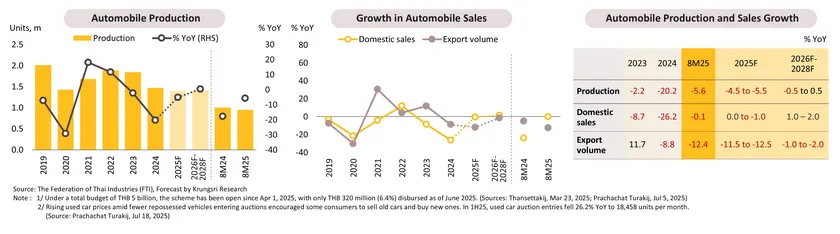

Automobile: Output is expected to stay flat due to indirect effects of U.S. tariff measures on demand, but XEV production will keep growing with government support.

-

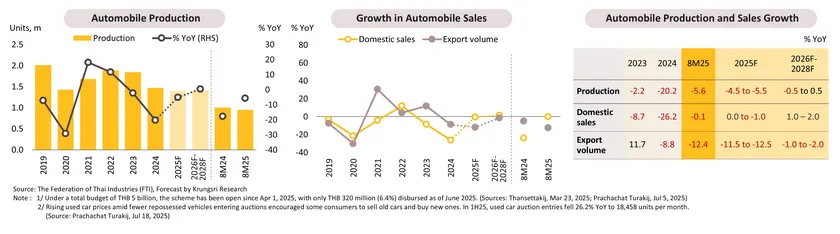

In 8M25, production fell -5.6% YoY to 949,140 units, with passenger car output down -7.9% and pickup production down -3.4%. Meanwhile, Passenger BEV production surged 497.5% YoY to 34,998 units, supported by the EV 3.0 scheme that requires automakers to domestically produce 1.5 times the volume of imported EVs. Domestic sales dropped -0.1% YoY to 399,428 units, led by a -12.0% decline in pickup sales, despite support from the “Kraba Phee Mee Khlang Kham” project, as disbursement has been slow1/ amid a weak economy and low agricultural prices, causing farmers and SMEs to delay vehicle replacements. Passenger car sales were stable (+0.2% YoY), supported by easing auto loan approvals as NPL and SML levels continued to decline. Exports fell -12.4% YoY to 603,062 units, pressured by (i) competition from aggressive exports by Chinese EV makers to clear domestic oversupply, and (ii) stricter environmental and vehicle safety regulations in the US and Europe, which affected exports of certain ICE models from Thailand. For 2025, production is expected to decline by -4.5% to -5.5%. Domestic sales will slightly fall by 0.0% to -1.0%, while exports decline by -11.5% to -12.5%.

- During 2026–2028, vehicle production is expected to remain flat ( -0.5% to +0.5% annually), due to weak demand from slow economic recovery and limited purchasing power in domestic and export markets. However, on the supply side, rising XEV production driven by local BEV manufacturing requirements under the EV 3.0 and EV 3.5 schemes, along with excise tax incentives for HEV and MHEV production during 2026–2032 will support the overall production. Domestic sales will grow 1.0-2.0% annually, supported by (i) continued infrastructure investment boosting transport demand, (ii) growth in tourism, transportation, and e-commerce, and (iii) rising used car prices2/, encouraging trade-ins and new car purchases. Exports are projected to decline -1.0% to -2.0% per year, weighed down by the US tariffs reducing purchasing power in trading partners and heightened competition from Chinese automakers who are accelerating exports to clear EV stock.

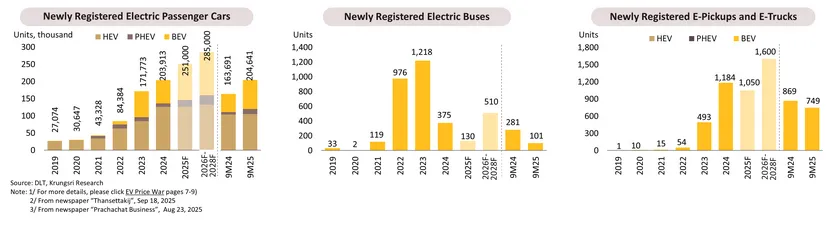

Electric vehicles: New vehicle registrations are expected to rise, driven by the launch of modern, affordable models and the latest BMTA electric bus procurement program.

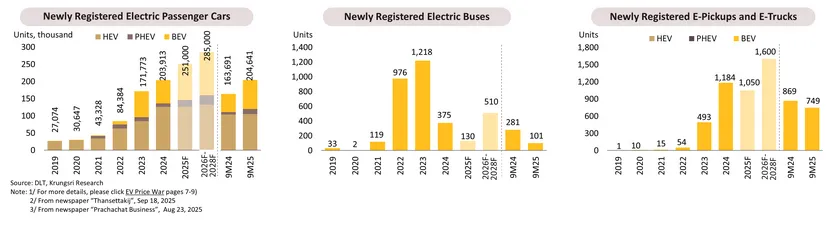

- In 9M25, new registrations of passenger XEVs rose 25.0% YoY to 204,641 units, comprising: Passenger BEVs: up 60.4% YoY to 84,546 units, supported by pent-up consumer demand and a slowdown in the EV price war, reflected in stable prices of Chinese EVs at the Motor Show 2025 (Mar–Apr)1/. Passenger HEVs: up 1.4% YoY to 105,103 units. Passenger PHEVs: up 105.3% YoY to 14,992 units, driven by flexible technology suited for buyers not yet ready to switch to full BEVs and new model from Japanese and affordable Chinese brands. New registrations of electric buses declined -64.1% YoY to 101 units, due to a slowdown in government procurement after extensive deployment in 2022–2023. Electric commercial vehicles fell -13.8% YoY to 749 units, limited by driving range per charge for commercial use, high maintenance and parts costs, and prices beyond the purchasing power of small businesses and farmers, leading to restricted loan approvals. As a result, 2025 new registrations are expected to reach 251,000 passenger XEVs, 130 electric buses, and 1,050 electric commercial vehicles.

- During 2026–2028, annual new registrations are expected to reach 285,000 passenger XEVs (125,000 BEVs, 28,000 PHEVs, and 132,000 HEVs), 510 electric buses, and 1,600 electric commercial vehicles, supported by: (i) subsiding EV price war; (ii) the launch of new EV models with advanced technologies; (iii) a new procurement program by the Bangkok Mass Transit Authority (BMTA) for 1,520 electric buses with a budget of THB 15.355 bn during 2026–20322/; (iv) the introduction of new electric pickup models, particularly from leading Japanese brands such as the Toyota Hilux BEV, expected by 20253/; and (v) advance in batteries for large electric vehicles that better meet commercial usage at lower costs, with the IEA (2025) projecting a -15% to -35% decline in global BEV heavy-truck purchase prices by 2030.

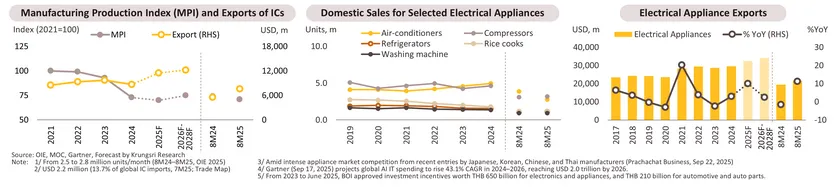

ICs and electrical appliances: Domestic sales and exports will increase, underpinned by the recovery in downstream industries and the upcycle in electrical appliance demand.

8M25

-

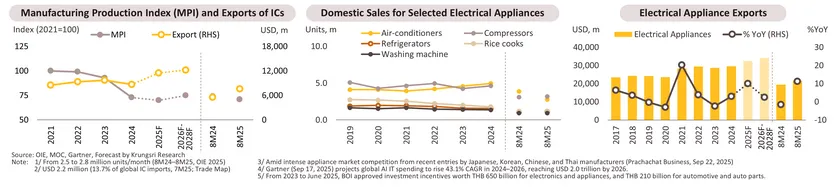

Integrated Circuits (ICs): Export value rose 36.6% YoY, driven by (i) a new cycle of electrical appliance and electronics replacement after the COVID-19 peak, (ii) rising demand for chips in AI infrastructure, continued global EV production growth, and (iii) accelerated electronics and appliance production in partner countries to expedite shipments to the US before reciprocal tariffs take effect. However, the production index fell -4.4% YoY, due to a 13.3% rise in inventory levels1/ and a 56.9%2/ surge in IC imports, particularly from China, during 7M25. Given these, IC export value will rise 30–35% in 2025, while the production index is projected to decline by -3.5 to -4.5%.

-

Electrical appliances: Domestic sales declined -9.1% YoY, led by a -28.9% drop in air conditioners, the largest segment, following last year’s peak during unusually hot weather in Thailand, and a -1.1% YoY decline in washing machines, continuing a downward trend since 2021 due to the growing laundromat usage. However, sales of refrigerators and rice cookers rose 8.4% and 3.1% YoY, respectively, supported by (i) more affordable new models3/ and (ii) consumer replacement cycles since the COVID-19 period. Meanwhile, export value rose 11.2% YoY, reflecting the global replacement cycle following the COVID-19 peak. Consequently, domestic sales will drop -8.5 to -9.5% in 2025, while export value is projected to rise 9.5–10.5%.

2026-2028 Outlook

-

ICs: The production index and export value will grow by 3.0-4.0% and 2.5-3.5%, respectively, supported by (i) global growth in AI4/ and Data Center, and (ii) domestic mid- and downstream industry investments that use ICs as production inputs, such as electronics, electrical appliances, and EVs5/. However, IC production may face risks of supply chain disruptions due to tightened rare-earth exports from China and potential US tariff increases, which could moderately constrain production and export growth (with exports from Thailand to the US accounting for 5.8% of Thailand’s total IC export value in 2024).

-

Electrical appliances: Domestic sales are expected to grow 1.5–2.5%, supported by (i) steady demand for affordable, versatile small appliances amid a still-recovering economy, and (ii) promotional campaigns driven by intense domestic market competition. Meanwhile, export value will rise 2.0–3.0%, driven by a global upcycle in electrical appliances. However, demand may remain subdued, particularly in 2026, due to slow economic recovery and potential impacts from the US tariff hikes (with exports from Thailand to the US accounting for 25.0% of Thailand’s total electrical appliance export value in 2024).

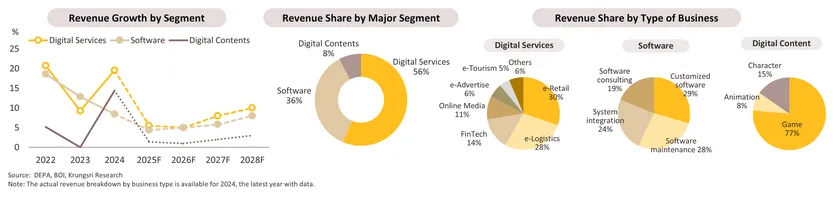

Digital services and software: Revenue growth is projected to slow in 2026, then strengthen in 2027–2028, supported by AI-driven digital services and software, along with data center expansion.

-

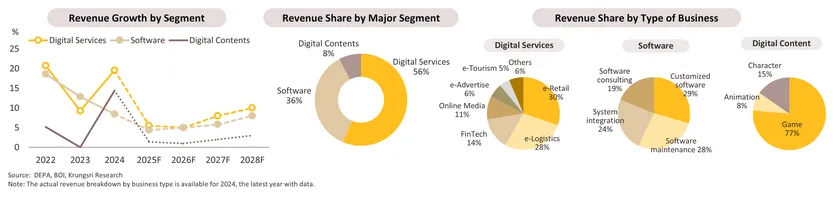

In 2025, revenue is projected to grow 4.8%, slowing from 14.9% in 2024, amid a broad deceleration across all segments. The digital services business remains the main growth driver, with revenue expected to rise 5.5%, down from 19.5% in 2024, reflecting heightened consumer caution amid an economic slowdown. Growth will be supported by (i) Cloud & Platform Services, driven by rising demand from the public sector and large enterprises, especially in Data analytics and Cybersecurity, and (ii) SMEs increasingly adopting digital marketing via social platforms and live streaming. The software business is expected to expand 4.4%, lower than 8.5% in 2024, in line with slower corporate IT investment and the Private Investment Index, which rose only 1.7% in 8M25 (Source: BOT). Some growth momentum remains from SMEs continuing to migrate to ERP/CRM Cloud systems. Meanwhile, digital content is forecast to grow modestly by 1.4%, down from 14.4% in 2024, pressured by fewer tourist arrivals and a slowdown in restaurants and

-

During 2026–2028, industry revenue overall is projected to grow steadily at an average of 6.8% per year. Growth in 2026 will remain modest at 4.7%, pressured by weak consumer confidence amid U.S. tariff-related economic uncertainty, before growing at a faster pace through 2027–2028, driven by advancements in AI and rising data center investment that boost demand for digital platforms and software services. Over the next three years, digital services revenue is forecast to grow at an average annual rate of 7.7%, led by robust expansion in e-Retail, e-Logistics, and FinTech segments. The software business is expected to grow 6.3% per year, driven by demand for data processing software and customized network software development. In contrast, digital content is expected to grow modestly at only 2.0%, as gradual recovery in demand is offset by intense price competition and lower-cost product development from neighboring countries, posing constraints on revenue growth in this segment.

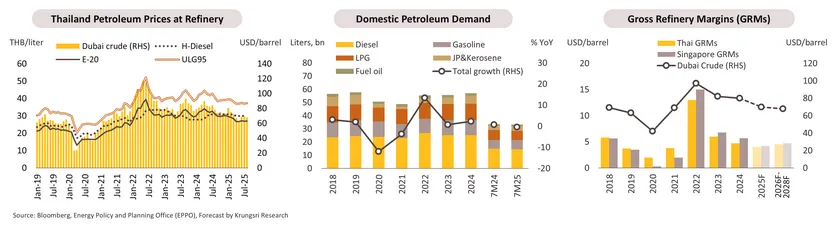

Refinery: Revenue pressured by slowing manufacturing amid shift to clean energy.

-

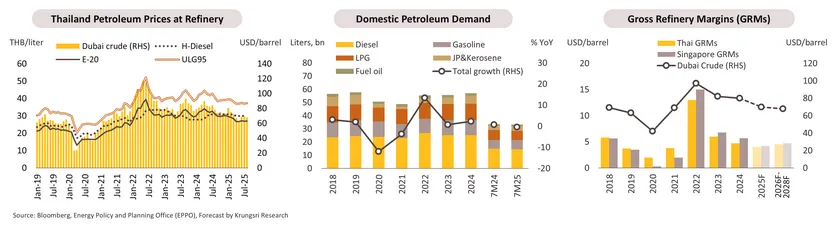

In 8M25, GRMs continued to drop due to slower global economic growth, and increasing crude supply from OPEC+ ramping up production. Thus, the average Dubai crude price fell to USD 70.3/bbl (-15.1% YoY). Refined oil prices, especially gasoline, dropped more sharply due to excess supply from China, causing Thai ex-refinery prices such as diesel and E-20 to decrease by -18.1% YoY and -25.0% YoY, respectively. Domestic demand for refined oil fell slightly by -0.4% YoY (January–July), mainly from a fall in diesel consumption (-1.8% YoY), reflecting weaker industrial production. Demand for gasoline and fuel oil rose by 1.0% YoY and 8.6% YoY, respectively. For the rest of the year, global crude prices will continue to fall due to increased OPEC+ supply and slowing global and Thai economies compared to 1H25. The average Dubai crude price for 2025 is forecasted at USD 70/bbl (-12.3%), resulting in Thai GRMs averaging USD 3.5–4.5/bbl, lower than USD 4.7/bbl in 2024.

-

From 2026-2028, the oil refining industry will face pressure from Thailand’s slow economic growth, with manufacturing expected to slow due to continued impacts from intensifying global trade wars affecting exports. However, tourism growth, which is projected to return to near pre-COVID-19 levels by 2028, and e-commerce will sustain demand for travel and goods transportation, supporting some increase in refined oil consumption. With the average Dubai crude price forecasted between USD 67-70/bbl, Thailand’s GRMs will average USD 4.0–5.0/bbl, compared to an average of USD 5.0/bbl during 2012–2019. Refiners are adapting by investing more in clean energy projects. For example, Thai Oil plans investments in the EEC to upgrade low-value products like fuel oil into higher-value products such as low-sulfur jet fuel. These efforts align with government policies to reduce greenhouse gas emissions and achieve Net Zero target.

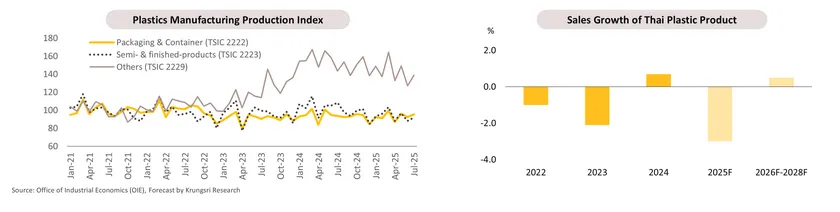

Plastic: Slowing downstream demand and trade wars weigh on industry.

-

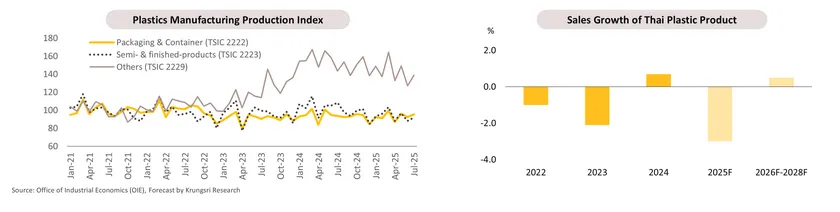

In 7M25, the plastics manufacturing production index showed a decline across almost all categories (packaging -1.2% YoY, finished and semi-finished products -10.5% YoY, and other plastic products -8.7% YoY). This was due to slowing downstream industries such as electrical appliances (-1.1% YoY) and automobiles (-2.2% YoY). Meanwhile, the value of imported plastic products rose by 16.5% YoY, driven by a sharp rise in China’s import of 26.3% YoY. Imports of self-adhesive and non-adhesive plastic films rose by 36.7% YoY. Conversely, the export value of plastic products grew by 18.1% YoY, with exports to the US rising by 67.0% YoY, driven by accelerated purchasing ahead of tariff hikes on imported goods in August. Plastic products related to construction saw a sharp rise of 216.5% YoY. For the rest of the year, plastic production will continue declining due to (1) a slowdown in the Thai economy, with GDP growth projected at 1.3% YoY in the 2H25, down from 3.0% YoY in 1H, (2) a slowdown in global plastic downstream industries, and (3) an influx of low-cost plastic products from China. As a result, in 2025, plastic production will contract by -4.0% to -5.0%, while the export value is projected to grow by 1.5% to 2.5%.

- In 2026-2028, demand for plastic products is expected to grow slowly, mirroring Thailand’s low economic growth. Continued expansion in tourism and e-commerce will benefit the packaging and household goods sectors. However, the plastic industry faces challenges, including slowing demand from downstream industries aligned with the global economy’s low growth. Reciprocal tariffs are likely to reduce Thai plastic exports, particularly PET exports to the US, accounting for 22.8% of Thailand’s total PET export value. Additionally, the industry is facing an influx of low-cost plastic products from China amid potential intensified trade conflicts with the US and global oversupply of plastic resin and products, especially from China. These factors suggest domestic plastic product demand will grow at an average of 0.5–1.5% annually, while export value is expected to grow 1.0–2.0%, down from an average of 2.5% during 2015–2024. Key challenges include (1) volatility in plastic resin prices linked to crude oil prices, (2) environmental movements reducing plastic demand, and (3) policies targeting single-use plastics, as well as carbon border adjustment mechanisms (CBAM) and plastic taxes from the EU, which will increase costs for manufacturers.

-

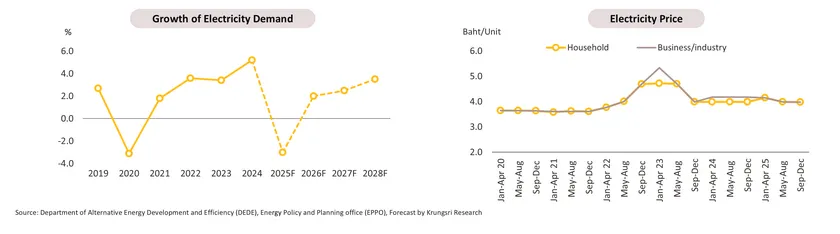

Power Generation: Electricity demand from clean energy is expected to increase, driven by target industries in the EEC.

-

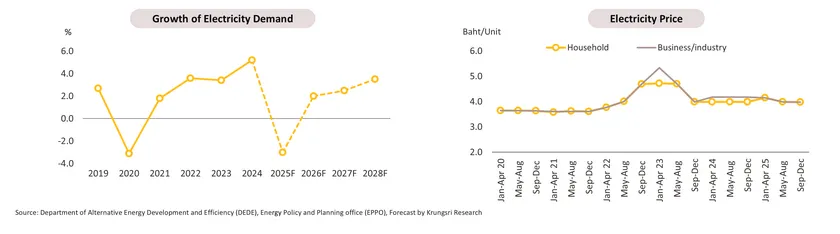

Over 8M25, electricity demand fell by -3.7% YoY, driven by an economic slowdown in Q3, especially in export manufacturing, while domestic purchasing power was pressured by high household debt, leading to more cautious consumer spending. Electricity consumption fell -2.7% YoY in industry, -4.3% YoY in business, and -6.2% YoY in households. However, the government has accelerated measures to ease energy costs, reducing the electricity tariff to THB 3.98/unit during September–December (from THB 4.15/unit at the beginning of the year), and promoting rooftop solar through subsidies, tax deductions, and soft loans. Thus, more households and businesses are adopting rooftop solar to cut long-term energy costs. Peak demand stood at 34,568.3 MW in April, down -5.2% from the April 2024 peak. For the rest of the year, demand will rise slightly during the year-end festive season, resulting in an overall -2.5% to -3.5% contraction in 2025, compared to 5.2% growth in 2024.

-

From 2026–2028, electricity demand is forecast to grow 2.5–3.5% annually, in line with a gradual economic recovery, mainly in the service sector. Clean energy demand will rise significantly in the EEC’s target industries and data centers, driving increased private investment in renewables. This growth aligns with the PDP 2025 plan, which promotes renewable generation and 2,000 MW of Direct Power Purchase Agreement (Direct PPA) projects under the Third Party Access system. The government is developing regulations for transmission fees, Utility Green Tariff, and Renewable Energy Certificates to enhance clean energy accessibility for businesses. However, delays in Direct PPA regulations and growing competition in the renewable energy market remain key challenges for new investments.

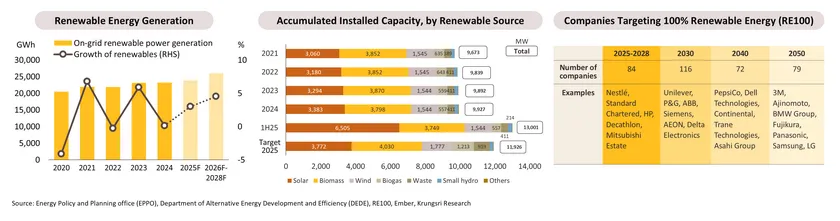

Renewable energy: Green electricity demand is growing, driven by data centers and RE100 companies.

-

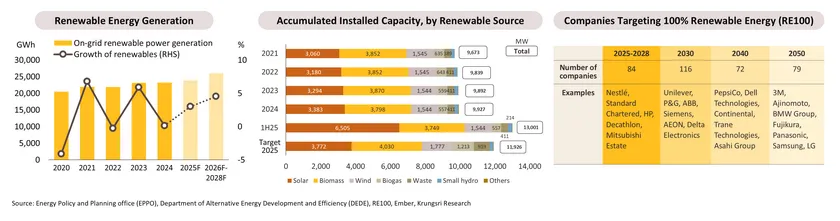

In 7M25, renewable power generation reached 14,459 GWh (+3.2% YoY), while installed capacity stood at 13,001 MW (+31% from end-2024) (as of June 2025). Solar accounted for 50% of total capacity (6,505 MW, +92.3% from end-2024), already exceeding the 2025 capacity target by 72.5%, followed by biomass (29%), whose capacity has continued to decline (-3.1% since 2023). On the demand side, total electricity consumption (including non-renewable sources) decline by -4.4% YoY due to the economic slowdown. For the full year 2025, renewable power generation is expected to reach 23,900 GWh (+3.0%), driven by steadily increasing installed capacity, while demand for green electricity continues to gain momentum, as large corporates—such as Nestlé and Siam Piwat—began purchasing green power under the Utility Green Tariff (UGT1) scheme starting in July 2025.

-

From 2026-2028, renewable power generation is expected to rise 4.0–5.0% per year, supported by (i) government incentives, including long-term purchase contracts for SPPs and VSPPs, and BOI investment benefits; and (ii) declining technology costs for solar panels and batteries. Green electricity demand will grow 2.5–3.5% annually, driven by (i) demand from businesses—especially data centers of tech firms (e.g., Google, Microsoft, AWS); global manufacturers based in Thailand (e.g., Nestlé, Unilever); and exporters pressured by trade regulations (e.g., CBAM)—and (ii) improved access to green power through initiatives like UGT (corporates pay a premium for green electricity supplied by state-owned utilities) and direct PPAs (users purchase directly from generators). However, the sector may face constraints from (i) delays in finalizing the Power Development Plan (PDP); (ii) anticipated slow growth in the Thai economy, which dampens power demand; and (iii) trade policies—particularly U.S. solar panel tariffs—which affect solar panel producers in Thailand and the renewable energy supply chain.

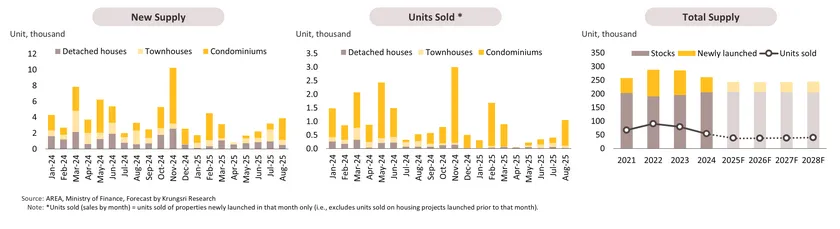

Housing (BMR): The residential property market is expected to recover slowly, weighed down by persistently high household debt.

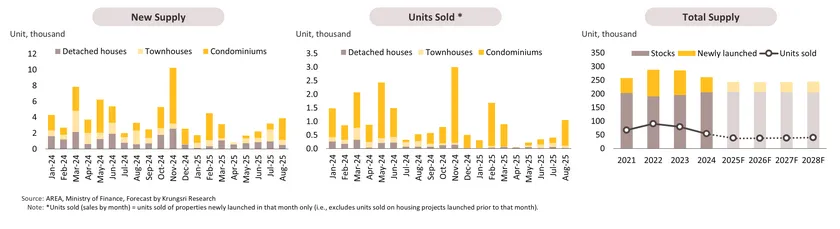

- In 8M25, the residential market remained under pressure from weak purchasing power, with sales of newly launched units down -50.6% YoY. Developers slowed new project launches to 21,282 units, a -39.9% YoY decrease. Detached houses and townhouses were hit hard, with sales plunging -50.0% YoY. For the remainder of the year, the market is expected to continue slowing, driven by global trade tensions weighing on Thailand’s economic growth and high household debt. These factors have led many buyers, especially in the sub-THB 3 million segment, to delay purchases. Government stimulus is likely to provide limited support amid income concerns. For 2025, residential sales are projected to fall by -30.0% compared to 2024, with new project launches down -35.0%.

- In 2026, residential demand will remain weak due to a slow economic recovery and ongoing household debt. While the tourism sector continues to support Thailand’s growth, it is insufficient to drive broad business expansion. However, the mid-to-high-end market will remain a key focus for developers. From 2027 to 2028, the market is expected to recover gradually, supported by: (1) an improving Thai economy, driven by government investments, job growth, and sustained tourism; (2) urban rail expansions enhancing suburban accessibility along transit lines; and (3) rising demand from expatriates and long-term residents, including retirees, spurring mid-to-high-end housing needs for rentals and purchases. From 2026-2028, new unit launches are expected to increase by 3.0–4.0% annually, averaging 38,000 units per year, well below the pre-COVID average of 110,000 units (2017–2019), with total sales increasing by 1.5-2.3% per year.

Office Building (BMR): The occupancy rate is expected to hit a record low as new supply continues to outpace the slow recovery in rental demand.

-

In 1H25, demand for office space rental showed signs of recovery but remained under pressure from 330,000 square meters of new supply (+47.0% YoY), bringing cumulative office supply to 10.2 million square meters (+4.3% YoY). Grade B offices comprised 72% of the supply, while Grade A and A+ offices accounted for 18% and 10%, respectively. Net take-up rose by 80,300 square meters, pushing total occupied space to 8.0 million square meters (+1.3% YoY), and the occupancy rate down to 79.3% from 81.6% a year earlier. In 2H25, new supply is expected to continue entering the market in line with developers’ investment plans, particularly for Grade A and above offices. Demand is projected to grow only gradually, driven by Thai and foreign firms, particularly in the electric vehicle (EV), digital, and advanced medical industries, which are seeking ESG-compliant Grade A+ office space in CBD areas. For 2025, new office supply is forecast to rise by 4.8%, while rental demand will grow by only 1.2%, lowering the occupancy

-

From 2026 to 2028, office rental demand is expected to improve, driven by service sector growth fueled by tourism, as well as technology, finance, and digital firms seeking modern city-center offices. Foreign investors and expanding luxury retail brands will also support demand. However, slow export recovery, fragile domestic purchasing power due to household debt, and global economic uncertainty may limit consumption and moderate office demand. On the supply side, new office space will steadily enter the market, mainly from phased, large-scale mixed-use projects. From 2026 to 2028, new office supply is expected to grow 1.5%–2.5% per year, while rental demand is projected to rise 0.7%–1.5% annually. This imbalance may push occupancy to a historic low of 79.1%, putting pressure on average rents, which are likely to remain flat or rise modestly. However, new Grade A and A+ offices in CBDs, highly sought after by businesses, may see sustained rent increases, while older and non-CBD buildings could face downward pressure to maintain long-term occupancy.

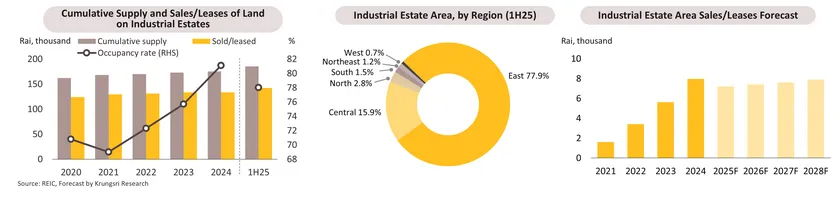

Industrial estate: Sales and leases are projected to recover over 2026-2028, amid risks from political and global economic uncertainties.

-

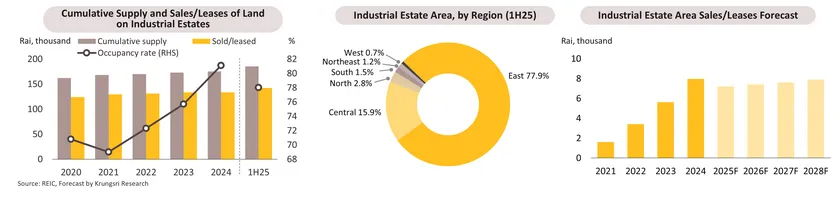

In 1H25, sales and leases totaled 3,383 rai (-15.8% YoY), reflecting economic uncertainty that has weakened investment confidence. The contraction was also partly due to a high base in the same period last year, when sales and leases expanded by 42.4% YoY in 1H24. The Eastern region accounted for 96% of industrial land sales and leases, which fell -6.8% YoY, bringing cumulative 1H25 sales to 142,009 rai. Meanwhile, investment promotion approvals and certificates rose 89.9% and 48.8% YoY, respectively. Seven new industrial estates totaling 9,979 rai were added, bringing the nationwide total to 78 estates covering 185,139 rai, with a 78.0% occupancy rate. Sales and leases are expected to decline further in 2025 due to U.S. tariff pressures, although increased investment relocation, particularly from China, is likely to help limit the contraction. Full-year sales and lease volumes are projected at around 7,200 rai, down -10% from 7,966 rai in 2024.

-

During 2026-2028, sales and leases are expected to grow at an average of 3.0–4.0% per year, or approximately 7,500-7,600 rai/year, supported by: (i) geopolitical factors, which are driving greater investment relocation to ASEAN and Thailand; and (ii) progress on infrastructure megaprojects, enhancing the strategic advantage of key locations, particularly in the EEC which features critical infrastructure such as deep-sea ports connected to major export markets. In 1H25, the number of projects and the value of investment promotion applications in the EEC increased by 75.6% YoY and 269.4% YoY, respectively. Meanwhile, developers are expected to increasingly focus on environmentally friendly industrial estate ecosystems in response to growing investment in smart industrial estates and BCG (Bio-Circular-Green) industries. However, potential supply-side constraints include: (i) economic and political uncertainty, which may affect the continuity of industrial estate development projects, especially in 2026; (ii) urban planning restrictions, which may not align with investment areas, potent

Construction: Overall construction investment is expected to rise modestly, driven by government megaprojects and a gradual recovery in the private sector.

-

In 1H25, total construction investment continued to grow strongly at 12.3% YoY, supported by a 24.5% YoY increase in public sector projects, particularly infrastructure construction, which accelerated by 31.0% YoY following delays in 2024 (-23.6% YoY in 1H24). Most of this growth came from ongoing transportation network projects. In contrast, private construction investment declined by -2.5% YoY, mainly due to a -4.7% YoY drop in residential construction, consistent with a -15.6% YoY contraction in newly registered housing nationwide. Looking ahead to 2H25, construction investment is expected to face headwinds from a slowing economy, weighed down by U.S. reciprocal tariff impacts, political uncertainties, and tighter mortgage lending by financial institutions, which further dampen housing construction. Nonetheless, increased investment relocation is likely to provide some support to industrial construction, helping to ease the contraction in overall private construction. As a result, total construction investment for 2025 is projected to expand only 1.0-2.0%, with public construction rising 2.0–2.5% and private construction contracting -0.5 to -2.0%.

-

For 2026-2028, total construction investment is expected to grow moderately by 2.5-3.0%, led by large-scale government projects. Public construction is projected to expand 3.5-4.0%, supported by major infrastructure projects under the 2026 fiscal budget, with THB 185.3 billion allocated to the Ministry of Transport in August 2025 (Source: Thansettakij, 13 August 2025) for new logistics initiatives and ongoing highway, rural road, and motorway projects. Private construction is expected to grow 1.5-2.0% annually, following a slowdown in 2025-2026, with recovery concentrated in strategic industrial and tourism hubs. Industrial estate and warehouse construction is set to rise steadily, driven by foreign production relocation and prime-location advantages.

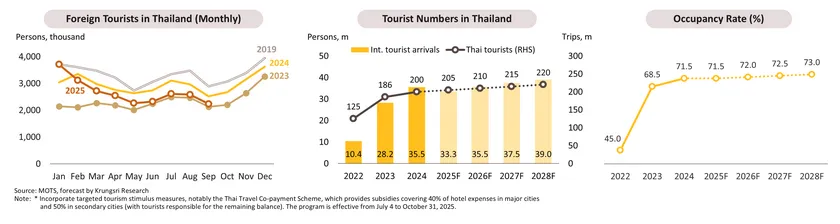

Hotel: International tourist arrivals during 2026–2028 are expected to remain below 2019 levels, while domestic tourism grows modestly, despite an occupancy rate above 70%.

-

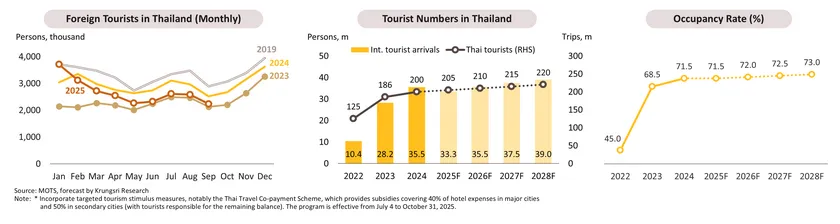

In 9M25, international tourist arrivals totaled 24.12 million, down -7.6% YoY, mainly due to declines from key markets. Chinese visitors (14.2% of total) fell -35.0% YoY amid ongoing safety concerns in Thailand, while many opted to travel to Vietnam (+43.9% YoY) and Japan (+47.9% YoY). Malaysian arrivals dropped -7.1% YoY due to economic uncertainty and higher travel costs, prompting many to opt for domestic trips instead. In contrast, Indian visitors rose 15.3% YoY, and long-haul markets such as Europe and the U.S. increased 14.4% YoY and 7.5% YoY, supported by additional flight services. Domestic tourism rose 3.1% YoY to 149 million trips in 9M25, partly supported by government initiatives*, keeping the overall occupancy rate in 9M25 at 70.9%, slightly higher than 70.8% a year earlier. For the remainder of the year, international arrivals are expected to remain subdued due to global economic slowdown and impacts from U.S. tariffs, particularly affecting China. For the full-year 2025, international visitors are projected at 33.3 million (-6.3%), with domestic trips rising to 205 million (+2.2%).

-

For 2026-2028, international tourist arrivals are expected to gradually recover, led by growing demand from India and Europe via increased direct flights to key destinations such as Phuket, Samui, and Chiang Mai. However, overall growth will remain moderate due to: (i) heightened global economic uncertainty, particularly from U.S. tariff policies, dampening travel confidence, especially in 2026; (ii) domestic factors affecting Thailand’s image, including safety and political instability; (iii) reduced value-for-money perception amid high living costs; and (iv) increasing competition from regional destinations like Japan and Vietnam targeting Chinese tourists. International arrivals are projected at 35.5 million in 2026, 37.5 million in 2027, and 39.0 million in 2028. Domestic trips are expected to average 215-220 million per year, while the overall occupancy rate is forecast at 72-73%, with major tourist destinations (Bangkok, Chonburi, Phuket) exceeding 75%.

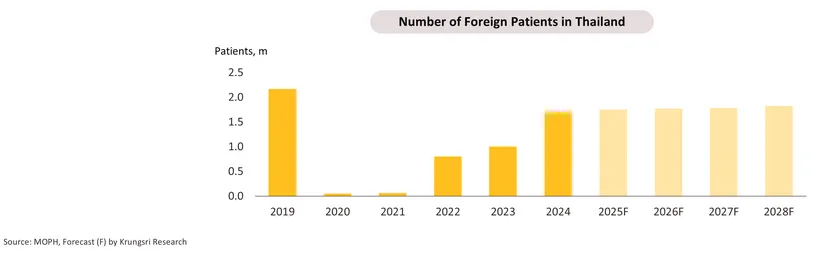

Private hospital: Foreign patients and health awareness trends support hospital revenue.

-

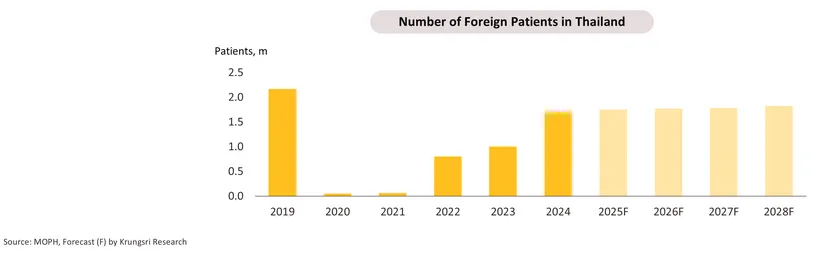

In 9M25, private hospital revenue grew steadily, driven by: (i) a 48.0% YoY rise in patients with infectious and seasonal illnesses (Jan–Jun), including an 80.4% YoY increase in influenza and 36.6% YoY in pneumonia cases; (ii) continued demand from foreign patients; and (iii) hospital expansions through new facilities, acquisitions, and strategic partnerships aimed at resource sharing and cost reduction. However, Thailand’s economic slowdown led some patients to choose more affordable public hospitals, and hospitals reliant on international patients saw fewer visitors from countries like China and Cambodia. For the rest of the year, demand from middle-to-upper income groups is expected to remain strong, boosted further by the winter season. Hospitals with diverse patient bases, such as international and insured patients, are likely to outperform those dependent on a single segment. The government’s “Healthy Body, Happy Wallet” initiative, effective October 28, will require hospitals to disclose generic drug prices. This is expected to have minimal revenue impact since these drugs are low-cost, unlike the pricier medications used for specialized treatments. Overall, private hospital revenue is projected to grow by 6.0–7.0% in 2025, compared to 8.0–9.0% in 2024.

-

From 2026 to 2028, the private hospital sector is expected to see continued growth, supported by several key drivers: (i) Thailand’s transition to a fully aged society, which is likely to increase healthcare spending; (ii) hospital operators expanding into new international markets to diversify their patient base; (iii) enhanced healthcare benefits for insured patients, including expanded Social Security Fund coverage for procedures like wisdom tooth extraction and dental implants, along with a revised contribution formula starting in 2026, enabling hospitals to raise treatment fees; (iv) rising demand fueled by growing health and wellness trends; and (v) expansion of hospital branches, services, and capabilities to address complex and specialized treatments. However, slow economic growth and high household debt in Thailand may limit consumer spending, while some international patient segments could be impacted by the global economic slowdown. Consequently, private hospital revenue is projected to grow at an average rate of 5.0–7.0% annually during this period.

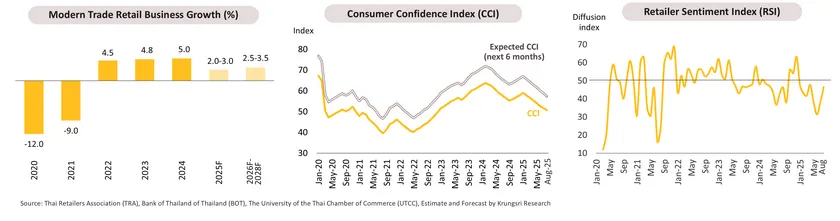

Modern trade: Sales pressured by slow Thai economy and sluggish tourism recovery.

-

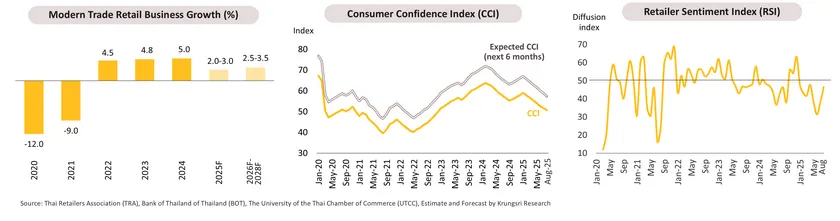

In 9M25, retail sales were pressured by weak domestic purchasing power, which has only gradually recovered, leading consumers to spend cautiously. The Consumer Confidence Index (CCI) in August fell to its lowest level in 31 months. Meanwhile, the tourism sector’s recovery slowed, with foreign tourist arrivals dropping -7.6% YoY, particularly Chinese tourists (-35.0% YoY) who typically contribute higher spending. These factors have led retail operators to remain concerned about the fragile economy, as reflected by the Retailer Sentiment Index (RSI) staying below 50 since January. The fragility is intensified by growing competition from online retail, which offers a wide range of prices and increases consumer options. Toward year-end, government stimulus measures such as the “Thai Travel Co-payment scheme” (Jul–Oct), “Half-half Plus Co-payment program” (Oct 29–Dec 31), and “Tourism Tax Incentives” (Oct 29–Dec 15) are expected to boost retail spending. As a result, modern trade revenue is projected to grow by 2.0–3.0% in 2025.

-

In 2026, retail sales are expected to remain flat or slow slightly from 2025 due to a weaker Thai economy and increased global uncertainty from trade tensions, dampening both domestic consumption and foreign tourist spending. During 2027–2028, the sector will gradually recover, growing by 3.0–3.5% per year, supported by the tourism rebound, with foreign arrivals reaching 39 million by 2028, boosting demand for consumer goods. In addition, the expansion of mass transit networks and residential projects will support urban growth, creating new opportunities for modern trade, particularly through convenience store expansions. Retailers are expected to grow sales by integrating online and offline channels and expanding into neighboring countries to diversify revenue. However, competition will likely intensify, especially from online retail players.

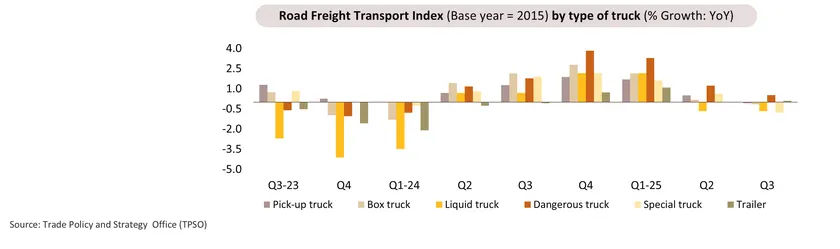

Road freight services: Freight demand growth is slowing but supported by ongoing tourism and e-commerce expansion.

-

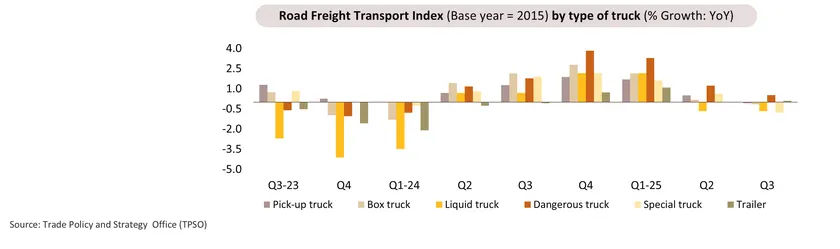

In 9M25, the business benefited from international trade growth (+12.3% YoY in 8M), driven by front-loading in 1H ahead of the US tariff implementation in August, increased agricultural output (production index +5.4% YoY in 8M), and continued e-commerce expansion. However, growth was constrained by weakening domestic purchasing power (private consumption +2.3% YoY in 1H), slower tourism recovery (foreign arrivals -7.6% YoY), and border trade contraction (-3.6% YoY in 8M). The road freight transport index rose 1.1% YoY, led by dangerous goods trucks (+2.8% YoY) and box trucks (+2.1% YoY). For the rest of the year, freight demand is expected to slow further amid Thailand’s decelerating recovery, particularly in exports. Year-end demand and government stimulus (e.g., “Half-half Plus Co-payment program") are expected to support inventory clearance and petroleum transportation, projecting 2025 road freight volume growth at 1.0–1.5%, down from 2.0% in 2024.

-

For 2026-2028, freight demand is expected to grow gradually amid Thailand’s modest economic recovery (projected average expansion of 1.8–2.3% per year), which may limit consumer goods demand, while US tariffs could negatively affect the competitiveness of exporters. However, the business will benefit from continued tourism growth, accelerated implementation of government construction projects (e.g., Dual-Track Railway Phase 2 worth THB 290 billion and expressway projects worth THB 52 billion), increased foreign direct investment (reflected by BOI applications +138% in 6M25), and sustained e-commerce expansion (e-Conomy SEA 2024 projects 15% annual growth for 2025–2030), supporting higher demand for transporting raw materials, consumer goods, industrial products, construction materials, and machinery/equipment. Consequently, freight volume is projected to grow 1.5–2.5% annually. Amid intensifying competition, particularly from medium and small operators, businesses may resort to price-cutting to maintain market share, putting downward pressure on overall freight rates.

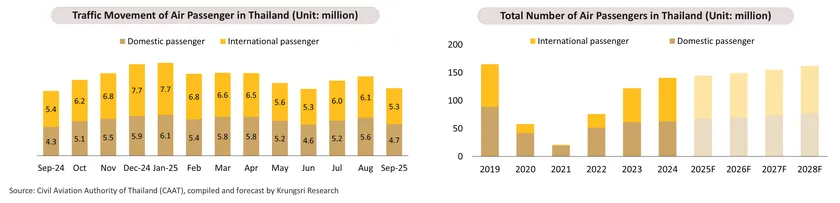

Air Passenger Services: Business benefits from continued tourism growth while faces competitive challenges.

-

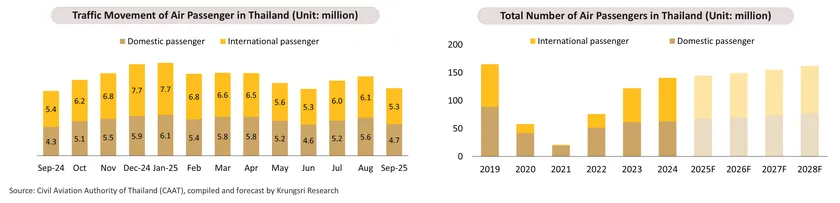

In 9M25, the business continued to grow as air passenger volume increased 3.6% YoY to 104.3 million (domestic +6.6% YoY, international +1.1% YoY). Growth was driven by new flight routes (Songkhla-Betong, Don Mueang-Nakhon Phanom, UAE-Bangkok-Danang), expanded airline networks, seasonal flight increases to key tourist provinces (Phuket, Samui, Chiang Mai), and government tourism stimulus measures, including the “Thai-Travel Co-payment Scheme” (July-October), which boosted domestic trips to 149 million (+3.1% YoY). For Q4, continued growth is anticipated from year-end holiday demand, new routes (Thailand-Almaty, Thailand-Riyadh, Japan, China), "Buy International, Free Thailand Domestic Flights" program (August-December), and lower fuel costs. Total passengers in 2025 are expected to rise 3.0% to 144.8 million, comprising +6.8% domestic (67.2 million) and -0.1% international (77.6 million, exceeding 76.0 million in 2019).

-

For 2026-2028, revenue growth is expected to track tourism recovery, with foreign arrivals projected to reach 39 million by 2028. Growth will be supported by global tourism recovery (APAC air travel +5.1% annually vs. global +3.7%, per IATA, ACI, and UNWTO), airline route expansion reducing reliance on the Chinese market (e.g., Las Vegas–Hong Kong–Bangkok, Bangkok–Central Asia–Europe, Bangkok–Middle East–Europe), targeted tourism stimulus (medical and sports tourism), and Suvarnabhumi Airport upgrades expected by 2028. Air passenger volume is projected to grow 3.0–4.5% annually (domestic 4.0–5.5%, international 2.0–3.5%). However, challenges remain from an uncertain global economy and intensifying trade tensions weakening purchasing power, geopolitical conflicts affecting flight routes and fuel costs, and competitive tourism policies from rival countries (e.g., South Korea's visa-free entry for Chinese groups) diverting visitors from Thailand.

Chilled, Frozen and Processed Chicken: Domestic demand is expected to improve with tourism and restaurant recovery, while exports still grow from market diversification.

-

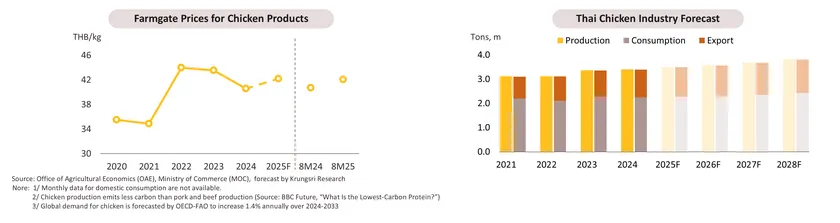

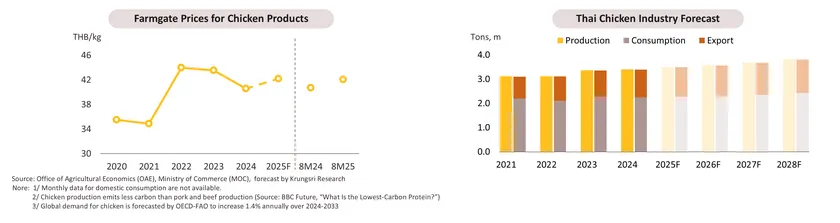

In 8M25, output rose 1.0% YoY, supported by continued export growth and higher average farmgate prices during 2022–2024, which encouraged farmers and large producers to expand production. Domestic consumption also increased1/, driven by: (i) a shift from pork to chicken, as pork prices rose faster than chicken prices (+15.1% YoY vs. +3.0% YoY), reflecting higher swine feed costs and hotter weather that slowed pig growth; and (ii) stronger demand from health-conscious consumers favoring chicken as a high-protein, low-fat, and affordable food amid elevated living costs. However, domestic growth remained modest due to weaker purchasing power and softer demand from restaurants following a decline in foreign tourist arrivals. Meanwhile, export volume rose 6.1% YoY as chicken remained an affordable protein source amid rising global living costs, while shipments also benefited from expanding markets in the Middle East. These factors are expected to sustain growth momentum through 2025, with output increasing by 0.8–1.8%, domestic sales by 0.5–1.5%, and exports by 6.0–7.0%.

-

During 2026–2028, chicken production is expected to grow 1.7–2.7% annually, supported by favorable prices and steady demand in both domestic and export markets. Domestic consumption is forecast to rise by 1.7–2.7% per year but remain subdued through 2026 amid economic uncertainty. Growth momentum is expected to improve thereafter, driven by the recovery in tourism and restaurant sectors, chicken’s cost competitiveness, rising health awareness, alignment with religious and sustainability preferences2/, and the increasing variety of ready-to-eat products catering to fast-paced lifestyles. Export volume is projected to expand by 3.7–4.7%, outpacing global chicken demand growth of 1.4%3/, reflecting Thailand’s strong comparative advantage. Growth will be supported by (i) rising sales of chilled and frozen products in halal and regional markets, (ii) growing demand for affordable protein, and (iii) Thailand’s solid reputation for food safety. While U.S. tariffs and border tensions with Cambodia pose some risk, their direct impact is expected to be limited as these are not key export markets.

Ready-to-eat (RTE) food: Domestic sales and exports are expected to slow in 2026, before picking up in 2027–2028, supported by market expansion in Asia and the EU.

-

Domestic sales in 2025 are expected to grow at a slow pace of 1.5–2.5%, weighed down by weaker purchasing power from the domestic economic slowdown, U.S. tariff pressures, declining tourist arrivals, and political uncertainties. Nonetheless, strong demand for affordable, convenient foods catering to fast-paced lifestyles is expected to support growth. Export volume declined by -6.0% YoY in 8M25 due to slowing economic conditions in key markets, which affected consumer confidence and spending. 2025 exports are expected to contract by -8.0% to -9.0% in volume, primarily due to: (i) U.S. tariff measures, which have raised Thailand’s import costs and weakened purchasing power in its largest export market; and (ii) tensions along the Thailand-Cambodia border, leading to disrupted cross-border trade and anti-Thai sentiment in Cambodia, which directly impacts instant noodle exports, for which Cambodia is a key market.

-

Over 2026-2028, domestic consumption is forecast to rise by 2.3–3.3% per year, supported by rising demand for convenience foods, expanded retail access, product innovation, and improved consumer targeting through data analytics, though growth will be constrained by a slowing economy, political uncertainty, high household debt, and intensifying competition, with momentum modest in 2026 and gradually improving in 2027–2028. Export volume is projected to rise by 2.9-3.9% annually, with a modest growth in 2026 due to sluggish global economic recovery, U.S. tariff barriers, and weaker demand from Cambodia amid border tensions. Growth is expected to improve in 2027–2028, driven by (i) rising demand for affordable and convenient products, (ii) Thailand as the “Kitchen of the World” with diverse agricultural resources, and (iii) market expansion in Asia under FTAs and RCEP (notably ASEAN, Japan, and China), as well as Western Europe, where younger urban consumers increasingly favor healthy and distinctive Thai favor healthy and distinctive Thai flavors. In the U.S., exporters are expected to focus on the premium segment.

Sugar and molasses: Output and exports will rise in 2026 but decline in 2027–2028 due to climate impacts, while domestic demand would be supported by economic recovery.

-

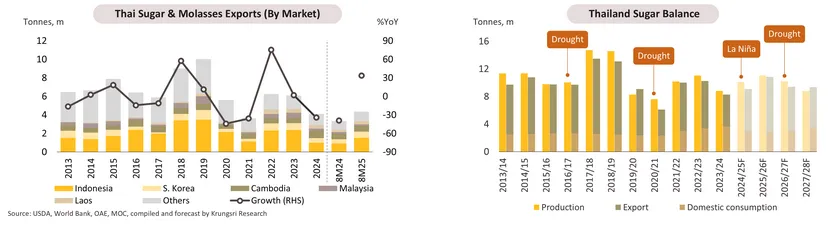

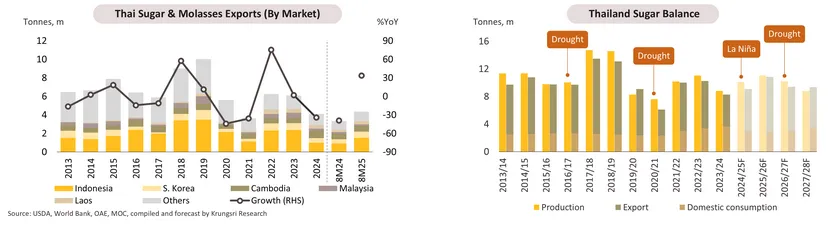

In 2025, sugarcane crushing volume is expected to reach 92.0 million tonnes (+12.0%), producing approximately 10.1 million tonnes of sugar (+14.4%). This growth is supported by: (i) improved weather and rainfall in the second half of 2024; and (ii) rising sugar prices in previous periods, which encouraged farmers to return to cultivation and invest more in crop care. Domestic sugar consumption in 1H25 stood at 1.2 million tonnes (-8.8% YoY), with declines in both direct household consumption (-7.5% YoY) and industrial use (-10.6% YoY), amid slower economic activity and declining tourist arrivals, which have dampened demand in the restaurant and beverage sectors. Meanwhile, sugar and molasses exports in 8M25 rose significantly to 4.7 million tonnes (+33.8% YoY), driven by strong orders from Indonesia (+66.0% YoY), South Korea (+52.0% YoY), and the Philippines (+82.5% YoY). This partly reflects Thailand’s ample export supply, prompting producers to focus on markets with restocking demand amid tightening domestic inventories. In 2025, domestic consumption is expected to contract by -5.6% to -7.6%, while exports are expected to increase by 29.7–31.7%.

-

In 2026, sugar output is expected to grow by 9.0–11.0%, driven by favorable weather, adequate rainfall, and sufficient reservoir water levels for cultivation. This expansion is expected to boost export growth to a range of 29.9–31.9%. During 2027–2028, output is expected to contract by an average of -10.1% to -12.1% per year due to three main factors: (i) the impact of El Niño conditions, (ii) the diversion of some farmers to drought-tolerant alternative crops such as cassava, and (iii) persistently high cultivation costs. Consequently, the declining raw material supply is expected to reduce sugar and molasses exports by approximately -13.2% to -15.2% per year, despite rising demand from export markets amid the economic recovery. Domestic consumption is forecast to expand by an average of 4.0–6.0% per year during 2026–2028, supported by the recovery of economic activities and tourism, which will sustain demand from downstream industries, especially food and beverages.

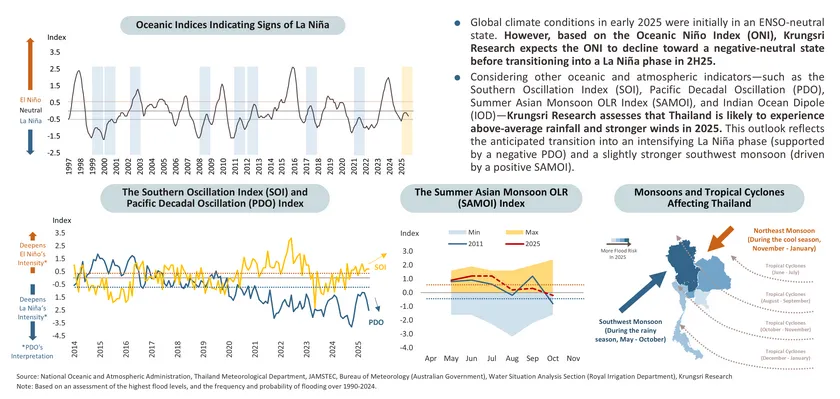

Global climate conditions were ENSO-Neutral in early 2025. Krungsri Research projects a shift toward a negative-neutral state and a transition to La Niña in 2H25.

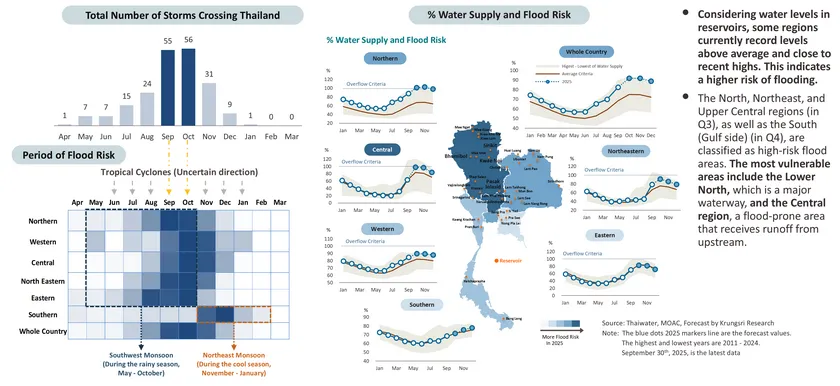

Water levels in reservoirs in some regions are above average and nearing recent highs, signaling elevated flood risks in the North, Northeast, and Upper Central regions, and the South (Gulf side).

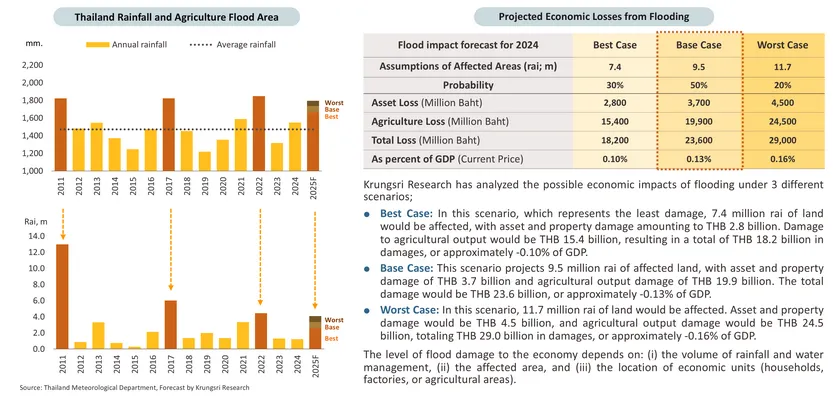

In the worst-case scenario, the maximum impact of the 2025 floods is projected to be approximately -0.16% of GDP, far below the THB 1.44 trillion loss from the 2011 great flood.

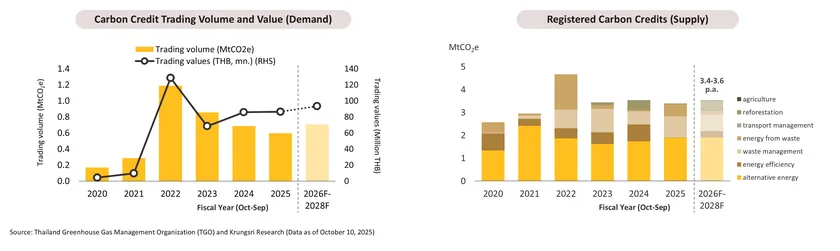

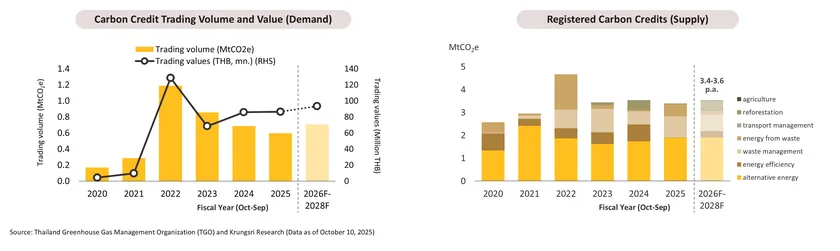

Carbon credits: Thailand’s new 2050 Net-Zero target is expected to drive stronger demand from corporate buyers.

-

In FY2025 (Oct 2024–Sep 2025), the registered supply of carbon credits under the TGO declined by -3.9% to 3.4 million tonnes of CO2 equivalent (MtCO2e). Approximately 56% originated from renewable energy projects, followed by waste management (27%), and waste-to-energy (16%) projects. On the demand side, the trading volume fell by -13.2% to 0.6 MtCO₂e as corporate buyers adopted a wait-and-see approach amid regulatory uncertainty, particularly regarding the draft Climate Change Act, and implemented cost-cutting measures during a fragile economic period. However, trading value rose slightly to THB 86.6 million (+0.9%), with an average price of THB 145.4 per tCO2e (+16.2%). This was driven by higher sales of nature-based credits, notably from forestry projects (THB 694/tCO2e, +36.3%) and P-REDD+ initiatives (Reducing Emissions from Deforestation and Forest Degradation) (THB 1,112/tCO2e).

-

In FY2026–FY2028, the supply of carbon credits is expected to range between 3.4-3.6 MtCO₂e per year, while demand is projected to increase modestly to 0.6-0.8 MtCO₂e (+8.0% p.a.). Growth will be supported by (i) continued corporate sustainability commitments—particularly from major buyers such as Kasikorn Bank, Bangkok Bank, Siam Piwat, Lion Corporation, and Precious Shipping—and (ii) Thailand’s tentatively revised net-zero target for 2050 (moved forward from 2065), which will stimulate demand for carbon credits, as the private sector accelerates progress toward emission goals, especially in high-emission industries. However, slow progress on mandatory regulations, including the Climate Change Act, remains a key risk that could constrain market growth.

.webp.aspx)