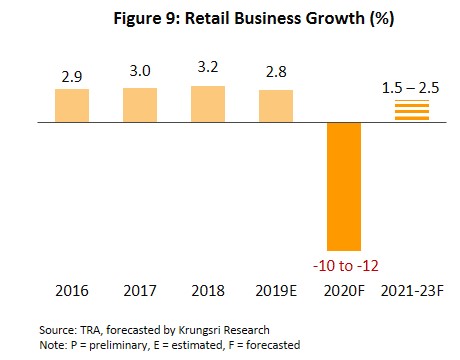

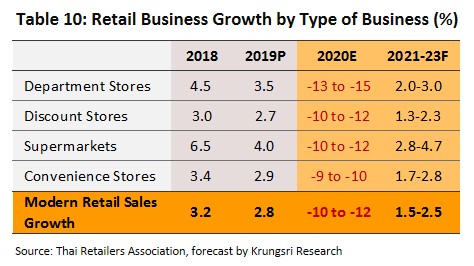

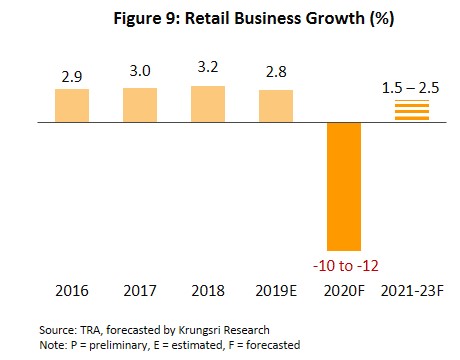

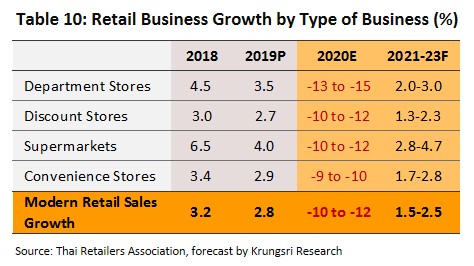

Over the period 2021-2023, sales from modern trade outlets are forecast to grow by an annual average of 1.5-2.5%, moving in step with the recovering economy. It would also be supported by government measures to stimulate domestic consumption and greater public-sector investment, and structural changes that will include ongoing urbanization in Thailand and economic growth in neighboring countries. However, businesses will face rising competition as new players, both Thai and foreign, try to exploit growth opportunities in the domestic retail sector, and e-commerce continues to register stellar growth rates. Hence, businesses need to rapidly overhaul and update their playbooks if they want to continue to enjoy expanding customer and revenue bases over the long term.

Overview

In 2019, the modern trade sector generated a combined value of THB2.8trn, up 7.7% from 2018 and accounting for 16.5% of GDP. This puts it in second place, after the manufacturing sector which accounts for 25.3% of GDP.

Previously, the Thai retail sector had been dominated by small, family-run grocers which obtained stock from middlemen and distributors. However, the situation has changed considerably and retail store formats have transformed to modern stores which are less dependent on wholesalers. Operators are typically large-scale and now own extensive branch networks, and have favorable bargaining position when negotiating with producers and wholesalers[1]. In addition, they have managed to adopt a range of innovations, including shop & stock and distribution management systems, distribution centers, and the widespread use of technology to help with a range of tasks. This gives them several marketing advantages.

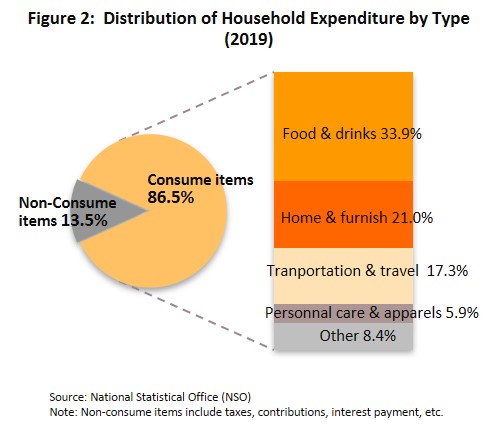

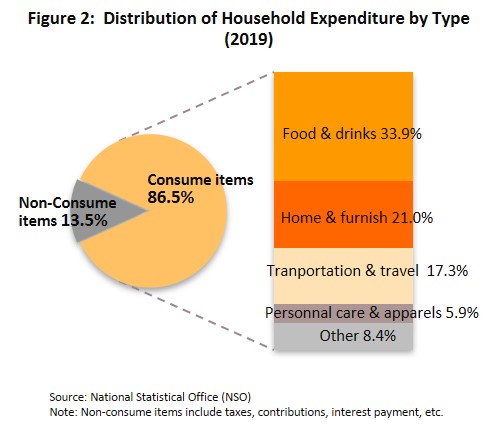

The modern trade sector has been expanding rapidly, especially in Bangkok and regional centers with high urbanization rates. This is attributable to the following: (i) the government has opened the domestic market to foreign investors with advanced technology to invest in retail businesses[2]; (ii) modern trade outlets are meeting consumer demand for greater convenience when shopping, for example, by offering a wide range of goods in a single store (e.g. food, personal and household goods) (Figure 2). Their items may also be cheaper than at traditional retailers; and (iii) ongoing investment in new branches to expand customer base. The ability to effectively meet consumer demand is one factor that has allowed modern traders to rapidly usurp the position of traditional grocers, a triumph underlined by the fact that modern traders controlled 61% of the market in 2014 compared with only 25% in 2001[3].

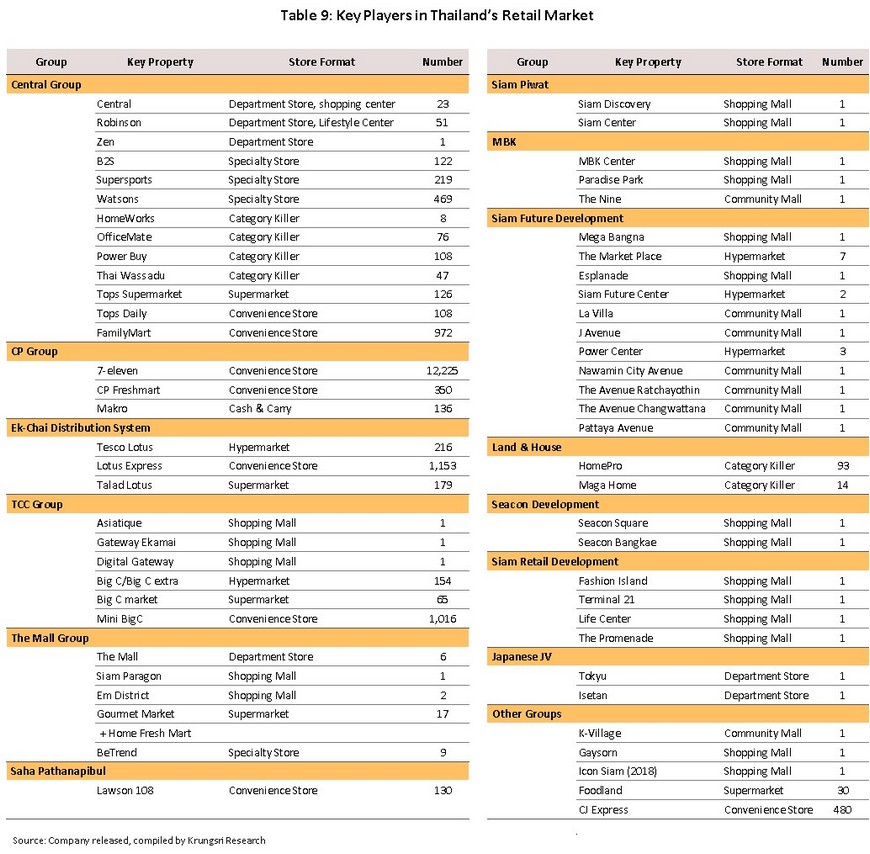

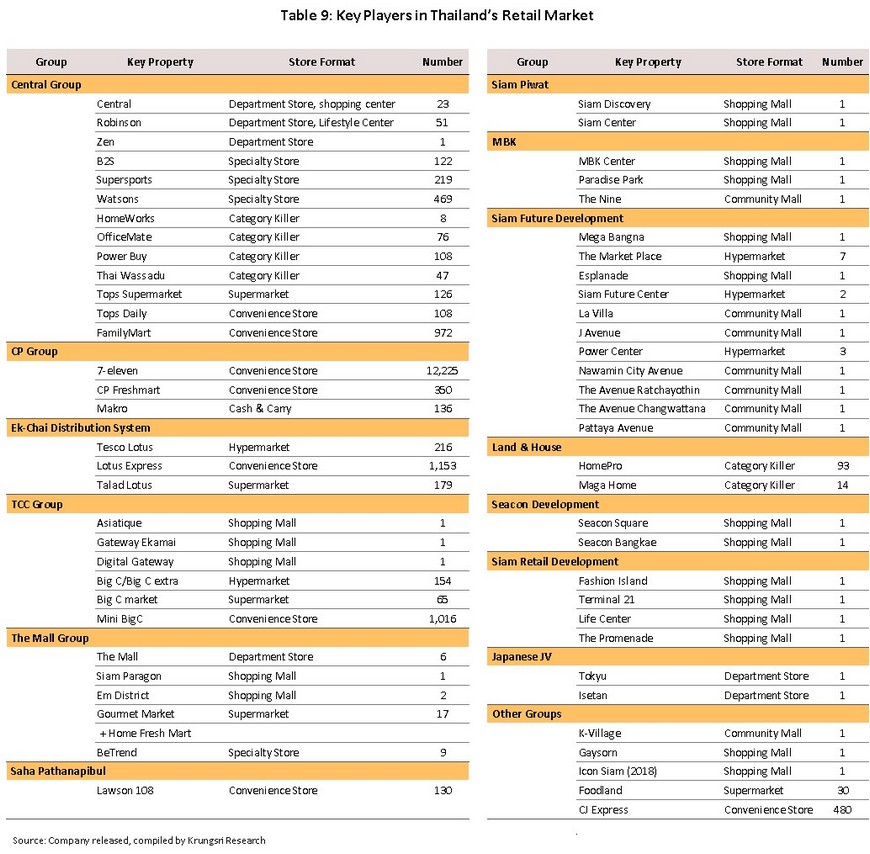

Presently, large-scale modern traders in Thailand are wholly-owned by Thai operators. They have been registering strong revenues because of better economies of scale with an extensive branch network, have financial strength, and diverse business formats to respond to several consumer segments.

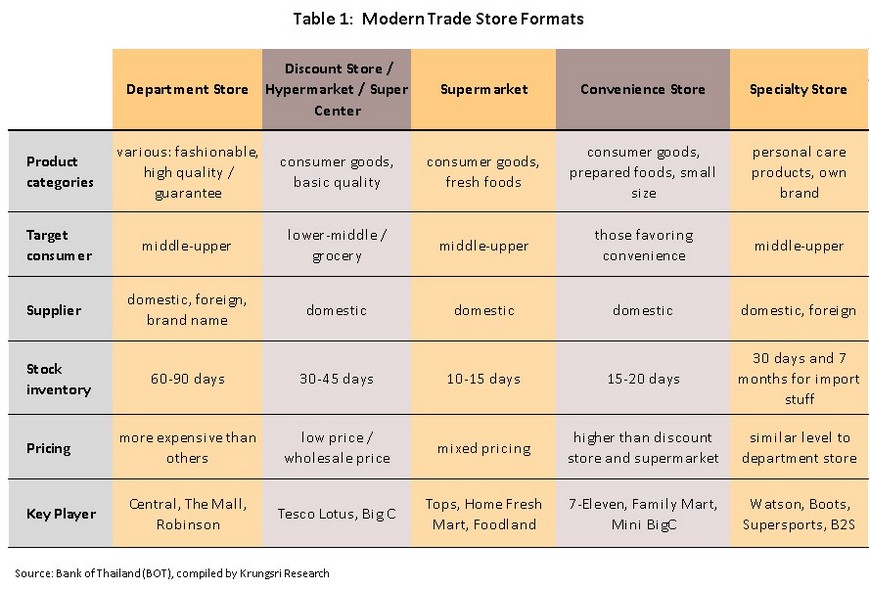

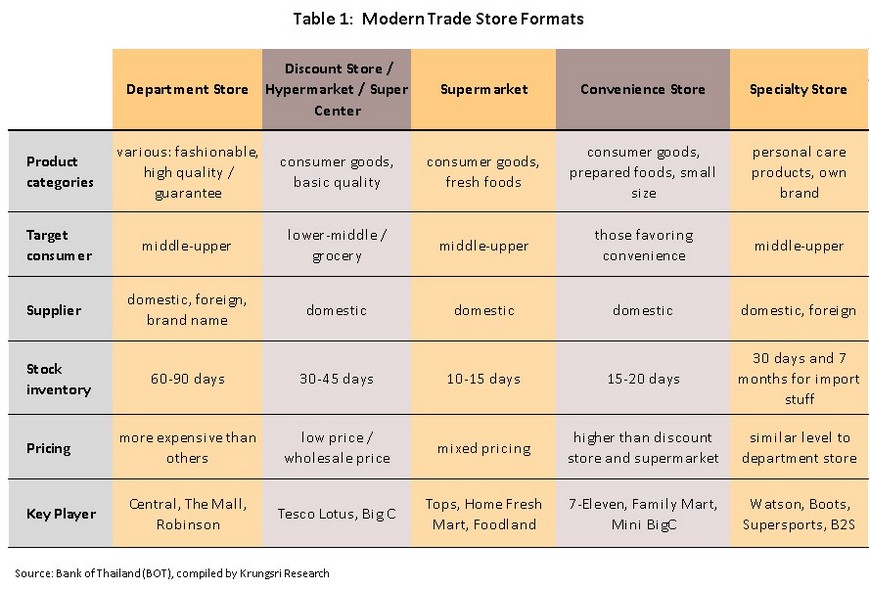

Outlets can be categorized into five types[4], each with distinct features.

1) Department stores are large-scale retail operations with over 1,000 sq.m. floor space and generally target medium- and high-income consumers. They sell a wide range of modern and high quality local and imported products, normally at or higher than the average market prices. Central, Robinson and The Mall are major operators in this mold.

2) Discount stores/ Hypermarkets/ Supercenters are retail stores with more than 1,000 sq.m. floor space. They primarily focus on lower- and middle-income consumers. These stores mainly sell daily use consumer products. Their main strategy is to emphasize low prices. In this group, Big C, and Tesco Lotus are the main players.

3) Supermarkets normally have more than 400 sq.m. of retail floor space and focus on medium- and high-income consumers. They distribute household consumer goods, a wide range of fresh food, and imported products. Key players include Tops Supermarket, Gourmet Market and Foodland.

4) Convenience stores/ Express/ Mini mart are small retail units with more than 40 sq.m. store space. They sell a range of daily products at market price. They are normally conveniently-located in or near communities. 7-Eleven and FamilyMart are notable examples in this segment.

5) Specialty stores emphasize specific product categories that are high quality. Boots, Watsons, and Supersports are examples here.

Modern trade has also developed new formats such as category killer (HomeWorks, PowerBuy and HomePro) and single-price stores (Daiso, Tokutokuya). They have expanded into other provinces and penetrated communities. Their outlets have become a popular center for communities.

Situation

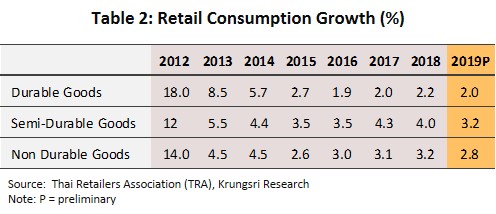

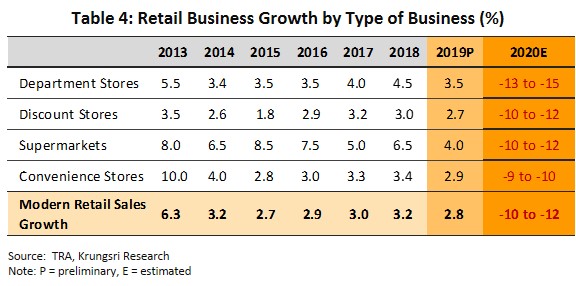

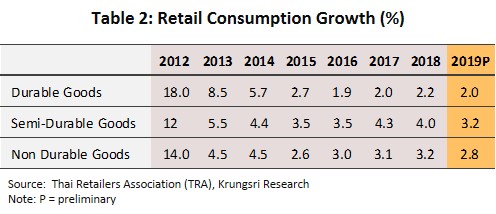

In 2019, retail sales growth slowed to 2.8%, in line with economic growth that decelerated to a 5-year low of just 2.4%. Sales of non-durable goods (e.g., food and beverages) weakened significantly (+2.8% vs +3.2% in 2018), while sales of semi-durable goods (e.g., clothing, makeup, leatherwear and footwear) and durable goods slowed from a year earlier, to just 3.2% and 2.0%, respectively (Table 2)

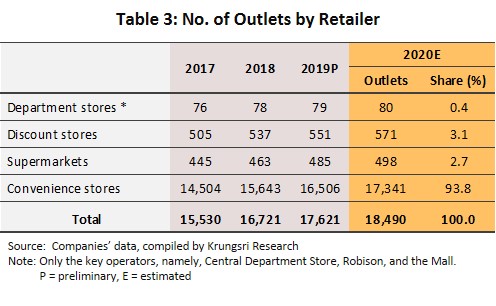

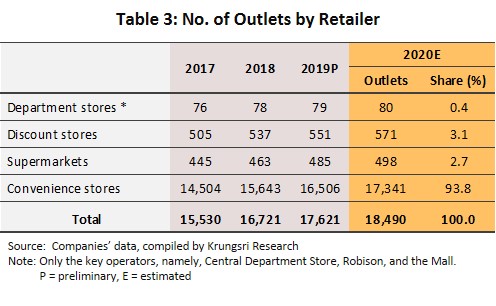

To improve access to retail floorspace, modern trade operators have been steadily expanding their branch networks in Bangkok and upcountry (Table 3) and investing to upgrade their existing outlets. This is reflected in data from the Thai Retailers Association, which shows investment by modern chain stores averaged THB43bn annually between 2016 and 2018. By 2019, cumulative total retail space in the Bangkok Metropolitan Region (BMR)[5] had reached 7.7mn sq.m., up 2.9% from a year earlier. This is split between shopping malls (63%), discount stores (15%), community malls (13%), entertainment complexes and supporting retail space (6%), and department stores (3%). Upcountry, major modern trade players like Robinson, Tesco Lotus and Big C have also been busy, expanding their store networks and offering different store formats in regional provincial centers, areas that attract large number of tourists, and second-tier provinces. The networks of small modern trade operators have also grown and can now be found across every province.

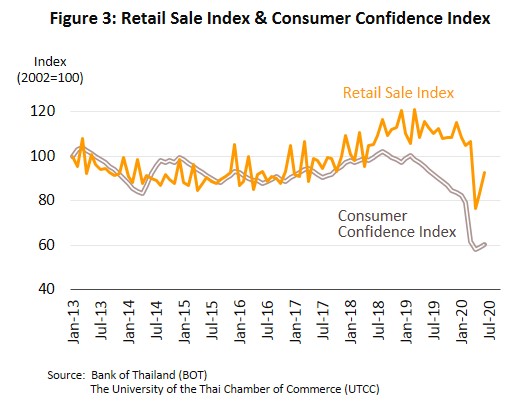

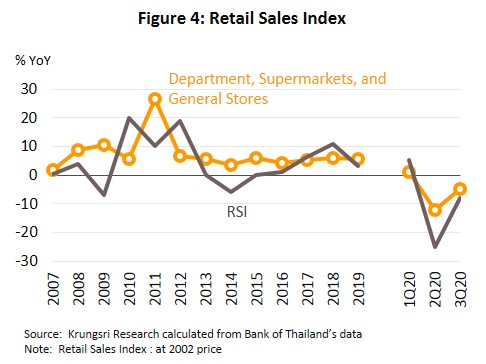

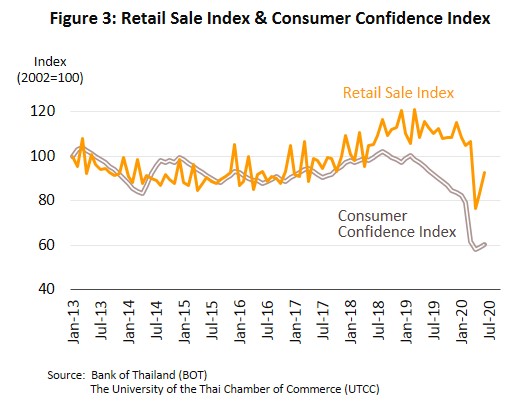

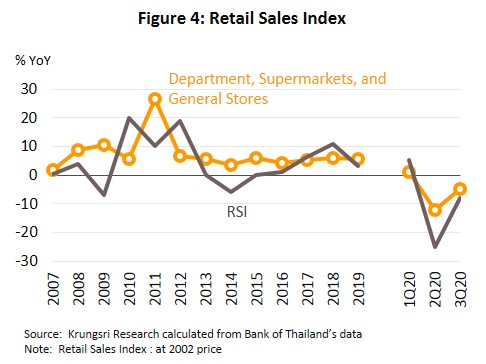

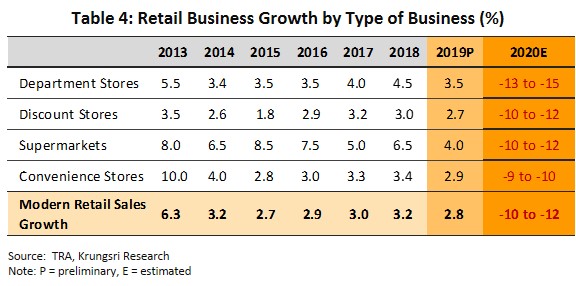

Krungsri Research estimates that in 2020, following the global COVID-19 pandemic, the modern trade industry experienced a historic contraction in sales, falling 10.0-12.0%. That can be attributed to several factors. (i) Consumer purchasing power fell as the economy entered a recession (GDP growth is projected at -6.4% in 2020) and the Consumer Confidence Index dropped to a record low of 52.6 (annual average). Meanwhile, foreign tourist arrivals crashed by over 80%, piling pressure on operators in destinations popular with foreign tourists (especially the Chinese). To make matters worse, in the first half of 2020, Thailand continued to be affected by the worst drought in 40 years, which eroded spending power of middle- to low-income consumers who work in the agriculture sector. (ii) The mandatory lockdown had forced non-essential retailers (e.g., department stores and shopping centers) to close their stores temporarily. Supermarkets and convenience stores were allowed to operate but business hours were curtailed sharply. (iii) The slow budget disbursement had also delayed the stimulus effect of government spending. As a result of this constellation of factors, the retail sales index slumped to an 11-year low in the second quarter of 2020 (Figure 4), before rebounding mildly in the second half of the year after the government relaxed the national lockdown and moved to restart the economy with a slew of stimulus measures to boost household spending. The latter included larger financial aid for low-income earners (increasing payments to government welfare card holders by THB21bn), ramping up rebates through the ‘shop dee mee kheun’ tax-rebate scheme (THB110bn), and measures to stimulate consumption and employment (worth THB68bn).

Operators have responded to this turbulent business environment by cutting expenses and costs, and employing more sales channels, including telephone, television and the internet. As such, these channels have risen in importance relative to in-store sales. Indeed, the index for sales made by mail order, television, telephone, radio, and the internet, jumped 133.1% YoY in 9M20. Priceza (an online marketplace) predicted that in 2020, internet purchases will reach THB220bn, rising 35% from 2019 figure. But despite the strong growth, internet sales remain relatively small compared to in-store sales, while simultaneously, purchasing power remains fragile and consumers are increasingly cautious about spending. This will hurt the retail sector, but the intensity would vary from segment to segment. (See details in Table 4).

- Retailers that are only moderately affected by the turbulence in 2020 include discount stores, hypermarkets, supermarkets and convenience stores. These operations benefited from distributing household necessities, though they were also beneficiaries of the rush by households to stockpile goods at the start of the pandemic and gained from government stimulus packages later in the year. This helped sales to rebound in the second half of 2020.

- Retailers that are severely affected by the pandemic and recession include department stores, which lost sales when they were forced to shutter temporarily. However, since reopening, customers have been reluctant to congregate in enclosed, crowded areas, while receipt from tourists has disappeared. Operators have been able to increase their online presence but currently, revenue from internet purchases is insufficient to compensate for losses in in-store revenues.

Most important features of modern retail business environment, by segment

Department stores

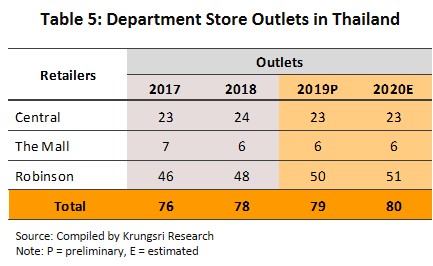

- There has been a steady flow of investment in department stores for several years, especially in 2012-2013 when the property market was booming upcountry. This led to increased activity in land sales and housing construction, which created opportunities for investors in large modern trade businesses and prompted several department-store chains to expand operations in regional centers and in tourism provinces.

- Competitive strategies employed by department stores include selling their strengths and simultaneously expanding to various formats to extend their customer base.

- Central Group has the most branches and floor space. To help segment the market, Central Group has invested in building several different brands ranging from lower- to higher-end: Robinson, Central, Zen and Central Embassy. New branches or store take different format according to location. Robinson branches upcountry is normally a ‘lifestyle center’ with a smaller overall area and emphasizes rental space. Central is investing in high-potential provinces. In addition, to reach a wider customer base, operators are also rushing to develop omni-channel businesses.[6] Central is targeting online channels to contribute 10% of total sales in 2020, up from 5% in 2019 and 1% in 2018.

- The Mall Group has concentrated its efforts to target the more exclusive market, investing in large, distinctive operations in central locations in Bangkok such as Emporium, EmQuartier and Siam Paragon. The recent opening of The Mall upcountry marks their move into tourist areas and signals an attempt to capture the foreign tourist market, such as BluPort (Hua Hin) and BluPearl (Phuket, opening soon).

- Other groups. There are many players in this segment, including a large number of Thai investors from other sectors who are investing in department stores. The investments typically take the form of developments in prime areas in Bangkok that target middle- and high-income consumers. These investors include Siam Piwat (Siam Discovery and Siam Center), Seacon Development (Seacon Square and Seacon Bangkae), Siam Retail Development (Fashion Island and Terminal 21), MBK Group (MBK Center and Paradise Park), Japanese JV (Tokyu and Isetan), Gaysorn Property (Gaysorn Plaza), Siam Future (Mega Bangna and Esplanade), TCC Group (Asiatique and Gateway Ekamai) and the joint-venture between CP Group and Siam Piwat (Icon Siam).

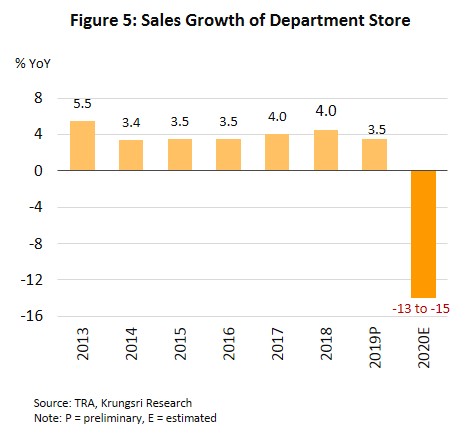

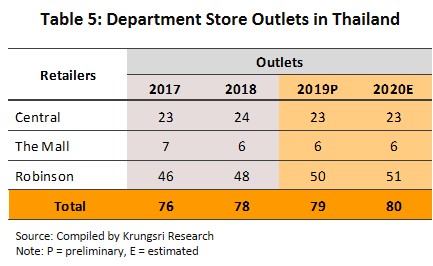

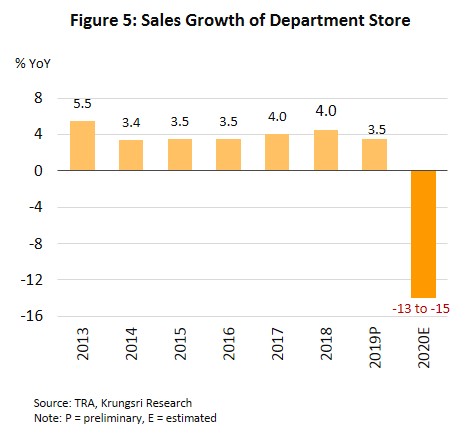

- As of 2020, the 3 largest department-store chains in Thailand (Central, Robinson and The Mall) operated a total of 80 outlets across the country (Table 5). Robinson had continued to expand its network throughout 2020 and invested in operations in Vietnam. However, it was a harsh year for this segment as COVID-19 pandemic forced the temporary closure of all department stores in 2Q20, and weak consumer spending led to the closure of Japanese-owned Isetan department store after almost three decades in the country. In response to these difficult conditions, players have overhauled their business models and made huge efforts to establish online presence to match that of their offline storefronts. This included developing ‘chat & shop’ and ‘call & shop’ sales channels, coupled with a sharp rise in social media activity (for example, promoting their brands on Facebook Live and LINE Official channels) as department stores try to boost sales, lift per-transaction value, attract new customers, and target more domestic shoppers. So far, most operators have been successful and online sales for some players have exploded by more than 300%. But despite the extraordinary growth rates, online markets still less than 10% of total sales, so they are still insufficient to offset losses triggered by the depressed economy. Given this, Krungsri Research estimates that in 2020, department store sales would contract by 13-15% against 3.5% growth in 2019 (Figure 5).

Discount stores/ Hypermarkets/ Supercenters

- Operators have revised investment plans to maximize long-term returns by increasing the number of discount stores they run. These are easier to operate than department stores because they require a smaller investment. But on the downside, they usually occupy large floor space, which is increasingly difficult to secure. Those that are available tend to be expensive, especially in city centers. Investments are also hampered by town planning regulations[7] that only permit large retail and wholesale properties to be built in restricted areas.

- Investments in BMR will focus on smaller branches and in expanding through alternative store formats. For example, Tesco Lotus is increasingly investing in Lotus Express, while Big C is opening Mini Big C stores and Big C Food that offer 24-hour service.

- Operators are reviewing investment in new branches, large and small, in major and second-tier provinces with rising urbanization rates. They are also expanding total retail space by opening new branches in second-tier districts. However, Big C, a major player in the sector, seems to be more flexible and responsive because it is expanding to smaller provinces and districts while reducing new store footprint to an average of only 3,000-4,000 sq. m. compared to more normal store size of 7,000-8,000 sq. m.

- Competition within this market is intense. And, players also face competition from other types of retail operations, including convenience stores, supermarkets and some specialty outlets. Hence, players have to work hard to protect their market share. They would employ special price promotions and offer discounts (a popular strategy in the segment), emphasizing product and service differentiation, and increasingly selling private brands. Players are also opening more, smaller, 24-hour outlets, which may be located near large stores or scaled-down and used as a tool to penetrate local community markets. At the same time, some operators have also invested in neighboring countries to secure new revenue streams, such as Big C’s expansion into Vietnam, Lao PDR and Cambodia.

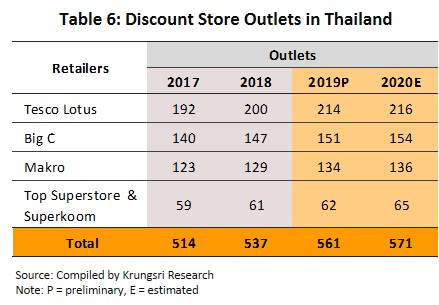

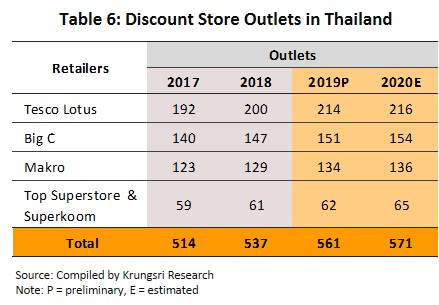

- As of 2020, players in this segment operated 571 branches (Table 6), a 1.8% increase from 2019. However, revenue dropped with sharply weaker spending power in the middle- and low-income segments, though this was partly offset by the government stimulus measures to support household spending. With the swift transformation in the market, businesses were quick to boost sales by adjusting their operations and developing new distribution channels to run alongside their in-store operations. Big C added several services – ‘call for shop’ feature (order goods by telephone or through LINE messaging service), drive-thru (order goods in advance for collection at the store), and ‘Big C shopping online express delivery’ (order goods online for delivery within 1 hour). The company also moved to address competition in the wholesale market by launching the ‘Big C Depot’ brand, which aims to make inroads into wholesale markets in second-tier districts upcountry. Tesco Lotus also developed an online presence last year with ‘Click & Collect’ (order goods online for collection at a branch) and ‘ShopBox24’ (order goods through a partner application). Krungsri Research projects that following 2.7% growth in 2019, discount store sales would crash by 10-12% in 2020 (Figure 6).

Supermarkets

- In the recent past, supermarkets had recorded the strongest sales growth in the retail industry because they sell daily necessities and consumables to high-spending middle- and upper-income earners. However, competition is stiffening in this segment as players from other segment start to venture in, price competition intensifies, and there are wide and more differentiated product lines. This is driving operators to adapt their marketing strategies to meet changing consumer behavior, for example, by offering more eat-in options, food delivery services, and redesigning branches to respond to rising purchasing power in local communities. Tops Supermarket has introduced the ‘Tops Superstore’ brand and Gourmet Market has spawned the ‘Gourmet Go’ spin-off. Supermarkets have also responded to rising incomes upcountry by opening new branches outside the Bangkok region. Collectively, these measures should help players sustain revenue growth in the coming period.

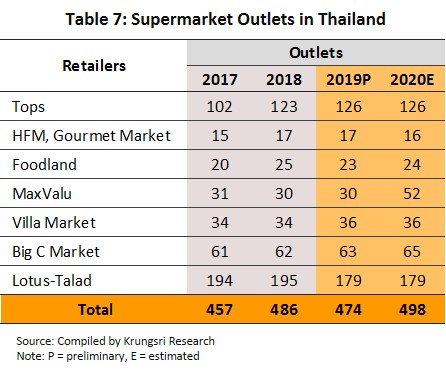

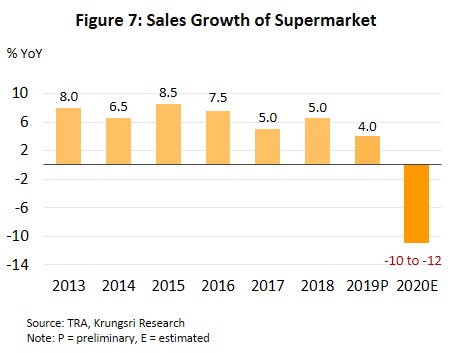

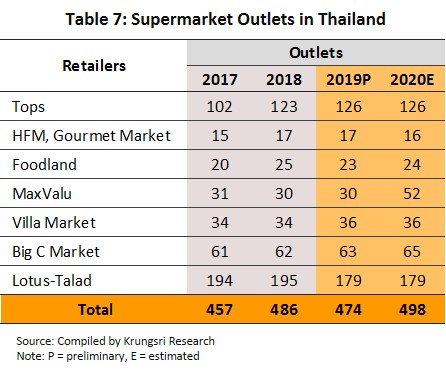

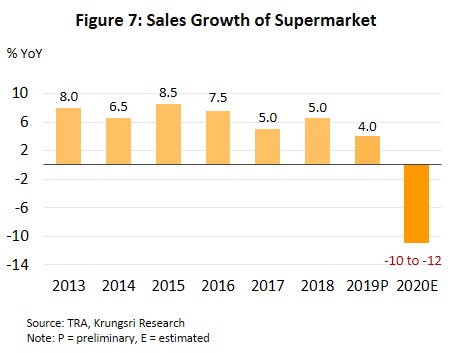

- In 2020, Thailand was home to 498 supermarkets (Table 7), 5.0% more than in 2019. Although these businesses were allowed to operate during the lockdown, consumers were tightening their belts and were concerned about hygiene in public areas. This had forced supermarkets to adapt, for example, by stepping up their online presence and offering drive-thru services (i.e., allowing customers to collect purchases without leaving their vehicle), as well as by marketing to high-spending customers by stocking a larger range of imported goods and reconfiguring some branches to operate as premium lifestyle supermarkets. Supermarkets have also expanded their presence in community malls to serve customers who wish to avoid shopping in large, crowded shopping centers. Krungsri Research projects supermarket segment sales would drop by 10-12% in 2020, compared to 4.0% growth in 2019 (Figure 7).

Convenience stores

- Convenience stores saw the strongest growth in investment among modern trade store formats and have taken the greatest market share from traditional retailers, because convenience store require less investment than other modern trade retail outlets. They have been investing and expanding into communities, sub-lanes and petrol stations to achieve complete national coverage. This segment has also seen several new entrants:

- Thai operators from other retail segments (such as Lotus Express, Mini Big C and Tops Daily) who operate stand-alone shops and outlets in petrol stations to serve travelers and communities, such as Lotus Express with Esso and Mini Big C with Bangchak;

- New players from non-retail sector such as “Jiffy” operated by PTT, and “CJ Express” run by Carabao Group, the producer of energy drinks.

- Foreign businesses such as Lawson from Japan has formed a joint venture with Sahapat, a major Thai manufacturer of consumer goods. In 2012, some of Sahapat’s 108shop branches were redesigned into Lawson108s. Aeon, another Japanese venture, operates MaxValu Tanjai which distributes ready-made meals and distinguishes itself from the competition by offering imported Japanese items, which comprise about a fifth of its total range.

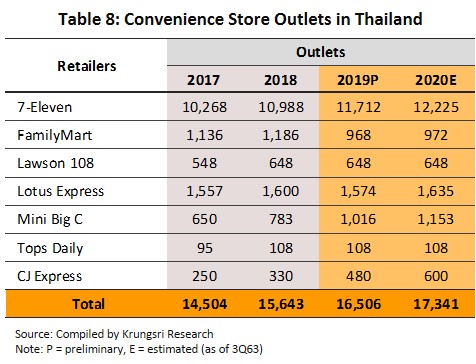

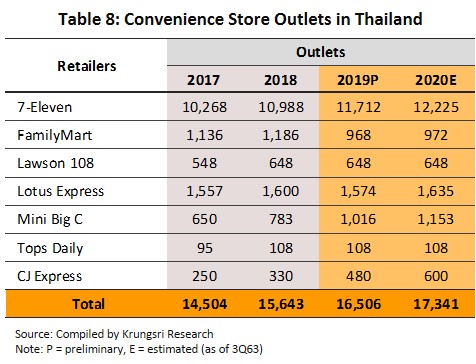

- In 2020, major chains operated 17,431 stores in Thailand (Table 8). With 70.5% share of this, 7-Eleven is the most important player in the segment. After adding 513 outlets to its network in 9M20, it now operates 12,225 branches in Thailand, the highest in a single country after Japan. Discount stores are also working their way into this market. Tesco Lotus and Big C are investing more in small, convenience-store-like outlets (or ‘super convenience stores’) in the shape of Lotus Express and Mini Big C. Because of this, players who want to extend their customer base now have to face competition across all aspects of their operations, including branch location, services offered, pricing, and sales promotions. They might also partner with other businesses (e.g., logistics and e-commerce companies) but their broad popularity and extensive branch networks have helped the convenience store segment to generate greater combined annual revenue than any other segment.

- Convenience stores prefer marketing through pricing and discounts, but also constantly try to improve their store layouts. For example, moving to 2-storey designs, expanding store size, adding car park facilities, and opening branches in shopping centers. Many convenience stores are also offering a larger range of products (e.g., fresh coffee, bakery goods, ready-to-eat food, and medicines) and services. The latter often include allowing customers to pay utility and credit card bills in-store, operate as banking agents for commercial banks, cooperate with logistics companies to send and receive parcels on behalf of their customers, or offer ‘open spaces’ where customers can meet, socialize and work. Convenience stores may compete with supermarkets by selling fresh fruit and vegetables or automate parts of their operations by deploying vending machines.

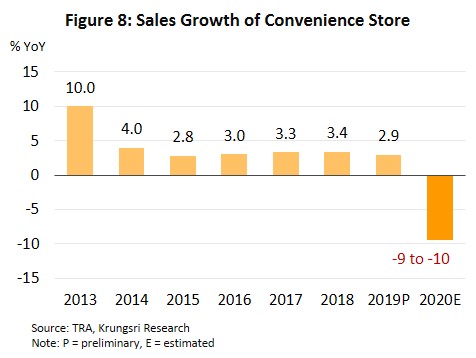

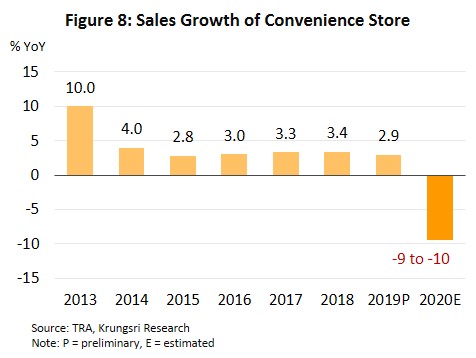

- Following 2.9% growth in 2019, convenience store segment revenue is estimated to have shrunk 9-10% in 2020 (Figure 8). This is attributed to the economic recession reducing spending power in the core customer group, middle- and low-income earners, and the temporary suspension of most economic activity during the lockdown. However, this was partly offset by other lockdown impact. Customers who were prevented from shopping in supermarkets in department stores were encouraged to visit stores such as (i) 7-Eleven and Family Mart, where the product range focuses on goods purchased for immediate consumption; and (ii) Mini Big C and Lotus Express, which sell a larger range of household store cupboard goods. Like elsewhere, operators have responded to the challenges of the COVID-19 crisis and of addressing customers’ concerns about leaving home to shop, by partnering with logistics companies and placing greater emphasis on online distribution channels, but these still contribute less than 5% of total sales.

Industry Outlook

From 2021 to 2023, modern trade is forecast to experience fragile average annual growth of 1.5-2.5% (Figure 9). Overall, Krungsri Research sees the Thai economy recovering these few years, but GDP growth will remain anemic and restricted to an average of just 3.0-4.0% per year, partly due to the latest wave of COVID-19 and lingering effects of the pandemic on consumer spending power. Likewise, although tourist arrivals will rise over the long term, the tourism sector will see a slow recovery with only 4mn arrivals projected for 2021. This is expected to rise to 11.4mn in 2022 and 26.4mn in 2023, but they are still way short of 2019 total of c.40mn foreign tourists. But despite these challenges,

the retail sector will benefit from several tailwinds: (i) The government is continuing with its measures to help the economy by supporting domestic purchasing power, for example through the ‘Travel together’ program (extended to 30 April 2021) to encourage greater spending by middle- and high-income earners, and increasing cash aid to holders of government welfare cards, which will benefit participating stores;

(ii) Accelerating disbursement of the annual budget and for high-value public investment projects, especially those connected to public transportation projects. This will increase the quantity of money in circulation, while progress in upcountry infrastructure projects would boost the growth of modern trade outlets.

(iii) Other longer-term structural shifts will also benefit the industry, including rising incomes, a growing middle-class, and ongoing urbanization, which would support demand for consumer goods. Economic growth in neighboring countries would also create opportunities for retailers to expand in border regions and in those countries as well.

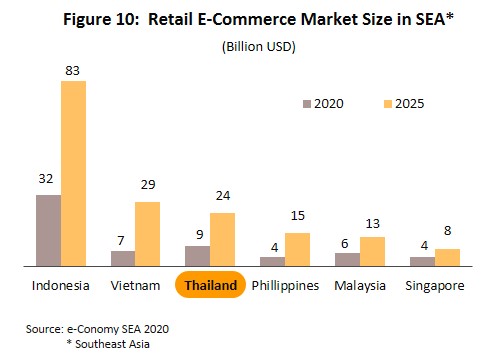

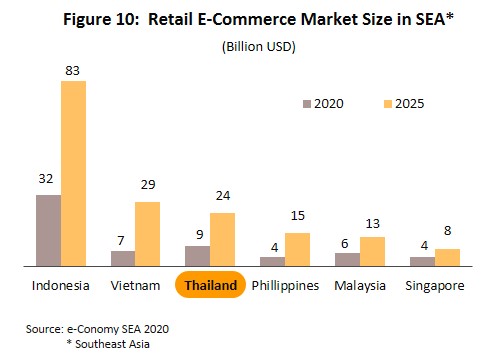

Factors that could hinder growth in modern trade in the coming period include: (i) weak or slow recovery of purchasing power in low-income communities. They comprise the largest segment of the Thai population. They would be constrained by a combination of volatile prices for agricultural goods and high household debt levels; and (ii) competition would intensify, coming from both within and without the industry and from new Thai and foreign entrants who will be attracted to the growth potential in the Thai retail sector. In addition, e-commerce sales are surging, so this segment will also be a greater threat. The e-commerce sector is broadly successful in meeting consumer demand (Box 1) and customers can now purchase a wider range of household necessities online. The industry is marked by a large number of sellers, including non-retail players and overseas operators (especially from China), that are ready to invest in Thai e-commerce. The Thai Retailers Association forecasts that by 2023, online purchases will account for more than 10% of all retail sales, up from just 2.0-3.0% in 2018, while e-Conomy SEA 2020 estimates that in 2020, the Thai e-commerce market had a value of USD9bn, up 81% from 2019, and that this will grow to USD24bn by 2025 (Figure 10).

Modern trade players would likely adjust their operations in the coming period to expand both revenue and customer bases over the long term. This would likely involve competing with large online sellers such as Alibaba and JD.com through the use of modern technology and new innovations. However, players will also emphasize off-line sales along with on-line sales by encouraging the use of e-payment systems (e.g., e-wallets and QR codes), partnering with complementary businesses such as ride-hailing apps, and continuing to invest to grow branch numbers to extend coverage and access to new customers. However, outlet size could shrink and formats could change depending on location.

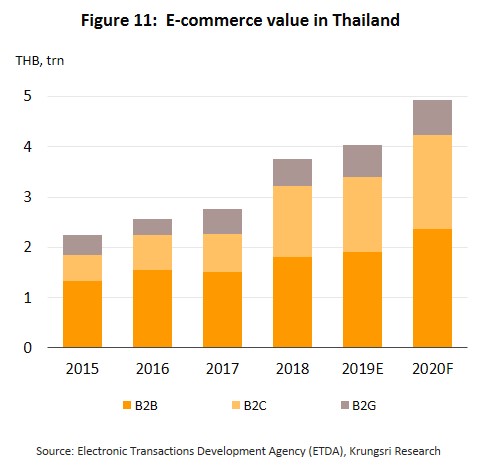

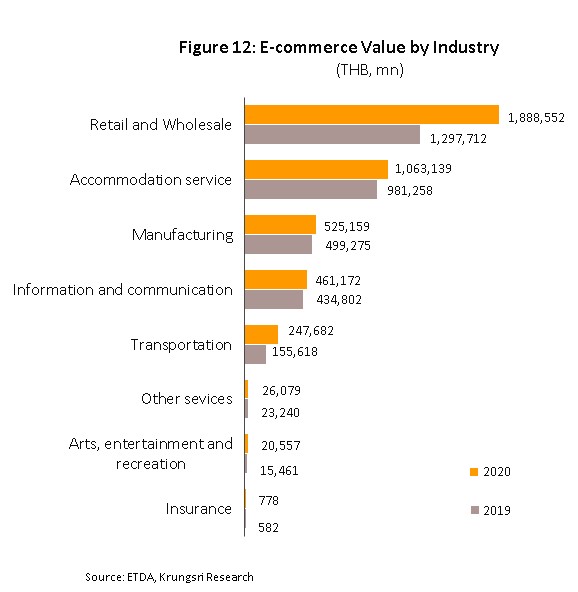

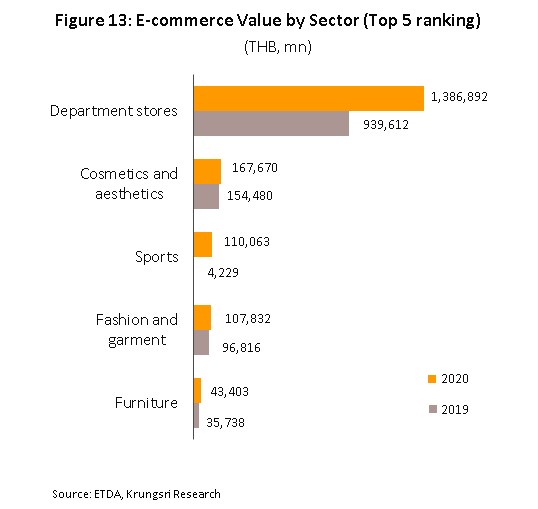

The Electronic Transactions Development Agency (ETDA) estimates that in 2020, Thai e-commerce sales jumped to THB4.9trn from THB4.0trn in 2019. This was split between the following categories:

- By type of seller: B2B (business-to-business) sales were the strongest at THB2.4trn, followed by B2C (business-to-customer) at THB1.9trn and B2G (business-to-government) at THB0.69trn (Figure 11).

- By type of business: The most valuable category was wholesale and retail, which had a value of THB1.9trn, followed by accommodation at THB1.1trn and manufacturing industries at THB0.53trn (Figure 12).

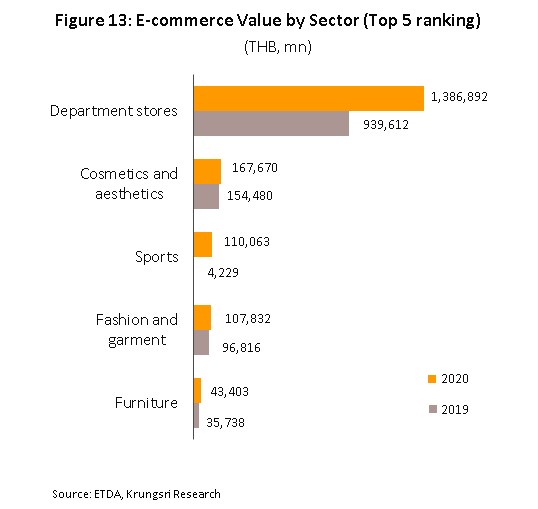

- By type of good or service: Department store sales came in first with a value of THB1.4trn, followed by cosmetics, food supplements, perfume and beauty accessories at THB0.17trn, and sports equipment at THB0.11trn (Figure 13).

- Domestic investment: Retailers plan to continue investing to expand their branch networks in Bangkok, provinces that attract large numbers of tourists, second-tier provinces, as well as areas with good transportation links, special economic zones, the Eastern Economic Corridor, and border areas. Ultimately, players intend to extend coverage down to the district level, although as they continue to expand, they would likely invest in smaller outlets that are ‘lifestyle’ oriented. In the immediate future, 7-Eleven is targeting to operate 13,000 outlets by the end of 2021, and plans to open 700 new branches annually. Big C plans to open 200-300 branches in 2021, mostly upcountry.

- Overseas investment: Large Thai players in the modern trade sector are also expected to increase investment in neighboring ASEAN nations. This is a market with potential for growth in terms of the size of the economy and the population, and a growing middle-class. The TCC Group’s has bought retail outlets and convenience stores in this market, including MM Mega Market and B’s Mart (a convenience store chain) in Vietnam and M-point Mart in Laos. The group has future plans to invest in retail outlets in Cambodia and Malaysia. Central Group has opened Supersports, Powerbuy and Big C (changed name to GO! and the format to a shopping mall) outlets and a ‘Robins’ department store in Vietnam, a Central department store in Indonesia, and Central i-City shopping center in Malaysia. HomePro has opened 6 branches in Malaysia. Index Living Mall has added branches in Malaysia, Indonesia, and the Philippines. Makro is investing in Cambodia, while 7-Eleven also plan to open stores in the country.

Operators will face several challenges in the coming period, including: (i) stricter government regulations, especially with regard to enforcing fair trade practice between retailers and manufacturers/distributors; (ii) the shift from an industry built on mass marketing to one more focused on niche markets and customization; (iii) the need to manage and exploit new technology, such as using big data resources to carry out in-depth customer and business analysis; and (iv) the need to increase competitiveness by raising the efficiency of stock and logistics management to ensure swifter distribution of goods to customers. As demonstrated above, the COVID-19 crisis has accelerated the shift to online distribution in the retail sector, including for food and consumer goods. This process is likely to continue over the long term. To meet this changing business landscape, retailers urgently need to review and adjust their online marketing strategies, and decide which platform is best for their products and best addresses the needs of their target consumers. At the same time, operators need to ensure that services are convenient and safe, and that they deliver goods into the customer’s hands as quickly as possible. This major shift in operating model now plays a significant role in determining business competitiveness.

Krungsri Research’s view

Modern trade operators are forecast to see average growth of 1.5-2.5% per year between 2021 and 2023. Expansion will be supported by the anticipated gradual recovery purchasing power, in line with the domestic economy. However, competition would intensify. Trends and opportunities for generating profits will not be spread evenly; they will vary from segment to segment. The details are listed below.

- Department stores: Sales are expected to grow following 2020 losses. Players have plans to invest in new stores and refurbish existing stores to meet rising demand supported by: (i) recovering consumer purchasing power driven by overall economic growth; (ii) recovering foreign tourist arrivals from 2023 onwards; and (iii) expansion of second-tier cities and those in border regions that are well connected to neighboring countries. Operators will seek to build new revenue streams by investing in high-potential markets elsewhere in the region, but at the same time, businesses will come under growing pressure from the expanding e-commerce industry. The latter could eat into department store sales; to preserve their customer base, it will be crucial for businesses to adjust their business models and ramp up investment in their own e-commerce operations. Locally-based department stores will also face stronger competition within the market.

- Discount stores, hypermarkets and supercenters: Following a sharp contraction, sales are expected to grow by 1.3-2.3% annually over the next 3 years as operators use tried-and-tested price-cutting strategies to undermine competitors and boost revenues. Operators would also benefit from their size, wide customer base and national coverage, so they should be able to maintain profitability. However, intra-segment price competition is intense, and players also have to face inter-segment competition from other types of retailers selling similar goods. This will cap profit growth.

- Supermarkets: The outlook for supermarkets is better than for other segments. From 2021 to 2023, they are projected to deliver 2.8-4.7% annual sales growth. This would partly compensate for the 10-12% drop in sales in 2020. This positive outlook can be ascribed to strong purchasing power of its core customers, who come from the middle- and upper-income groups, the wide range of products offered, and the large range of imported goods. Operators also benefit from their ongoing efforts to develop and improve their stores, high quality stock, their size, and their extensive presence in large communities. Given this, supermarkets are able to respond effectively to customer demands and businesses are expected to be able to generate profits in the foreseeable future.

- Convenience stores and minimarts: Over the next 3 years, sales are expected to grow by 1.7-2.8% annually, after contracting by 9-10% in 2020. This is premised on the continuing expansion of branch coverage to include small communities, residential areas along new metro lines in the BMR, and other areas with a high population density. Branch sales are also benefitting from broader stock lines that include ready-to-eat food and a range of new services (including online sales) that meet rising demand for convenient access to goods and services at local shops. However, like other segments, competition will intensify, both directly from competitors opening branches nearby and indirectly from supermarkets and discount stores that are opening smaller outlets to grab the same customer base. As a result, the geographical reach of individual stores is narrowing, and with this, per-branch profits. Although convenience store franchise holders will continue to generate profits, general convenience stores will face greater risks.

[1] Modern traders have significant bargaining powers and can undercut traditional grocers and retailers since they are able to specify terms of trade to their advantage and to collect a variety of charges from suppliers and agents who wish to be stocked by an operator. These include: charges for first orders or for providing a product code; fees to support services or activities such as rent for store space and charges for signage, meeting sales targets, and transportation from distribution centers to branches; charges for promotions and marketing such as those for printing leaflets, and subsidizing giveaways, and discounts, particularly for occasions such as anniversaries, new store openings, renovations and festivals; providing favorable credit terms to retailers, typically 90-120 days; and contracts which allow for unilateral termination of business.

[2] Working in retail and wholesale is a restricted activity, according to the Foreign Business Act B.E. 2542 and as such, non-Thai nationals who wish to make investments of less than THB100 million are required to seek authorization from the Foreign Business Committee. However, those investing more than this limit need only notify the authorities and they will automatically be granted authorization to engage in retail and wholesale trade in Thailand and thus the law provides an opening for non-Thais to enter the sector.

[3] The Standing Committee on Commerce, Industry and Labor, the National Legislative Assembly.

[4] Cash and Carry stores are regarded as wholesalers and were not discussed here.

[5] Colliers International Thailand

[6] Omni-channel: Development of marketing channel as cross-channel by integrating both online and in-store channel to create complete cohesion (It removes all barriers between a customer’s online and off-line journey)

[7] Regulations on the establishment of commercial buildings (retail and wholesale) are, for instance, 1) those with a store floor space of less than 300 sq.m. may be located in the area which is permitted and specified in the comprehensive city plan; 2) those with a store floor space of between 300-1,000 sq.m. should face a public road with at least four lanes or over 20 meters wide, and with a front road setback of at least 50 meters from public roads; 3) those with a store floor space over 1,000 sq.m must be located outside the area specified in the urban comprehensive plan, face public road or over 40 meters wide, and a front road setback of over 75 meters from public roads.

.webp.aspx)