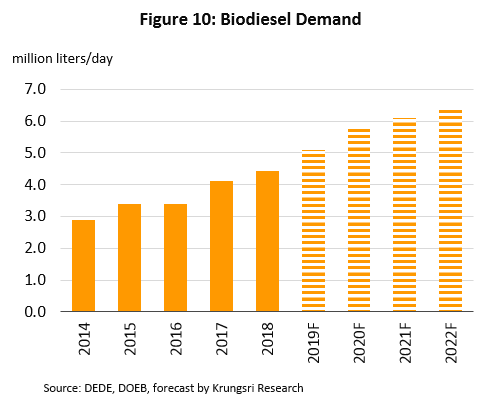

The biodiesel sector will continue to grow over the next three years, with demand forecast to rise by 5-10% p.a. to 5.8-6.5 million liters/day. This is premised on the following: (i) improving transportation infrastructure in Thailand (especially inland transportation) leading to better inter-connections within the region will increase vehicle use and economic activity; (ii) the number of diesel-powered vehicles registered in Thailand is forecast to grow by 5-6% p.a.; and (iii) supportive government policies would encourage greater consumption of biodiesel. Since 2019, the government has been pushing for larger trucks to use B20 (20% biodiesel) and smaller vehicles to continue to use that. From 2020, the standard diesel mix will be upgraded to B10 (10% biodiesel) from B7.

Between 2020 and 2022, capacity utilization in the sector is expected to improve to 65-70% because manufacturers - both incumbent and new players - in the sector would not be able to add capacity to keep pace with rising demand. But despite this upbeat forecast, players will be exposed to risks arising from uncertainty over oil palm supply and possible government intervention in the market to support oil palm cultivators.

Overview

Biodiesel, or alternatively B100, is a fuel that can be produced from a range of biological inputs including plant matter, animal fats, and waste cooking oil. The process converts these complex inputs into smaller chain molecules of ethyl ester and methyl ester, which can be used as liquid fuel in place of regular mineral diesel. Biodiesel production would also help Thailand to achieve a greater degree of security over its energy supplies.

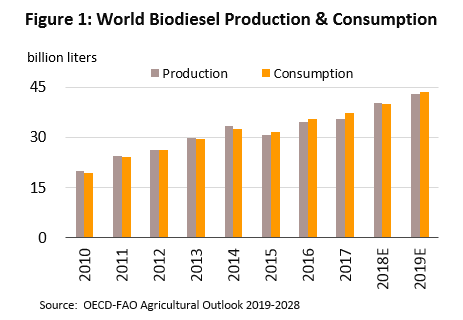

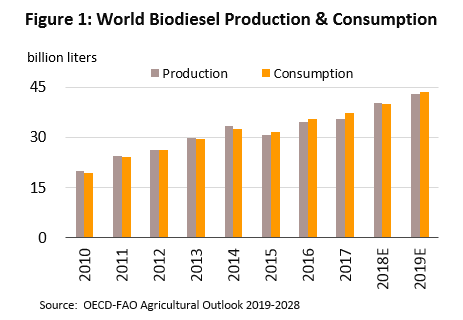

Global biodiesel demand and production are rising rapidly. Between 2010 and 2019, world consumption rose from 19.5 to 43.5 billion liters (up c.10% p.a.), with biodiesel now widely used in Europe, the United States, Canada, Latin America, Australia, Japan, and several Asian countries. At the same time, production rose at a slightly slower – but still rapid – rate of 8% p.a., to jump from 20.0 to 43.1 billion liters one the same period (Figure 1). The United States, Brazil and Argentina are the world’s largest producers (Figure 2) and their biodiesel is typically produced from rape seed, sunflower, coconut, soy bean, palm oil and jatropha. Thailand is currently the 5th largest producer and its biodiesel manufacturers generally use crude palm oil (CPO) as primary input.

The production of biodiesel for mixing in commercially-sold standard diesel started in 2007 in Thailand. At first, this was restricted to 2-3% mix (or B2). In 2012, this increased to 5% (B5), and in 2014 to 7% (B7). Naturally, the steady increase in the proportion of biodiesel mixed in standard diesel has led rising demand for biodiesel overall, but the government has also been adjusting the ratio to the quantity of CPO available in the domestic market. When there was a shortage in 2015 and 2016, the mix was reduced, while in 2018 and 2019 when there was abundant supply of CPO, the mix was increased (Figure 3). Because of this, Thai biodiesel production is almost entirely consumed domestically, and imports of biodiesel need to be approved by the Department of Energy Business.

Government policy towards the sector (Alternative Energy Development Plan, or AEDP) will determine the direction of the biodiesel sector. Specifically, the government needs to ensure there is sufficient domestic supply of CPO to meet demand from the biodiesel sector. Hence, the sector has been the recipient of investment incentives offered by the Board of Investment (BOI), and for investors involved in biodiesel production, this included an 8-year exemption from corporate income tax, 50% reduction in tax on net profits for five years, and waiving of import duties for machinery purchased for use in biodiesel production.

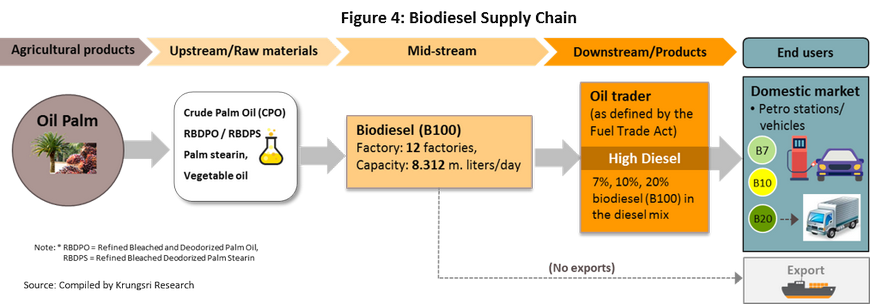

In Thailand, biodiesel is mostly produced from CPO. Some manufacturers also use refined bleached and deodorized palm oil (RBDPO), palm stearin and other vegetable oils (Figure 4). In 2018, a total of 5.76 million rai was employed for oil palm cultivation and yielded 15.38 million tonnes of oil palm, which produced 2.78 million tonnes of CPO. Of this, 1.2 million tonnes or 43% of national CPO production was consumed by the biodiesel sector.

The biodiesel sector had gone through a process of development in the last few years, and because of this, there are very few players active in the industry. This means there is little competition, although some bigger operators produce biodiesel to meet European standards. According to latest available data (August 2019), there are 12 biodiesel factories registered with the Department of Energy Business and these have a combined production capacity of 8.31 million liters per day, up from 7.68 million liters per day in 2018. Most of these operations are integrated into the palm oil, petrochemical (from refinery products) or chemical production chains. The largest player is Patum Vegetable Oil, followed by Global Green Chemicals, New Biodiesel, Bangchak Biofuels and Energy Absolute (Table 1). Their output is consumed primarily by the domestic market, while community-level small-scale biodiesel production[1] is mostly used by the agricultural sector in the northern, northeastern and southern regions of the country.

For manufacturers, the largest production cost is raw material, in this case usually CPO[2], which account for 70% of total production cost. Chemical inputs run to another 20%, and the remaining 10% is operating costs. The domestic price of biodiesel (B100) is determined by a resolution of the Committee on Energy Policy Administration, and is used as a reference price[3] in trades by oil refineries and distributors (as defined by the Fuel Trade Act).

Operators’ profits depend on two main factors: (i) government policy on alternative energy[4] and setting biodiesel mix that is appropriate with the supply of raw materials[5], and (ii) difference between selling price and the cost of inputs, or the ‘spread’. (Oil refineries and oil traders may have stronger negotiating power than biodiesel producers, and so they may be able to set purchase prices at a level that diverges from the reference price.)

Situation

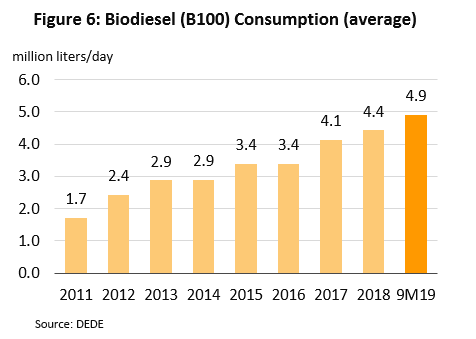

From 2011 to 2017, demand for biodiesel rose steadily in Thailand, not least because of government-mandated increases in the proportion of biodiesel mixed into standard diesel, which had risen from 2% to 5% in 2012 and then to 7% in 2014. This lifted demand from 1.72 million liters per day in 2011 to 4.1 million liters in 2017.

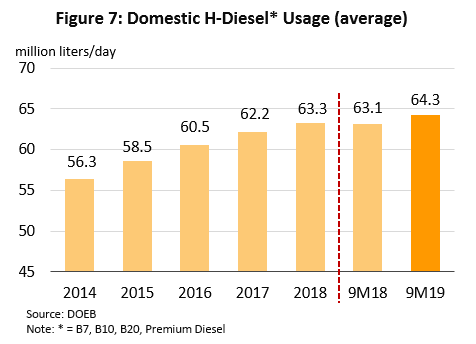

In 2018, demand for biodiesel for mixing with mineral diesel rose by 7.3% YoY to an average of 4.4 million liters per day. This rise is partly explained by an increase in general demand for diesel, buoyed by economic growth and partly by sale of a rising number of diesel-powered vehicles. In addition, selling price were maintained at a level that encouraged consumption. Hence, demand for diesel averaged 63.3 million liters per day in 2018 (up 1.8% from the year before). Meanwhile, production rose by 10.3% YoY to an average of 4.3 million liters per day in 2018 but new production facilities with a total daily capacity of 1 million liters per day came on-stream in the year and took total capacity to 7.68 million liters per day. This caused capacity utilization to drop from 59% in 2017 to 56% in 2018 (Figure 5).

In the first 9 months of 2019, demand for biodiesel for mixing with mineral diesel surged 12% YoY to an average of 4.9 million liters per day (Figure 6). This was driven by several factors:

- Total demand for diesel rose in line with the developing transportation infrastructure and the rising number of diesel vehicles registered in Thailand, especially commercial vehicles including pick-ups, pick-up passenger vehicles, trucks and buses. Thus, by the end of 9M19, there were 11.2 million diesel-powered vehicles on Thai roads, up from 10.8 million at the end of 2018, while diesel fuel sales rose by 1.9% YoY to an average daily total of 64.3 million liters (Figure 7).

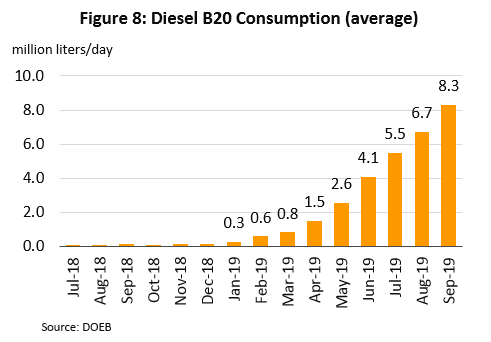

- The government has continued to encourage consumption of biodiesel by raising diesel mix to 20% (B20 available from July 2018) for larger trucks and keeping B20 price 5 baht cheaper than the retail price of standard diesel (B7)[6]. Because of this, demand for B20 has risen steadily (Figure 8); in 9M19, B20 sales averaged 3.4 million liters per day or 5% of all diesel sales in the country.

- The government also promoted sales of B10[7] by keeping selling price 2 baht cheaper than for B7 (from October 1, 2018). Meanwhile, PTT and Bangchak have increased the number of pumps dispensing B10 to meet additional demand.

-

Hence, consumption of biodiesel for all of 2019 is estimated to rise by 800,000 liters per day of 18% compared to 2018 volume (5.2 million liters).

Production of biodiesel grew in 2019 because manufacturers increased output to meet rising demand. Production capacity rose 8.2% relative to 2018 figure, and 630,000 liters of daily production capacity came on-stream in 2019. However, capacity utilization also improved, from 56% in 2018 to 62% in 2019.

Given the business environment described above, operators should be able to maintain healthy profits. The reference price, that is the price biodiesel manufacturers get from selling to oil and petrol retailers, averaged THB21.2/liter (or THB24.5/kilogram[8]) in 9M19. Although this was a decline of 17.3% YoY, cost of inputs had dropped by a larger quantum; cost of CPO averaged THB16.7/kilogram (-18.2% YoY) in the period, while palm stearin cost an average of THB17.0 (-17.8% YoY). Hence, manufacturers were able to preserve their margins. Spreads for CPO biodiesel averaged THB7.8/kilogram in 9M19 (Figure 9).

Outlook

The outlook for the biodiesel sector is for solid growth throughout 2020-2022 as consumption is forecast to increase by 5-10% per year to an average of 5.8-6.5 million liters per day (Figure 10). This is supported by several factors:

- Accelerating economic growth and integration in the region is driving greater demand for transportation services, especially by road and rail. This will increase the consumption of diesel especially for use in diesel-powered trains. In addition, the number of diesel-powered vehicles registered in Thailand is forecast to increase by 5-6% per year. The combination of these two factors is expected to raise domestic demand for diesel fuel by 3% p.a. over 2020-2022.

- The government’s move to raise standard diesel mix from B7 to B10 from 2020, and efforts since 2019 to encourage the use of B20 in large trucks, buses and smaller commercial vehicles (e.g. pickups)[9], will increase the volume of biodiesel required to produce diesel mixes.

Krungsri Research estimates that by 2022, daily consumption of B10 will average 60 million liters, B20 will average 5 million liters, and B7 - which will be used only in older vehicles - will fall to 2-5 million liters. This would lift daily demand for biodiesel to 6.2-6.5 million liters.

This will in turn stimulate greater investment in the sector from both incumbent and new players in the market (including oil refineries and palm oil processors). Over the next 3 years, capacity utilization is forecast to rise to 65-70% (Figure 11).

Krungsri Research’s view:

Throughout 2020-2022, the biodiesel sector continue to grow driven by factors that will encourage greater consumption. These include: (i) the developing transport infrastructure in Thailand (especially land transport) and the 5-6% per year increase in the number of diesel-powered vehicles in Thailand; (ii) government support for the sector, which has been in the form of increasing standard diesel mix from B7 to B10 from 2020, and from 2019, efforts to encourage greater use of B20 in large trucks, buses and pickups. These should lead to higher demand for biodiesel for use in diesel mixes. However, uncertainty over supply of CPO and possible government intervention to control CPO prices might have an impact on operators’ ability to register steady income. Over the next 3 years, profits are expected to be similar to last year’s.

[1] There are 70 such community production centers across the country. The majority of these are teaching centers and centers that promote the production and use of biodiesel by local communities.

[2] The reference price for CPO, set by the Department for Internal Trade.

[3] The regulations for specifying the biodiesel price reflect the real costs of production by considering the costs of 3 main inputs: crude palm oil (CPO), refined bleached and deodorized palm oil (RBDO), and palm stearin. The price is set weekly and depends on the overall situation with regard to supply and demand.

[4] Currently under the Alternative Energy Development Plan (2018-2037) or AEDP 2018.

[5] The Department of Energy Business is responsible for setting the proportion of B100 in the diesel mix in line with the amount of palm oil available, priority for which is typically for consumption.

[6] The government extended to the end of September 2019 its increase in price support for B20 diesel oil (which rose from THB 3 to THB 5 per liter). This originally ran from December 1, 2018 to July 2019.

[7] The Ministry of Energy has stipulated that the standard diesel mix should be raised to B10 from B7 nationally from March 2020

[8] Calculated on the basis that 1,000 liters weigh 0.865 tonnes.

[9] The Ministry of Energy has released a list of small trucks (e.g. pickups) that can run on B20. This includes pickups from Isuzu and Toyota, which between them have a 70% share of the pickup market in Thailand.

.webp.aspx)