EXECUTIVE SUMMARY

The palm oil industry has benefited from improving conditions through 2023. Supply has expanded on more favorable weather, especially in the South, the incentive effect of elevated prices on growers’ efforts to maximize production, and better timing of the harvest, which has then resulted in palm fruits having a higher oil content, and as a result overall yields have risen. Sales have also benefited from stronger domestic demand, the latter resulting from the reopening of the country, the return of the economy—and especially the restaurant industry—to normal, the rebound in the tourism sector, and the increase in the diesel mix from B5 to B7. However, exports have weakened, as Thai export prices are above global averages, exports to India and Malaysia have thus softened, with consumers there turning instead to a greater reliance on cheaper alternatives. Over 2024 to 2026, the supply of oil palm and palm oil will tend to contract as the effects of the current El Niño are felt on outputs, but domestic demand should continue to strengthen on post-pandemic growth in the economy and resulting higher demand from the food processing and oleochemicals industries, the rapid return of the tourism sector to normal, which will then stimulate greater demand from restaurants and food processors, and greater uptake of transport services, which will boost demand for biodiesel. Unfortunately, the outlook for exports will remain depressed as falling domestic outputs eat into the supply glut and prices remain above those of Thailand’s competitors. Given the combination of weaker outputs and stronger domestic demand, prices for both oil palm and palm oil are expected to edge up slightly.

Krungsri Research view

Overall, the palm oil industry has an improving business environment over 2024-2026. The domestic market will benefit from stronger demand from the food processing, oleochemicals, and biodiesel industries, and this will tend to lift incomes, but the impending drought will weigh on yields, and with supply tending to contract, the cost of fresh oil palm will likely rise. As such, some companies may see their profits come under pressure.

-

Palm growers: Income will tend to rise on a combination of steadily strengthening domestic demand and assistance from the government, which will ensure that the sale price of palm fruits stays above production costs. Nevertheless, farmers will be exposed to risk resulting from the rising cost of fertilizer and the coming drought, which will reduce yields per rai.

-

Crude palm oil mills: Turnover will be supported by the strength of the domestic market over 2024-2026. The reopening of the country, growth in tourist arrivals, and expansion in demand for commercial transport services will all boost income. Players will be further helped by government measures to support the industry and to raise energy standards, for example by using crude palm oil (CPO) to produce biodiesel and other higher value-added goods, and to promote an expansion in exports. Nevertheless, national milling capacity exceeds the quantity of palm oil supplied to the market and this leads to excess in production capacity. Furthermore, competition for inputs raised CPO production costs. As such, profitability may come under pressure and some producers may have to shoulder periodic stock losses. This will be a particular problem for small, independent operators that are not part of commercial networks integrated into downstream industries such as the production of refined palm oil, biodiesel, or oleochemicals1/, or of byproducts such as pure glycerin2/, phase change materials (PCMs)3/, or fatty alcohols4/. Income from exports will also tend to soften on lower outputs and the weakening contribution of major overseas markets to industry income.

-

Palm oil refiners: Refiners will continue to see their turnover grow at a healthy rate. Demand for CPO to convert into refined palm oil will expand by 3.0-4.0% annually on recovery in the tourism, hotel and restaurant businesses, which will then trigger greater demand for palm oil products from food processors. Demand from the oleochemical industry for CPO and palm fats (produced from the purification of palm oil) is also forecast to rise with improving sales of consumer goods manufactured by downstream industries (e.g., detergent, soap, medicine, and cosmetics).

-

Traders in crops used in the production of vegetable oil (oil palm collection yards): Income growth will slow because of the impact of the El Niño on outputs. Nevertheless, most palm plantations are small-scale operations that lack bargaining power, so they are dependent on sales to collection yards and traders, which occupy the dominant market position.

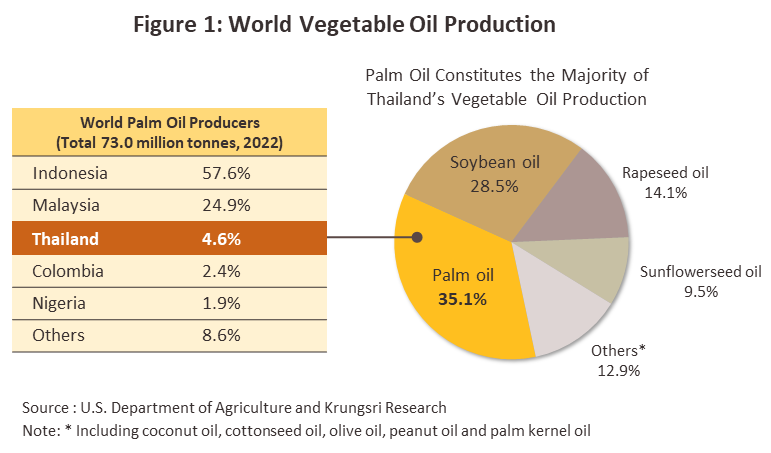

Overview

Palm oil5/ is the cheapest vegetable oil to produce, partly because it generates yields that are 6-10 times6/ higher than those of other oil crops such as soy, rapeseed, sunflower, coconut and olive. As of 2022, global production of palm oil totaled 73.0 million tonnes, while worldwide consumption came to the slightly lower total of 69.7 million tonnes, figures that represent respectively 35.1% and 34.4% of total global vegetable oil production and consumption. The ASEAN region is the principal palm oil producing area, and because they are the most important suppliers to world markets, Indonesia and Malaysia play a significant role in setting prices on global exchanges; in 2022, Indonesia produced some 42.0 million tonnes of CPO annually, while Malaysia contributed another 18.2 million tonnes to world markets and so combined, these accounted for 82.4% of global output. Naturally, these two countries are also the world’s major exporters, producing 86.2% of the CPO bound for international markets. In terms of imports, India is the single biggest market, taking 19.2% of world imports in 2022. India is followed in size by the European Union (12.0%), China (10.5%), and Pakistan (6.8%). Over the five years between 2018 and 2022, global demand for CPO for both direct consumption and for production of energy grew by an average of 1.7% per year, while output has risen at an annual rate of 0.9%. By the end of 2022, accumulated stocks of CPO stood at a total of 16.3 million tonnes (Figure 1 and Table 1).

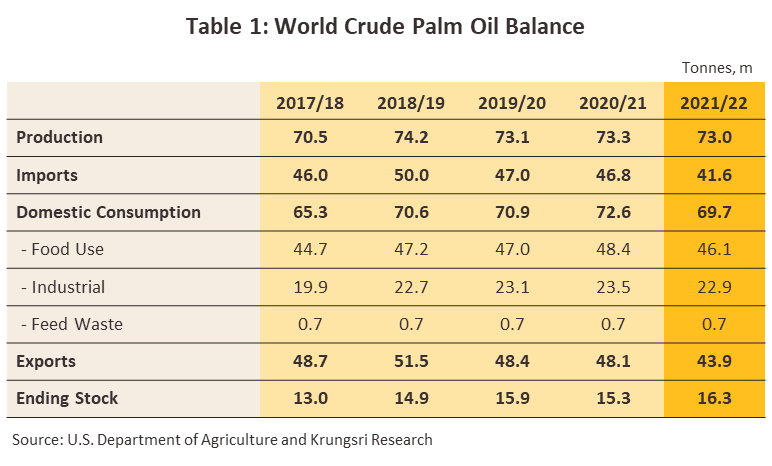

In 2022, although Thailand stood in third place in the world palm oil production rankings, its output came to only 4.6% of the global total and so, unlike Indonesia and Malaysia, Thai influence on global prices is only slight. The domestic industry is very geographically concentrated, and 85.9% of the total area covered by oil palm plantations is in the south of the country7/, clustered in particular in the provinces of Surat Thani, Krabi, and Chumphon, which together are home to some 57.3% of the country’s oil palm plantations. In order of importance, the remainder is found in the center, the northeast and the north of the country (Figure 2). Oil palm cultivation expanded in the decade from 2009-2018 as a consequence of the government’s strategy for developing renewable and alternative energy supplies, and so in 2022, The total harvested area of palm came to 6.2 million rai (+1.9%). In the same year, national output totaled 19.1 million tonnes of oil palm (+12.8%)8/, which was converted into 3.4 million tonnes of CPO (+13.9%) (source: The Office of Agricultural Economics, Department of Internal Trade).

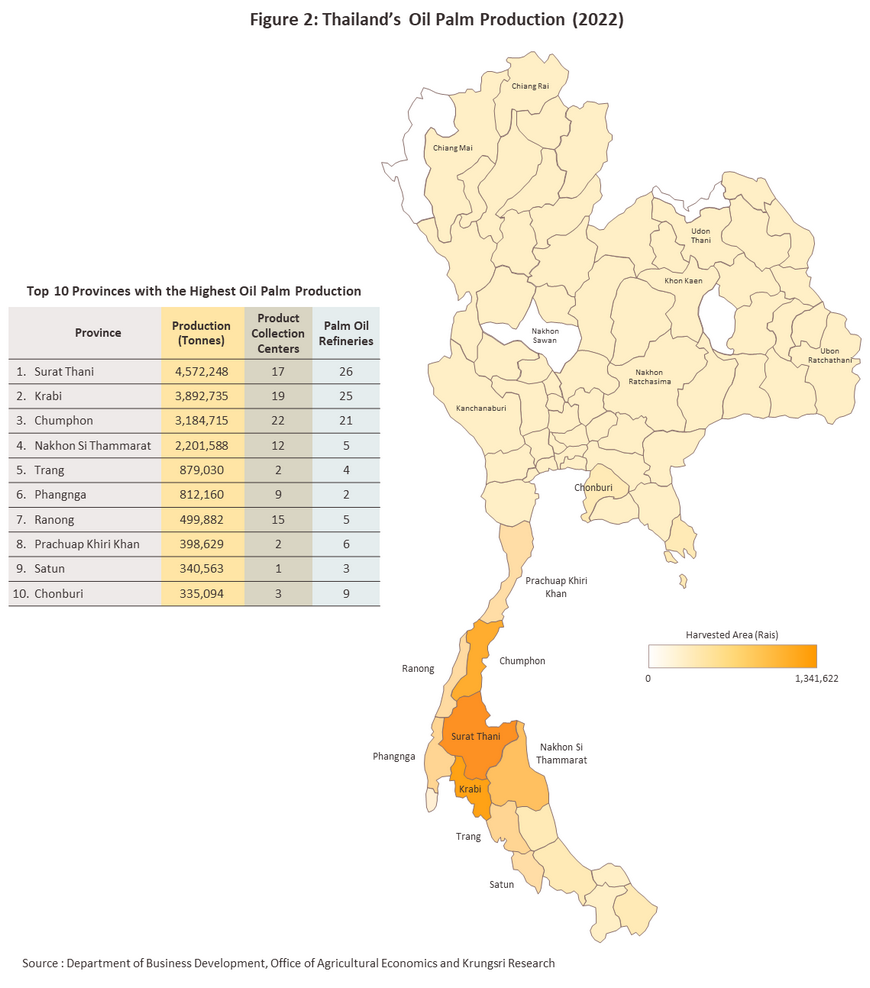

One strength of the Thai palm oil sector is its comprehensive supply chain (Figure 3). This is composed of the following:

-

Oil palm grower (upstream production): This is centered on the roughly 0.41 million households across the country that grow oil palm, the majority of which are small-scale producers. Large producers typically invest in operate their own CPO mills.

-

CPO mills (midstream production): This is based on mills that output CPO. Currently there are 132 of these in Thailand (source: Department of Internal Trade), and the Office of Industrial Economics (OIE) estimates that the country’s installed processing capacity comes to around 5.6 million tonnes of CPO per year. Large operators of oil mills may also invest in their own palm oil plantations, growing seedlings and developing new palm cultivars. Processing plants also produce a wide range of by-products from the milling of palm and these may be used to generate additional income; kernel meal is used as an animal feed and the palm shells, fiber and other waste may be used for the production of biomass energy or organic fertilizer.

-

Palm oil refiners (downstream production): The final stage of the industry supply chain is comprised of palm oil refineries, of which there are 22 in Thailand. The OIE reports that these have an annual production capacity of 2.5 million tonnes. Large operators are often connected through their investments to other parts of the palm supply chain including, for example, CPO mills and the production of vegetable oils

-

Other industries: These help to absorb additional supply, and include biodiesel refineries, food processors, and the chemicals and oleochemicals industries.

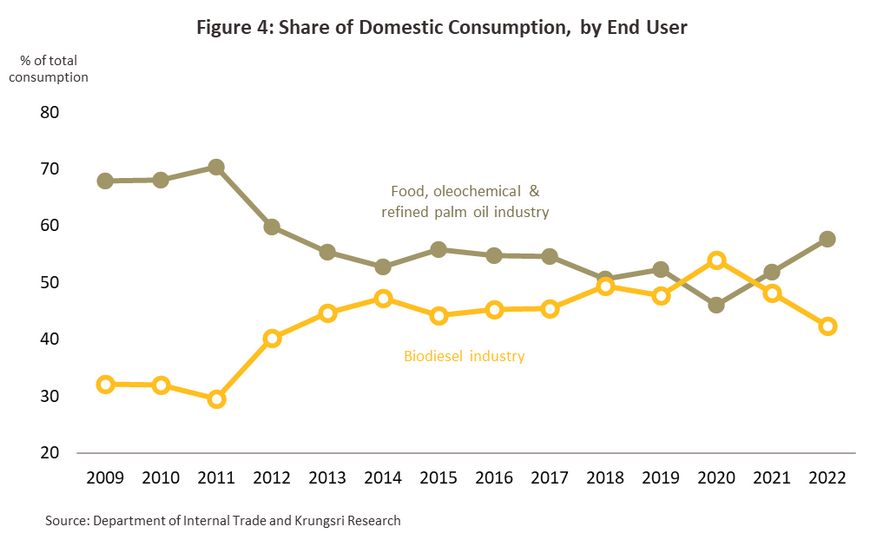

As of 2022, around 61% of Thailand’s output of CPO was distributed to the domestic market (Figure 4).

-

Production of refined palm oil: In 2022, 58% of CPO was converted into refined palm oil, which is then used in: (i) the food industry, where it is a component in snacks, instant noodles, condensed milk, creamer, margarine, shortening, ice cream, food supplements and vitamins, and chemical and oleochemical products; and (ii) the manufacture of other products such as soap, cosmetics, shampoo, and lubricants (Figure 3).

-

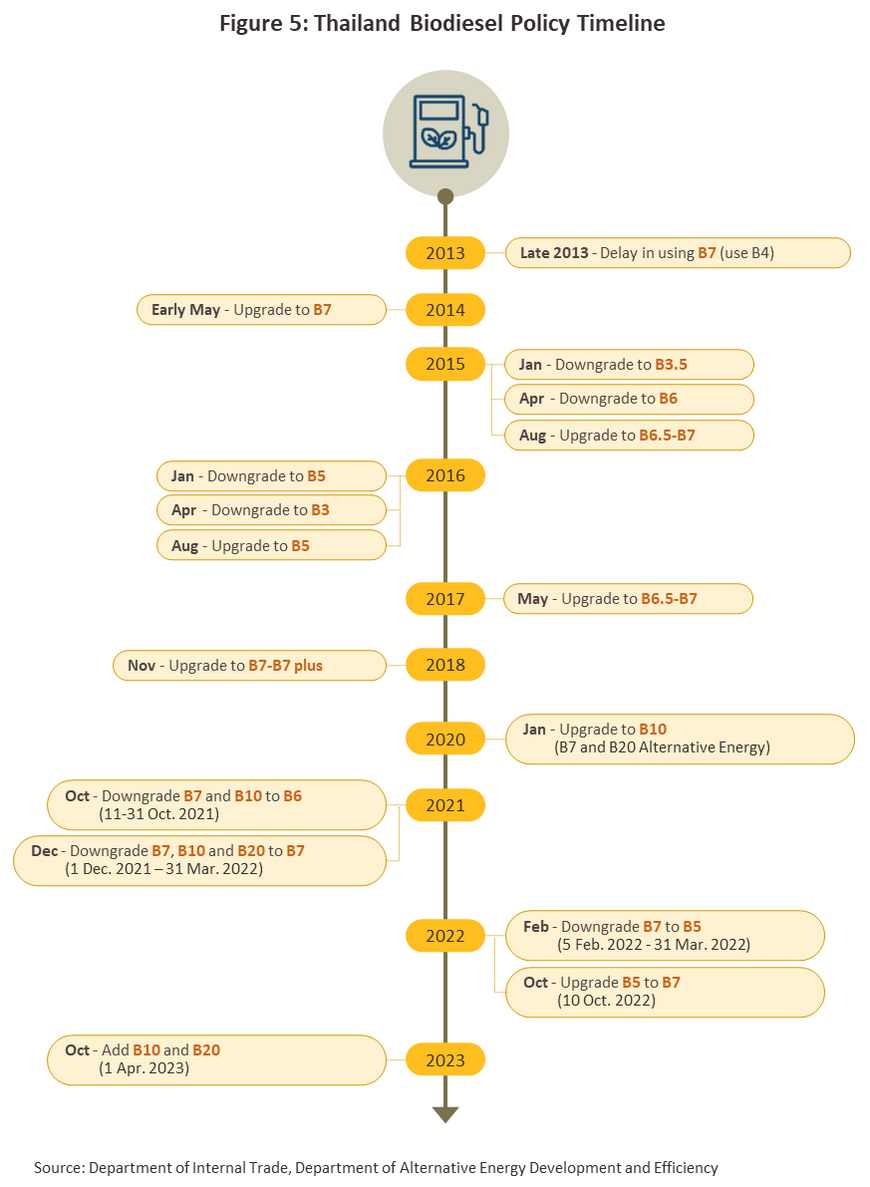

Production of biodiesel (B100): The remaining 42% of the market is accounted for by the production of biodiesel (B100), which is then mixed with mineral diesel for sale as a transport fuel. The authorities typically adjust the amount of B100 included in the diesel mix to match each season’s output of CPO. Thus, in 2020, the mix was raised from B7 to B10 as part of the move to soak up the CPO supply glut, but this was then cut to B7 in 2021 and then to B59/ in 2022 as domestic prices for CPO rose and stocks ran down (Figure 5).

Annual exports of CPO tend to be somewhat limited, though because the government periodically instigates programs to reduce supply gluts by promoting CPO exports, the exact size of the export segment depends on the extent of oversupply to the market at any particular time. Likewise, imports tend to be limited to periods when there are domestic supply shortages and when the CPO buffer stock falls below the reserve level, which is set by the authorities at 0.25-0.30 million tonnes10/.

At present, the palm oil industry falls under the oversight of the National Oil Palm Policy Committee, which is tasked with maintaining stability across the palm oil supply chain. The committee meets these goals through its planning and policy development activities, allocating the oil palm harvest between household and industrial consumers, controlling imports of oil palm and palm oil11/, and intervening to buy up the harvest when prices are low and slowing the use of goods when prices are high. However, the committee does not act alone and it needs to coordinate with a number of other government bodies, including the Ministry of Industry, which provides support for the food and oleochemical industries, the Ministry of Energy, which is responsible for the biodiesel, power generating, and bioenergy industries, and, through the Department of Internal Trade, the Ministry of Commerce, which sets prices for fresh palm and for palm oil. Details of this follow.

-

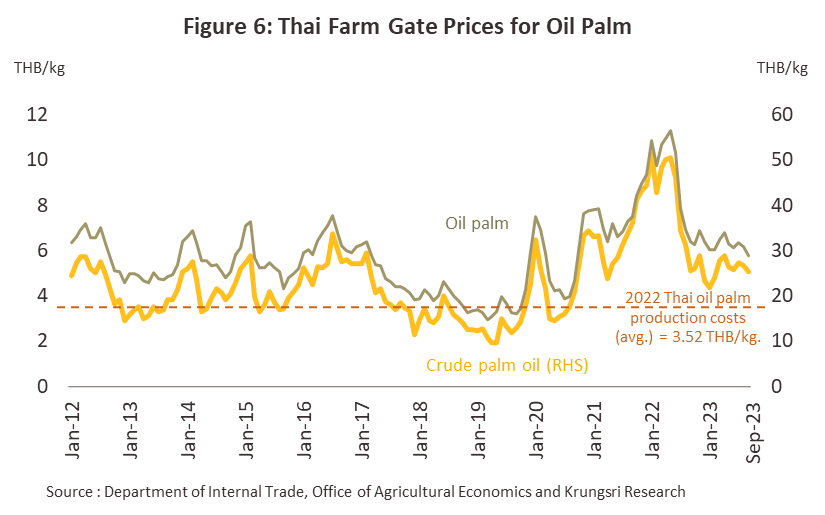

The purchase price of fresh oil palm from farmers is set by the Central Committee on the Prices of Goods and Services (CCP) (operating under the Department of Internal Trade within the Ministry of Commerce), which specifies the reference prices for mixed grades of palm fruits according to their oil content. Since 2017, the regulations have stated that mills should buy only fruits that are at least 18% oil (up from 17%) since by setting a minimum oil content, it is hoped that the quality of Thai palm oil will increase, and by harvesting fully ripe fruit, yield will increase and farmers will be able to sell their oil palm fruits at a higher price. However, prices remain volatile, and by September 2023, these had slipped -1.2% YoY to THB 5.06/kilogram (Figure 6).

-

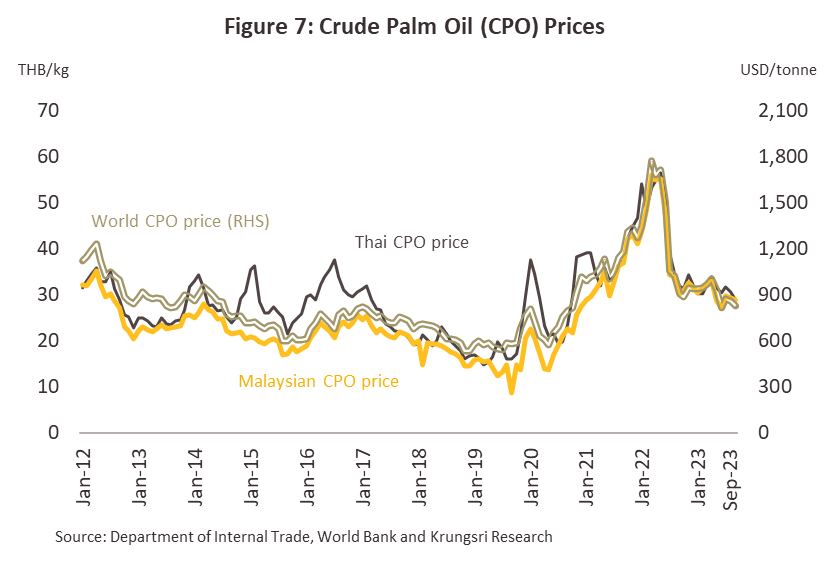

The CPO price is set with reference to the cost of inputs (i.e., the domestic cost of fresh oil palm) and trends in the price of CPO on world markets. As of September 2023, the CPO purchase price has been set at THB 29.0/kg (-9.5% YoY). This takes into account the increase in the supply of fresh palm and CPO to world markets and reflects the high prices prevalent in the earlier period (Figure 7).

-

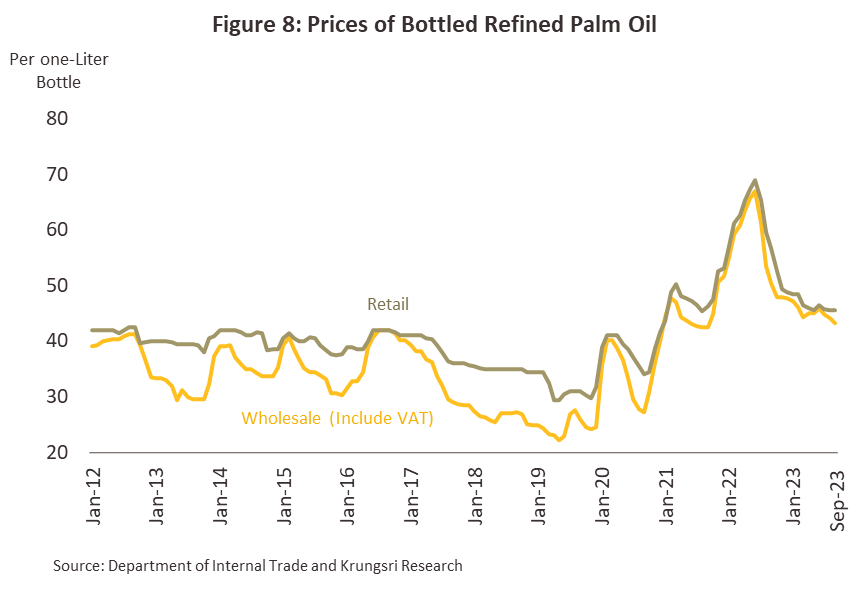

In the past, the retail price of bottled refined palm oil was controlled by the Department of Internal Trade but since February 2019, this has allowed the market to determine prices12/, and these thus tend to move with the cost of inputs. As of September 2023, the retail price for bottled refined palm oil stood at THB 45.5 per bottle (-19.9% YoY) (Figure 8).

Situation

The Thai palm oil industry faced a number of challenges in 2022 arising from weakening domestic demand, especially for oil palm for use in the production of biodiesel, and although consumption of refined palm oil rose gradually, domestic and international stocks of palm oil continued to expand. This then led to a rapid decline in the price of CPO.

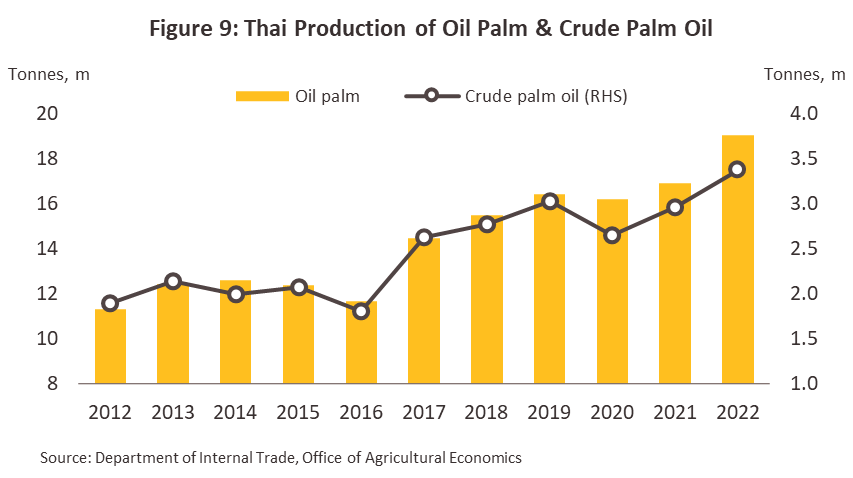

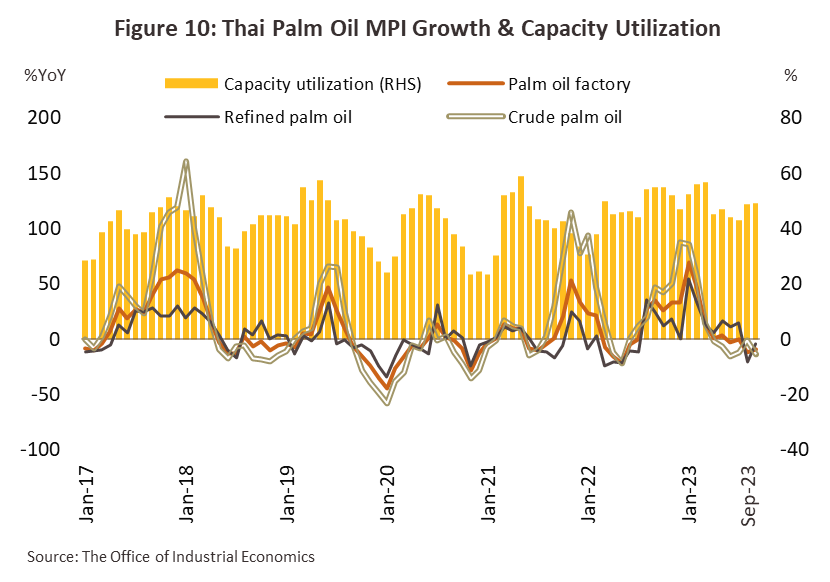

- Outputs of fresh palm and output of CPO hit historic highs in 2022 (Figure 9). Data from the Office of Agricultural Economics indicate that for 2022, the total area of oil palm plantations rose 1.9% to 6.15 million rai, and in the year, this yielded a record-breaking total of 19.1 million tonnes of oil palm fruit (+12.8%), up from 16.9 million tonnes in 2021. This then translated into a 10.6% increase in oil palm yields, which climbed to 3,099 kilograms/rai. This improvement was driven by: (i) better weather and heavier rainfall; and (ii) a 13.9% jump in prices for fresh oil palm to THB 7.7/kilogram (this mirrored the rise in global prices for palm oil to an average of USD 1,276/tonne) that then incentivized growers to look after their plantations better and to maximize outputs by following best practices. In the year, output of CPO also climbed 13.9% to 3.38 million tonnes (up from 2.96 million tonnes in 2021) and this was then reflected in the 2022 palm mill MPI, which rose 21.0%, and in industry capacity utilization, which edged up to 46.9% from 42.3% in 2021 (Figure 10).

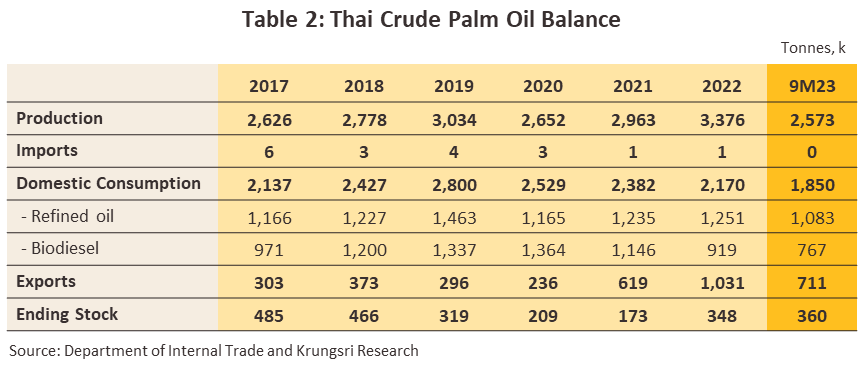

- Domestic demand softened in 2022 on weaker consumption by the transport sector, but exports strengthened (Table 2).

-

Overall domestic demand for CPO slipped -8.9% to 2.17 million tonnes in 2022. High oil prices affected the transport sector, and this then undercut demand from manufacturers of biodiesel. This change was sufficient to overwhelm the positive effects of stronger demand for refined palm oil, which was lifted by the return of economic activity to normal, especially for restaurants, pubs, and bars. Details of the domestic market are given below.

-

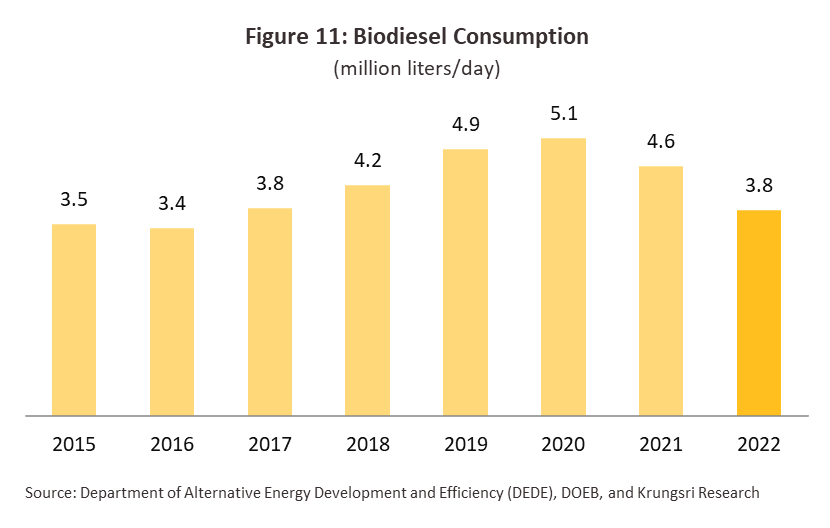

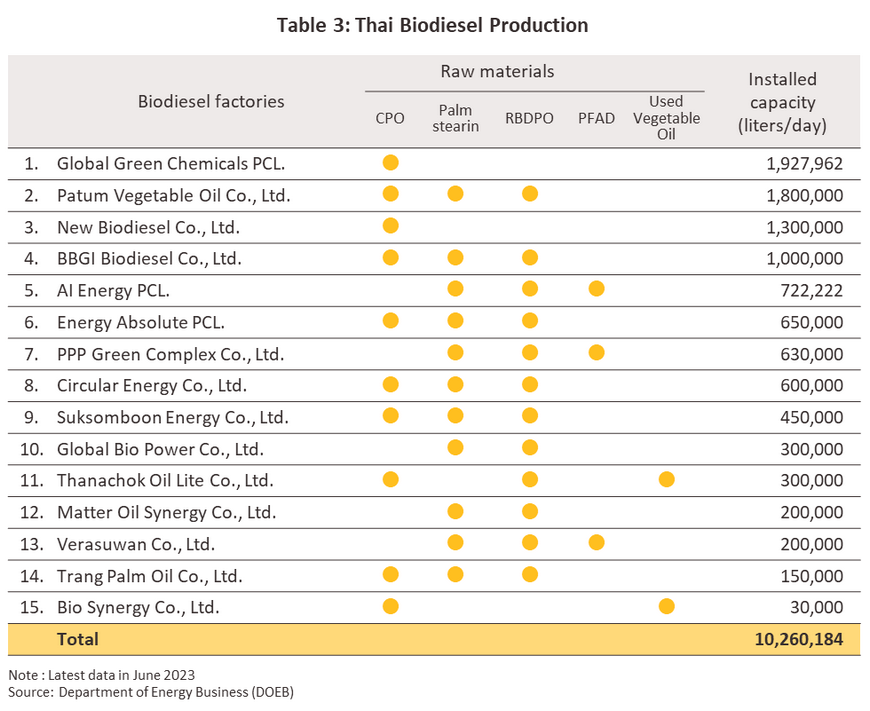

Biodiesel production: Overall production and consumption of biodiesel (for mixing with regular mineral diesel) declined by respectively -16.2% and -17.5% to average daily totals of 3.81 million liters and 3.78 million liters (Figure 11). This then fed through into a -19.8% slump in demand for CPO for use in biodiesel production, which then fell to 0.92 million tonnes. The primary driver of this decline was the high cost of CPO, and this encouraged the Energy Policy and Planning Office to cut the diesel mix from B7 to B5 from February to October 2022 as it looked to hold back any increase in diesel pump prices. Sales of CPO thus fell, and this combined with the entry to the market of a new player (Thanachok Oil Light) to bring industry capacity utilization down from 2021’s 48.4% to just 37.1%, against a maximum capacity of around 10.3 million liters per day (Table 3).

-

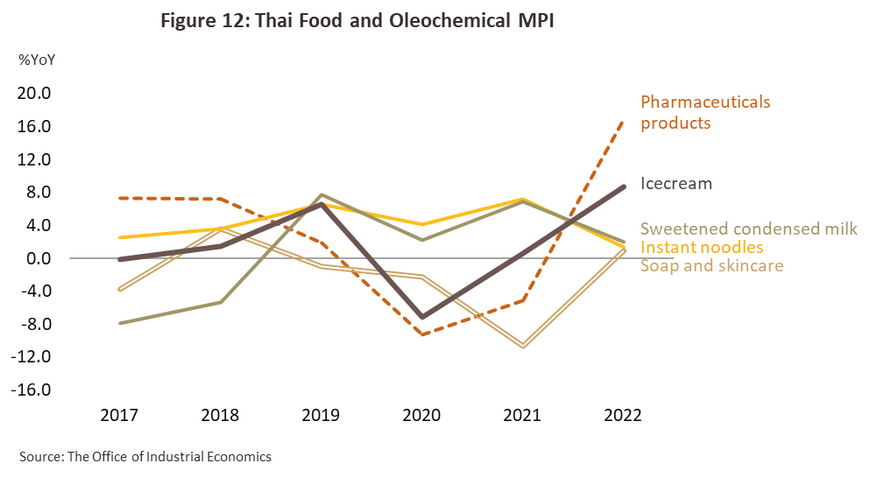

Production of refined palm oil: Through 2022, the easing of lockdowns and the reopening of the country helped economic activity to return to normal and consumer purchasing power to revive, and this then boosted demand for consumer goods produced from oleochemicals (e.g., pharmaceuticals, soap, cosmetics, etc.). As such, demand for CPO for conversion into refined palm oil and for use in the oleochemicals industry (for the production of both household and industrial goods) edged up 1.3% to 1.25 million tonnes in 2022. The segment was further supported by ongoing consumer demand for PPE and for medical treatments. However, demand for palm products for use in the production of foods with long shelf-lives (e.g., instant noodles and condensed milk) weakened with the ending of the pandemic and the return of consumers to dining out, which has then reduced the need to store food at home. This overall shift in the food and oleochemicals industries was then reflected in the MPIs for these (Figure 12).

-

2022 exports of palm oil products jumped 37.3% to 1.1 million tonnes, and this then generated USD 1.5 billion in receipts (+56.2%). Overseas sales benefited from a combination of tight supply in export markets and government efforts to address a domestic supply glut by increasing overseas sales.

-

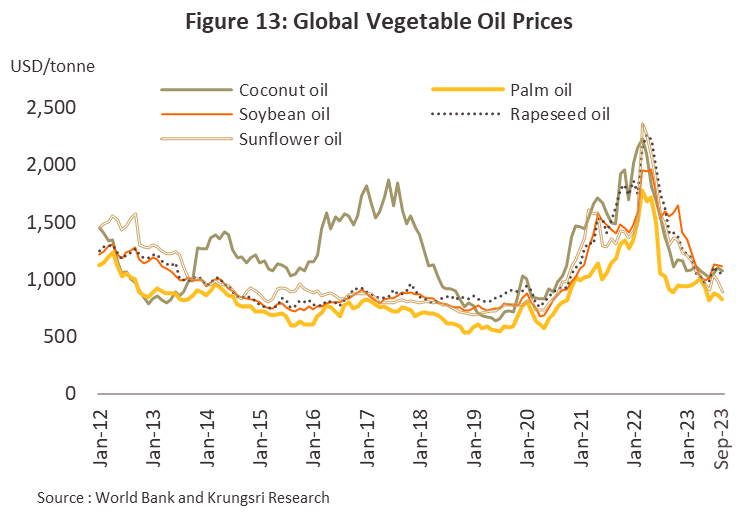

Crude palm oil: Exports of CPO surged 35.6% and 54.2% by volume and value to totals of 1.0 million tonnes and USD 1.3 billion, though this was driven by the 57.5% jump in exports to India, which at 0.84 million tonnes, account for 84.0% of all overseas sales of CPO. Sales into India were boosted by the move by the Indonesian and Malaysian governments to control domestic palm oil costs by restricting exports, which then diverted demand to Thai producers. In addition, the Ukraine-Russia war has substantially increased global seed oil costs, and to address the effects of this on the domestic cost of living, the Indian government has cut import duties on vegetable oils13/ (e.g., palm, soya, and sunflower oil). It is hoped that this will reduce costs in the food processing industry14/, and this thus also helped to boost exports from Thailand (Figure 13).

-

Refined palm oil: Exports of refined palm oil performed well in the year, jumping 64.3% to 99,808 tonnes. Sales into Myanmar accounted for 86% of the total (85,455 tonnes), and these rose 156.1%, although many other markets also turned in good performances, with increases of 59.3% seen in Cambodia, 27.5% in Lao PDR, 96.2% in Djibouti, and 355.3% in Pakistan. This then helped to compensate for the fall in sales to India, where the cut in import duties on CPO encouraged buyers to switch to this in place of refined palm oil15/. Over the year, the cost of fresh palm and CPO rose by respectively 13.9% and 14.7%, and this then pushed up export prices by 12.3%. As such, growth in export income outpaced growth in export volume, the former rising 84.5% to USD 151.6 million.

-

Declining demand for biodiesel and the resulting softening of domestic consumption meant that stocks of CPO naturally rose, and so by the year-end, these were above their official target. Thus, as of the end of 2022, inventories had risen 101.6% to 0.35 million tonnes against a target buffer stock of 0.25-0.30 million tonnes.

-

Prices for palm fruit and palm oil have slipped as domestic stocks of CPO have risen above target levels. Prices reached a record high in January 2022, when fresh palm fruits hit THB 10.3/kilogram, but these had then slumped to THB 4.7/kilogram by December, while for the year overall, these averaged THB 7.7/kilogram (+13.9%). By December, CPO prices were also down to THB 32.0/kilogram, below the 2022 average of THB 43.6/kilogram (+14.7%). By contrast, export prices for palm oil products rose in the year, climbing 13.8% on the restricted supply to world markets from Indonesia and Malaysia. To counter expanding domestic inventories and falling prices, the Energy Policy and Planning Office agreed to raise the standard diesel mix from B5 to B7 in October, although 2022 prices remained above their 5-year average.

Over the first 9 months of 2023, high prices ensured that outputs remained strong and so the domestic supply of palm oil continued to expand. Domestic demand benefited from the return of economic life to normal and the reopening of the country, which has boosted tourist numbers and brightened the outlook for restaurants, hotels, night spots, and the transport industry. However, Thai exports are expensive, and this makes them uncompetitive in the major markets of India and Malaysia, where buyers are tending to switch to alternative, lower cost seed oils.

-

The supply of fresh oil palm for pressing into palm oil rose 2.9% YoY to 14.1 million tonnes over 9M23 thanks to: (i) sufficient rainfall through the first half of the year and an overall beneficial climate, especially in the South; and (ii) average prices of THB 5.2/kilogram for fresh palm, significantly above production costs of THB 3.5/kilogram and a major incentive encouraging farmers to maximize outputs and to expand their palm plantations. Production of CPO thus totaled 2.6 million tonnes (+5.2% YoY). For the remainder of the year, supply will continue to benefit from the mix of the favorable climate that prevailed through 1H23 and the positive effects of strong gross profits, which will outweigh the increasingly clear impacts of this year’s El Niño and its possible consequences for per-unit yields. For all of 2023, supply should thus rise 0.5%-1.5% to 19.1-19.3 million tonnes, and this will then be used to produce 3.4-3.5 million tonnes of CPO (up 0.5%-3.5%).

-

The volume of CPO distributed to the market rose 12.5% YoY to 2.6 million tonnes over 8M23, though these improvements were driven by the strength of the domestic market.

-

Domestic consumption jumped 18.5% YoY to 1.9 million tonnes on stronger demand for use in the production of refined palm oil and for processing into biodiesel. The volume of CPO consumed by manufacturers of refined palm oil thus rose 20.2% YoY to 1.1 million tonnes as, from mid-2022, the reopening of the country and the relaxation of pandemic controls allowed restaurants, hotels and night spots to return to normal service, and with this, consumption of food and oleochemical products rebounded. Likewise, demand from producers of biodiesel strengthened 16.1% YoY to 0.8 million tonnes. This segment benefited from the switch to B7 diesel mix from October 2022 (from February 2022, B5 had been standard) and the generally lower cost of crude, which then pulled down diesel pump prices. Given this, total demand for B100 biodiesel climbed 20.5% YoY to an average of 4.39 million liters per day, while average monthly demand for CPO and biodiesel rose by 18% to 22% YoY. For 2023 overall, an improving economic outlook and the rapid return to health of the tourism sector will support stronger demand for CPO for use in the food, oleochemicals, and transport and logistics industries. Thus, across the year as a whole, a total of 2.6-2.7 million tonnes of CPO should be distributed domestically (up 20.0%-23.0%), split between 1.08-1.12 million tonnes for biodiesel producers (up 17.5%-21.5%) and 1.52-1.55 million tonnes for manufacturers of refined palm oil (up 22.0%-24.0%).

-

At the same time, exports contracted -0.7% YoY to 0.71 million tonnes. (i) India, Thailand’s major export target, reduced imports from May 2023 and from June, no imports from Thailand were made at all. Similarly, the high price of Thai CPO meant that exports to Malaysia slumped -24.6% YoY. (ii) Buyers in export markets have tended to switch to cheaper seed oils. As a result, 2023 exports are expected to contract by between -14.0% and -16.0% YoY to 0.86-0.89 million tonnes. However, Russia’s recent refusal to extend the Black Sea grain initiative may help to stoke additional demand for Thai CPO as countries look to buffer their food security and prices for alternative vegetable oils rise.

-

Stocks had risen 5.1% YoY to 0.36 million tonnes by the end of August. This was above the buffer target level of 0.25-0.30 million tonnes, and this excess helped to pull prices for fresh palm and CPO down to respectively THB 5.0-5.8/kilogram and THB 29.0-34.0/kilogram, below their averages for the previous year. In September 2023, average prices for palm fruits came to THB 5.1/kilogram (-1.2% YoY), while for CPO, prices were down -9.5% YoY to THB 29.0/kilogram. For all of 2023, weak exports will mean that stocks are expected to 0.31-0.33 million tonnes. This will then undercut prices for palm fruits and CPO, which will fall to averages of respectively THB 4.8-5.2/kilogram and THB 28.0-32.0/kilogram.

Outlook

Over 2024-2026, outputs of Thai oil palm and palm oil will contract between -1.0% and -2.0% annually.

-

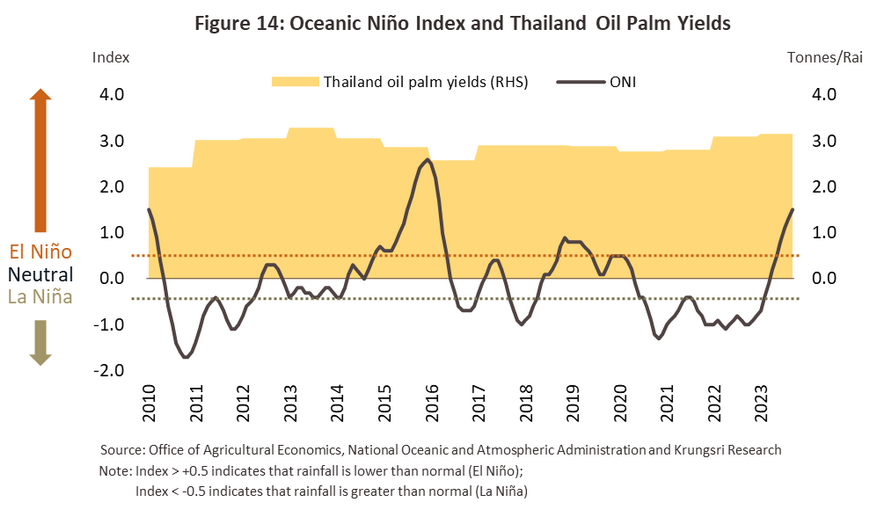

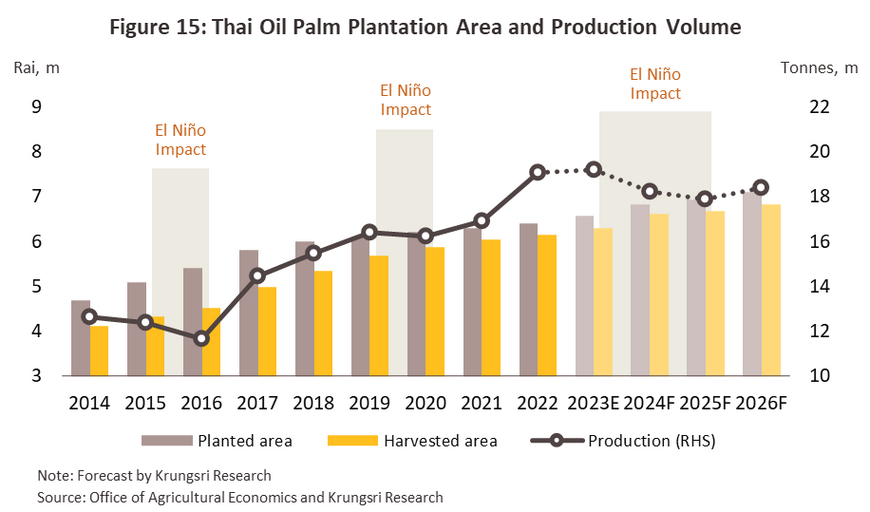

The supply of palm fruits and CPO will shrink by between -2.0% and -4.0% in each of 2024 and 2025 as the current El Niño intensifies, and palm plantations endure extended drought (Figure 14), which will then cause yields to fall. However, the impacts of this will be somewhat offset by two positive trends. (i) To provide an additional source of alternative energy, government policy aims to extend the area given over to palm oil cultivation to 10 million rai by 2029. Nationally, plantation sizes are thus expanding by 0.1-0.2 million rai annually, concentrated in the northeast region, and the share of these over 8 years old (when yields are at their highest16/) is increasing. (ii) High prices are incentivizing growers to plant more oil palm, with some farmers replacing less profitable rubber with this. Over the next 2 years, the supply of CPO will move in line with the supply of palm fruits, and so the former is expected to slip by an average of -3.5% per year to 3.2-3.3 million tonnes.

-

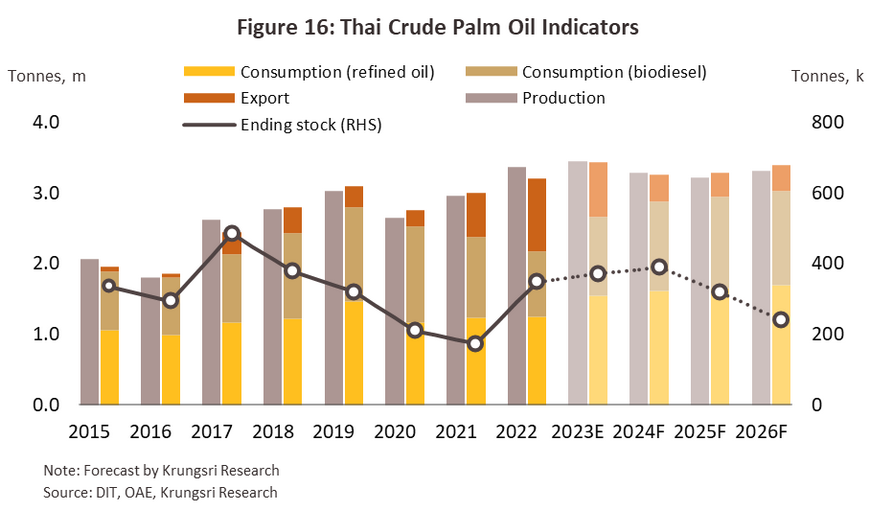

The outlook should improve in 2026 when supply will expand again due to (i) the easing of El Niño and the ending of its peak impacts, as well as the low baseline set in the previous 2 years; (ii) ongoing high prices that will continue to encourage growers to maximize yields; and (iii) the earlier expansion in plantations, which are now entering their period of maximum yields. Supply of fresh palm fruits should therefore return to growth of 2.5%-3.5% in the year (Figure 15), and this will lift the supply of CPO to 3.3-3.4 million tonnes (Figure 16).

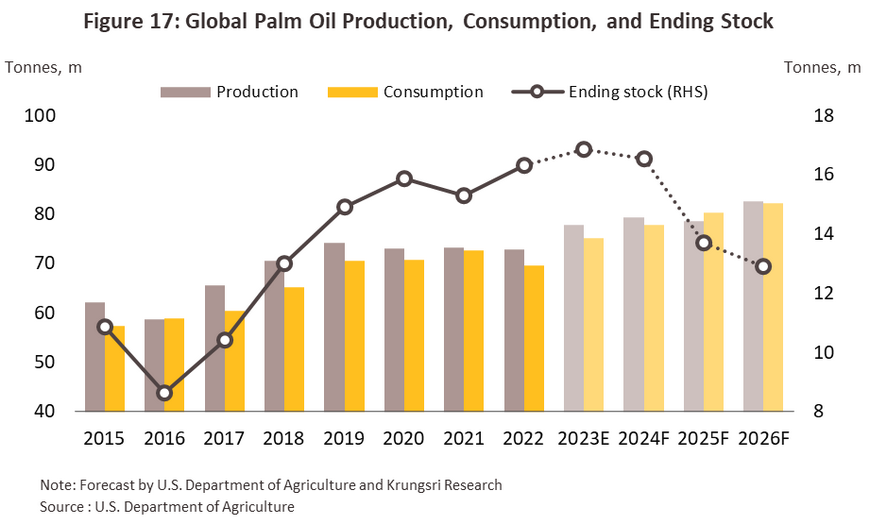

- At the same time, global output of fresh palm and palm oil will also tend to track upwards. The easing of the COVID-19 pandemic is allowing production to return to normal for the major producers of Indonesia and Malaysia (Figure 17), and so the global supply of CPO will expand in the coming period. Nevertheless, the effects of this will be limited by: (i) the current El Niño, which will drag on output in major production areas in 2024 and 2025; and (ii) a combination of environmental concerns and the need to deal with prolonged geopolitical tensions on global crude prices that will motivate major producing nations to increase domestic consumption of palm oil17/. If producers restrict exports and focus instead on ensuring that the domestic supply of palm remains uninterrupted, expanding global supply may have only a limited impact on prices, while global demand will also rise. Domestic prices for oil palm and palm oil will thus likely remain above production costs.

-

Over 2024-2026, domestic demand for CPO is forecast to rise by 3.0-5.0% annually. Growth in consumption will be driven in particular by the food industry, producers of oleochemicals, and the transport industry, which should benefit from an improving outlook for the economy.

-

Refined palm oil: Annual demand for CPO for refining is forecast to expand by 3.0%-4.0%. This improvement will be driven by recovery in the tourism, hotel, and restaurant industries, which will then feed into greater demand for goods from food processors. In addition, consumption of palm oil/palm fats (obtained from the palm oil purification process) by players in the oleochemical industry will firm up on greater demand for products such as detergent, soap, medicines, and cosmetics. Moreover, as laid out in the 2018-2037 plan for the reform of the Thai oil palm and palm oil industry, officials hope to boost demand for CPO and to raise standards in the domestic oleochemical industry.

-

Biodiesel production: Demand for biodiesel should continue to strengthen by an average of 6.0%-7.0% annually to around 5.0-5.5 million liters/day. (a) Use of diesel-powered vehicles in the transport sector will increase due to: (i) recovery in economic activity; (ii) an expansion in e-commerce, which will then support greater use of commercial vehicles, especially of pickups; (iii) improved economic integration within ASEAN, which will also tend to increase demand for commercial vehicles; and (iv) an expected 3.0-4.0% annual rise in the number of diesel vehicles on Thai roads. (b) Major auto manufacturers are developing new engines that can run on fuels containing a greater proportion of biodiesel, and these will be fitted to pickups, SUVs, trucks, and other large vehicles.

-

Growth in exports is likely to turn strongly negative, with these contracting by between -20% and -25% per year. This will be a consequence of: (i) the negative impact of the El Niño on outputs, which will likely restrict any potential supply glut, and as this will no longer push domestic stocks above the target buffer level, the government will likely end export promotion measures18/ (a way of absorbing supply gluts); and (ii) export prices that will remain above those of Thailand’s major competitors of Malaysia and Indonesia.

-

Stocks of CPO: Year-end stocks should fall to around 0.30-0.32 million tonnes thanks to a combination of weakening supply and strengthening demand on the domestic market. Alongside this, expanding international supply will put only weak downward pressure on prices since major producers are likely to restrict exports, while global demand will also strengthen. Given the domestic and international influences on the market described above, Thai prices for palm fruit and CPO will likely remain high, with the former expected to run in the range of THB 5-7/kilogram.

Potential risks and headwinds that may pose a challenge to the industry will include the following.

-

Changes to government policy may have a significant impact on the industry since government agencies (including the Ministry of Agriculture and Cooperatives, the Ministry of Industry, the Ministry of Energy, and the Ministry of Commerce) are involved both directly and indirectly across the supply chain, from upstream production of inputs through to downstream distribution of finished goods. This then exposes players to risk arising from changes to prices, production volumes, and the regulatory environment.

-

Energy prices are being pushed up by geopolitical tensions, including the war in Ukraine and the violence between Hamas and Israel, and this may undercut demand for diesel from the transport sector.

-

Competition remains stiff from alternative products, new entrants to the market, and existing players that have extended their production capacity. Indeed, over the 3 years from 2020-2022, capacity utilization in the palm oil industry averaged just 42.5%, which is very low when compared to similarly priced alternative oils such as soy (96.7% capacity utilization) and rice bran (63.7% utilization).

-

Across te industry, production costs are higher in Thailand than in the competitor nations of Indonesia and Malaysia, while Thai palm mills also operate with lower capacity utilization. This then raises their marginal costs and makes Thai products uncompetitive on global markets.

-

Non-tariff barriers stand in the way of exports. These are particularly important in the context of environmental protection measures put in place by the EU, one of the world’s largest markets for palm oil since these specify that EU member states should steadily reduce consumption of biofuels made from potentially high-carbon palm oil. Europe has thus set the goal of EU industries becoming ‘zero palm oil’ by 203019/. In addition, because palm oil is saturated fat and contains a much higher proportion of carcinogenic adulterants than other vegetable oils, there is also a growing interest in Europe becoming ‘palm oil free’. One outcome of this was the establishment of the Roundtable on Sustainable Palm Oil (RSPO)20/, which works to reduce barriers to trade that are placed in the way of palm exports. Although exports of palm oil from Thailand are relatively small compared to the domestic market, these trade barriers constitute a significant threat to downstream manufacturers that use palm oil and that export to the EU or to other countries that have instituted similar measures.

-

Government promotion of electric vehicles (EVs) will affect demand for biofuels. The government hopes that by 2030, at least 30% of domestic auto production will be ZEVs (zero-emission vehicles), which would then weaken the consumption of biofuels.

Government measures/programs targeting the palm oil and oil palm industry, 2023

1) Income support program for oil palm growers: On 21 April, 2023, the National Oil Palm Policy Committee authorized the establishment of a program to pay oil palm growers the difference between the guaranteed price for oil palm and its reference price. The program has received funding of THB 3.13 billion. Payments will need to be approved by the cabinet and will be available to households operating plantations up to 25 rai in size that were at least 3 years old and already producing fruit (when market prices were beneath the set price). The guaranteed price was set at THB 4/kilogram for 18% palm oil.

2) Additional measures to maintain stability in the domestic palm oil market include the following:

2.1) The committee for managing domestic palm oil supply has agreed to: (i) change the proportion of biodiesel mixed with mineral diesel; (ii) push forward with plans to promote exports of palm oil; (iii) build CPO inventories; and (iv) establish criteria for purchases of oil palm.

2.2) The government has established a CPO export promotion scheme to help alleviate problems with the domestic supply glut. This aims to export 0.15 million tonnes of CPO by providing financial support worth THB 2/kilogram for the expenses entailed in this21/. This will apply when domestic stocks rise above the target level of 0.30 million tonnes (the stock buffer has a minimum level of 0.25 million tonnes) and domestic prices are higher than those on global markets. THB 309 million was approved for this on 21 April, 2023.

3) The government plans to add value to the oil palm and palm oil industry by targeting eight product groups, namely: (i) base oil; (ii) bio-transformer oil; (iii) environmentally friendly detergents (these are based on methyl ester sulfonate); (iv) bio-lubricants and bio-greases; (v) paraffin; (vi) pesticides and insecticides; (vii) bio-hydrogenated diesel (BHD)22/; and (viii) bio-jet fuels23/.

4) On 11 February, 2020, the cabinet approved measures to manage the supply of palm oil across the industry. The cabinet has allocated THB 372.5 million to pay for the installation of measuring devices in 469 CPO/CPKO storage tanks, and the project will be administered by the Department of Internal Trade.

5 )The Public Warehouse Organization has established two import routes: (i) customs checkpoints (for normal imports) at Map Ta Phut, Bangkok, and Laem Chabang; and (ii) checks at Bangkok for goods bound for Thailand and at Chanthaburi (for goods in transit to Cambodia), Nong Khai (for goods going on to Lao PDR) and Mae Sod (for goods to be shipped on to Myanmar).

Plans for the Development of the Thai Oil Palm Sector

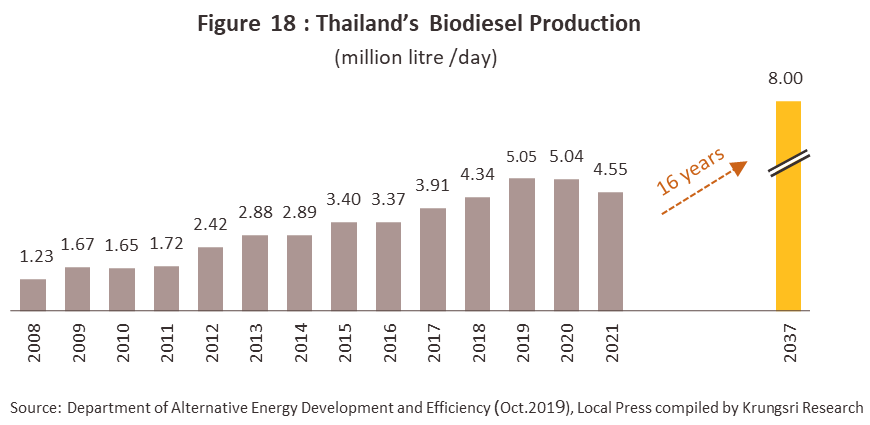

1) Alternative Energy Development Plan for 2018-2037 (AEDP2018): In 2020, the National Energy Policy Office and the cabinet agreed to a new alternative energy development plan that reduced the targets for consumption of biodiesel by bringing these into line with the Power Development Plan (PDP) for 2018-2037. This increases the proportion of energy being produced from other types of alternative and renewable sources but cuts targets for consumption of ethanol and biodiesel because of the likely increase in use of electric vehicles (tentative plans for 2037 biodiesel production are for this to be reduced from 14 million liters to 8 million liters per day).

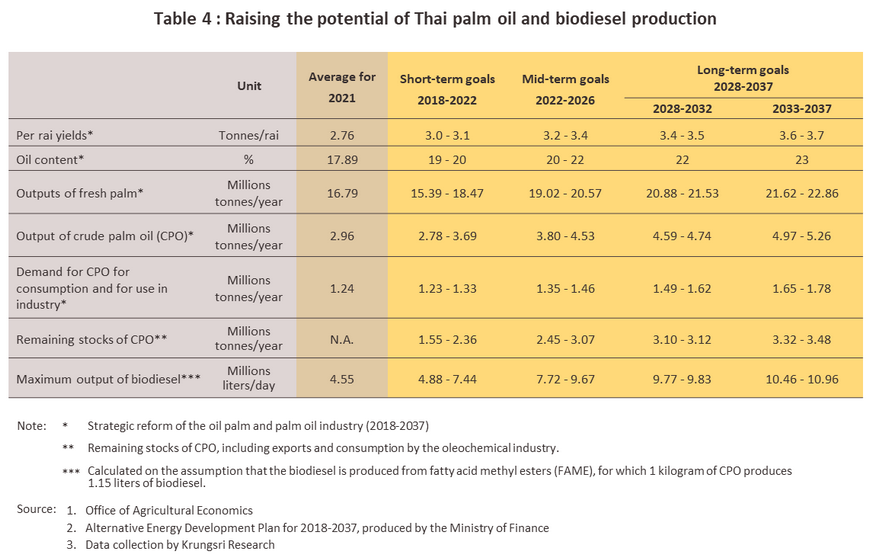

2) Plan for the systemic reform of the oil palm and palm oil industry (2018-2037): This sets targets for improving production efficiencies and for raising output of CPO for consumption by households and industry. Details of this are as follows:

1/ Oleochemicals are biochemicals produced from vegetable oils and animal fats. These include fatty acids, glycerin, fatty acid esters, and fatty alcohols, and these are typically used in the food processing and consumer goods industries, where they are found in products such as cosmetics, pharmaceuticals, soap, shampoo, detergents, lubricants, and insecticides.

2/ This is a precursor utilized in the production of chemicals and is often used in food processing and the manufacture of pharmaceuticals, personal healthcare products, cosmetics, and soap.

3/ Phase change materials are used to absorb and control temperatures. These are used in construction materials, textiles, goods transport, and packaging.

4/ Fatty alcohols are a type of basic oleochemical used in the manufacture of products across a range of industries including fragrancies, cosmetics, shampoo, surfactants, solvents, flavorings, detergents, lubricants, colorings and coatings, plasticizers, foam stabilizers, and additives used in the production of fibers and paper.

5/ Palm oil may be extracted either from the oil palm fruit and from the oil palm seeds, although as of the 2021/2022 season, extraction of oil from palm fruit accounted for 89.7% of global palm oil production.

6/ Yields for other types of vegetable oil are: oil palm: 512 kg/rai; oil palm seeds/kernels: 73 kg/rai; rapeseed: 89 kg/rai; sunflower seed: 81 kg/rai; coconut: 54 kg/rai; soy: 52 kg/rai; and peanut: 51 kg/rai.

7/ CPO mills are generally located close to plantations since to guarantee high-quality oil, the palm fruits need to be processed within 24 hours of harvesting.

8/ Typically, harvesting can begin when oil palms are 3.5-4 years old. Yields peak when palms are 6-16 years old and then decline, although production can continue until trees are 25-28 years old. At this point, the palms are usually cut down and replaced.

9/ B5, B7, and B10 refer to mineral diesel mixed with respectively 5%, 7% and 10% biodiesel.

10/ The safety stock or buffer stock is the stock of CPO that the Public Warehouse Organization maintains in reserve in order to protect against shortages that may occur from sudden increases in consumption by downstream industrial consumers. In the event of temporary disruptions to supply, the existence of the buffer stock means that producers will be able to continue manufacturing goods that use palm oil as an input. The Ministry of Commerce is responsible for setting an appropriate level for the stock buffer, and to this end, the National Oil Palm Policy Committee has established a working sub-committee to oversee the market and to maintain its stability. On 7 June, 2022, this passed a resolution setting the buffer stock level at 0.20 million tonnes per month.

11/ The National Oil Palm Policy Committee has appointed the Public Warehouse Organization (a state enterprise operating under the Ministry of Commerce) as the sole importer of palm oil for periods when shortages are seen in the domestic market. Import duties are levied on palm oil at the rates of: (i) 20% for imports up to the quota limit of 4,860 tonnes, (ii) 143% for over-quota imports, and (iii) 0% for imports made under the ASEAN Free Trade Area Agreement.

12/ The Department of Internal Trade had previously set a price ceiling of THB 42/bottle.

13/ The Indian Excise Department announced that between 14 October, 2021, and 31 March, 2022, duties on imports of CPO from countries with most favored nation status would be reduced from 10% to 2.5%, while for refined palm oil, these would be cut from 37.5% to 17.5%. In addition, for importers of CPO, special CESS taxes that pay for social security measures and support for the agricultural sector have been reduced from 24.75% to 8.25%. To help alleviate the cost-of-living crisis, reduce the price of edible oils, and cut overheads for food processors, these measures were then extended through to the end of 2022.

14/ In India, over 90% of palm oil is used in food processing.

15/ From 13 February, 2022, India cut import duties on CPO from 7.5% to 5%.

16/ Palm trees planted in response to government incentives that ran from 2008-2012 are now 8-12 years old, and so these are within their peak producing age range of 7-16 years (source: Office of Agricultural Economics).

17/ Indonesia is moving forward with the development of the aviation biofuel “bioavtur” for use in Boeing B737-800 NGs, and the authorities are also raising the diesel mix from B30 to B35, with the goal of moving to B40 by 2030. This is being supported by the state oil company Pertamina and the Bandung Institute of Technology. Similarly, the Malaysian authorities are also supporting an expansion in the consumption of biofuels, for example, by approving the use of B30 in trucks and heavy goods vehicles by 2030.

18/ The government put in place a CPO export promotion scheme to help deal with the domestic supply glut, effective during 2022-2024. This provided THB 2/kilogram subsidies to cover administrative costs resulting from these exports when domestic stocks rose above the target level of 0.30 million tonnes and domestic prices were higher than those on global markets.

19/ In March 2019, the European Commission agreed to draft a ‘delegated act’ that laid out sustainable alternative energy standards, and under these rules, palm oil did not qualify as a sustainable product.

20/ The Roundtable on Sustainable Palm Oil (RSPO) is an association joining farmers and producers of oil palm and palm oil products that was established in 2004 with the aim of promoting the sustainability of the industry across economic, social, and environmental fronts. As an industry body, the RSPO also hopes to promote increased production and consumption of palm oil products that meet certain standards. However, only the British Standards Institution (BSI) in Singapore and Malaysia have the authority to accredit organizations with these standards, and only palm plantations in excess of 300 rai are eligible to apply. Unlike in Malaysia and Indonesia, where production is mostly by larger players, much of Thailand’s production comes from small, family-owned plantations that average only 15-16 rai each and so Thai producers hoping to be accredited often have to join together. Thus, in 2023, it is estimated that only 5.1% of all Thai palm plantations (around 0.33 million rai) was managed by RSPO-recognized companies. In light of these problems, the Department of Agriculture and Department of Agricultural Extension, Ministry of Agriculture and Cooperatives has joined with the German Agency for International Cooperation (GIZ) to create a program to promote the sustainable, environmentally friendly development of the palm oil industry. This has drawn on the RSPO standards to develop a program targeted at Thai growers, and it is hoped that these guidelines will encourage Thai farmers and players in the palm oil industry to more closely adopt the RSPO measures.

21/ Including transportation charges, warehousing fees, the cost of product improvements, documentation costs, and other miscellaneous charges.

22/ This will allow the diesel mix to return to B10 as per the Euro 5 standards and to keep any drop in consumption of CPO to no more than 0.64 million tonnes per year.

23/ Measures to manage bio-jet fuels are being developed in response to the imposition of a carbon tax on planes burning non-biofuels in EU airspace. Under the Renewable Energy Directive (REDII), the European Commission announced its target of meeting commitments made in the Paris agreement to reduce CO2 emissions by 40% before 2030. This is to be achieved by replacing these with clean energy by the same date, and then to achieve net zero carbon emissions by 2050.

.webp.aspx)