Industry Horizon (July 2024)

23 July 2024

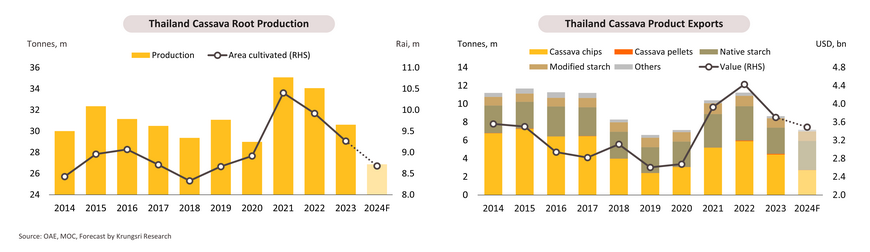

Cassava: The effects of the drought will drag on exports, but domestic consumption will continue to increase on stronger demand from the food and ethanol industries.

-

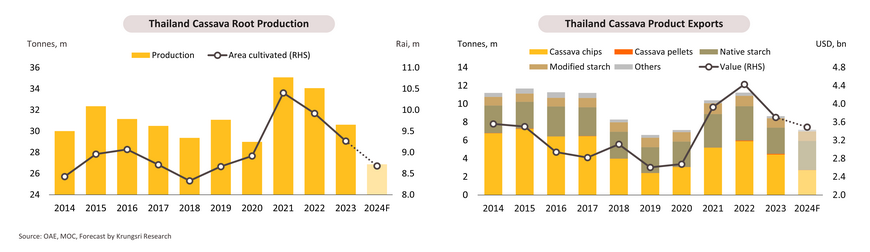

The cassava output index fell by -8.8% YoY in 5M24 due to the spread of cassava mosaic disease and a shortage of the cuttings needed for planting that encouraged some farmers to plant alternative crops instead. The shortage of cassava reduced the output of the downstream product exports. By volume and value, exports thus contracted respectively -38.2% YoY to 3.0m tonnes and -18.2% YoY to USD 1.46bn. Nevertheless, demand from industrial consumers of cassava signaled strengthened domestic consumption.

- Problems relating to El Niño-induced drought will recede through the rest of 2024, but cassava mosaic disease will continue to pose a threat. Farmers thus will still have to contend with limited access to the cuttings needed for planting. Outputs will fall by an estimated -11.0% to -13.0% over all of 2024 to a total of 26.6-27.3m tonnes. The resulting shortage of inputs to the production of cassava products will then cause exports to decline by -17.0% to -18.0%, reaching 7.1-7.2m tonnes. However, declines will tend to be restricted to cassava chip, while exports of native and modified starch are expected to continue to rise. Domestic consumption will move in the opposite direction, growing by 3.0-4.0% to 13.5-13.7m tonnes of fresh cassava as a result of (i) economic growth that will increase annual demand from the food industry by 3.0-4.0%; (ii) the rebound in the tourism sector and increased investment in infrastructure that will boost demand for travel and transport services, lifting consumption of E20 and E85 gasohol and boosting demand for cassava for use in ethanol production by 5.0-6.0%; and (iii) the relatively greater impacts of the drought on sugarcane outputs, which has resulted in higher prices and a limited supply of cane and molasses and as such, demand for fresh cassava, cassava chip and cassava starch for use in the production of ethanol is rising.

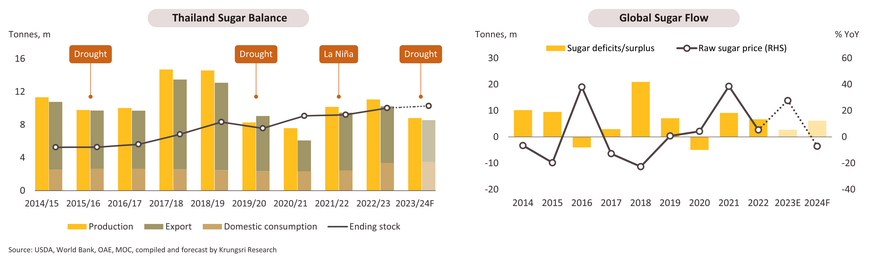

Sugar and molasses: The rebound in the tourism industry and related sectors will boost domestic demand but exports to major markets are softening.

-

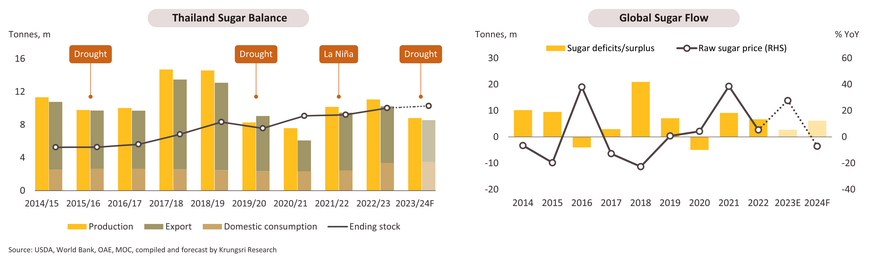

The domestic market absorbed 0.66m tonnes of sugar over 3M24 (+3.1% YoY), split between 0.39m tonnes (+5.3% YoY) that was consumed directly and another 0.27m tonnes (+0.1% YoY) that was used by downstream industries. The market was buoyed by the increasing pace of economic activity, most notably the ongoing rebound in the tourism, restaurant, and drinks industries. However, exports suffered through 5M24, crashing -43.6% YoY to just 2.2m tonnes on strong declines across the major markets of Indonesia (Thailand’s main market, -58.3% YoY), South Korea (-54.0% YoY), the Philippines (-79.4% YoY) and Malaysia (-52.9% YoY). This fall in exports was driven by a combination of softening economies that undercut spending power and the drought that lowered Thai sugar outputs.

- Through the rest of 2024, a brightening outlook for energy providers and the ongoing recovery in the tourism sector and allied industries will continue to boost domestic demand for sugar, and so for 2024, consumption is predicted to rise 3.0-4.0% to 3.5-3.8m tonnes. However, tight supply will continue to hamper exports of sugar and molasses, and so exports are forecast to slump by between -25% and -30% to 4.8-5.1m tonnes. The volume of sugarcane being pressed in the 2024 growing season is also expected to fall to 82.2m tonnes (-12.5%), implying that output of sugar will drop -20.4% to 8.8m tonnes. This worsening outlook will be the result of: (i) the drought and the resulting crop losses and reductions in yields; (ii) the switch by some farmers to alternative crops; (iii) elevated production costs, especially as a result of more expensive fertilizer and energy; and (iv) ongoing problems with labor shortages and rising wages, which will add further to overheads.

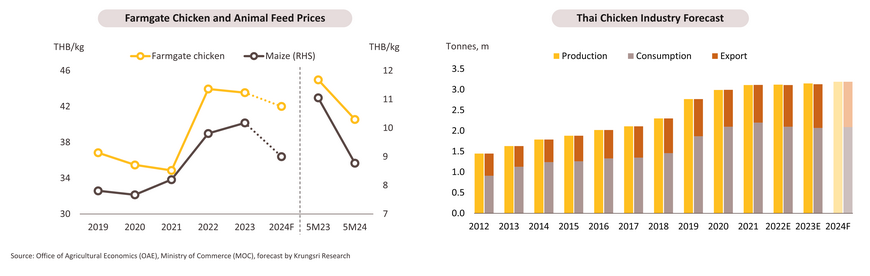

Chilled, Frozen and Processed Chicken Industry: Domestic demand will be supported by food services and tourism recovery, while exports will benefit from new market channels.

-

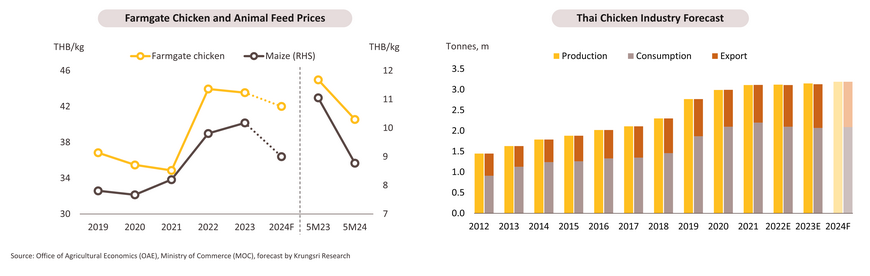

Exports totaled 0.47m tonnes over 5M24 (+3.9% YoY), generating earnings of USD 1.72bn (+4.0% YoY). Growth was driven by the 14.3% YoY jump in exports of processed chicken, with the strongest sales in the Japanese (+8.9% YoY) and the UK (+18.9% YoY) markets. Exports have been helped by the fast pace of life in the advanced economies, which is lifting demand for ready-to-eat products, and lukewarm growth in the world economy, which benefits chicken sales since prices for this have weakened on the falling cost of inputs.

-

Demand for chicken products will strengthen in both domestic and export markets through the remainder of 2024. Within Thailand, demand will increase by 0.5-1.5% to 2.08-2.10m tonnes due to (i) slow economic growth and purchasing power that will then encourage shoppers to buy more affordable products; and (ii) the recovery in the restaurant industry and the tourism sector as foreign arrivals continue to rebound. Export volume is expected to grow 3.5-4.5% to 1.09-1.11m tonnes thanks to (i) deepening trade relations in the Middle East and CLMV markets; (ii) stronger demand among global consumers for lower-cost sources of protein; (iii) chicken’s positioning as a low-fat, high-protein food that is suitable for health-conscious consumers; and (iv) lower feed costs that have undercut export prices. Output is forecast to rise by 1.0-2.0% to 3.18-3.20m tonnes of chicken meat.

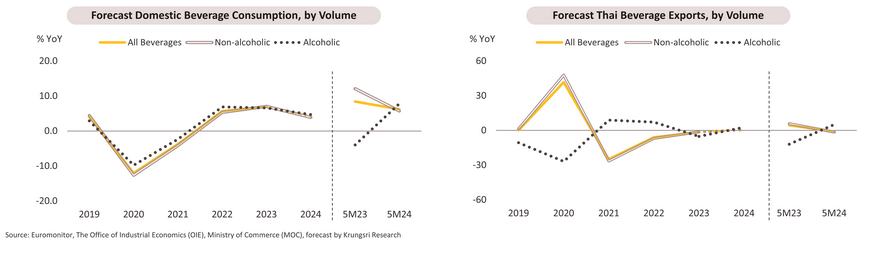

Beverages Industry: Domestic sales will rise with the recovery in tourism, food services and convenience store sales, but exports to neighboring countries remain weak.

-

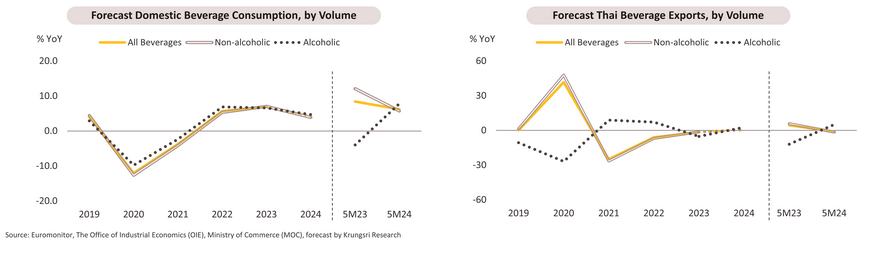

Overall output of beverages rose 7.7% in 5M24. Production of non-alcoholic beverages rose from the increases in the production of bottled water (+3.9%YoY) and soda/carbonated drinks (+9.3%YoY). For alcoholic drinks, spirits and beer production climbed by 6.9% YoY and 8.5% YoY respectively. This then helped to meet the 6.2% YoY increase in domestic demand, boosted by rises in the consumption of bottled water and soda/carbonated drinks of 3.7% YoY and 7.9% YoY, thus lifting total sales of non-alcoholic drinks by 5.7% YoY. Consumption of alcoholic beverages also jumped 7.8% YoY on stronger sales of both spirits (+12.0% YoY) and beer (+6.8% YoY). The market benefited from the rebound in tourism and the rising number of tourist arrivals (especially from the major destinations and during important holiday periods), the development of new product lines, and the hottest summer in many years. However, exports moved against this to soften -1.1% YoY. Exports of soft drinks fell -1.5% YoY due to declines of -11.7% YoY and -8.4% YoY in the bottled water and soda/carbonated drinks segments, respectively. These suffered from a drop in neighboring markets due to slowing economies, their subsequent worsening exchange rates, and the higher cost of sugar, which then lifted overall prices. Nevertheless, increases in exports of beer, up 6.5% YoY on a rise in sales to the UAE, Cambodia, and Israel, and of spirits, up 17.3% YoY thanks to the strength of the Malaysian and Latvian markets, pushed up overall exports of alcoholic drinks by 5.1% YoY.

-

Output of beverages should be up 7.0-8.0% across all of 2024, principally due to the strength of domestic demand. Domestic sales will thus climb by some 3.5-4.5% on the solid prospects for domestic and international tourism and the resulting improvement in the food services industry outlook. Exports will also increase, though with economies slowing in overseas markets and Thai producers increasingly investing directly in these countries (partly to cut shipping costs), these are expected to be up by just 1.0%.

Automobile: Domestic market slowdown and stricter lending will hinder output, especially for commercial vehicles, but exports will edge up due to pent-up demand.

-

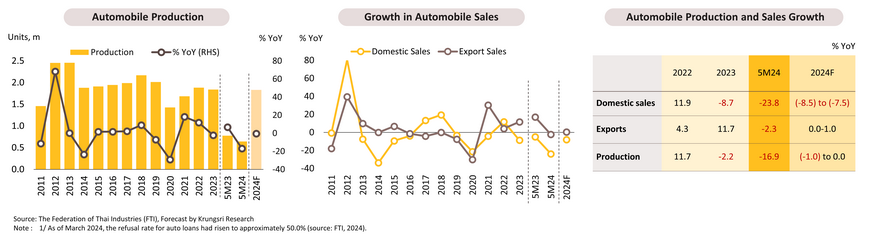

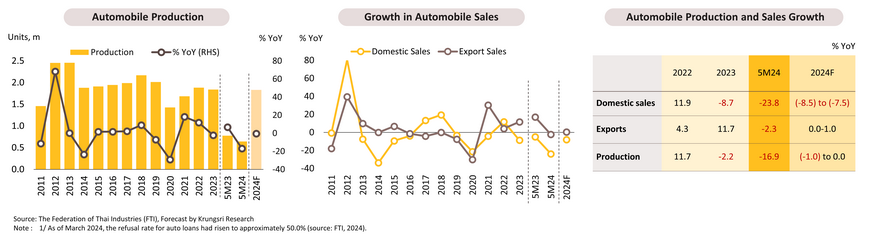

Output of autos fell to 644,951 vehicles (down -16.9% YoY) over 5M24, with production of pickups and passenger vehicles down by -20.9% and -12.1% YoY. By contrast, output of passenger HEVs jumped 17.0% YoY, though production of BEVs reached only 4,156 vehicles. Domestic sales also crashed -23.8% YoY to 260,365 units, largely driven by the -41.0% YoY slump in sales of pickups due to tightening lending conditions1/ and weak purchasing power, especially in agriculture, which was affected by El Niño. In addition, the increase up in the cost of living and the drop in second-hand auto prices, which meant that those looking to trade in older vehicles were forced to postpone purchases, also cut sales of passenger vehicles by -17.8%. Exports edged down -2.3% YoY to 429,969 vehicles due to: (i) still-weak purchasing power in major exports market; and (ii) the high baseline in the previous year, when chip shortages began to ease. Nevertheless, the value of exports of HEVs and PHEVs (a combined 9.9% of the value of all exports of passenger vehicles) jumped 60.6% YoY, with strong growth seen in exports to Saudi Arabia (+49.2% YoY) and Australia (+45.6% YoY).

-

2024 overall: Despite the easing of global chip shortages, auto output will remain flat or inch down by up to -1.0% mainly due to an anticipated -7.5% to -8.5% decline in domestic sales. This will be driven by: (i) still-weak purchasing power; (ii) the rising proportion of auto loans classified as special-mention loans, which will tend to raise NPLs and discourage the release of new credit; and (iii) delays to infrastructure spending, which is then dragging on investments in provincial transport services. Exports will stay unchanged or possibly edge up by up to 1.0% thanks to continuing pent-up demand for ICE-powered vehicles in Thailand’s main foreign markets, while exports of HEVs and PPVs will continue to rise on respectively increasing global acceptance of EVs and strong growth in spending power among upper-income earners.

Electric vehicles: Production of BEV will increase to compensate for imports, while new vehicle registrations will benefit from ongoing government support.

-

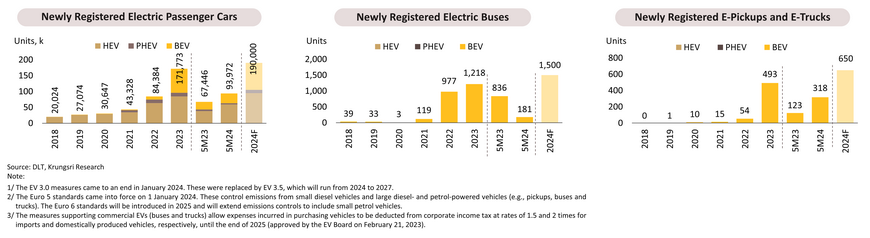

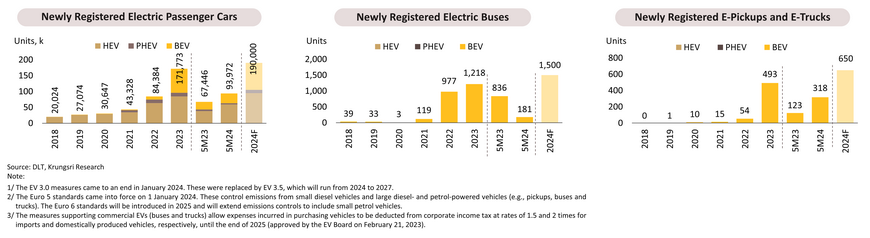

Over 5M24, registrations of xEV passenger vehicles surged 39.3% YoY to 93,972 units, split between the following. (i) Sales of passenger BEVs jumped 29.0% to 30,857 vehicles, benefited from the EV 3.0 and EV 3.51/ measures, the growing variety of models available, and their greater range, (ii) Domestic sales of passenger HEVs surged to 59,064 vehicles (+54.1% YoY), boosted by the combination of ICE and EV technologies in HEVs, which became an attractive choice given the undersupply of charging points during transitions to EVs. Sales also benefited from the wide range of models available, especially from the leading Japanese manufacturers. (iii) However, PHEVs are losing market share to BEVs, boosted by government subsidies and strong competition on price. Sales of PHEVs thus slumped -22.0% YoY to just 4,051 vehicles. Registrations of new bus BEVs also crashed -84.8% YoY to 107 vehicles, following a significant increase in the market over the previous 2 years. Registrations of new commercial BEVs (pickups and trucks) were up 214.4% YoY, but the limited range of commercial EVs and the lack of charging stations upcountry resulted in only 650 vehicles being registered in the period.

-

2024 overall: To meet the requirements of the EV 3.0 measures by offsetting EV imports of EVs with 1-1.5 domestically assembled units will boost output and lift annual xEV production capacity to 400,000-500,000 vehicles by 2025. Registrations of new passenger BEVs, HEVs, and PHEVs are expected to come in at respectively 85,000, 95,000 and 10,000 units thanks to the EV 3.5 measures, falling prices as a greater variety of models become available, the 2026 hike in excise rates, which will pull demand forward, and the enforcement of the Euro 5 and Euro 6 standards2/ in 2024 and 2025, respectively. Registrations of EV buses and commercial vehicles are expected to rise to 1,500 and 650 units, lifted by the EV 3.5 measures that aim to stimulate EV pickup sales, changes to tax regulations that will encourage stronger sales of large commercial vehicles3/, and expanded public EV bus services.

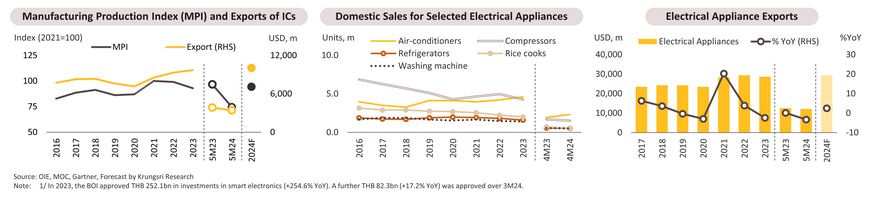

ICs and electrical appliances: Production and exports will gradually strengthen as the replacement cycle swings back into the industry’s favor.

5M24

-

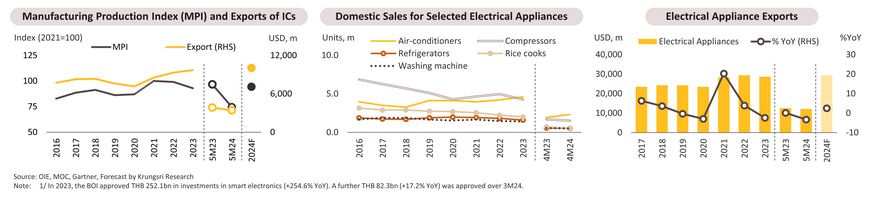

Production of integrated circuits (ICs) fell -22.9% YoY, with exports also down -11.1% YoY. The industry was affected by the continuation of 2023’s weak conditions in the global PC and smartphone markets, though exports fell at a lower rate than the drop in the IC MPI thanks to an uptick in the production and export of higher value products.

-

Domestic sales of electrical appliances in 4M24 fell -8.7% YoY. Although the Easy E-Receipt scheme (Jan 1 – Feb 15) offered tax rebates on purchases up to THB 50,000 and the unusually hot weather helped to lift air-conditioner sales by 20.7% YoY, consumers continued to struggle against the household debt and elevated inflation. Also, exports were down -2.4% YoY, and so with the world economy still uncertain and energy prices still high, demand has still failed to return to the 2021 peak.

2024 overall

-

Production and exports of ICs will rise by respectively 1.0-2.0% and 3.0-4.0% YoY. The market will benefit from (i) the swing back in the replacement cycle and rising global demand for PCs and smartphones, which Gartner sees growing by 3.5% and 4.2% YoY each; (ii) the increase in investment in smart electronics production capacity seen since 20231/; and (iii) the IEA’s forecast of an 18.2% strengthening in annual demand for EVs over 2024-2030. which will boost domestic and international EV production.

-

Sales of electrical appliances to the domestic market are expected to edge up by 1.0-2.0% YoY on (i) growth in the tourism and real estate sectors, and in the economy overall; (ii) strong purchasing power among higher income earners, which will lift demand for premium products; (iii) heavier demand for air-conditioners due to rising temperatures, and the introduction of the new 5-star energy rating system, which will improve energy efficiency and reduce greenhouse gas emissions; and (iv) the increasing range of product choices. However, the growing popularity of launderettes is eating into demand for washing machines, potentially hindering overall electrical appliance market growth. Finally, the onset of a new replacement cycle, economic recovery in overseas markets, and easing cost-of-living pressures will help to raise exports by 2.0-3.0% YoY.

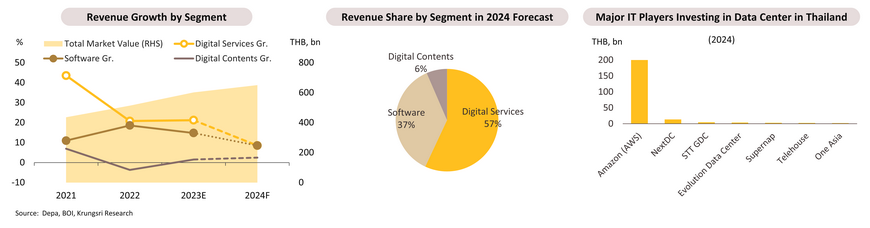

Digital services and software: Revenue will grow in line with the investment boom in data centers and cloud services supporting digital ecosystem development.

-

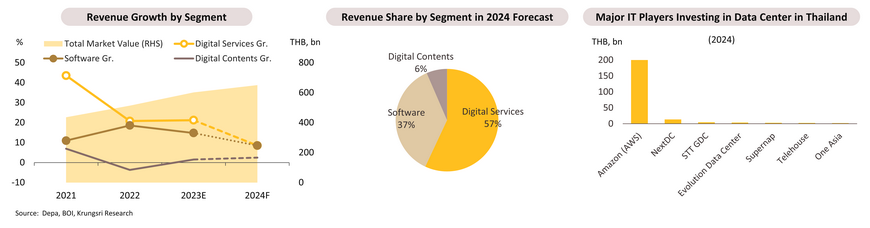

In 1H24, the business's revenue continued to grow (after expanding by 17.3% in 2023). The digital service sector was driven by: (i) increased demand for transactions through real-time live commerce, and online shopping platforms to apply for the Easy e-receipt program early in the year, and (ii) supply-side development of new platforms featuring live streaming, enhancing the digital services ecosystem. The software business continued to grow in response to increasing demand from businesses competing to use AI-powered software for intelligent big data management. The digital content business is recovering slowly due to weakened purchasing power amid an economic slowdown. The gaming sector is growing more slowly as more people return to offices, while animation and character content are rebounding thanks to the tourism industry.

-

Throughout 2024, the digital service business is expected to maintain growth momentum, particularly through the integration of various digital services and social media platforms to tailor real-time customer experiences. The delivery platform business is also set for significant expansion, with Grab projecting a 15% market value growth in online car and food delivery through 2025. However, competition will intensify due to the rising number of players and the trend of returning to office work. The software business continues to benefit from the transformation towards cloud services and data centers in offices. As of July 2024, the BOI has approved 37 investment projects in these areas, totaling THB 98.5bn, with Amazon Web Services (AWS) leading the majority. Gartner also projects a 30.1% increase in organizations' spending on public cloud services in Thailand for 2024. Meanwhile, the digital content business is gradually recovering, with KANTAR predicting an 8% rise in digital advertising value in 2024. This is driven by the growth in the tourism sector, benefiting animation and character content sectors. However, the online gaming market may grow more slowly due to weakened purchasing power. Krungsri Research forecasts an 8.0-9.0% average growth across the digital industry in 2024, with digital and software services expected to grow by 8.0-9.0%, and the digital content sector projected to expand by 2.0-3.0%.

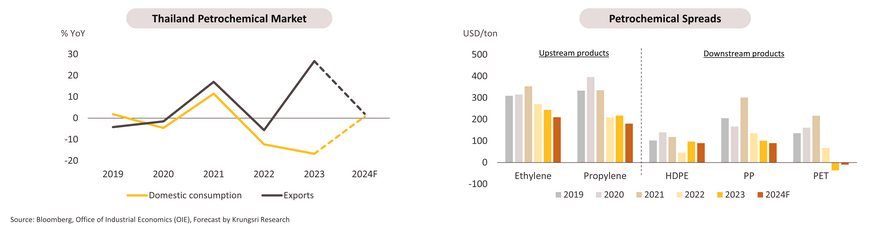

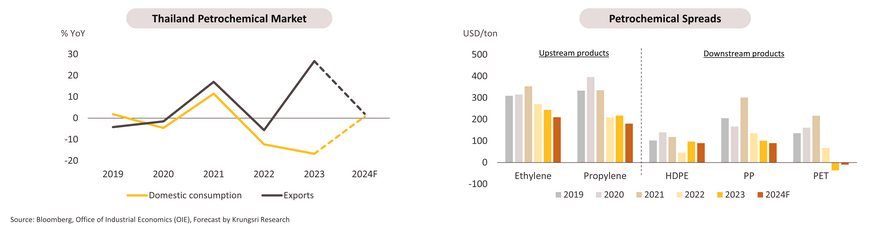

Petrochemical: Elevated feedstock prices due to high crude costs and slow demand recovery are putting downward pressure on the spread.

-

The domestic petrochemicals market contracted over 4M24. Domestic petrochemical consumption fell -7.5% YoY due to depressed conditions in the manufacturing and export sectors, as evidenced by the MPI slipping -2.0% YoY. This caused a softening in the demand for petrochemicals used as inputs in downstream manufacturing processes. However, export volumes expanding by 2.0% YoY due to improving conditions in overseas markets. Sales to China, Thailand’s main overseas market, were particularly strong, buoyed by a 1.9% YoY rise in the Caixin Manufacturing PMI. Despite this, high crude prices have increased the cost of feedstocks, with naphtha averaging USD 704.7/tonne compared to 2023's average of USD 653/tonne, leading to narrower spreads for many products.

-

The domestic market should strengthen gradually through the rest of 2024 thanks to an uptick in public and private investment and a rebound in the tourism sector. This will lead to an improved economic outlook and higher demand for petrochemicals from downstream industries (e.g., packaging and construction supplies). Businesses are also responding to changes in global demand by channeling investment into several key areas: (i) overhauling production lines and shifting focus towards the manufacture of the resins (e.g., ABS) used in the high-value specialty plastics supplied to the S-curve industries (e.g., EV auto parts, batteries, and medical supplies); (ii) increasing the production of biodegradable plastics; (iii) setting facilities for processing high-quality, food-grade recycled plastics; and (iv) developing carbon capture, utilization and storage (CCUS) technologies that can use CO2 as a feedstock in the plastic production. However, during the COVID-19 pandemic, Chinese players expanded investment in large-scale domestic production facilities. As a result, this expansion is expected to reduce petrochemical exports from Thailand. In addition, the Chinese market faces increased risk due to worsening US-China trade relations. For all of 2024, domestic demand for petrochemical products is expected to expand by 0.5-1.0%, while exports will rise by 1.5-2.5%. With crude forecast to average USD 85/bbl across the year, feedstocks will also remain expensive and so spreads will come under further pressure.

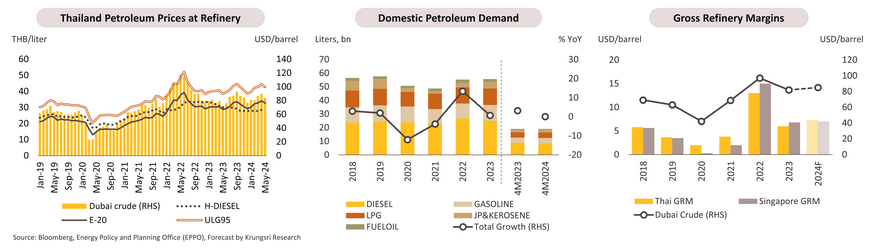

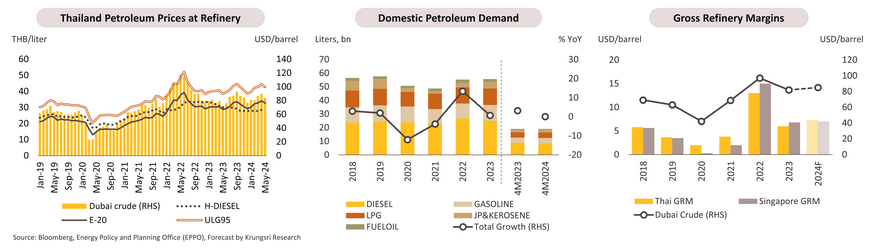

Refinery: The primary drivers of growth will be tourism and the expansion in investment in clean energy projects.

-

Gross refinery margins (GRMs) improved through 4M24 on a combination of a stronger energy demand, ongoing geopolitical tensions (e.g., the extended Russia-Ukraine war and the Israel-Hamas conflict), and production cuts by the OPEC+ to tighten supply and support market prices. Oil prices have thus periodically edged higher, and with Dubai Crude averaging USD 83.7/bbl (up 4.0%YoY), Thai ex-refinery prices have risen 5.4% YoY for gasoline and 6.4% YoY for E-20. In contrast, demand for refined products has been almost flat, inching up just 0.1% YoY. This sluggishness is due to the weak manufacturing and industrial sectors, resulting in -4.0% YoY and -21.1% YoY fall in demand for diesel and bunker fuel. This, though, was offset by continuing recovery in the tourism sector that fed stronger demand for transport services, leading to a 1.0% YoY increase gasoline demand and a 19.1% YoY rise in aviation fuel demand. These opposing forces largely balanced each other out, keeping overall demand close to its 2023 level.

-

An increase in economic activity will lift demand for refinery products through the rest of 2024. The continuing recovery in the tourism sector will particularly boost demand for travel, especially airline services. In addition, manufacturing and exports should see a gradually improving outlook. However, demand growth from industrial consumers will be limited by structural issues within the sector and worsening global trade tensions. Players will likely respond to broad economic growth and strengthening demand by increasing their investments and exploring new market opportunities. This includes expanding into clean energy, exemplified by Thai Oil’s decision to invest in large-scale facilities in the EEC to convert low-value bunker oil into higher-value refined products such as diesel and low-sulfur aviation fuel, with commercial operations expected to begin in 2024. With crude prices expected to average USD 85/bbl across 2025, Thai GRMs should stay in the range USD 6.5-7.5/bbl, above the pre-Covid average of USD 5-6/bbl.

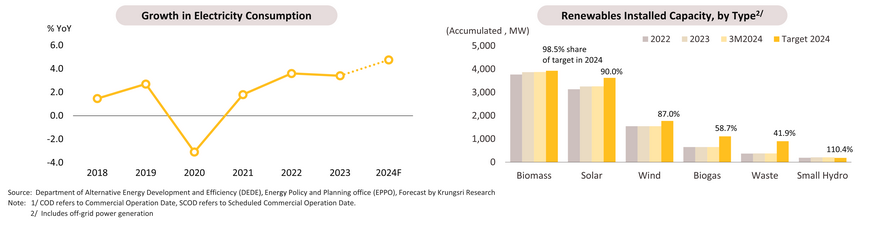

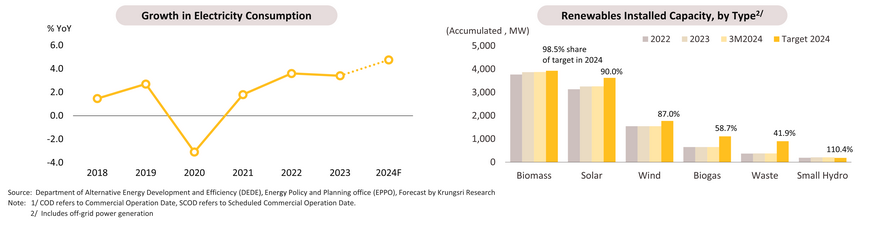

Power Generation: Demand for electricity will strengthen with the increase in the number of EVs on the road and overall economic growth.

-

Power generators benefited from steadily growing demand through 1H24 (up 9.9% YoY in 4M24). Household power consumption (29.0% of all electricity consumption) grew 17.0% YoY, fueled by unusually hot weather and government subsidies for electricity bills that reduced retail prices from THB 4.72/unit in 2023 to THB 3.99/unit this year. Electricity demand from business and industry (66.0% of total demand) also rose by 6.8% YoY, supported by a better outlook for the tourism and export sectors, and a 17.8% YoY rise in newly registered BEVs and PHEVs during the same period. Peak demand reached a new high of 36,477.8 MW in April, up 6.9% from the 2023 peak. As of 1Q24, total installed renewables capacity (COD1/) was 10,018 MW, an increase of 0.3% from the end of 2023, driven by a 0.2% increase in solar farm capacity.

-

Demand should continue to build through 2H24. (i) Energy consumption will rise with ongoing economic growth and improving conditions in the export sector, driving increased demand from manufacturers. The tourism industry will also contribute to higher electricity consumption. Additionally, progress on the construction of government projects will stimulate further private-sector investment, such as in industrial estates, adding more demand on the grid. (ii) The number of newly registered BEVs and PHEVs in 2024 is forecast to climb by 9.0% to 97,000. Supply will benefit from measures encouraging the installation of home-based power generation and the termination of government subsidies for electricity bills, which will exceed THB 4.0/unit from September to December 2024. This increase will encourage households, as well as commercial and industrial users, to install rooftop solar facilities. Consequently, for the year, demand growth is expected to reach 4.5-5.0%, up from 3.4% in 2023.

-

For all of 2024, the supply of renewables to the national grid is forecast to increase by 5.0-6.0% from its 2023 level, reaching 10,500 MW. This growth will primarily come from biomass, solar, wind, bio-gas, and waste-to-energy schemes. Going forward, BOI investment support, which exempts clean energy providers from corporation tax as part of plans to reach net zero, will attract more funds into the industry. This investment will primarily come from IPPs, SPPs, engineering, procurement and construction companies specializing in electrical works, and companies currently producing and developing solar equipment and related technology that are looking to move into renewables production.

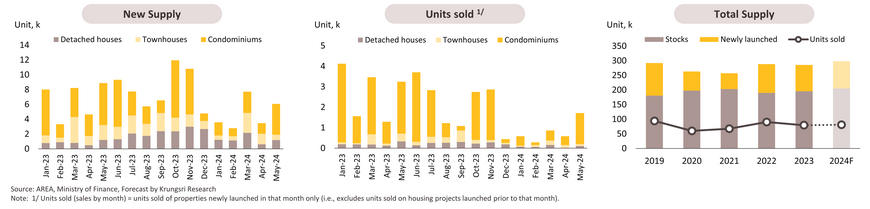

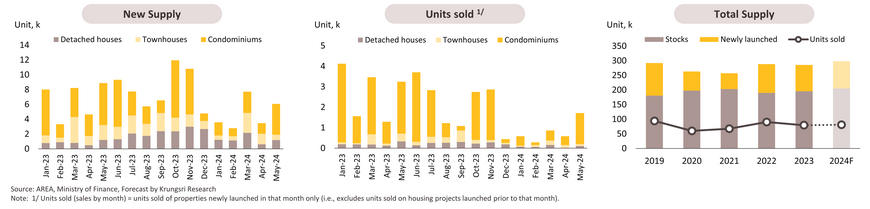

Housing (BMR): Sales are boosted by stimulus measures and demand from overseas.

-

The softening in supply and demand that began in the 3Q23 continued through 5M24, reflecting in a large drop in sales of new units by -70.5% YoY to 4,032 units, due to : (i) the limited growth in the Thai economy and high levels of household debt (at 90.8% of GDP in 1Q24); (ii) tighter lending conditions, especially for low- to middle-income borrowers (source: BOT); and (iii) the rises in interest rates through 2023, which has reduced housing affordability. In response to weak demand, developers have slowed the release of new projects, causing the number of newly launched units to fall by -28.6% YoY to a 2-year low of 23,605 units, with significant drops of respectively -44.6% YoY and -29.2% YoY in the number of new condominiums and town houses coming to market, as developers clearing their backlog of unsold stock. By contrast, there was a 51.4% YoY jump in the number of newly launched detached houses which are typically targeted at higher-income buyers who have retained strong purchasing power.

-

Demand for housing units should firm up through 2H24 as the economy gradually improves and the tourism sector continues its rebound, further supported by government measures that include the introduction of visa-free travel and the extension in the permitted length of stay for arrivals from many countries. These measures will funnel additional purchasing power into the market, in particular from Chinese buyers accounting for 47% of all transfers of ownership made by non-Thais in 2023, thereby boosting overall demand for condominiums. The housing market will also benefit from government measures introduced in April 2024, to stimulate sales particularly in the mid- to upper-middle segment. However, high levels of household debt and the continuing tightening of the release of new credit by lenders will tend to depress sales further in mid- to lower market segments. Thus, for 2024 overall, total sales are expected to rise by 2.0-2.5% YoY against an increase in new supply of 3.0-4.0% YoY. The outlook for individual segments is as follows:

-

Low-rise housing: Sales growth of detached houses will slow as supply expands, especially in the upper-middle and upper segments. For townhouses, sales will remain flat as buyers are typically mid- to lower-income earners, for whom rising interest rates and high levels of debt have undercut purchasing power.

-

Condominiums: Sales will be boosted by the demand from long-term investors. Given the high cost of living, demand for condominiums to rent is rising. Sales are also being lifted by foreign buyers and tourists looking for second homes, partly as a hedge against geopolitical tensions.

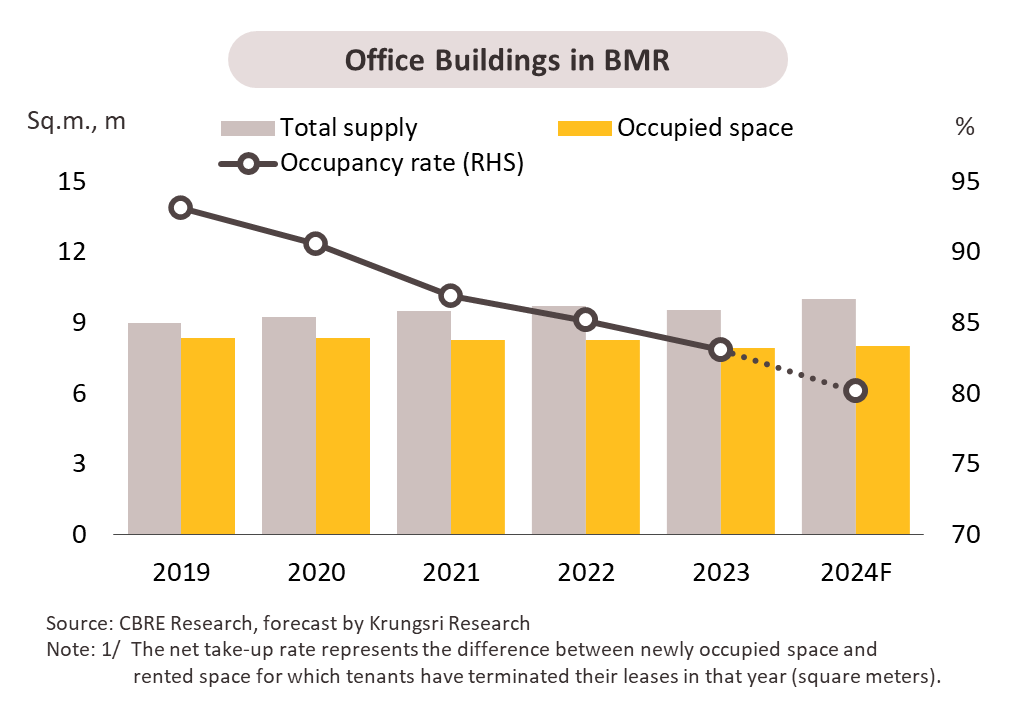

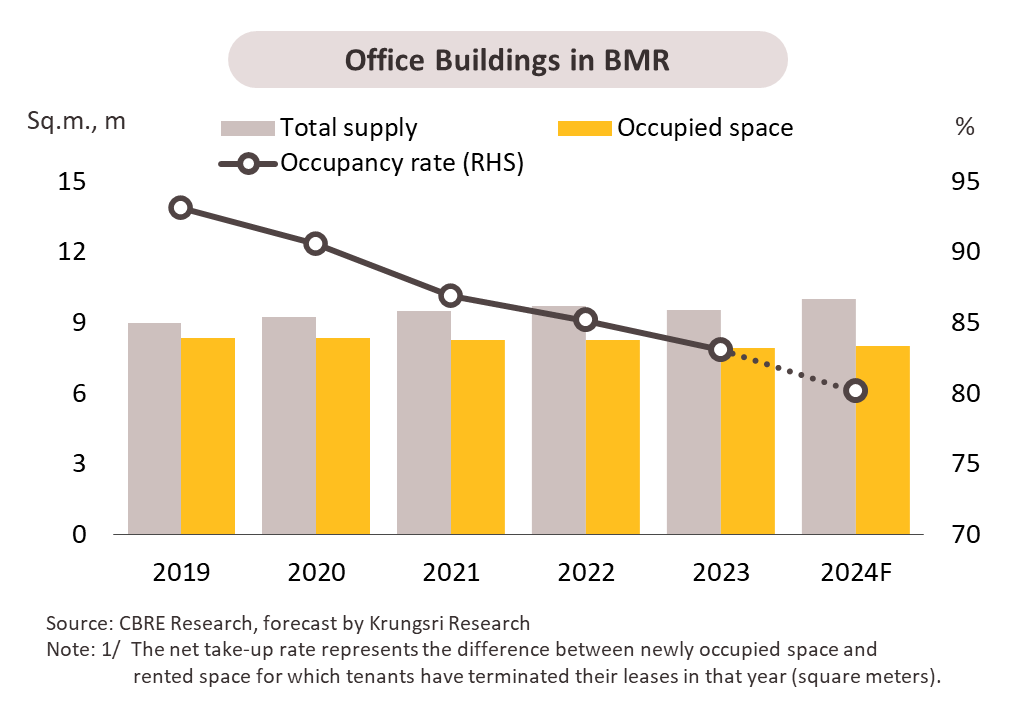

Office Building (BMR): New office space supply is expected to outpace demand, putting downward pressure on both the occupancy rate and average rents.

-

In 1Q 2024, only one new office building opened in the CBD, the 96,302 sq.m One Bangkok Tower 4, a grade A+ building. This increased the total supply of office space by 0.6% to 9.6m sq.m. from the end of 2023, with 22% classified as grade A office and 78% as grade B. The net take-up1/ also fell by 13,760 sq.m. as major tenants of grade B office in the CBD relocated to owner-occupied buildings, which are excluded in these calculations (e.g., the Panyapiwat Building). This relocation reduced the total occupied space by-0.4% QoQ to 7.9m sq.m., leading to a fall in the occupancy rate to 82.2%, down from the 83.3% at the end of 2023.

-

Through the rest of the year, it is expected that new office space will gradually be constructed and completed according to the investment plans of developers. Approximately 80% of this will be grade A or A+, particularly within large-scale mixed-use projects (e.g., Cloud 11, One Bangkok, KingBridge Tower, and APAC Tower). On the demand side, increases will come from segments of the economy where employment is rising, such as the service sector, manufacturers and distributors of consumer goods, operators of co-working spaces, as well as overseas companies. The latter will be particularly interested in grade A+ green offices in the CBD, or units constructed in line with ESG principles or internationally recognized standards (e.g., the LEED certification). However, the rise in hybrid working patterns that allow staff to ‘work from anywhere’ or reduce the number of on-site workdays will drag on growth. For 2024 overall, although supply of new office space will rise by 4.7% YoY, or 450,000 sq.m., demand will inch up by just 1.0%, or 80,000 sq.m. This discrepancy between supply and demand will put pressure on occupancy rates, dropping from 83% in 2023 to around 80% for 2024. The resulting oversupply in some locations will force operators to compete more heavily on price to retain existing tenants and attract new renters, leading to softer average rents and undercutting income and profits for operators in the office rentals market.

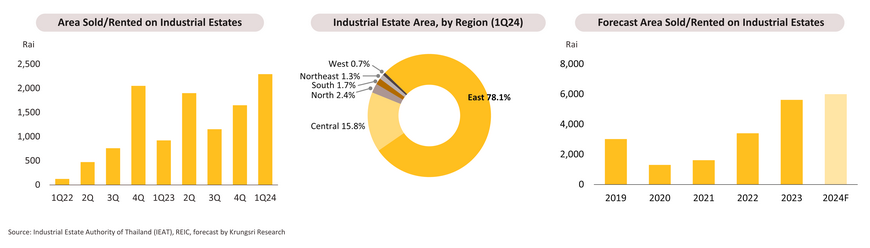

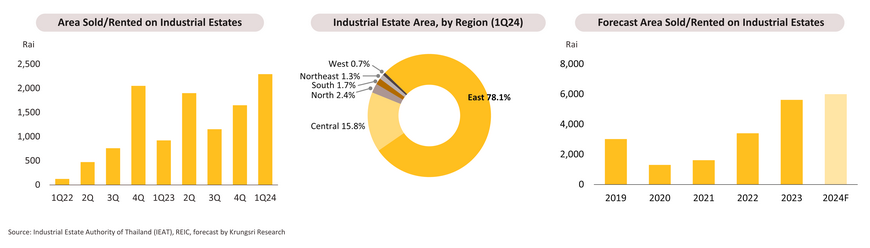

Industrial Estate: The number of sales and leases agreed in the EEC will continue to increase, helped by FDI inflows as foreign players relocate production facilities.

-

The situation for industrial estates improved steadily through 1Q24, especially for sites in the EEC. Data from the Real Estate Information Center (REIC) show that in 1Q24, national sales and leases of land on industrial estates jumped 148.6% YoY to 2,292 rai, with 2,068 rai of this located in the eastern region (+158.8% YoY). Japanese companies held the largest share in this market (28% of the total), followed by Chinese (13%) and Singaporean (9%) investors. On the supply side, no new industrial estates were opened in 1Q24 and so across the country, there is still a total of 68 industrial estates in 16 provinces. These have a combined area of 173,000 rai, of which 122,000 rai has been sold or leased. This is overwhelmingly concentrated in the eastern region, which is home to 78.1% of supply and 80.2% of leased/sold land.

-

Growth will continue through 2024 thanks to: (i) the rising trend for foreign players to relocate to Thailand, particularly from China, Taiwan, and the United States, as companies look to mitigate risks arising from trade tensions; and (ii) progress on infrastructure megaprojects, especially in the EEC. The latter will include work on the deep-sea ports, namely phase 3 of the development of Map Ta Phut Port (currently 80.9% complete overall) and phase 3 of the work on Laem Chabang Port (29.0% complete) (source: EEC, 10 June 2024). In addition, ground should be broken on the 3-airport high-speed rail-link at the start of 2025. Overall, sales and leases are expected to increase from 2023’s 5,624 rai to around 6,000 rai, a rise of 6.0-7.0%, though developers will increasingly respond to growing investment in smart industrial estates and the BCG industries by focusing more on the development of environmentally friendly projects. The latter will include industrial estates that maximize the efficiency of resource use and that promote recycling, thus reducing waste and improving their sustainability.

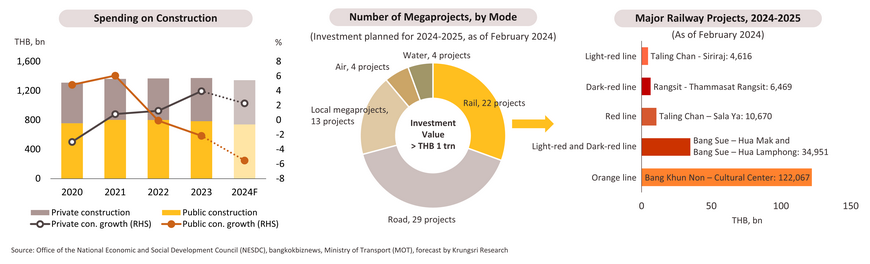

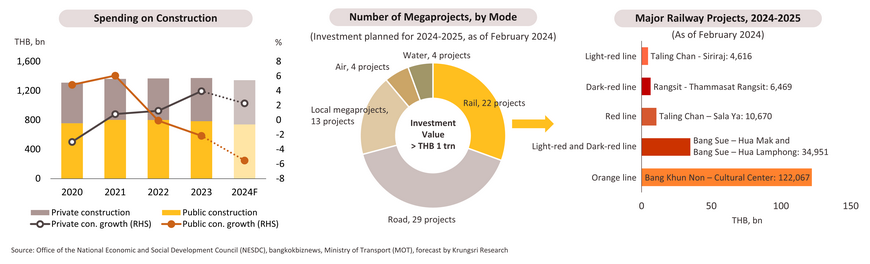

Construction: Despite slow growth in private construction, overall levels of investment will contract on the sharp drop in public spending.

- Total investment in construction slipped -17.3% YoY in 1Q24 because of delays to approval of the 2024 budget that then resulted in a -30.4% YoY slump in public spending on construction (down to THB 156bn). In contrast, private investment increased 4.7% YoY to THB 139bn, principally due to the 9.8% YoY jump in spending on non-residential and especially commercial projects (e.g., hotels and commercial buildings). However, the high level of unsold housing stock meant that investment in new residential buildings edged up just 1.3% YoY.

- Through 2024, investment in construction will soften. Delays to the budget will continue to impact overall levels of public investment through the year despite an uptick in spending on construction in 2H24. This will include ongoing work on megaprojects both in the EEC (e.g., phases 3 of the Laem Chabang and Map Ta Phut port developments, respectively 29.0% and 80.9% complete as of June 2024) and elsewhere in the country (e.g., extensions to the Pink and Purple MRT lines, respectively 57.4% and 33.8% complete as of May 2024). Work will also begin on new projects through 2024 and 2025. In the private sector, the pace of development for non-residential projects (e.g., factories and office rentals) will accelerate solidly, but conditions will remain sluggish in the residential segment. For all of 2024, total investment in construction is thus expected to contract by between -2.0% and -3.0%, split between a decline of between -5.0% and -5.5% in public spending and growth of 2.0-2.5% in private investment.

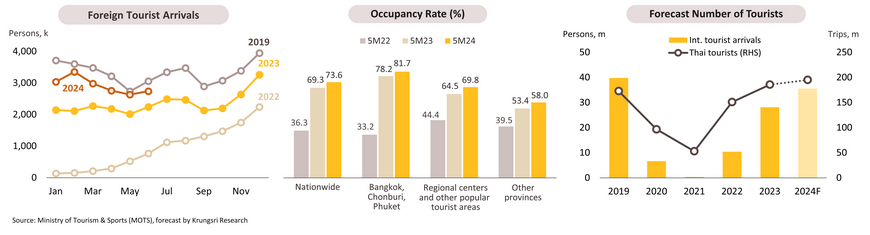

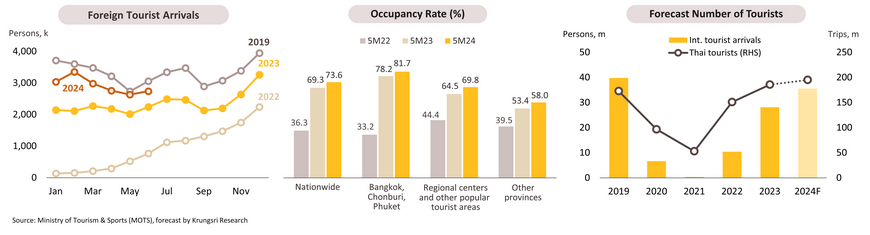

Hotel: The broadening of visa-free travel will sustain growth momentum for foreign arrivals, while domestic tourism will benefit from an uptick in travel to second-tier cities.

-

Foreign tourist arrivals grew by 35.0% YoY to 17.5m over 1H24, bringing this to 88% of the 1H19 total. This was lifted by the visa-free travel for visitors from many countries, which then helped to boost Chinese arrivals by 157.4% YoY (up to 3.4m, or 61% of the 1H19 level). China was followed in importance by the Malaysian, Indian, South Korean and Russian markets. Thais also took 84.6m domestic trips in 5M24 (+10.4% YoY) as travelers took advantage of offers promoting tourism in second-tier cities. The 5M24 occupancy rate therefore rose from 5M23’s 69.3% to 73.6%. Occupancy rates in the major tourist destinations all edged up, with Bangkok at 79.6% (+3.2ppt), Phuket at 85.5% (+3.2ppt), and Chonburi at 79.9% (+3.9ppt). Other important tourist destinations also benefited from improving domestic tourism and so occupancy rates stood at 78.4% in Chiang Mai (+4.5ppt) and 70.4% in Nakhon Ratchasima (+6.2ppt). Nationwide, average room rates have also risen 37.2% YoY to THB 1,920, though in the South, room rates run above this at THB 2,479 (+36.0% YoY).

-

Tourist arrivals are forecast to increase 26.5% to 35.6m in 2024. Growth will be supported by: (i) the ongoing impacts of visa-free travel arrangements, which have now been extended to 93 countries, including Thailand’s main tourist markets of China, India and Russia; and (ii) the expected return to normal in the number of international flights in 2024. Domestic tourists are forecast to take 195.0m trips this year (+5.0%), boosted by: (i) continuing government efforts to stimulate the domestic market, especially in second-tier cities; and (ii) the post-COVID recovery in MICE (meeting, incentive, convention, and exhibition) markets. However, headwinds will restrain growth, coming in particular from: (i) the sluggish performance of the Chinese economy; and (ii) still-high fuel prices that will put upward pressure on travel costs. The national occupancy rate is expected to average 71% for the year, though in the main tourist destinations (Bangkok, Chonburi and Phuket), this should rise to 80%.

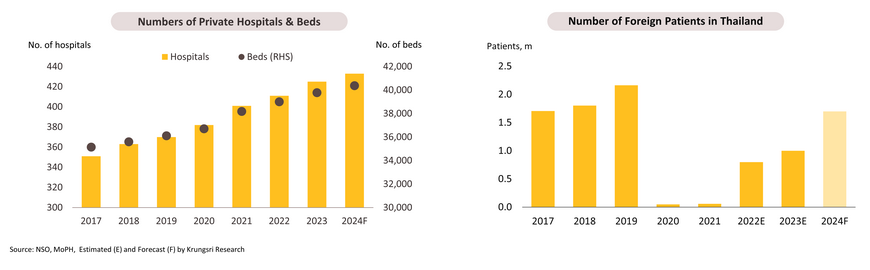

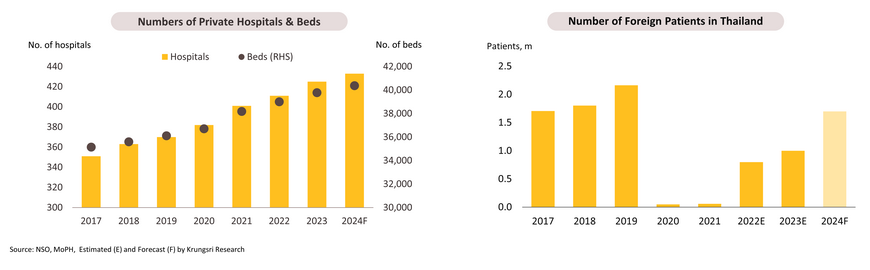

Private hospital: Players will continue to step up their investments to meet anticipated growth in demand.

-

Private hospitals saw their income continue to rise through 1H24 as domestic patients returned for the treatment of seasonal illnesses and complicated conditions. Income was further boosted by the Social Security Office, increasing the rates paid for complex disease treatment. The number of overseas patients also rose on the ongoing rebound in the tourism sector. With arrivals climbing to 17.5m during the period, demand for health checks and preventative treatments from medical tourists also increased. However, weak domestic purchasing power has weighed on income growth, especially for hospitals serving middle-income groups since demand from these individuals is more sensitive to changes in the economic environment. Seasonal factors including the long holidays and the onset of the tourism low season in Q2 also impacted business conditions.

-

The situation will continue to improve in 2H24. (i) The onset of the annual rains will increase demand for the treatment of seasonal illnesses (e.g., influenza and dengue fever). (ii) The gradual growth in the economy will lift domestic purchasing power and so patients will be more inclined to seek treatment. Many hospitals are therefore renovating existing sites and opening new branches and offering new treatments, especially in special economic zones. (iii) With total tourist arrivals expected to reach 18.1m in 2H24, the number of foreign patients is sure to trend upwards. (iv) Hospitals will expand their Thai and international customer bases by offering more treatments to patients with health insurance and increasing the range of services available in provincial hospitals, such as treatments for more complex conditions. (v) The spending power of hospitals’ core target demographic (i.e., upper-middle- and upper-income consumers) remains solid. Given the above, operators’ income is expected to grow by 9-10% YoY in 2024.

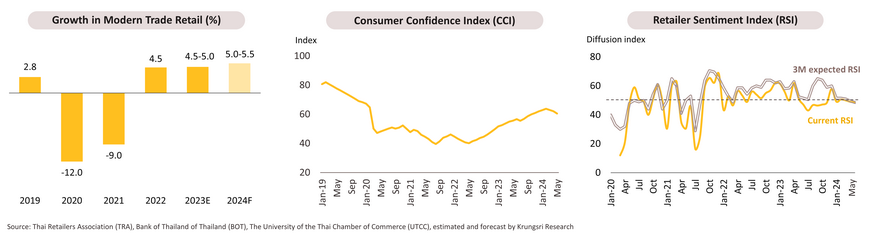

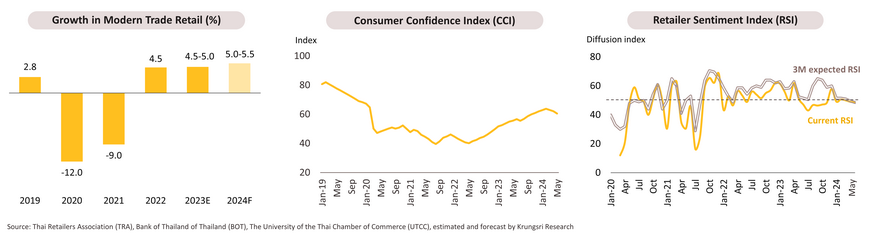

Modern trade: Income will gradually rise, but competition from e-commerce will remain intense

-

Income grew gradually through 1H24 due to several factors: (i) the positive impacts on the Thai economy from continued growth in the tourism sector, particularly the 138.3% year-over-year jump in Chinese arrivals to 3.4 million in 1H24, which boosted retail spending and income in sectors related to tourism; (ii) government stimulus measures, including the Easy e-Receipt scheme (Jan 1 - Feb 15); and (iii) an acceleration in government spending following the approval of the 2024 Budget Bill in April. With disbursements to public investment projects and additional funds injected into the economy, consumer confidence in purchasing increased. Major players also opened more branches in rural areas to expand their customer base, such as the openings of Central Nakhon Pathom and Central Nakhon Sawan. However, many operators remained concerned about cost pressures and the impact on spending power following the end of government support for energy costs, leading consumers to be more cautious with their spending, causing the Retailer Sentiment Index to fall below 50 since April.

-

Throughout 2H24, income for players in the retail sector is expected to continue strengthening due to: (i) ongoing economic expansion, gradually lifting consumer purchasing power; (ii) continued vitality in both domestic and international tourism, with arrivals predicted to reach 35.6 million in 2024, boosting spending on consumer goods and tourism-related products; and (iii) plans to expand branch networks in Bangkok and rural areas. Simultaneously, the opening of several mixed-use mega-projects, including Bangkok Mall and Robinson Lifestyle shopping malls in Nong Khai and Nakhon Phanom, will contribute to business income growth. However, strong competition will remain, particularly from the increasing number of online sellers. Additionally, the purchasing power of low- to middle-income consumers remains weak and is pressured by high household debt levels (90.8% of GDP as of Q1 2024). Overall, income growth for 2024 is projected to range between 5.0-5.5%, up from 4.5-5.0% in 2023.

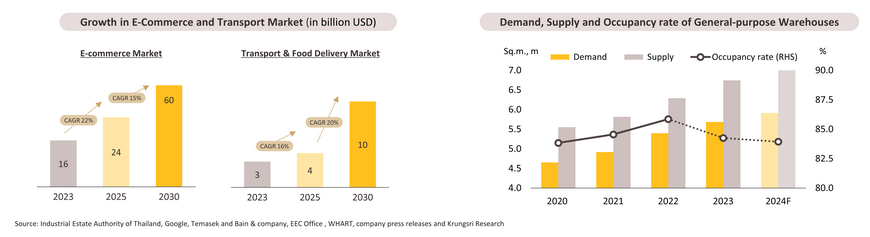

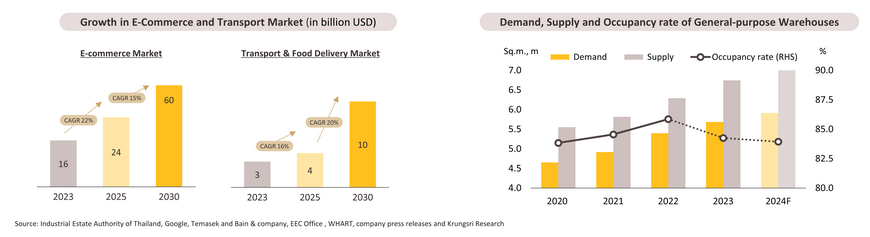

General-purpose warehousing: Demand for warehouse space will rise in line with recovery in exports and an improving investment outlook.

-

Demand for warehouse space was lifted over 5M24 by: (i) worsening US-China trade tensions prompted some foreign companies to relocate production facilities to Thailand, resulting in a 9.6% YoY rise in foreign direct investment in Q1; and (ii) growth in manufacturing that then showed up in the 2.1% YoY expansion in 5M24 exports. At the same time, both private consumption and the tourism sector have continued to strengthen, lifting overall demand and encouraging players to build inventories of consumer goods. Less positively, public investment slumped -27.7% YoY in Q1, limiting the extent of demand growth.

-

Demand will continue to rise through the rest of the year thanks to: (i) an uptick in activity in the tourism and manufacturing sectors and an acceleration in government spending, especially on mega projects; (ii) higher private investment, reflected in the 16.4% YoY rise in foreign investment applications through the BOI in the 3M24 and the approval of 8 major investment projects in June; and (iii) ongoing growth in e-commerce, including in cross-border sales. In addition, to meet increased demand for air cargo services, the government has approved private investment in warehousing at Suvarnabhumi Airport. Nevertheless, growth in the warehousing market will be restrained by the only gradual improvement in domestic spending power. Furthermore, the move to impose VAT on imported goods with a value less than THB 1,500 (5 July-December 2024) is likely to negatively affect purchases and undercut demand for warehouse space. As such, operators are expected to add to supply only gradually and to partner with other businesses as they look to expand new customer bases. For example: (i) SCGJWD has joined with SINO to bring their transport and warehousing services to new markets; and (ii) CRC Thai Watsadu is using automated storage and retrieval systems to improve its warehouse stock management. Given the above, 2024 demand for warehousing space is forecast to increase by 4.0% to 5.9 million sq.m., while supply will expand by 5.0% (or by 300,000 sq.m.).

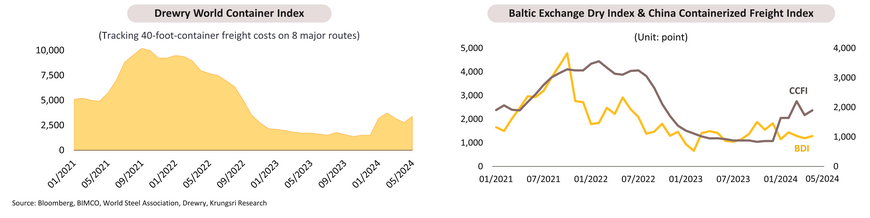

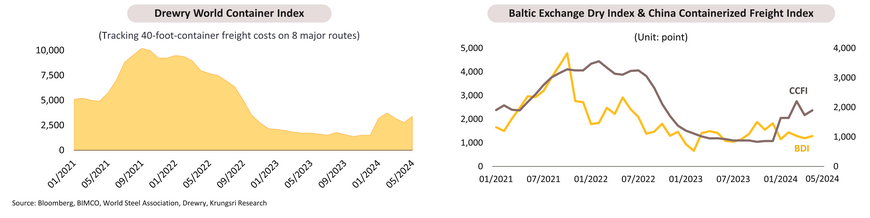

Sea freight services: Businesses will benefit from elevated freight rates and an uptick in commercial activity.

-

Business conditions improved over 5M24 on strengthening demand. Economies in export markets gradually improved, while drought impacts from El Niño increased demand for food imports. Shippers also benefited from the imminent hike in duties on imports of Chinese goods to the US, prompting many businesses to rush their orders in advance. Other tailwinds came from the combination of ongoing threats to shipping in the Red Sea (the main trade route from Asia to Europe covering about 12% of global maritime trade routes) Additionally, low water levels in the Panama Canal (another result of El Niño) encouraged liners to either suspend or alter their routes. As a result, transit times have lengthened, and freight charges have risen on many routes. This increased demand for the shipment of commodities, food, energy, and raw materials has pushed the Baltic Exchange Dry Index up by 7.4%, with the China Containerized Freight Index also jumping 74.2% YoY. Consequently, sea freight operators have hiked their rates on numerous routes.

-

Through the rest of 2024, demand for sea freight services will continue to rise steadily due to several factors. (i) Domestic business conditions are improving, and imports and exports in 2024 are expected to rise by 4.2% and 1.8% respectively (up from declines of -3.1% and -1.7% in 2023). (ii) The extended problems in the Red Sea, now expected to last into 2025 (source: Lloyd’s List), will add to portside congestion. As such, businesses will tend to expedite orders and restocks to prevent supply shortfalls. (iii) The worsening US-China trade war and the increase in US tariffs on imports from China may have positive effects on domestic businesses by accelerating orders from Thai companies that are embedded in Chinese supply chains or by diverting demand from China to Thailand. Thai bulk shippers will also benefit from the fact that while the global fleet capacity is growing 2.6% YoY, demand for bulk shipping services is accelerating at the faster rate of 3.0% YoY. This growth is supported by a 1.7% YoY increase in iron ore shipments and a 2.6% YoY rise in the volume of grains moved by sea. Likewise, Thai containerized shippers will also enjoy an improving outlook, helped by the 15.0% YoY rise in global demand for container shipping (source: BIMCO). This demand will again outpace the 10.3% YoY expansion in supply of boxship, thereby keeping freight charges elevated. Beyond this, Thai container shippers are expanding into new routes in India, the Middle East and Africa, regions that are becoming hubs for the production of advanced tech products.

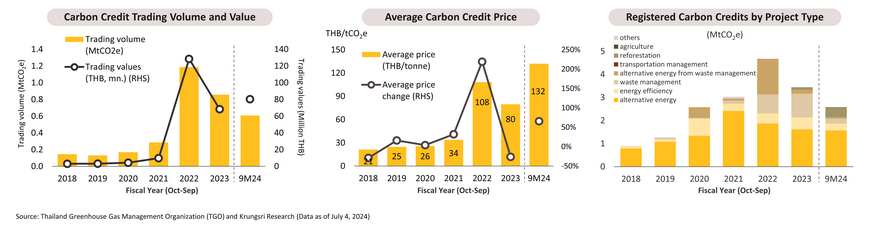

Carbon Credits: Prices continue to rise from surging demand, with a major challenge remains in aligning Thai standards with international ones.

-

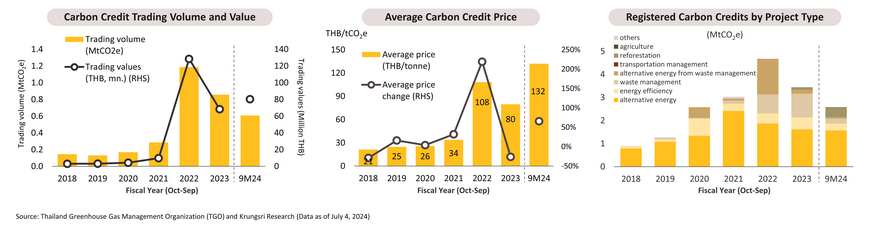

In the first nine months of the FY2024 (Oct 2023 - June 2024), the trading volume of carbon credits under the Thailand Voluntary Emission Reduction Program (T-VER), run by the Thailand Greenhouse Gas Management Organization (TGO), was 0.6 million tonnes of CO2 equivalent (MtCO2e), with a total trading value of THB 80 million. This surpassed the total for FY2023, with an average price of THB 132 per tCO2e.

-

On the supply side, the volume of registered carbon credits was 2.6 MtCO2e, showing sluggish growth (-25% compared to FY2023). Most of these credits involve the development of alternative energy sources (60%), reforestation (16%), energy efficiency (11%), and waste management (9%), respectively.

-

On the demand side, purchases were driven by carbon offsetting from large organizations, especially Lion Corporation, Precious Shipping PCL, and Double A. Demand for reforestation credits experienced a significant growth, with the highest average price of THB 510 per tCO2e.

-

In FY2024, the supply of carbon credits is expected to slightly decrease from the FY2023 level, following a high cumulative supply surplus. However, rising demand is anticipated, which is likely to drive prices and trading values above those observed in FY2023. Supporting factors include: (i) more organizations striving for net-zero goals, and (ii) the development of domestic laws e.g., Climate Change Act, together with international green measures. However, The key challenge lies in doubts surrounding the integrity and quality of Thai carbon credits compared to international standards, e.g., Core Carbon Principles (CCPs) and CORSIA-eligible credits. To address this, the TGO approved the first four Premium T-VER projects in June 2024 to enhance standards for Thai carbon offsets and align them with international norms. These forestry projects are expected to reduce emissions by 19,517 tCO2e annually.

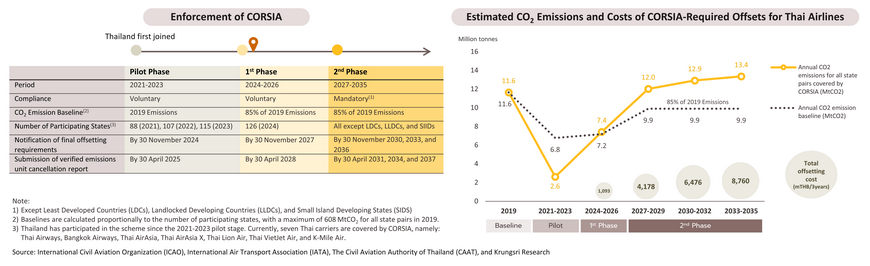

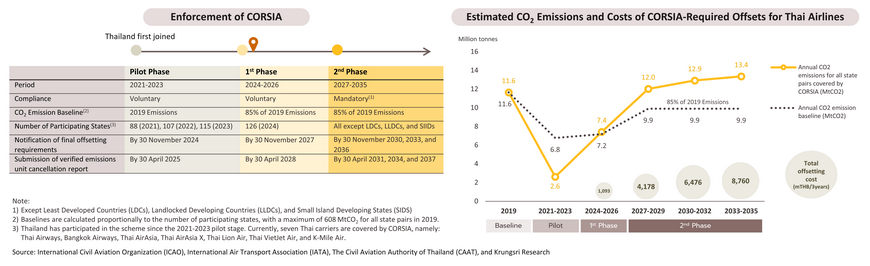

CORSIA: New requirements will impose cost burdens on the airline business but will provide an investment opportunity in SAFs.

- The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is a global agreement that aims to increase the sustainability and lessen the environmental impacts of the aviation industry. The scheme has two principal components:

- MRV requirement: Airlines in member states of the International Civil Aviation Organization (ICAO) are currently required to conduct annual measuring, reporting and verifying (MRV) of carbon emissions arising from international aviation.

- Offsetting requirement: Emissions exceeding the baseline, which is calculated from the 2019 emission level, must be offset using eligible carbon credits. Initially voluntary for participating states from 2024 to 2026, offsetting will become mandatory for nearly all international flights from 2027 to 2035.

- To meet those requirements, CORSIA will increase operating costs for Thai airlines, which could potentially total THB 20 billion from 2024 to 2035 to offset an anticipated 40 million tonnes of excess CO2 emissions. However, CORSIA is expected to stimulate growth in markets for carbon credits required as offsets and for sustainable aviation fuels (SAFs). For the SAF industry, Thai businesses, particularly Bangchak and Energy Absolute (EA), are beginning to ramp up production. The enforcement of CORSIA will thus encourage Thailand to (i) develop its MRV system, (ii) further expand investments in SAF production, and (iii) enhance carbon credit standards.

Back

.webp.aspx)