EXECUTIVE SUMMARY

Domestic rice outputs are likely to dip slightly over 2023-2025 due to the likely emergence of El Niño conditions and a resulting decline in the volume of rain and the availability of irrigation water. Outputs will also be hurt by high operating costs, despite ongoing government support for the agricultural sector. However, domestic demand is expected to rise over the next few years on stronger demand from restaurants, hotels, and the food industry as well as downstream industrial consumers, most obviously food processors. Exports are also forecast to expand on a combination of rising purchasing power in overseas markets and continuing worries over food security due to the extension of the war in Ukraine. This combination of tightening supply and strengthening demand on domestic and export markets will lift prices for Thai rice, but the effect of this will be to expose exporters to intensified competition for market share, especially from Indian and Vietnamese products since on cost, Thai goods will be at a relative disadvantage to these.

Krungsri Research view

The rice industry will face more challenging conditions over 2023 to 2025, largely as a result of an expected decline in rainfall that will then result in lower outputs. Although prices will tend to rise, elevated production costs and more intense competition will weigh on profitability across the rice supply chain. This will affect all parts of the industry, from farmers through mills and silo operators to retailers, but SMEs will be especially exposed to risk.

-

Farmers: Lower rainfall and reduced access to irrigation services will drag on outputs, while labor, energy and fertilizer costs will all remain elevated. Growers also occupy a weak position within the market, especially when negotiating prices with middlemen and traders, and this will put downward pressure on profitability. However, this will be somewhat offset by central government help for the industry, and income will be underpinned by measures that aim to stabilize prices.

-

Mills: Declining outputs will compound preexisting problems with the excess supply of milling capacity. This will be a particular problem for smaller operators, which will lose out to mid-sized and large players since the latter enjoy a stronger negotiating position when securing inputs, and this will then mean that small players will have to shoulder higher overheads. The most competitive players will therefore be large integrated operations and mid-sized mills that are able to control costs most effectively.

-

Producers of packaged rice: Income will tend to increase gradually in this segment, especially for large players that run integrated operations and that control supply chains from milling through to exports. The segment will be helped by the fading of the COVID-19 pandemic and subsequent growth in demand from the household, restaurant and tourism markets. However, the entry of new players to the market is increasing competition on price, while business costs are also rising, for example for marketing and paying for retail space in modern trade outlets.

-

Traditional rice retailers: Against a backdrop of increasing competition from packaged rice and its advantages with regard to price, convenience and shelf-life, traditional rice sellers may lose out to modern trade outlets. Income and profits will thus come under greater pressure as they fight against ever-stiffening competition.

-

Exporters: Strengthening demand in overseas markets will drive ongoing growth in exports. Although the higher cost of Thai products will continue to work against demand, exporters will try to build competitiveness by narrowing the gap between the price of Thai rice and that of the alternatives. Thus, although receipts will tend to increase through the coming period, profits are likely to remain flat.

-

Silos: Income from silo operators will come under pressure from lower outputs which cause reduction in demand for storage, and this will then add to competition within the industry. At the same time, silo customers are at a relative advantage compared to silo operators and this will restrict the ability of the latter to generate profits. Some players may thus be forced to cease trading, despite finding alternative markets for their storage space.

Overview

Rice has long been Thailand’s major agricultural export, with its cultivation accounting for 43.7% of all Thai farmland1/, and 5.1 million households (or 63.6% of those in the agricultural sector2/) are involved in its cultivation. Rice farmers have thus naturally long been the recipients of government aid. This has included price policies, such as price guarantees, rice-pledging schemes, and a mix of other programs that include financial assistance with planting and harvesting costs and help with the development of new rice varieties.

Thailand is a globally important producer and exporter of rice, and in the 2021/2022 growing season, Thai outputs were sufficient to place the country 6th in the world rankings of raw production; by volume, Thai-grown rice accounted for 4.0% of global outputs, coming after China (29.0% of total output), India (25.2%), Bangladesh (7.0%), Indonesia (6.7%), and Vietnam (5.2%). Considering just exports though, Thailand ranked 2nd globally, having a 13.5% share of the global market after India, which accounted for 38.8% of the total. Other competitors that Thailand faces in global markets include Vietnam, Pakistan, Myanmar, and China (Figure 1). However, because rice is overwhelmingly grown for domestic consumption and to ensure domestic food security, only 11.1% of global outputs ends up on world markets (Figure 2), with exports coming from any surplus that is available after domestic markets have had their share. The result of this is that global supply and demand may be somewhat turbulent, with imports mostly being made by countries in Africa, the Middle East, and Asia (Figure 3).

During the 2021/2022 growing season3/, rice cultivation covered 72.56 million rai of farmland clustered in the northeastern, lower northern and central parts of the country (Figure 4). Generally, Thai rice is rainfed and so the major growing season begins in May-July (the start of the rainy season) and the crop is then harvested towards the end of the year (usually in October). This is ‘seasonal’ or ‘on-season’ or ‘Major’4/ rice. During the main growing season, regular white rice, Thai jasmine rice and glutinous rice are all grown. 81% of the national output is produced during this period, with the remaining 19% coming from ‘off-season’ or ‘Second’4/ rice grown during the dry season. The latter is dependent on artificial irrigation5/ and this restricts cultivation largely to the central and northern regions 6/.

Over the last 10 years, annual outputs of rice paddy have averaged 31-33 million tonnes, which after processing produces 20-22 million tonnes of milled rice. The domestic market absorbs around 10-12 million tonnes of this, with the balance either being exported or used to build stocks. This total is split between the following:

1) Direct consumption accounts for around 30% of Thailand’s paddy outputs7/. At present, rice is distributed to consumers through three main channels.

1.1) 43.1% of rice distributed to Thai consumers is sold pre-packed in bags, demand for which has been strengthening for some years with shifting consumption patterns and rising rates of urbanization. In response to this, an increasing number of players have entered the market8/, especially mills and exporters that have turned to the domestic market as a way of reducing exposure to risks arising from uncertainty over fluctuating export income. Players in the modern trade sector, including Ek-Chai Distribution System (selling under the Tesco brand) and Siam Macro (selling under the Aro brand), have also entered the pre-packed rice segment through the sale of house brands9/ (Table 1). These operators have been able to steadily expand their market share through their ability to deploy advantageous pricing strategies and the advantages that they have with regard to distribution; typically, gaining access to shelf space in a modern retail outlet for pre-packed rice entails paying a fee, which operators naturally exempt themselves from, while their advertising costs are also lower. Hypermarkets are the most important channel through which pre-packaged rice is distributed (27.3% of all rice distributed directly to consumers for consumption), followed by convenience stores (9.4%) and supermarkets (6.4%).

1.2) Rice is also sold in small local grocers and specialty shops10/. These shops remain the main distribution channel up-country, and they account for respectively 40.5% and 14.5% of domestic sales of rice to consumers.

1.3) Distribution through non-grocery and e-commerce operations accounts for another 1.9% of sales.

2) About 25% of Thailand’s paddy output7/ is used as an input into downstream processing This 25% is split between: (i) 15% that goes to rice processing industries, including producers of standard rice flour, glutinous rice flour, instant rice porridge, rice noodles, rice-based snacks, alcoholic drinks, and rice bran oil; and (ii) 10% that is used in the production of animal feed (most of which is for livestock, e.g., pigs, chickens, and ducks).

3) Rice saved as seeds for the next planting is taken from harvests made across the country, and this accounts for a further 5% of Thailand’s paddy outputs7/. The quantity of seed that is required varies with the type of rice being planted, and whereas organic rice requires around 16 kg/rai, for Jasmine rice, white rice, and specialty rice, the figure rises to 25 kg/rai.

4) Exports soak up the remaining 40% of Thailand’s paddy outputs7/ (Figure 5).

By volume, 2022 export markets consumed 40.1% of Thailand’s paddy outputs. Because Thai rice is recognized globally for its high quality, it remains in demand in a large number of countries, though the most important export markets are Iraq, South Africa, China, the United States, Benin, and Japan. A wide range of rice products are exported from Thailand, but the main export categories are in order, white rice, parboiled rice11/, jasmine rice, broken rice12/, glutinous rice and brown rice (Figure 5). Individual segments of the export market are described below.

-

White rice: Globally, this is the most widely traded type of rice. Thai exports totaled 3.86 million tonnes of milled rice in 2022, or 50.2% of all overseas sales of Thailand-grown rice, with the main markets in Asia and Africa. Iraq was Thailand’s most important purchaser of white rice in the year, taking 41.4% of white rice exports, followed by China (7.9%), Japan (7.8%), Angola (5.1%), the Philippines (4.7%), and Mozambique (4.5%). White rice is graded according to the proportion of broken rice that it contains, cheaper varieties containing a higher proportion of this13/.

-

Parboiled rice: Thailand exported 1.51 million tonnes of parboiled rice, and so this accounted for 19.6% of all Thailand’s rice exports. Export markets are concentrated in Africa, with the most important of these being South Africa (48.4% of all exports of parboiled rice), followed by Benin (18.5%), Yemen (7.6%), Bangladesh (5.4%), and Cameroon (4.6%).

-

Jasmine rice: 16.3% of all Thailand’s rice exports were of jasmine rice (or 1.25 million tonnes of milled jasmine rice). The US was the biggest buyer, taking 36.0% of all exports of jasmine rice by volume, followed by China (11.1%), Hong Kong (10.4%), Canada (7.5%), and Singapore (4.0%).

-

Broken rice: Thailand exported 0.80 million tonnes of broken rice, which comprised 10.5% of all Thailand’s rice exports. The largest buyers were Senegal (28.8% of Thai exports of broken rice), China (28.6%), Indonesia (6.9%), and Papua New Guinea (5.2%). Broken rice is generally used to produce rice flour and animal feed.

-

Glutinous rice: Only 2.2% of all Thailand’s rice exports were of glutinous rice (these totaled 0.17 million tonnes of milled glutinous rice). The main buyers for this were in China (42.9%), Lao PDR (11.8%), the US (10.8%), and Vietnam (6.4%).

-

Brown and other types of rice14/: This was the smallest category of exports and with total 2022 sales of just 0.09 million tonnes, it comprised only 1.2% of the total. The most important markets were South Korea (56.7%), the US (10.9%), New Caledonia (6.0%), and Singapore (4.9%).

Situation

Through 2022, the Thai rice industry enjoyed growth with regard to both outputs and sales into domestic and overseas markets (Figure 6). This was a result of a wide range of factors, including: favorable climatic conditions; government support for farmers; the relaxation of pandemic controls; stimulus measures targeting the tourism industry and domestic consumption more broadly; the easing of congestion on shipping routes, greater access to containers and a fall in freight rates; the outbreak of war between Russia and Ukraine, which then stoked fears over food security and encouraged the stockpiling of food; and the fact that export prices for both Thailand’s and competitors’ rice rose to a similar level.

-

Outputs climbed 3.9% in 2022 to a total of 33.0 million tonnes of paddy/unmilled rice or 21.4 million tonnes of milled rice. This was a consequence of two main factors. (i) In the year, data from the Office of Agricultural Economics show that the total planted area increased 2.5% to 72.6 million rai. This was itself the result of a combination of government income guarantee schemes and rising fears over food security that then affected global markets and pushed up prices. Farmers responded to these incentives by increasing the area under cultivation, and the data show that the number of families engaged in rice farming climbed 1.4% to 5.1 million15/. (ii) La Niña conditions persisted through the year, keeping rainfall high and creating generally more favorable conditions, which then lifted per-unit yields 1.9% to 472.6 kilograms/rai.

-

Domestic demand edged up 3.5% to 11.5 million tonnes of milled rice in 2022. This was due to: (i) the easing of the COVID-19 pandemic; (ii) the relaxation of government pandemic controls; (iii) the introduction of measures to stimulate domestic tourism and the reopening of the country to international arrivals, which then helped restaurants return to eat-in dining; and (iv) broader economic recovery that lifted purchases of rice by food processors and other downstream industries. As a result, demand rose across a broad front, from the retail market, through modern trade sales to online distribution, boosting sales with regard to both volume and value. Given this, domestic rice prices climbed by an average of 8.3% in 2022, though the aggregate figure masks significant variations between different product categories. Thus, prices for white and jasmine rice rose by respectively 5.2% (to THB 8,765/tonne) and 19.9% (to THB 12,850/tonne), but due to a strong increase in outputs, prices for glutinous rice contracted -3.3% to THB 9,228/tonne (Figure 7).

- Exports strengthened in 2022, rising 22.2% by volume to 7.7 million tonnes of milled rice and 14.7% by value to THB 4.0 billion. Overseas markets were boosted by: (i) increased worries over food security that were driven by Russia’s invasion of Ukraine; (ii) the diversion of demand to Thailand as supply from India and Vietnam (major suppliers to world markets) were disrupted by respectively a temporary halt on exports16/ and the impact of natural disasters on outputs (Figure 8); (iii) the impact of natural disasters on domestic production in China and the Philippines (major consumers of rice), which then forced these countries to switch to external supplies; and (iv) the easing of problems relating to a global shortage of shipping containers and bulk carriers, high shipping rates, and extended portside checks on shipments. Nevertheless, despite this generally positive environment, Thai exports remained expensive relative to products coming from Vietnam, India, Pakistan, and China (which distributed old stocks of rice) and this placed Thai exporters at a relative disadvantage (Figure 9).

Growth continued on both the demand and supply sides of the market through the first four months of 2023.

-

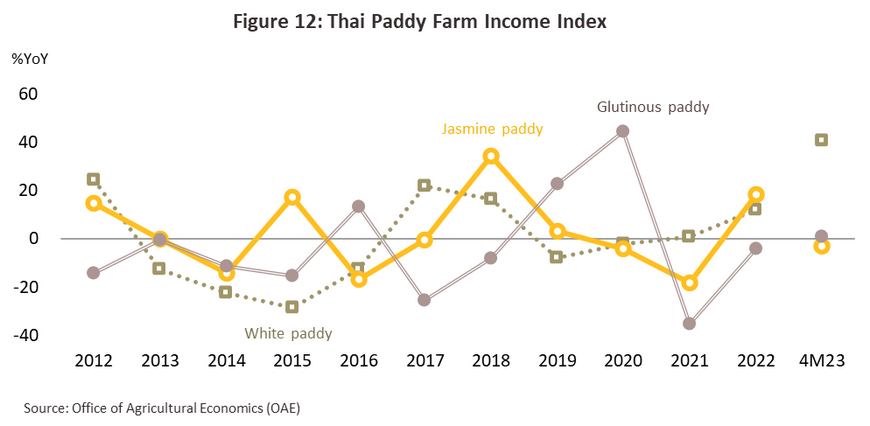

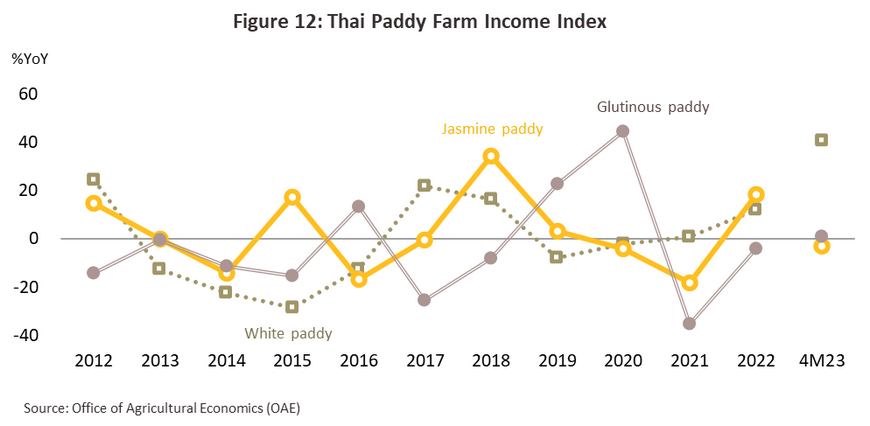

Outputs remained on an upward track through 4M23 thanks to favorable weather, ongoing access to water, and the incentive effect of government measures to stabilize rice prices. The Thai Paddy Production Index thus jumped 17.9% YoY in 4M23, largely due to a rise of 18.2% YoY in outputs of white paddy. The Thai Paddy Price Index also surged 18.6% YoY, with rises of 20.3% seen for white rice, 16.4% YoY for jasmine rice, and 18.5% YoY for glutinous rice. Given this, incomes for rice growers jumped 38.9% YoY but at the same time, the cost of energy, fertilizer, and labor all rose, and this then added to downward pressure on profits (Figures 10-12).

-

Exports also strengthened through 4M23. Demand for food stocks continued to be driven by worries over food security, the war in Ukraine and general uncertainty over the geopolitical situation, as well as by the easing of problems with international sea freight that have disrupted supply chains in many parts of the world. Thai rice exports thus increased 14.3% YoY to 2.6 million tonnes of milled rice in 4M23, generating receipts of USD 1.4 billion (+19.4%). In the period, Thailand’s main overseas markets were Iraq (17.9% of Thai rice exports by volume), Indonesia (11.4%), South Africa (9.1%), the US (8.7%), and China (5.0%) (Table 2). Sales were led by exports of white and parboiled rice since in these segments, Thai exporters benefit from the quality and standing of their products.

-

White rice: Exports totaled 1.5 million tonnes and brought in USD 699.0 million, representing rises of respectively 27.5% YoY and 39.4% YoY. Export prices averaged USD 485.4/tonne (+9.5% YoY) and the main markets for this were Iraq (the destination for 32.3% of all Thai exports of white rice), Indonesia (19.4%), Japan (8.1%), Cameroon (4.6%), and Mozambique (4.5%).

-

Parboiled rice: Exports jumped 42.8% YoY by volume to 0.5 million tonnes and 63.0% YoY by value to USD 208.2 million. In 4M23, export prices rose 16.6% YoY to an average of USD 466.5/tonne, with the main markets being South Africa (49.2% of 4M23 exports of parboiled rice), Bangladesh (25.5%), Benin (6.6%), Yemen (4.8%) and Russia (1.4%).

-

Jasmine rice: In 4M23, 0.4 million tonnes of jasmine rice were exported and this generated USD 352.1 million in receipts, though these figures represent declines of respectively -25.5% YoY and -15.5% YoY. Average export prices rose 13.5% YoY to USD 925.6/tonne, and the principal export markets were the US (47.2% of Thai jasmine rice exports), Hong Kong (10.3%), China (9.0%), Singapore (4.2%), and Canada (4.2%).

-

Broken rice: 0.3 million tonnes (+13.6% YoY) of broken rice were sold into overseas markets in 4M23 and this generated value worth USD 126.5 million (+27.9% YoY). In 4M23, export prices rose 11.7% YoY to an average of USD 469.2/tonne. The most important export market was Senegal (44.7% of exports), which was followed in importance by China (14.7%), Indonesia (7.0%), Côte d’Ivoire (5.3%), and Papua New Guinea (4.4%).

-

Glutinous rice: Exports slipped -19.8% YoY to 0.05 million tonnes, which then generated USD 32.4 million in receipts (-7.3% YoY). As with other product categories, export prices rose in the period, climbing 15.1% YoY to USD 724.5/tonne. Almost half of exports were made to China (47.1% of all overseas sales of glutinous rice in 4M23), which was followed in importance by the US (13.1%), Lao PDR (7.6%), Vietnam (5.5%), and Hong Kong (3.3%).

-

Brown rice and other rice products: Exports dropped -33.0% YoY by volume and -23.2% YoY by value to just 0.02 million tonnes and USD 17.6 million, respectively. Nevertheless, prices on overseas markets strengthened 3.8% YoY to an average of USD 926.0/tonne. In order of importance, Thailand’s major export markets during this period were South Korea (the destination for 47.4% of exports of these products), the US (11.1%), New Caledonia (7.6%), Poland (7.1%), and Singapore (5.7%).

Outlook

-

Outputs are expected to expand by another 3.0-3.5% in 2023 to a total of 34.0-34.2 million tonnes of paddy or 22.1-22.2 million tonnes of milled rice. Output will continue to be supported by the supply of irrigation water, high prices, and government aid to the industry, all of which will encourage farmers to expand the area under cultivation and/or increase the number of plantings. However, over 2024 and 2025, outputs are forecast to contract by between -1.5% and -2.0% to 32.0-32.5 million tonnes of paddy or 20.8-21.1 million tonnes of milled rice (Figure 13). This decline will be driven by: (i) the likely emergence of El Niño conditions in mid-2023, which will then persist for 1-2 years (Figure 14), reducing rainfall and increasing the risk of drought; and (ii) rising production costs, especially for fertilizer, which will then cause some farmers to cut back on applications and so reducing per unit yields. Nevertheless, government support for the rice industry, which extends to include income guarantee schemes, measures to maintain market stability, financial assistance with production costs, and plans to improve water management and irrigation17/, will incentivize some farmers to continue to expand production.

-

Domestic demand is forecast to edge up by 0.8-1.0% annually, bringing this from around 11.5 million tonnes in 2022 (2021/2022) to 11.7-11.9 million tonnes by 2025. Consumption will be lifted by the ending of the COVID-19 pandemic, the reopening of the country, and the rise in tourist arrivals, all of which will support stronger demand from restaurants, hotels, and downstream industries, especially from food processors.

-

Exports are expected to strengthen by 11.0-12.0% per year, rising from a total of 7.7 million tonnes in 2022 to 8.0-11.0 million tonnes annually. This outlook is supported by: (i) forecast economic growth in export markets over 2024 and 2025, in particular in the US and Asia; and (ii) continuing demand for food stocks that will be driven by worries over geopolitical tensions, most obviously the extended Ukraine-Russia war.

-

Export prices are also likely to trend upwards on: (i) worsening climatic conditions that will translate into a contraction in domestic outputs and tighter supply; and (ii) stronger economic performance in export markets that will feed increased demand for rice on world markets, which will occur alongside a decline in stock levels (Figure 15). Demand will be further boosted by the extension of the war in Ukraine and a continuation of worries over food security.

1/ 2021 data on the ratio of rice planted area to Thailand’s agricultural land use comes from the Office of Agricultural Economics.

2/ Data on the number of households planting on- and off-season rice in 2021/2022 is supplied by the Office of Agricultural Economics and the Ministry of Agriculture and Cooperatives.

3/ 2022 outputs are calculated from on- and off-season rice planted in 2021-2022.

4/ Seasonal rice is generally grown from strains that produce grain on a predictable timetable since these varieties use the day length to determine their growth, and as the days shorten (i.e., as the climate moves from the rainy season into winter), seasonal rice varieties will switch from vegetative growth to reproduction. These types of rice are thus classified as ‘photoperiod sensitive’, and in Thailand, favored varieties include Khao Dawk Mali 105, RD 15, RD 6, and Prachinburi 1. However, because of the time of year during which off-season rice is grown, day length is not an appropriate determinate of the growing cycle and so growers instead use rice that produces grain after a fixed period of time (generally 90-150 days) regardless of the planting season. Preferred varieties for off-season rice include Phitsanulok 2, Suphanburi 1, Pathumthani 1, and Chainat 1.

5/ The main irrigated areas in Thailand (accounting for 80-90% of all the country’s irrigated farmland) receive water from the Bhumibol and Sirikit dams, which are located in the Chao Phraya watershed.

6/ In the 6 south-eastern provinces of Nakhon Ratchasima, Phatthalung, Songkhla, Pattani, Yala, and Narathiwat, seasonal rice is grown from mid-June to the end of February in the following year. Off-season rice is thus grown from March to mid-June.

7/ Source: Comprehensive Rice Production and Marketing Action Plan, 2022/2023

8/ Over 100 brands are registered with the Thai Rice Packers Association. This does not include the considerable number of exporters, mills, modern trade operations, small-scale producers, community groups, agricultural cooperatives, individual farmers, and other operators that are not registered with the association but that are carrying out their own branding and promotion.

9/ House brands are products that are sold under the brand of the parent retailer. Generally, house brands are produced by outside manufacturers operating on contract for the retailer, and these products are then usually sold at a discount relative to national brands.

10/ ‘Specialty shops’ includes food, drink, and tobacco retailers (e.g., bakeries, sellers of fresh fruit, etc.)

11/ Parboiled rice is prepared by soaking paddy rice until it has a moisture level of 30-40%. The rice is then steamed or boiled until cooked, dehydrated and then milled to remove the husk. The parboiling process improves the quality of the milling, reduces the proportion of broken rice, and because the soaking pulls nutrients out of the bran and germ and into the grain, it also raises the final product’s nutritional value. Parboiling gives the rice a pale yellow color.

12/ Broken rice is rice that is damaged during processing and that has a length from 2.5 parts or more to 80% of full grains. Broken rice is mostly consumed by mixing with whole grains to make 25% white rice, though some is also used in downstream industries for the production of animal feed, flour, and beer.

13/ As per the 1997 Ministry of Commerce guidelines on rice quality, sample grades are as follows: (i) 100% white rice is the highest quality and Level 1 100% white rice contains no more than 4% broken rice; (ii) 5% white rice is 5-7% broken rice; and (iii) 25% white rice is 25-28% broken rice.

14/ Brown rice comprises the majority of this category, with the remainder consisting of other types of rice, including rice seed for planting.

15/ The combined total of families growing on- and/or off-season rice. Source: Office of Agricultural Economics.

16/ India halted exports of broken rice and imposed export duties on other products, including unmilled rice, brown rice, semi-milled rice, and 20% white rice (parboiled and basmati rice were exempted from these).

17/ On June 18, 2019, the cabinet approved the 20-year water resource management plan (for the years 2018-2037). This aims to solve long-running national problems with water management and to develop access to national water resources. The plan is being implemented primarily by the Office of National Water Resources, and has 6 main pillars: (i) managing water supplies for general use; (ii) providing security of supply to the agricultural production sector; (iii) managing floods and flood prevention; (iv) managing water quality and preserving water resources; (v) preserving and reviving degraded forests in watersheds and preventing soil loss; and; (vi) general management of water resources.

.webp.aspx)