Krungsri Research’s forecast is that in the period 2019-2021, the value of pharmaceuticals distributed to the domestic market is expected to grow by 4.2-4.6%. This outlook is based on: (i) rising rates of illness, especially of non-communicable conditions; (ii) growing number of aging population; (iii) the extension of universal healthcare coverage to essentially all of the population, which has led to a steady increase in expenditure on medicines by hospitals; and (iv) the expansion in medical tourism and the rise in the number of foreign patients seeking treatment in Thai hospitals. Meanwhile, as regards the value of exports, the possibility now exists to expand markets within the ASEAN zone following Thailand’s admission to the Pharmaceutical Inspection Co-operation Scheme (PIC/S) and Thai manufacturers’ having achieved the ‘Good Manufacturing Practice’ (GMP) standards. These developments have also helped to strengthen consumer confidence in Thai-made pharmaceuticals.

However, at the same time, competition is tending to strengthen on: (i) increasing imports of cheaper goods from India and China (although China has adjusted the prices of its generic medications upwards, they generally remain cheaper than those of other countries); and (ii) an increase in the number of new entrants to the market, especially foreign players. In addition, the sector is also being affected by rising costs as a result of adjustments to production facilities that were required to meet GMP-PIC/S standards and upward trend of prices for imports, and given this, operators’ turnover may be affected.

Overview

The pharmaceutical and medical supplies sector includes conventional medicine and chemicals which are used in the diagnosis and treatment of all types of illness. Conventional pharmaceuticals can be split into two groups:

1) Original drugs are medicines or patented drug which have gone through a lengthy process of research and development and which therefore have high production costs. Manufacturers of original drugs are given a twenty-year patent[1] protection and when the patent expires, other manufacturers are then allowed to produce these medicines.

2) Generic drugs are copies of original drugs that are typically manufactured under a trademark or brand name but which do not have patent protection. Generic drugs will, though, contain active ingredients that are identical to those which are found in original drugs for which patent protection has expired and since the production of these generics does not usually require expensive inputs or costly clinical trials, the cost of manufacturing generic drugs is typically lower than that of original drugs.

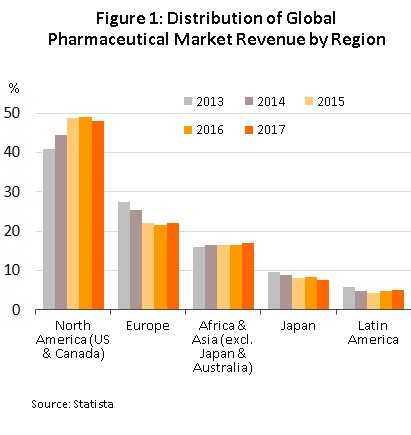

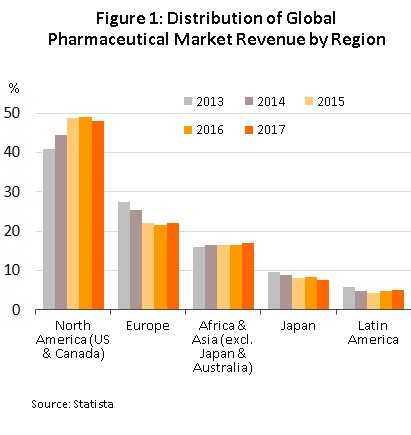

Because of the high and continuous costs of research and development of new medicines and materials,

the global production facilities of pharmaceutical and medical supplies, especially those of original drugs, have tended to cluster in the developed economies of the United States, Europe, and Japan, because these areas are better able to draw on resources of skilled professionals, expertise and manufacturing technology. These countries are then able to export to meet global demand (Figure 1), with developing countries left to play the role of importers of expensive patent-protected medicines.

โครงสร้างอุตสาหกรรมยาแผนปัจจุบันแบ่งตามขั้นตอนการผลิต (ภาพที่ 2)

1) The primary stage involves the research and development of new medicines.

2) The intermediate stage involves the production of materials for combination into the final product. These materials may be either active or inert ingredients, which are added to speed up chemical reactions. Chemicals manufactured at the intermediate stage are products which are already known but manufacture at this stage may require the development of special techniques in order to produce particular chemicals or to change the molecular structure of existing chemicals, a process which relies on advanced technology and the investment of a large amount of money.

3) 3) The final stage entails the production of the finished pharmaceutical product with developed chemical formula. Active ingredients are imported and these are mixed to produce a range of finished products, such as pills, capsules, and liquids medicines.

The majority of Thai conventional medicine manufacturers are final-stage producers of finished generic drugs, the active ingredients of which are usually imported for domestic mixing and production in a range of forms for use in treatments. Thailand imports around 90% of all inputs used in the production of finished products. The highest value medicines are analgesics and medicines for treating fevers. Data from the Food and Drug Administration show that as of May 2018, there were 160 domestic pharmaceuticals producers accredited with the Good Manufacturing Practice (GMP) standards but that no more than 5% of the total had the ability to manufacture active ingredients (such as aluminum hydroxide, aspirin, sodium bicarbonate, or deferiprone) themselves and when they are able to produce active ingredients, these will largely be used within manufacturers’ own facilities as inputs into finished products. In terms of primary research and development, Thailand has been particularly involved in research into vaccines, for example for vaccination against HIV and bird flu.

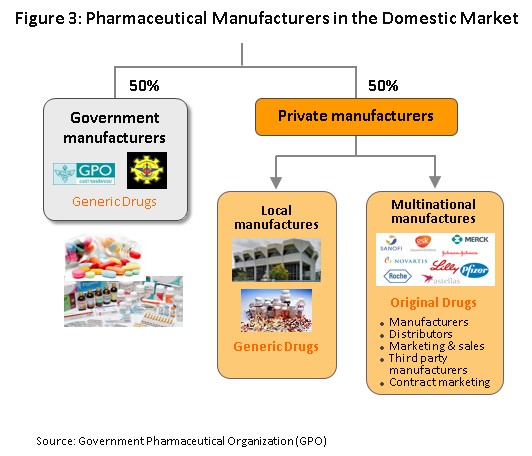

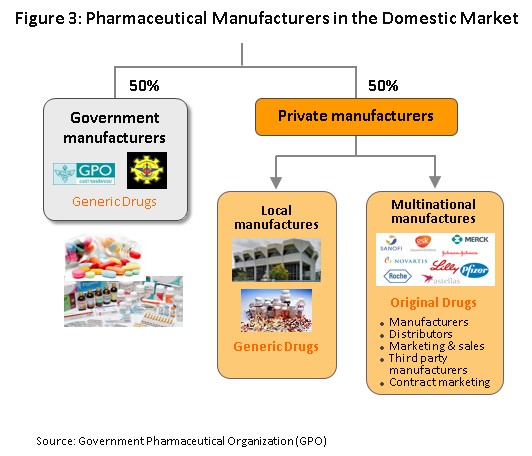

The main state manufacturer of pharmaceuticals is the Government Pharmaceutical Organization (GPO). Previously, government’s relevant regulations determined government hospitals to purchase their supplies principally from state suppliers. However, the Government Procurement and Supplies Management Act B.E.2560, which came into effect in August 2017, is intended to increase competition and so this has removed state hospitals’ obligation to purchase supplies from the GPO, thus placing the organization on a level playing field with other enterprises and increasing competition between the GPO and private sector players, including foreign operators such as those in India and China which export low-cost products. Players in the medicines sector can thus be split into two groups (Figure 3).

Group 1 comprises state enterprises, such as the GPO and the Defense Pharmaceutical Factory, which emphasize the production of generic drugs as alternatives to imported goods.

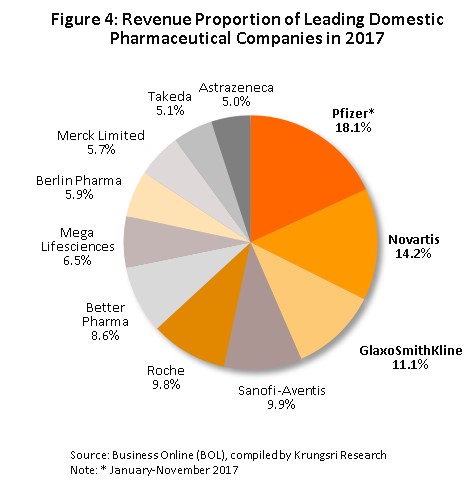

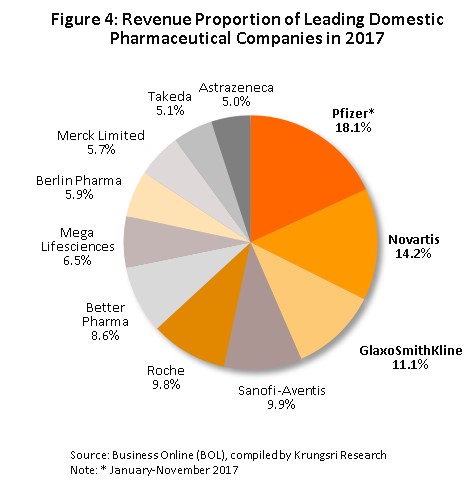

Group 2 is composed of private sector producers, which may be further divided into two sub-groups: (i) local manufactures with Thai shareholders, which typically produce general-purpose low-cost generics. Examples of these include Siam Pharmaceuticals, Berlin Pharmaceutical Industry, Thai Nakorn Patana, Biopharm Chemicals and Siam Pharmacy. Contract manufacturers such as Biolab, Mega Lifesciences and Olic (Thailand) also belong in this group; and (ii) multinationals (or MNCs) with foreign shareholders, which are focused more on original drugs and which operate as agents to import more expensive goods for distribution at high prices in Thailand, though some have also established production facilities in the country. Examples of operators in this group include Pfizer, Novartis, Roche, and Sanofi-Aventis (Figure 4).

At present, two laws govern the manufacture of pharmaceuticals in Thailand. These are the law on patents, which grants patent-protection to discoverers and inventors (i.e. it determines intellectual property rights) and the 1967 Drug Act and its amendments[2], which has provisions on the manufacture, import, sale and marketing of drugs in Thailand. In terms of regulatory bodies, the Food and Drug Administration, or FDA, is responsible for overseeing the sector and its tasks include licensing operators and registering drugs for domestic distribution.

Private sector manufacturers of pharmaceuticals typically face intense competition. This is due to: (i) the setting of reference prices by the Ministry of Public Health and the Comptroller General’s Department, which use the reference price as a tool to control expenses and to set appropriate costs for the purchase of pharmaceuticals by public healthcare providers; (ii) imports of cheap products from India and China, which have lower production costs than Thailand; and (iii) the fact that the domestic private sector still faces disadvantages relative to the GPO in terms of manufacturing and distribution. In addition, the sector is also experiencing increased manufacturing costs as a result of the implementation of the GMP-PIC/S standards[3] (effective from 1 August 2016).

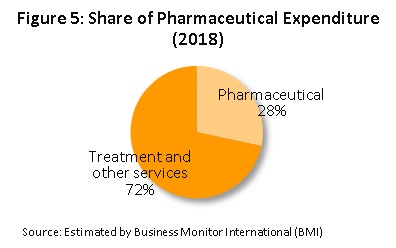

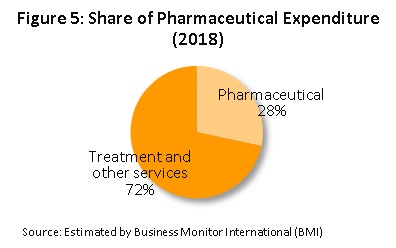

In terms of distribution, approximately 95% of the output of the Thai pharmaceutical sector is consumed on the domestic market. This is a consequence of the expansion of the Thai national universal healthcare coverage (UHC)[4], in particular of the Universal Coverage Scheme (UCS), which now covers 99.78% of the country, the effect of which has been to increase access to healthcare to a very high level nationwide and this has naturally caused the consumption of medicines to increase to an equally high level; the market in medicines now accounts for approximately a quarter of all domestic medical expenses (Figure 5), with the majority of this being distributed through hospitals.

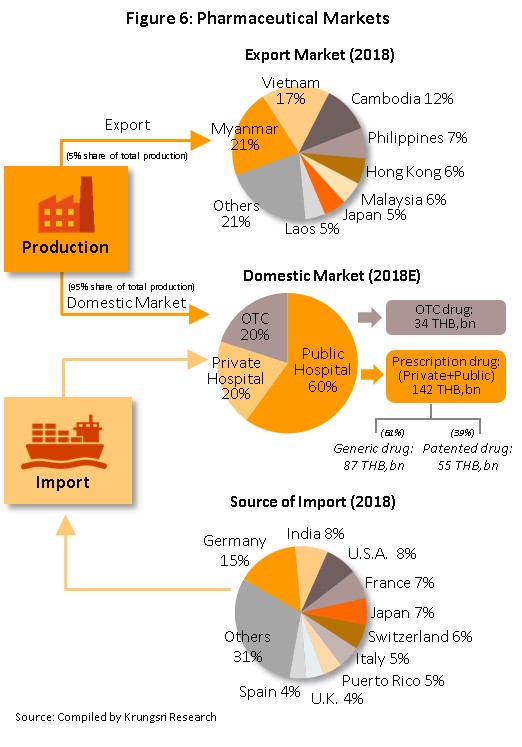

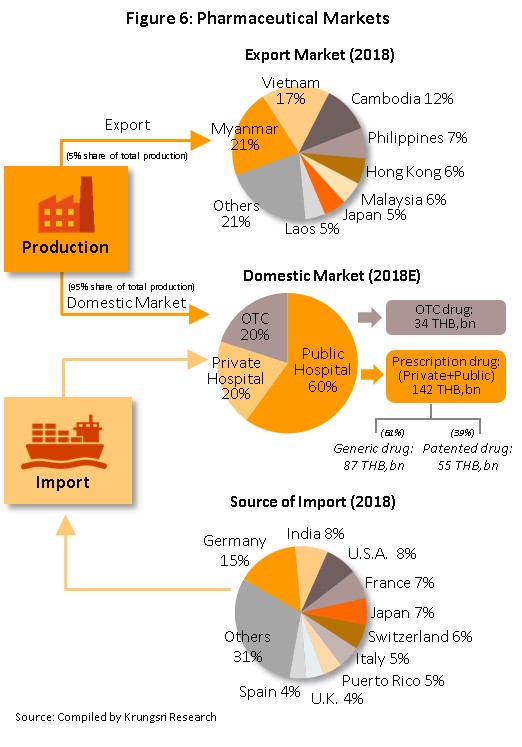

Medicines and pharmaceuticals are distributed through two main channels (Figure 6).

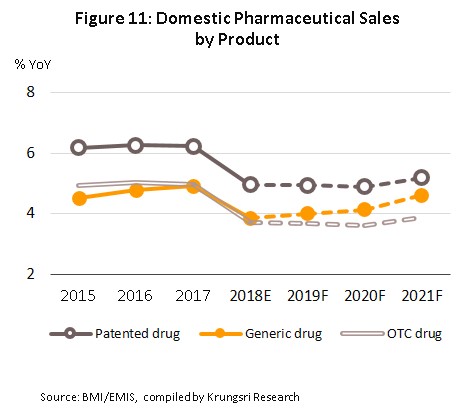

- Distribution via hospitals: Thailand’s public healthcare system is now very extensive, covering both civil servants and the majority of scheme claimants, and so by value, 80% of the total domestic market for medicines is distributed through hospitals, comprised of 60% government hospitals and 20% private-sector operations. Medicines that are distributed via hospitals are generally prescription drugs, which can be further subdivided between (i) generic drugs, which account for 61% of the value of medicines distributed via hospitals and (ii) patented drugs, which make up the remaining 39%, but although this latter group has a smaller share of the total, the rate of growth of consumption of patented drugs is higher than for generics due to their use in treating chronic non-communicable conditions, such as high blood pressure and diabetes.

- Distribution of Over-the-Counter (OTC) medicines: Although the government health insurance scheme has tended to encourage individuals to increasingly seek medical care in hospitals instead of buying medicines in pharmacies, the latter remain an important distribution channel and when unwell with everyday illnesses and conditions that can be self-treated, individuals continue to buy medicines in these outlets. Thus, the value of the market for OTC drugs has remained fairly constant at around a 19-20% share of the total market for medicines currently, across the country, there are 24,941 pharmacies of all types, 25% of which are in Bangkok and 75% in the provinces (source: Food and Drug Administration, October 2018). Pharmacies can be split into the two major groups of (i) stand-alone stores, the majority of which are SMEs and which account for over 80% of all pharmacies and (ii) chain stores, which may either be run and financed centrally or organized for expansion through franchising such as Fascino, Save Drug (a member of BDMS). Nevertheless, modern trade outlets (including discount stores, supermarkets, convenience stores and specialist health stores) are turning over a part of their floorspace to medicines and pharmaceuticals and so are able to reach a wide range of customers.

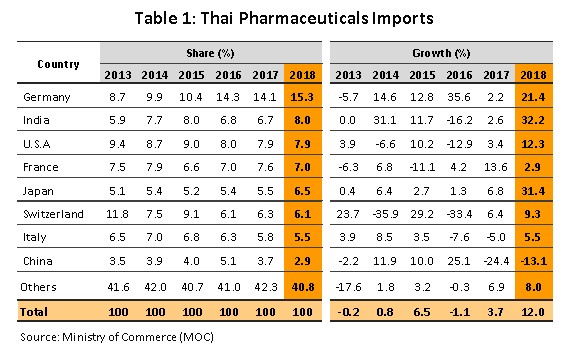

In terms of exports, only around 5% of domestic output leaves the country and although between 2012 and 2017, exports of Thai pharmaceuticals grew by around 9% per year, since these are of low-value generics, they still account for only 0.20% of the value of all exports. A large share of these goes to neighboring countries, with Vietnam, Myanmar, Lao PDR, and Cambodia taking 55% of the total by value. Imports, on the other hand, tend to be of high-value products that the domestic sector is unable to produce. These include products such as anti-anemia treatments, antibiotics, and cholesterol-lowering medications. The main exporters to Thailand are Germany, the United States, and France and because the exchange has been so one-sided, there has been a long-standing imbalance of trade in pharmaceuticals. It is worth noting that in the last 2-3 years, there has been a significant increase in the value of imports from India. Over these past few years (2014-2017), goods originating in India have accounted for 7.3% of all imports of medicines, compared to 5.9% in 2013. Most of these imports are of cheap generics since India has benefited from open patents and a system of ‘compulsory licensing’ [5] that allows local manufactures to override patent protection in some cases and so enables them to manufacture generic versions of original drugs at much reduced costs.

Situation

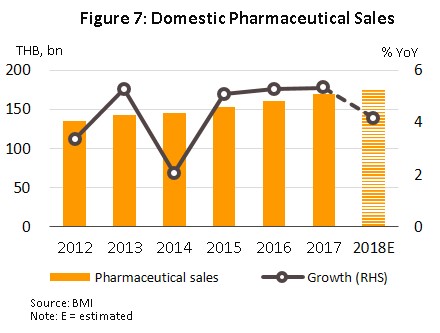

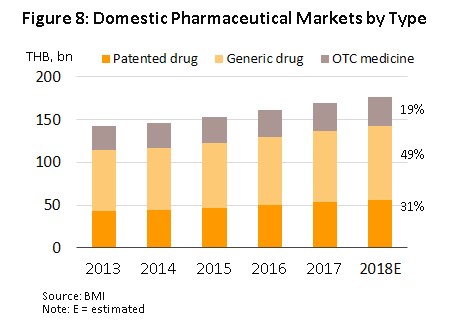

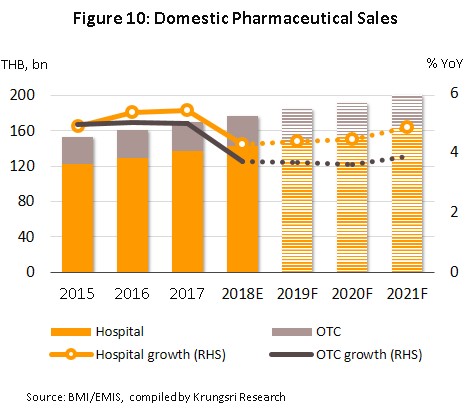

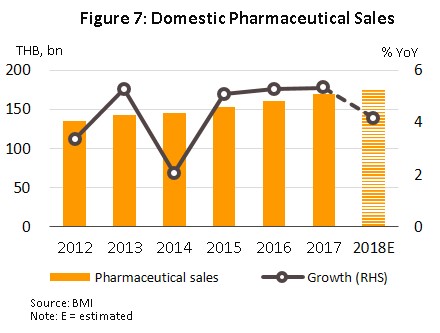

Over the period 2013 to 2017, the value of pharmaceuticals distributed to the domestic market grew by an average of 4.6% per year (Figure 7) with the result that in Southeast Asia, the Thai pharmaceuticals market now ranks second after Indonesia. Growth in distribution through hospitals has outpaced that of the OTC channel, partly due to the expansion of universal healthcare coverage in Thailand, which has tended to weaken growth in consumer purchases for OTC channel.

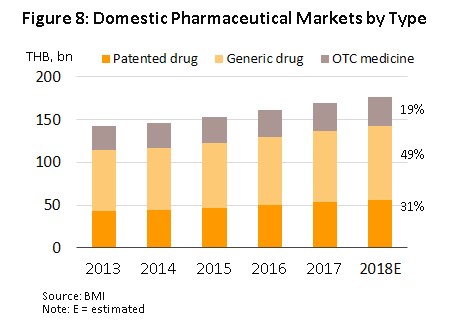

In 2018, the entire domestic market had a value of approximately THB 176.6 bn, a rise of 4.2% YoY (Figure 7). This was split between prescription treatments distributed via hospitals and doctors’ prescriptions, and OTC drugs. The former includes generics, worth THB 86.7 bn, up 3.8% YoY in 2018, and patented drugs, worth THB 55.6 bn (+5.0% YoY), while in 2018, the value of the OTC category rose 3.7% YoY to THB 34.2 bn (Figure 8).

By volume, the total output of medicines in Thailand[6] in 2018 came to 67,241 tonnes, which represented a 9.1% YoY rise, an improvement on the 5.3% expansion seen in 2017. Production of tablets (26.6% of the sector’s total output) rose 15.4% YoY, while that of powders (11.3% of the total) and capsules (5.7%) increased by 12.6% YoY and 15.4% YoY, respectively, on an expansion in orders from export markets, especially for tablets. At the same time, though, production of solutions and liquids, which at 41.0% of the total is the most important product category, rose by just 1.8% YoY following a 7.9% YoY increase in 2017. These disappointing results stemmed from restrictions placed on the quantities of riskier goods distributed to pharmacies[7], examples of which include cough medicines containing diphenhydramine, promethazine or dextromethorphan. For 2018, then, the manufacturing production index of pharmaceutical products stood at 122.47, up 13.4% YoY from 2017’s figure of 107.99.

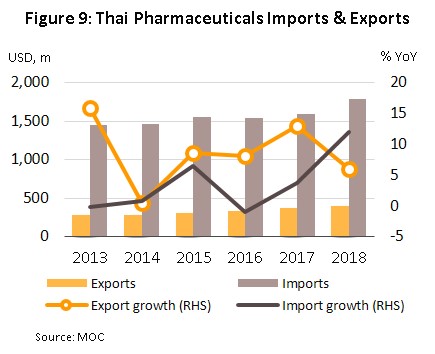

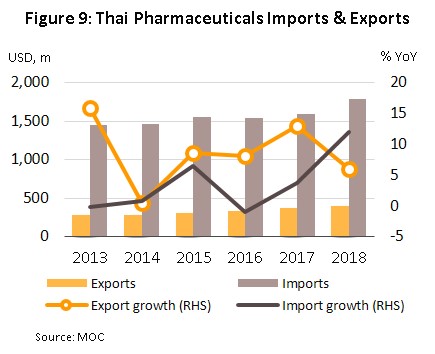

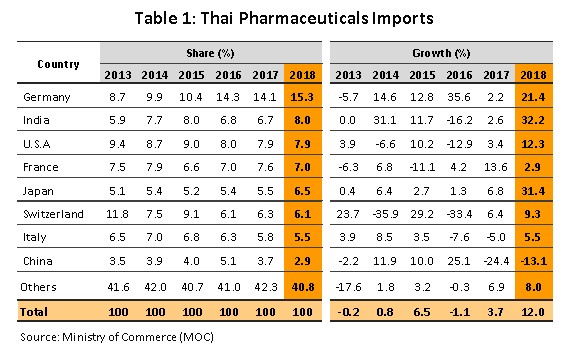

In 2018, imports of medicines rose 12.0% YoY to USD 1.78 bn, following a 3.7% rise in 2017 (Figure 9). The majority of these imports were for either precursor chemicals or for patented medications, especially those used in the treatment of high blood pressure and diabetes. The principal originating countries of imports to Thailand were Germany, India and the United States, which together supplied 31% of all imports of medicines by value. Imports from these countries jumped 21.5% YoY in 2018, with increases in the import of cheap Indian medicines being particularly noticeable; these surged by 32.2% YoY and now comprise 8.0% of all imports, up from 6.7% in 2017. At the same time, imports from China (2.9% of the total) fell from the year before (Table 1) on a combination of rising prices and the increasing ability of Thai operators to manufacture the main generic product groups exported by China.

Exports of medicine generated income of USD 397 m in 2018, or a rise of 5.9% YoY (Figure 9). Exports to Hong Kong showed the biggest increase, expanding 34.0% YoY, with this being explained by the relative lack of pharmaceutical production facilities there; domestic output is insufficient to meet demand so imports are needed to fill the gap created by rising demand. Following Hong Kong in order of importance were Malaysia (up 25.3% YoY), Cambodia (25.1% YoY), Myanmar (17.3% YoY), Laos PDR (10.2% YoY) and the Philippines (9.0% YoY). These large increases in exports have partly been caused by Thailand’s admittance to the ASEAN Listed Inspection Service[8], which has made it much more convenient for Thai manufactures to export to other member states in the ASEAN zone.

Outlook

Between 2019 and 2021, the value of medicines distributed to the domestic market is forecast to rise by 4.2-4.6% (Figures 10 and 11) in line with increasing demand. This outlook is supported by a number of factors.

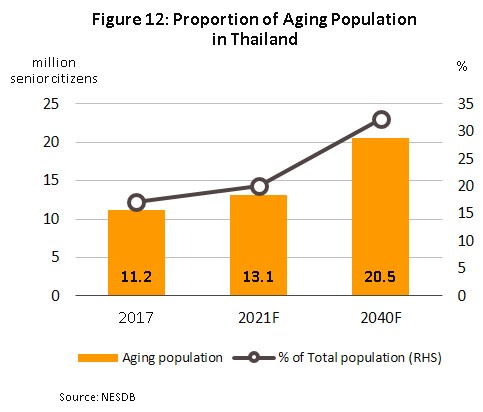

1) Rates of illness are increasing in the general population, especially for chronic non-communicable conditions (diabetes, high blood pressure, etc.). while at the same time, the Thai population is steadily aging. Illnesses that typically affect the elderly include high blood pressure (found in approximately 31% of the elderly), followed in order of importance by diabetes, heart disease, stroke, and cancer. The Office of the National Economic and Social Development Council thus estimates that the number of people aged over 60 will rise from 11.2 million in 2017 to 13.1 million in 2021 (Figure 12) and as such, expenditure on healthcare for the elderly will rise to THB 228 bn in 2022 (or 2.8% of GDP) from THB 63 bn in 2010 (or 2.1% of GDP) (source: 12th National Health Development Plan, 2017-2021).

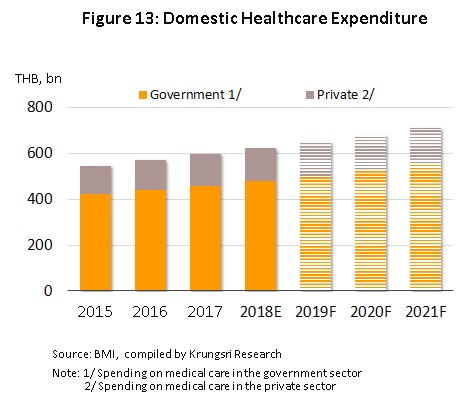

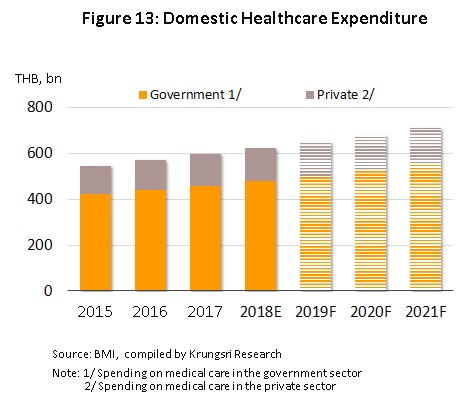

2) Improved access to treatments made possible by universal healthcare coverage has naturally had the effect of steadily raising expenditure on these same treatments (both for medicines and for other expenses) and it is thus expected that distribution will increase at the rate of 4.4-4.7% in the period 2019-2021 (Figure 13), with increases being especially strong for private-sector treatments, which are forecast to grow by 4.7% in 2021, up from 2018’s 4.6% increase.

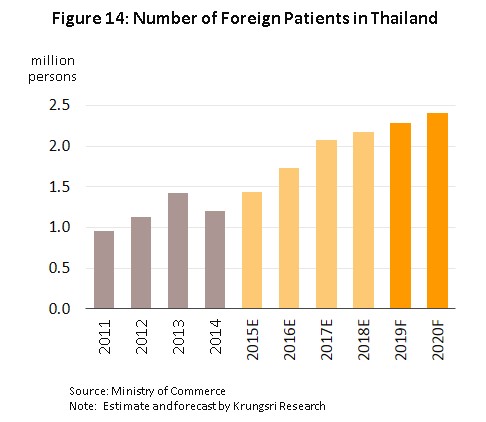

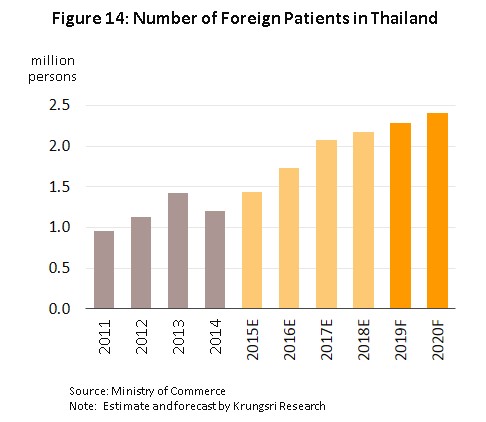

3) Growth in medical tourism will also support the sector. It is driven by Thailand’s advantages in the quality of service that it can provide and standards of treatment which support the government policy to establish Thailand as a regional medical hub; and Thai hospitals have now progressed to the point that they can meet demand for the treatment of specialist conditions, especially for serious non-communicable diseases including heart disease, bone and skeletal conditions, and cancers. In addition, old-age care centers have also been set up in the country and these typically have lower costs than their competitors in, for example, Singapore and Malaysia. Foreign patients are thus arriving in Thailand for treatment in increasing numbers, with patients coming from both the population of general tourists and those traveling specifically as medical tourists; together, these two groups account for around 80% of foreigners receiving treatment in Thai hospitals. It is therefore expected that in 2019, there will be a 5.0% increase in the number of foreign patients treated in Thailand and that this will rise to 8.0% in 2020, compared to a 5.0% increase in 2018 (Figure 14).

At the same time, investment in the pharmaceuticals sector is tending to increase, helped by the policies of the Board of Investment (BOI). The BOI has moved to compensate for the increased burdens stemming from the upgrades to production facilities required to meet GMP standards (as per the PIC/S requirements) by reducing operators’ costs and as such, applicants for investment support that made successful applications in 2017-2018 are eligible for an 8-year corporate tax waiver. Those that make a successful application in 2019 will receive a 5-year exemption. In addition to this, the pharmaceuticals sector is also one of the so-called targeted ‘new S-curve’ industries, which, if businesses are established in the Eastern Economic Corridor (EEC), are also eligible for further investment support in the form of government financial assistance with research and additional tax waivers.

Imports of pharmaceuticals are forecast to slow on government plans to restrict the inflow of original drugs and instead, open opportunities to Thai producers that have the capacity to step into the gap that this move creates. This will be especially the case for joint ventures with overseas players to manufacture high-value products and/or generics, or non-patent-protected medicines, (such as treatments for high blood pressure and diabetes and antibiotics), and biological products, demand for which, for example for treating cancer, is expected to rise in the future. The FDA has also reduced the costs involved in registering new drug formulas and, moreover, players from outside the sector are planning to enter the market by producing active pharmaceutical ingredients. Examples of the latter include PTT’s joining with the Government Pharmaceutical Organization to establish production facilities for the manufacture of cancer treatments, SCG Chemicals’ investments in the production of biological products, and Medicpharma’s (part of the Bangkok Hospital group) move into the production of pharmaceutical precursors. Following Thailand’s admission to the Pharmaceutical Inspection Co-operation Scheme (PIC/S) and Thai producers achieving the Good Manufacturing Practice (GMP) standards, importers of Thai pharmaceuticals now feel a greater degree of confidence in Thai products. Given this, operators now have the opportunity to expand exports to the rest of the ASEAN zone.

However, despite this positive outlook, potential problems exist with rising levels of competition that have been caused by (i) the import of cheap medicines from India and China (although China recently raised the price of its generics, they remain cheaper than those produced in other countries) and (ii) an increase in the number of new entrants to the market, especially foreign players (e.g. from Japan). These are investing in Thai-based production partly to re-export back to their home countries and partly to increase their penetration of the CLMV market.

Krungsri Research’s view

For both manufacturers and distributors, growth over the next three years (2019-2021) should continue at a level similar to that of the past year but rising levels of competition will place a limit on profitability and this will likely be held at mid-levels.

Manufacturers of conventional medicines: income for these players is expected to rise steadily. Manufacturers that distribute their products through hospitals, especially those that produce patented drugs that are required in increasing numbers for the treatment of common conditions such as high blood pressure, diabetes, heart disease, stroke and cancers, will likely see solid rates of growth, while the increase in access to public health services made possible by Thailand’s universal healthcare scheme will also support increased demand for generics. In addition, sales opportunities to the rest of the ASEAN zone have also been substantially improved. However, stiffening competition and for domestic manufactures, rising prices that have been pushed up by a combination of the GMP-PIC/S manufacturing process requirements and higher costs for imports of raw materials will, together with government controls on the prices that private hospitals are allowed to charge for medications, tend to put downward pressure on operators’ turnover.

Distributors of pharmaceutical products (retailers and wholesalers): Income for these operators will increase gradually. Distributors will see business conditions benefit from rising domestic demand for pharmaceuticals but at the same time, competition within the sector is strong, especially for stand-alone wholesalers and retailers, which will face rising levels of competition from chain stores that are planning to expand their operations. Examples of the latter include Fascino, which plans to open another 89 outlets in the period 2019-2021, and Save Drug (part of the Bangkok Hospital network), which has plans to open 50 new branches in 2019 and then to expand by a further 20% per year in the subsequent period. In addition, the increasing investment in the sector by modern retail outlets, such as discount stores and supermarkets which, over the next three years, are likely to be opening a combined total of least fifty new branches per year. Modern retail outlets are also increasing the area given over to medicines and food supplements and overall, the proportion of pharmacies which are chain stores will increase. Convenience stores are also increasing the shelf-space devoted to medicines. These are found in every corner of the country and on average another 600-700 branches open annually so this too will increase pressure on stand-alone pharmacies, and therefore operators of pharmacies generally are expected to see a slow growth in performances. Wholesalers of pharmaceuticals are for their part increasingly expanding into the retail market and because they enjoy cost advantages when placing larger orders, they should be able to maintain continuing growth, similar to that of the past year.

[1]Under the WTO’s Agreement on Trade Related Aspects of Intellectual Property Rights

[2]The Drug Act has been enforced since 1967 and was amended. The Drug Act (No. 6) B.E. 2562 the has been completed and is enforced.

[3]The Pharmaceutical Inspection Co-operation Scheme (PIC/S) is a cooperative framework which was set up by GMP inspectors from a number of countries (but especially European ones) that wished to establish universal standards for assessing GMP in pharmaceuticals production. Thailand officially became its 49th member on 1st August 2016.

[4]In November 2002, Thailand instituted a system of universal healthcare through the passing of the National Health Security Act. This means that all Thai citizens are able to access state-provided medical care through one of three funds: (i) the national health insurance fund, or ‘gold card’; (ii) the social security fund; and (iii) the civil service health fund.

[5]Compulsory licensing (CL) is employed to reduce the conditions of monopoly and to help other countries can apply CL to produce medicines for solving public health or treating

hazardous communicable disease their countries

[6]Source: Office of Industrial Economics, produced liquid medicines, tablets, capsules, creams, powders and injectable medicines

[7]The Food and Drug Administration (FDA) has placed restrictions on the sale and distribution of these medicines. Pharmacists are also now required to maintain a register of sales of

these items.

[8]Thailand was formally admitted into the ASEAN Listed Inspection Service in March 2015 and this was then confirmed by the FDA. Entry allowed Thailand to join other members (Singapore, Malaysia and Indonesia) in being able to export within the ASEAN region while being exempted from GMP or other examinations on entry into the export market and this helps to reduce duplication of work and cost burdens.

.webp.aspx)