Global growth is slowing down; IMF slashed global growth outlook amid higher inflation, rising interest rates, Ukraine war, and China’s strict covid policy

Major economies continue to slow down despite recovering economic activity in China, improving delivery times, and better supply situation

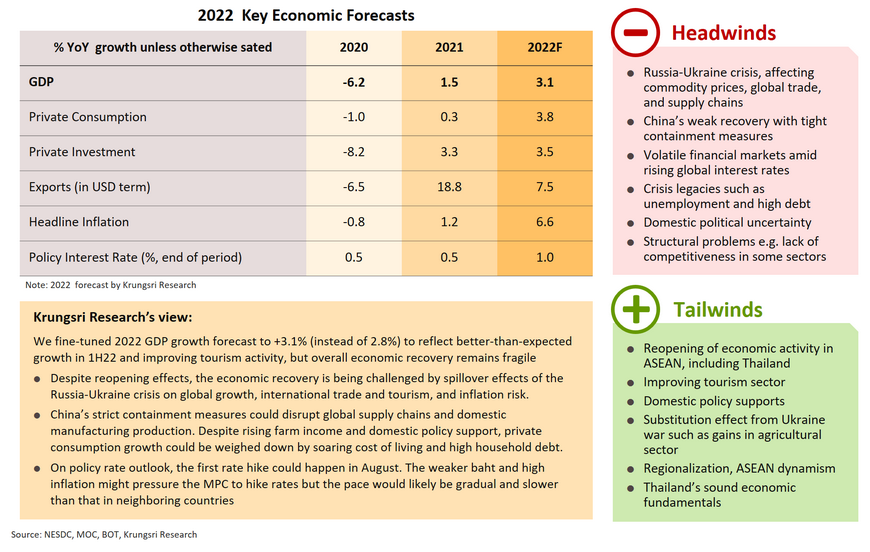

Thailand Economic Outlook

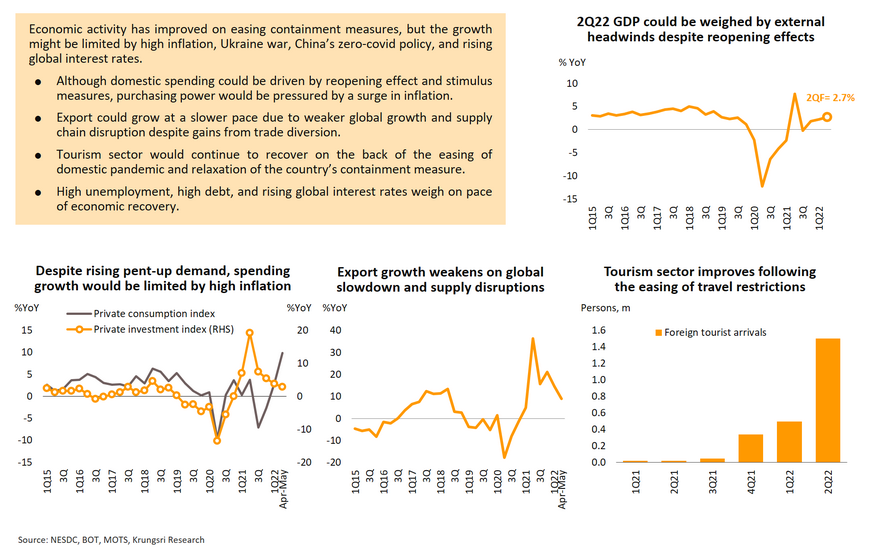

2022 Outlook: Divergent growth across key drivers amid external headwinds

Recent Economic Development

Chip shortages: expected to drag on into mid-2023 as a result of the extension of the Russia-Ukraine war and China's zero-Covid policy

Automobile: Growth in output remained low through 1H22 due to problems with the supply of parts, and expected to run to around 3-4% in 2022

Housing in BMR: Gradual recovery due to rising cost of living affecting eroded income and soften demand

Retail Space: Downwards trend on rental rates by fragile demand recovery amid over supply

Construction Contractor: Limited growth on rising cost and delayed infrastructure projects

Refinery: The continuing high price of crude will feed into a significant increase in gross refinery margins

Digital Services and Software: Income continues to rise on the growing uptake by consumers of the services provided by online platforms

Modern Trade: Growth should return with country reopening, tourism recovery, and government stimulus measures

Hotel: The tourism sector showed signs of recovery

Private Hospitals: Income growing with the rebound in the number of domestic and international patients

Road transport services: Limited growth in the volume of goods transportation

Sea freight services: Freight charges will likely remain elevated through all of 2022

Agriculture: Prices will tend to strengthen through 2022

The outlook for the Thai agricultural sector is strengthening on: (i) the Ukraine-Russia war and the COVID-19 pandemic, which is encouraging many countries to increase their food security measures and this has then led to an uptick in global prices for the major agricultural commodities; (ii) declining outputs in other exporting countries that have resulted from natural disasters and outbreaks of crop and livestock diseases (e.g., in Indonesia, Malaysia and Vietnam); and (iii) more favorable climatic conditions in Thailand that have boosted domestic outputs.

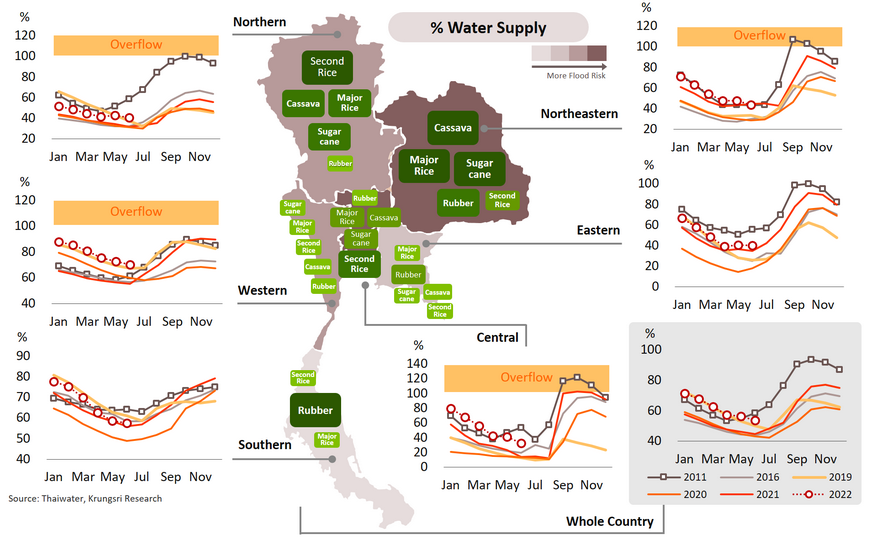

Both rainfall and reservoir levels elevate but remain lower than in the year of the great flood

As of June 2022, reservoir levels were at 54% of total capacity, significantly above June 2021’s level of 45%. For all of 2022, the emergence of a moderate La Niña will mean that rainfall and reservoir levels will tend to rise further, and this will add to the risk of flooding in the northeastern and central parts of the country, and in areas where major crops (rice, cassava, sugarcane, and rubber) are grown.

Farm incomes expected to rise by 10.0-12.0% in 2022 due to both higher prices and outputs

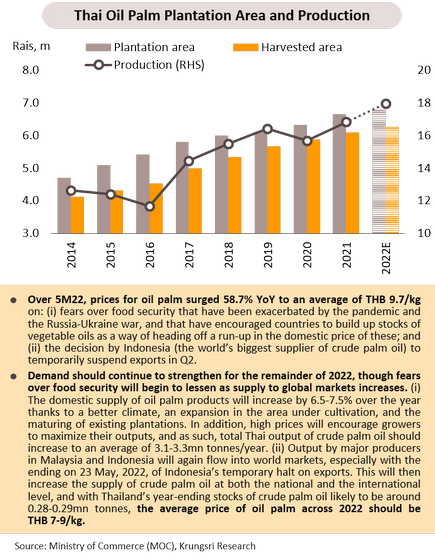

Oil Palm: Output expected to rise steadily, limiting the room for price increases

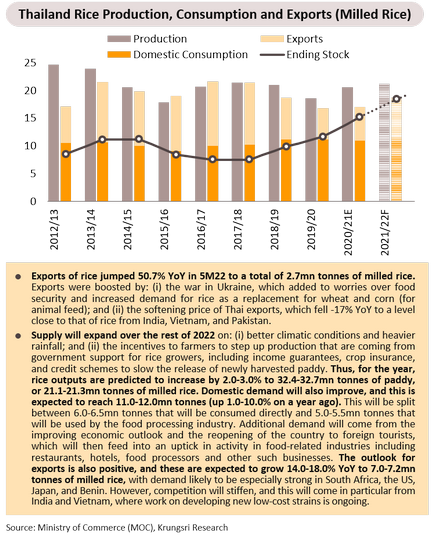

Rice: Competition on world markets tends to intensify, especially from India and Vietnam

Rubber: Growth driven mainly by improving demand in the export segment

Cassava: Demand from China for use in the manufacture of alcohol, ethanol and animal feed is increasing