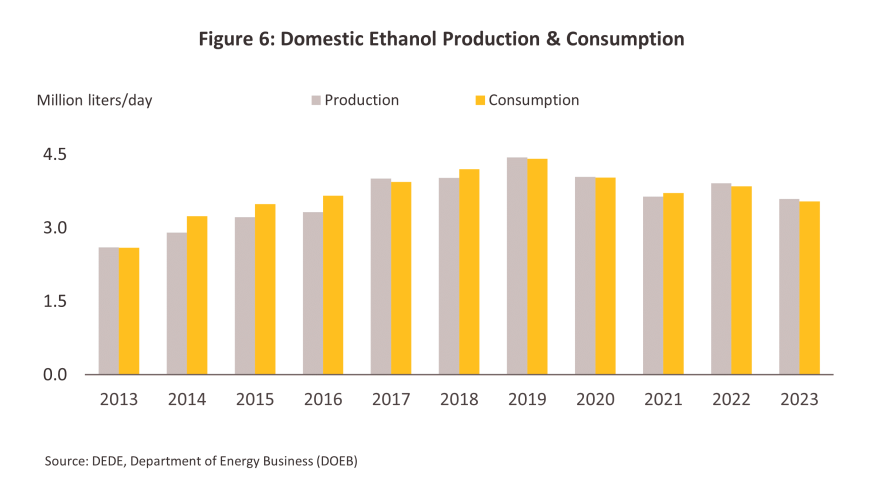

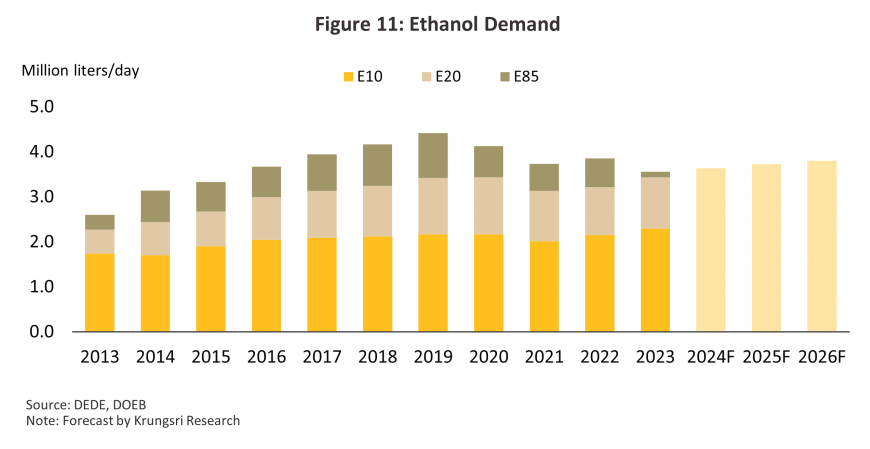

In January 2013, the government ended sales of 91 octane benzene (at the time, 41% of sales of all benzene products) and instead made gasohol the primary petrol product available on forecourts. This was in line with the requirements of the AEDP to promote the use of alternative fuels, though it also helped to alleviate problems with an oversupply of production capacity that had weighed on the market through the period 2007-2012. Demand for ethanol had also been boosted by: (i) the impacts of the First Car Buyer scheme, which pushed new car registrations to an historic high in 2011; (ii) petrol prices that averaged THB 46.3/liter in 2013-2014, compared to average gasohol prices of THB 38.9/liter; (iii) the use of the Oil Fund to cross subsidize pump prices of E10 and E20, which then caused a substantial increase in sales of the latter from 2016; (iv) the development and release to the market of new car models that can run on E20 and E85; and (v) the increase in the number of forecourts selling E20 and E85. Thanks to the combined effect of these factors, average daily ethanol consumption rose from 2.6 million liters in 2013 to 4.4 million liters in 2019, or average annual growth of 20.3%. At the same time, average daily output rose 14.5% per year, or from 2.6 million liters to 4.4 million liters per day (Figure 6).

As with the rest of the economy, the outbreak of Covid-19 delivered a major shock to the ethanol industry and production sank through 2020 and 2021, in particular because of the sharp decline in demand for transport fuels. However, this was partly offset by the surge in sales of sterilizing hand gels containing alcohol produced from ethanol, and to ensure that the supply of the latter was sufficient, officials loosened the requirements for ethanol for mixing with transport fuels between March and September 2020. Nevertheless, in 2021, production and consumption of ethanol fell to the 5-year lows of respectively 3.6m and 3.7m liters per day, drops of -18.0% and -15.9% from their 2019 levels and a sharp turnaround from the average 4.7% growth recorded over 2015-2020. The situation improved in 2022 with the easing of infections, the relaxing of pandemic controls, and the start of economic recovery, and as social and economic life returned to normal, demand for travel services strengthened. These processes were accelerated by the full reopening of the country to foreign arrivals in July 2022 and the parallel uptick in e-commerce sales as consumers carried shopping behaviors adopted during the pandemic into the post-pandemic world, which then boosted demand for delivery services. The outcome of this was that overall demand for gasohol strengthened by 4.4% through the year, with a total of 3.85 million liters of ethanol being used daily to produce this gasohol (up 3.8%). Total average daily output also climbed 7.4% to 3.91 million liters.

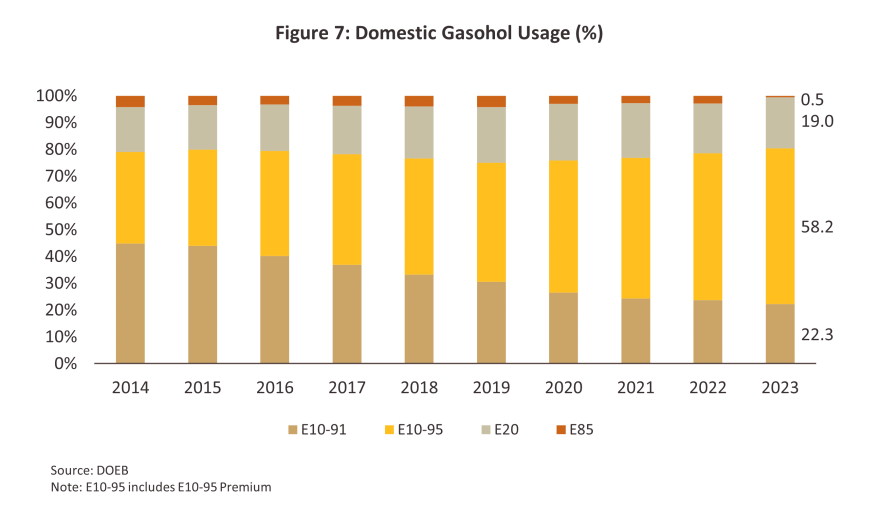

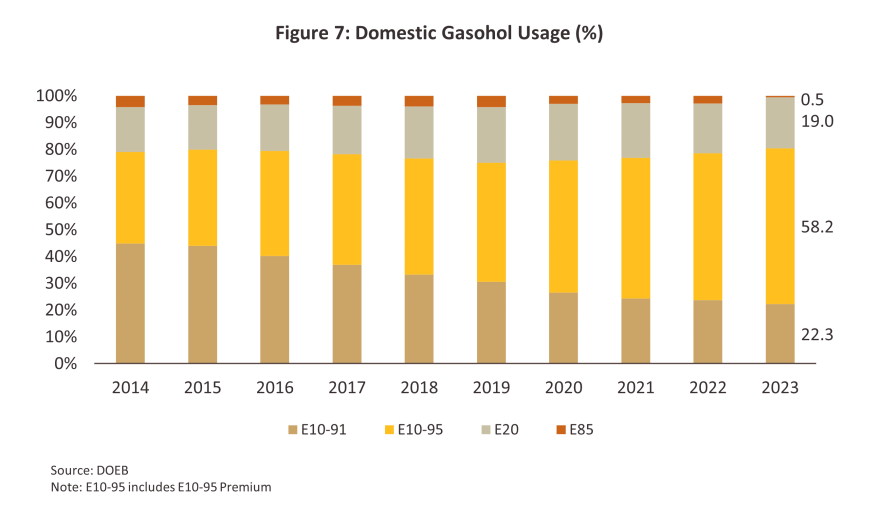

In 2023, total demand for gasohol expanded 4.3% YoY to an average of 30.9 million liters per day. Consumption was boosted by: (i) greater demand for petrol-based products as a result of economic growth, and in particular by the rebound in the tourism sector; (ii) a 4.2% rise in the number of petrol-powered vehicles on Thai roads (up to 2.3 million) in the 2022 financial year; and (iii) the fall in forecourt prices for all petrol variants as part of end-of-year government measures to help with the cost of living (from 7 November, 2023 to 31 January, 2024). Despite this, the ending of price subsidies from the Oil Fund for sales of E85 meant that demand for ethanol for blending into gasohol in fact fell from its 2022 level. These cuts were the result of the government’s decision to make E20 the nation’s primary petrol product by 2027, and the result of this was then that average E85 prices rose 8.5% to THB 34.8/liter, up from THB 32.1/liter in 2022 and an average of THB 0.3/liter more than E20. Given this relative price disadvantage, sales of E85 then fell, while the share of E20 sales rose from 18.6% to 19.0% of all gasohol distributed domestically (Figure 7). The situation for the industry through 2023 is described below.

-

Demand for ethanol averaged 3.5 million liters per day through the year, a drop of -8.1% from 2022. This was a consequence of the -81.2% YoY crash in sales of E85 (down from 2.8% of all gasohol sales in 2022 to just 0.5% in 2023), which was itself driven by the phasing out of price subsidies from the Oil Fund from 2022 onwards3/. As a result, consumers increasingly switched to cheaper-priced E10 (95) (58.2% of gasohol sales) and E20 (19.0% of gasohol sales) (Figure 7).

-

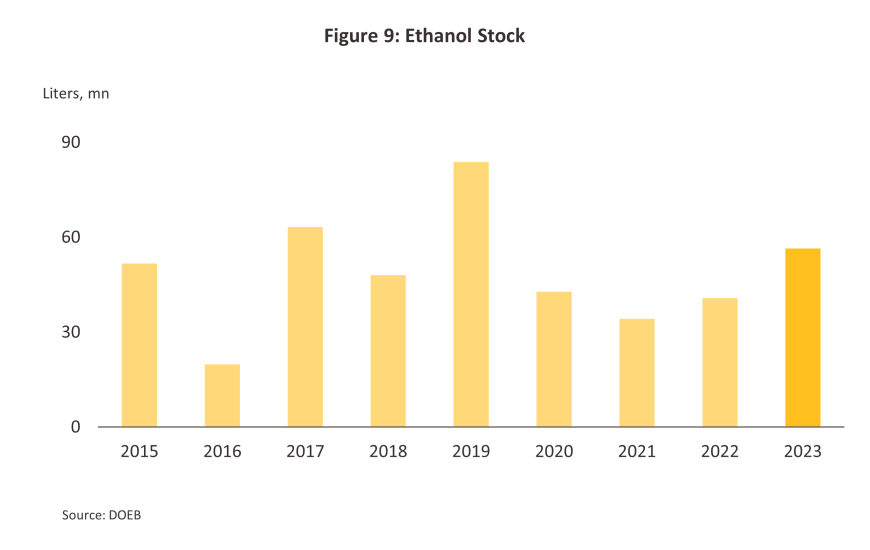

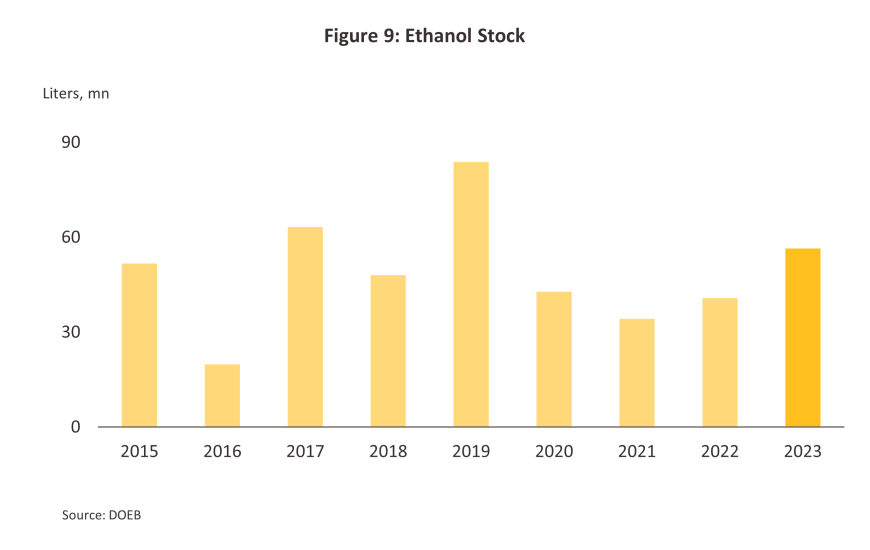

Daily output slipped -8.2% in 2023 to an average of 3.6 million liters. Production was undercut by weaker demand, while the onset of drought and ongoing outbreaks of cassava mosaic disease also reduced yields of inputs in the 2022/23 season (this ran from October 2022 to September 2023). Production from molasses (61% of ethanol output) and cassava (33% of output) thus fell by -3.6% YoY and -17.9% YoY to respectively 2.2 million and 1.2 million liters per day. However, production from sugarcane juice (6% of the total) climbed 12.5% to 0.2 million liters per day (Figure 8), though with supply outpacing demand, 2023 year-end inventories jumped 38.4.% to 56.5 million liters (Figure 9). Likewise, capacity utilization dropped to an average of 53% from 2022’s 59.5%.

Outlook

Krungsri Research sees demand for ethanol expanding by 2.0-2.5% annually over 2024 to 2026, which would then bring daily consumption to around 3.0-3.8 million liters (Figure 11). This outlook will be supported by the following factors.

-

Domestic economic growth is forecast to gradually increase to 2.5-3.5% annually and business activity should thus accelerate generally. This will be most pronounced in the tourism sector, which has been rebounding strongly since 2023 and so arrivals are now expected to return to their pre-Covid level of around 40 million by 2025. 2024 growth has been boosted by government support for the industry that has come in the form of visa-free travel for arrivals from China, Kazakhstan, India and Taiwan, and the promotion of travel to second-tier Thai destinations. This will all then tend to increase levels of domestic travel.

-

The size of the national vehicle fleet running on gasohol will expand by 2.5-3.5% per year. The number of total vehicles distributed domestically will grow by 2.0-3.0% annually to 0.79-0.85 million, and more than 70% of these will run on petrol. At the same time, the total number of Evs (including HEV, PHEV, BEV but excluding motorcycles) on the road will remain low, and will likely not exceed 3-5% of the size of the ICE fleet.

-

The Thai e-commerce industry is forecast to enjoy 10.7% average annual growth over 2024 to 2029 (source: Statista), and this will generate additional demand for services delivering parcels, documents and other goods.

-

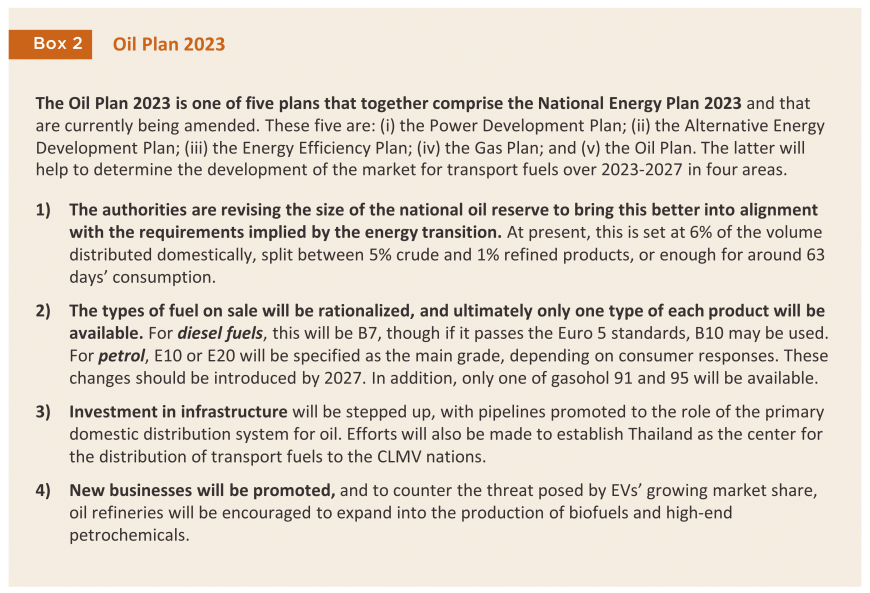

The government aims to establish E20 as the main type of petrol sold on the nation’s forecourts. The government thus plans: (i) to keep prices for E20 THB 3/liter below the price of E95; (ii) to reduce the types of fuel on sale, including ending the sale of gasohol 95 and E85 by 2027; and (iii) to end subsidies for sales of gasohol by 24 September, 2024, though there is a possibility that this may be delayed for another 2 years4/.

Over the long term, the government plans to support ongoing expansion in the ethanol market, and to this end, the Alternative Energy Development Plan (2018-2037) has laid out a target of this reaching 7.5 million liters per day by 2037 (down from the 11.3 million specified in the AEDP 2015). Plans for absorbing excess production capacity thus include the following.

-

Using ethanol in the production of sustainable aviation fuels (SAFs): The 2023 Oil Plan has set a target of replacing 1% of standard A-1 jet fuel with SAFs by 2027. Moves such as this are being repeated worldwide, including in the European Union’s ‘Destination 2050–A Route to Net Zero European Aviation’. This aims to cut carbon emissions generated by flights leaving the EU, the UK and EFTA member states by 55% by 2030 and to reduce these to zero by 2050, and a central plank of this strategy relies on the use of SAFs. In addition, many countries are planning to have switched over to the use of the Airbus A321neo by 2035, which has been designed to increase fuel economy and to provide an all-round more environmentally friendly service. However, at present, biojet fuels are only available in small volumes since producing these is expensive and depends on access to a significant quantity of inputs.

-

Promoting greater use of ethanol in other industries: At present, the major markets for ethanol are in the production of biofuels and alcohol, and it is hoped that in the future, markets in the pharmaceuticals, cosmetics, and bioplastics industries will expand. Indeed, an example of the latter is the joint venture set up by Braksem and a Thai petrochemicals company to produce bioplastics including bio-ethylene and bio-polyethylene. This would not only help to build demand for ethanol but would also support the development of the BCG (bio, circular and green) economy and through this, help meet Thailand’s 2050 carbon neutrality and 2065 net zero commitments. To this end, the Excise Department has considered extending the tax-exempt status of ethanol from that used in the production of fuels to also include ethanol used in the manufacture of bio-ethylene and other bioplastics. These moves are, though, still in their infancy and so over the next three years, their likely impacts on the ethanol industry will be minimal.

Nevertheless, such ambitious plans for growth in the ethanol industry will put pressure on supplies of inputs, in particular of sugarcane and cassava, and this may then impact demand for these for consumption. The authorities therefore need to press forward rapidly with plans to expand the area under cultivation and to research how production processes can be improved so that ethanol can be made from agricultural waste (e.g., from rice husk and corncobs). This would then serve the twin goals of reducing the air pollution caused by seasonal burning of farm waste and help the authorities meet their targets for increased ethanol output.

Although the outlook is broadly positive, the industry will face a number of challenges. (i) The onset of El Niño conditions and the resulting drought in many countries has impacted access to inputs, and so over the 2023/2024 growing season, sugarcane yields have contracted and output of sugar and sugar products has fallen. At the same time, demand for molasses and cassava from other industries (e.g., in the production of alcohol, animal feed and food and beverages) on both domestic and export markets is rising and this will tend to increase upward pressure on prices (a survey by Reuters indicates weaker sugar output by India over 2023/2024 will result in a nearly 20% increase in raw sugar prices in 2024). Given this, production costs will tend to rise and margins will narrow. (ii) Consumer fears that using gasohol with a higher ethanol content will result in engine problems and greater fuel consumption will continue to weigh on sales (the strength of this perception is reflected in the weaker demand for E20 than for E10). (iii) Uncertainty remains over whether E10 or E20 will be set as the main gasohol variant, though if this is E10, overall demand for ethanol will clearly suffer. (iv) Demand for EVs will build steadily, helped by the government’s goal of at least 30% of new auto production being zero emission vehicles (ZEVs) by 2030, which will then undercut demand for ethanol for blending into gasohol. The Department of Energy Business thus estimates that demand for ethanol from the transport sector will peak at 6 million liters per day and then steadily decline, and the impacts of these changes will become evident within the next ten years.

1/ A replacement for octane additives in benzene, or MTBE (methyl tertiary butyl ether).

2/ Gasohol 91 and 95 are made by mixing lead-free benzene with 10% ethanol. This results in 91 and 95 octane gasohol,

which can then be used in vehicles in place of regular 91 and 95 octane mineral fuels.

3/ The 2019 Oil Fund Act specifies that subsidies to biofuels should cease by 24 September, 2022, though with the provision that this deadline can be extended twice by a maximum of 2 years per extension. So far, the deadline has been extended once, to 24 September, 2024.

4/ In accordance with the 2019 Oil Fund Act, the Ministry of Energy will end subsidies for biofuels by 24 September, 2024, thus bringing pump prices into line with those set on global markets. At the same time, the range of fuels sold on forecourts will also be reduced: (i) for benzene-based products, only non-ethanol fuels and gasohol 95 (or possibly E20) will remain; and (ii) for diesel products, only mineral biodiesel and B7 (or possibly B10) will still be sold.

.webp.aspx)