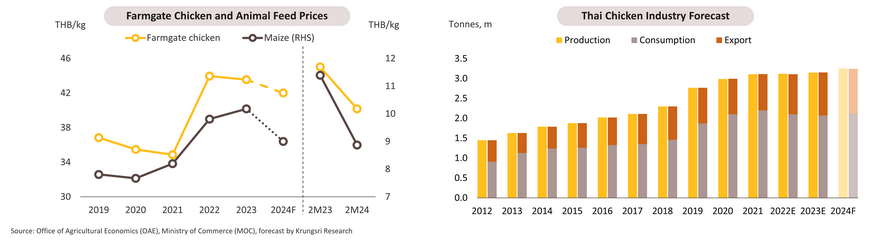

Chilled, Frozen and Processed Chicken Industry: Domestic demand is being lifted by recovery of Thai economic activities and tourism sector, while exports are benefiting from deepening penetration into new markets in the Middle East.

-

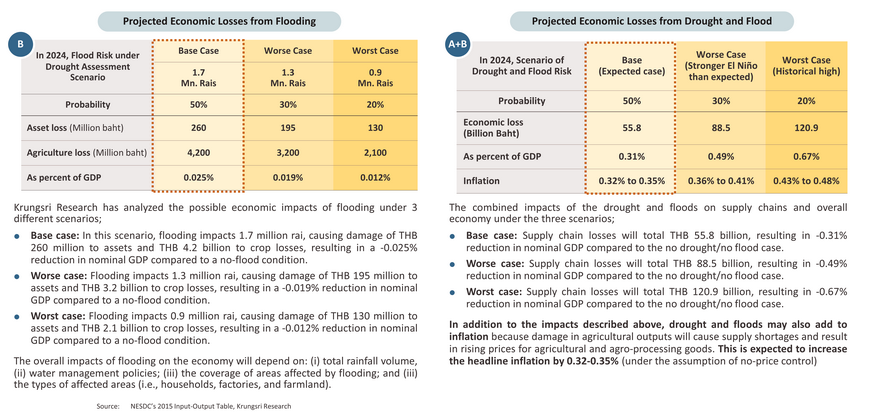

Output contracted -6.5% YoY over 2M24 as chicken farmers cut back on flock sizes. This was in response to a prior supply glut that had adversely affected orders and triggered a -10.8% YoY fall in average farmgate prices (down to THB 40.2/kg). Domestic consumption of chicken products has also come under pressure from the high cost of living, and with this encouraging shoppers to be more careful about their spending, demand slipped -0.6% YoY. However, export volume climbed 6.3% YoY on: (i) better trade relations with the Middle East, especially with Saudi Arabia, which is now importing more processed and frozen Thai chicken; (ii) protests by European farmers against cheap chicken imports from Ukraine that has then diverted demand to Thailand; and (iii) lower feed costs (due to higher yields domestically and globally) that cut export prices for frozen chicken (-13.2% YoY) and processed chicken (-7.4% YoY).

-

The production can expect to see growth across 2024, with yields up 2.5-3.5% to 3.24-3.26m tonnes on rising prices and the need to restock now that inventories have been run down. Demand will also be boosted by the growing economy and rising tourist numbers, and with business improving for hotels and restaurants, domestic consumption should increase by 1.5-2.5% to 2.10-2.12m tonnes. Exports are also predicted to expand by 4.0-5.0% to 1.12-1.13m tonnes on: (i) greater cooperation between Thai and Saudi businesses to expand sales into markets in the Middle East; (ii) improving economic conditions in the main markets of Japan, the EU, and Malaysia; and (iii) the continuing high cost of living in some export markets (e.g., South Korea), which is boosting imports of Thai chicken in place of more expensive alternatives.

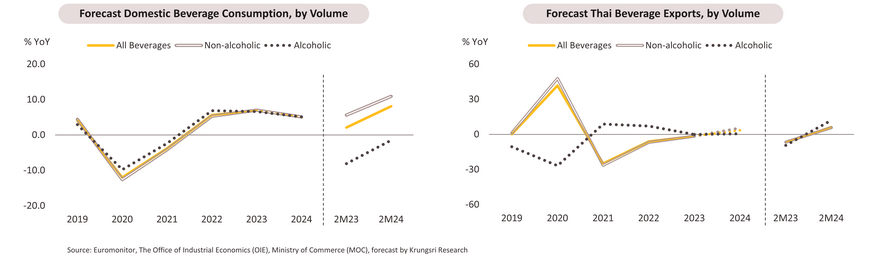

Beverages Industry: Recovery in the tourism industry is boosting domestic consumption, benefiting this business. Exports will also be lifted by development of new product lines.

-

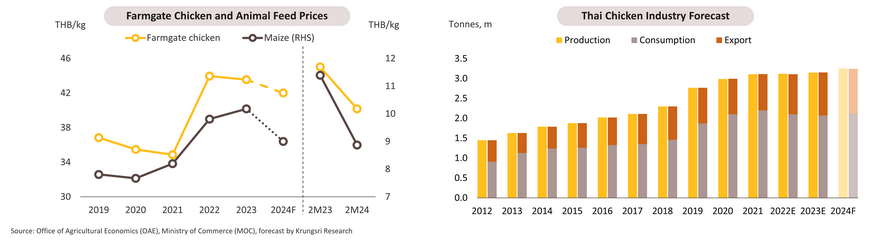

The Thai beverage production index strengthened by 5.8% YoY over 2M24 on the effects of El Niño on overall temperatures and the uptick in economic activity that has led to a fall in beverage stockholdings. Likewise, domestic consumption was up 8.1% YoY by volume thanks to growth in the food and beverage services, while strengthening tourist arrivals and the extension in opening hours in tourist areas are translated into increased business in nightspots. Overall beverage exports also climbed 6.2% YoY by volume thanks to the easing of restrictions on border crossings, especially for cross-border trading transition with Myanmar, a major export market, that become operated as usual. Exports of non-alcoholic drinks rose 5.8% YoY, partly because these are something of a necessity and are accepted in the quality of manufacturing standards (exports of bottled water were up 6.6% YoY). Meanwhile, overseas sales of alcoholic drinks jumped 12.1% on lower export prices and the advancement of Thailand - Cambodia relations to a strategic partnership, fostering a broad range of bilateral trade.

-

The beverage industry can look forward to continuing growth through 2024, and for the year, output should increase 5.0-6.0% on hotter weather and the development of new product lines as manufacturers react to stronger demand. Domestically, this will rise by 5.0-6.0% on the continuing growth in domestic and international tourism and the positive effects of this on the food and drink industry. Overall exports will rise at a slower rate of 3.0-4.0% YoY. Exports of non-alcoholic drinks will be up 5.0-6.0%, because they are essentials and new products will become available (e.g., healthier drinks such as fruit juices), However, growth in exports of alcoholic drinks will be held to just 0.5-1.5% due to the worsening situation in Myanmar, a major export market, though cooperation over improving trade relations with other neighboring countries will help to counterbalance this.

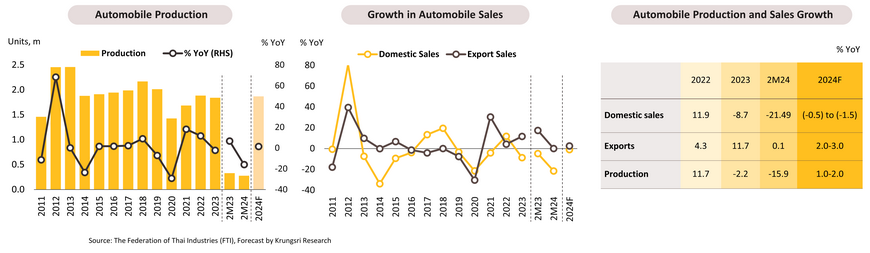

Automobile: Output and domestic sales are sluggish, especially for commercial vehicles, due to tighter lending conditions to cope with rising NPLs amid soft spending power.

-

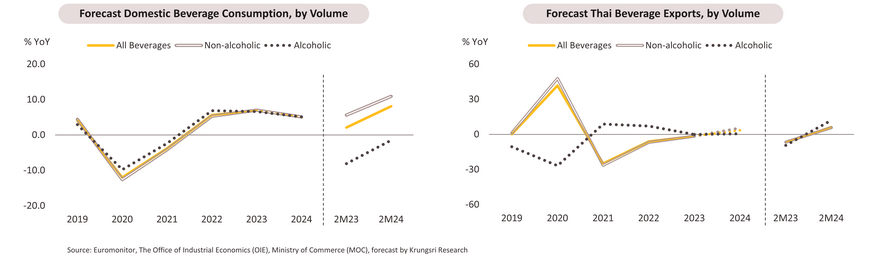

Production slumped -15.9% YoY to 275,792 vehicles in 2M24 on weaker spending power that then fed through into falls of respectively -22.5% YoY and -9.1% YoY in output of pick-ups and passenger vehicles. However, production of HEVs rose 41.0% YoY to 38,348 vehicles, and the assembly of BEVs also began, with 1,418 vehicles coming off production lines, though output of PHEVs crashed -80.0% YoY (to 942 units). Domestic sales slipped -21.5% YoY to 107,657 vehicles due to weaker purchases of passenger vehicles and pick-ups, especially pick-ups whose sales declined -43.8% YoY. The market has been affected by the tightening of credit by lenders, which are looking to control the rise in NPLs for low- and mid-income borrowers, especially among farmers since these have been affected by the El Niño, the run-up in the cost of living and high levels of debt. Nevertheless, exports inched up 0.1% YoY to 175,436 vehicles against a strong 2023 baseline as manufacturers increased output in response to accumulated outstanding orders in high-growth markets, e.g., in Brazil (+382.4% YoY), Australia (+78.5% YoY) and Saudi Arabia (+25.0% YoY).

-

Output should strengthen by 1.0-2.0% across all of 2024, but although investment in new fabs has helped to overcome problems with global shortfalls in the supply of auto chips, auto output has yet to fully recover. This will be partly due to this year’s expected -0.5% to -1.5% contraction in auto sales, which will be driven by: (i) tighter credit conditions as lenders respond to the rising trend of auto loan NPLs, following an increasing proportion of special-mention (Stage 2) accounts; (ii) delays to budget disbursements for government infrastructure projects; and (iii) the impact of El Niño on sales of commercial vehicles to farmers. However, exports should increase by 2.0-3.0%, helped by economic growth in export markets and pent-up demand for ICE vehicles; Deloitte (2020) sees global exports of ICE-powered vehicles increasing to 81.7m by 2025, prior to an acceleration of XEVs exports in the following periods.

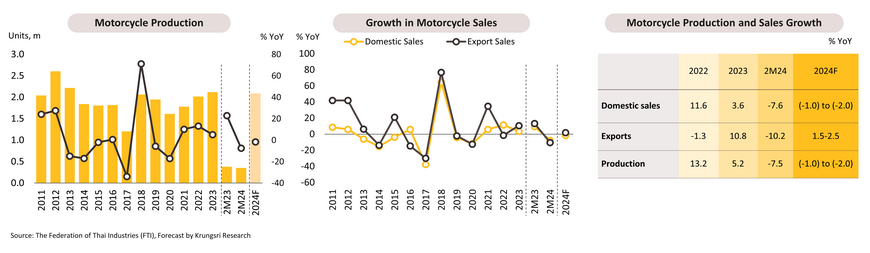

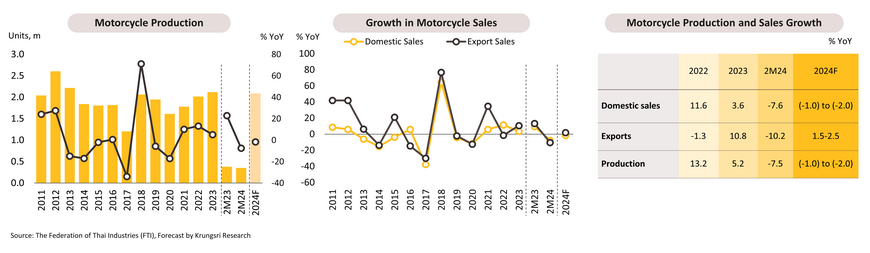

Motorcycles: Output and domestic sales will decline, especially of smaller models targeting low-income groups in upcountry market, but exports of ‘big bikes’ will strengthen.

-

2M24 output fell to 353,592 units (-7.5% YoY) on weaker domestic demand. Declines in output were sharpest for small models, falling -19.2% YoY for family models and -62.3% YoY for sub-150 cc sports motorcycles, while production of big bikes with an engine capacity of over 400cc increased 2.8% YoY. With household debt high, tighter credit conditions, and drought affecting income for low- and middle-income consumers, especially in the upcountry, domestic sales contracted -7.6% YoY to 297,666 vehicles. Sales of sub-250cc units (over 90% of the market) were down -9.3% YoY, despite the boost to the market given by expanding food and e-commerce delivery services. However, sales of big bikes, typically made to mid- and upper-income buyers, jumped 27.6% YoY. Exports also slipped -10.2% YoY to 80,732 vehicles, though this was due to the comparison with last year’s high base.

-

Both output and domestic sales are expected to contract by between -1.0% and -2.0% across all of 2024. The market has been boosted by the easing of problems with chip supplies, growth in food delivery and e-commerce services, and recovery in the economy especially in the tourism sector. However, the heavy burden of household debt, the increase in the cost of living, delays to the budget, and the impact of El Niño will all drag on demand. Because they are primarily bought by low- to middle-income earners, sales of family models and small-engined motorcycles in other segments will be most heavily affected by these factors. On the other hand, exports should rise 1.5-2.5% thanks to overseas market recovery and the high level of pent-up demand for big bikes.

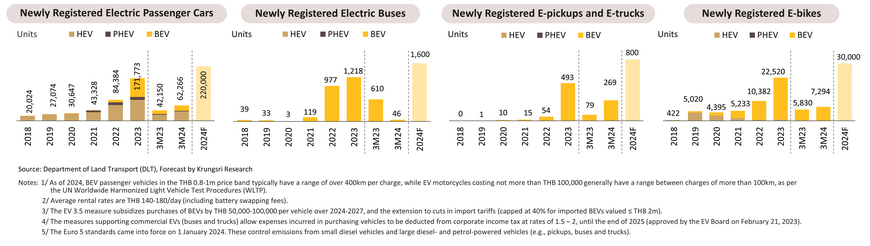

Electric vehicles: The improving capability of EVs and ongoing government support for the industry will help to boost registrations of new electric vehicles.

-

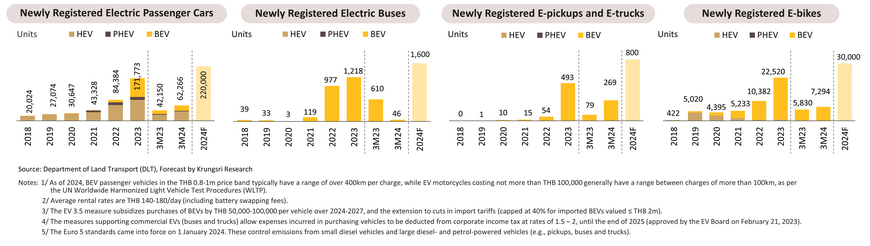

The number of XEVs on Thai roads continued to increase over 3M24. Vehicle registrations thus rose 47.7% YoY for e-passenger vehicles (to 62,266 units), 240.5% YoY for EV commercial vehicles (269 units) and 25.1% YoY for e-motorcycles (7,294 units). Sales of EVs have benefited from: (i) the EV3.0 and EV3.5 measures, which provide subsidies and tax reduction to buyers; (ii) the increasing number of models to choose from (as of March 2024, 54 different models sold under 25 different brands were available in Thailand); (iii) the expanding capability range of EVs1/; and (iv) the move by operators of delivery platforms to rent EV motorcycles to drivers cheaply2/. However, following a surge in sales over the past few years of EV buses for use on the major routes in the Bangkok Metropolitan Region, registrations of these crashed -92.5% YoY to just 46 vehicles. Moreover, while registrations of BEV passenger vehicles jumped 48.4% YoY to 21,574 units, these slumped -28.9% YoY in February and March. This follows the ending in January of the EV3.0 scheme, which offers more generous subsidies than are available under EV3.5.

-

Production of EVs will expand from 2024 onwards in keeping with the conditions imposed under the EV3.0 scheme, which states that imports of EVs have to be balanced by domestic production at a ratio of 1-1.5-times of the imports volume. 2025 XEV production capacity is thus expected to reach 400,000-600,000 vehicles annually, while registrations of e-passenger cars, e-buses, e-commercial vehicles, and e-motorcycles will increase to around 220,000, 1,600, 800, and 30,000 units respectively in 2024. This will include 80,000-90,000 BEV cars. The market will be buoyed by: (i) the EV3.53/ scheme and other measures to promote the use of e-buses and e-commercial vehicles4/; (ii) falling prices and better performance; (iii) increasing provision of e-buses services by the public and private sectors; (iv) the enforcement of the stricter Euro 5 standards for ICE vehicles5/; and (v) increasing use of EVs in delivery services.

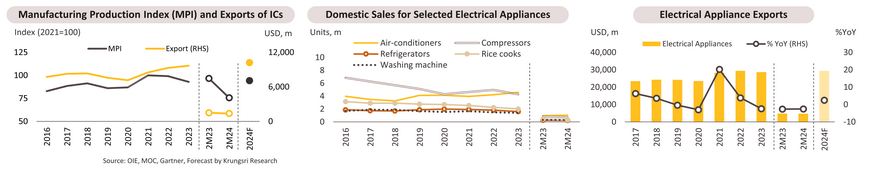

IC and Electrical Appliances: Sales will be lifted by the onset of new replacement cycle for PCs, smartphones and appliances.

Situation in 2M24

-

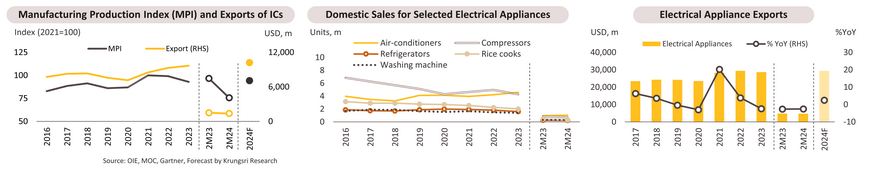

Production and exports of integrated circuits (ICs) fell by respectively -21.8% YoY and -7.6% YoY. Although sales of PCs rose for the first time since their peak in the pandemic by 0.3% YoY in Q4/23, Thai IC manufacturers continued to suffer from weak global sales of PCs and smartphones that carried over from last year, especially semiconductors used for memory products (-37.0% YoY.)

-

Domestic sales value of electrical appliances contracted -8.7% YoY in 2M24. Although the market benefited from the stronger tourism sector and the government’s Easy E-Receipt scheme that allowed income tax rebate for purchases worth up to THB 50,000 (effective Jan 1, to Feb 15, 2024), high level of household debt and still-high cost of living dragged on consumer spending power. Nevertheless, sales of air conditioners moved against the trend, rising 6.0% YoY on the unusually hot weather. Export value also slipped -2.4% YoY, aligned with ongoing sluggishness in global demand caused by rising cost of living and energy prices. As such, the market has not returned to the pandemic era peak in demand.

Outlook for 2024

-

Production and exports of ICs will increase by 1.0-2.0% YoY and 5.0-6.0% YoY respectively over 2024 thanks to: (i) the entering to cyclical return of global demand for PCs and smartphones. Gartner sees +3.5% YoY and +4.2% YoY rises respectively, especially for AI-enabled PCs and smartphones that use a large number of chips and that are forecast to account for 22% of all new sales of PCs and smartphones worldwide; and (ii) the increase in domestic and international production of EVs, which will rise in step with the expected 18.9% annual average increase in global sales over 2023-2030 (source: IEA), especially for the highly autonomous EVs that use a large number of chips.

-

Domestic sales of electrical appliances will edge up by 1.0-2.0% YoY on: (i) growth in the economy and continuing recovery in the tourism sector; (ii) the firmness of spending power for upper-income earners, which will support sales at the premium end of the market; and (iii) ongoing demand for air-conditioners, especially for energy-saving units larger than 10,000 BTUs, in light of rising electricity bills, El Niño and the resulting hotter weather, and the stricter No. 5 energy-saving standards. However, delays in infrastructure projects disbursement, the high cost of living, and weakening demand for washing machines now that launderettes are more widespread will weigh on sales of appliances. Export value is forecast to rise at the slightly higher rate of 2.0-3.0% YoY thanks to the onset of a new replacement cycle and the easing of inflationary pressures.

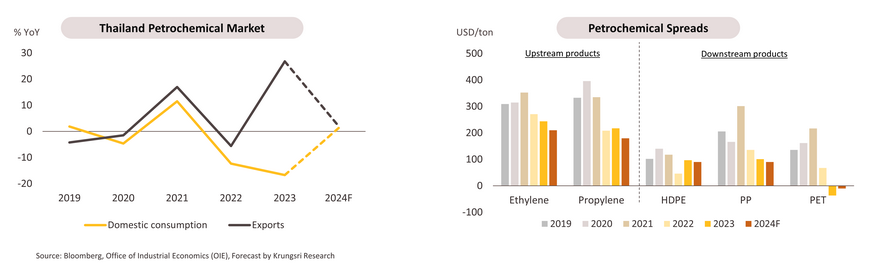

Petrochemical: Business conditions improve on domestic economic recovery, with new investment focusing on specialty product development to meet net zero commitments.

-

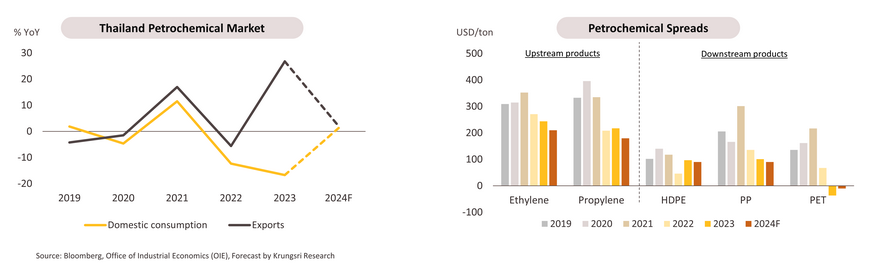

Domestic consumption of petrochemical products fell -10.3% YoY over 2M24 on softness in the manufacturing sector, which was reflected in the Manufacturing PMI spending 7 consecutive months in contractionary territory through to February. However, this was counterbalanced by a better outlook in overseas markets (especially in China, where the PMI rose by 10.2% YoY over 2M24) that then boosted exports by 10% YoY. The high cost of oil on world markets kept feedstock prices elevated (naphtha prices averaged USD 697.5/tonne, up from USD 653/tonne for all of 2023), and this is putting pressure on spreads for some products.

-

Domestic demand will gradually rise through 2024, helped by the forecast 2.7% expansion in the economy (up from 1.9% in 2023) and increased investments that will then add to sales opportunities. Businesses are tending to respond to changes in global demand by: (i) overhauling production lines and switching to a greater emphasis on the resins (e.g., ABS) that are used in the manufacture of the high-value specialty plastics supplied to the S-curve industries (e.g., for use in the production of EV auto parts, batteries, and medical supplies); (ii) increasing production of biodegradable plastics; (iii) setting up facilities for the processing of high-quality, food-grade recycled plastics that meet international standards; and (iv) developing the technology needed for carbon capture, utilization and storage facilities (CCUS) that can use CO2 as a feedstock in the production of plastics. Domestic demand for petrochemical products should therefore rise by 1.0-1.5% this year. Growth in exports will be driven by ongoing growth in overseas markets, particularly in the ASEAN region. However, due to a high base effect from the previous year, exports are anticipated to expand by just 1.5-2.0%. Nevertheless, the continuing high cost of crude (this averaged USD 87.0/bbl in 2024) will lift feedstock prices and put downward pressure on spreads for many products.

Refinery: The market will benefit from economic growth, especially from the rebound in the tourism sector and rising investment in clean energy projects.

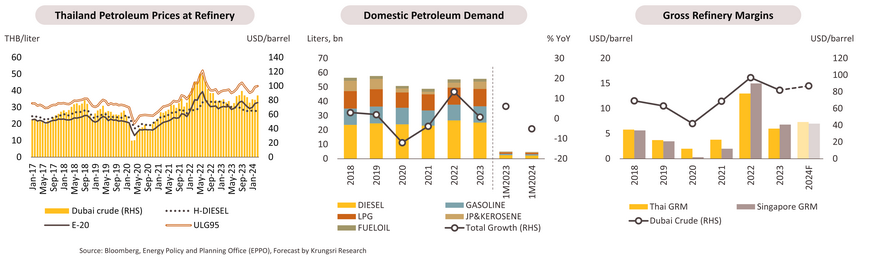

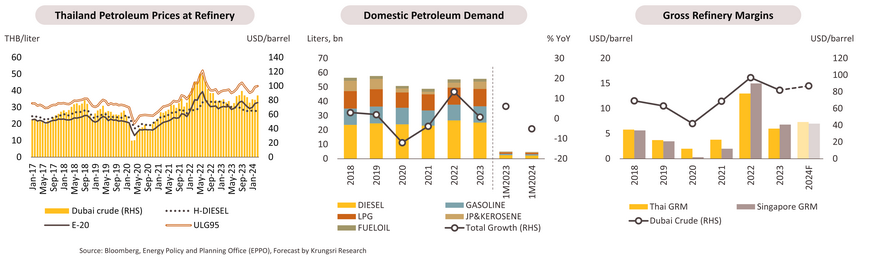

- Gross refinery margins (GRMs) improved over 1Q24 relative to 2023 thanks to growth in the global economy. However, crude prices are trending upwards on a combination of supply cuts initiated by the OPEC+ group to keep prices high and ongoing geopolitical risk connected to the war in Ukraine and fighting in the Middle East. Prices for Dubai Crude have thus averaged USD 81.7/bbl (+2.6% YoY) and so in 1Q24, domestic ex-refinery prices for benzene and E-20 rose by respectively 3.9% and 4.7% YoY. Nonetheless, weakness in manufacturing and exports meant that domestic demand for refinery products in January 2024 slipped -5.1% YoY, with demand for diesel falling -11.3%YoY, though due to the strength of the tourism sector, demand for benzene and jet fuel climbed by 3.0% YoY and 14.9% YoY.

- Refineries will benefit through 2024 from the ongoing uptick in domestic economic activity, especially from the continuing expansion in the tourism sector and the resulting growth in demand for travel services. The outlook is also expected to slowly improve for exports, adding to consumption of oil products by manufacturing industries. Refineries will tend to increase their investment in response to rising demand and improving market opportunities, and this will include directing funds to clean energy projects. For example, in keeping with government plans to cut pollution and to reach net zero by 2065, Thaioil Group is investing in a major development in the EEC that will convert low-value bunker oil into higher-value refined products such as diesel and low-sulfur aviation fuel (commercial operations are scheduled to begin in 2024). Crude prices are predicted to average USD 87.0/bbl across 2024, and thanks to the positive factors described above, Thai GRMs should broaden from the pre-COVID average of USD 5.0-6.0/bbl to USD 6.5-7.5/bbl.

Power Generation: Income will rise on strengthening demand, while government policy is encouraging players to invest in clean energy and other environmentally friendly businesses

-

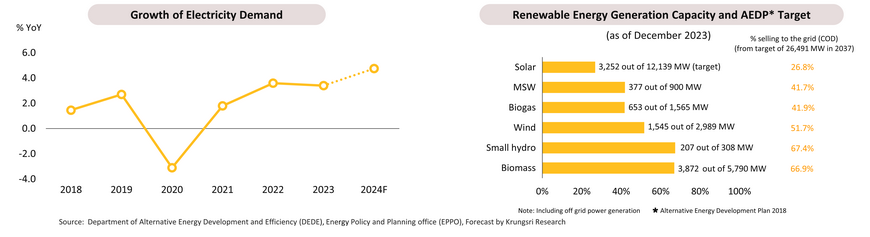

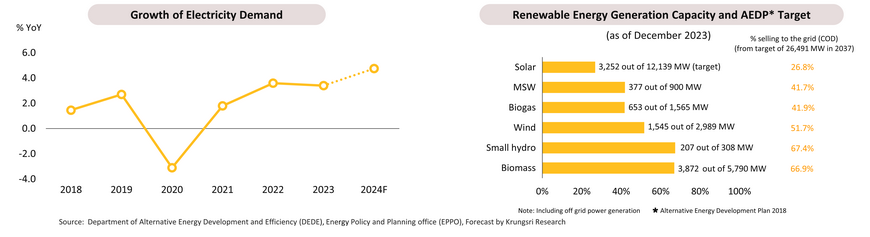

Over 1Q24, income rose on (i) Overall demand for 2M24 has risen 11.4% YoY, with increases of +19.5%, +15.0% and +4.6% YoY from respectively household, commercial and industrial users. Demand for domestic use has risen on the hot weather, while business and industrial consumption has strengthened on the continuing rebound in tourism and a better outlook for exports (+6.7% YoY over 2M24), and the 35.5% jump in the number of newly registered BEVs and PHEVs combined. The peak demand thus hit 30,000 MW in February, which is earlier than usual (in 2023, the peak was reached in April). (ii) Tariffs have increased from THB 3.99/unit in Sep-Dec 2023 to THB 4.18/unit over Jan-April 2024.

-

Demand will continue to strengthen through the rest of 2024, helped by: (i) ongoing economic growth, rising tourist arrivals, and a better outlook for the export sector; (ii) the continuation of government megaprojects, which will help pull in additional private-sector investment; and (iii) the growing number of new XEVs registrations in Thailand (in 2024, this should reach 0.22m, up from 0.17m in 2023). Demand is thus expected to hit a new high of over 35,000 MW, beating 2023’s peak of 34,827 MW, while for all of 2024, average demand should be up by 4.5-5.0%, an improvement from 2023’s growth of 3.4%. Tariffs will also average THB 4.0/unit. This will then support additional growth for electricity generators.

-

In the coming period, operators will tend to step up their investments in clean energy as a result of: (i) increasing government purchases of renewables (e.g., solar, biomass, hybrid solar/biomass/wind, and waste-to-energy) as per the requirements of the PDP and AEDP (the latest versions are expected to be effective in Q4); (ii) the positive effects of investment support schemes from the BOI that target net zero and that will involve the waiving of corporation tax for qualifying companies; and (iii) liberalization of the energy industry (a testing/pilot period will run over 2024-2025), which hopes to increase competition and to properly reflect costs. This will also open the market to new entrants as the government moves towards its 2050 net zero commitments, and so overall levels of competition will intensify as large corporations with access to the necessary technology and capital move into the energy space. These will include IPP and SPP power providers, civil engineering and construction companies with expertise in the development and installation of electrical systems, and manufacturers of solar equipment (e.g., EA, SPCG, GUNKUL, TSE, and PSTC). Players will also tend to expand their ESG commitments in related areas, such as the production of electricity from hydrogen, engaging in reforestation schemes, entering carbon credit markets, and selling renewable energy certificates (RECs).

Housing (BMR): Sales have been boosted by government stimulus measures, amid some challenging factors that might limit growth.

-

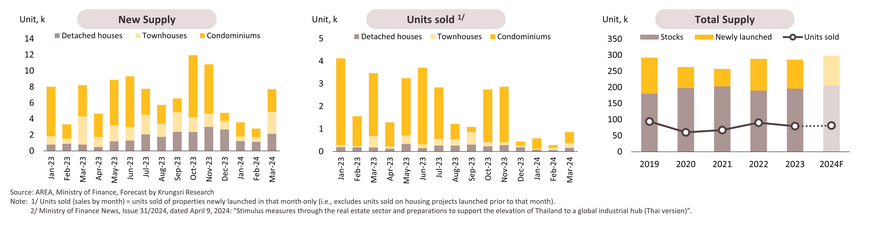

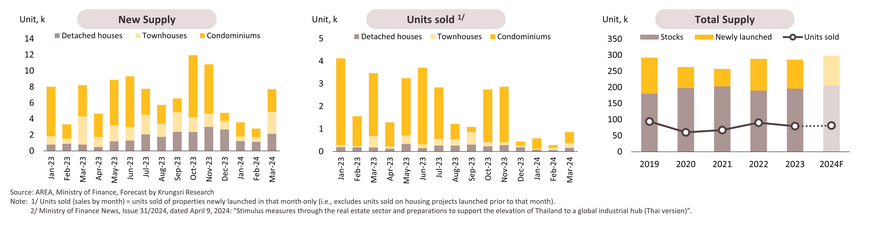

In 1Q24, the number of new housing units coming to market fell -28.0% YoY to 14,075 units. For condominiums and townhouses, new supply slumped by respectively -51.9% YoY and -25.5% YoY, but for detached houses, this jumped 81.9% YoY. New units were concentrated at the upper-mid to upper level of the market, where buyers are still considered creditworthy. Sales of new units crashed -81.1% YoY to just 1,732 units, with around 80% of this accounted for by weak sales of condominiums, especially in the sub-THB 3m market, where the high level of household debt is pushing up the loan refusal rate.

-

The housing market should strengthen slightly through the rest of 2024, with slow economic growth offset by government stimulus measures2/ that will include: (i) cuts to the fees for registering mortgages and transfers of ownership reduce to 0.01% of the property’s price for units worth not more than THB 7m (up from the previous of not more than THB 3m) that have been implemented from April 9 to December 31, 2024); (ii) tax breaks for home builders paying personal tax (April 9, 2024 to December 31, 2025); and (iii) soft loans for low-income home buyers. These moves will help to encourage home purchases and will prevent demand weakening too much, but through the year, the latter will continue to be undercut by: (i) Slow economic recovery may cause developers to face more difficulties for their marketing promotions; (ii) the continuing high level of household debt, which is encouraging lenders to tighten credit conditions; (iii) the high cost of construction materials, labor and energy, which will push up construction costs and thus new home prices by 5-10% this year; and (iv) weak purchasing power among low- to mid-income earners and the resulting ongoing oversupply of unsold housing stock in some locations. Sales are thus forecast to rise by 2.0-2.5% YoY in 2024, behind the expected 3.0-4.0% YoY increase in supply. The situation for individual segments will be as follows.

-

Low-rise housing: Sales of detached houses will continue to strengthen, especially at the upper end of the market and in locations near international schools, e.g., in east Bangkok (New Krungthep Kreetha Road). For townhouses, sales will remain flat because buyers are typically mid- to lower-income earners, experiencing weakening purchasing power due to rising interest rates and high debt burdens.

-

Condominiums: Sales will be boosted by the demand from long-term investors. since with oil prices elevated and the cost of living high, demand for condominiums to rent is rising. Demand is also coming from foreign buyers and tourists looking for second homes, especially in downtown locations, partly as a hedge against geopolitical stresses. However, the demand for condominiums in suburban areas continues to lag behind that of low-rise projects, while in some locations, the market is still struggling due to a supply glut.

Office Building (BMR): Growth in supply will tend to outpace that of demand, and so the occupancy rate will likely decline.

-

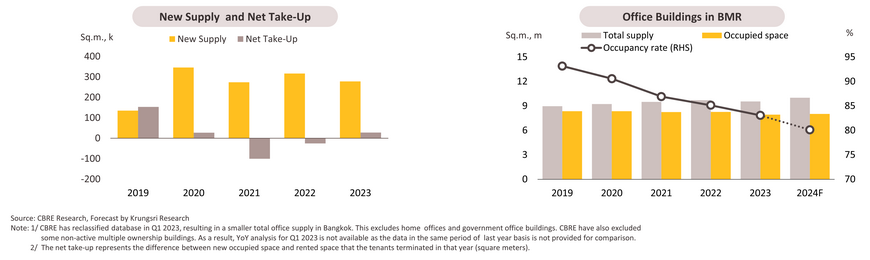

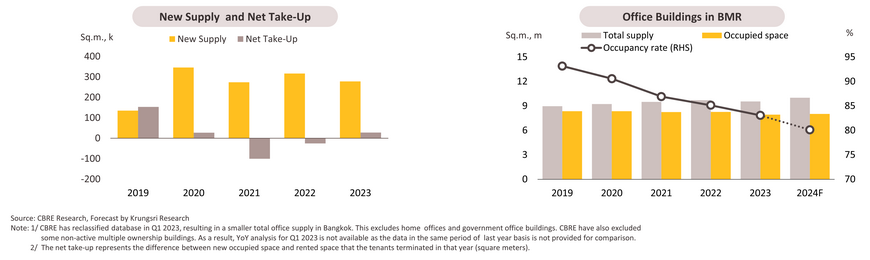

In 2023, the supply of new office space expanded by 278,142 sq.m. (down -12.1 YoY), around 60% of which was classified as grade A. This brought total supply to 9.5m sq.m.1/. While the total occupied space came to 7.9m sq.m., the net take-up rate2/increased steadily from Q2, rebounding after a contraction since 2021, driven by the recovery of the tourism sector. This has led to an increase in demand for office spaces, particularly from service sector businesses, consumer product companies, co-working space businesses, and online marketing companies. Demand was strongest for sites in the CBD and adjacent areas with good travel connections, where rental prices were not too expensive. However, supply exceeded demand and so the occupancy rate slid from 2022’s 85.1% to 83.1%.

-

In 2024, new supply is forecast to reach 450,000 sq.m., increasing by 4.7% from 2023. Around 80% of this will be grade A office building, examples of which include the One Bangkok, Supalai Icon Sathorn, KingBridge Tower, APEC Tower, and Cloud 11 developments. Meanwhile, the demand for rental office space is expected to increase gradually by 1.0% or 80,000 sq.m. (down from the 2017-2019 average of 140,000 sq.m./year). Still-uneven economic recovery will result in slow expansion in business sector, while there is still demand from international companies for office space rental due to increased investment activities in Thailand. The continuation of hybrid working practices and the increase in supply at a faster pace than that of demand will put upward pressure on business competition. Thus, the overall occupancy rate will trend down to 80% from 2023’s 83%, while the upward adjustment of rental rates will be limited due to more advantage in bargaining power of tenants. Nevertheless, developers of high quality and environmentally friendly/green projects will be able to charge higher prices and so will enjoy more rapid returns on their investments.

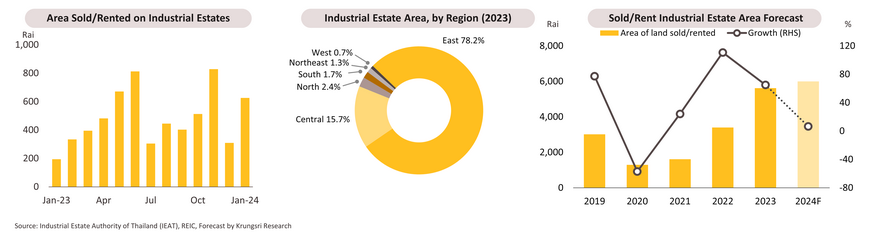

Industrial Estate: Sales and leases will increase in step with strengthening investment in developments in strategic locations, especially in the EEC.

-

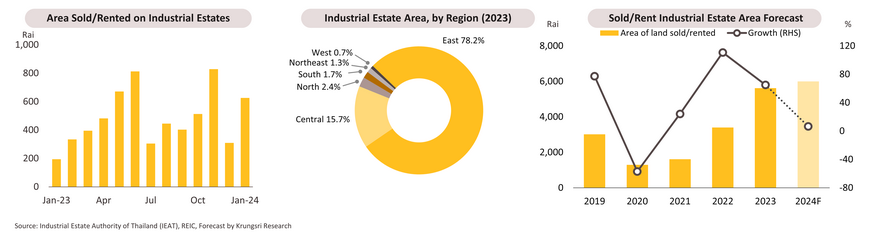

The outlook for industrial estates improved over 1Q24, especially for those in the EEC. Data from the Industrial Estate Authority of Thailand showed that in January 2024, national sales and leases of land on industrial estates jumped 221.0% YoY to 626 rai and that investment totaled THB 14.3bn, of which THB 11.7bn (or 81%) was directed to the EEC. Support for ongoing growth will come from foreign investors’ continuing interest in the EEC. Thus, South Korean investors are looking for an 800-1,000 rai site in Chonburi for use by South Korean EV, high-tech and BCG manufacturers. Similarly, Chinese investors are looking to lease space in the Smart Park industrial estate (Rayong) for use by players in the new S-curve industries, such as EV manufacturers.

-

Growth will continue through 2024 thanks to: (i) improving overseas confidence in Thailand that is translating into stronger investment; (ii) the trend for players in world-leading industries to establish production facilities in the ASEAN region, which will then increase future investment in Thailand; and (iii) greater government spending and progress on infrastructure megaprojects, especially in the EEC. The latter will include work on the deepwater ports, namely phase 3 of the development of Map Ta Phut Port, which was 73% complete as of December 2023, and phase 3 of the work on Laem Chabang Port, with phase 3 expected to be handed over to the Port Authority of Thailand in June 2024 as planned (source: Matichon, 8 January 2024). This will then have a positive influence on exports. Overall, sales and leases of space on industrial estates are expected to increase from 2023’s 5,624 rai to around 6,000 rai, a rise of 6.0-7.0%, though developers will increasingly respond to growing investment in smart industrial estates and the BCG industries by focusing more on the development of environmentally friendly estates.

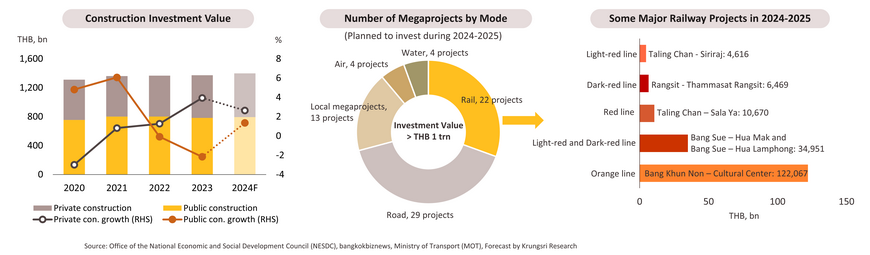

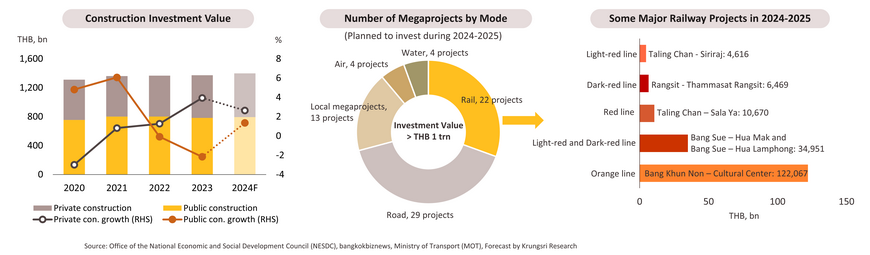

Construction: Construction spending will expand at a slow pace on a gradual recovery of private investment projects, following an uptick in megaprojects investment.

-

Overall construction investment remained depressed over 1Q24. Public construction was disrupted by delays to the 2024 budget. Meanwhile, private construction was affected by the high level of unsold stock, especially of residential projects, resulted from the erosion of spending power in markets for new housing, elevated interest rates, the high level of household debt, the tightening of lending conditions, and the higher cost of labor and materials, which has then pushed up house prices. These unfavorable conditions are reflected in drops of respectively -25.6% YoY and -12.4% YoY in the volume of construction steel and cement (portland and mixed) distributed to the market in 2M24.

-

Through 2024, overall investment in construction should recover. The 2024 budget will be passed in Q2/24, and this will then allow disbursements for public-sector construction to accelerate in 2H24. As per the Ministry of Transport’s action plan, the government expects progress to be made on 72 projects over 2024-2025 at a cost of more than THB 1tn. This will include ongoing work on projects in the EEC, though this is likely to exclude the high-speed three-airport rail-link since contracts for this have expired and new contractors now need to be selected. Relative to the first half of the year, the outlook for the private sector will improve in 2H24, especially for residential projects, sales of which will be boosted by government stimulus measures including cuts to the fees for registering mortgages and transferring ownership of properties worth not more than THB 7m (effective since 9 April 2024 until the end of 2024). Non-residential private construction will also continue to strengthen on increased investment in industrial estates, offices and retail units in strategic locations. Overall construction investment should thus rise by 1.0-2.0% over 2024, split between growth in public- and private-construction investment of respectively 1.0-2.0% and 2.0-3.0%.

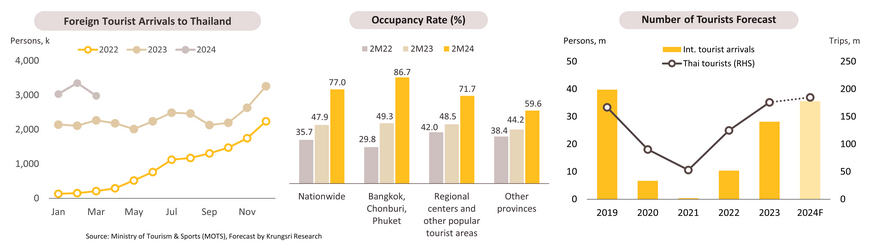

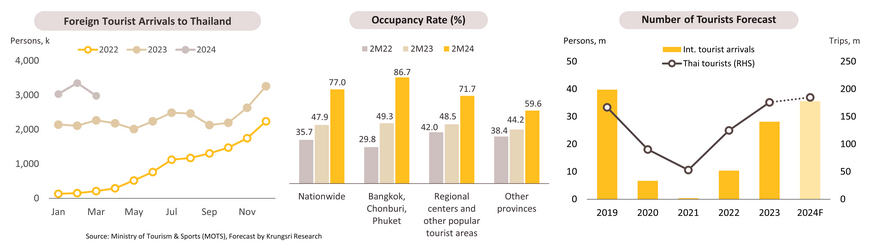

Hotel: The rising number of domestic and international tourists lifted the 2M24 national occupancy rate to 77.0%, though this is still below the 2M19 average of 79.8%.

-

Foreign tourist arrivals jumped 44.0% YoY to 9.37m over 1Q24, bringing this to 87% of the 2019 total. The market was boosted by government stimulus measures that have been in effect since Q4 of 2023, especially the introduction of visa free travel for some countries and the extension of the Chinese New Year holidays, which then helped to lift Chinese arrivals to 1.76m (56% of the 2019 level). This was sufficient to make China Thailand’s most important source of tourist arrivals, followed in order by Malaysia (the most important market in 1Q23), Russia, South Korea and India. Thais also took 32.96m domestic trips in 2M24, a 7.38% YoY increase that was driven by the promotion of tourism in second-tier cities. The 2M24 occupancy rate therefore rose from 2M23’s 47.9% to 77.0%, though this was particularly strong in the major tourist areas, and the return of foreign tourists helped to increase the occupancy rate to 82.9% in Bangkok (+36.3ppt), 91.7% in Phuket (+43.9ppt), and 85.5% in Chonburi (+32.0ppt). Average room rates have also risen 30.5% YoY.

-

Arrivals are forecast to increase 26.5% to 35.6m over 2024. Growth will be supported by: (i) recovery in the main tourist markets, especially China (although the Chinese economy remains sluggish and the government is promoting domestic tourism), and the development of new markets in the Middle East and Eastern Europe; (ii) the expected return to normal of the number of international flights in 2024; and (iii) the continuation from 2023 of measures promoting tourism to Thailand. Domestic tourists are expected to take 185.0m trips this year (+5.0%), with demand boosted by: (i) continuing government efforts to stimulate the domestic market, especially in second-tier cities; and (ii) the post-COVID recovery in MICE travel. However, growth will be restrained by the high level of household debt and elevated fuel costs. The national occupancy rate is expected to average 71% for the year, though in the main tourist destinations (Bangkok, Chonburi and Phuket) this should rise to 80%.

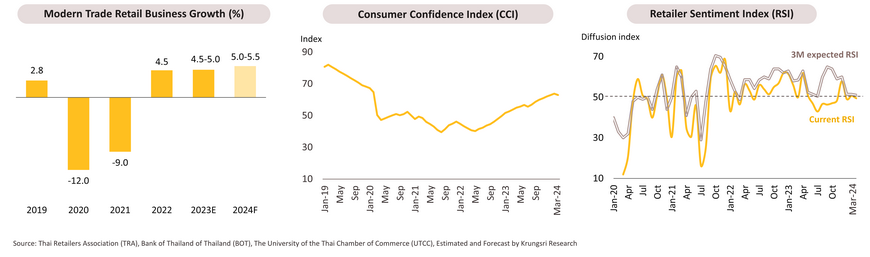

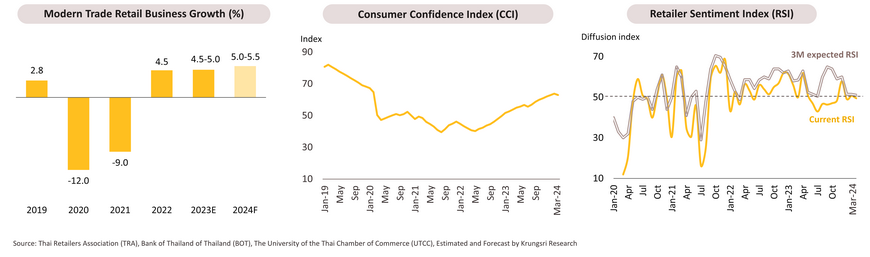

Modern trade: Income will improve on demand recovery but competition will be intense, including that coming from e-marketplaces.

-

Growth in the modern trade industry was supported through 1Q24 by gradually strengthening spending power in areas connected to tourism. The recovery in the Chinese market (1.8m arrivals in the period, or a fifth of all foreign tourists) was especially important since these account for more than a third of all shopping by foreign arrivals. Sales further benefited from the government’s Easy E-Receipt stimulus package (from Jan 1, to Feb 15, 2024). Alongside this, in February, the Consumer Confidence Index increased to a 48-month high of 63.8, while the Retailer Sentiment Index also edged up slightly in the same month.

-

Sales will continue to grow for the remainder of 2024, helped by: (i) gradual growth in the economy and the associated steady strengthening of consumer spending power; (ii) the boost to the tourism sector provided by the waiving of visa requirements for tourists from some countries, which will help to boost arrivals by a forecast 26.2% YoY to 35.6m; and (iii) the opening of new outlets in 2024, the more important of which will include Bangkok Mall (mixed-use) and sites in regional centers (e.g., Central Nakhon Pathom and Central Nakhon Sawan). However, headwinds blowing against sales growth will include stiffening competition from incumbents, new entrants to the market, and domestic and international online retailers that are selling through e-marketplaces. Consumers will also have to contend with the high level of household debt (91.3% of GDP as of Q4 2023) and the effects of this on spending power, while more expensive energy will push up overall costs. 2024 sales growth is thus expected to run in the range 5.0-5.5%, slightly higher than 2023’s rate of 4.8%.

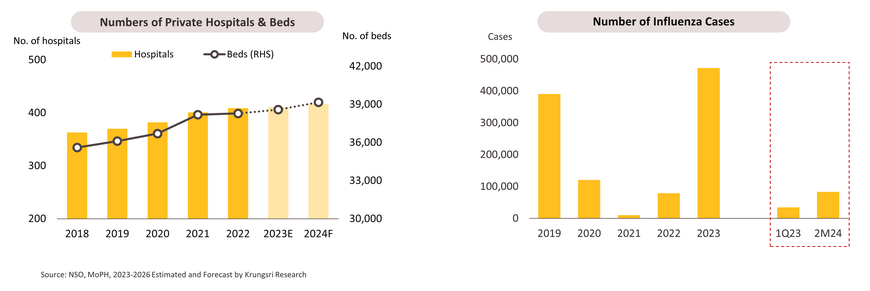

Private hospital: Income will grow strongly on promising demand with healthcare concerns.

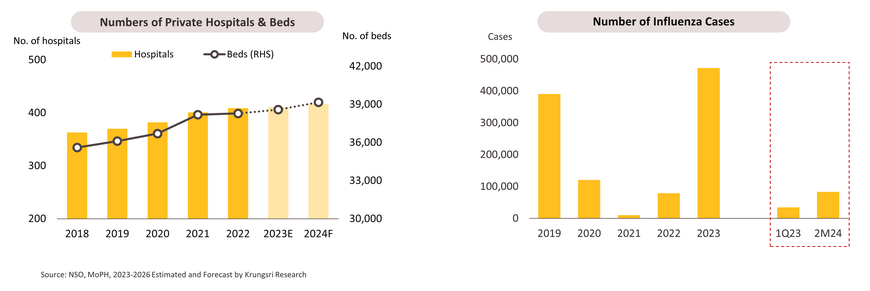

-

Income continued to rise through 1Q24 on stronger number of patients, partly due to the onset of seasonal illnesses including influenza (+139% YoY in 2M24), dengue fever (+94%) and hand, foot and mouth disease (+7%). In addition, payments by the Social Security Office were raised for the treatment of some conditions, e.g., for obstructive sleep apnea (up to THB 27,000/case), mobile dentistry services (THB 900/person/year) and leukemia treatments involving cell transplants (THB 1.3m/case). With foreign arrivals up 44.0% YoY to 9.37m, income from overseas patients also rose. However, growth was limited in the Middle East market by the timing of this year’s Ramadan (Mar 12, to April 9, 2024), 21 days of which fell in Q1 compared to just 10 days in 1Q23, and by the decision by the Kuwaiti authorities to temporarily halt transfers to Thailand while the quality of Thai services is assessed. Unrest in Myanmar further affected patient admissions.

-

Through the remainder of 2024, ongoing economic growth will lift purchasing power and this will feed through into stronger income for hospitals. In addition, total tourist arrivals (including medical tourists) are expected to reach 35.6m this year, and this will support increased demand for hospital services from non-Thai patients, while the market for preventative healthcare services is also expanding. Hospitals are responding to better conditions by increasing investment in the renovation and extension of existing sites and the construction of new branches, in particular in major industrial and tourist provinces, and to this end in 2023, the authorities authorized environmental impact assessments carried out by five private hospitals. These were for projects with a total of almost 800 beds, and construction on some of these should begin in 2024. Alongside this, investment in non-hospital businesses is expanding, especially in areas connected to wellness products and services. For all of 2024, income is thus expected to grow by 8.0-10.0%.

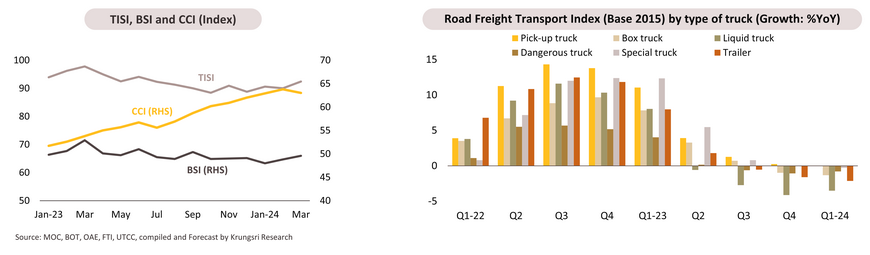

Road freight services: Demand will continue to strengthen urged by acceleration of government disbursements, amid rising costs of fuel and labor.

-

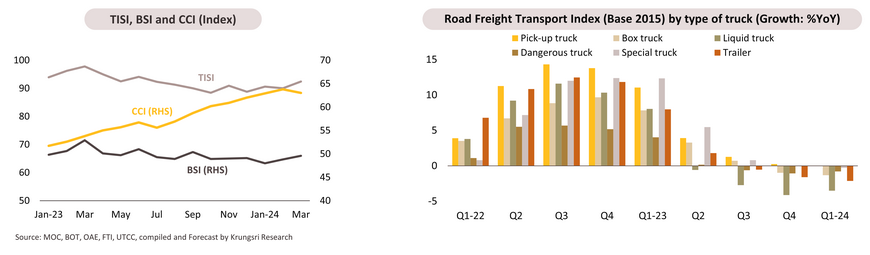

Income growth for road freight companies slowed slightly through 1Q24, and this showed up in a -0.8% YoY decrease in the Index of Road Freight Charges. This was a result of lower freight volumes in the wake of the New Year celebrations that encouraged operators to cut their prices as they tried to maintain their customer base, while delays to government budget disbursements added pressure on work on some construction projects and undercut business sentiment. In addition, the hotter-than-normal weather reduced agricultural outputs (down -5.4% and -7.5% YoY in January and February respectively). The price index thus fell -3.5% YoY for the transport of liquids, -2.1% for trailers, -1.3% for box trucks, -0.8% for dangerous goods, and -0.3% for specialist transport services. However, they stayed flat for pick-up delivery services thanks to stronger domestic consumption, ongoing recovery in the tourism sector, and an improvement in exports.

-

Through the rest of 2024, demand for hauliers to ship raw materials, construction supplies and consumer goods by road will improve thanks to: (i) the pick-up in the pace of government disbursements, which will sustain work on government construction projects and encourage an increase in private investment; (ii) continuing recovery of private consumption and the tourism sector, which will add to demand for consumer goods, while exports will be lifted by the seasonal fruit harvest; and (iii) the positive impacts on agricultural outputs of the weakening of the drought and the possible move into La Niña in 2H24. Overall demand for road transport services should thus rise by 2-3% in 2024, up from 1.6% in 2023. Nevertheless, challenges will remain in the form of: (i) uncertainty over the outlook for trade partners, especially for China, and the potential impact on cross-border trade of political uncertainty in the region; (ii) the high cost of transport fuels, and elevated labor costs due to continuing labor shortages; (iii) the effect on consumer spending power of high levels of household debt; and (iv) plans by the government to levy VAT from Q2 onwards on imports ordered through online platforms, which may reduce sales (at present, goods valued at less than THB 1,500 are VAT-exempt).

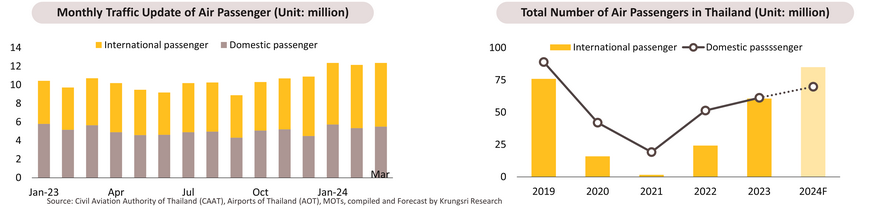

Air Passenger Services: Demand was boosted by the influx of international tourists, while operators hastened strategies to accommodate the increasing demand for travel.

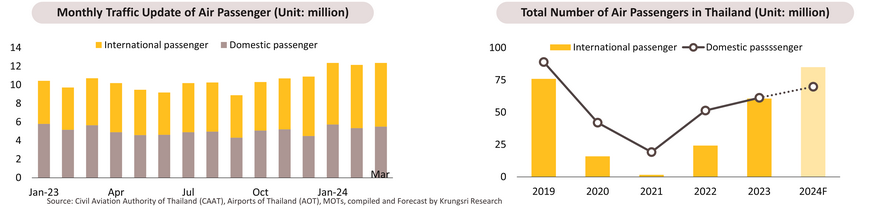

- Total air passenger numbers jumped 19.5% YoY to 36.9m in 1Q24, split between 20.3m international travelers (+42.3% YoY) and 16.6m domestic travelers (-0.1% YoY). The increase in total numbers come from; (i) International arrivals have risen 44.0% YoY to an average of 3m per month, with increases particularly strong in countries benefiting from new visa-free travel arrangements. Thus, Chinese arrivals are up 239.5% YoY (following visa-free travel implemented on Mar 1, 2024, March arrivals averaged 41,113/day, up from 39,727/day over 2M24), Taiwan (+103.1%), India (+46.6%), and Kazakhstan (+28.7%). Arrivals also benefited from the New Year holidays in January and Chinese New Year in February, which helped to lift arrivals above their normal level. (ii) The major airport operator (AOT) has incentivized airlines to put on more flights through the ‘Performance-Based Incentive Scheme’, which offers discounts to airlines laying on flights in excess of those that are authorized between Nov 1, 2023 and Mar 31, 2024, and the ‘New Routes to Airlines’, which encourages operators to open up new lines (Nov 1, 2023 – Oct 31, 2025).

- The air travel market will expand through 2024, supported by; (i) The tourism industry will continue to rebound at both the national and global levels. UNWTO sees international tourism rising 2% above its pre-pandemic levels in 2024. Inbound tourism to Thailand will also benefit from the rising number of foreign arrivals and from government stimulus measures. (ii) Operators (e.g., Thai Airways, Thai AirAsia, Thai Lion Air, and Thai VietJet Air) are boosting demand by expanding overseas destinations and the frequency of their flights, for example to China, India, and Japan. Airlines are also meeting rising demand (especially during festivals and holidays) by increasing the number of flights to major tourist destinations in Thailand and overseas. (iii) The government is supporting the industry by increasing the number of slots by 30-40% YoY during Songkran, and by promoting the tourism industry, e.g., through music, sport, and other international festivals and by simplifying the process of applying for visas and work permits. In addition, the easing restrictions on flights linking Thailand and India would increase the number and frequency of these flights, making it easier to serve new destinations. However, some challenges will drag on industry growth. (i) Jet fuel prices tend to stay elevated, potentially pushing up the cost of fuel (30% of all overheads) and adding to ticket prices. (ii) Competition will stiffen from new players (5 domestic companies to begin operating in 2024) and overseas operators planning to increase the number and frequency of flights to Thailand (e.g., Singaporean airline Scoot plans to fly to Samui). (iii) The uncertain outlook for global economy, including Chinese economy, combined with geopolitical stresses in many regions, may cause demand to suffer. Given this, Thai air passenger numbers are expected to reach 155m in 2024 (+26.9% YoY), split between 85m international travelers (up 40.0% YoY) and 70m domestic travelers (up 14.0% YoY).

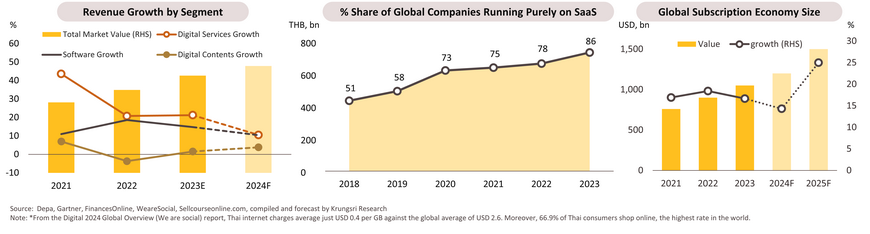

Digital services and software: Players will benefit from growth in the subscription economy driven by AI and data analytics.

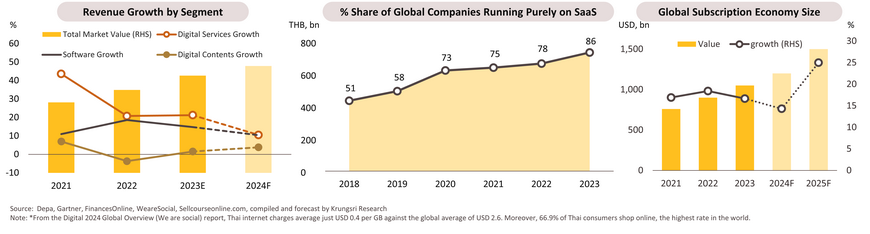

- Overall industry income strengthened through Q124, having already jumped 17.3% in 2023. Digital services benefited from: (i) the use of AI to improve social media algorithms and to develop automatically personalized marketing; (ii) the move by many Thai app operators to develop multi-function ‘super apps’ (e.g., Robinhood and TrueMoney); and (iii) increasing speed of internet networks and lower prices*. Restructuring and the move to a greater use of data analytics to improve development and security has benefitted software business, as has the increasing switch by enterprises to cloud-based SaaS services (this mirrors global trends, with 86% of enterprises following this in 2023). Recovering tourism and entertainment industries and stronger demand for games, animations, and characters has also fed an improvement in conditions for digital content creators following sluggishness in 2023.

- The digital services industry will expand through 2024 on increasing demand for platforms that help consumers complete transactions online. On the supply side, the market will be buoyed by the development of new features allowing content marketing platforms that helps buyers compare goods and services. Growth will thus be driven by online marketplaces, ride, car and space sharing platforms, and social commerce applications. For software developers, solid rates of growth will be maintained thanks to expansion in the use of software delivered via easy-to-use apps. Companies can thus improve their operating efficiency with this paid for on a subscription basis, with simplified and serverless cloud-based solutions that will help to bring SMEs into the market. Gartner thus expects that in 2024, spending on software in Thailand will rise by 15.9%, tracking the anticipated 14.2% global expansion in the subscription economy. Digital content creators will see conditions improve thanks to the strength of the tourism sector and demand for characters and animation for use in advertising, product development, and cloud gaming supply chains that are improved by the entry into the market of major players such as TRUE, AIS and Netflix. Overall digital services and software industries are forecast to grow by 9.0-10.0% through 2024. Digital service providers and software developers will both enjoy 10.0-11.0% growth, for digital content creators, will grow by 3.0-4.0%.

Carbon credits: Demand is increasing as transitions toward sustainability continue; however, challenges persist regarding the standard and integrity.

-

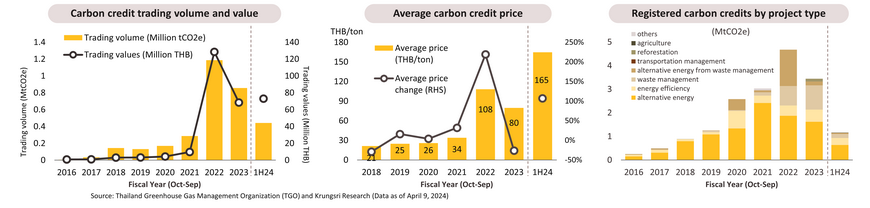

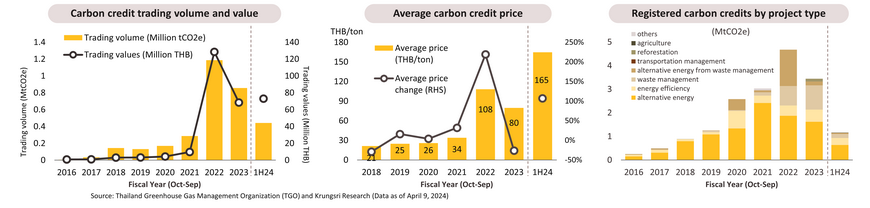

In the first half of the FY2024 (Oct 2023 - Mar 2024), the trading volume of carbon credits under the Thailand Voluntary Emission Reduction Program (T-VER), run by the Thailand Greenhouse Gas Management Organization (TGO), was 0.44 million tonnes of CO2 equivalent (MtCO2e), surpassing half of last year’s total volume. However, the trading value exceeded that of the entire FY2023, reaching the historic highest average price at THB 165 per tCO2e.

-

On the supply side, the volume of registered carbon credits was 1.2 MtCO2e, which was sluggish compared to the previous two years. Most of these credits involve the development of alternative energy sources, energy efficiency, and waste management, respectively. Notably, 14,450 tCO2e of carbon credits from agricultural projects were generated for the first time in FY2024, through Sri Trang’s projects on carbon sequestration and emission reduction in rubber plantations.

-

On the demand side, purchases were driven by carbon offsetting for products, especially for paper goods of Double A, which bought carbon credits generated by Mitr Phol’s biomass projects. This made biomass energy the most significant source of credits traded in the first half, accounting for 0.15 MtCO2e or around one-third of the total volume. The demand for nature-based carbon credits has been growing, suggested by the credits from reforestation being the third largest sold after biomass and solar energy. Moreover, they were priced the highest at THB 510 per tCO2e on average.

-

Going forward, additional supply of carbon credits in FY2024 is expected to slightly decrease from the FY2023 level, following a cumulative surplus in supply. More credits will be sourced from nature-based removal and agricultural projects, while fewer will come from renewable energy development. However, demand is anticipated to continue rising, leading to expected increases in trading values and prices above the FY2023 level, particularly as carbon credits from forestry projects are traded more extensively. Supporting factors include: (i) more organizations, especially in the private sector, are striving for carbon neutrality and net-zero goals, and (ii) the development of domestic laws and regulations e.g., Climate Change Act and carbon tax, together with international green measures, is expected to propel businesses’ climate actions. However, The key challenge lies in the doubt surrounding the integrity and quality of carbon credits, which affects demand. This could put pressure on Thai standards to gain international accreditation, such as the Core Carbon Principles (CCPs), and eligibility under the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

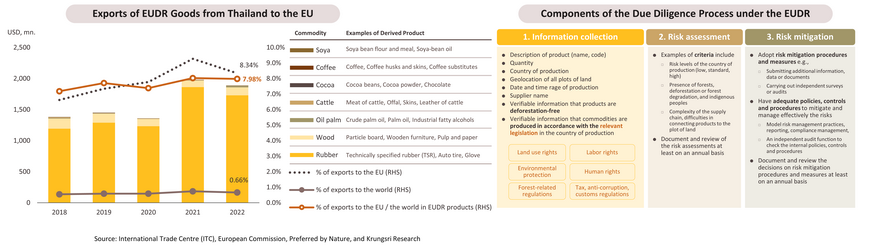

EUDR: The regulation would impact the supply chain traceability of Thai businesses, particularly in the rubber sector.

-

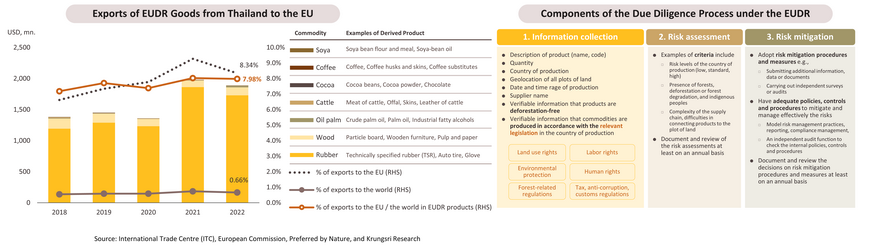

The European Union’s Deforestation Regulation (EUDR) specifies that trades in goods with the EU in seven product categories, namely rubber, oil palm, cattle, wood, coffee, cocoa, and soy, together with derived products e.g., latex gloves, paper, and wooden furniture, must meet the following three criteria: (i) The goods must be deforestation-free, (ii) The goods should have been produced in conditions that are fully compliant with local laws (e.g., land ownership, labor and human rights, the environment, forest protection, taxation, etc.), and (iii) Businesses need to carry out due diligence on the origin of the goods, which consists of information collection, risk assessment, and risk mitigation. Currently, enforcement of the EUDR has been in a transitional phase since June 29, 2023, with full implementation scheduled to commence on December 30, 2024, when all conditions under the EUDR will be applied.

-

The impacts of the EUDR on Thailand will include: (i) Higher costs for both manufacturers and exporters connected to reporting and supply chain checking and verification, especially for rubber products which accounted for more than 90% of the total EUDR goods exports to the EU, (ii) The possible loss of competitiveness for smaller players if these cannot meet the EUDR requirements, and (iii) The gradual exclusion of Thai players from global supply chains and investment flows if Thailand is classified as a high-risk country by the EU.

-

However, if the country can adequately prepare and adapt, particularly in the development of data collection and tracking systems for supply chain traceability, effective enforcement of environmental, social, and governance laws, as well as the support for sustainable production standards among business owners, it will open opportunities for trade and investment in the EU and the global production chain.

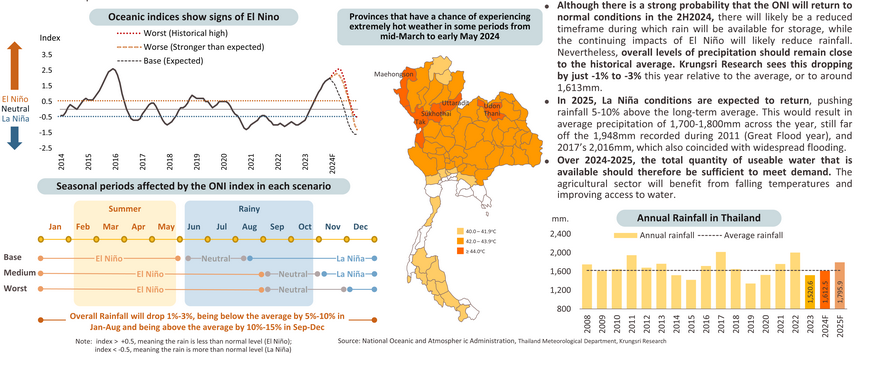

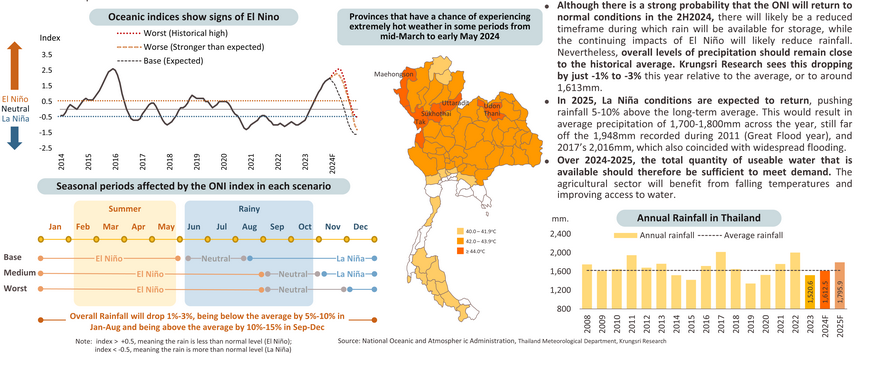

Since early 2024, Thailand has remained in El Niño conditions. Peak temperatures are likely to be 1.0-1.5oC above normal. The highest temperatures will be in the north and northeast.

Krungsri Research has assessed outcomes for 2024 based on three different scenarios. Base case: Having begun to weaken in January, the ONI will enter neutral conditions in June 2024 and La Niña in August 2024. Worse case or stronger than expected El Niño: the ONI will increase to close to its 1982-1983/1997 levels in March before returning to neutral conditions in September 2024 and La Niña in November 2024. Worst case or historical high: In this scenario, the ONI will hit a 74-year high in April, as in 2015, and then transition to neutral conditions in September 2024 and a La Niña in December 2024.

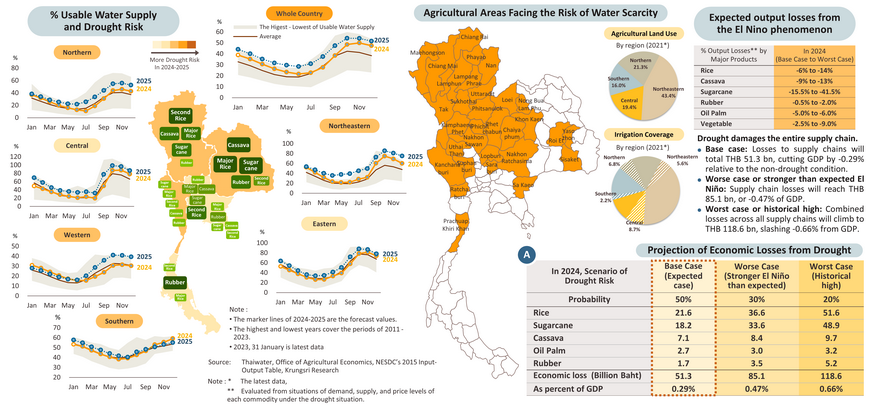

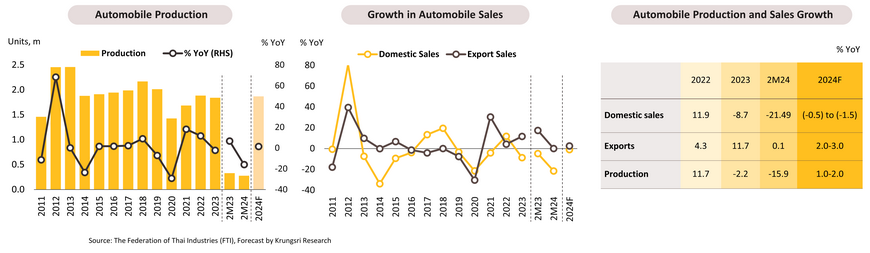

In 2024, harvested areas in irrigation areas will still benefit from adequate water supplies. In the base case, the drought will cut -0.29% from GDP.

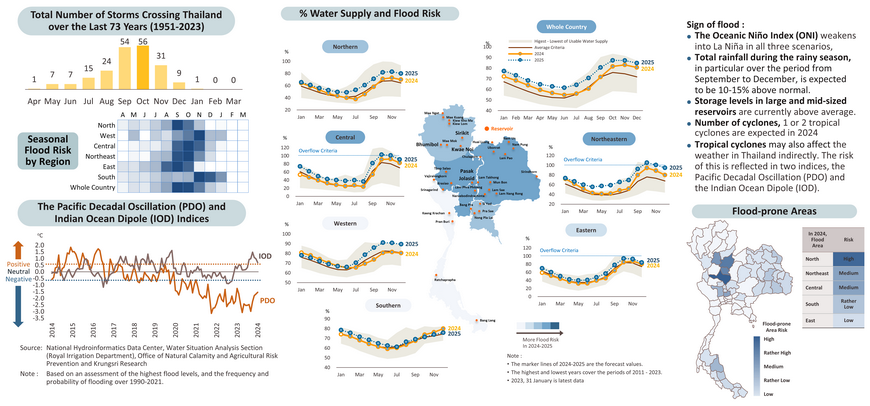

Signs of flood increased in 2H2024, especially in flood-prone areas of northeast, lower north, and central regions.

In 2024, combined losses from drought and flooding are expected at THB 55.8 bn, resulting in a -0.31% reduction in nominal GDP.

.webp.aspx)