Executive Summary

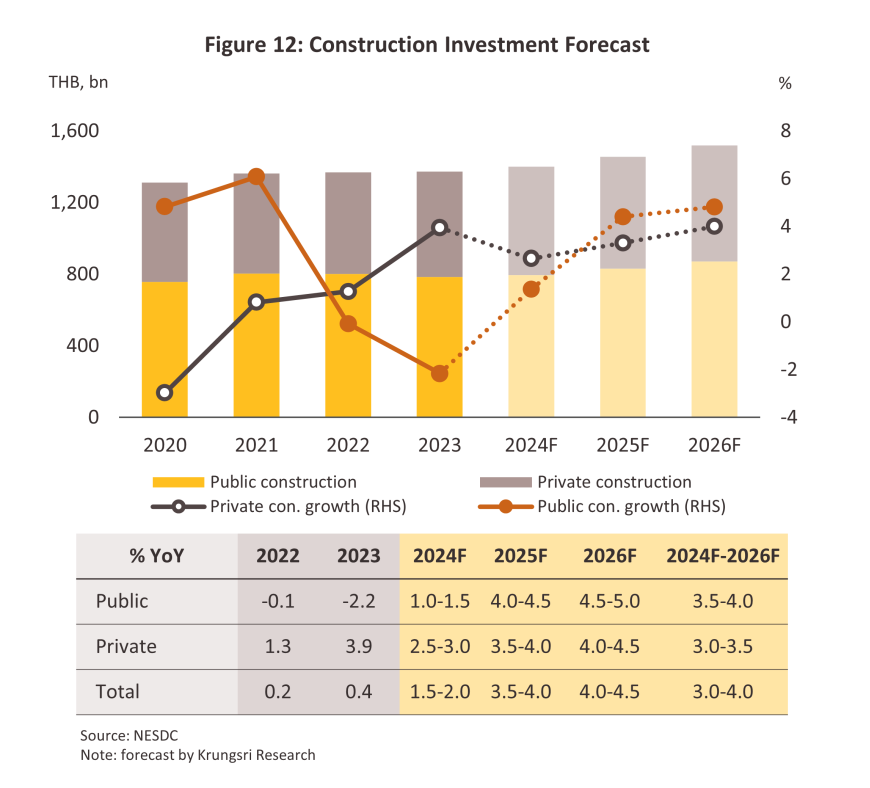

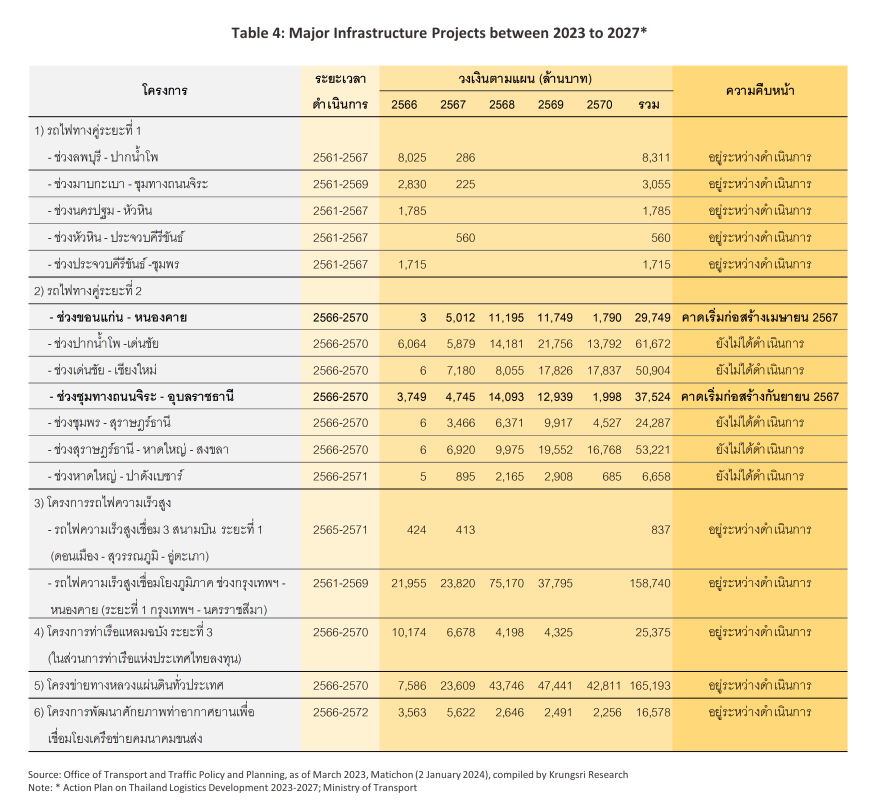

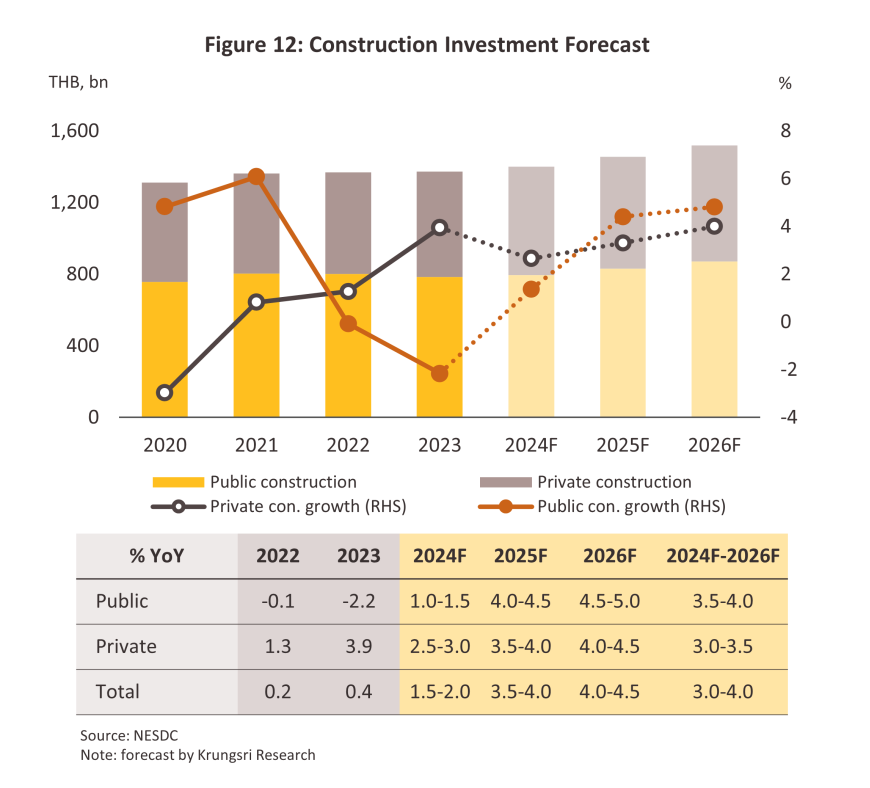

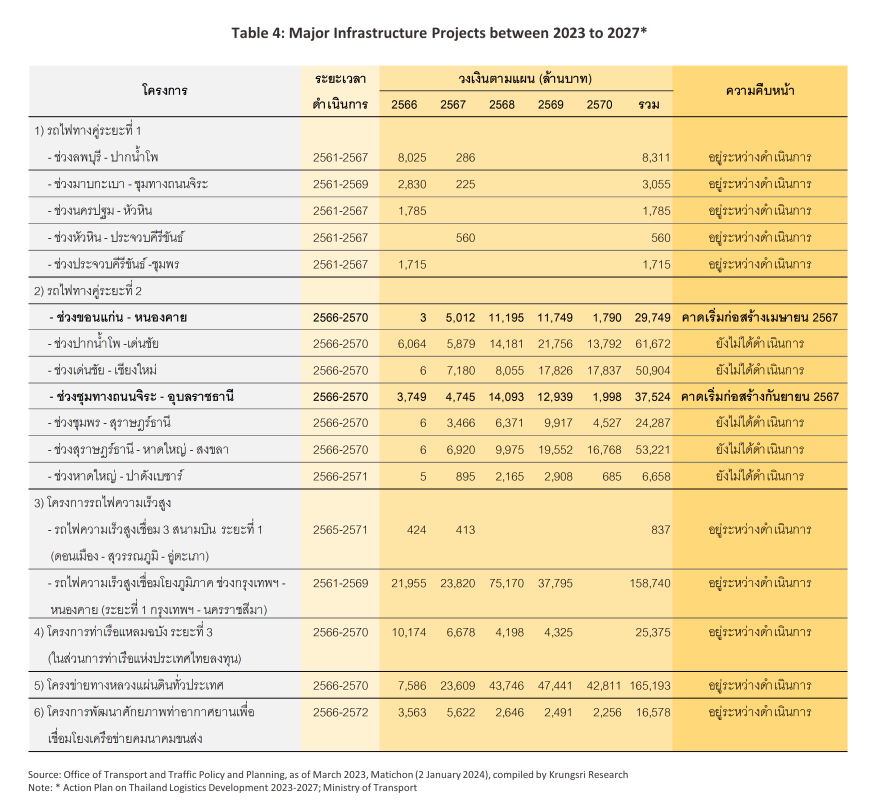

ธุรกิจรับเหมาก่อสร้างปี 2567-2569 มีแนวโน้มเติบโตตามมูลค่าการลงทุนก่อสร้างโดยรวมที่คาดว่าจะขยายตัว 3.0-4.0% ต่อปี โดยมูลค่าก่อสร้างภาครัฐจะขยายตัว 3.5-4.0% ต่อปี ด้วยปัจจัยขับเคลื่อนที่สำคัญ ได้แก่ การลงทุนโครงการขนาดใหญ่ของภาครัฐ โดยเฉพาะโครงการที่เกี่ยวเนื่องกับเขตพัฒนาเศรษฐกิจพิเศษภาคตะวันออก (Eastern Economic Corridors: EEC) ภายใต้การเร่งดำเนินงานตามแผนปฏิบัติการด้านการพัฒนาระบบโลจิสติกส์ของประเทศไทย พ.ศ. 2566-2570 ขณะที่มูลค่าการลงทุนก่อสร้างภาคเอกชนทั้งที่อยู่อาศัยและอสังหาริมทรัพย์เพื่อการพาณิชย์ มีแนวโน้มทยอยฟื้นตัว โดยจะขยายตัว 3.0-3.5% ตามกำลังซื้อที่น่าจะปรับตัวดีขึ้นตามภาวะเศรษฐกิจและการลงทุนในโครงสร้างพื้นฐานที่คืบหน้ามากขึ้น โดยปัจจัยที่อาจจำกัดการเติบโตส่วนใหญ่มาจากต้นทุนก่อสร้างทั้งวัสดุก่อสร้างและค่าแรง รวมถึงค่าขนส่งที่จะยังทรงตัวสูงตามทิศทางราคาพลังงาน ขณะที่ปัญหาการเปลี่ยนแปลงสภาพภูมิอากาศและเป้าหมายการปล่อยก๊าซเรือนกระจกสุทธิเป็นศูนย์ (Climate change and the race to Net Zero) จะเป็นปัจจัยท้าทายให้ผู้ประกอบการฯ ต้องเร่งปรับตัวในการลงทุนด้านเทคโนโลยีเพื่อลดการใช้วัสดุก่อสร้างที่สิ้นเปลือง

มุมมองวิจัยกรุงศรี

ในปี 2567-2569 รายได้ของกลุ่มผู้รับเหมาที่เน้นโครงการขนาดใหญ่ของภาครัฐมีแนวโน้มขยายตัวต่อเนื่องตามการลงทุนก่อสร้างภาครัฐ ขณะที่รายได้ของกลุ่มที่เน้นโครงการภาคเอกชนจะทยอยปรับตัวดีขึ้นอย่างค่อยเป็นค่อยไป

-

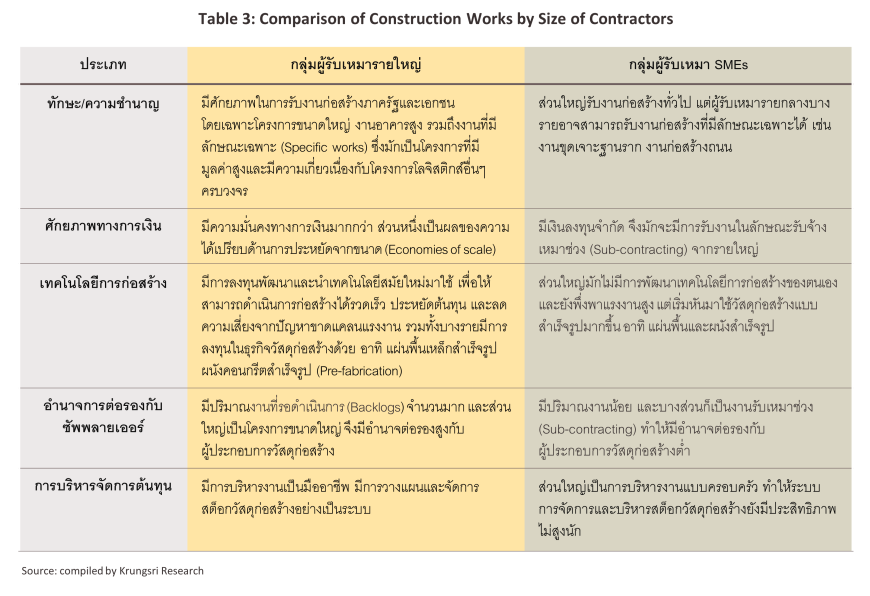

ผู้รับเหมางานก่อสร้างรายใหญ่ คาดว่ารายได้จะขยายตัวต่อเนื่องตามการเร่งลงทุนโครงสร้างพื้นฐานของภาครัฐ เนื่องจากเป็นกลุ่มที่มีความพร้อมในการประมูลรับงานและมีศักยภาพในการบริหารงานก่อสร้างขนาดใหญ่ ทั้งโครงการลงทุนต่อเนื่องของภาครัฐ อาทิ รถไฟฟ้า รถไฟทางคู่ มอเตอร์เวย์ และโครงข่ายคมนาคมขนาดใหญ่ (Megaprojects) ที่เชื่อมโยงกับพื้นที่ EEC รวมทั้งโครงการสาธารณูปโภคพื้นฐานในพื้นที่อื่นๆ ทั่วประเทศที่ยังมีการดำเนินงานต่อเนื่อง ตลอดจนงานก่อสร้างขนาดใหญ่ของภาคเอกชน ทั้งด้านที่อยู่อาศัย กลุ่มอาคารสูง และอาคารขนาดใหญ่ ทำให้มีแนวโน้มที่ปริมาณงานที่รอดำเนินการ (Backlog) จะยังคงเพิ่มขึ้นต่อเนื่อง

-

ผู้รับเหมางานก่อสร้างรายกลาง-เล็ก (SMEs) รายได้มีแนวโน้มทรงตัวในปี2567 และจะทยอยฟื้นตัวในปี 2568-2569 โดยได้แรงหนุนจากภาวะเศรษฐกิจและกำลังซื้อที่ทยอยฟื้นตัว โดยเฉพาะรายกลางที่มีโอกาสรับงานจากรายใหญ่เพิ่มขึ้น ท่ามกลางปัจจัยที่ยังเหนี่ยวรั้งผลประกอบการจากต้นทุนดำเนินงาน และการขาดแคลนแรงงาน ที่อาจส่งผลให้ผู้รับเหมากลุ่มนี้ยังมีความเสี่ยงด้านปัญหาสภาพคล่องทางการเงิน

ข้อมูลพื้นฐาน

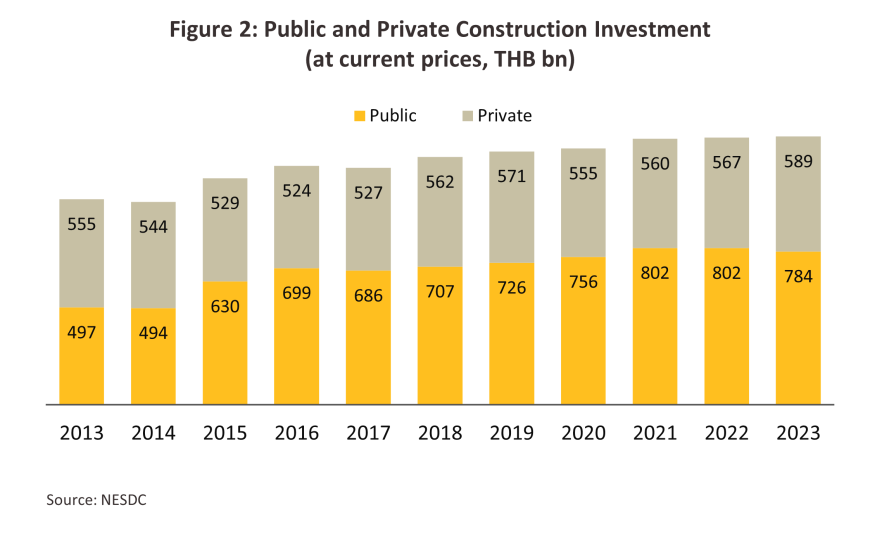

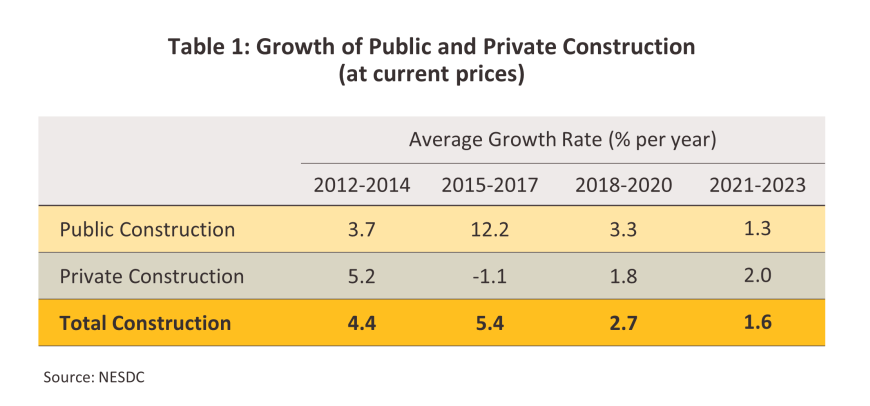

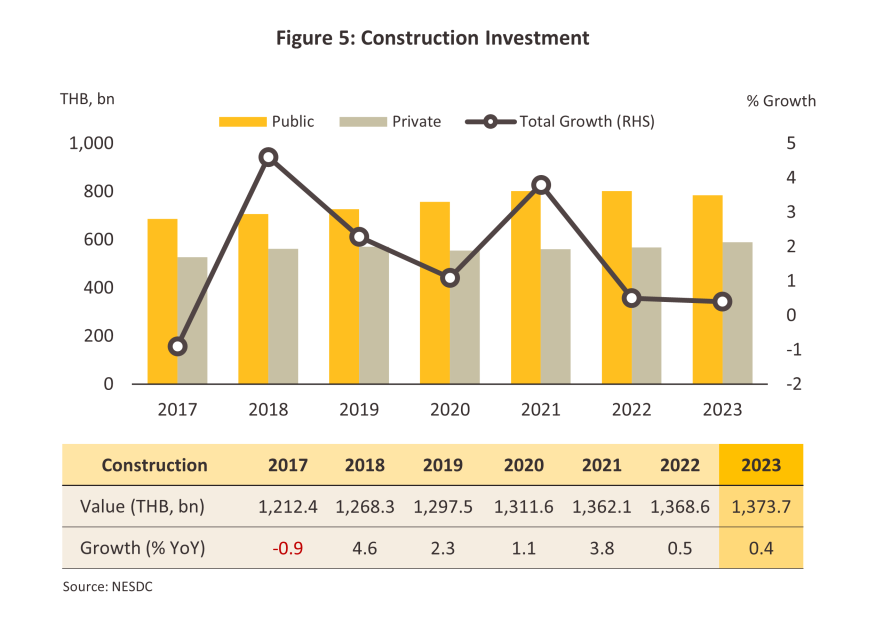

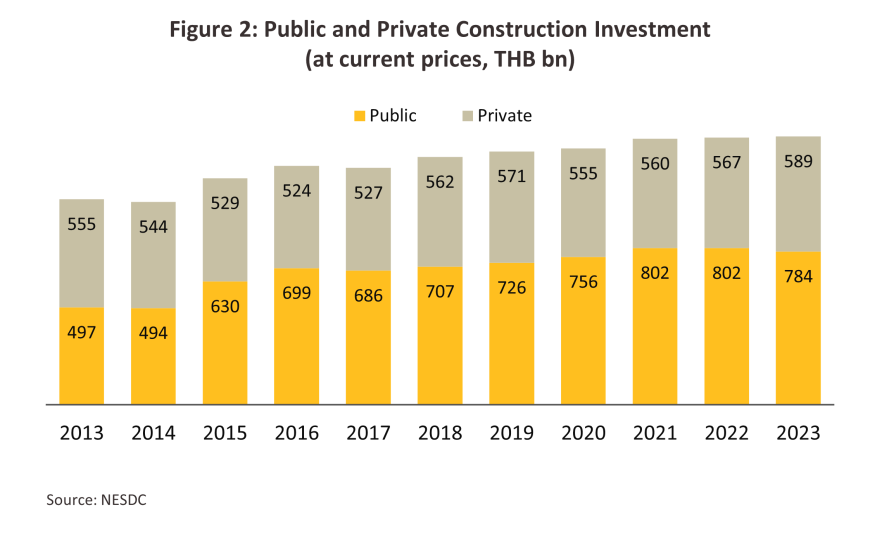

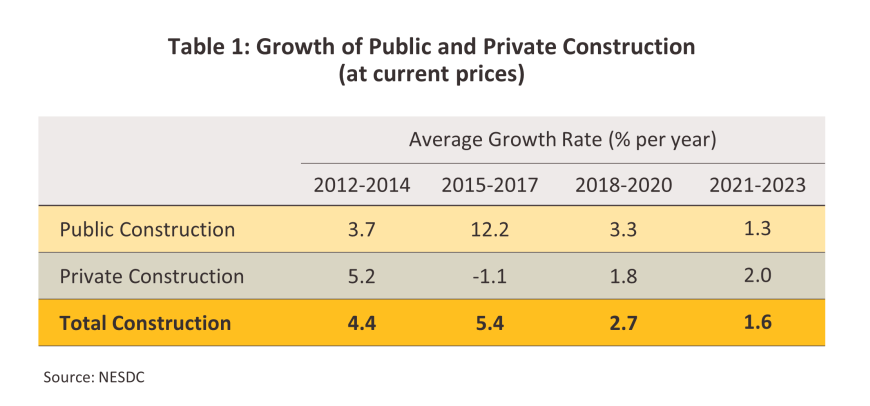

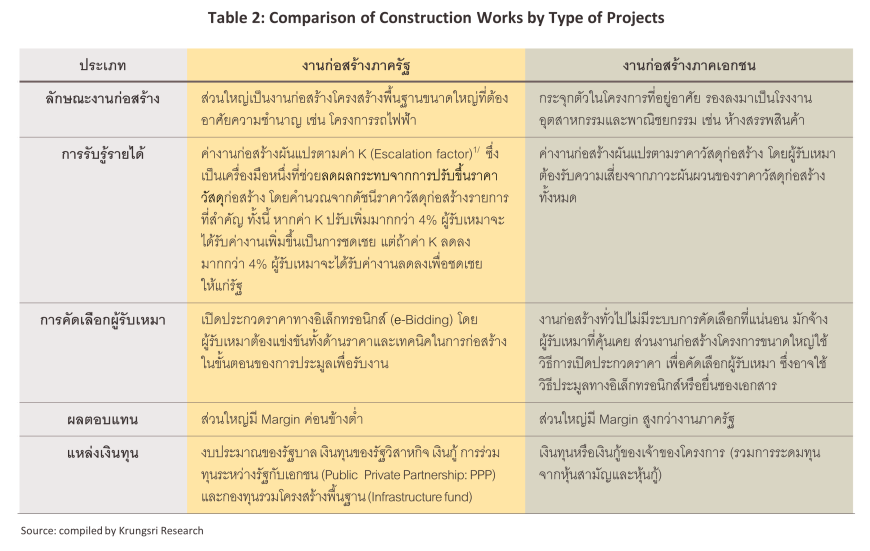

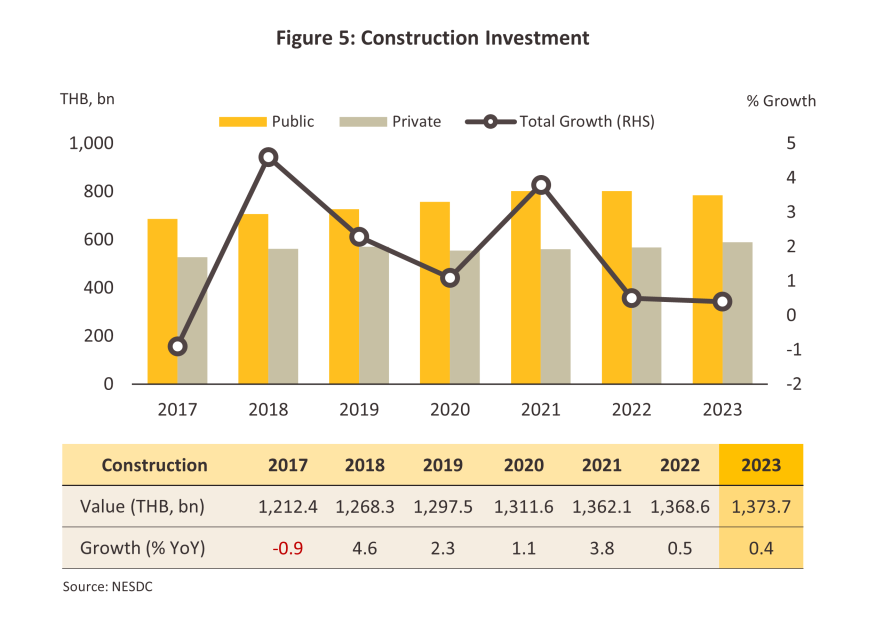

ในช่วงปี 2557-2566 มูลค่าการลงทุนก่อสร้างโดยรวมมีสัดส่วนเฉลี่ย 8.0% ของผลิตภัณฑ์มวลรวมในประเทศ (Gross Domestic Product: GDP) (ภาพที่ 1) ส่วนใหญ่เป็นงานก่อสร้างในประเทศ ซึ่งแบ่งออกเป็น 2 ประเภทตามลักษณะผู้ว่าจ้าง ได้แก่ งานภาครัฐและเอกชน โดยมีสัดส่วนของมูลค่าการลงทุนก่อสร้างอยู่ที่ 57:43 ในปี 2566 (ภาพที่ 2) ทั้งนี้ ผลจากวิกฤต COVID-19 ในช่วงปี 2563-2565 มีส่วนทำให้มูลค่าการลงทุนก่อสร้างโดยรวมเติบโตในอัตราชะลอลงตามมูลค่าการลงทุนก่อสร้างภาคเอกชนที่ลดลงเทียบกับปี 2562 ขณะที่มูลค่าการลงทุนก่อสร้างภาครัฐยังขยายตัวได้ (ตารางที่ 1) ส่วนหนึ่งเป็นผลจากภาครัฐยังคงเร่งลงทุนก่อสร้างโครงสร้างพื้นฐานอย่างต่อเนื่อง (แม้มีหลายโครงการยังล่าช้ากว่าแผนงาน) เพื่อขับเคลื่อนการเติบโตทางเศรษฐกิจและดึงดูดการลงทุนจากต่างชาติ

-

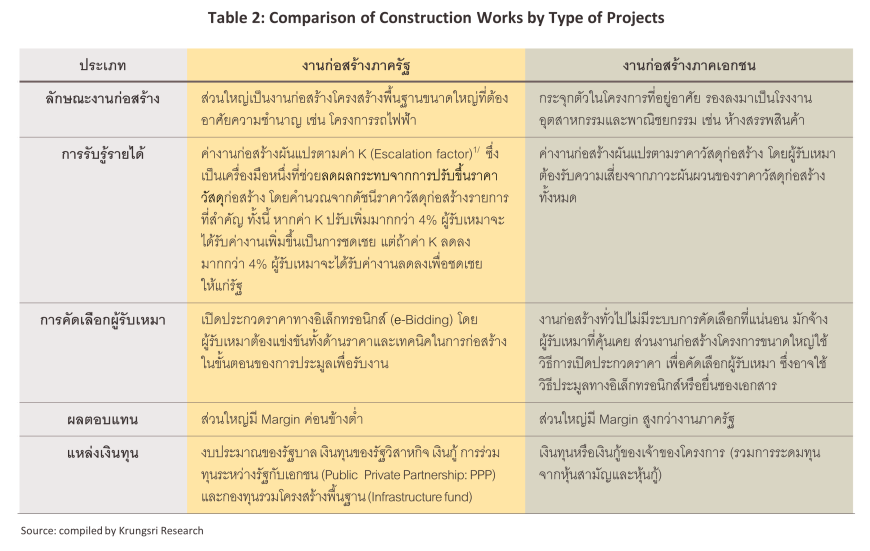

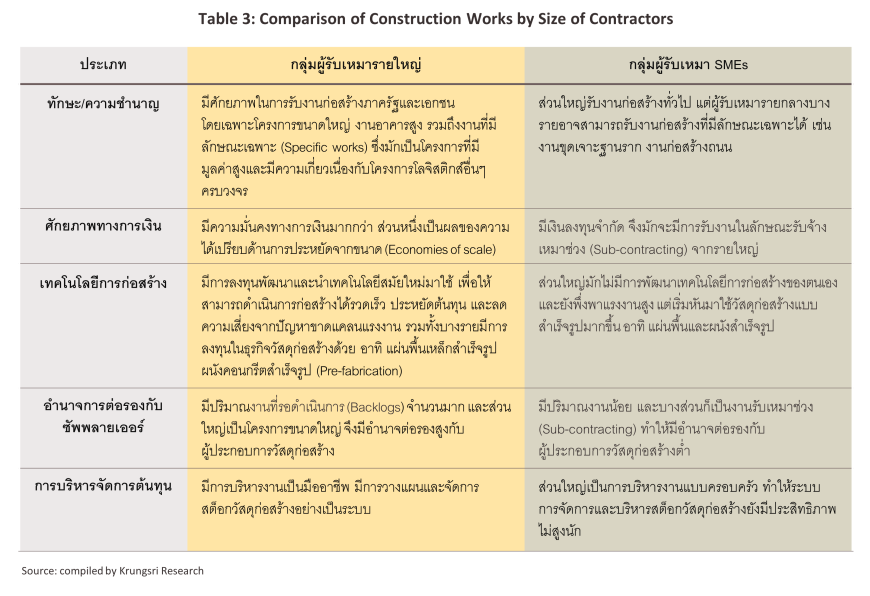

งานก่อสร้างภาครัฐ: ส่วนใหญ่เป็นโครงการลงทุนโครงสร้างพื้นฐาน คิดเป็นสัดส่วน 81% ของมูลค่าก่อสร้างภาครัฐทั้งหมดในปี 2566 ที่เหลือเป็นโครงการก่อสร้างอาคารของหน่วยงานรัฐ (17%) และที่พักของข้าราชการ (2%) ผู้รับเหมาก่อสร้างรายใหญ่มักได้เปรียบในการรับงานภาครัฐ โดยเฉพาะงานโครงสร้างพื้นฐานขนาดใหญ่ เนื่องจากมีทั้งประสบการณ์ ความชำนาญเฉพาะด้าน ศักยภาพทางการเงิน และการพัฒนาเทคนิคและเทคโนโลยีในงานก่อสร้างมาอย่างต่อเนื่อง ส่วนผู้รับเหมา SMEs จะมีโอกาสรับงานภาครัฐในลักษณะของผู้รับเหมาช่วง (Sub-contractors)

-

งานก่อสร้างภาคเอกชน: ส่วนใหญ่เป็นงานก่อสร้างที่อยู่อาศัย คิดเป็นสัดส่วน 52% ของมูลค่าก่อสร้างภาคเอกชนทั้งหมด ที่เหลือเป็นงานก่อสร้างโรงงานอุตสาหกรรม และอาคารพาณิชยกรรม เช่น ศูนย์การค้า โรงแรม และโรงพยาบาล เป็นต้น ทิศทางงานก่อสร้างภาคเอกชนขึ้นอยู่กับภาวะเศรษฐกิจ ความเชื่อมั่นในการลงทุน เสถียรภาพการเมือง การลงทุนโครงสร้างพื้นฐาน และนโยบายกระตุ้นการลงทุนของภาครัฐ

ที่ผ่านมา ผู้รับเหมาของไทยได้ขยายฐานลูกค้าโดยออกไปรับงานต่างประเทศ (ส่วนมากเป็นผู้รับเหมารายใหญ่) โดยเน้นกลุ่มประเทศเพื่อนบ้าน อาทิ กัมพูชา สปป.ลาว เมียนมา เนื่องจากประเทศเหล่านี้อยู่ในช่วงของการเร่งพัฒนาโครงสร้างพื้นฐานและสิ่งอำนวยความสะดวกต่างๆ เช่น โครงข่ายถนน รถไฟ โรงไฟฟ้า รวมถึงงานก่อสร้าง ซ่อมแซม/ตกแต่ง อาคารและที่อยู่อาศัย

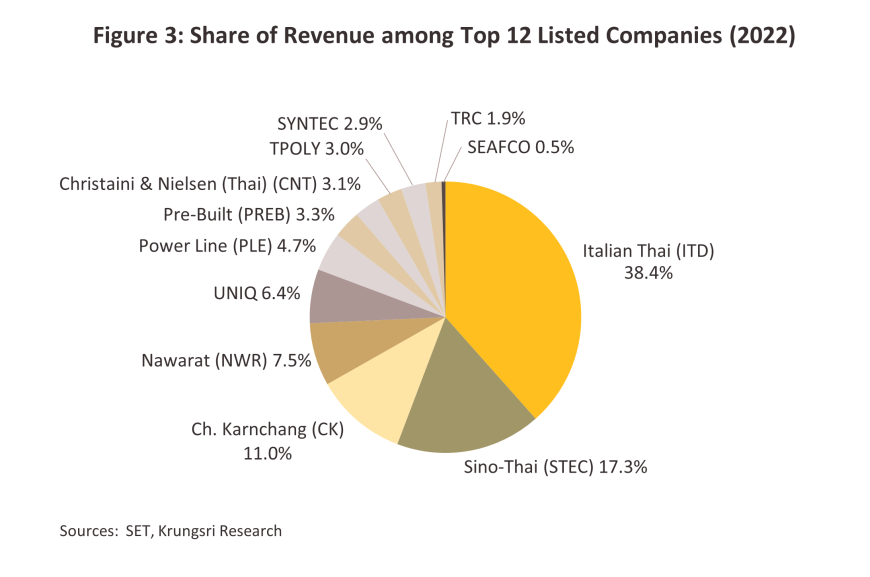

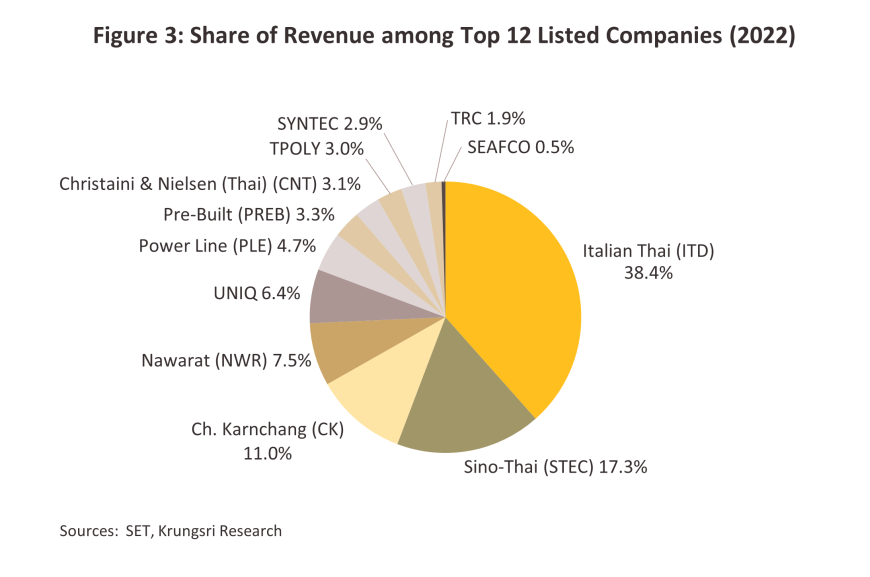

ธุรกิจรับเหมาก่อสร้างที่จดทะเบียนเป็นนิติบุคคลในไทยและที่ยังดำเนินการอยู่ มีจำนวนทั้งสิ้นประมาณ 108,000 ราย (กรมพัฒนาธุรกิจการค้า ปี 2565) ผู้ประกอบการรายใหญ่มีจำนวนเพียง 709 ราย หรือสัดส่วนเพียง 0.7% ของจำนวนผู้ประกอบการทั้งหมด อย่างไรก็ตาม รายได้ของผู้ประกอบการรายใหญ่มีสัดส่วนสูงประมาณ 55% ของผู้ประกอบการทั้งหมด โดยผู้ประกอบการรายใหญ่ในตลาดหลักทรัพย์ที่มีรายได้มากที่สุด 3 อันดับแรก ได้แก่ บมจ.อิตาเลียนไทย ดิเวลอปเมนต์ บมจ. ชิโน-ไทย เอ็นจีเนียริ่ง แอนด์ คอนสตรัคชั่น และ บมจ.ช.การช่าง มีส่วนแบ่งรายได้รวมกัน 67% ของ 12 บริษัทรับเหมาก่อสร้างที่จดทะเบียนในตลาดหลักทรัพย์2/ (ภาพที่ 3, ข้อมูลปี 2565) และ 17% ของกลุ่มผู้ประกอบการรายใหญ่ทั้งหมด

ทั้งนี้ ปัจจัยสำคัญที่มีผลในการกำหนดทิศทางภาวะธุรกิจรับเหมาก่อสร้าง ประกอบด้วยปัจจัยทั้งด้านตลาดและต้นทุน

1) ด้านตลาด: หมายถึงโอกาสการรับรู้รายได้ของผู้ประกอบการซึ่งผันแปรตามภาวะเศรษฐกิจ การเมือง แผนและความก้าวหน้าของการลงทุนในโครงการของภาครัฐและภาคเอกชน รวมถึงกฎระเบียบการลงทุนของแต่ละประเทศที่อาจเอื้อหรือเป็นอุปสรรคต่อธุรกิจ

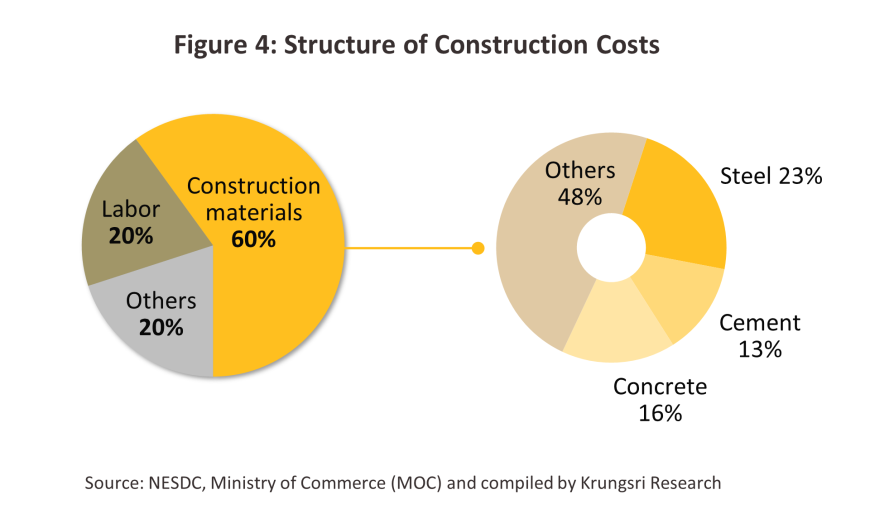

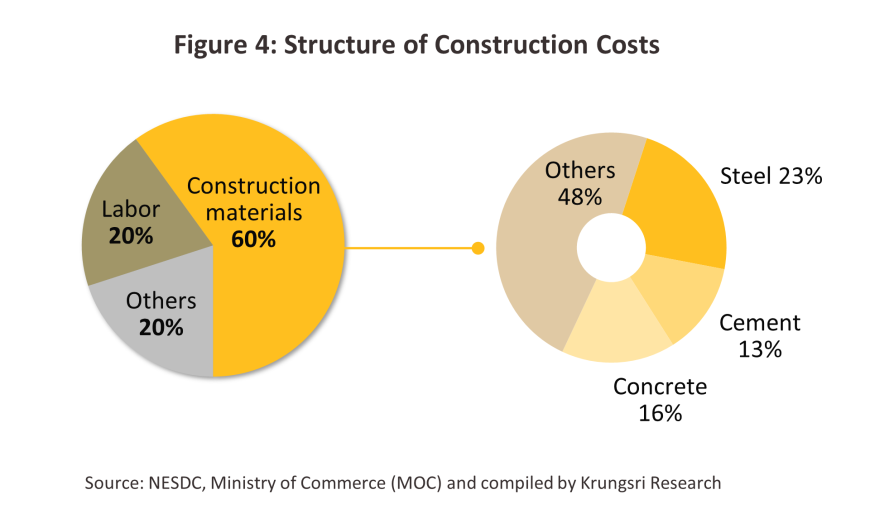

2) ด้านต้นทุน: หมายถึงการเปลี่ยนแปลงของราคาวัสดุก่อสร้างและค่าจ้างแรงงาน โดยปัจจุบันธุรกิจก่อสร้างไทยประสบปัญหาการขาดแคลนแรงงาน รวมทั้งทักษะที่ยังไม่เพียงพอ ส่งผลให้ผลิตภาพแรงงานส่วนใหญ่ยังต่ำกว่าค่าจ้าง ซึ่งมีผลต่อความสามารถในการทำกำไรของธุรกิจ โดยโครงสร้างต้นทุนของธุรกิจรับเหมาก่อสร้าง ประกอบด้วย (1) ค่าวัสดุก่อสร้าง ได้แก่ เหล็ก คอนกรีต ปูนซีเมนต์ และอื่นๆ คิดเป็นสัดส่วนประมาณ 60% ของต้นทุนรวม (2) ค่าจ้างแรงงาน 20% และ (3) ค่าใช้จ่ายอื่นๆ 20%3/ (ภาพที่ 4)

สถานการณ์ที่ผ่านมา

ปี 2566 ธุรกิจรับเหมาก่อสร้างอยู่ในภาวะทรงตัวเมื่อเทียบกับช่วงเดียวกันปี 2565 พิจารณาจากมูลค่าการลงทุนภาคก่อสร้างโดยรวมที่เพิ่มขึ้น 0.4% คิดเป็นมูลค่า 1,373.7 พันล้านบาท เทียบปี 2565 ที่ขยายตัว 0.5% คิดเป็นมูลค่า 1,368.6 พันล้านบาท (ภาพที่ 5) ปัจจัยหนุนมาจากทั้งมูลค่าการก่อสร้างภาคเอกชนที่เพิ่มขึ้นตามแรงขับเคลื่อนของการก่อสร้างหมวดโรงงานอุตสาหกรรมและอาคารพาณิชย์ ขณะที่มูลค่าก่อสร้างภาครัฐหดตัวตามความล่าช้าของโครงการก่อสร้างขนาดใหญ่ และยังไม่มีโครงการขนาดใหญ่ที่เริ่มก่อสร้างใหม่ในช่วงนี้ ส่วนหนึ่งจากผลของปัจจัยการเมืองในช่วงรอกระบวนการจัดตั้งรัฐบาลชุดใหม่

-

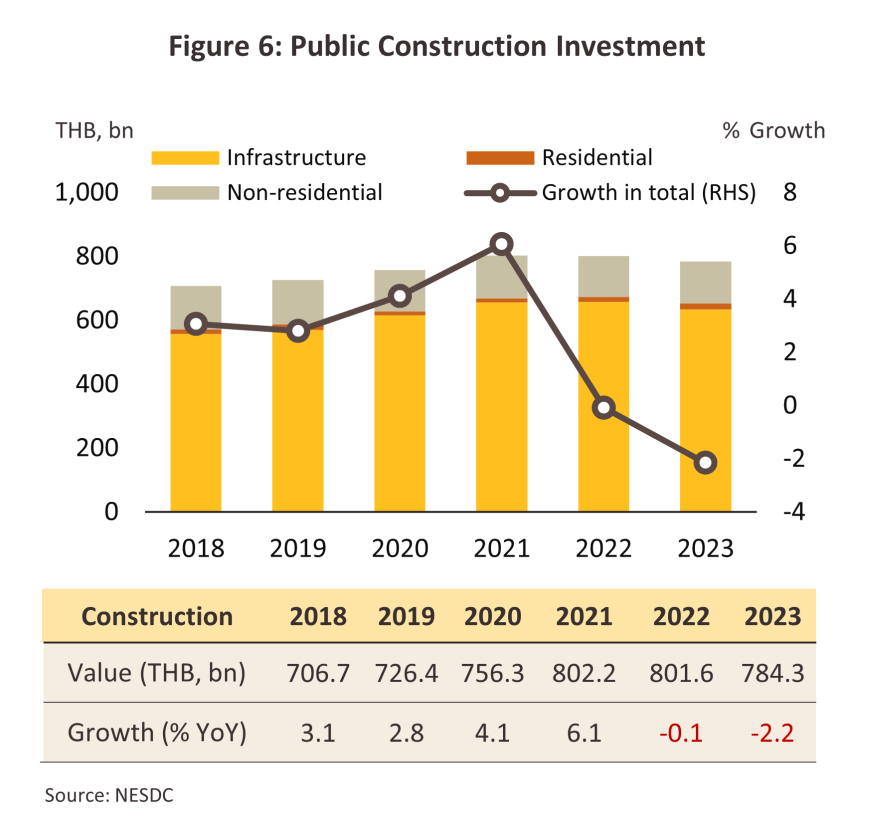

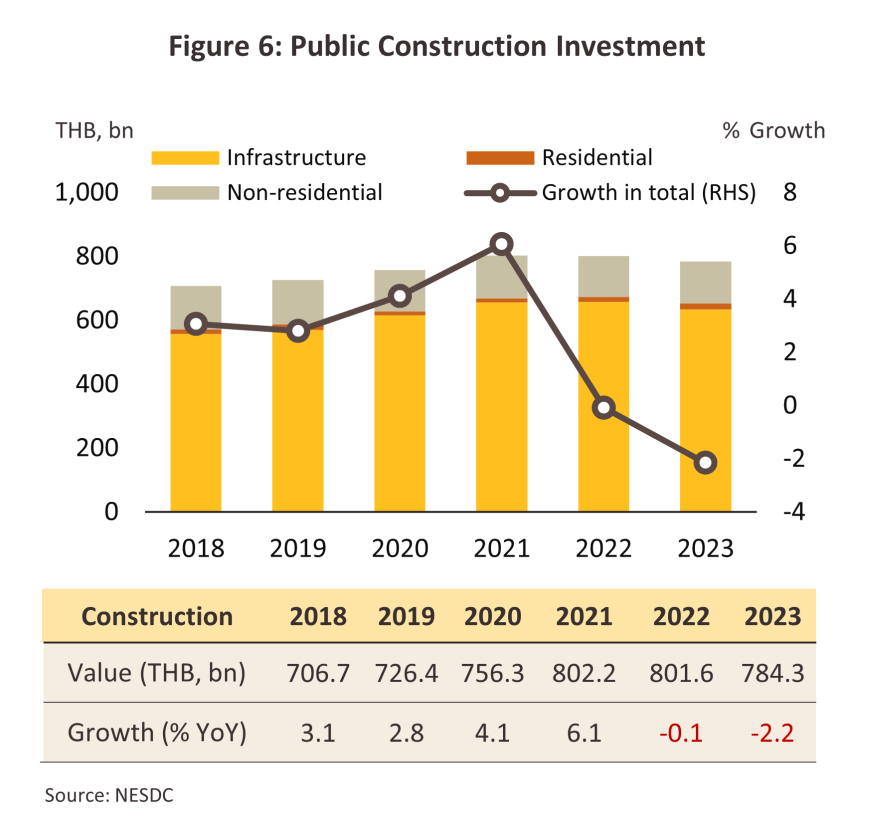

งานก่อสร้างภาครัฐปี 2566 มีมูลค่า 784.3 พันล้านบาท หดตัว -2.2% (ภาพที่ 6) ตามการหดตัวของการก่อสร้างโครงสร้างพื้นฐาน

-

งานก่อสร้างด้านโครงสร้างพื้นฐาน (สัดส่วน 81% ของมูลค่าการก่อสร้างภาครัฐทั้งหมด) มีมูลค่าการลงทุนก่อสร้าง 633.4 พันล้านบาท หดตัว -3.6% ส่วนหนึ่งเป็นผลจากความล่าช้าของกระบวนการก่อสร้างตั้งแต่การเบิกจ่ายงบประมาณจนถึงระยะเวลาการก่อสร้าง โดยเฉพาะไตรมาส 4 ที่หดตัวถึง -22.0% (เทียบกับไตรมาส 4 ปี 2565 ที่ขยายตัว 10.3%) โดยโครงการลงทุนก่อสร้างสำคัญที่ยังขยายตัวได้ในช่วงปีที่ผ่านมา มาจากโครงสร้างพื้นฐานขนาดใหญ่ที่กำลังลงทุนก่อสร้างต่อเนื่อง อาทิ รถไฟฟ้าสายต่างๆ เช่น (1) โครงการรถไฟฟ้าสายสีชมพู ช่วงแคราย-มีนบุรี ความคืบหน้า 98.9% (2) โครงการรถไฟฟ้าสายสีชมพู ส่วนต่อขยาย ช่วงสถานีศรีรัช-เมืองทองธานี ความคืบหน้า 44.6% (ข้อมูล ณ มกราคม 2567) และ (3) สายสีม่วง ช่วงเตาปูน-ราษฎร์บูรณะ (วงแหวนกาญจนาภิเษก) ความคืบหน้า 24.6% (ข้อมูล ณ ธันวาคม 2566) รวมถึงโครงการเมะโปรเจกต์ในพื้นที่ EEC อาทิ (1) โครงการพัฒนาท่าเรืออุตสาหกรรมมาบตาพุด เฟส 3 ความคืบหน้าในการก่อสร้าง 73.0% (ข้อมูล ณ ธันวาคม 2566) (2) โครงการท่าเรือแหลมฉบัง เฟส 3 ซึ่งได้ส่งมอบพื้นที่ถมทะเลบางส่วนไปแล้วเมื่อ 1 ตุลาคม 2566 และคาดว่าจะส่งมอบพื้นที่ถมทะเลส่วนที่เหลือได้ในเดือนมิถุนายน 2567 โดยมีกำหนดแล้วเสร็จเดือนมิถุนายน 2569

-

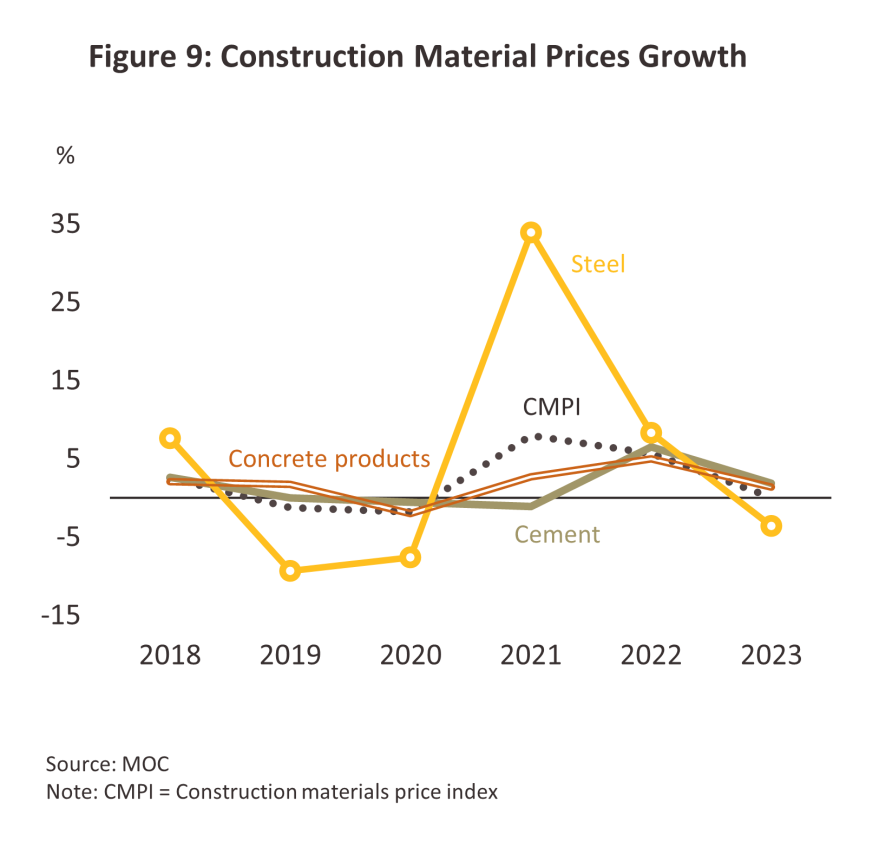

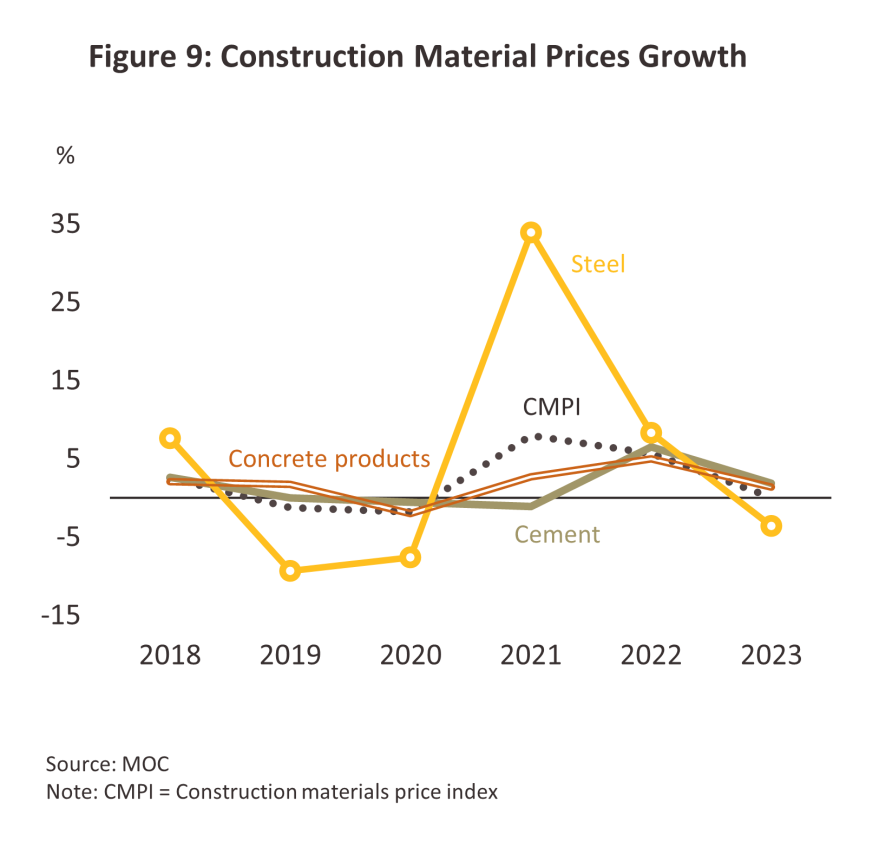

งานก่อสร้างประเภทอื่นๆ ได้แก่ การก่อสร้างอาคารสำนักงานของหน่วยงานภาครัฐ มีมูลค่าการลงทุนก่อสร้าง 132.5 พันล้านบาท เพิ่มขึ้น 3.2% (เทียบกับปี 2565 ที่หดตัว -3.8%) เนื่องจากกลุ่มผู้รับเหมาขนาดกลาง-เล็ก (SMEs) หลายรายประสบปัญหาสภาพคล่องทางการเงินและขาดแคลนแรงงานจำนวนมากในช่วงที่ COVID-19 ยังคงระบาดหนัก ส่วนอาคารที่อยู่อาศัยสำหรับพนักงานองค์กรของรัฐมีมูลค่าการลงทุนก่อสร้าง 18.4 พันล้านบาท เพิ่มขึ้น 12.6% (เทียบกับปี 2565 ที่เพิ่มขึ้น 18.1%) หลังจากที่ต้นทุนด้านวัสดุก่อสร้างเริ่มทยอยปรับลดลงต่อเนื่อง เทียบกับที่ปรับสูงขึ้นในช่วงปี 2564-2565 (ภาพที่ 9-10)

-

งานก่อสร้างภาคเอกชนปี 2566 มีมูลค่า 589.4 พันล้านบาท ขยายตัว 3.9% (ภาพที่ 7) แรงขับเคลื่อนส่วนใหญ่มาจากโครงการก่อสร้างโรงงานและอาคารพาณิชย์

-

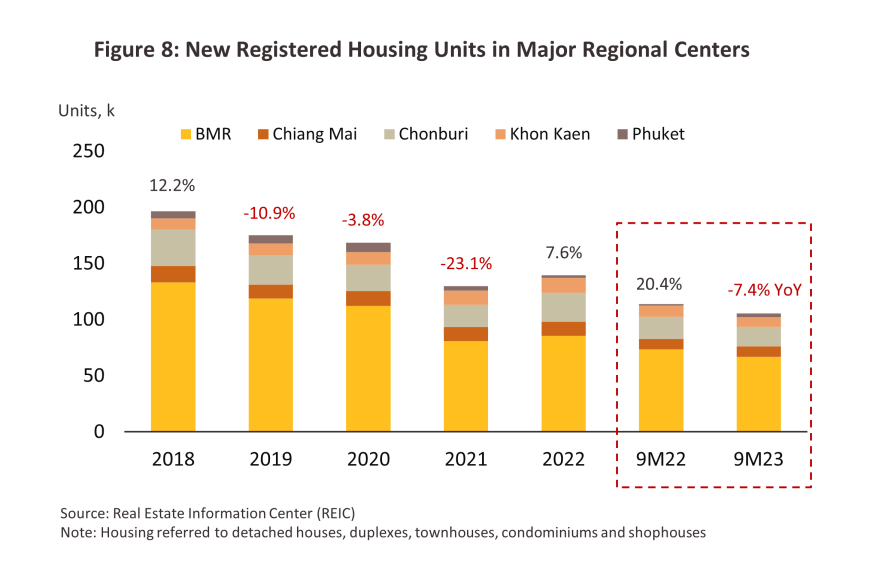

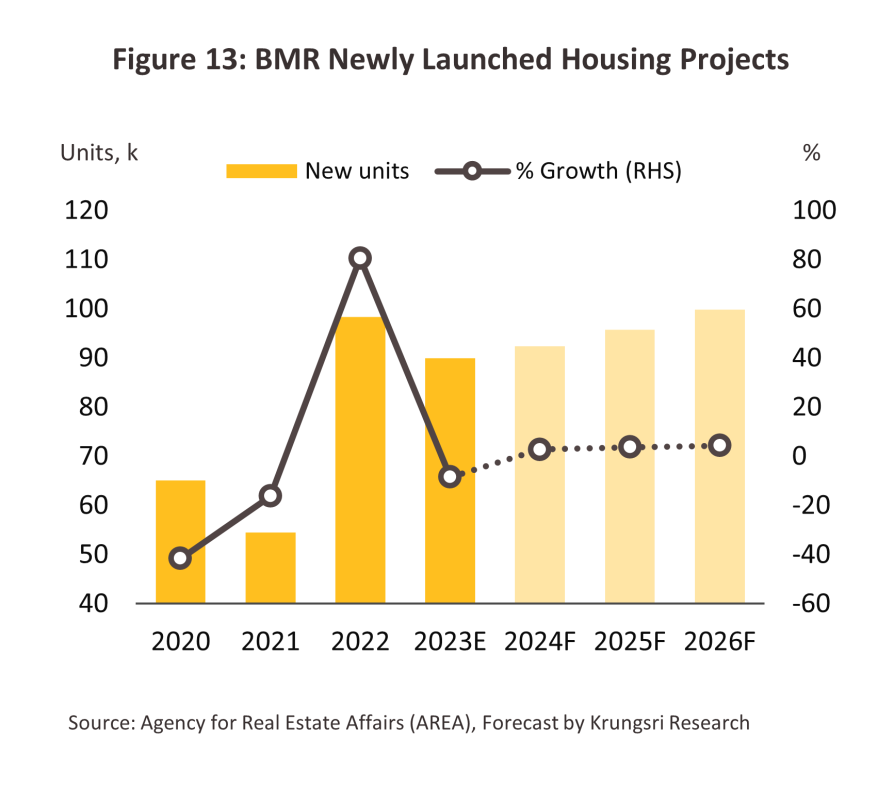

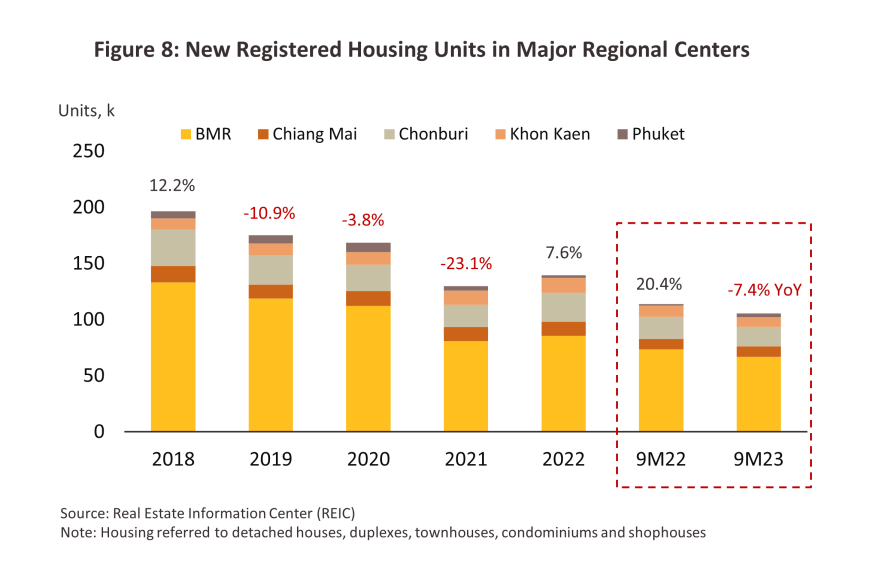

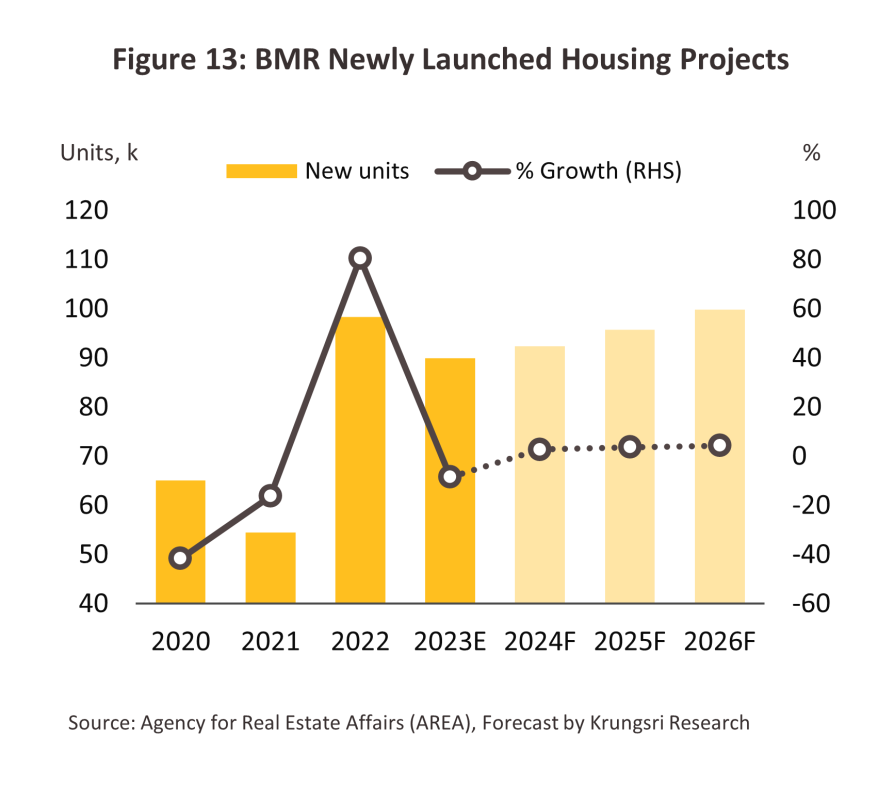

งานก่อสร้างโครงการที่อยู่อาศัย (สัดส่วน 52% ของมูลค่าการก่อสร้างภาคเอกชนทั้งหมด) มูลค่าการลงทุนก่อสร้าง 306.5 พันล้านบาท แม้ขยายตัว 3.1% ตามทิศทางกิจกรรมทางเศรษฐกิจและการท่องเที่ยวที่ปรับตัวดีขึ้น แต่เป็นอัตราการเพิ่มขึ้นที่ชะลอตัวลงจากปี 2565 ที่เพิ่มขึ้น 5.6% สอดคล้องกับจำนวนโครงการที่อยู่อาศัยสร้างเสร็จจดทะเบียนใหม่ทั่วประเทศช่วง 9เดือนแรกปี 2566 ที่ลดลง -5.8% YoY โดยเฉพาะในกรุงเทพฯ และปริมณฑล และ 4 จังหวัดหลักภูมิภาค (เชียงใหม่ ชลบุรี ขอนแก่น และภูเก็ต) ที่ลดลง -7.4% YoY (ภาพที่ 8) เนื่องจาก (1) กำลังซื้อผู้บริโภคโดยรวมยังซบเซา ภายใต้แรงกดดันของอัตราเงินเฟ้อและค่าครองชีพที่ยังสูง (2) สถาบันการเงินระมัดระวังการให้สินเชื่อมากขึ้น ขณะที่อัตราดอกเบี้ยอยู่ในช่วงขาขึ้น และ (3) การขาดแคลนแรงงานก่อสร้าง ส่งผลกระทบต่อบางโครงการโดยเฉพาะโครงการที่อยู่ในความรับผิดชอบของผู้รับเหมาก่อสร้างรายกลาง-เล็ก (SMEs)

-

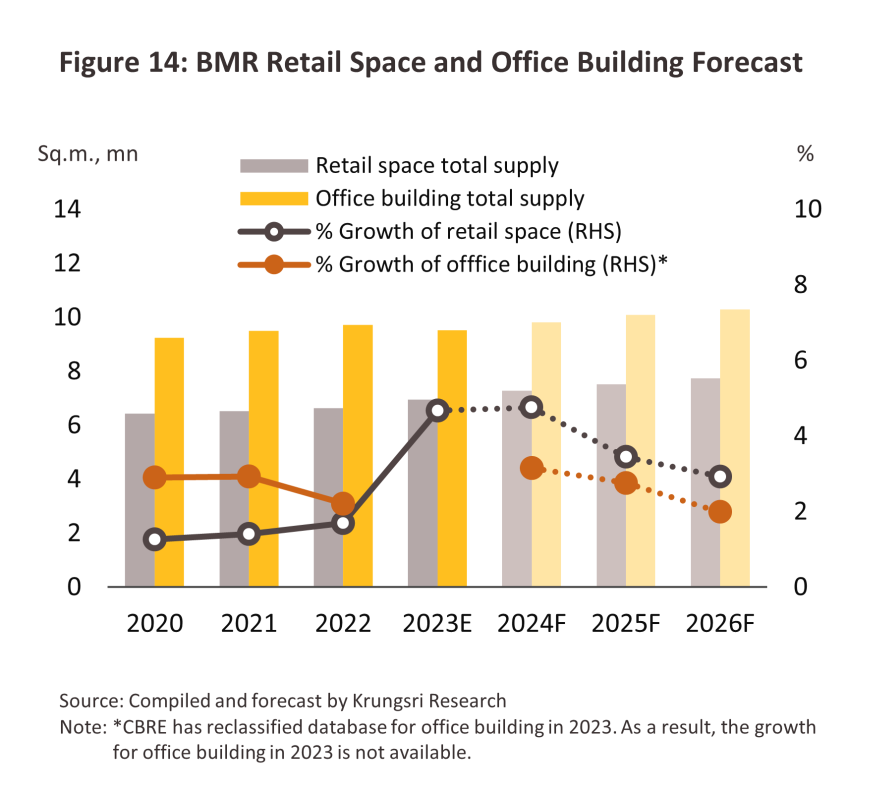

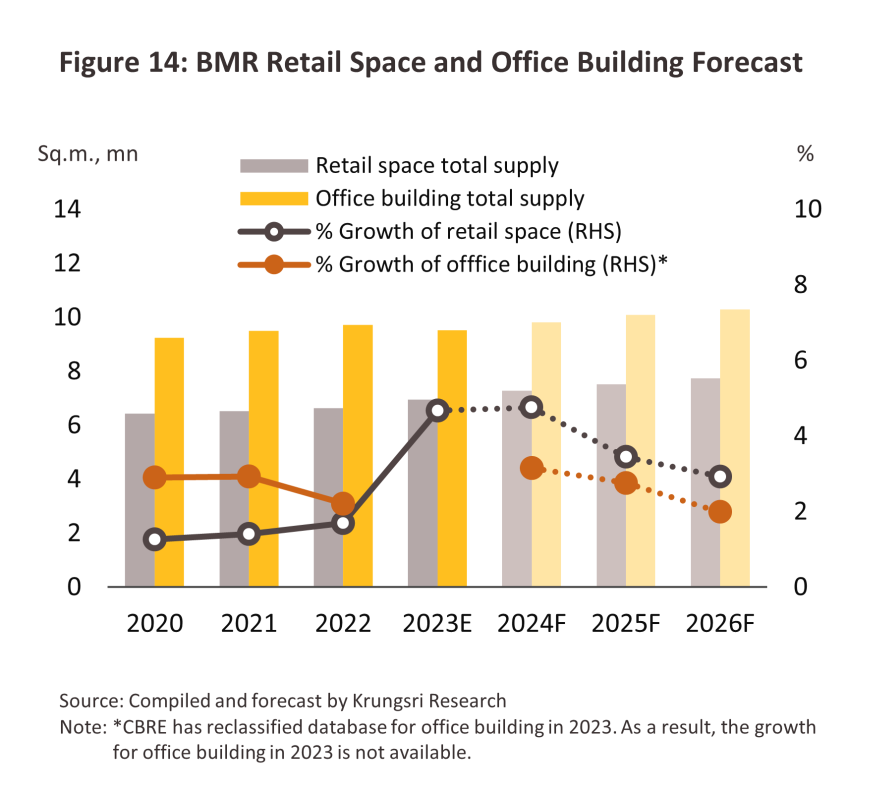

งานก่อสร้างโครงการที่ไม่ใช่ที่อยู่อาศัย ประกอบด้วย โครงการก่อสร้างหมวดอาคารเพื่อการพาณิชย์ การก่อสร้างในหมวดการบริการและขนส่ง และการก่อสร้างโรงงานอุตสาหกรรม โดยมีมูลค่าการลงทุนก่อสร้าง 282.9 พันล้านบาท เพิ่มขึ้น 4.9% ส่วนหนึ่งเป็นแรงหนุนจากขยายตัวของการลงทุนก่อสร้างโรงงาน และอาคารสำนักงานในนิคมอุตสาหกรรมโดยเฉพาะ EEC ตามการลงทุนที่ทยอยฟื้นตัว

-

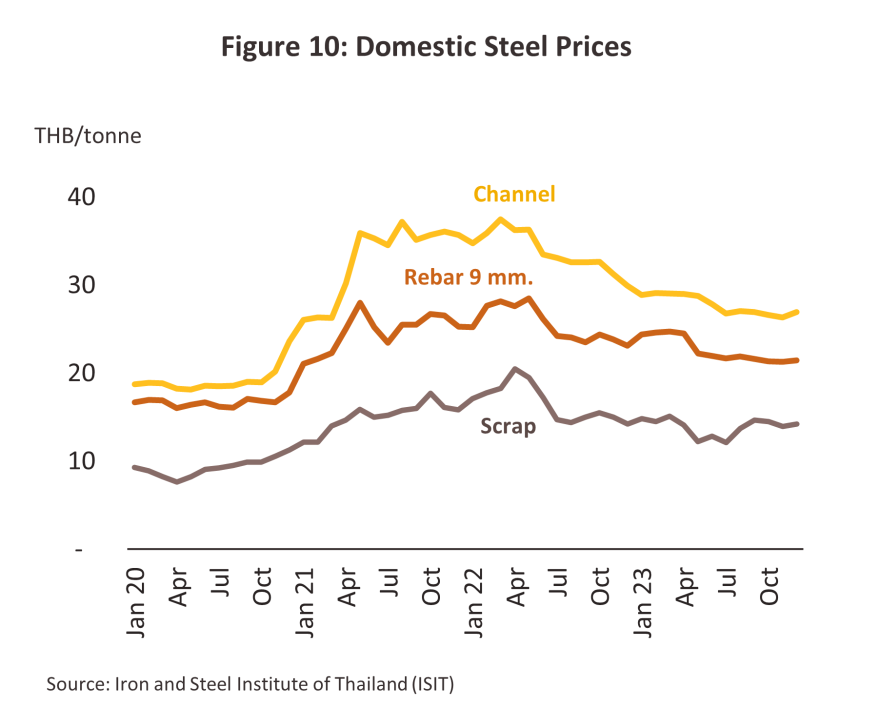

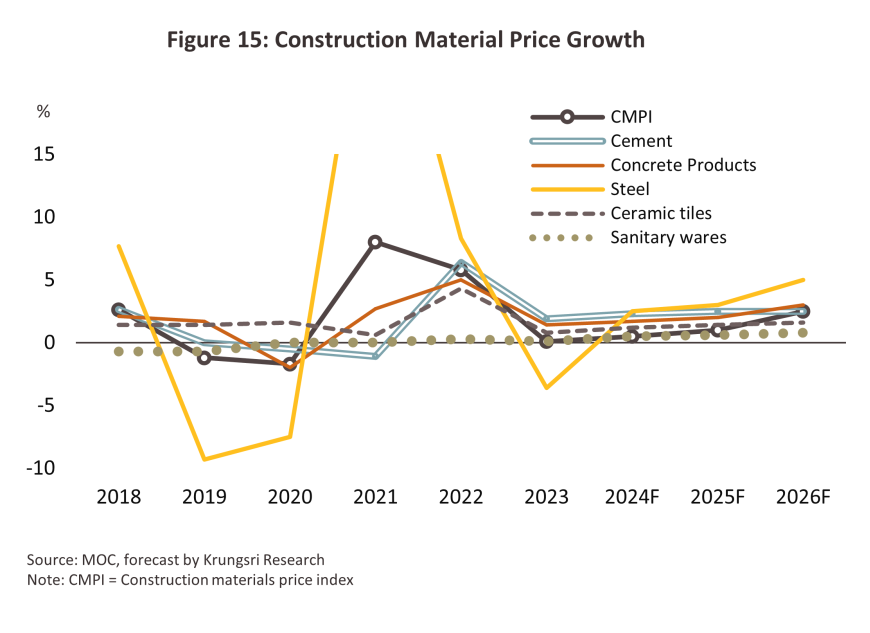

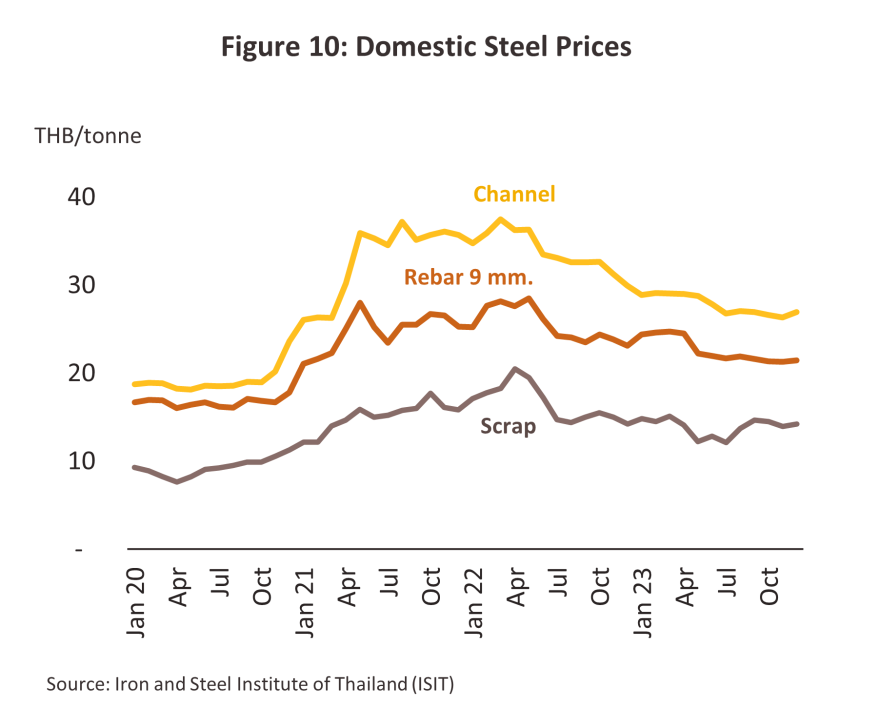

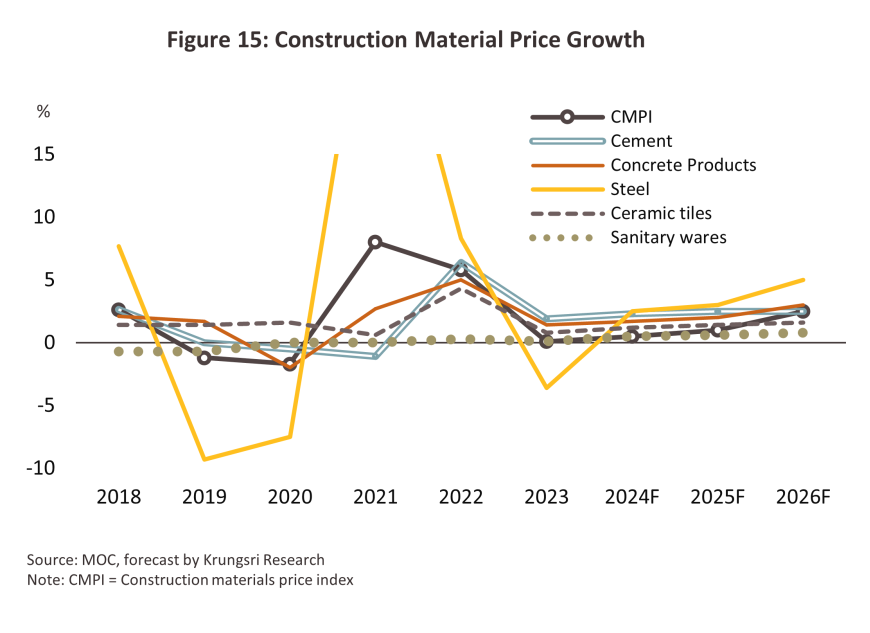

ดัชนีราคาวัสดุก่อสร้างปี 2566 เพิ่มขึ้นเพียง 0.1% เทียบกับที่เพิ่มขึ้น 5.8% ในปี 2565 ตามดัชนีราคาวัสดุก่อสร้างหมวดเหล็กและผลิตภัณฑ์เหล็ก (สัดส่วน 23% ของมูลค่าต้นทุนวัสดุก่อสร้างทั้งหมด) ที่ลดลง -3.6% (ภาพที่ 9) โดยเป็นการลดลงของราคาเหล็กก่อสร้างบางประเภท อาทิ เหล็กเส้นกลม เหล็กข้ออ้อย และเหล็กโครงสร้างรูปพรรณตัวซี (Channel) (ภาพที่ 10) เนื่องจากปัญหาวิกฤตอสังหาริมทรัพย์ของจีน ทำให้จีนต้องระบายสินค้าเหล็กส่งออกมากขึ้นโดยเฉพาะตลาดอาเซียน ขณะที่ดัชนีราคาปูนซีเมนต์ (สัดส่วน 13%) ปรับเพิ่มขึ้น 1.9% ตามความต้องการใช้ในภาคก่อสร้างทั้งภาครัฐและเอกชนที่ขยายตัว ขณะที่ดัชนีราคาผลิตภัณฑ์คอนกรีตเพิ่มขึ้น (+1.4%) ตามราคาวัตถุดิบ อาทิ ทราย และปูนซีเมนต์ ที่ยังปรับสูงขึ้น

-

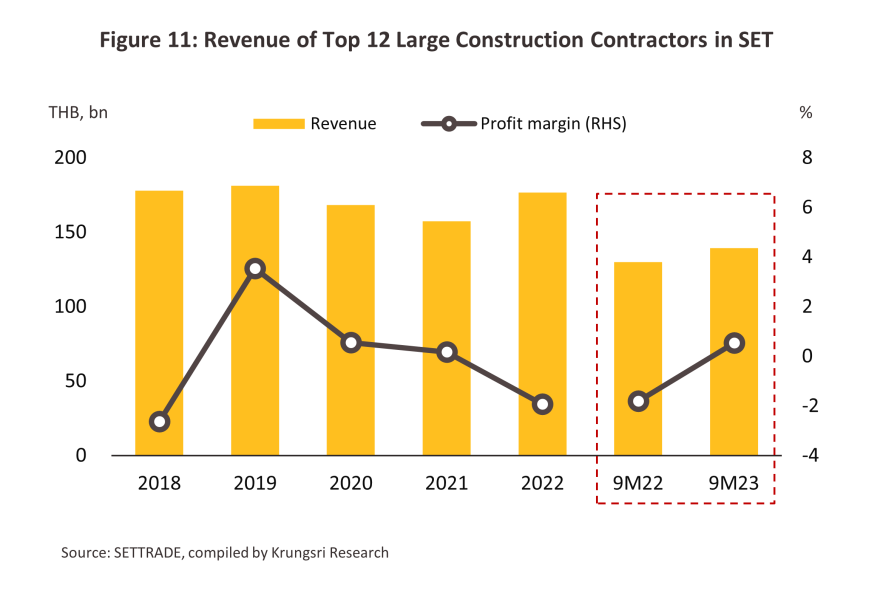

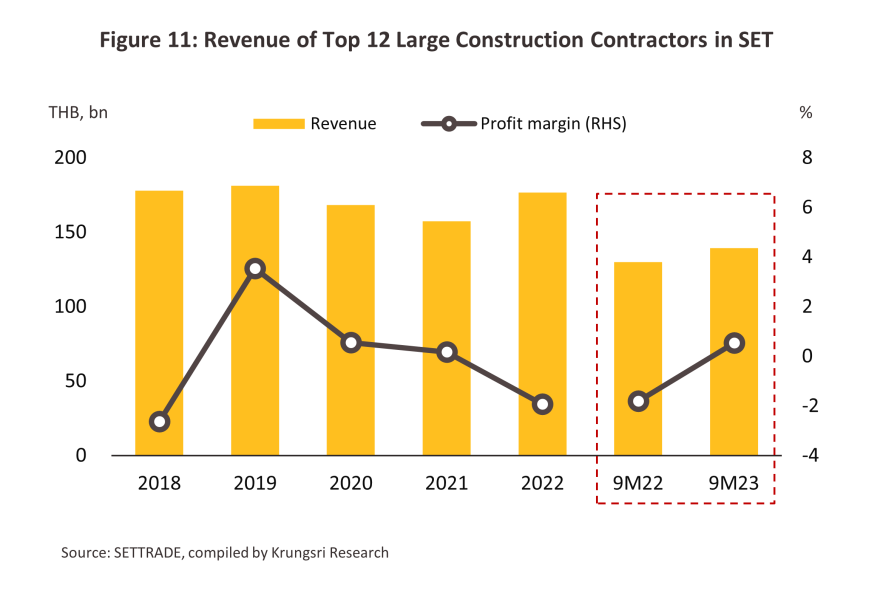

รายได้ของผู้ประกอบการรับเหมาก่อสร้างที่จดทะเบียนในตลาดหลักทรัพย์ (12 รายแรกที่มีรายได้สูงสุด) ในช่วง 9 เดือนแรกปี 2566 เพิ่มขึ้น 7.3% YoY ตามการฟื้นตัวของภาวะการก่อสร้าง ขณะที่อัตรากำไรสุทธิ (Net profit margin) ยังไม่สูงนักเพียง 0.5% (ซึ่งปรับตัวดีขึ้นเทียบกับ -1.8% ในช่วงเดียวกันปี 2565 ที่ยังได้รับผลกระทบจากความล่าช้าของงานก่อสร้างอันเนื่องมาจากปัจจัย COVID-19 และแรงงานขาดแคลน) โดยอัตรากำไรสุทธิที่ยังค่อนข้างทรงตัวดังกล่าว ส่วนหนึ่งเป็นผลจากต้นทุนการดำเนินที่ยังคงสูง อาทิ ค่าวัสดุก่อสร้าง และค่าขนส่ง (ภาพที่ 11)

แนวโน้มอุตสาหกรรม

ธุรกิจรับเหมาก่อสร้างมีแนวโน้มจะเติบโตต่อเนื่องในช่วงปี 2567-2569 ตามมูลค่าการลงทุนก่อสร้างโดยรวมที่คาดว่าจะขยายตัว โดยมีแรงขับเคลื่อนหลักจากการลงทุนโครงการขนาดใหญ่ของภาครัฐ โดยเฉพาะโครงการที่เกี่ยวเนื่องกับ EEC และโครงการขยายเส้นทางการคมนาคมขนส่ง โดยเฉพาะทางรางและถนน รวมถึงการลงทุนโครงการก่อสร้างภาคเอกชน ทั้งในส่วนที่อยู่อาศัยและอสังหาริมทรัพย์เพื่อการพาณิชย์ที่มีแนวโน้มทยอยฟื้นตัวตามภาวะเศรษฐกิจ คาดว่ามูลค่าการลงทุนก่อสร้างโดยรวมจะขยายตัวได้ในอัตรา 3.0-4.0% ต่อปี (ภาพที่ 12) โดยยังมีปัจจัยเหนี่ยวรั้งที่อาจจำกัดการเติบโตของมูลค่าการลงทุนก่อสร้าง อาทิ แนวโน้มอัตราดอกเบี้ยที่น่าจะยังทรงตัวอยู่ในระดับสูง ต้นทุนก่อสร้างที่ยังสูงตามทิศทางราคาพลังงาน ค่าขนส่ง และวัสดุก่อสร้าง

- ราคาวัสดุก่อสร้างในประเทศโดยรวมในปี 2567-2569 มีแนวโน้มขยับขึ้นเล็กน้อย (ภาพที่ 15) ตาม (1) อุปสงค์ในภาคก่อสร้างที่จะฟื้นตัวต่อเนื่อง (2) ต้นทุนวัตถุดิบนำเข้าที่อาจจะยังคงสูงตามทิศทางราคาในตลาดโลก อาทิ เศษเหล็ก (Scrap) เหล็กแท่งเล็ก (Billet) แม้ว่าอุปทานเหล็กนำเข้าจากจีนอาจทะลักเข้ามาจำนวนมาก ซึ่งจะทำให้ราคาเหล็กกึ่งสำเร็จรูปและสำเร็จรูปในประเทศปรับลดลงบ้างเมื่อเทียบกับปีก่อนหน้า และ (3) ต้นทุนพลังงานที่ทรงตัวสูงจากปัจจัยเสี่ยงด้านภูมิรัฐศาสตร์ (Geopolitical risks) ทั้งสงครามรัสเซีย-ยูเครน และอิสราเอล-ฮามาส ที่น่าจะยืดเยื้อ

-

การทำธุรกิจรับเหมาก่อสร้างในตลาดต่างประเทศ โดยเฉพาะในประเทศเพื่อนบ้านกลุ่ม CLM ซึ่งศักยภาพในการลงทุนส่วนใหญ่จะจำกัดอยู่ในกลุ่มผู้รับเหมารายใหญ่ เนื่องจากมีความพร้อมด้านเงินทุน ด้านเทคโนโลยีในการเพิ่มประสิทธิภาพงานก่อสร้างขั้นสูง และสายสัมพันธ์ทางธุรกิจ (Business connection) กับนักลงทุนท้องถิ่นที่เอื้อต่อการขยายช่องทางการลงทุน โดยผู้รับเหมาของไทยมีโอกาสรับงานเพิ่มขึ้นในประเทศเพื่อนบ้าน ซึ่งคาดว่าจะมีการลงทุนโครงสร้างพื้นฐานอย่างต่อเนื่องรองรับการเติบโตทางเศรษฐกิจและการขยายตัวของความเป็นเมือง (Urbanization) ซึ่งรวมถึงโรงงานอุตสาหกรรม อาคารสำนักงาน และที่อยู่อาศัย อย่างไรก็ตาม การรับงานก่อสร้างในประเทศเพื่อนบ้านยังมีปัจจัยเสี่ยงทางธุรกิจ ได้แก่ (1) ด้านกฎระเบียบในการว่าจ้างที่อาจไม่เป็นไปตามมาตรฐานสากล เงื่อนไขสัญญารับเหมาที่มีความไม่แน่นอน (2) ความไม่มั่นคงด้านเสถียรภาพทางการเมืองในบางประเทศ (3) การแข่งขันกับผู้รับเหมาต่างชาติรายอื่นๆ รวมถึงผู้รับเหมาในประเทศผู้ว่าจ้าง ซึ่งแนวทางในการลดความเสี่ยงข้างต้น ผู้รับเหมาไทยควรหาพันธมิตรทางธุรกิจในห่วงโซ่อุปทานรับเหมาก่อสร้างในประเทศผู้ว่าจ้าง อาทิ ผู้พัฒนาอสังหาริมทรัพย์/ผู้รับเหมาท้องถิ่น รวมถึงบริษัทจัดหาแรงงานท้องถิ่น เพื่อให้มีช่องทางในการรับงานได้ต่อเนื่อง

-

ปัจจัยจำกัดการเติบโตทางธุรกิจ ได้แก่

-

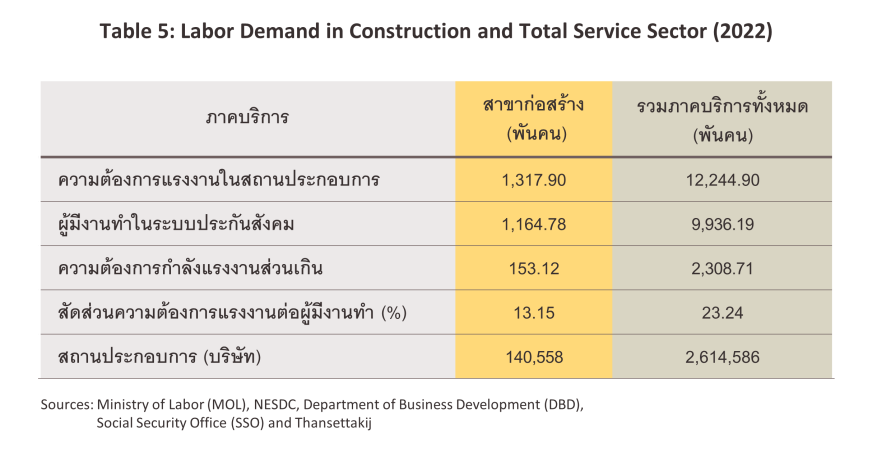

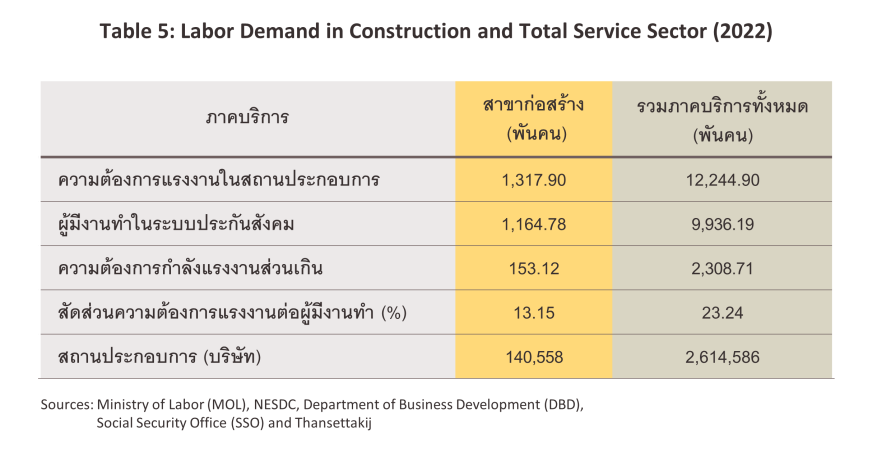

ภาวะขาดแคลนแรงงานก่อสร้าง เป็นผลกระทบต่อเนื่องจากวิกฤต COVID-19 มาถึงปัจจุบัน อีกทั้งยังต้องแย่งแรงงานจากภาคการผลิตและบริการอื่น (โดยเฉพาะแรงงานต่างด้าว) อาจมีผลให้บางโครงการล่าช้า ส่งผลกระทบต่อรายได้ของผู้รับเหมาก่อสร้างโดยเฉพาะรายกลาง-เล็ก โดยข้อมูลจากสำนักงานสภาพัฒนาการเศรษฐกิจและสังคมแห่งชาติ (สศช.) และกระทรวงแรงงาน ระบุว่า ในปี 2565 ความต้องการแรงงานในสถานประกอบการสาขาการก่อสร้างมีจำนวน 1.32 ล้านคน แต่มีผู้มีงานทำสาขาก่อสร้างในระบบประกันสังคม 1.16 ล้านคน เท่านั้น (ตารางที่ 5)

-

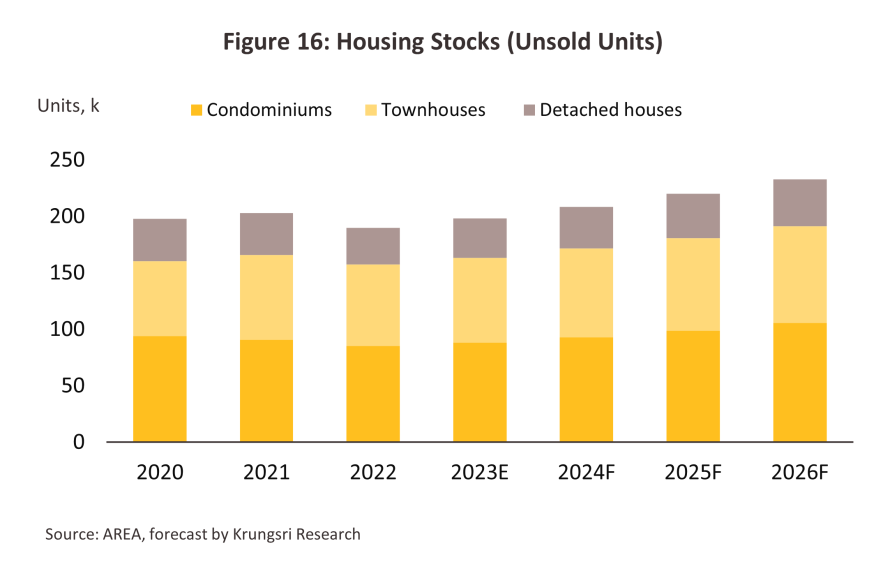

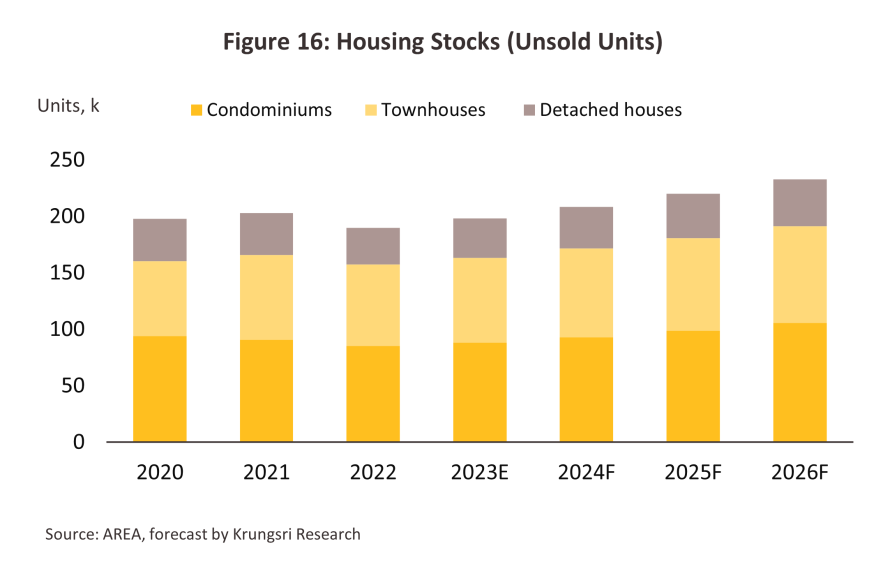

สต็อกที่อยู่อาศัยยังทรงตัวในระดับสูง (ภาพที่ 16) ขณะที่อุปทานใหม่ยังเข้ามาในตลาดอย่างต่อเนื่อง ทำให้มูลค่าการลงทุนก่อสร้างที่อยู่อาศัยโครงการใหม่ๆ ของภาคเอกชนอาจมีแนวโน้มอยู่ในระดับต่ำ

-

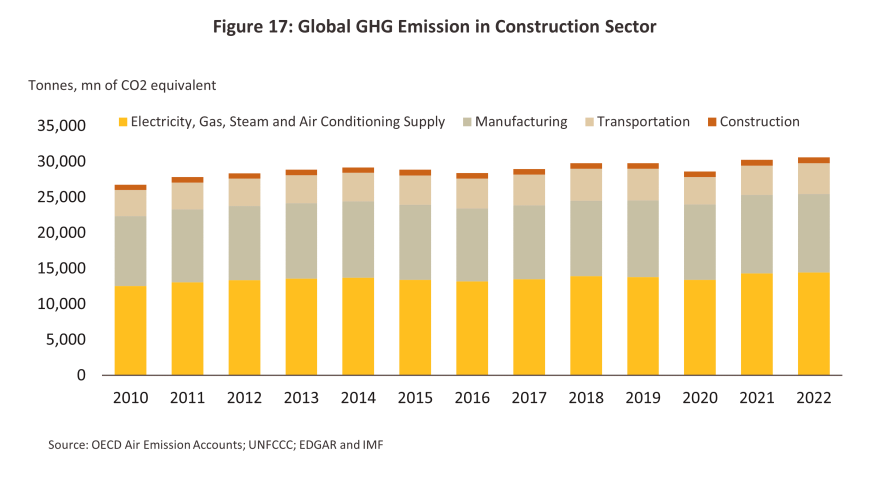

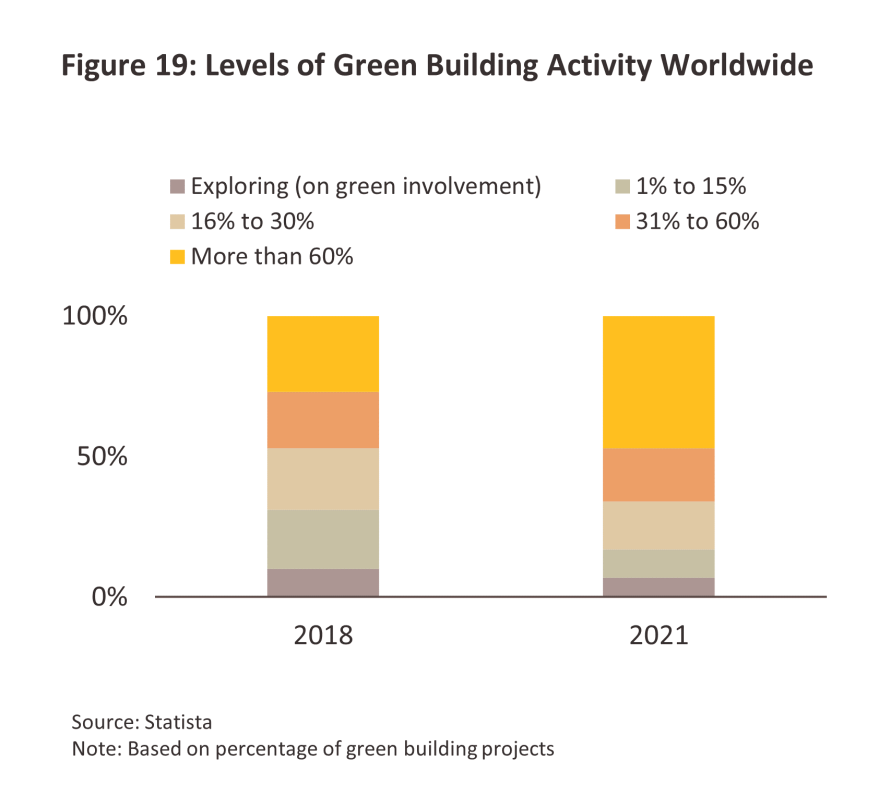

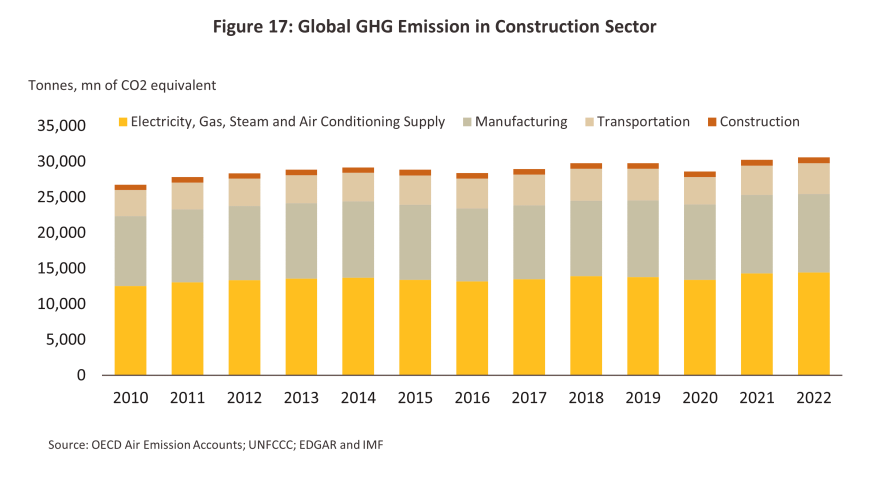

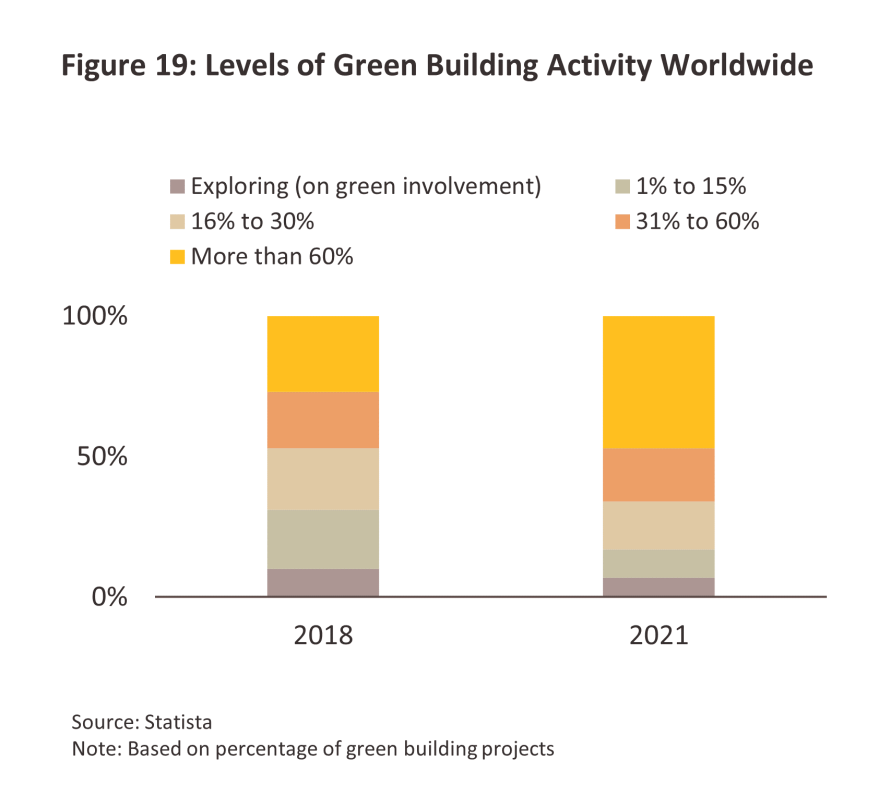

เป้าหมายการปล่อยก๊าซเรือนกระจกสุทธิเป็นศูนย์ เป็นปัจจัยท้าทายทางธุรกิจ อุตสาหกรรมก่อสร้างเป็นอีกอุตสาหกรรมหนึ่งที่มีการปล่อยก๊าซเรือนกระจกสู่บรรยากาศจำนวนไม่น้อยและเพิ่มขึ้นทุกปีเช่นเดียวกับกิจกรรมทางเศรษฐกิจอื่น (ภาพที่ 17) การก่อสร้างอาคารที่เป็นมิตรกับสิ่งแวดล้อม (Green Building)5/ จึงมีแนวโน้มเพิ่มขึ้นต่อเนื่องตามกระแส ESG (Environmental, Social and Governance) ซึ่งกำลังเป็นเทรนด์สำคัญของโลกในปัจจุบัน ทั้งนี้ Precedence Research ประมาณการว่ามูลค่าตลาด Green Building ของโลกจะขยายตัวต่อเนื่องเฉลี่ยประมาณ 9.5% ต่อปี ในช่วงปี 2566-2571 (ภาพที่ 18) และการดำเนินการที่เกี่ยวกับอาคารสีเขียวทั่วโลกจะมีสัดส่วนเพิ่มขึ้นต่อเนื่อง (ภาพที่ 19)

ผู้รับเหมาก่อสร้างรายใหญ่จะเป็นกลุ่มที่มีศักยภาพในการดำเนินการด้านเป็นมิตรกับสิ่งแวดล้อมได้ก่อนผู้รับเหมากลุ่ม SMEs เนื่องจากมีความพร้อมทางด้านเงินทุนและเทคโนโลยีที่จะนำมาใช้ในการก่อสร้างเพื่อลดการใช้วัสดุก่อสร้างที่สิ้นเปลือง เพิ่มประสิทธิภาพของการดำเนินงานก่อสร้าง รวมถึงลดการใช้แรงงานจากการลงทุนใช้โดรนก่อสร้าง โดย Allied Market Research (ตุลาคม 2563) คาดว่ามูลค่าตลาดโลกของโดรนที่ใช้ในการก่อสร้างจะอยู่ที่ 4.8 พันล้านดอลลาร์สหรัฐในปี 2562 และเพิ่มเป็น 11,968.6 ล้านดอลลาร์สหรัฐในปี 2570 หรือมีอัตราการเติบโตประมาณ 15.4% ต่อปี (CAGR) ในช่วงดังกล่าว นอกจากนี้ ยังมีเทคโนโลยีอื่นที่คาดว่าจะมีการลงทุนเพิ่มขึ้นในธุรกิจก่อสร้าง ได้แก่ 3D-Printing และการสร้างแบบจำลองข้อมูลอาคาร (Building Information Modeling: BIM) เป็นต้น

1/ ค่า K คือ ดัชนีที่ใช้วัดการเปลี่ยนแปลงของค่างาน ณ ระยะเวลาที่ผู้รับเหมาก่อสร้างเปิดซองประกวดราคา เปรียบเทียบกับระยะเวลาที่ส่งงานในแต่ละงวด เพื่อใช้สำหรับคำนวณเงินชดเชยค่าก่อสร้างให้กับผู้รับเหมา เพื่อลดผลกระทบด้านต้นทุนจากราคาวัสดุก่อสร้างที่ปรับสูงขึ้นในช่วงระหว่างการดำเนินโครงการก่อสร้าง (ที่มา: สำนักงานนโยบายและยุทธศาสตร์การค้า กระทรวงพาณิชย์)

2/ ได้แก่ 1) บมจ. คริสเตียนีและนีลเส็น (ไทย) 2) บมจ. เพาเวอร์ไลน์ เอ็นจิเนียริ่ง 3) บมจ. ซีฟโก้ 4) บมจ. พรีบิลท์ 5) บมจ. ซินเท็ค คอนสตรัคชั่น 6) บมจ. ยูนิค เอ็นจิเนียริ่ง แอนด์ คอนสตรัคชั่น 7) บมจ. เนาวรัตน์พัฒนาการ 8) บมจ.

ช.การช่าง 9) บมจ. ซิโน-ไทย เอ็นจีเนียริ่งแอนด์คอนสตรัคชั่น 10) บมจ. อิตาเลียนไทย ดีเวล๊อปเมนต์ 11) บมจ. ไทยโพลีคอนส์ และ 12) บมจ. ทีอาร์ซี คอนสตรัคชั่น

3/ คำนวณจากโครงสร้างต้นทุนของผู้ประกอบการรายใหญ่ และตารางปัจจัยการผลิต-ผลผลิต สำนักงานสภาพัฒนาการเศรษฐกิจและสังคมแห่งชาติ พ.ศ. 2558

4/ ได้แก่ 1) เชียงใหม่ 2) ชลบุรี 3) ระยอง 4) นครราชสีมา 5) ขอนแก่น และ 6) ภูเก็ต

5/ อาคารสีเขียว (Green building) มีส่วนช่วยในการประหยัดพลังงาน ประสิทธิภาพน้ำ การลดของเสีย การลดคาร์บอนไดออกไซด์ และการควบคุมมลพิษ

.webp.aspx)