EXECUTIVE SUMMARY

Overall, the Thai rubber industry will continue to see an improving outlook on both the supply and the demand sides of the market through 2022. Outputs will tend to rise on a combination of an expansion in the area under cultivation, more favorable climatic conditions, and the motivating effect of high prices on growers, while at the same time, labor shortages will continue to affect supply from Malaysia and Indonesia. On the consumption side, demand from downstream industries will strengthen in both domestic and overseas markets, though due to the effect of the Russia-Ukraine war on oil prices, demand for natural rubber is especially strong for use as an alternative to synthetic products. Over 2023 and 2024, the expectation is that the industry will continue to grow, helped further by strengthening demand from downstream industries including auto production (partly due to stronger investment in electric vehicles resulting from government incentives), the production of latex gloves and medical devices, and the construction sector, where plans for an increase in spending on infrastructure will also feed into higher demand for rubber. In addition, government policy that aims to keep prices stable will help to maintain stability across the industry. Nevertheless, the industry will remain exposed to risk arising from greater competition from growers in the CLMV nations, which may be able to rapidly steal market share, and from the tightening of non-tariff barriers (NTBs) to trade.

Krungsri Research view

The Thai intermediate rubber industry will see turnover improve over the three years from 2022 to 2024, but increasing supply from neighboring countries will add to competition within the industry. Additionally, although rubber growers will benefit from high prices, they will need to be careful about the possible impacts of leaf fall disease on outputs.

-

Producers of intermediate products: Manufacturers of sheet rubber and TSR will benefit from rising demand for imports into China and Japan that will be driven by a combination of a better outlook for auto, tire and EV manufacturers and the need to build rubber stocks. However, players will face stiffening competition thanks to expanding supply from growers in the CLMV countries. The outlook for producers of concentrated latex is also positive thanks to anticipated increases in demand from downstream manufacturers of latex gloves, medical supplies and condoms. In addition, supply is somewhat limited as producers tend to output cup lump and rubber scraps, rather than concentrated latex, and so competition on export markets is not unduly intense. Likewise, producers of compound rubber will also gain from an improving business environment that will be lifted by rising demand from Chinese tire and auto parts manufacturers. However, Thai players may need to deal with the impact of more expensive crude on the cost of synthetic rubber and/or other chemical inputs used in compound rubber. In addition, investment in domestically produced compound rubber is rising in China, the room for export growth may be limited.

-

Rubber traders: Income will be uncertain for this group because distribution channels are narrowing with the trend by processors to buy directly from growers, central markets and cooperatives. Moreover, Chinese operators are increasingly traveling to Thailand to buy from rubber farmers directly, and this too may help to cut Thai traders out of the loop.

-

Rubber growers: Income will tend to stay flat due to a combination of downward pressure on prices and the effects of outbreaks of leaf fall disease on outputs. At the same time, growers will benefit from government assistance for the industry that includes income guarantee schemes and grants for rubber growers, soft loans, and financial support for the planting of alternative crops.

OVERVIEW

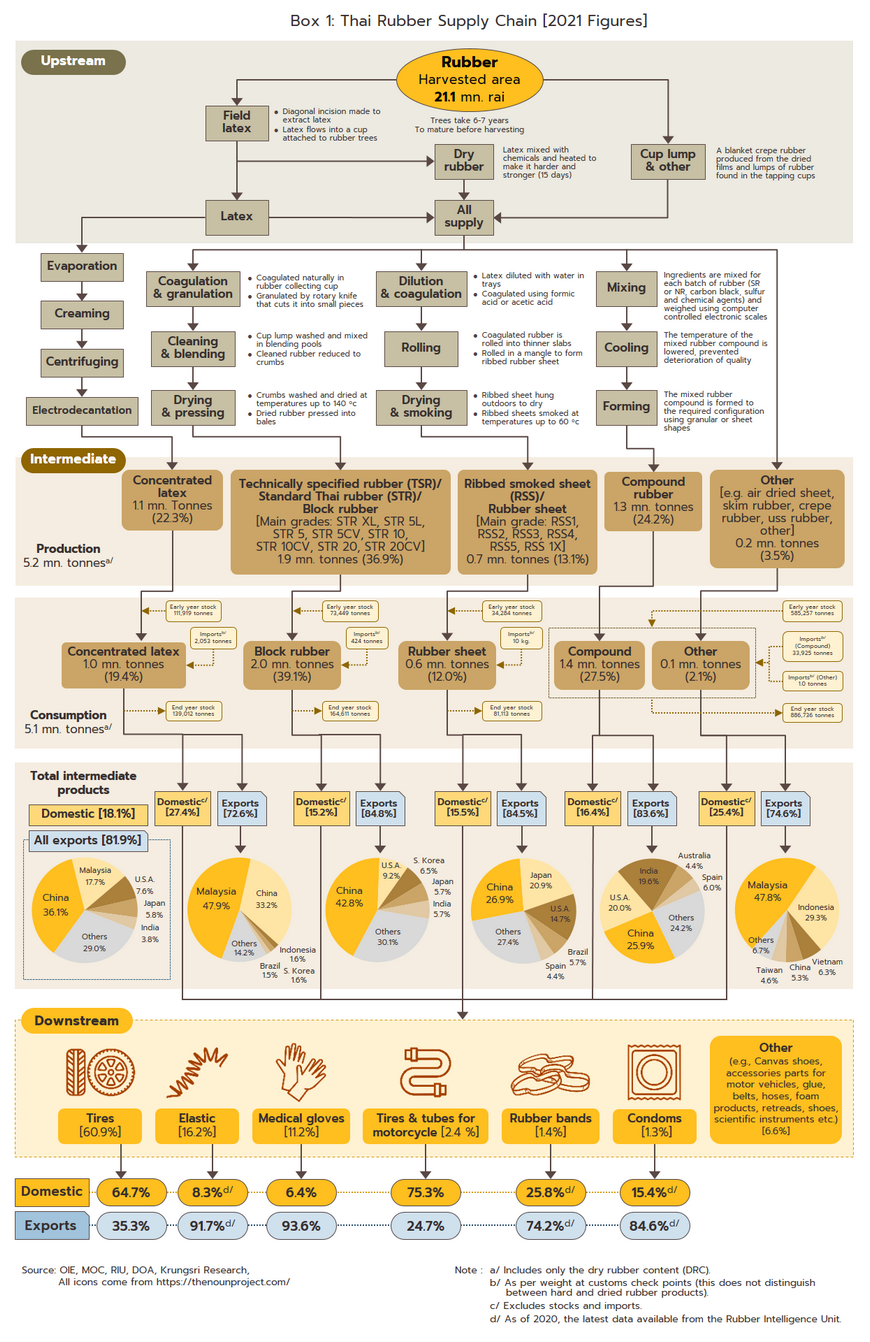

The Thai rubber supply chain has three main components. (i) Upstream industries involve the growing and harvesting of rubber on plantations by growers and tappers. To add value to primary production, some producers also engage in basic processing of their field latex to produce dried rubber products such as cup lump, scraps, sheet and crepe rubber[1]. Almost all upstream production in Thailand is consumed as inputs into the domestic midstream rubber industry. (ii) Intermediate or midstream rubber industries, or rubber processors, take rubber produced on plantations[2] and convert this into semi-finished products, such as ribbed smoked sheet, technically specified rubber, concentrated latex, compound rubber and skim rubber, which have the qualities and properties required for use as inputs into the different downstream production processes. (iii) Downstream producers include manufacturers of items such as automobile tires, latex gloves, condoms, elastics, and so on, although synthetic rubber, which has been developed by the petrochemical sector3/, may also be used in place of midstream natural rubber products in applications where its qualities make it more suitable.

Majority of Thai-produced intermediate rubber goods is sold on overseas markets for processing into downstream products (as of 2021, 81.9% of Thai intermediate rubber goods were sold abroad), with the most important export markets being China (36.1% of all exports of Thai intermediate goods, by value), Malaysia (17.7%), the United States (7.6%), Japan (5.8%) and India (3.8%). The remaining 18.1% of midstream production is consumed domestically, and here, the most important end-use is for the production of tires (the source of 60.9% of all domestic demand for intermediate rubber products), followed in importance by elastics (16.2%), latex or surgical gloves (11.2%) and then other products such as hosing, condoms, and rubber bands (Box 1).

In 2021, the total value of intermediate rubber production in Thailand came to around THB 0.34 trillion[4]. Thailand is in the fortunate position of its production being overwhelmingly of fresh latex rubber (92% of upstream production is of fresh rubber[5]) and because this can be used as an input for processing into all types of midstream rubber goods, Thai intermediate rubber production is very diversified. This differs from the situation in Malaysia and Indonesia, where most upstream production is of cup lump, which is largely used for conversion into block rubber/technically specified rubber (TSR).

Given this, the output from Thai intermediate rubber production encompasses sheet rubber, TSR, concentrated latex and other products, though of these, TSR is the most important, accounting for 39.1% of all production by volume.

-

Ribbed smoked sheet (RSS) is produced by first filtering field latex to remove dirt and impurities. This filtered latex is then mixed with concentrated formic acid, which causes the rubber to coagulate. These solids are then rolled into raw sheet rubber before being dried for six hours in the sun to produce air-dried sheets. If these sheets are then smoked or dried further, a process that reduces the moisture content and with this, the risk of fungal infection, these are called ‘ribbed smoked sheet’ (RSS). The resulting dried sheets can be stored for longer periods of time than can other types of rubber.

-

Ribbed smoked sheet is graded according to its quality on a 6-point scale that goes from 1X (the best) and then from 1 through to 5 (the worst). Grading is made according to a variety of criteria, including the number of air bubbles in the product, the proportion of dirt and impurities, its color, the consistency of the material, and so on. Over 95% of Thai output is of grade 3 RSS, a standard quality that has properties equivalent to TSR, and this can be used in the production of goods such as tires, belts, hosing, auto parts, and shoes.

-

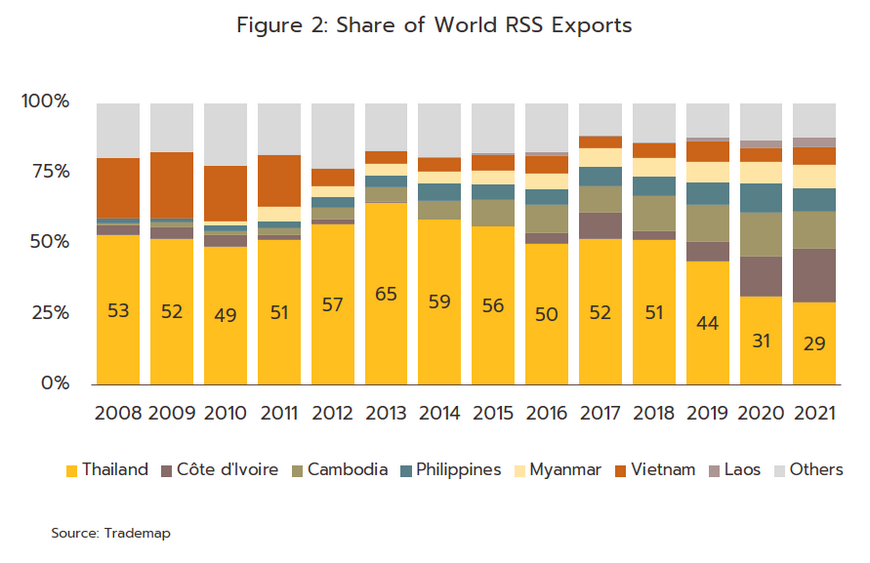

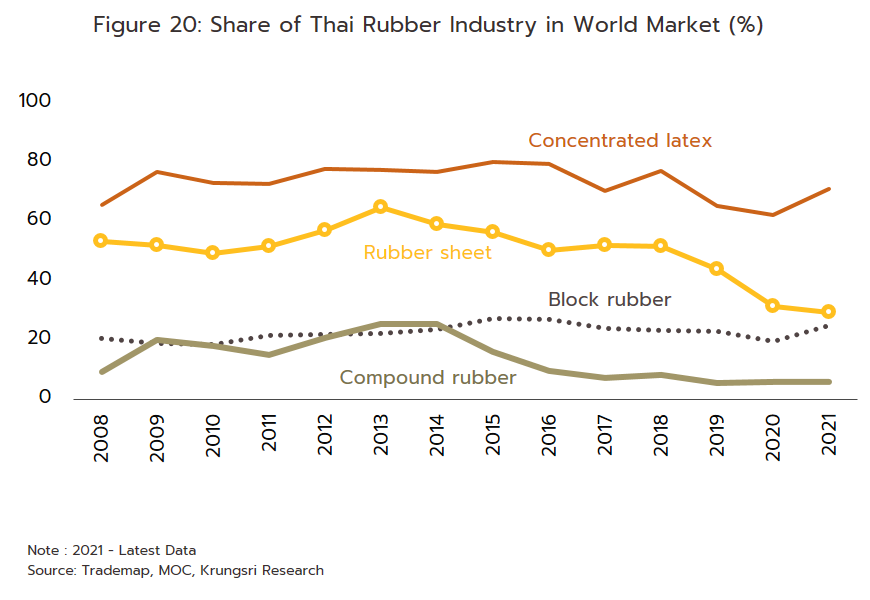

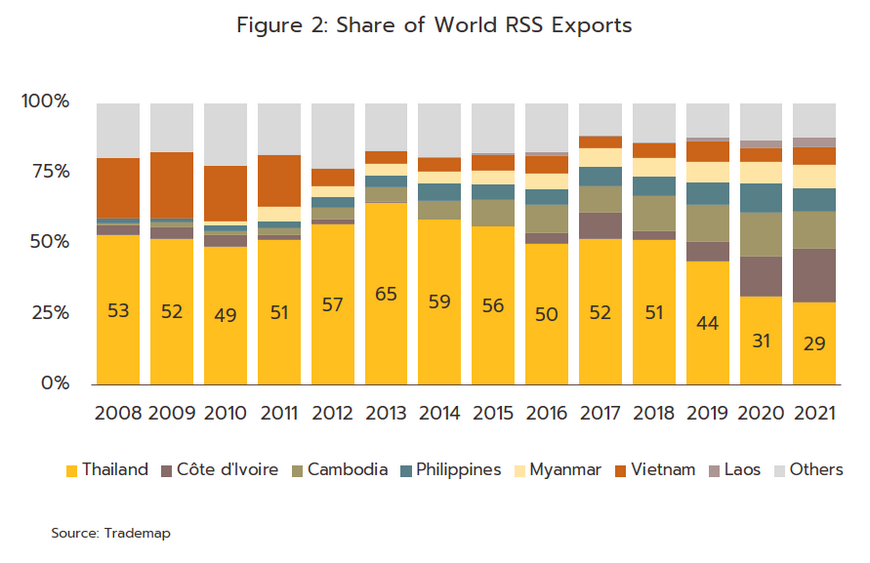

As of 2021, the combined value of the domestic and export markets for RSS stood at just THB 41 billion, down from THB 0.13 trillion in 2011. This thus represents an average annual decline of -11.0% (CAGR for 2011-2021) attributable to increasing competition from players in other ASEAN countries, including Cambodia, the Philippines, Myanmar, Vietnam, and Lao PDR. With a 29.3% share of all global exports of RSS, Thailand has nonetheless maintained its leading position in the market (Figure 2). In fact, Thailand exports 84.5% of its output of RSS, and the major export markets include China (responsible for 26.9% of all Thai RSS exports) and Japan (another 14.7% of exports) (Box 1). The remaining 15.5% of RSS output is consumed on the domestic market.

-

Technically specified rubber (TSR) is made from either field latex or some form of dried rubber such as sheet rubber, rubber cup or scrap rubber, that is separated into small pieces, washed, dried, and cut into bars. TSR that is produced in Thailand is typically made from one of two inputs. (i) Field latex produces a product with good physical properties (i.e., it has the preferred levels of purity, viscosity and flexibility) and this is therefore suitable for use in manufacturing high-quality goods such as radial and aircraft tires. In addition, this type of TSR is also used to manufacture products such as elastic bands, hair bands, sports goods, and other types of components and parts. Standard Thai Rubber (STR) is divided into the three grades6/ of STR XL, STR 5L and STR 5, with the majority of Thai production being STR 5L. (ii) TSR may also be made from dried rubber, but this may be inconsistent and lack uniformity because the manufacturing process involves using and mixing different rubber inputs. These products are divided into two grades[7]: STR 20 (made from rubber scraps mixed with sheet rubber, rubber cup or RSS) and STR 10 (made from rubber cup and high-quality sheet rubber). Most Thai TSR made from dried rubber is of the former type, which is then consumed by downstream tire manufacturers.

-

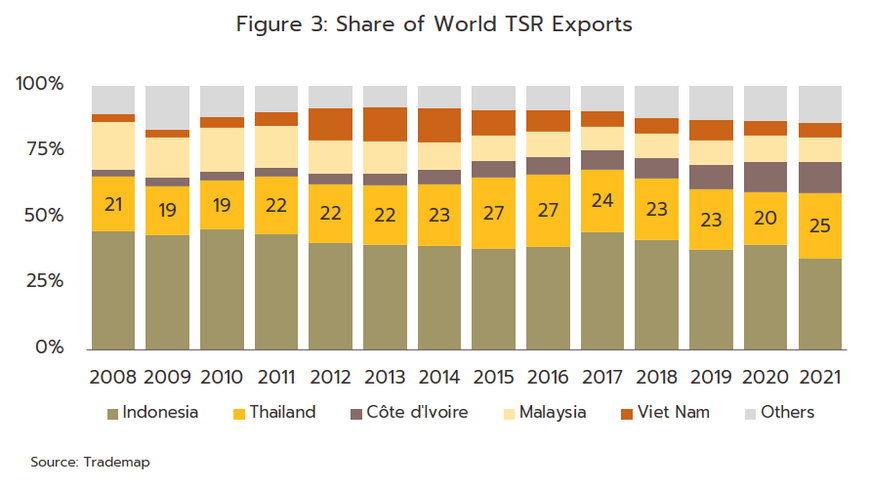

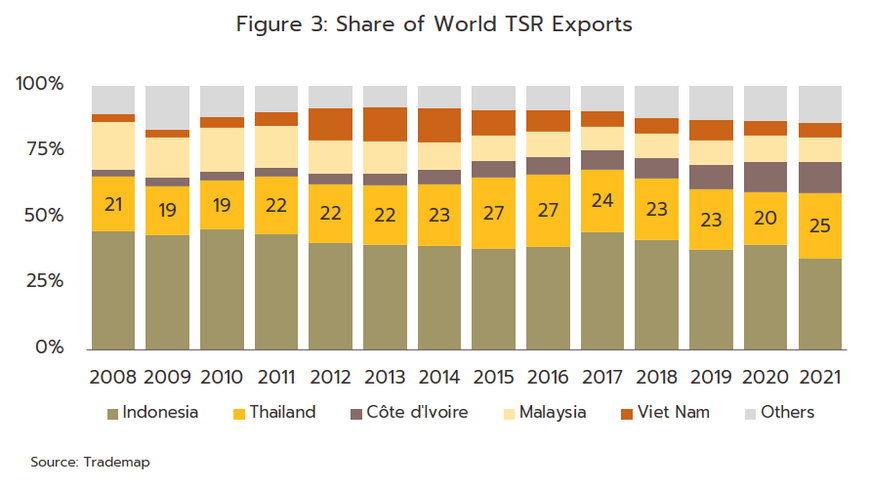

In total, the Thai rubber industry produced THB 0.1 trillion's worth of TSR in 2021. 84.8% of this was sold on overseas markets, and with a 25.0% share of global exports of TSR, Thailand is in second place after Indonesia in the ranking of suppliers to the world market (Figure 3). Thailand’s main export markets are China (which takes 42.8% of Thai-made TSR by quantity), the United States (9.2%) and South Korea (6.5%). Almost all TSR sold on the domestic market (15.2% of output) is used in the manufacture of tires (Box 1).

-

Concentrated latex is produced from field latex by using high-speed centrifuges to separate out water and any impurities that are dissolved in this. The resulting concentrated latex is at least 60% rubber and now has the qualities required for use as a raw material in further processing (generally, field latex is no more than 33% rubber, making it unsuitable for use directly in the manufacture of downstream products).

-

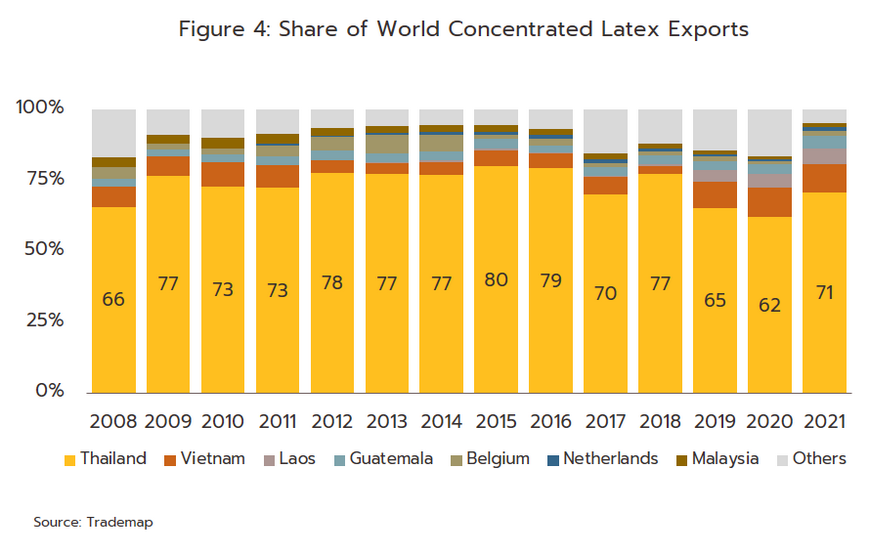

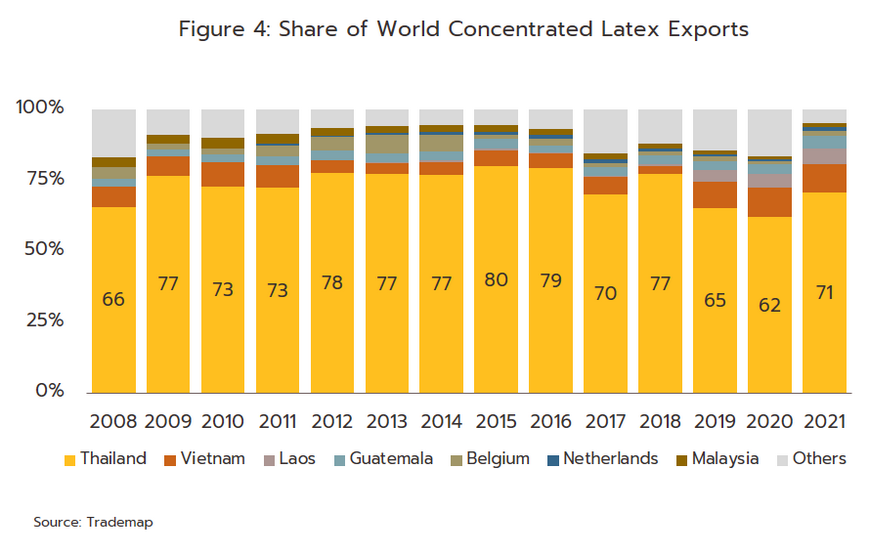

In 2021, Thai players distributed roughly THB 68 billion’s worth of concentrated latex to the market. 72.6% of this went to overseas buyers, with the remaining 27.4% of output consumed domestically. Controlling around 71% of global supply, Thailand is comfortably the world leader in this segment, though over 2020 and 2021, its share of the market declined (Figure 4). This was partly because the COVID-19 pandemic increased domestic demand, which jumped from an annual average of 0.17-0.18 million tonnes to between 0.28 million and 0.36 million tonnes and as such, players switched to a greater focus on the domestic market. At the same time, buyers of Thai rubber products also increased purchases from suppliers in other countries (e.g., Malaysia increased its imports from Côte d’Ivoire, while China switched to a greater reliance on imports from Vietnam). However, the major markets for Thai exports remain Malaysia, which takes 47.9% of exports of Thai concentrated latex, China (33.2%) and Indonesia (1.6%) (Box 1). Most concentrated latex sold on export markets to downstream industries is used in the manufacture of latex gloves and condoms.

-

Other important segments within the rubber industry include compound rubber. These midstream products mix natural and synthetic rubber with other chemicals such as vulcanite, catalysts, and fillers in order to produce a material that has the special properties required for a particular downstream forming process. Examples of the latter include the manufacture of tires, latex gloves, rubber bearing pads, hosing and elastic ties.

-

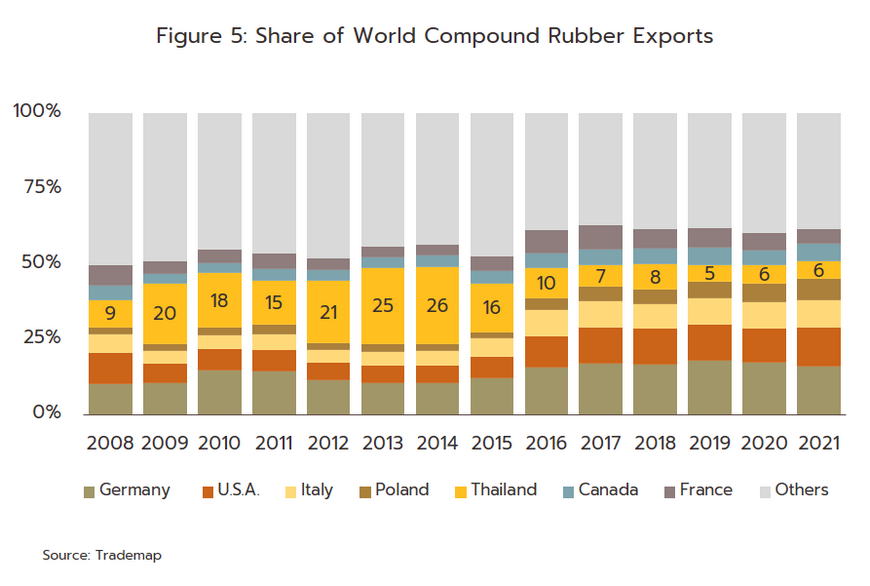

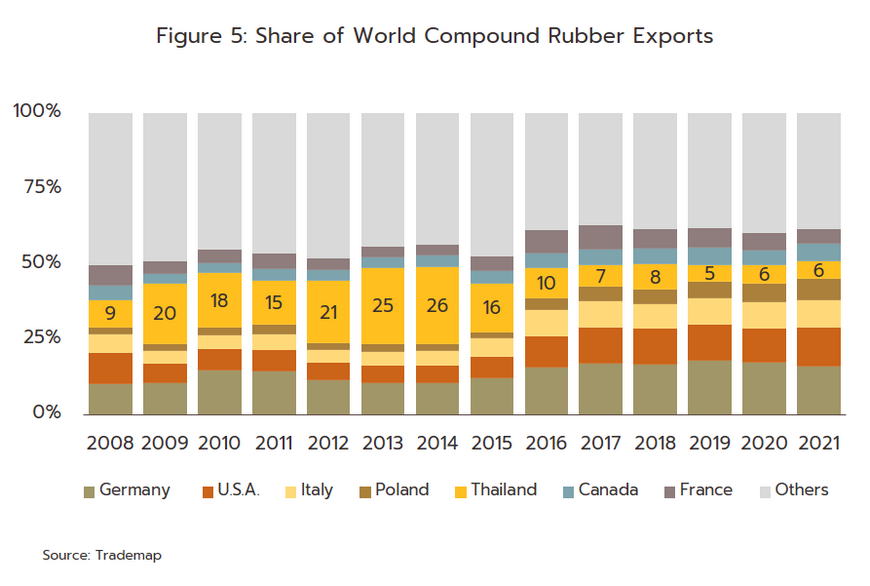

The production of compound rubber is worth THB 0.13 trillion to Thai players, with 83.6% of output distributed on export markets (16.4% is thus consumed domestically). Thailand is the world’s fifth exporter of compound rubber, sitting behind Germany, the US, Italy and Poland in the global rankings (Figure 5). Thailand’s share of the global market slipped over 2021 and 2022 with the switch by some players from producing compound rubber to instead outputting concentrated latex to meet strong domestic demand for use in the production of latex gloves. Despite this, China remains Thailand’s most important export market and the Chinese market soaked up 25.9% of exports in 2021 (Box 1). Thai-made compound rubber is generally 80-95% natural rubber, though the exact proportion will depend on demand in particular export markets and the final uses to which the rubber will be put.

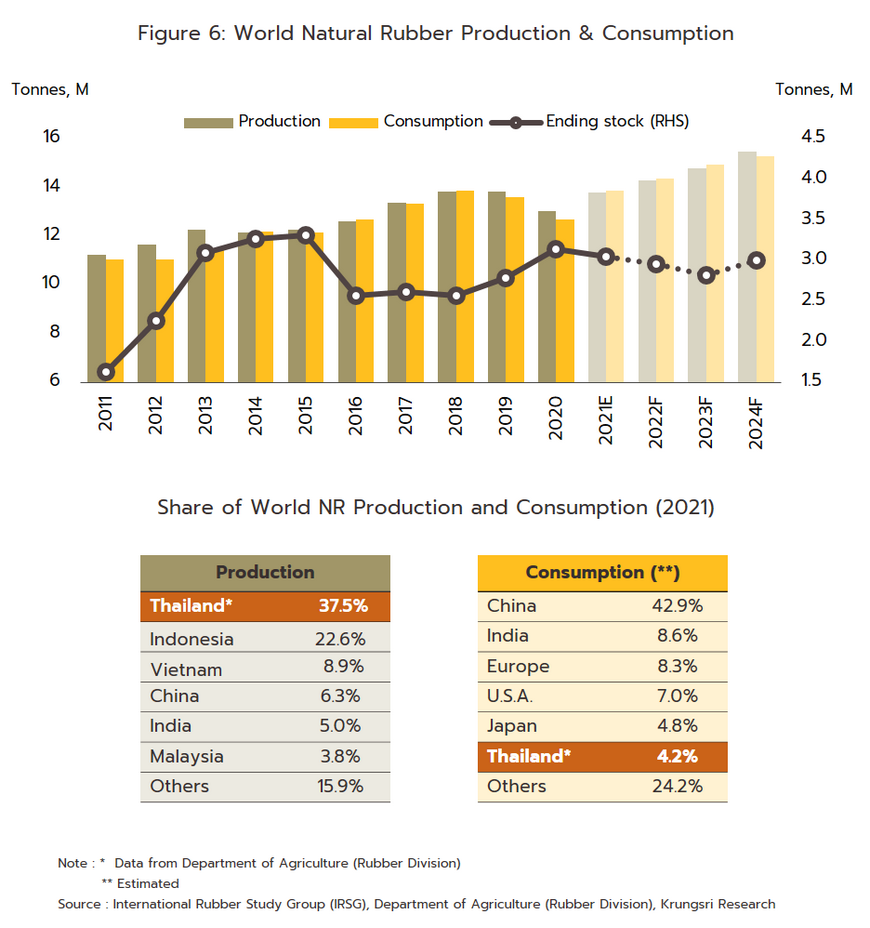

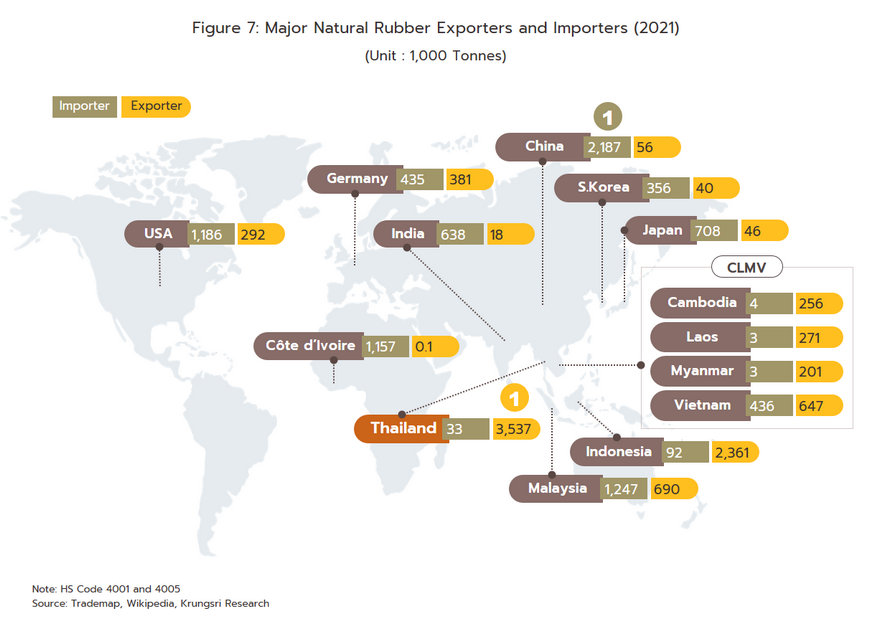

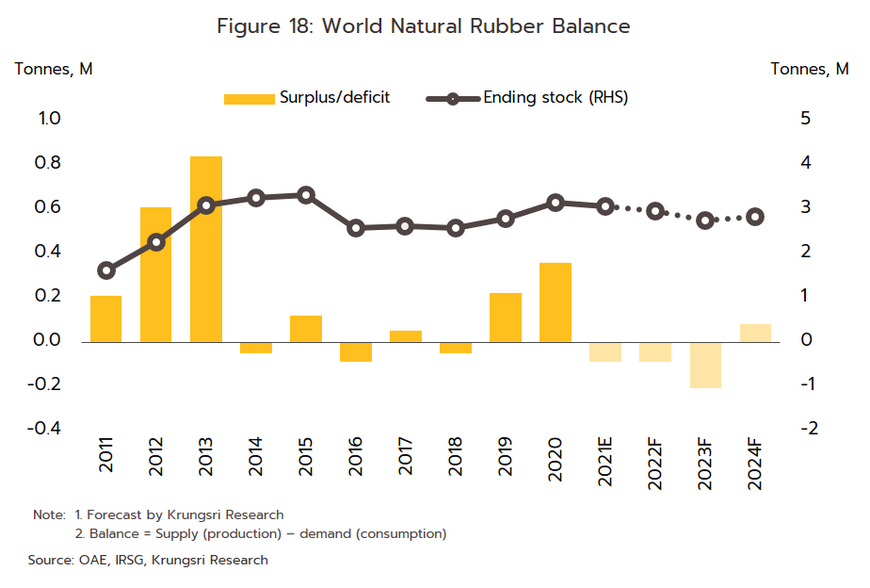

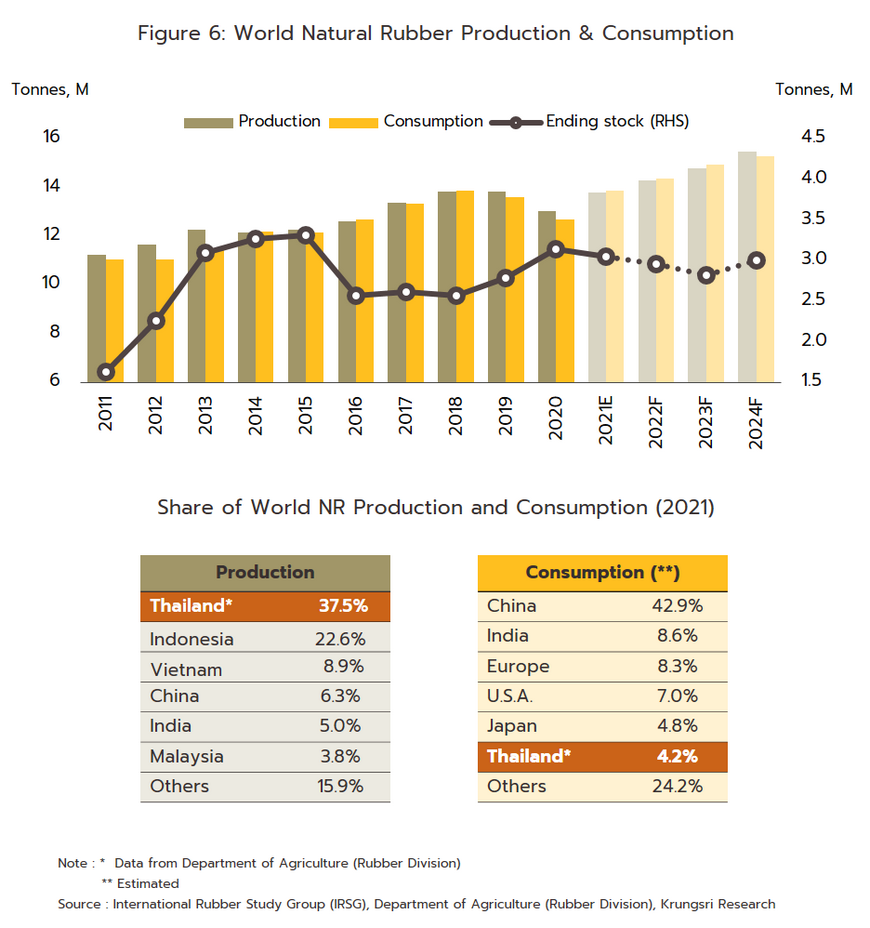

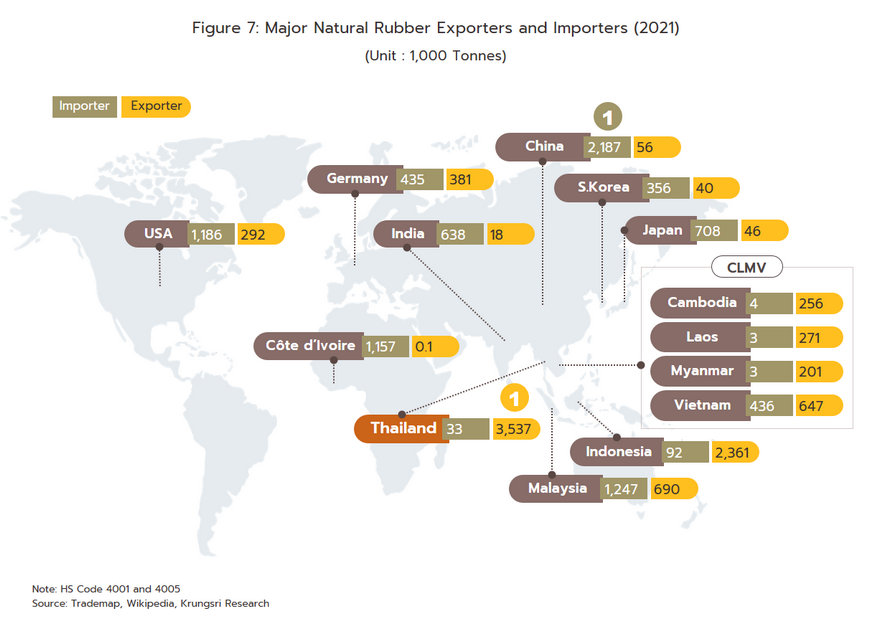

The Thai rubber industry’s reliance on exports means that midstream Thai operators have to manage a high degree of exposure to changes in both the health of the global economy and the state of downstream industries in export markets. Moreover, because Thai exports are generally dependent on only simple production methods and have low levels of product differentiation, Thai midstream players are subjected to high levels of competition in a market that is also currently awash with surplus production. In 2021, the global supply of natural rubber came to 13.8 million tonnes. 37.5% of this, or 5.2 million tonnes, came from Thailand, which remains the world’s most important source of rubber. Thailand is followed in importance by Indonesia, Vietnam, China, India and Malaysia (Figure 6), and indeed overall, Asia is the source of over 94% of the world’s rubber. Thailand’s main competitors are thus other ASEAN producers, and in particular, Indonesia, Malaysia and the CLMV group (Cambodia, Laos, Myanmar and Vietnam) (Figure 7), all of which are, like Thailand, suffering from a supply glut[8]. Nevertheless, despite these rising threats to its dominance, the Thai intermediate rubber industry has retained its place as the world leader, and it is still the number one supplier to global markets of concentrated latex and RSS, and the second most important source of TSR.

As regards demand for rubber products, globally this totaled 13.9 million tonnes in 2021. China is the most important market for rubber, which in the year accounted for 42.9% of global consumption and 24.3% of global imports, followed by India, the EU, the US, and Japan (figures 6 and 7). Because of the way the market is structured, Thai exporters tend to be reliant on demand from a small number of countries that are major consumers, and so in 2021, by value, 36.1% of exports of all Thai rubber products went to China and another 17.7% went to Malaysia. This clustering of demand is especially noticeable in the TSR segment, where 42.8% of all exports went to China, and for concentrated latex, where 47.9% of overseas sales were made in Malaysia and another 33.2% were made in China. However, this degree of concentration leaves the industry highly exposed to the risk of changes in the economic outlook in these markets.

In addition, between 2006 and 2012, Chinese investors ploughed funds into developing rubber plantations in the CLMV region. This is now translating into a steady expansion in supply. As a result, Thailand is losing market share to these countries, and this is being replaced by the rising contribution of CLMV exports to world supply (Figure 2). Meanwhile, China is simultaneously producing more rubber products, and so its bargaining position on world markets is rising relative to that of suppliers.

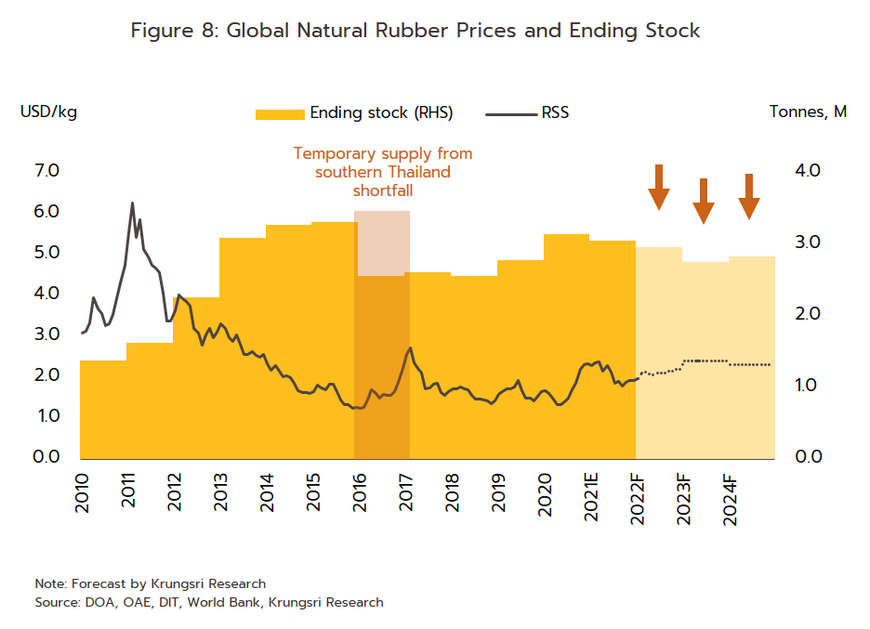

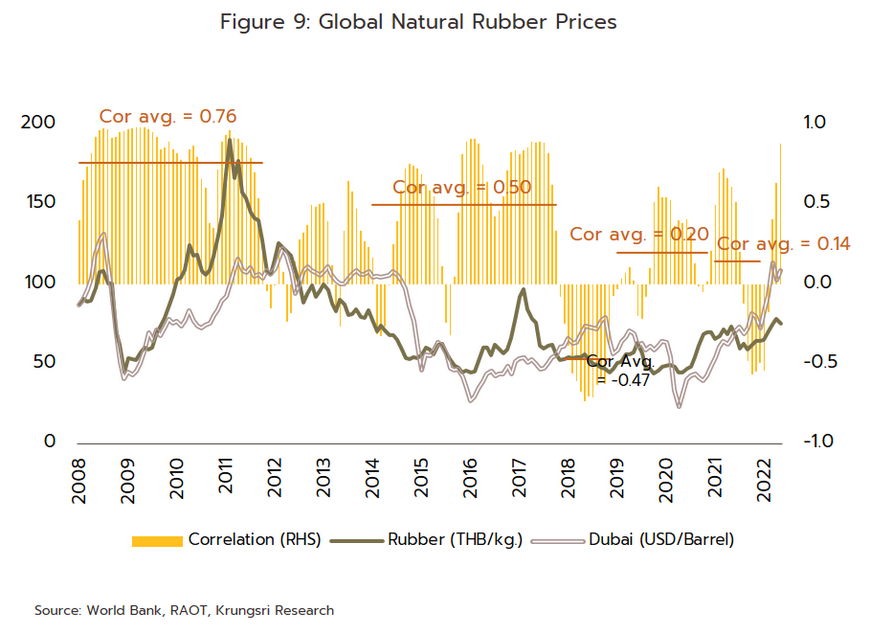

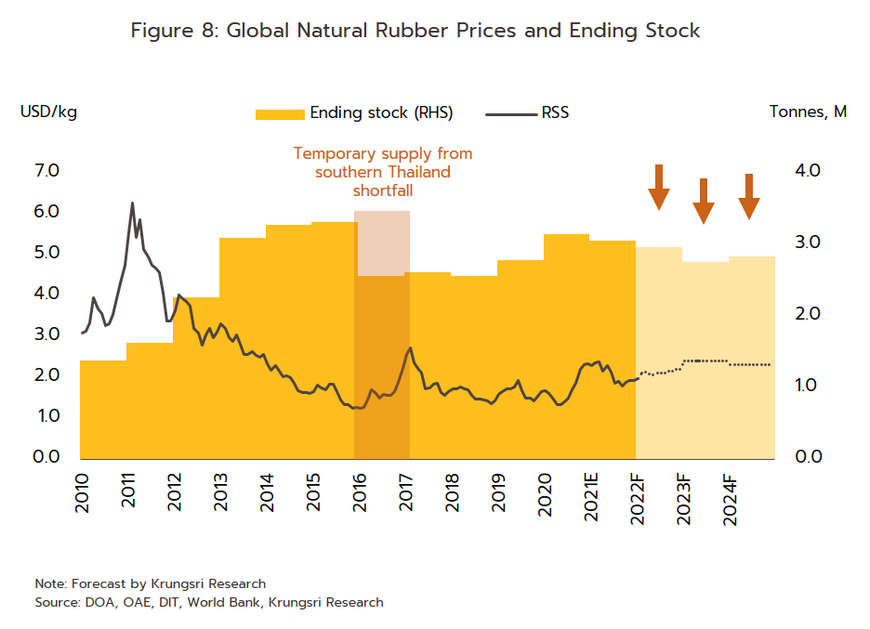

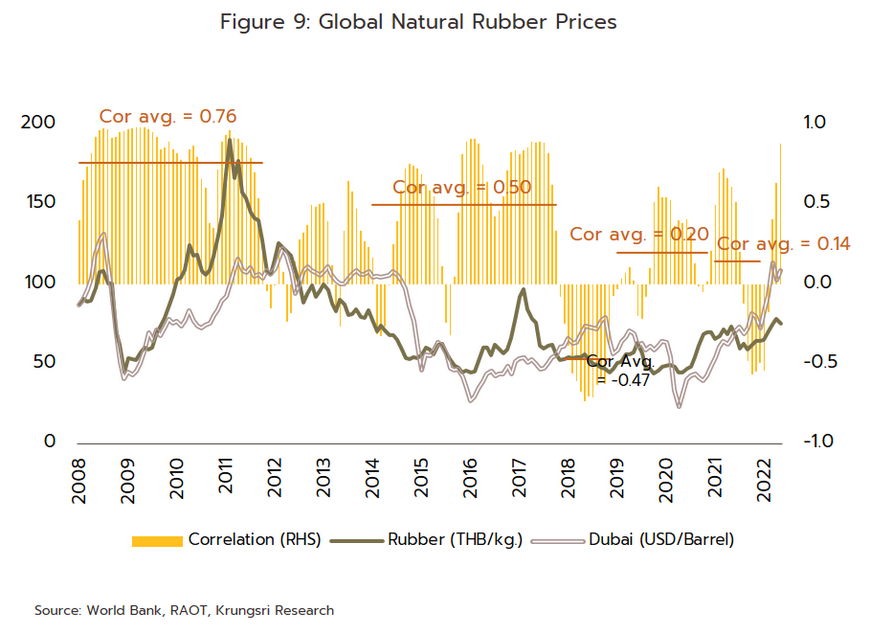

Unlike in the past, changes in the price of rubber are now more tightly linked to supply and demand factors and to global rubber stocks than they are to changes in the price of oil (Figure 8). This decoupling is reflected in changes to the correlation coefficient between the price of Dubai crude and average monthly rubber prices, which slipped to just 0.14 in 2021 from an average of 0.76 over 2005-2011 and 0.50 over 2014-2017 (Figure 9).

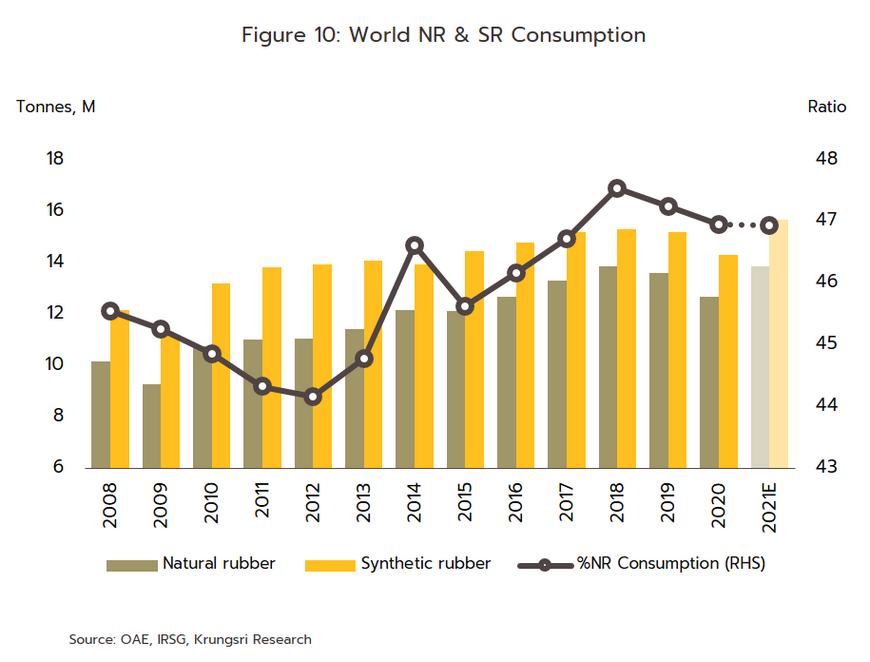

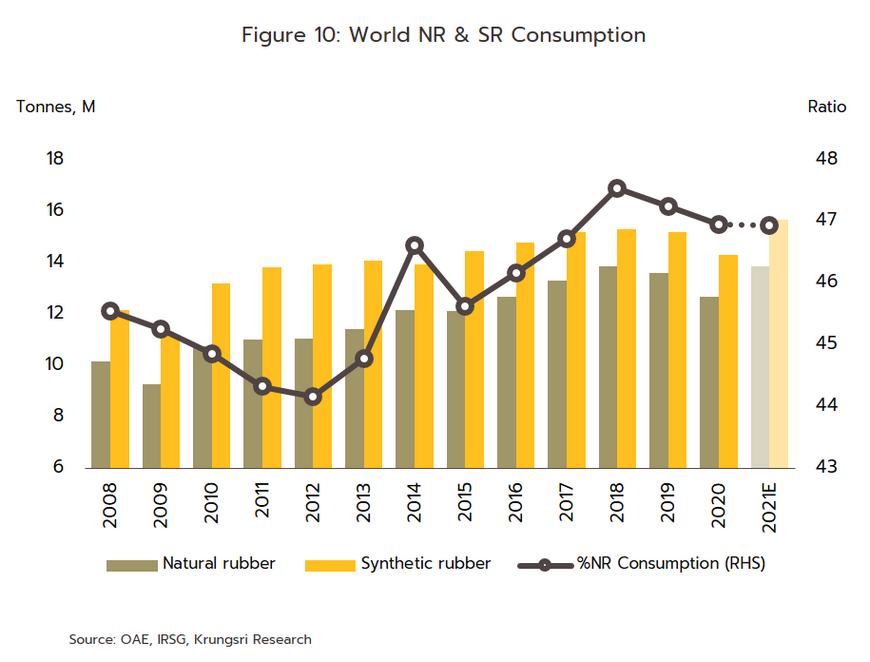

The primary alternative to natural rubber is synthetic rubber, and this is thus another growing threat to the Thai intermediate rubber industry. Although it is not possible to substitute synthetic for natural rubber in all applications, synthetic rubber is now used slightly more than natural rubber in midstream production (in 2021, inputs were split 47:53 between natural and synthetic rubber) (Figure 10). The rising importance of synthetic rubber stems from the fact that it overcomes many of the weaknesses of its natural counterpart, including greater tolerance of heat, light, oil, and chemicals. In addition, because synthetic rubber is an industrial product (it is derived from oil), the manufacturing process is easier to control and the final product displays a much greater uniformity than does natural rubber, which is subject to all the vagaries of biological systems. Using synthetic rubber in industrial applications thus makes it easier for downstream producers to plan and to control quality, though the high cost of oil on global exchanges also translates to the higher cost of input for synthetic rubber.

SITUATION

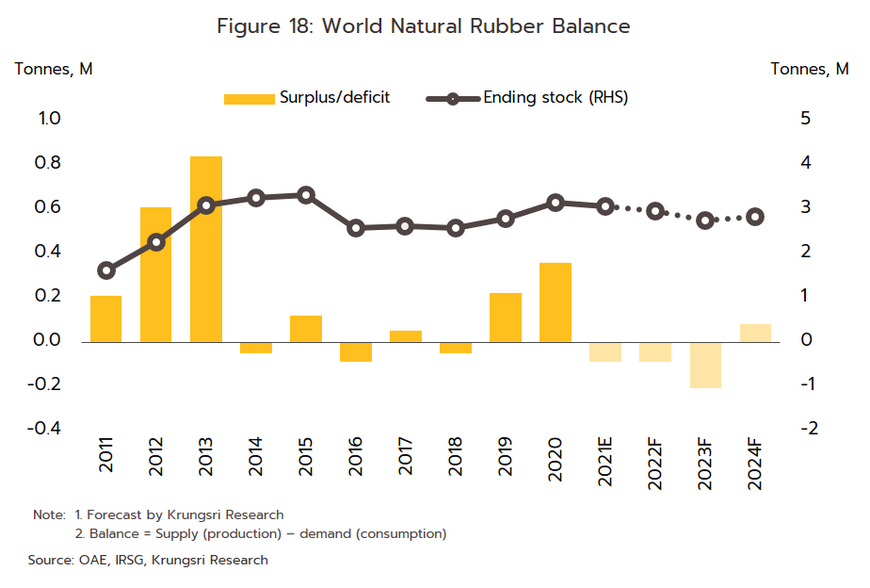

In 2021, global production of midstream rubber goods rose 5.7% to a total of 13.8 million tonnes. Thailand maintained its place as a leading source of rubber thanks to more favorable climatic conditions and price incentives that pushed growers to maximize outputs, while other major producers such as Indonesia and Malaysia suffered from a combination of labor shortages (for rubber tappers) and outbreaks of leaf fall disease[9]. Alongside this, global consumption of midstream products jumped 9.4% to 13.9 million tonnes on stronger demand from manufacturers of autos and auto parts and of medical products, in particular for use in protection against COVID-19. At the same time, China (a major importer) also stepped up its imports in response to a drop in domestic stock holdings.

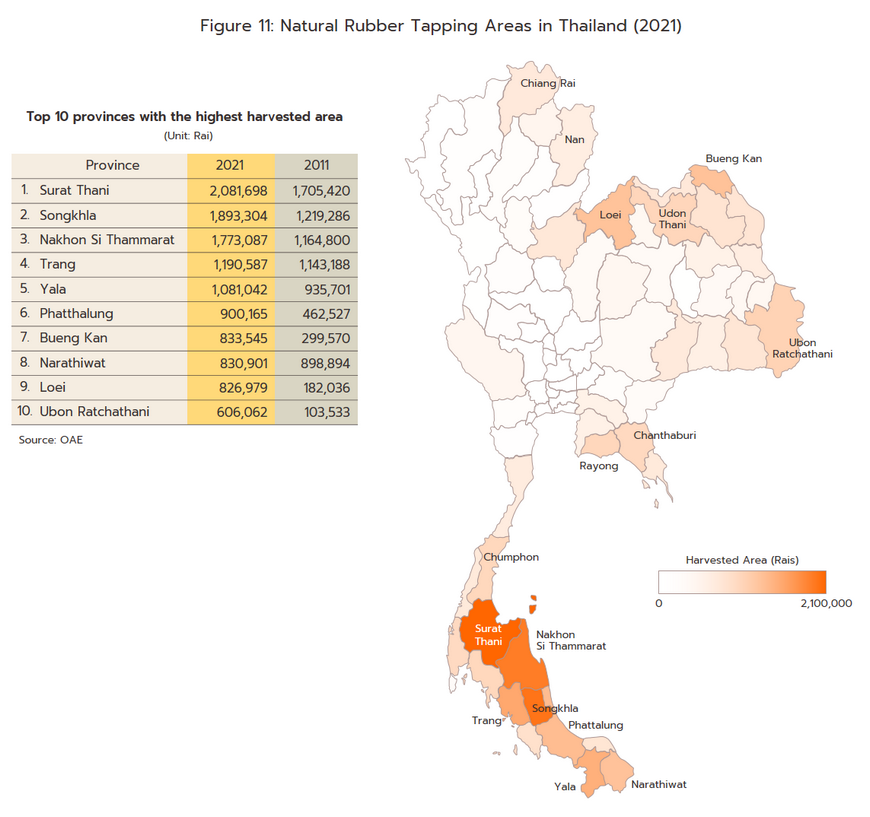

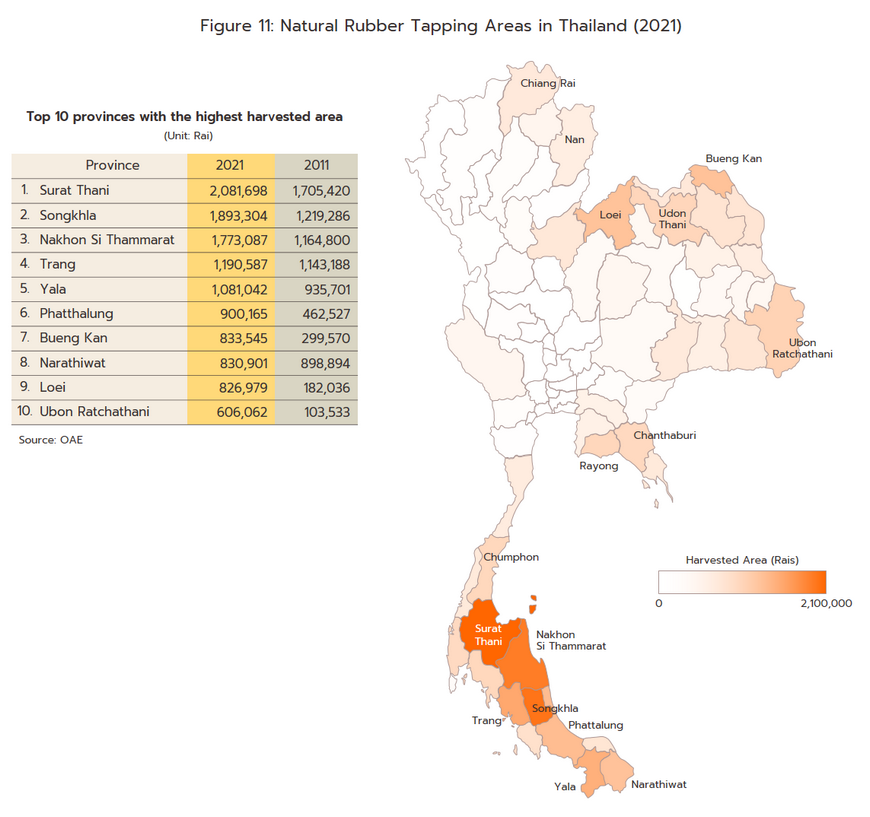

In Thailand, as of 2021, a total of 21.9 million rai was given over to rubber plantations (+6.6%), which then gave primary rubber outputs of 4.9 million tonnes (+3.3%). Growth in outputs was helped by: (i) the earlier expansion in plantations, with these trees now entering their most productive phase[10]; and (ii) high rubber prices that encouraged growers to maximize outputs from their harvested area. 58% of Thai rubber plantations are in the south of the country, though this has fallen from 76% a decade ago with the expansion of plantations in the northeast (these now account for 24% of the total) (Figure 11).

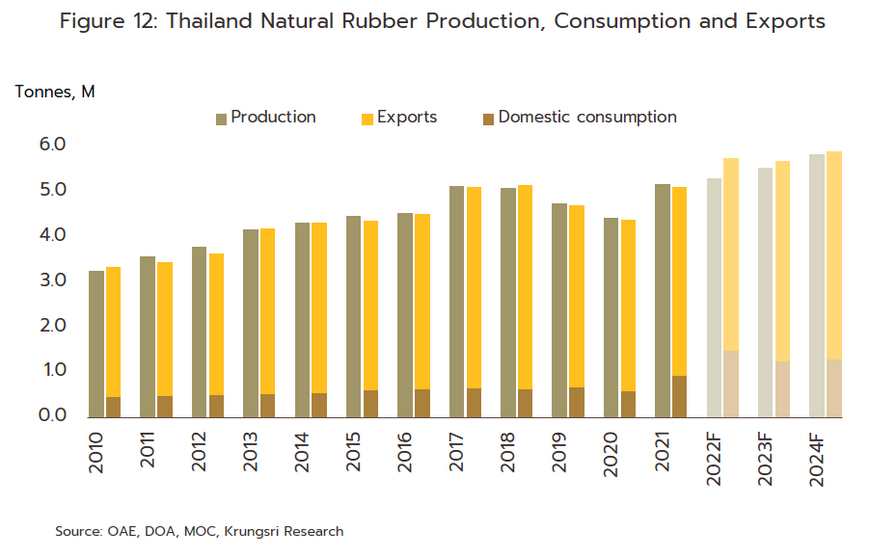

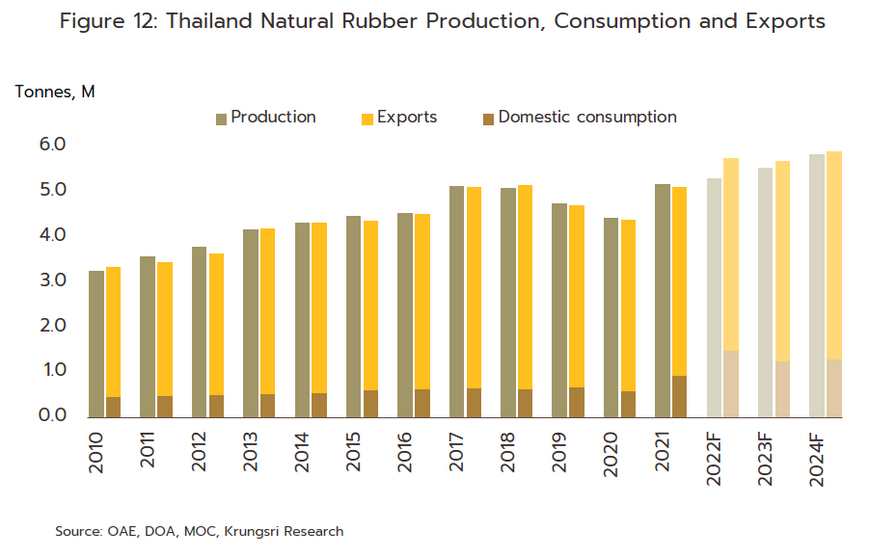

These outputs were then converted into 5.17 million tonnes of midstream products (Figure 12), output of which rose 17.0%. Increases were seen in all product categories, though these were most notable for sheet rubber (+26.6%), followed by concentrated latex (+19.3%), TSR (+17.0%), compound rubber (+11.8%) and other rubber goods 5%).

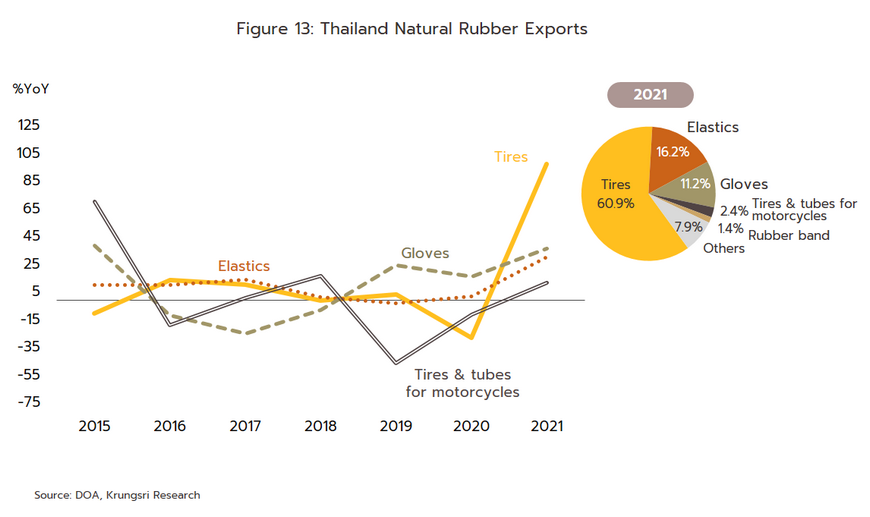

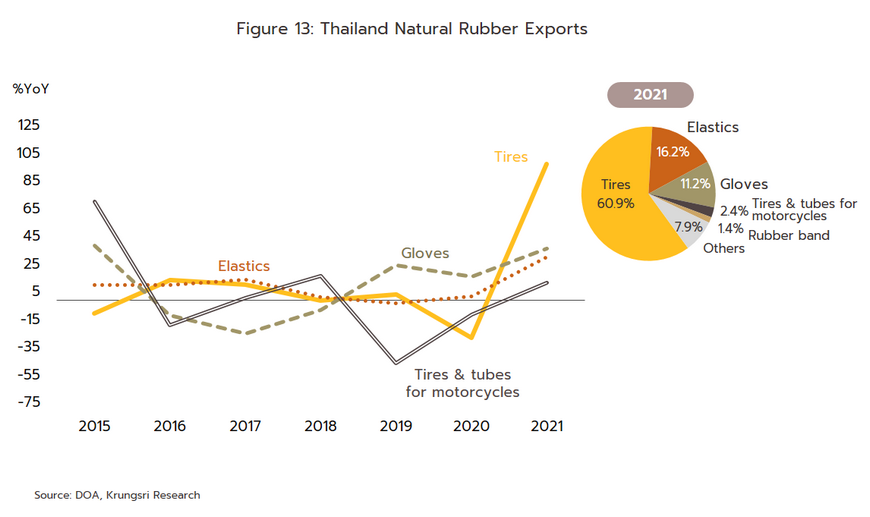

At the same time, domestic demand surged 59.2% to 0.93 million tonnes[11]. Demand strengthened in all product categories, rising to totals of 0.30 million tonnes for TSR (+31.8%), 0.27 million tonnes for concentrated latex (+22.1%), 0.23 million tonnes for compound rubber (+1,338.8%), 0.095 million tonnes for RSS (+8.7%), and 0.027 million tonnes for other rubber products (+2.8%). Growth was helped by: (i) stronger demand from downstream domestic industries, including auto and motorcycle tire manufacturers, for which output jumped by 98.1% and 12.6% respectively (due to the switch to greater use of private vehicles as a way of maintaining social distance), manufacturers of elastics (+31.3%), and producers of latex gloves and other medical goods (+37.2%) (Figure 13); and (ii) policy that aimed to help absorb excess supply through an increase in purchases by government bodies.

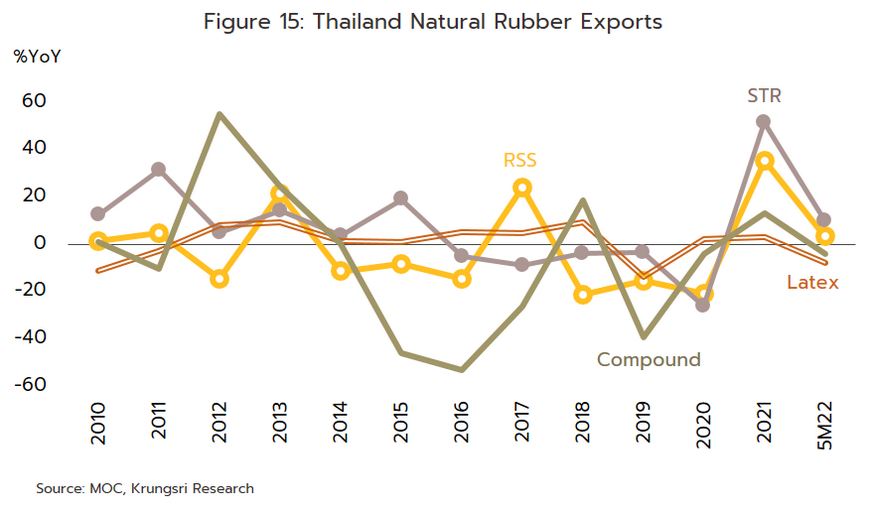

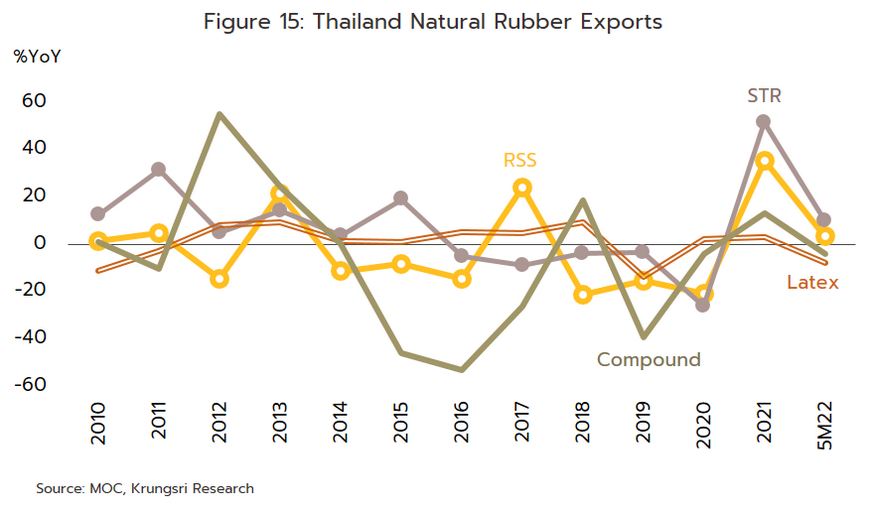

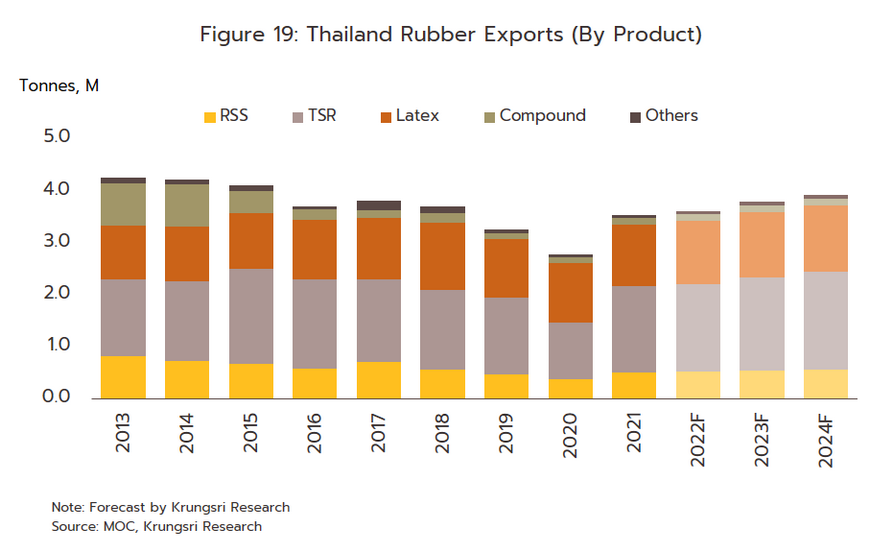

Thai exports of intermediate rubber goods jumped 27.7% to 3.5 million tonnes in 2021[12], which then generated receipts of USD 5.9 billion (+57.4%). Improving conditions were seen in almost all export markets, with strong growth supported by several factors. (i) Demand strengthened in downstream industrial markets, including that coming from overseas producers of autos, tires, latex gloves, and medical devices. (ii) China and Japan both engaged in extensive restocking following the drop off in stock levels in 2020 (Figure 14). Thus, at the end of 2020, stocks of rubber available on the Shanghai Futures Exchange stood at just 0.17 million tonnes (down from an average of 0.24-0.32 million tonnes over 2015-2019) and in response, imports from China increased 33.5% to 0.23 million tonnes in December 2021. Likewise, Japanese imports increased to 9.2 thousand tonnes from 5.6 thousand tonnes in December 2020 (+63.7%). (iii) Production in Indonesia, Malaysia and Vietnam, which are competitors of Thailand, suffered under outbreaks of leaf fall disease. However, headwinds also blew against the Thai rubber industry, including a global shortage of shipping containers, delays on international shipping routes, elevated freight charges, and problems in the auto industry resulting from the COVID-19 pandemic and accompanying chip shortages that then weighed on production and ate into demand for rubber for use in auto parts and tires. Details for the various product categories and how their export markets fared over 2021 are given below (Figure 15).

-

RSS: Exports totaled 0.51 million tonnes (+35.6%), generating receipts of USD 1.09 billion (+68.4%). Export figures were helped by the need to rebuild stocks and to secure raw material supplies following the steep rundown in these, especially for use in tire manufacture in China, and by the low baseline set in 2020. Exports to China thus jumped 136.3%, while exports from Thailand to other major markets also did well, including those to Japan (+18.7%), the US (+24.1%), Brazil (+31.0%), and Spain (+22.5%). Export prices also strengthened, rising to USD 2,147.1/tonne (+24.3%).

-

TSR: In the year, exports came to 1.66 million tonnes (+51.8%), which then brought in USD 2.85 billion (+84.1%). The segment was boosted by companies looking to build stocks of rubber especially for use in the production of tires. China remained the biggest market, absorbing 0.71 million tonnes of TSR (up 35.7%), followed by the US (+63.7%), South Korea (+65.7%), Japan (+48.8%), and India (+158.0%). Export prices rose over 2021, increasing 21.3% to USD 1,720.9/tonne.

-

Concentrated latex: Exports edged up 3.4% to 1.19 million tonnes in 2021, though the income from these sales rose at the faster rate of 22.6% to USD 1.56 billion. Sales to the main market of Malaysia slipped -0.8% to 0.57 million tonnes due to the imposition of a lockdown in the country and the move to restrict industrial activity to 60% of capacity, which then cut demand for concentrated latex for further processing. However, this was offset by gains in smaller markets. China increased its imports by 2.5% to 0.39 million tonnes, while sales to Brazil jumped 80.1% to 18,000 tonnes. Alongside this, 2021 export prices climbed 18.6% to USD 1,316.7/tonne.

-

Compound rubber: Exports totaled 0.12 million tonnes which brought in USD 341.6 million, increasing by 13.3% and 39.9% respectively. Overall sales were boosted by an increase in exports to the US (+63.8%) and Australia (+141.0%), which helped to compensate for a -14.2% decline in sales into China that was caused by a combination of an increase in investment in domestic production and the only incomplete recovery in some downstream industries. Across the year, export prices averaged USD 2,860.6/tonne (+23.5%), rising with the higher cost of synthetic rubber, chemical inputs, and factice[13], which is used in the production of compound rubber and for which prices rose with the 63.2% increase in the cost of oil[14].

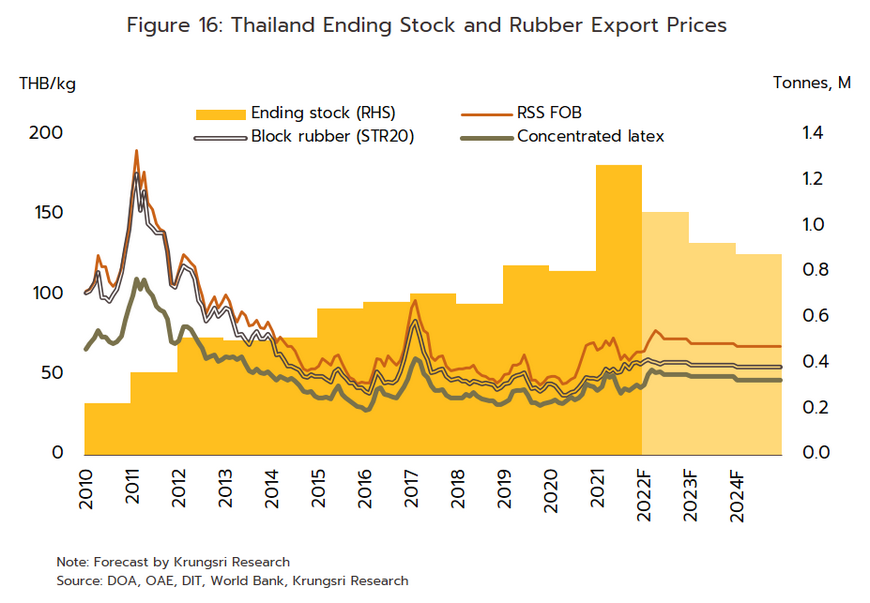

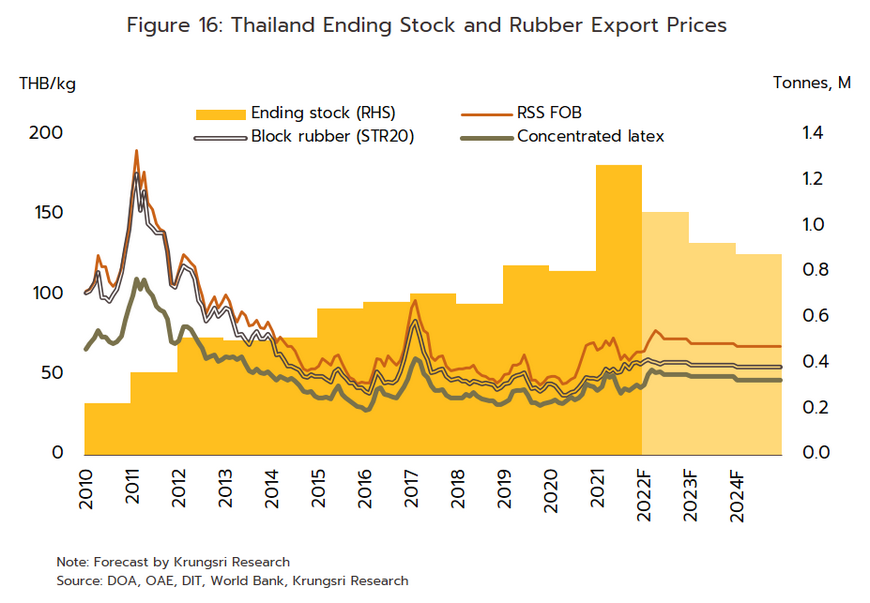

Prices for intermediate processed rubber products rose on both domestic and international markets. Domestic prices for grade 3 unsmoked sheet averaged THB 52.7/kilogram, a rise of 22.7% that tracked the 28.7% rise in RSS export prices to THB 67.7/kilogram. Prices for STR and concentrated latex also rose by respectively 25.4% and 20.8% to THB 54.1/kilogram and THB 41.5/kilogram, thereby mirroring global price movements for TSR 20, which climbed 26.2% to USD 1.68/kilogram (Figure 16). Prices were boosted by recovery in the global economy that then lifted demand in downstream industries and by the decline in world stocks. In addition, the high price of crude oil and shortages of natural gas and coal, especially in the EU and China, fed into elevated prices for synthetic rubber (an alternative to natural products) and as downstream processors switched to natural rubber, prices for this rose.

Over 6M22, the Thai rubber industry continued to grow. On the supply side, the industry benefited from tight global production caused principally by ongoing labor shortages and outbreaks of leaf fall disease in Indonesia and Malaysia, and on the demand side from rising consumption by downstream industries in Thailand and internationally.

-

Domestic outputs are continuing to expand, Total outputs of Thai intermediate rubber products rose by 8.2% YoY to 2.51 million tonnes. Increases were seen in almost all product categories, though these were most notable for TSR (+12.8%), followed by concentrated latex (+6.2%), compound rubber (+4.3%) and other rubber goods (+19.5%), while the sheet rubber slight reduced -0.2%.

-

The volume of intermediate rubber goods distributed to the market edged up by another 20.8%, largely thanks to the better performance of export markets.

-

Exports expanded 5.0% YoY to 1.8 million tonnes, with exports of TSR increasing by 10.8% YoY to 0.84 million tonnes. However, overseas sales of sheet rubber and concentrated latex and compound rubber slipped by -0.4% YoY, -0.8% YoY and -1.8% YoY to respectively 0.24 million tonnes, 0.59 million tonnes and 0.057 million tonnes. Markets that saw growth in the period included South Korea, the EU (France, Slovenia, Spain, and Romania), the US, Indonesia, and Turkey. Exports benefited from the switch by these countries to importing natural rubber to replace synthetic products, for which prices have risen with the impact on global crude oil prices of the war in Ukraine. However, China, Malaysia and Japan, which are important export markets for Thailand, cut their imports and instead turned to domestic stocks of rubber that had been built up during 2021. In addition, sales to China suffered under ongoing manufacturing supply chain disruptions (e.g., chip shortages in the auto industry) caused by the country’s pursuit of its zero-COVID policy and the periodic reimposition of strict lockdowns.

-

The domestic market performed very well in the period, and data from the Rubber Division at the Department of Agriculture show that in the first half of the year, the volume of intermediate rubber goods (i.e., RSS, TSR, concentrated latex, and compound rubber) consumed in Thailand surged 97.7% to 0.62 million tonnes. Sales totaled 0.07 million tonnes for sheet rubber (+78.5% YoY), 0.18 million tonnes for TSR (+17.5% YoY), 0.14 million tonnes for concentrated latex (+29.8% YoY), 0.17 million tonnes for compound rubber (+98,082.7% YoY), and 0.057 million tonnes for other types of rubber (+375.5% YoY). In these segments, sales were lifted by increased demand for tires[15] for autos, trucks, and buses.

-

Average domestic rubber prices climbed through 6M22. Thus, prices for grade 3 unsmoked rubber rose 7.2% YoY to THB 59.2/kilogram, mirroring the 14.5% YoY increase in the export price of TSR to THB 59.6/kilogram. Likewise prices for concentrated latex strengthened by 5.9% to THB 45.7/kilogram, thereby moving in line with changes in global prices for TSR 20, which increased 3.4% YoY to USD 1.71/kilogram. While the sheet rubber reduced -2.7% to THB 68.4/kilogram.

OUTLOOK

The rubber industry should continue to see positive business conditions through 2022.

-

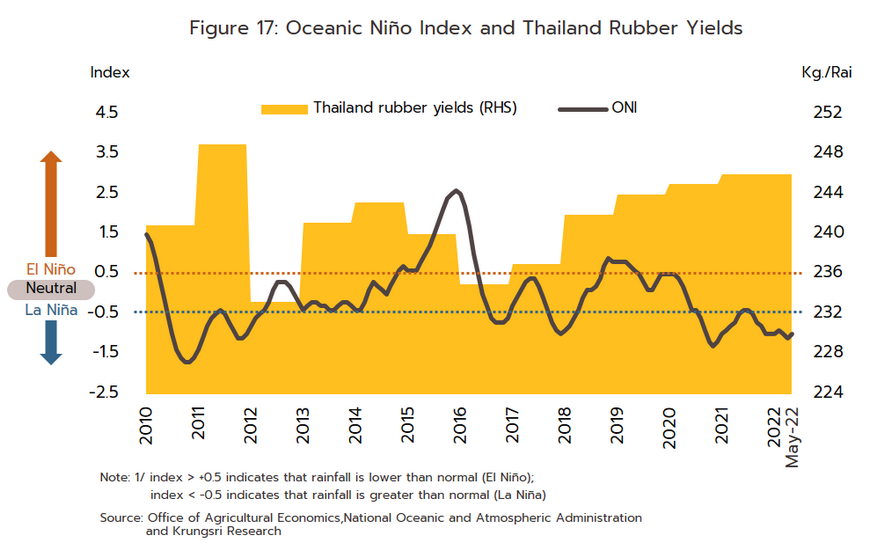

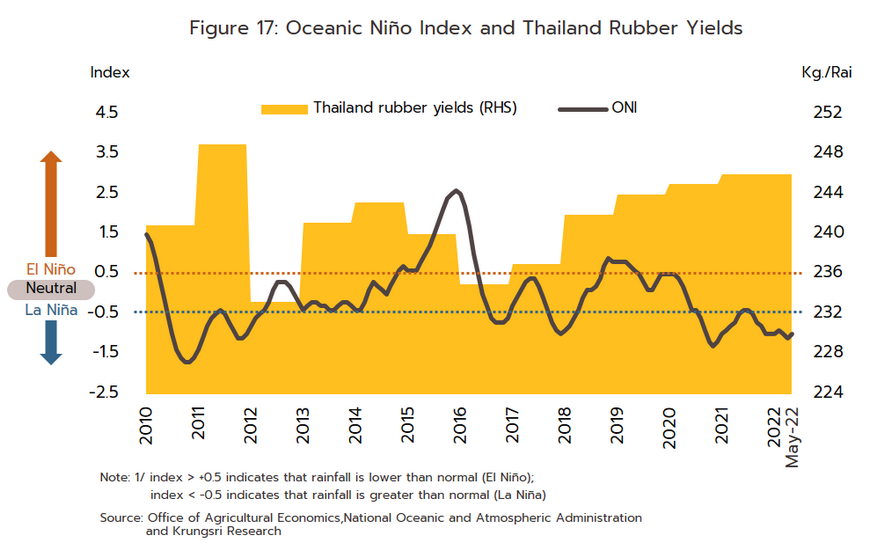

Upstream outputs are forecast to increase by 3%-4% to 5.3-5.4 million tonnes in the year, supported by: (i) the expansion in plantation sizes seen over 2003-2013[16] that are now maturing into their period of maximum yields[17]; (ii) climatic conditions that are expected to remain favorable[18], with rainfall in the south of Thailand benefiting from the influence of a La Niña that will last for 1-2 years (Figure 17); and (iii) the influence of high prices on farmers. However, the spread of leaf fall disease will mean that outputs will fall in some areas.

-

Distribution of rubber products is expected to rise by around 10%-12% for 2022. The domestic market should see growth of 40%-50%, supported by: (i) the switch by downstream processors to use more natural rubber in place of synthetic products, for which prices have risen due to the impact of the extended Russia-Ukraine war on the cost of crude; (ii) stronger demand for rubber for use in the manufacture of medical supplies, and with the continuation of the COVID-19 pandemic, demand is especially strong for latex gloves; and (iii) the government measures to stimulate the domestic consumption, e.g., the promotion of EVs that stays reliant on a high content of rubber in type and rubber parts, the expansion in domestic auto production, and an increase in the manufacture and production of rubber goods by government agencies. Export markets will also continue to expand, though at the slower rate of 2.0%-3.0%. Here, support will come from: (i) greater demand for natural rubber as a replacement for synthetic rubber; (ii) China’s relaxation of its COVID-19 controls, which is allowing industry, and most importantly tire manufacturers and EV auto assemblers, to return to work; and (iii) continuing problems with supply from Thailand’s competitors (i.e., Indonesia and Malaysia) due to labor shortages and outbreaks of leaf fall disease. However, headwinds will also blow against exports, most notably those originating from the drag on global economic growth caused by the prolonged war in Ukraine.

-

Prices for rubber will continue the run-up seen since 2021, but these will remain close to production costs. By the end of 2022, stocks are expected to have slipped to 1.1 million tonnes from 1.3 million tonnes a year earlier, and this will help to lift prices by an average of 5-7%, but despite this, domestic prices will likely remain not far off the cost of production (production and sale costs for unsmoked sheet will remain near THB 59-60/kilogram).

Over 2023-2024, the Thai rubber industry is expected to enjoy average annual growth of 4.5-5.5%[19], reflecting that of the industry globally, for which growth should average 4.0-5.0% per year. This outlook will be underpinned by: (i) the expansion in the total plantation area over 2003-2013, which now entering the period of maximum outputs; (ii) the increase in outputs that better weather will bring; (iii) the impact of strong prices (now at a 5-year high) on growers’ care of their plantations and attention to outputs; and (iv) government supports for rubber growers. Nevertheless, growth in domestic outputs may be threatened by outbreaks of disease, and especially by both older and new variants of leaf fall disease[20] and by the move by some farmers to replace rubber trees with durian and other crops when rubber prices were depressed.

-

For the following two years, domestic market should continue to expand, though at the slower annual rate of 0.5-2.0%, lifted by: (i) strengthening demand in downstream industries, in particular in auto and auto parts, tire, latex gloves and other medical supplies, and the EV industry[21], the latter thanks to government efforts to reduce the country’s dependency on imports; (ii) greater research and development of new higher value-added rubber products that will lead to an expansion in the range of rubber applications (in areas, e.g. agriculture, auto assembly, chemicals, beauty accessories, construction and packaging); (iii) greater consumption of rubber products by the public sector, thanks to an acceleration of work on public infrastructure products, especially phase 2 of the plan for the development of infrastructure in the EEC over 2023-2027; and (iv) government measures that aim to maintain price stability by soaking up some of the excess supply to the market through projects such as easing the release of credit to players in the rubber industry, increasing consumption of rubber products by government agencies, and supporting the issuing of loans for use as working capital for producers of dried rubber goods.

-

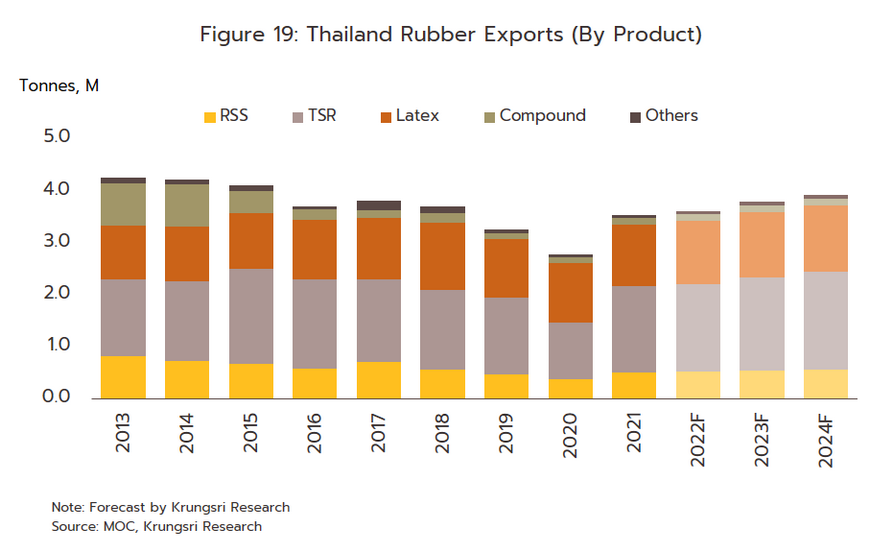

Exports are forecast to grow by 3.5-4.5% per year (global demand for intermediate rubber products is forecast to expand by an annual average of 3.0-4.0%) on: (i) growth in downstream industries, in particular auto assembly; (ii) stronger demand for medical devices, most importantly for latex gloves, and medical implements and devices made from rubber thanks to the aging of society; (iii) the continuing weakness in supply from competitors in Indonesia and Malaysia caused by infection with leaf fall disease; and (iv) the likely persistent high price of synthetic rubber, which will be caused by the prolongation of the war in Ukraine and the effects of this on crude prices, thus contributing to higher demand for natural rubber as a cheaper substitute. In light of this, export prices for RSS3 are expected to average THB 71-73/kilogram over 2023-2024 (global prices for TSR20 are expected to average USD 2.1-2.2/kilogram over 2022-2024, compared to USD 1.68/kilogram in 2021, source: World Bank). This compares to prices of THB 65.5/kilogram in 2021 and THB 72.7/kilogram in 2022. The outlook for individual segments is given below (Figure 19).

-

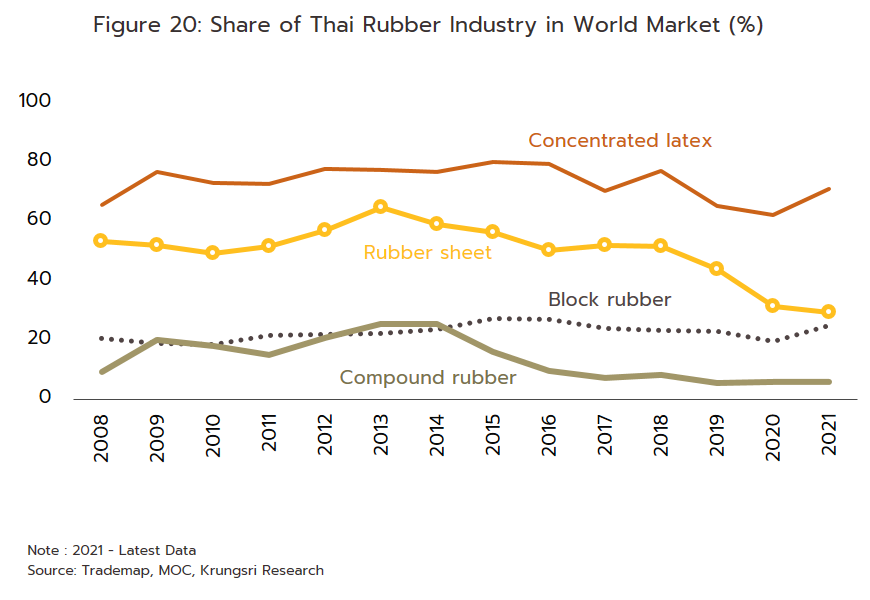

RSS: Exports are forecast to expand by 4.0-5.0% per year, helped both by the high quality and widespread recognition of Thai RSS and the effect of broader economic recovery on demand from downstream industries. However, growth rates will be constrained by the erosion of Thailand’s competitive advantages by players in Vietnam, Cambodia, Lao PDR, and Myanmar, and this will translate into a steady loss of market share (Figure 20). Growth will also be affected by the fall off in orders from China and Japan, where stocks have been previously rebuilt to ensure security of supply of inputs to the tire, hosing, and latex glove manufacturing industries.

-

TSR: Exports should increase by 5.0-6.0% annually with recovery in downstream industries, most notably in the auto, auto parts and tire industries. In addition, to meet environmental targets, production and use of EVs is going to increase sharply in many countries, including in Thailand’s main export market of China, and this will then likely feed stronger demand for TSR for use in the production of tires. Indeed, IHS Markit expects that global production of autos will increase by 9.0% in 2022 and by 10.0% in 2023.

-

Concentrated latex: Exports are expected to increase by 2.0-3.0% annually on the continuing improvement in the outlook for manufacturers of latex gloves and rubber medical devices. Demand for these remains strong thanks to their use when testing and treating COVID-19 and when administering vaccines. Thailand’s main market for concentrated latex is Malaysia, which is in addition the world’s most important producer of latex gloves. The Malaysian Rubber Glove Manufacturers Association (MARGMA) forecasts a 10% increase in global demand for latex gloves in 2022 and a further 15% rise in 2023 that will be driven by the continuing spread of the omicron and now BA.4 and BA.5 COVID-19 variants. On the flip side, Thai players will have to contend with increasing competition from players in Indonesia and Malaysia as supply from these countries returns to normal and exports increase.

-

Compound rubber: This segment can look forward to annual export growth of 2.0-3.0%. Sales will be boosted by stronger demand in the principal market of China for use in auto assembly, which has benefited from government support for greater output and use of EVs. This will then translate into greater demand for compound rubber for use in the production of tires and auto parts. Now that the government has relaxed its stringent lockdowns, additional demand will also come from the Chinese electronics, construction, transport, petroleum, and chemicals industries. However, investment is increasing in China’s own compound rubber industry, and this will place a cap on how fast exports from Thailand will grow.

At the same time, the Thai rubber industry will face a number of challenges. (i) Risk of Chinese players have increased their investments in rubber plantations in the CLMV nations and imports to China from these sources is now increasing at the expense of Thai producers. (ii) International shipments will continue to be affected by a global shortage of containers and high freight charges. (iii) The imposition of non-tariff barriers to trade may disrupt exports, especially international measures that aim to increase sustainability within the industry (e.g., the FSC and CBAM standards and carbon taxes).

[1] Crepe rubber is made by cleaning rubber cup lump and rubber scraps and then rolling this into sheets that are dried through exposure to the sun or by using hot-air dryers. This is then generally used to produce brown crepe rubber. This form of processing has become more popular among growers in the north and north-east of Thailand, areas that are relatively new to rubber growing but that have been increasingly important suppliers of the market.

[2] Rubber farmers may sell either to middlemen or directly to midstream processors.

[3] Precursors used in the manufacture of synthetic rubber include butadiene, which is produced from oil. Important types of synthetic rubber include styrene butadiene rubber (SBR), butadiene rubber (BR), ethylene propylene-diene rubber (EPDM), nitrile butadiene rubber (NBR), chloroprene rubber (CR), isoprene rubber (IR), isobutylene isoprene rubber (IIR), and styrene block copolymer (SBC).

[4] This includes sheet rubber, block rubber or TSR, concentrated latex, and compound rubber and is calculated from the value of domestic consumption and exports.

[5] Source: Rubber Research Institute, Department of Agriculture

[6] The standards for Thai TSR produced from. field latex are: (i) STR XL, which contains no more than 0.02% impurities and has a color of not more than 4 degrees Lovibond; (ii) STR 5L, which contains no more than 0.04% impurities and has a color of not more than 6 degrees Lovibond; and (iii) STR 5, which also contains no more than 0.04% impurities but which may be of any color and so may be used in any high-quality product that is not highly colored.

[7] The standards for Thai TSR that is manufactured from dried rubber specify grades according to the dirt content, the initial plasticity (Po), the plasticity retention index (PRI), the volatile matter content, and the nitrogen content. (i) STR 20 should have dirt content no greater than 0.16% and Po and PRI values of no more than 30 and 40, respectively. (ii) STR 10 should have a dirt content no higher than 0.08% and Po and PRI values that are no higher than 30 and 50 each. Material graded as STR 10 is thus of higher quality than that marked as STR 20. In addition, there is also STR 10 CV and STR 20 CV, with the CV standing for ‘constant viscosity’. This type of rubber has been modified through the addition of chemicals that control the rubber’s viscosity, thus making it easier and less energy intensive to cut, mix, and heat (source: Rubber Research Institute, Department of Agriculture).

[8] Thailand, Indonesia and Vietnam consume only around 15-20% of their rubber output domestically (average for 2016-2021), and as such, a supply glut has steadily built up on export markets (source: Trademap, OAE, DOA, and Krungsri Research).

[9] Affected areas typically see a 30-50% drop off in outputs relative to pre-infection totals.

[10] This is a result of government schemes that ran over 2003-2013 that had the goal of increasing rubber plantations by 1 million rai. The scheme ran three times: 1 million rai were added over 2003-2006, a further 1 million rai were added over 2007-2010, and 800,000 rai were added over 2011-2013. Generally, rubber trees begin to become productive when they are 7-8 years old, before being taken out of production when they are around 25 (source: Department Of Agriculture).

[11] Calculated from the dry rubber content (DRC) only and does not include liquids or other solids.

[12] As per confirmed weight at customs check points. Calculated by the DRC, the total weight came to 4.2 million tonnes. For concentrated latex, the DRC averages 60% of the total weight, while for compound and mixed rubber, the DRC is 80%-95% of the total.

[13] Factice is an unsaturated vegetable oil or animal fat that is mixed with rubber to help additives and chemicals disperse more evenly, to control the thickness and coverage of extruded products (i.e., their calendaring), to reduce imperfections (i.e., calendar grain), to prevent shrinkage, to reduce blooms on the surface of rubber products from oil and sulfur, and to reduce die swell.

[14] Prices for Dubai crude, which averaged USD 68.8/bbl over 2021 (+63.2%).

[15] Regular tires that are fitted to motorcycles, cars, trucks and commercial vehicles.

[16] The program to expand rubber plantations by 1 million rai ran from 2003 to 2013.

[17] Typically, rubber trees begin to produce their greatest yields after 7 years.

[18] Data from NOAA (National Oceanic and Atmospheric Administration) for the past 60 years show that strong El Niños and La Niñas occur approximately every 12-15 years. The last strong La Niña was recorded in 2010-2011, while the last strong El Niño was seen in 2015-2016. In 2021, slightly heavier than normal rainfall coincided with a weak La Niña, though this had only limited effects on rubber plantations.

[19] This is on the assumption that there is no wide scale reduction in the number of rubber trees and that no concerted and coordinated efforts are made by Asian producers to reduce supply to the market.

[20] in 2021, leaf fall disease was reported in almost 70 provinces across Thailand and over 1 million rai of rubber plantations were affected by this, and unfortunately the spread of the disease is widening. In affected areas, outputs typically drop by 20-50% and growth of affected trees is halted. Currently, Thai plantations are being infected by Pestalotiopsis sp. and Colletotrichum sp., which can be spread by air or rain, or by the movement of infected plants or soil.

[21] Government promotion of EV production includes increasing duties on internal combustion engine-powered vehicles, zero emission schemes, encouragement of the use of EVs, and expansion in EV production facilities.

.webp.aspx)