The construction industry is expected to recover over the next 3 years, with total construction spending forecast to rise by 4.5-5.0% in 2021 and then by 5.0-5.5% in 2022-2023. A major driver will be public-sector spending on infrastructure megaprojects, especially in the Eastern Economic Corridor, where investment in government-backed projects will encourage crowding-in of private-sector investment (e.g., in industrial estates). Beyond this, the gradual recovery of the Thai economy will also support greater investment in residential accommodation and commercial properties. And, there will be new opportunities in neighboring countries as their governments continue to improve national infrastructure in response to continued economic growth and urbanization.

Overview

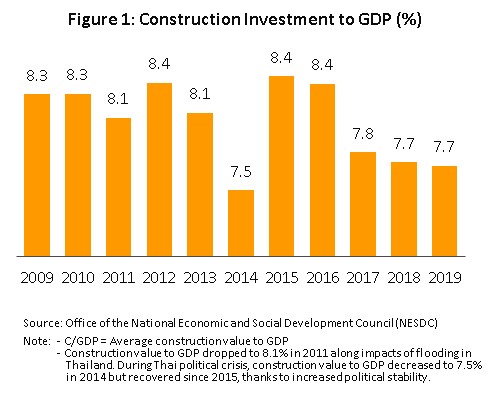

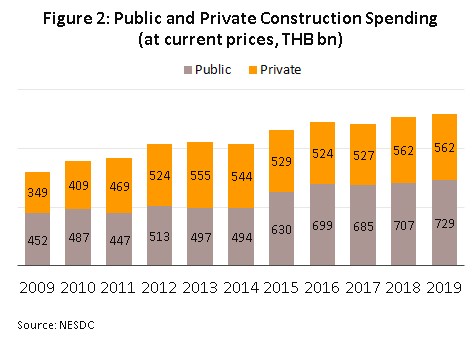

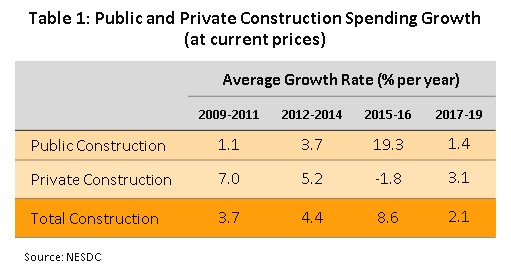

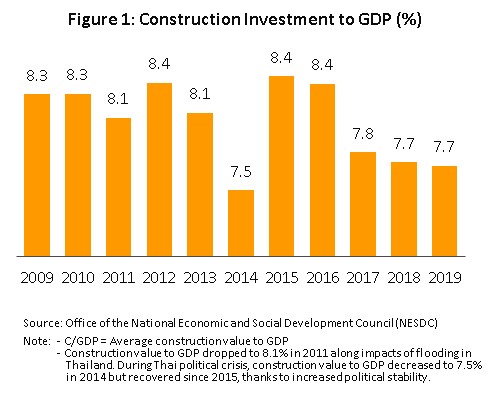

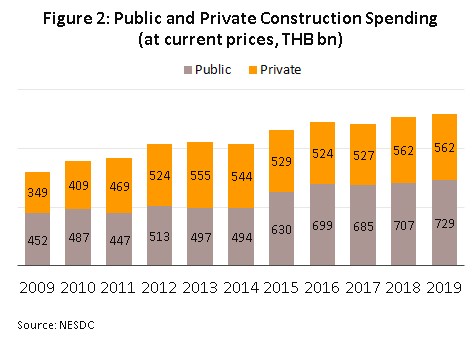

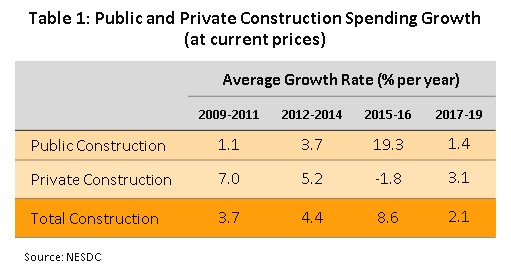

The construction industry plays a significant role within the Thai economy. From 2009 to 2019, construction spending accounted for an average of 8.1% of gross domestic product (GDP) annually (Figure 1). The industry is primarily driven by the domestic market. Construction work is split by value at a ratio of 56:44 between public and private construction spending (Figure 2)

.

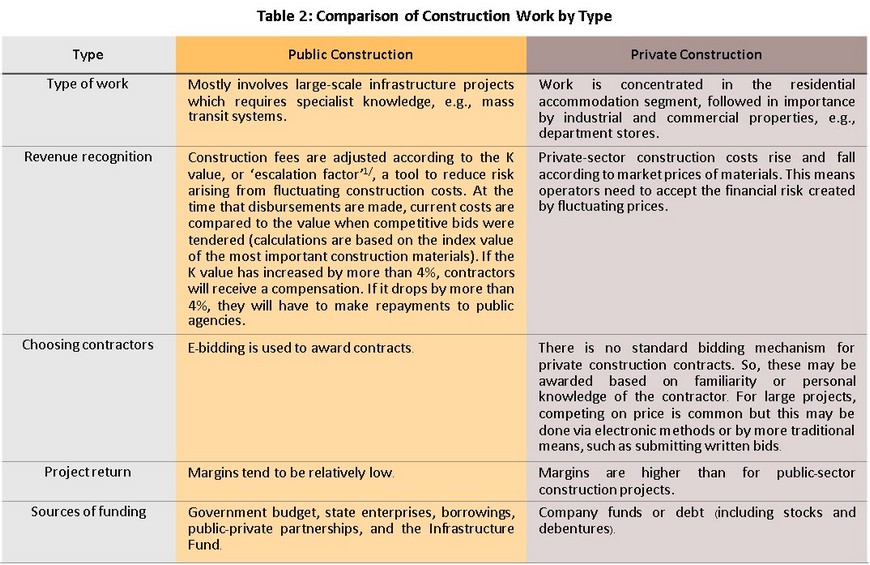

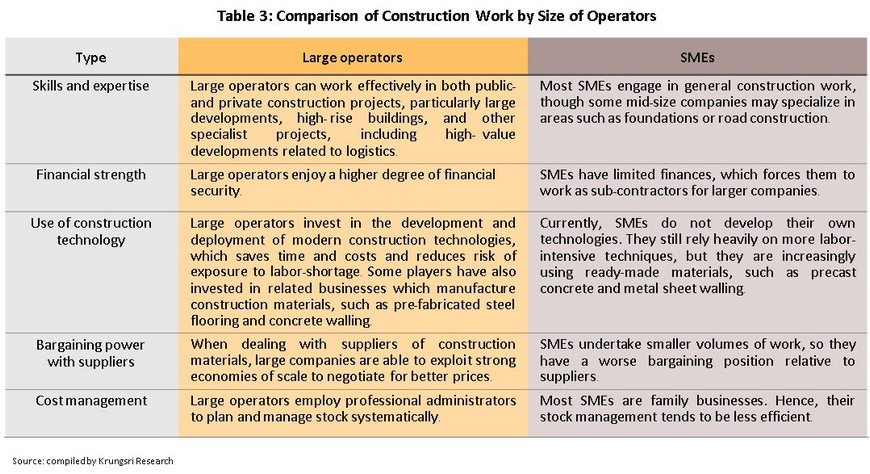

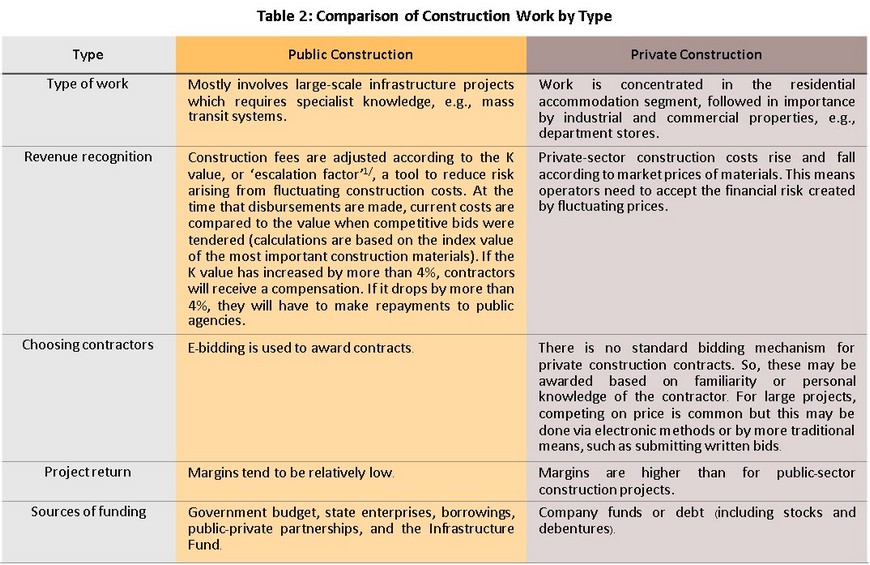

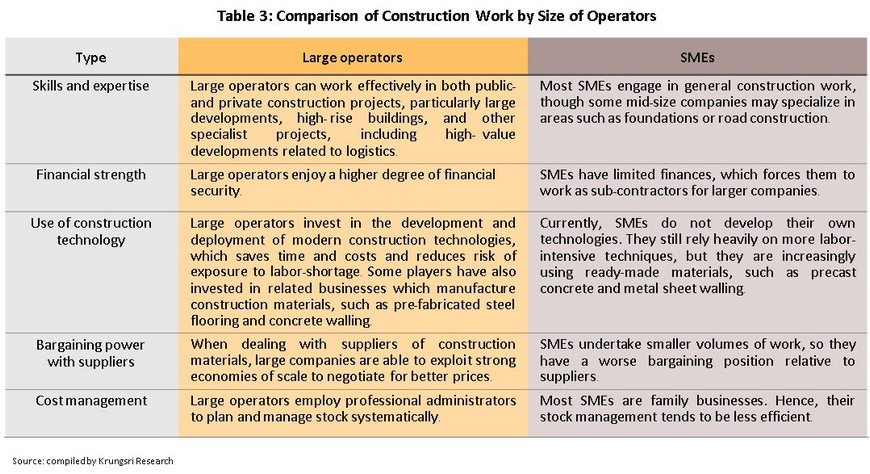

- Public construction: The lion’s share of public-sector construction comprises build-out of infrastructure, which accounts for 82% of total spending in this segment. The rest goes towards building offices for government agencies and housing for civil servants. Large contractors have strong advantage when securing government construction contracts, especially for infrastructure megaprojects, due to their experience, expertise, financial efficiency, and ability to exploit specialist techniques and technologies. Hence, SMEs tend to be sub-contractors for larger corporations in publicly-funded projects.

- Private construction: This is mostly driven by residential accommodation, which contributes 54% of the total value in the segment. The rest is split between industrial factories (9%), commercial buildings (8%), and other developments (29%), a category that includes hotels and hospitals (source: the Office of the National Economic and Social Development Council, 2018). Private-sector construction spending is normally dictated by the overall health of the economy, investor confidence, degree of domestic political stability, extent of infrastructure spending, and government measures to stimulate investment.

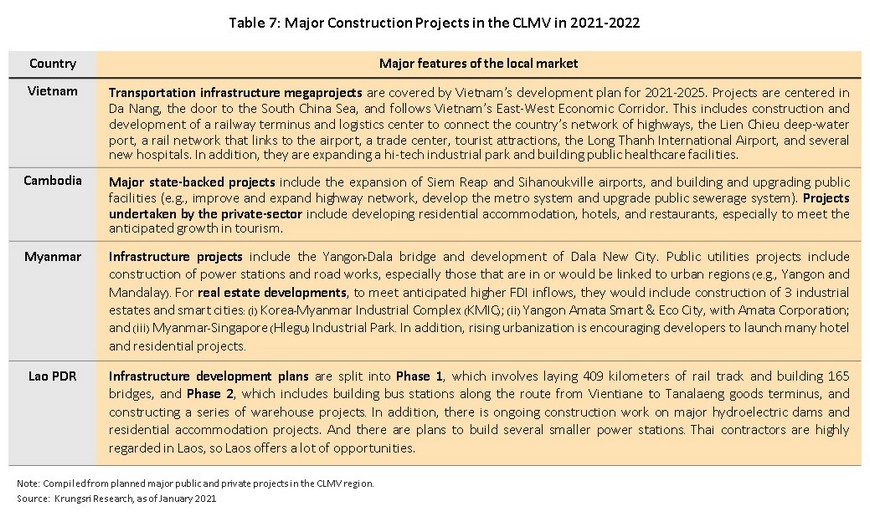

- Thai construction companies, especially larger ones, have also been venturing into overseas markets, especially the CLMV countries (Cambodia, Laos PDR, Myanmar and Vietnam). They are attracted by the high investment in infrastructure and utilities projects in those countries, for example, in road networks, rail links and power stations. Thai operators are also hired for the construction, repair and renovation of housing and other structures in the CLMV nations.

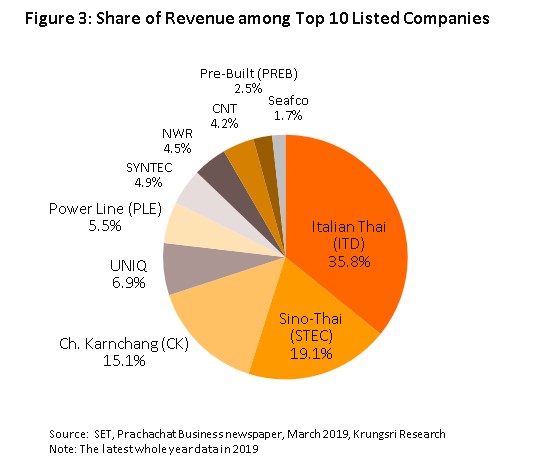

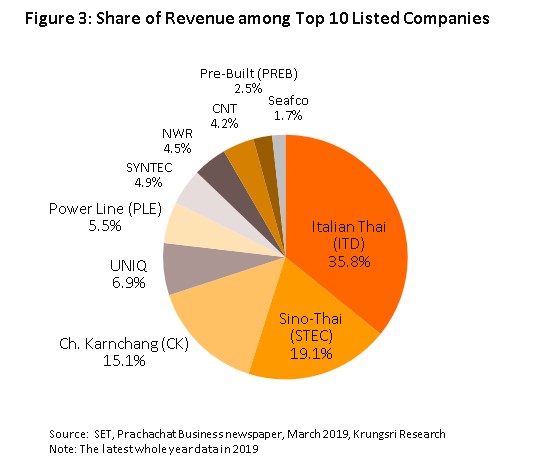

At present, there are about 80,000 construction companies registered in Thailand (source: Department of Business Development, 2019). But of these, only 55 (or 0.07%) qualify as large-scale operators which command about 50% share of industry revenue. They are mostly listed on the stock exchange. Indeed, the three largest players, (Italian Thai Development, Sino-Thai Engineering and Construction, and Ch. Karnchang) have 24% share of total market value and over 70% share of the revenue of the 10 biggest construction stocks traded on the Thai stock market (Figure 3).

To evaluate the state of the construction sector, we need to consider the following:

1) The market: The volume and value of projects available (and hence, revenue) depends largely on the state of the economy, political environment, plans for and progress in public and private construction investment, and regulations governing investment in those countries, which might support or hinder the industry.

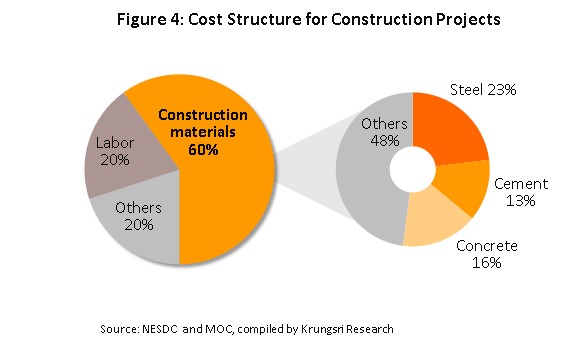

2) Costs: Changes in construction material and labor costs, would affect profits. Currently, Thai construction companies are facing labor shortage, in terms of both quantity and quality. This means costs have exceeded productivity. The cost-structure for construction companies broadly comprises 60% for construction materials (construction steel, concrete, cement and other materials), 20% for labor, and 20% for other costs[2] (Figure 4).

Situation

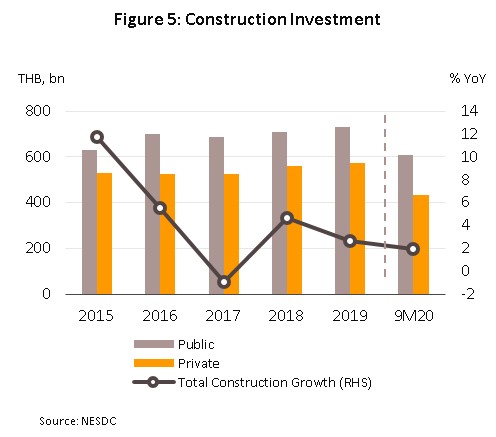

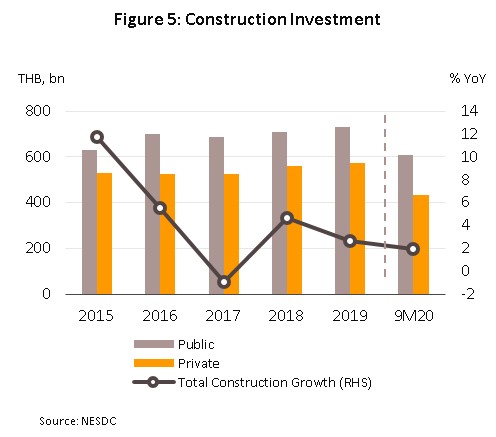

In the first 9 months of 2020, construction contractors experienced a mild growth in business, with construction spending rising 1.9% YoY to THB1.04 trillion, following 2.7% growth in 2019. This was largely driven by public construction projects (56.5% of total construction spending), especially ongoing works for megaprojects, as the government had accelerated budget disbursements. However, private-sector spending shrank with the wider contraction of the economy, triggered by the COVID-19 crisis and the need to impose strict measures to control the spread of the virus. This had severely reduced construction contracts for residential property in the Bangkok Metropolitan Region and major provincial centers, as property developers postponed new projects, consumer spending power weakened, and lenders tightened the release of new credit.

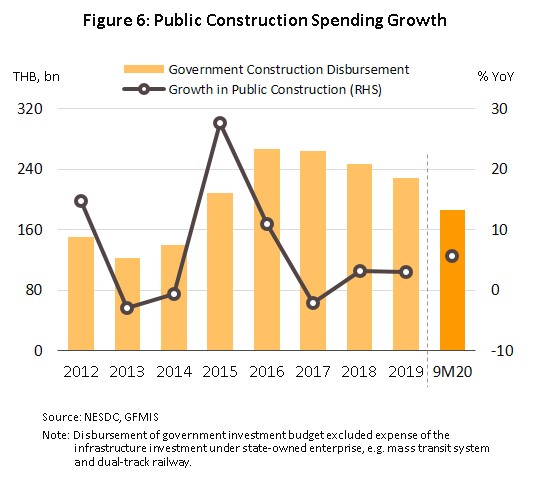

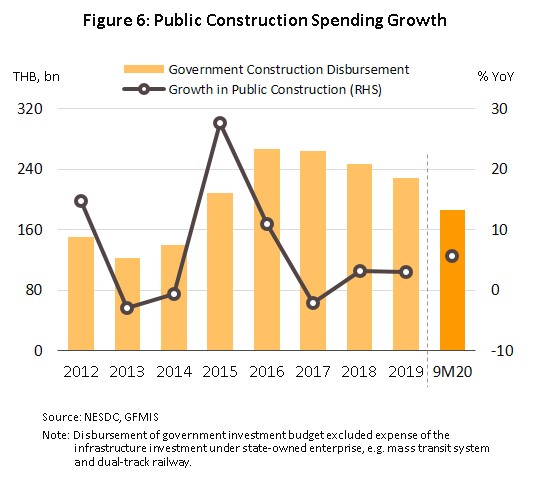

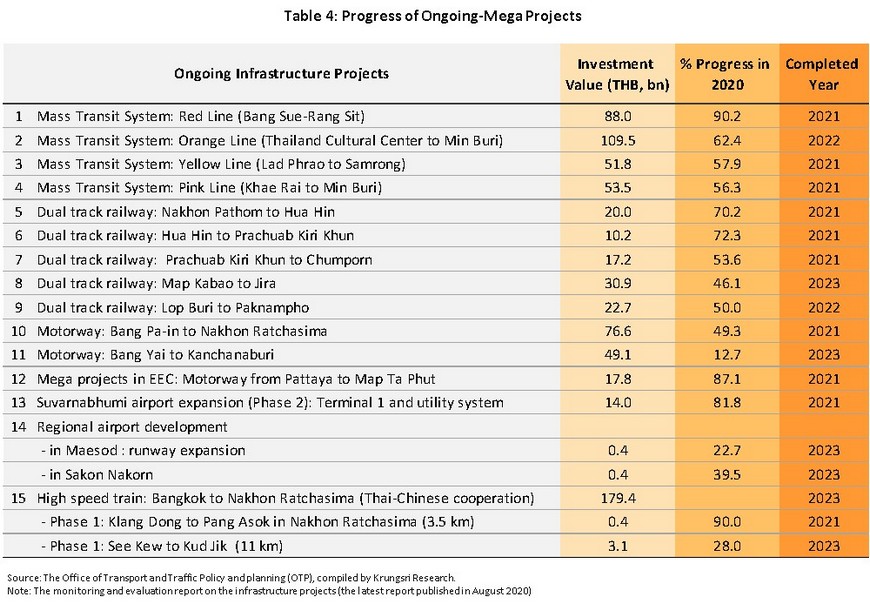

Public construction spending grew 5.6% YoY to THB608 billion in 9M20 (Figure 6), after the government accelerated the annual budget disbursements. Details are as follows:

- Infrastructure projects (82.3% of public-sector construction spending by value) may be divided into the following categories:

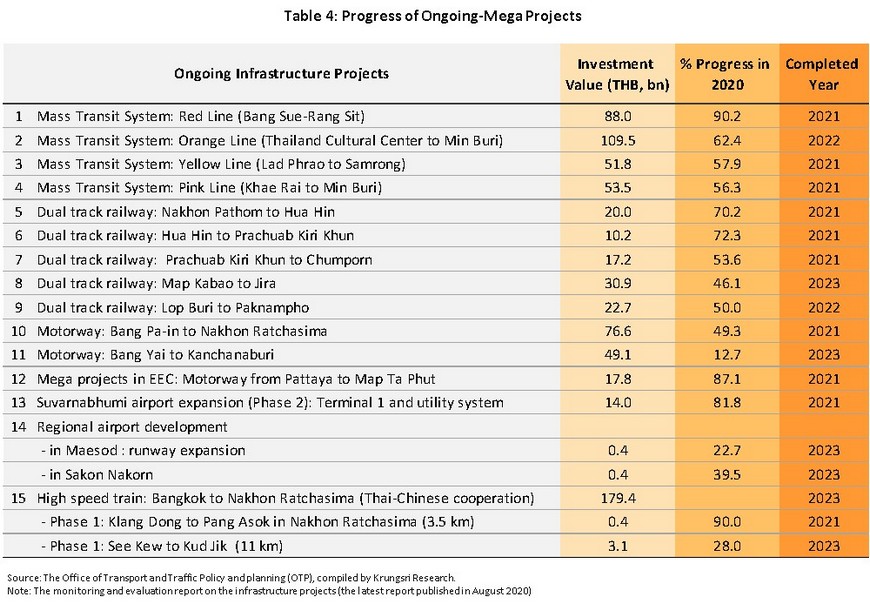

- Government projects: The most important includes: (i) The Integrated Plan for the Development of the Transport and Logistics Systems under the Ministry of Transport. They are mostly ongoing megaprojects, including the MRT Orange Line (Cultural Center-Minburi), Pink Line (Khae Rai-Minburi), and Yellow Line (Lat Phrao-Samrong) which are 64%, 56% and 58% complete, and the 50%-complete Phase 1 dual-track railway from Bangkok to Nakhon Ratchasima (source: government progress reports, August 2020). (ii) To address the effects of the last drought, the Ministry of Agriculture and Cooperatives is working on a large number of construction projects across the country. These are managed through the ministry’s plan to develop local irrigation systems.

- State enterprise projects: The bulk of construction work is ongoing projects, including projects by the Electricity Generating Authority of Thailand and the Provincial Electricity Authority’s to develop the national power grid, TOT’s telecommunications network, and the Metropolitan Waterworks Authority’s water mains development project.

- Other public construction (17.7% share): This includes construction of residential accommodation for government employees (which slumped 36.3% YoY) and buildings used by government agencies (which fell 11.5% YoY). These drops can be partly attributed to the COVID-19 impact because much of such work is normally carried out by SMEs. And they were badly affected in 2020, many experiencing liquidity and labor shortage.

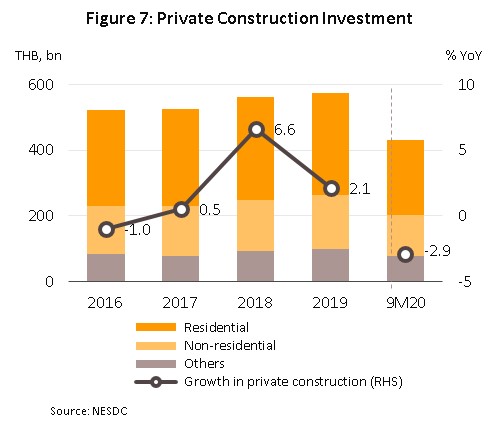

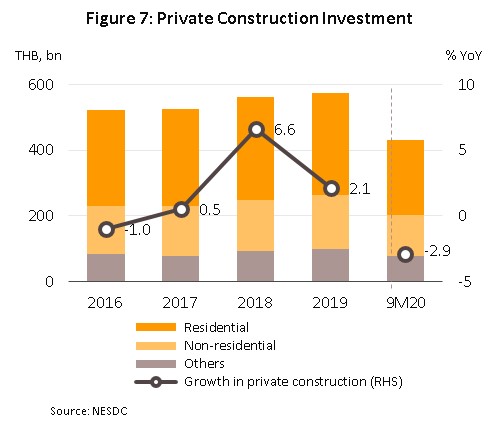

Private construction spending contracted 2.9% YoY in 9M20 to THB431 billion (Figure 7) because of fewer residential and commercial building developments.

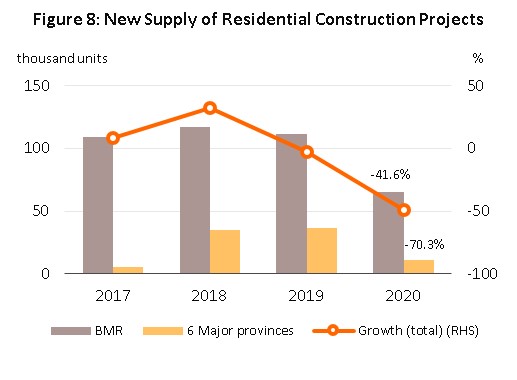

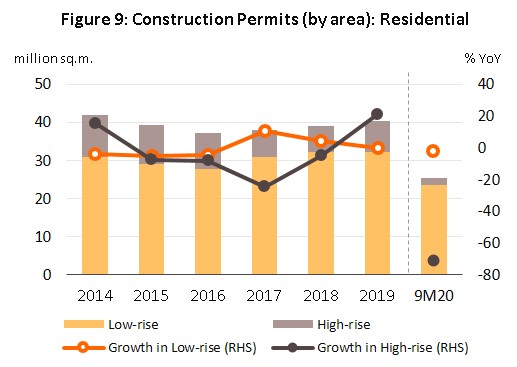

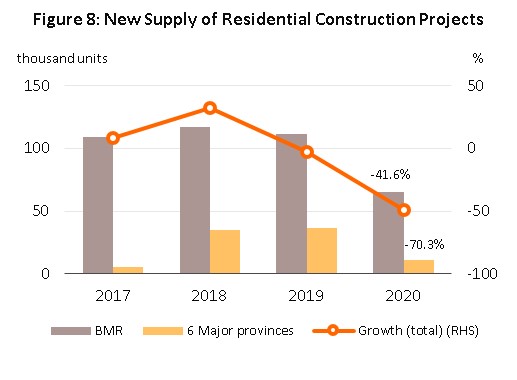

- Residential construction (53.1% of private construction spending): Total spending in this segment slipped 6.8% YoY during the period. This was in line with the sharp drop in building activity throughout 2020 in the Bangkok Metropolitan Region and six major provinces (Chiang Mai, Chonburi, Khon Kaen, Nakhon Ratchasima, Phuket and Rayong), which crashed by 41.6% and 70.3%, respectively (Figure 8). Property developers responded to the challenging conditions by postponing several new projects (both low- and high-rise). To preserve cashflow and liquidity, they had focused on running down existing stock of unsold properties by employing strategies that included giving steeper-than-normal discounts, renting out properties, and deferring payments by 1-2 years. The market was also hit by weaker consumer spending power because of the recession and lenders being more cautious about approving new credit, even though interest rates are very low.

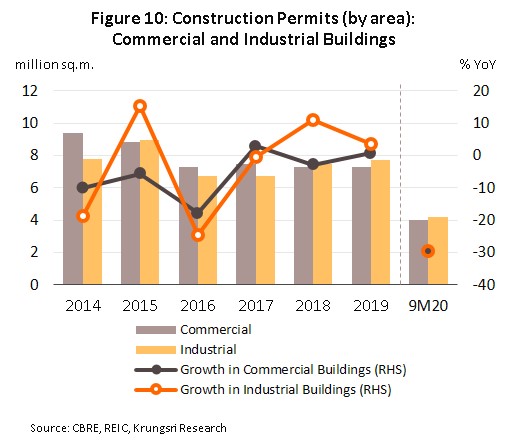

- Non-residential construction spending (28.7% share): Spending in this segment fell by 3.1% YoY, covering commercial buildings, construction work in the services and transport sectors, and industrial factories. This is premised on total investment and the broad economy contracting this year due to the COVID-19 pandemic and subsequent lockdown as well as need to maintain social distancing measures, like for most industries.

- Other private construction spending (18.2% share): Spending in this segment grew 10.9% YoY. It was mostly driven by the construction of structures that are non-buildings (e.g., bridges) on private land. This work is typically in communities that are expanding and experiencing urbanization.

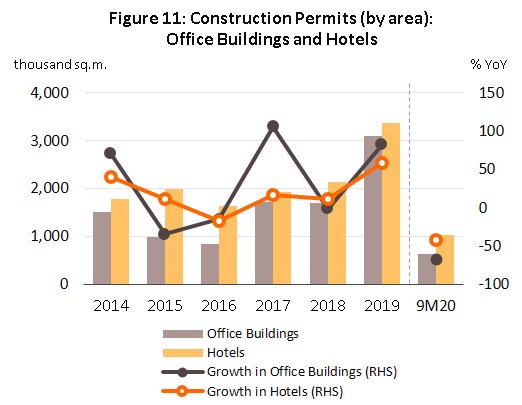

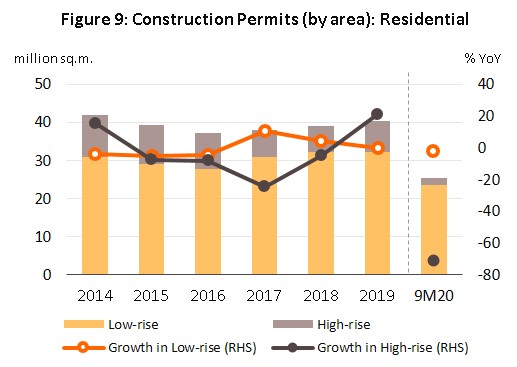

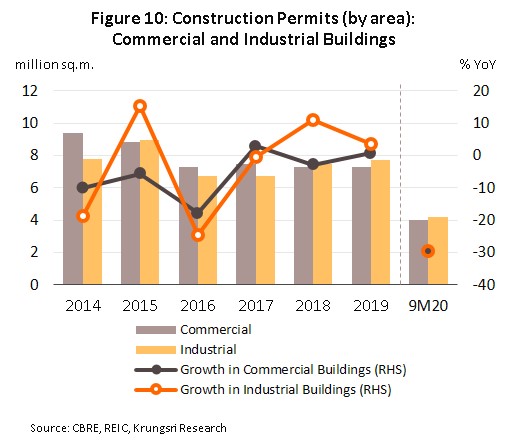

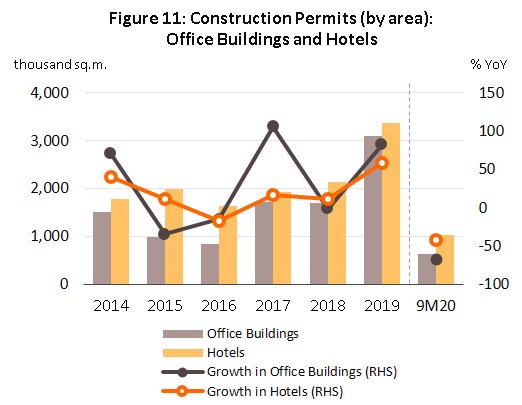

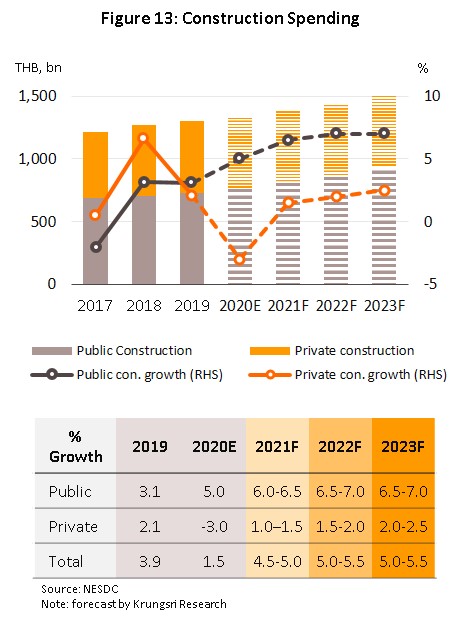

In the last quarter of 2020, we estimate public construction spending had continued to rise. This is premised on government attempts to accelerate budget disbursements for Bangkok’s metro system and the dual-track railway projects, as well as local projects that include 2,000 separate programs to repair and upgrade the country’s road network. However, private construction likely remained depressed as property developers postponed new projects (for rent and for sale) and instead focused on running down existing stock. This is reflected in fewer number of applications for construction permits (leading index for private-sector construction activity) in 9M20, for all categories. For residential construction, there were fewer permits for low-rise projects (-2.1% YoY) and high-rise developments (-70.6%). For non-residential construction, declines were recorded for commercial properties (-29.6% YoY), industrial properties (-29.7%), offices (-67.4%) and hotels (-42.2%) (Figures 9, 10 and 11). Thus, for full-year 2020, total construction spending likely rose by only 1.5% (to THB1.321 trillion), driven by 5.0% growth in public sector spending and 3.0% contraction private sector spending. This follows 3.1% and 2.1% growth in 2019, respectively.

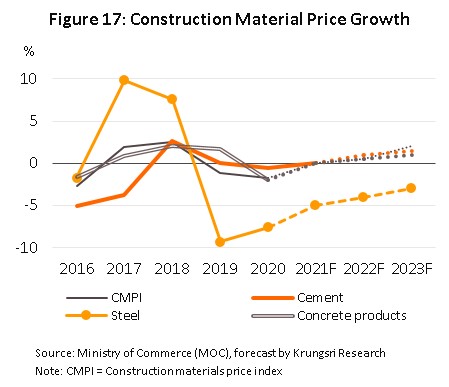

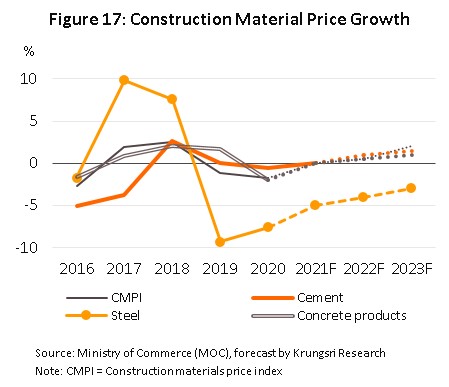

Cost of construction materials fell by 1.8% in 2020, after falling 1.2% in 2019 (Figure 12). The depressed construction market had caused prices to drop for the major product categories. The price drop was most severe for construction steel (23% of total cost of construction materials), which fell by 7.6%. This was followed by concrete products (16% of costs) and cement (13% of costs) which prices fell by 2.0% and 0.6%, respectively.

Outlook

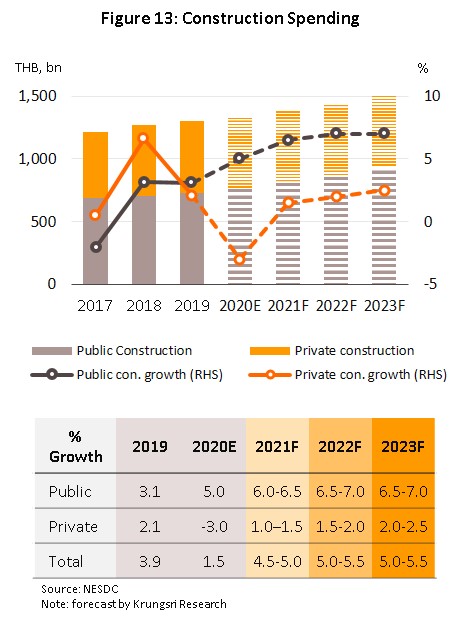

Krungsri Research sees conditions improving for the construction industry and predicts investment will rise by 4.5-5.0% in 2021 and then by 5.0-5.5% in 2022-2023 (Figure 13). The major growth drivers will be government spending on megaprojects, especially those connected to the development of the Eastern Economic Corridor (EEC), and the broad economic recovery following the 2020 recession, which will boost spending on residential accommodation.

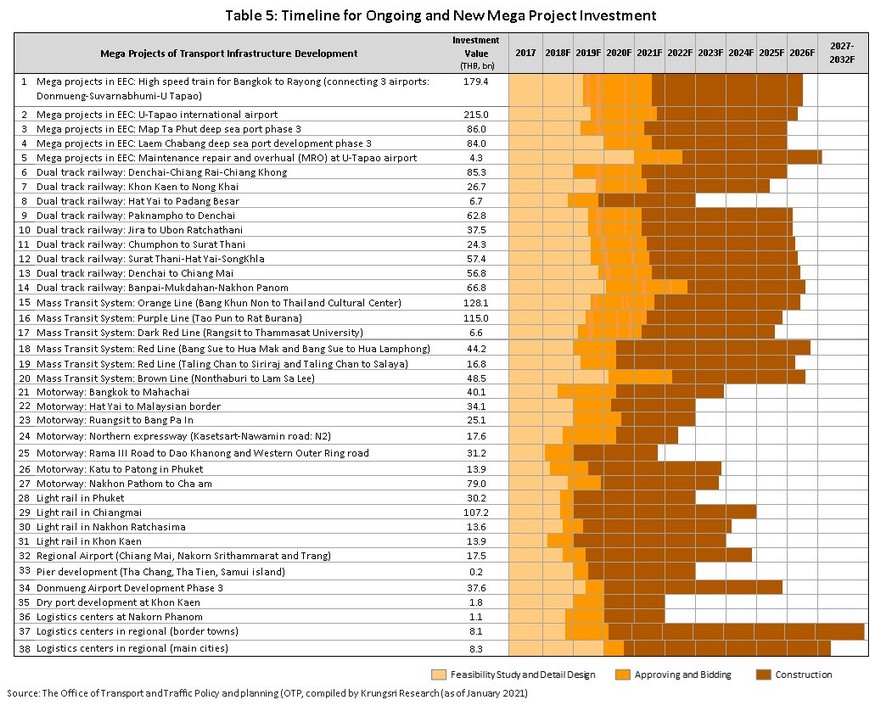

Public-sector construction spending is forecast to expand by 6.0-6.5% in 2021 and by 6.5-7.0% annually in 2022 and 2023. The bulk of the increment will be led by investment in ongoing megaprojects under the 2018 Urgent Transport Action Plan, which is part of the 20-year Strategic Transport Infrastructure Development Plan (2017-2036). This had allocated THB1.8 trillion for spending on infrastructure projects, the most important of which are laid out in the next section.

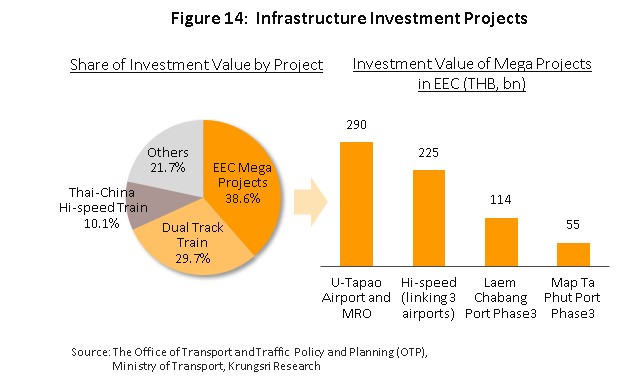

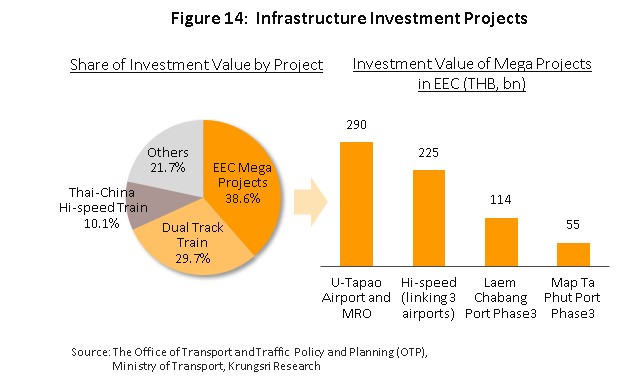

- Projects linked to the EEC will be the most important because they will account for 38.6% of total public-sector spending on construction (Figure 14). The EEC is a strategically important region and many of the related megaprojects will commence in 2021, including: (i) Phase 1 (Suvarnabhumi-U-Taphao) of the high-speed rail-link to connect three airports (Don Muang, Suvarnabhumi and U-Taphao); (ii) Phase 3 of the Map Ta Phut and Laem Chabang Port development, scheduled for construction once land reclamation work is complete; and (iii) construction of a new passenger terminal at U-Taphao. Spending on these 3 projects will exceed THB60 billion in 2021, while total cost would reach over THB680 billion. The government has also approved plans to expand the scope of some existing projects, including the Laem Chabang Port development, to improve links between the EEC and the south of Thailand and neighboring countries, to establish Thailand as an ASEAN transportation hub. This will create new projects, such as construction of a dry port which should be completed in 2023-2024. The whole development will help to extend transportation links to other regions through a multimodal transport network.

- Major projects in other areas (ongoing and new projects that will break ground in 2021) include the dual-track railway (29.7% of total public-sector construction spending) and the Thai-China high-speed train (10.1%) (Figure 14).

- Urgent projects in 2021 include:

- The Den Chai-Chiang Khong and Baan Phai-Nakhon Phanom dual-track railway links.

- The Bangkok-Nong Khai section of the Thai-China high-speed railway (Phase 1 from Bangkok to Nakhon Ratchasima is under construction and work on phase 2 from Nakhon Ratchasima to Nong Khai will begin in 2022).

- Extensions to the MRT Western Orange Line (Bang Khun Non-Cultural Center) and the Southern Purple Line (Tao Poon-Rat Buruna), which will improve coverage of the transportation network in the area.

- Projects that are likely to be expedited in 2021-2023:

- Construction of Highway 58, which will include construction of bypasses and elevated road intersections nationwide.

- The Motorway Rail Map (MR Map) aims to integrate the dual-track and high-speed railways through the 3 pilot sections of Nakhon Ratchasima-Nong Khai (203 kilometers), Nakhon Ratchasima-Ubon Ratchathani (301 kilometers) and Nakhon Pathom-Cha-Am (119 kilometers). These are part of the 20-year plan to develop an intercity motorway network (2017-2036).

The majority of these large infrastructure projects will be funded through public-private partnerships (PPPs). They are likely to be under the PPP net cost model rather than structured as PPP gross cost projects because this gives private sector partners more rights to collect charges from the public and helps to reduce operating costs for the government.

Total private-sector construction spending is projected to grow by 1.0-1.5% in 2021, 1.5-2.0% in 2022, and 2.0-2.5% in 2023, supported by the following factors.

- Stronger government investment in infrastructure will create crowding-in from the private sector.

- The EEC project will help to stimulate spending on the construction of factories and industrial estates. Work is scheduled to start on two new industrial estates in the area in 2021 – Rojana Nong Yai Industrial Estate in Chonburi (1,900 rai, to be construction over 2021-2024) and Egco Industrial Estate in Rayong (621 rai, constructed 2021-2022). In addition, to meet rising demand from overseas businesses to relocate to Thailand, industrial estates that are in operation are also expanding. Amata City in Rayong plans to expand by 1,000 rai.

- The number of residential developments is forecast to grow by an average of 3.0-4.0% per year in 2021-2023, to 61,000-63,000 new units/year. But, to meet rising non-speculative demand, property developers are likely to increase the proportion of low-rise projects in their portfolios, especially in suburban locations. The outlook for condominiums will improve in certain areas, notably the city center and along some of Bangkok’s metro lines, but construction work on these will largely be controlled by major players. The 10 largest developers in Thailand plan to invest a combined THB230 billion to develop residential projects (both low- and high-rise) in 2021, up 13.4% from 2020. They will be targeted at middle-income earners (called the ‘affordable’ segment) (source: Prachachat Turakij, 25-27 January 2021).

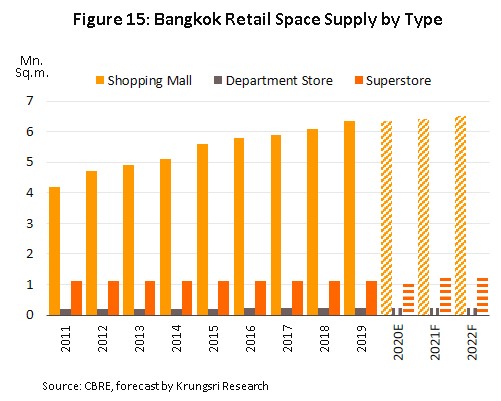

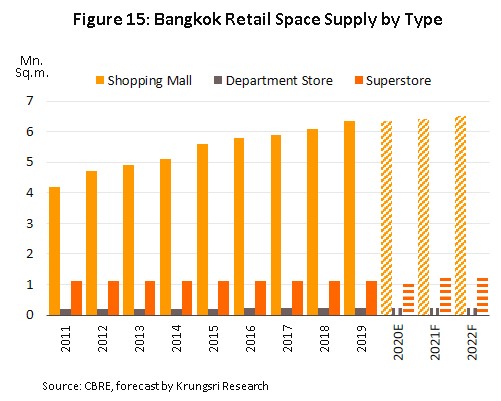

- Development of commercial buildings is split into (i) retail space, which supply normally rises (Figure 15) when there are expectations of a recovery in private-sector consumption and a rebound in tourism activities, and (ii) office space, which is also forecast to see better conditions as private-sector investment improves. However, to better meet demands for modern urban lifestyles, commercial buildings are increasingly being developed as mixed-use projects. Between 2021 and 2023, projects that are currently under construction or will start construction soon, would add 1 million sq.m. of new supply (Table 6).

Business responses to a changing market

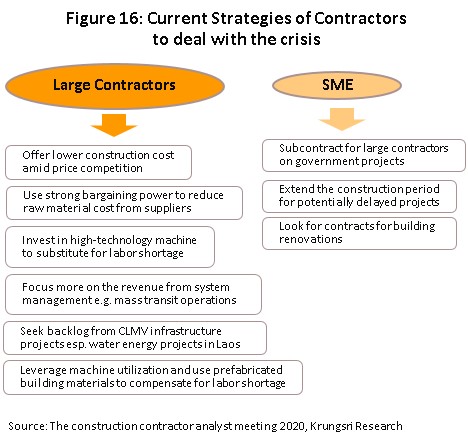

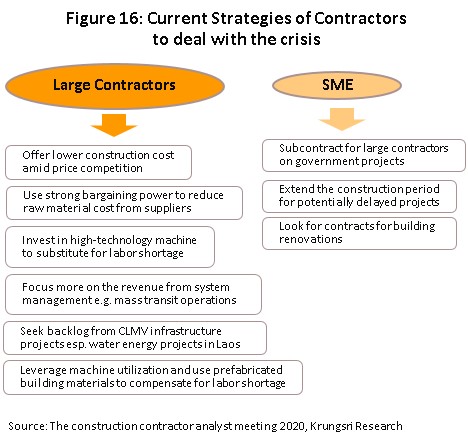

- Large players will apply proactive strategies to both their operations and investments. Looking at business operations, companies will try to cut costs and improve price competitiveness to boost their chances of winning public- and private-sector contracts. These players also enjoy a strong bargaining position relative to manufacturers and suppliers of construction materials. And they are able to find and exploit profitable activities that arise subsequent to the primary construction works, such as operating a mass transit system. Looking at investments, large companies will likely step up spending on labor-saving high-tech equipment because this is the best way to reducing exposure to risk of continued labor shortage, and social-distancing rules which are expected to be in force for some time.

- SMEs are predominantly family-run businesses with limited access to capital. They also operate from a much weaker bargaining position when it comes to dealing with suppliers. Most will take on sub-contract jobs from large players, especially for government megaprojects. They would also seek additional sources of revenue, such as by offering from repair and renovation services.

(Figure 17). This is premised on the projected uneven recovery in investment and the economy, and large construction companies being able to negotiate for lower prices from suppliers and distributors. Thus, over the next few years, the cost of cement and concrete products will trend up, driven by government-funded projects that are intense consumers of these two products. However, price of construction steel will continue to trend down, depressed by high inventories worldwide and cheap imports from China.

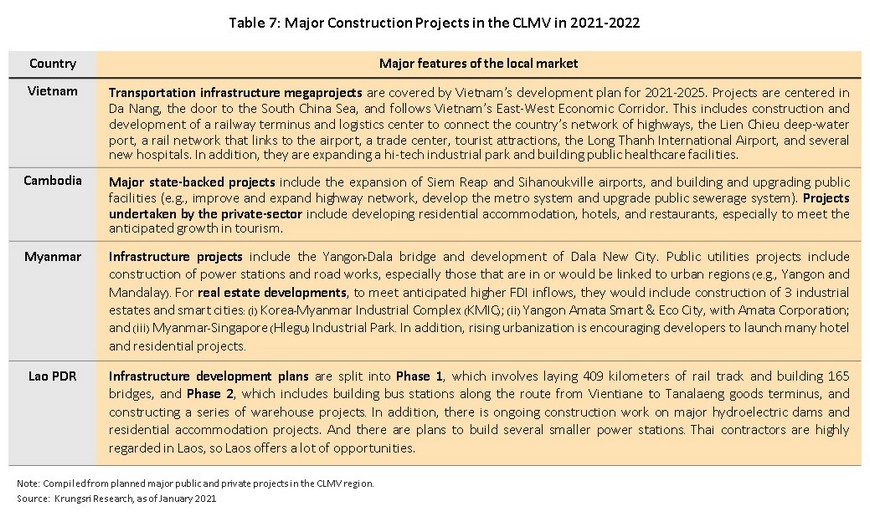

For Thai players, the opportunities include construction work for factories, office buildings, and residential accommodation. In this region, Vietnam would be most attractive given the heavy investment in infrastructure and industrial estates to meet strong FDI inflows (Table 7). The regulatory conditions are also now favorable to expand regionally, because under the ASEAN Framework Agreement on Services (AFAS), signatory members cannot restrict contractors from signatory countries from participating in the domestic markets. However, they may be required to operate as a joint venture or sub-contractor to a local partner (source: www.asean.org). Nevertheless, expanding into the regional market is mostly reserved for large operators because only they have the requisite financial capacity, access to technology, and business connections to make this a viable proposition.

Over the long term, Thailand will cooperate with the Cambodian and Vietnamese governments to create an economic corridor that connects the three nations. This plan is pursued under the auspices of the Cambodia-Vietnam-Thailand Economic Corridor Cooperation Conference (CVTEC). That has been operating since 2018 with the participation of government agencies and private-sector organizations from the member states, and a plan has been created to develop a coastal corridor linking the 3 countries that connects to the Belt and Road Initiative (BRI) on the Chinese coast. The successful implementation of this plan is dependent on considerable investment in a large number of projects, such as new transportations links between Thailand, Cambodia and Vietnam.

But on the flip side, when competing for contracts in the CLMV countries, Thai contractors might face risks arising from employment practices that fall short of international standards, contracts with unfavorable clauses that could increase business uncertainty, possibility of losses if there is political instability, and stronger competition from players from other countries. To reduce these risks, Thai contractors might need to partner with players in local supply chains, most obviously local property developers or building contractors. And, to avoid the risk of labor shortage, they should also work with a local labor agency.

Krungsri Research’s view

Between 2021 and 2023, construction companies that work on large-scale public-sector projects will see their revenues rise steadily. But those that focus on private-sector projects will see a slow recovery.

- Revenues will rise at a healthy rate for large and mid-size civil engineering companies that undertake large-scale projects. This is attributed to government attempts to accelerate these projects. These companies will benefit from their ability to participate effectively in competitive bidding and to manage major current and future public construction projects, including metro lines, dual-track railway, motorways and transportation networks that connect to the EEC. In addition, they are well-placed to compete for work in the growing market to construct utilities and power stations in the CLMV zone. Small operators will also experience revenue growth driven by more opportunities to sub-contract for large players who manage government megaprojects

- Revenue will grow much more slowly for contractors who focus on private and general construction projects, and high-rise and large buildings. In 2021, revenue would be flat or only inch-up because of the lingering effects of the COVID-19 pandemic. But in the subsequent two years, the situation should improve as investor confidence returns along with heavier spending on infrastructure. Large and mid-size players will enjoy relatively quicker revenue growth, especially those that target mixed-use developments, for which there is a steadily rising construction backlog. Large players will also be able to seek private-sector projects in neighboring countries, mostly residential, commercial and industrial developments, as this market should expand along with the projected economic growth in the region. However, there would be less small-scale projects than large developments, which means revenue growth will remain sluggish for small operators. Their situation will be worsened by the challenges of having to manage costs. As such, some small operators could see their revenues drop substantially, which could lead to liquidity problems.

[1] The K value is an index that is used to evaluate the scale of changes in construction costs between the day on which tenders are submitted and the period when a stage of work is completed. Prices are calculated using 13 different indices, including the consumer price index and the index of diesel costs (source: Office of Policy and Strategic Trade, Ministry of Commerce).

[2] Calculated from large operators’ costs and from the Office of the National Economic and Social Development Board (NESDB) input-output tables.

.webp.aspx)