Industry Horizon (July 2025)

23 July 2025

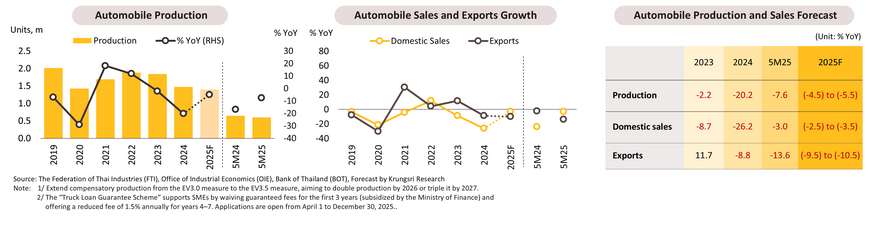

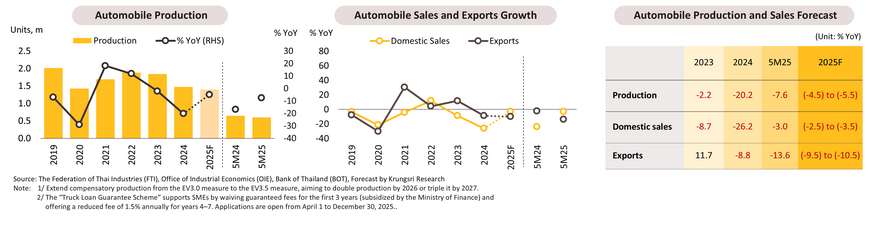

Automobile: Production is expected to decline throughout 2025, weighed down by weakening demand in both domestic and export markets amid a sluggish economy.

-

In 5M25, production declined -7.6% YoY to 595,935 units, with passenger cars down -5.9% YoY and pickup trucks down -10.2% YoY. Amid weak domestic and export demand, some producers shifted toward auto parts with stronger REM market demand. In contrast, passenger XEV output rose sharply, with BEVs up 393.1% YoY, PHEVs up 271.3% YoY, and HEVs up 6.8% YoY, despite the extension of the grace period under the BEV scheme1/. Domestic sales fell -3.0% YoY to 252,625 units, reflecting subdued purchasing power amid economic uncertainty and high household debt, particularly in the agricultural sector. However, growth resumed in April (+1.0% YoY) and May (+4.7% YoY), marking the first rebound in 19 months, supported by eased auto loan approval criteria following slower growth in NPLs and special mention loans. Exports declined -13.6% YoY to 371,359 units, weighed down by weak demand in key markets, intensifying competition from low-cost Chinese EVs, and stricter environmental regulations affecting certain ICE models.

-

In 2025, production is projected to decline by -4.5 to -5.5%, driven by weakening demand in both domestic and export markets, as well as the postponement of local production to offset EV imports under the EV 3.0 scheme. The latter is expected to become more apparent in the remainder of the year due to a sluggish economy, softening purchasing power, and persistent pressure from Chinese import flooding. Domestic sales are expected to fall by -2.5 to -3.5%, mainly due to: (i) indirect impacts from US tariff measures, which are likely to further dampen economic activity and consumer confidence, particularly in 2H25; (ii) delays in fiscal stimulus disbursement, which may impact certain infrastructure projects and dampen private sector investment; and (iii) a slow recovery in purchasing power among farmers and SMEs, continuing to weigh on pickup truck sales despite support from the “Truck Loan Guarantee Scheme.2/” Exports are forecast to decline by -9.5 to -10.5%, pressured by US tariff policies that will erode market confidence and reduce demand from key trading partners, exacerbated by the risk of losing market share to China as it seeks to offload excess vehicle supply.

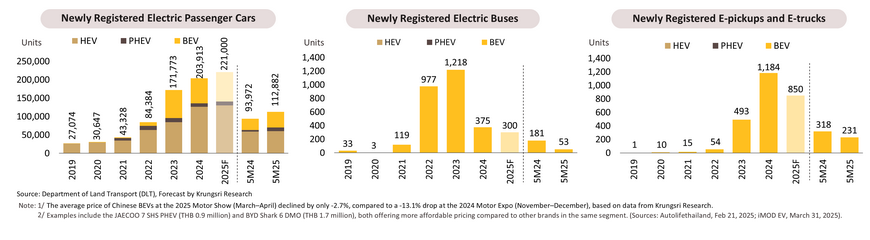

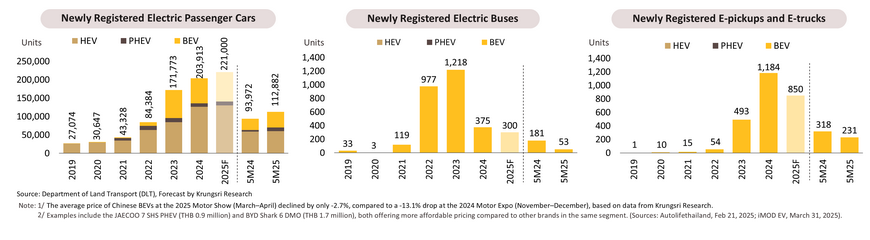

Electric vehicles: Registrations will continue to rise, driven by government measures and new models with more stable prices, despite insufficient charging station availability.

-

In 5M25, new registrations of passenger BEVs rose 39.1% YoY to 42,916 units, supported by (i) pent-up demand following the easing of the price war earlier this year, as reflected in the stabilization of average Chinese EV prices during the 2025 Motor Show1/; and (ii) the launch of new models featuring advanced technologies and extended driving ranges, which boosted consumer interest. New passenger PHEV registrations increased 141.9% YoY to 9,799 units, while HEVs grew 1.9% YoY to 60,167 units, driven by (i) powertrain options well-suited to consumers interested in EVs but not yet ready to fully transition to BEVs; and (ii) the growing availability of more affordable Chinese models2/. In contrast, new electric commercial vehicle registrations fell -27.4% YoY to 231 units, while electric bus registrations plummeted -70.7% YoY to 53 units, following strong growth in recent years. The decline was attributed to (i) insufficient charging infrastructure in rural areas; (ii) limited driving range unsuitable for long-haul commercial operations; and (iii) economic headwinds that led some businesses to delay electric bus purchases.

-

In 2025, new passenger BEV registrations are expected to average 80,000 units, passenger HEVs 130,000 units, and passenger PHEVs 11,000 units, driven by (i) easing of the price war in Thailand, leading to more stable prices; (ii) ongoing EV 3.5 incentives; (iii) the launch of new, more efficient XEV models, particularly from Japanese and Chinese manufacturers; and (iv) the implementation of Euro 6 standards, which will increase prices of ICE vehicles. Meanwhile, registrations of electric buses and electric pickups/trucks are projected to decline to approximately 300 and 850 units, respectively, due to (i) weakened purchasing power and economic slowdown throughout the remainder of the year; (ii) limited driving range unsuitable for interprovincial travel; and (iii) insufficient expansion of charging infrastructure, especially in provincial areas, which continues to constrain demand for commercial use.

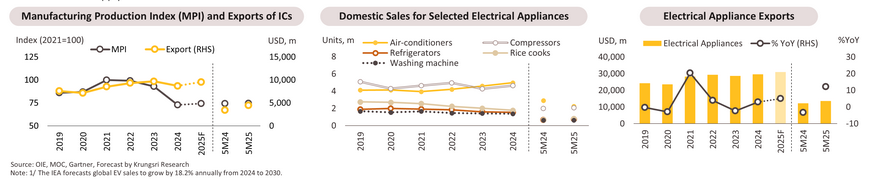

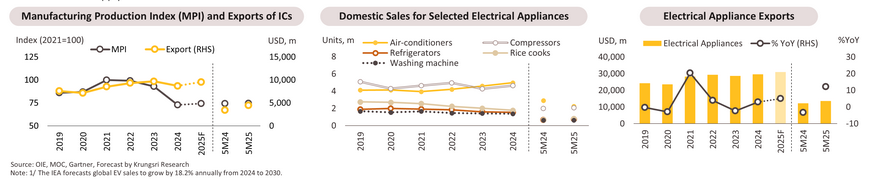

ICs and electrical appliances: Exports are expected to rise, supported by the global replacement cycle, though constrained by the impact of US tariffs, particularly in 2H25.

Situation in 5M25

-

ICs: Production increased by 0.4% YoY, aligning with a 30.9% YoY rise in export value, driven by the upcycle in the global IC industry. Growth was supported by a new replacement cycle for household appliances, smartphones, personal computers, and electronic devices, as well as continued expansion of EV production. The greater increase in export value relative to production volume reflects higher value-added IC exports, consistent with recent investment promotion efforts increasingly targeting smart electronics.

-

Electrical appliances: Domestic sales declined by -5.0% YoY, primarily due to a -22.6% YoY drop in air conditioner sales, following a high base last year amid unusually hot weather in Thailand. However, sales of other household appliances rebounded, with rice cookers (+19.0% YoY), refrigerators (+11.6% YoY), compressors (+4.9% YoY), and washing machines (+1.2% YoY) recording their first growth after continuous declines from 2021 to 2024. This rebound reflects intensified promotional strategies aimed at capturing pent-up demand. Meanwhile, exports of electrical appliances rose 12.1% YoY, driven by a new replacement cycle following the COVID-19 crisis.

Outlook for 2025

-

ICs: Production and exports are projected to increase by 1.5-2.5% and 9.5-10.5%, respectively, driven mainly by (i) the global upcycle in PCs and smartphones (Gartner, 2024), which continues to support demand for electronic products, alongside growing global EV demand1/; and (ii) a global investment trend toward next-generation smart technologies—particularly data centers, PCBs, smart devices, and rapidly expanding EVs—all of which rely on ICs as a key upstream component in the production supply chain. However, overall expansion remains modest, partly due to the US tariff hike, which may directly affect Thailand’s IC exports to the US (5.8% of total IC export value) and indirectly dampen global demand for electronic devices and appliances amid rising economic uncertainty.

-

Electrical appliances: Domestic sales are projected to decline by -2.5 to -3.5%, due to a drop in air conditioner sales from last year’s high base, compounded by weakening purchasing power amid an economic slowdown, particularly in 2H25. Exports are expected to grow by 4.5-5.5%, driven by the global replacement cycle. However, growth may be constrained—particularly in 2H25—due to high exposure to the US market (25% share), which faces tariff hikes and rising competition from Chinese oversupply.

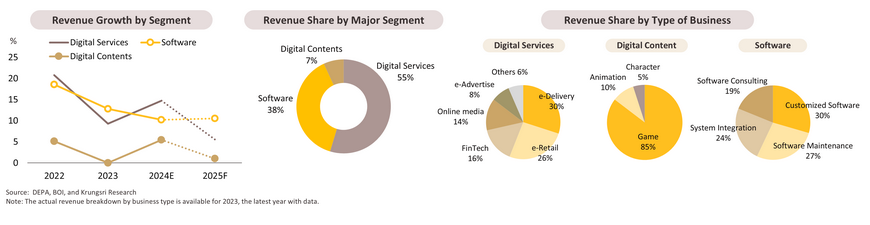

Digital services and software: Digital services and content growth will slow from economic pressures, while software remains robust, driven by AI transformation.

-

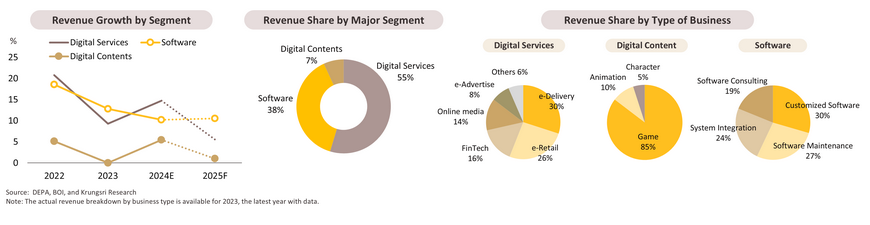

In 1H25, overall revenue continued to grow, driven mainly by the digital services and software segments. Digital services were supported by (i) the expansion of e-commerce, delivery platforms, and digital payments; and (ii) increased private investment in data centers, cloud infrastructure, and AI, enabled by the accelerated nationwide 5G rollout. These developments have rapidly extended digital platforms to regional businesses, particularly in major smart cities. Notably, BOI-approved digital projects (including data centers) reached THB 222.7 billion in 1Q25, up from THB 21.3 billion in 1Q24. The software segment also gained momentum from enterprise restructuring focused on big data and AI-powered customized solutions, along with rising adoption by public organizations under the Cloud First Policy (Aug 2024), which promotes secure cloud adoption to enhance service delivery and reduce IT infrastructure costs. However, economic uncertainty stemming from US trade policy and a tourism slowdown has led to more cautious spending and investment, resulting in a moderating growth pace.

-

In the second half of the year, the sector is expected to maintain its growth momentum, supported by the expansion of digital platforms that leverage big data and AI to meet mass-customized demand. However, growth is projected to decelerate—particularly in digital services and content segments such as games, animation, and character-based businesses—due to continued demand-side headwinds from the economic slowdown and weaker tourism. Meanwhile, the software segment is expected to remain resilient—particularly in system integration, storage software, and SaaS—driven by growing adoption of AI transformation, public cloud solutions, and cybersecurity systems. Throughout 2025, total revenue is forecast to grow by 7.0% (down from 12.3% in 2024), led by the software segment (10.5%, slightly up from 10.2%), digital services (5.5%, down from 10.2%), and digital content (1.0%, down from 5.4%).

Refinery: Revenue is under pressure due to declining domestic demand for refined products.

-

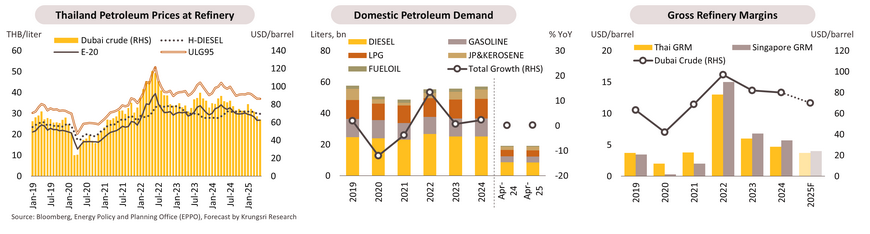

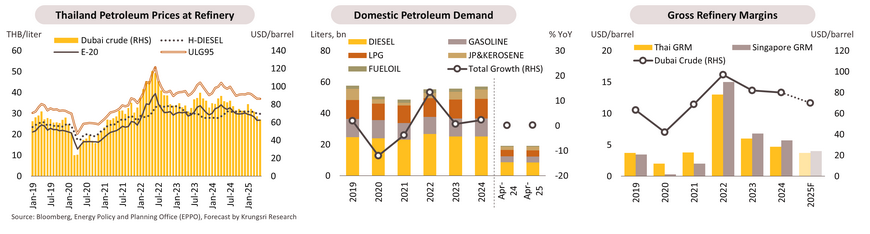

In 5M25, Gross refinery margins (GRMs) have shown a continued downward trend, in line with the weakening global economic conditions due to escalating tensions in global trade, particularly after the US raised tariffs on imports from trading partners. This led to a slowdown in global manufacturing, reflecting in the April Global Composite PMI Output Index for falling to a 17-month low of 50.8. Consequently, global oil demand declined. At the same time, crude oil supply increased due to the OPEC+ raising production capacity starting in April. This resulted in a rise in crude oil inventories, putting pressure on Dubai crude price in 5M25 to fall by -15.3% YoY, averaging USD 71.4/bbl. Refined oil prices declined at a sharper rate than crude oil prices due to an influx of supply from expanded capacity in China and the Middle East, causing ex-refinery prices of refined oil products in Thailand, particularly diesel and E-20 to decrease by -18.7% YoY and -24.9% YoY, respectively. Meanwhile, domestic demand for refined oil products in 5M25 remained relatively flat at 0.2% YoY, supported by increased consumption of jet fuel and fuel oil. This increase stemmed from the manufacturing sector benefiting from an acceleration in export activities. However, benzene and diesel consumption declined due to weaker private spending (private consumption index in April dropped by -4.0% YoY for the first time in 16 months) and a sluggish tourism sector (foreign tourist arrivals in 5M25 dropped by -2.7% YoY). These factors put pressure on refinery business performance compared to the previous quarter.

-

For the remainder of 2025, refineries are expected to continue facing headwinds, including (i) a continued global economic slowdown, which will reduce global oil demand. This, combined with OPEC+ gradually ramping up production after ending its output cuts, is expected to result in the average price of Dubai crude oil falling to around USD 70/bbl for the year, down -14.3% from 2024; and (ii) Slower growth in the Thai economy, amid subdued purchasing power and a lower number of foreign tourists compared to 2024. This is likely to reduce demand for refined oil in the manufacturing, transportation, and tourism sectors. Nonetheless, government measures to stimulate tourism in the second half of the year are expected to help sustain oil demand and prevent a steep decline. As such, Thailand’s GRM is forecast to fall to USD 3.0-4.0/bbl, down from USD 4.7/bbl in 2024.

Biodiesel: Demand set to decline amid Thai economic slowdown.

-

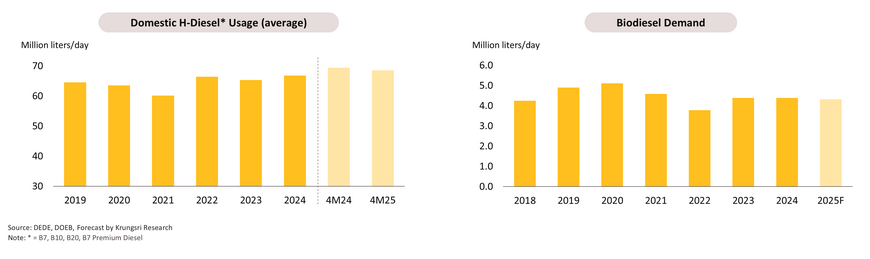

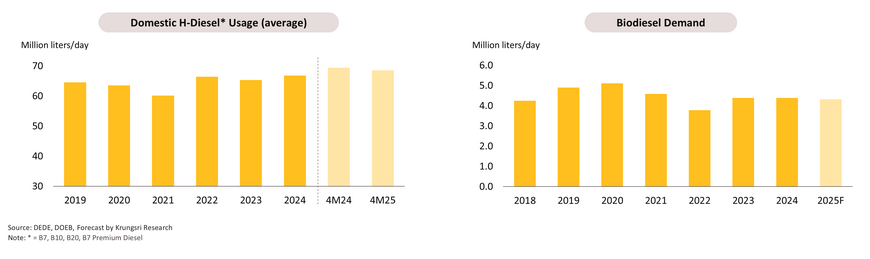

In 4M25, biodiesel demand declined by -24.4% YoY, primarily due to (i) slowed domestic production and consumption, reflected by a -0.7% YoY contraction in the Manufacturing Production Index, a decrease in international tourist arrivals to Thailand, and weakened domestic purchasing power caused by high household debt; and (ii) the government maintaining the biodiesel blending ratio in high-speed diesel at 5% (B5) starting in November 2024, down from the previous 7%, following a rise in crude palm oil prices. This increase was driven by reduced palm yields due to earlier drought conditions and stronger demand for palm oil as a substitute for the now more expensive soybean oil. The overall decline in biodiesel demand led to a -25.1% YoY drop in biodiesel (B100) production.

-

In the second half of 2025, biodiesel demand is expected to be supported by two main factors: (i) the government may increase the biodiesel blending ratio in high-speed diesel to 7% (B7) to address persistently low palm oil prices caused by a high level of supply; and (ii) government tourism stimulus measures—such as the “Thai travel co-payment scheme” campaign—are likely to boost consumer spending and travel activity. However, demand for high-speed diesel will continue to face downward pressure from the overall economic slowdown in both the production and consumption sectors. In addition, automobile sales are projected to decline further in 2025 (estimated contraction of -2.5% to -3.5%), which will also weigh on diesel consumption. As a result, overall biodiesel demand for the full year of 2025 is forecast to contract by an average of approximately -1.0% to -2.0% compared to 2024.

Power Generation: Electricity demand in the system is set to decline across both business and household segments.

-

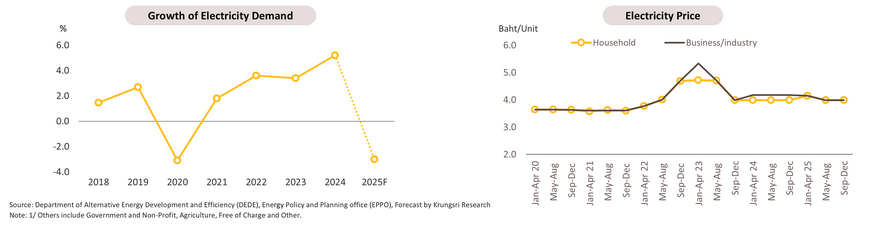

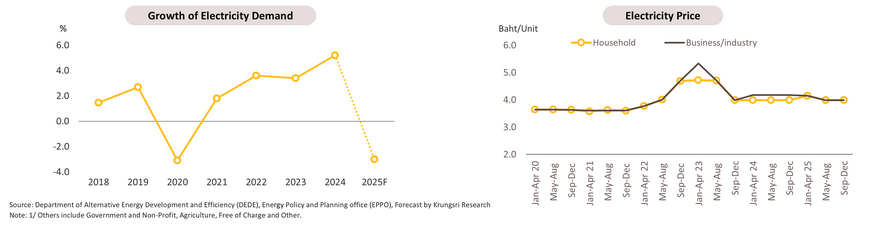

Over 4M25, electricity demand declined in line with subdued economic activity. Some consumer groups also shifted to self-generation, particularly via rooftop solar installations, to reduce electricity costs. Total electricity consumption contracted by -5.9% YoY, comprising industrial sector (41.2% of electricity consumption) -3.7% YoY, household sector (27.6%) -10.2% YoY, business sector (25.3%) -6.5% YoY, and others1/ (5.9%) +4.7% YoY. The government has accelerated measures to alleviate energy costs, reducing the electricity tariff for May–August to THB 3.99/unit (from THB 4.15/unit). Peak demand stood at 34,568.3 MW in April, down -5.2% from the April 2024 peak.

-

For the rest of 2025, electricity demand is expected to continue declining due to the slowing Thai economy, particularly in the export-oriented manufacturing sector. At the same time, domestic purchasing power is being pressured by high household debt, leading consumers to be more cautious with their spending. Additionally, the government is promoting rooftop solar adoption through subsidies, tax deductions, and soft loans from state-owned banks. As a result, more households and businesses are turning to rooftop solar to cut long-term energy costs. For all of 2025, average demand is forecast to contract by -2.5% to -3.5%, compared to 5.2% growth in 2024.

-

As part of policy and regulatory developments, the government has launched a pilot program for Direct Power Purchase Agreements (Direct PPA), aiming to procure 2,000 MW of renewable electricity by 2025. This will utilize the Third Party Access (TPA) model for grid connection. Regulatory frameworks for transmission fees and related charges are under development, with commercial transactions expected to begin in 2025. In addition, the Utility Green Tariff (UGT) and Renewable Energy Certificates (REC) are being developed to enhance clean energy accessibility for businesses.

Housing (BMR): Government stimulus measures are expected to support purchasing decisions among potential buyers, helping to prevent a sharp downturn in the market.

-

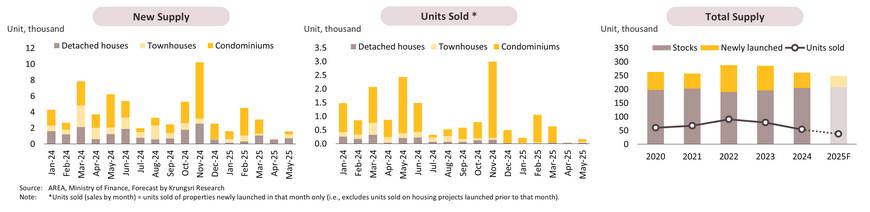

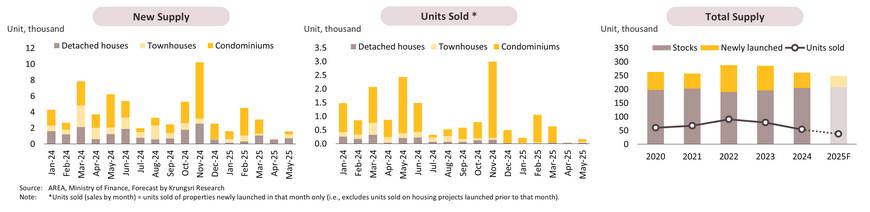

In 5M25, the residential market remained under pressure due to persistently weak purchasing power, particularly among middle- to lower-income households heavily burdened by household debt. This is reflected in a sharp -72.4% YoY drop in sales of newly launched units, totaling only 2,126 units. In response, developers became more cautious in launching new projects, resulting in a significant -53.9% YoY decline in new supply to 11,411 units. All housing segments saw a contraction: townhouse launches fell the most at -67.4% YoY, followed by detached houses at -58.3% YoY. Meanwhile, the condominium segment continued to face negative sentiment after the March earthquake, with new launches declining -44.2% YoY. Amid fragile market conditions and increasing economic uncertainty, the government introduced stimulus measures to support the sector. These include the relaxation of loan-to-value (LTV) limits—allowing 100% mortgage financing for second homes priced below THB 10 million and for first homes priced above THB 10 million (effective 1 May 2025 to 30 June 2026)—as well as a reduction in property transfer and mortgage registration fees to 0.01% for properties valued up to THB 7 million (effective 22 April 2025 to 30 June 2026).

-

The Thai economy is expected to continue slowing throughout the remainder of the year, weighed down by escalating global trade tensions and sustained high household debt. These factors are likely to weaken the creditworthiness of potential homebuyers, leading many to postpone their purchasing decisions while monitoring market developments. Nevertheless, government stimulus measures are anticipated to partially offset the slowdown by encouraging real demand from end-users with stronger financial standing. Meanwhile, foreign demand is projected to decelerate in line with global economic headwinds, particularly from investment-driven buyers. Overall, residential sales for the full year 2025 are expected to decline by -30.5%, while the number of new project launches is forecast to fall by -25.3%.

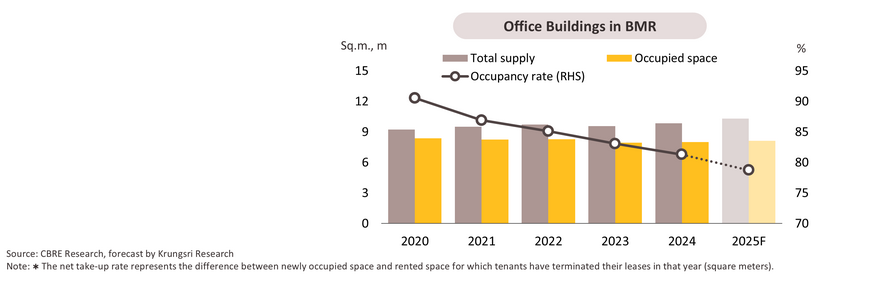

Office Building (BMR): Occupancy rate is expected to continue declining in 2025, pressured by an influx of new office supply outpacing demand.

-

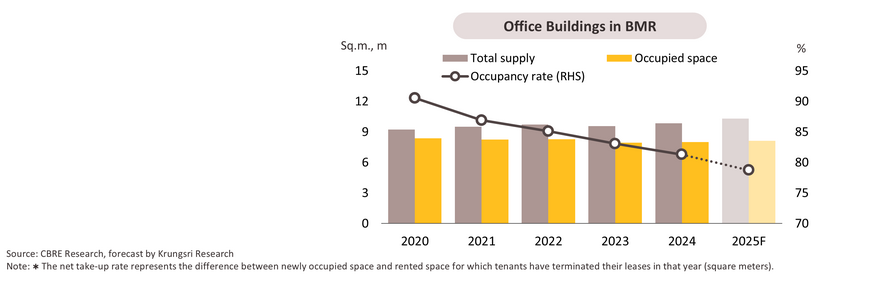

In 1Q25, new office space supply totaled 170,000 square meters (+75.3% YoY), primarily driven by four key projects—V.One Tower, Ramkhamhaeng Hills, BTS Visionary Park (Tower A & B), and Summit Tower. This brought the total accumulated supply to 10.0 million square meters, an increase of 4.1% YoY. Of this, 73% is classified as Grade B office space, 19% as Grade A, and 8% as Grade A+. Net take-up* surged 415.9% YoY or 43,469 square meters, lifting total occupied space to 8.0 million square meters, an increase of 1.7% YoY from Q1 2024. However, the influx of new supply led to a decline in the overall occupancy rate to 80.3%, down from 82.2% in the same period last year.

-

For the rest of the year, new office supply is expected to continue entering the market in line with developers’ planned project completions. Approximately 90% of this new supply will consist of Grade A and A+ offices, including notable developments such as One Bangkok Tower 5, and Central Park Offices. Total new supply for 2025 is projected to reach 450,000 square meters, representing a 4.6% increase from 2024. Meanwhile, office demand is expected to grow by only 1.3% or approximately 100,000 square meters, mainly driven by Thai companies looking to expand office space to enhance corporate image, supported by average rental rates remaining below pre-COVID-19 levels. Additional demand is anticipated from multinational corporations expanding operations in Thailand. These tenants tend to favor newly developed Grade A+ office buildings in CBD locations, especially those offering green office concepts that meet ESG standards, aligning with global sustainable business practices. However, with new supply outpacing demand growth, the average occupancy rate is projected to decline further to 78.7%, down from 81.3% in 2024. reflecting oversupply conditions in certain locations, especially where new projects have recently launched. Consequently, landlords are expected to adopt more competitive pricing strategies and offer attractive lease terms to retain existing tenants and attract new ones. This will likely lead to a downward trend in average rental rates, particularly among older buildings. As a result, office landlords may face increased pressure on revenues and profitability in the short to medium term, especially for aging properties, lower-grade offices, and those located in highly competitive areas.

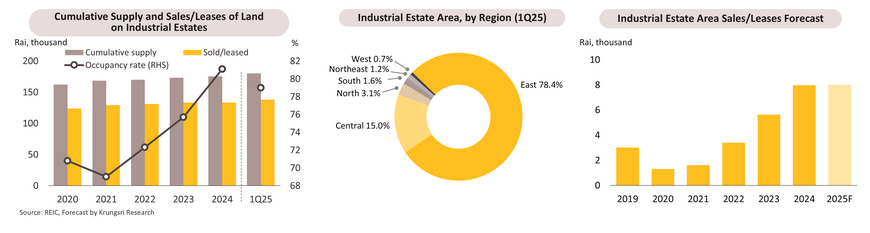

Industrial estate: Sales and leases will remain flat, weighed down by a high base in 2024 and the impact of US tariffs, despite ongoing relocation from China.

-

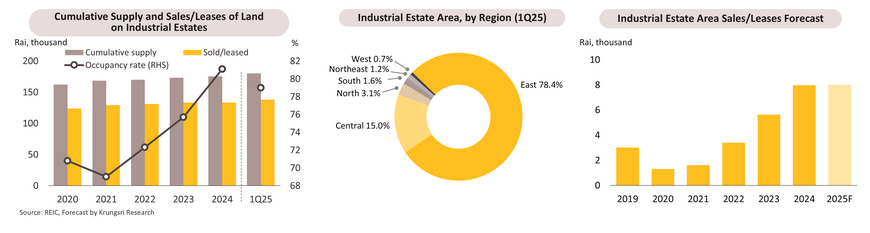

On the demand side, industrial land sales and leases nationwide declined by -28.3% YoY to 1,643 rai in 1Q25, partly due to a high base in 1Q24 (2,292 rai, +148.6% YoY). The Eastern region continued to account for the largest share, with 1,579 rai sold or leased (-23.6% YoY), representing 96% of the total. This trend aligns with strong growth in the values of FDI applications to and approvals by the BOI, which rose by 62.4% and 85.8% YoY, respectively—primarily in the electronics, digital, machinery, and automotive sectors. On the supply side, three new industrial estates were launched in Chonburi, Rayong, and Lamphun, adding 4,641 rai and bringing the total to 74 estates across 17 provinces. The cumulative industrial land area reached 180,039 rai (+2.6% from end-2024), with 137,912 rai available for sale or lease, resulting in an occupancy rate of 79.0%.

-

Over the rest of the year, new industrial land sales and leases are expected to slow down, compared to a high base in the previous year and ongoing constraints from: (i) global economic volatility—particularly the impact of US tariff policies, which may weigh on investment confidence, especially in the manufacturing sector; (ii) The U.S. government's plan to restrict AI chip exports to Thailand—aimed at preventing re-exports to China—may affect investment confidence among some electronics and smart device manufacturers; and (iii) domestic political uncertainty, which could delay progress on certain infrastructure megaprojects. Nonetheless, several positive drivers remain, including continued relocation momentum from Chinese, Taiwanese, and Japanese investors seeking to mitigate geopolitical risks. Notably, some major industrial estate developers have recently closed land deals with leading data center operators and are likely to secure additional deals with data center clients from the US, China, and Europe. As a result, new industrial land sales and leases are expected to remain flat or grow modestly by 0.0-1.0%, reaching approximately 8,000 rai in 2025.

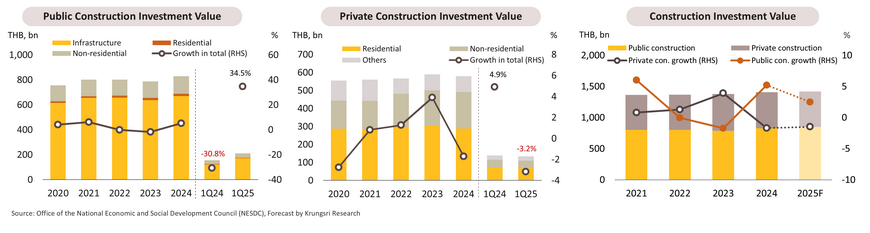

Construction: Overall construction investment is set to rise modestly, supported by government megaprojects, though delays may arise amid political uncertainty.

-

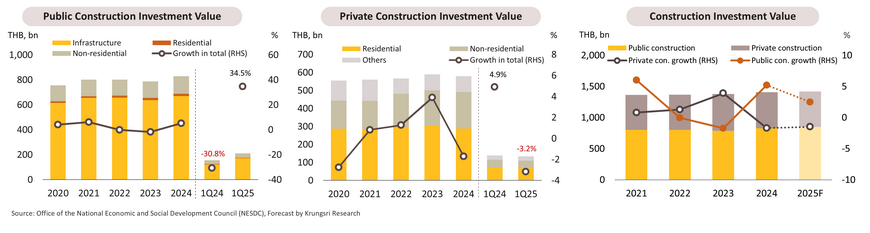

In 1Q25, total construction investment recorded a solid growth of 16.7% YoY, driven primarily by the accelerated expansion of public infrastructure projects. Public construction investment totaled THB 209.7 billion (+34.5% YoY), led by infrastructure spending, which rose by 42.8% YoY to THB 172.3 billion, with a large portion allocated to transportation network development. In contrast, private construction investment declined to THB 134.4 billion (-3.2% YoY), mainly due to weaker residential construction (-5.2% YoY). New housing completions fell nearly -18% YoY nationwide, and over -27% YoY in Bangkok and key provinces. However, factory construction continued to grow, as industrial building transfers rose 3.2% YoY overall, with a sharp 143% surge in the Eastern region, supported by investment in the EEC and favorable government policies.

-

In 2025, total construction investment is expected to grow modestly by 1.0-1.5%, driven by large-scale government projects. Public construction is projected to expand by 2.0-2.5%, supported by the 2025 budget, which allocates significant funding to major infrastructure projects, including EEC-related transport networks. Key initiatives—such as the high-speed rail connecting Don Mueang, Suvarnabhumi, and U-Tapao airports—are set to begin construction in 2025. Recently, the government approved a THB 48 billion budget plan for transport projects, with some expected to begin construction in 2025-2026. However, political instability may cause slight delays in public construction growth. Meanwhile, private construction is expected to continue contracting by -1.5 to -2.0%, mainly due to a prolonged slump in the residential sector, as domestic economic pressures and trade tensions continue to weigh on purchasing power. In contrast, construction of industrial estates and warehouses is projected to grow steadily.

Hotel: International arrivals are projected to decline to 34 million in 2025, driven by a contraction in the Chinese market and ongoing global economic volatility.

-

International tourist arrivals declined consistently from February to June 2025, totaling 16.69 million in 1H25, down -4.7% YoY, primarily due to a sharp -34.1% drop in Chinese visitors to 2.26 million (13% share). This placed China as the second-largest source market, behind Malaysia at 2.3 million (14% share, -5.6% YoY). India and Russia ranked third and fourth, with 1.2 million (7% share, +13.8% YoY) and 1.0 million (6% share, +12.4% YoY), respectively. Domestic tourism recorded 84.6 million trips in 5M25 (+2.5% YoY), pushing the average hotel occupancy rate (OCC) to 73.6%, up from 72.6% in 5M24. Chonburi posted the highest OCC at 83.2% (+3.3 ppt YoY), supported by rising Thai tourist numbers. In contrast, Bangkok’s OCC declined by 3.6 ppt YoY, while Phuket saw only a slight increase (+2.0 ppt YoY), constrained by falling Chinese arrivals.

-

In the second half of 2025, international tourist arrivals are expected to continue declining despite a possible year-end rebound, due to: (i) heightened global economic uncertainty, particularly from the US tariff policies, which dampen purchasing power and consumer confidence in travel; (ii) escalating and prolonged tensions in the Middle East; (iii) domestic issues affecting Thailand’s image, such as safety concerns and political instability; (iv) declining appeal as a “value-for-money” destination amid rising living costs; and (v) intensifying competition from regional destinations such as Japan and Vietnam, which are also targeting Chinese tourists. As a result, total international arrivals in 2025 are projected at 34 million (-4.2%). Domestic travel is forecast to reach 210 million trips (+4.7%), supported by ongoing government tourism stimulus measures1/. This should help maintain the national hotel occupancy rate at around 71.0–71.5%.

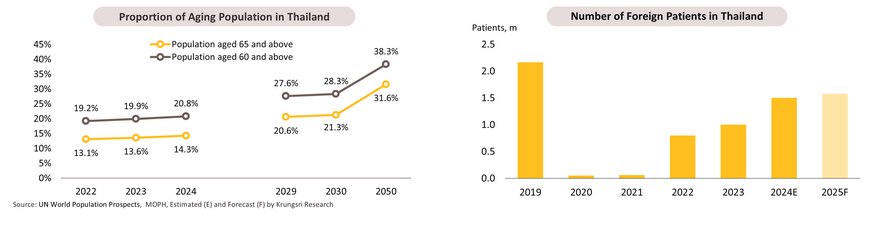

Private hospital: Growth will be driven by aging society and foreign patients, but slowing purchasing power may shift demand toward public hospitals.

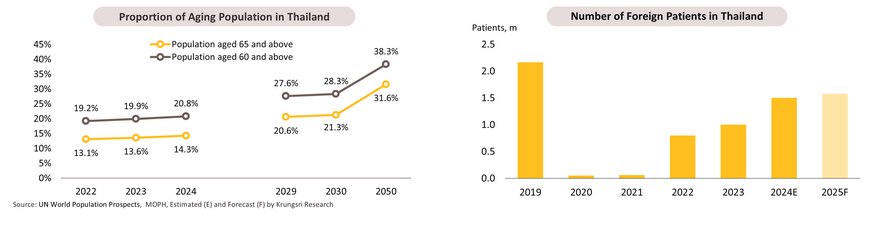

-

In 1H25, revenue continued to grow, driven by an increase in patient numbers, reflected in a significant rise in notifiable diseases (+64.1% YoY in Q1/2025), especially influenza (2.2 times higher than the same period last year) and pneumonia (+43.5% YoY). Foreign patients also increased, particularly in hospitals located in major tourist provinces (e.g. Chiang Mai, Phuket, and Pattaya). Additionally, the Social Security Office raised the reimbursement rate for high-cost diseases from 8,500 to 12,000 baht, benefiting hospitals that rely on patients covered by social security. Operators are expanding their networks and enhancing services for complex diseases to provide comprehensive care. However, economic uncertainty and high household debt have prompted some patients to be more cautious with spending or to switch to public hospitals. Moreover, the introduction of copayment health insurance policies has led patients to seek treatment only when necessary. Hospitals that rely heavily on foreign patients also faced pressure from a decline in Middle Eastern patients due to a longer Ramadan period in March compared to 2024. Additionally, the Kuwaiti government has yet to announce its list of approved hospitals, delaying the return of government-supported patients to Thai hospitals.

-

For the remainder of the year, the hospital business is expected to grow, supported by several factors: (1) Thailand’s transition into a complete aged society, which is likely to drive higher healthcare spending; (2) continued inflow of foreign patients due to Thailand’s high medical standards and lower costs compared to competitors, allowing hospitals to charge higher prices than for domestic patients; (3) rising popularity of health and wellness trends; and (4) hospital operators expanding branches, service areas, and treatment for complex diseases. However, Thailand’s slowing economy is expected to pressure patients to shift toward public hospitals. Some foreign patients may also be affected by the global economic slowdown. These factors are expected to result in private hospital revenue growth of 5-7% in 2025, slowing from 7-9% in 2024.

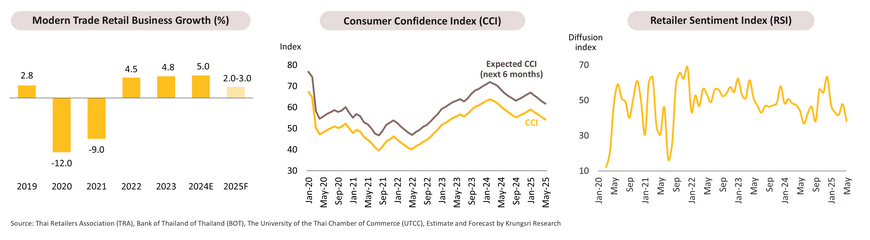

Modern trade: Revenue growth expected to slow amid limited domestic purchasing power recovery and intensifying competition from cross-border e-commerce platforms.

-

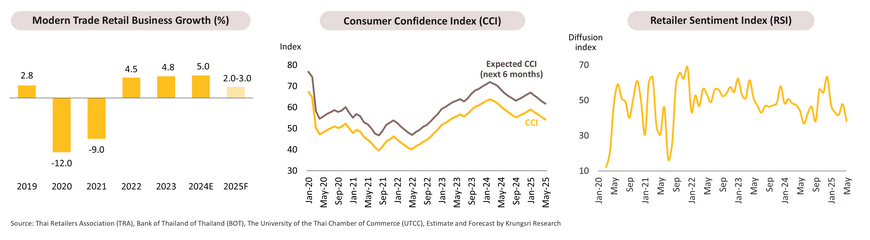

Over 1H25, retail growth has slowed, supported mainly by government stimulus measures such as Easy E-Receipt (Jan 16 - Feb 28) and the second phase of the Digital Wallet Top-up program. However, the retail sector remains under pressure from limited domestic purchasing power recovery as household debt remains persistently high, prompting more cautious consumer spending. This is reflected in the continued decline of the Consumer Confidence Index (CCI), which fell to a two-year low of 54.2 in May. Meanwhile, the tourism sector weakened, with foreign tourist arrivals down -4.7% YoY, particularly from China (-34.1% YoY). In addition, some consumers are turning to international online platforms offering multiple price options, coupled with the influx of low-priced imports from abroad. Retail operators are concerned about economic fragility, with the Retailer Sentiment Index (RSI) declining steadily over the first five months and remaining below the neutral threshold (50), reflecting weaker spending sentiment across all regions.

-

For the rest of the year, retail sales are expected to remain flat or decline slightly compared to the same period in 2024, due to a slowing Thai economy and heightened global economic uncertainty stemming from intensifying trade wars, which will likely dampen spending by both domestic consumers and international tourists. However, government measures such as the “Thai travel co-payment scheme” will provide some support to retail spending. Meanwhile, retailers are expected to continue expanding their store networks to improve market reach and diversify revenue streams. These factors will help cushion the downside, with retail revenue in 2025 projected to grow modestly by 2.0-3.0% from 2024.

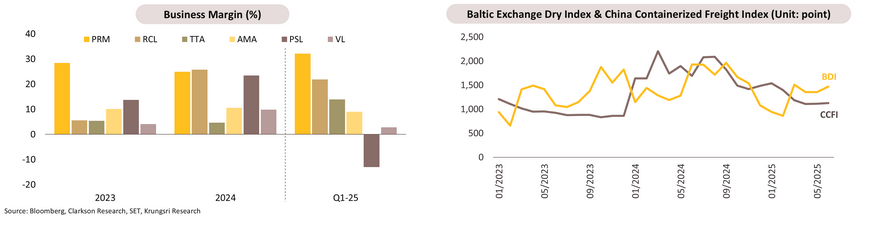

Sea freight services: Global economic and trade slowdown constrains business growth.

-

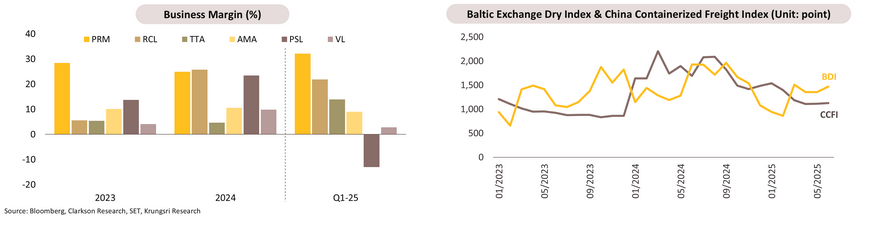

5M25 performance: The shipping industry benefited from US tariff hikes, which prompted businesses to accelerate stockpiling before the implementation date (after July 9). This led to a 14.9% YoY increase in Thailand’s exports and an 11.3% YoY rise in imports, especially in electronics such as computers, HDDs, and circuit boards. Thai exports to key markets surged significantly: the US (+35.1% YoY), China (+28.0% YoY), EU (+16.6% YoY), and ASEAN (+8.8% YoY). Additionally, geopolitical conflicts in the Red Sea, the Russia-Ukraine war, and escalations in the Middle East forced shipping lines to adopt safer but longer re-routing, which pushed freight rates higher early in the year. However, lower fuel oil prices (spot rate down -5.3% YoY) and a high base effect from the same period last year — when freight rates spiked due to Middle East tensions causing Red Sea diversions and increased demand for Chinese goods ahead of US tariffs on Chinese imports (such as EVs, batteries, and steel) — led to freight rate contractions during 5M25. Specifically, the bulk carrier Baltic Dry Index (BDI) fell -5.2% YoY and the container carrier China Containerized Freight Index (CCFI) dropped -30.4% YoY.

-

For the remainder of the year, Thailand’s shipping business is expected to grow gradually, supported by: (1) the 90-day temporary tariff agreement between China and the US (effective May 14, 2025), which will increase demand for accelerated imports and exports; and (2) freight rates trending gradually higher due to ongoing global geopolitical tensions in the Red Sea and Middle East, which increase risks for shipping through the Strait of Hormuz — a critical global shipping route connecting Europe and Asia. Additionally, shipping lines are reducing vessel supply on certain routes (such as China-US) while negotiations between the two countries continue. However, slowing global economic and trade growth (IMF projects +2.8% and +1.7% respectively, down from 3.3% and 3.8% in 2024) will moderate Thailand's trade sector growth in 2025. Exports and imports are expected to grow by 3.5% and 5.0% respectively, compared to 5.8% and 6.3% in 2024. Consequently, revenues form Thai bulk carriers are projected to grow by 0-1% from 2024, while the container shipping business is expected to grow at a low rate of 1.0-2.0%.

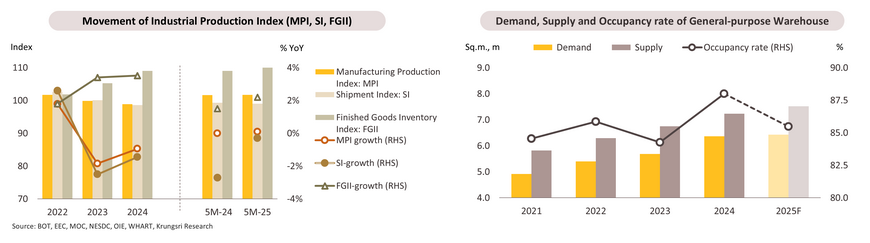

General-purpose warehousing: Rental demand set to weaken sharply in second half of year.

-

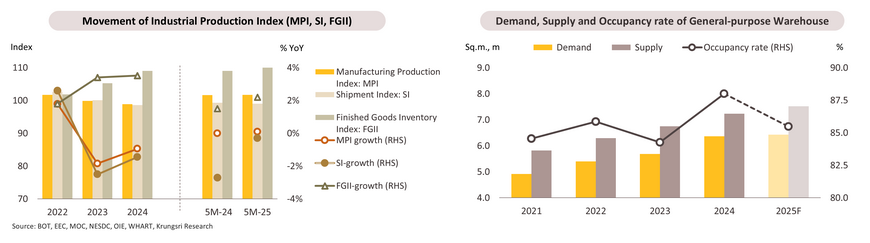

Warehouse demand growth decelerated in 5M25, reflecting broader economic slowdown with industrial production index rising only 0.1% YoY and private consumption expanding 2.6% YoY in 1Q25 (below GDP growth of 3.1%). Private investment contracted for four consecutive quarters (-0.9% YoY in 1Q25), while foreign tourist arrivals declined -4.7% YoY in 1H25. However, general-purpose warehouse demand received support from accelerating international trade (exports +14.9% YoY, imports +11.3% YoY) due to front-loading before US tariff negotiations in July, and continued government investment expansion (+26.3% YoY in 1Q25), resulting in finished goods inventory index increasing by 2.2% YoY.

-

For the remainder of the year, warehouse rental demand will benefit from (i) short-term economic stimulus measures (115 billion baht government budget) that will boost employment and income generation and (ii) continued e-commerce business growth, projected by the Department of Business Development to expand by 8.1% in 2025. However, overall demand may be tempered by the broader economic slowdown affecting nearly all sectors. Krungsri Research forecasts modest GDP growth of 2.1% for 2025, with export growth at 3.5% and foreign tourist arrivals at 34.0 million. Additionally, high household debt continues to weigh on consumer behavior, leading many to spend cautiously or prioritize only essential purchases, which may limit growth in warehouse demand. Consequently, general-purpose warehouse rental demand for 2025 is expected to increase by only 1.0% or 65,000 square meters, while supply will expand by 4.0% (290,000 square meters), resulting in occupancy rates declining to 85.5%.

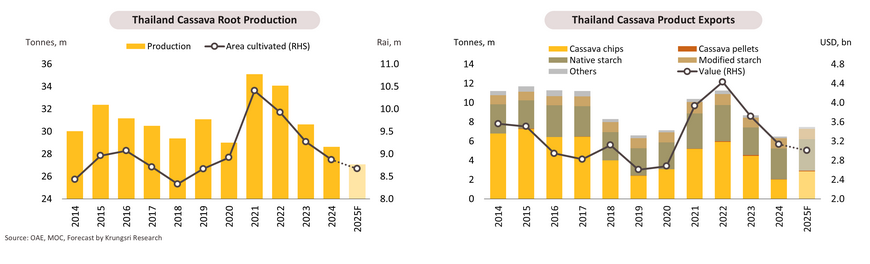

Cassava: Output declines due to drought and disease carryover, while exports surge across products, led by cassava chip shipments to China.

-

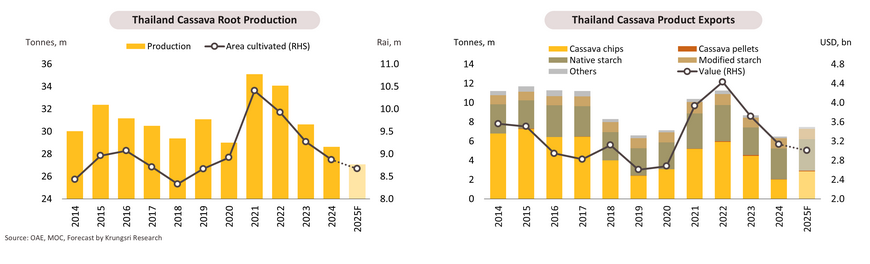

Thailand’s cassava production index contracted by -4.0% YoY in 5M25, pressured by drought, below-average rainfall, and continued outbreaks of mosaic disease and pests from the previous year. The price index declined by -41.4% YoY, driven by lower quality and starch content as farmers accelerated harvesting before crops fully matured due to concerns over drought and disease. Consequently, the farmer income index fell by -43.5% YoY. Cassava product export volume rose 37.3% YoY to 4.06 million tonnes, supported by stronger demand across all product categories, particularly dried chips to China. However, export value declined -7.1% YoY to USD 1.35 billion, pressured by lower prices amid intensified competition and accelerated clearance of old inventories.

-

In the second half of 2025, despite improved weather conditions under the neutral climate phase, cassava output remains pressured by lingering damage from the previous year’s extreme weather and continued pest and disease outbreaks. Throughout 2025, production is forecast at 26.8-27.3 million tonnes of fresh roots, contracting by -4.5% to -6.5%. Exports are expected to grow by 14.3-15.3%, supported by: (i) rising demand for dried chips from China as a corn substitute amid tighter supply and higher prices; (ii) steady global industrial demand, particularly from China’s food and ethanol sectors; (iii) rising food security concerns amid recurring geopolitical tensions and economic uncertainty; (iv) increased supply from the clearance of old inventories; and (v) a low base effect from the same period of last year. Domestic demand is projected to grow by 0.7-2.7%, driven by ongoing demand from downstream industries and ethanol production.

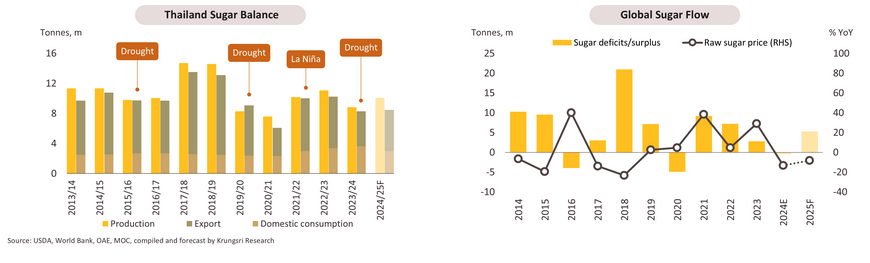

Sugar and molasses: Domestic consumption will contract due to weaker household and industrial demand, prompting producers to intensify export efforts.

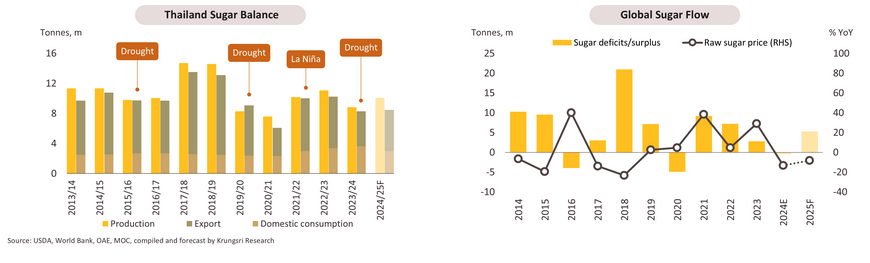

- In 2025, sugarcane crushing volume is expected to reach 92.0 million tonnes (+12.0%), producing approximately 10.1 million tonnes of sugar (+14.4%). This growth is supported by: (i) improved weather and rainfall in the second half of 2024; and (ii) rising sugar prices in previous periods, which encouraged farmers to return to cultivation and invest more in crop care. Domestic sugar consumption in 1Q25 stood at 0.6 million tonnes (-8.4% YoY), with declines in both direct household consumption (-7.7% YoY) and industrial use (-9.4% YoY), due to economic uncertainty and weakening consumer confidence. Meanwhile, sugar and molasses exports in 5M25 rose significantly across all products to 3.0 million tonnes (+29.6% YoY), driven by strong orders from Indonesia (+61.1% YoY), Cambodia (+24.9% YoY), and South Korea (+75.5% YoY).

- For the remainder of 2025, domestic sugar consumption is expected to decline, weighed down by weaker purchasing power from ongoing economic pressures and a slowdown in tourism, driven by a projected drop in foreign arrivals. High living costs continue to dampen consumer spending, particularly in the beverage, beer, and spirits industries. Throughout 2025, domestic sugar consumption is forecast at 3.0 - 3.1 million tonnes, contracting by -14.5% to -17.5%. In contrast, sugar exports are projected to rise significantly to 5.4 – 5.5 million tonnes, an increase of 17.4-18.4%, supported by: (i) improved raw material availability due to favorable weather, enabling higher production for exports; (ii) reduced competition from India, as more sugarcane is diverted to ethanol production under government policy; and (iii) a low export base in 2024.

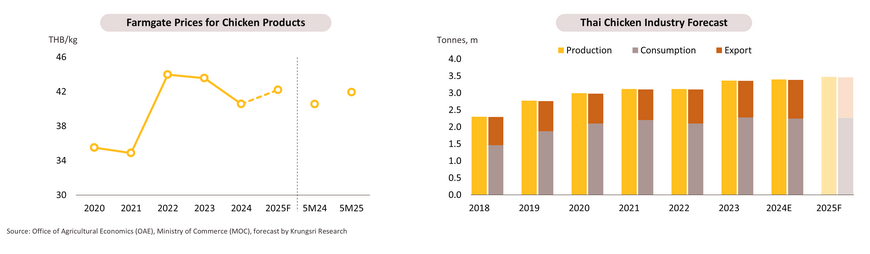

Chilled, frozen and processed chicken industry: Exports will drive growth through market diversification, with modest domestic demand growth from cost-effective consumption.

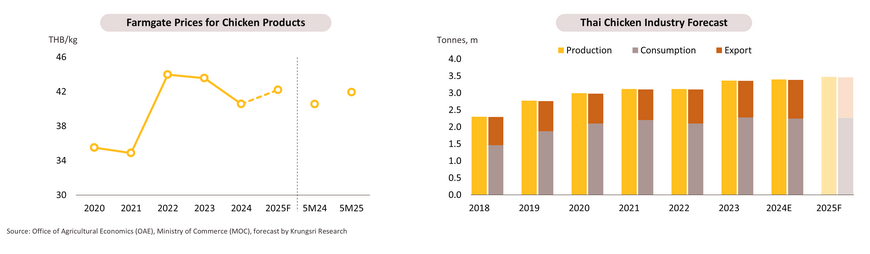

- Output rose by 2.2% YoY in 5M25, driven by increased foreign demand and higher average farmgate prices over 2022-2024, which incentivized farmers and major operators to expand production. However, domestic consumption was flat due to still-high living costs and household debt burdens, which pressured consumer spending. Meanwhile, export volume rose by 6.5% YoY, as chicken serves as an affordable protein source amid rising global living costs, prompting consumers to shift toward cheaper food options. Export growth was also supported by market expansion in the Middle East.

- Production is expected to grow throughout 2025 by 1.7-2.7% to 3.45-3.48 million tonnes, as attractive chicken prices are anticipated to continue incentivizing farmers and major operators to expand capacity in response to rising foreign demand. Domestic demand is expected to increase by 0.3-1.3% to 2.25-2.27 million tonnes, supported by a shift in consumer behavior amid economic slowdowns. This has driven demand for chicken as an affordable basic protein source, with consumers switching from more expensive meats to chicken to save costs. Exports are projected to grow by 4.7-5.7%, reaching 1.19-1.21 million tonnes despite the global economic slowdown. Key supporting factors include continued demand from key trading partners and the strong credibility of Thai chicken products, which provides a significant advantage amid ongoing avian flu outbreaks in other major chicken-producing countries. Additionally, market diversification into the Middle East is increasing. Meanwhile, Trump's tariff policy is expected to have limited impact, as Thailand's exports are primarily focused on Japan (42%), the UK (18%), China (10%), and Malaysia (8%), with minimal exposure to the US market (less than 0.01%).

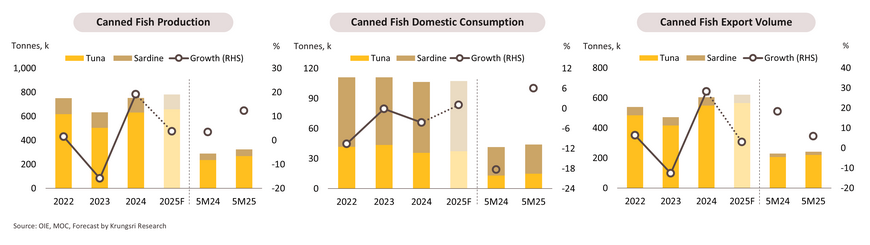

Canned fish industry: Domestic demand will grow modestly amid economic uncertainty, while export growth will be constrained in 2H25 following front-loaded shipments in 1H25.

-

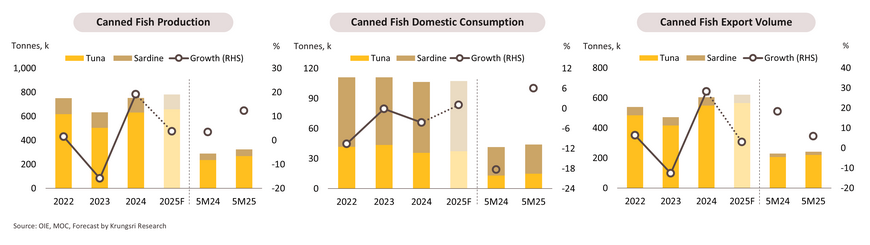

Output increased by 12.3% YoY over 5M25 to 324.4 thousand tonnes, mainly driven by canned tuna production, which rose by 14.2% YoY due to rising export demand. Meanwhile, canned sardine production grew by 3.9% YoY, due largely to accelerated restocking efforts. Domestic consumption increased by 6.0% YoY, led by a 14.2% YoY rise in canned tuna consumption, driven by a shift toward high-quality, value-for-money protein and partly by a low base in the previous year. Canned sardine consumption also rose by 2.3% YoY. Export volume rose by 5.9% YoY, driven by a 6.5% YoY increase in canned tuna exports due to i) The front-loaded demand from the US—occurring ahead of the implementation of the US tariff hike policy—drove a significant increase in exports of canned tuna and other non-fish canned and preserved seafood products to the US, rising by +19.4% YoY and +15.5% YoY, respectively, and ii) sustained demand from major importers, including Middle Eastern countries amid food security concerns stemming from the war. Meanwhile, canned sardine exports were flat at -0.1% YoY, weighed down by weakening demand from South Africa, a key market.

-

Production is expected to grow by 3.2-4.2% in 2025, driven by front-loaded export demand earlier in the year amid uncertainty over US tariff measures, resulting in slower growth in the latter half compared to the previous year. Domestic canned fish consumption is expected to grow by only 0.5-1.5%, weighed down by economic uncertainty and competition from alternatives such as ready-to-eat meals, food delivery services, and home cooking aimed at saving costs. Exports are expected to grow by 2.4-3.4%. Exports are expected to contract in 2H25, particularly to the U.S. market, which is a key destination—especially for canned tuna. This follows a typical boom-and-bust cycle, with U.S. importers having front-loaded purchases in 1H25 ahead of the tariff hike taking effect.

Thailand Taxonomy: The regulators have launched Phase II, which covers several key industries. Businesses should comply with the criteria to ensure long-term competitiveness.

-

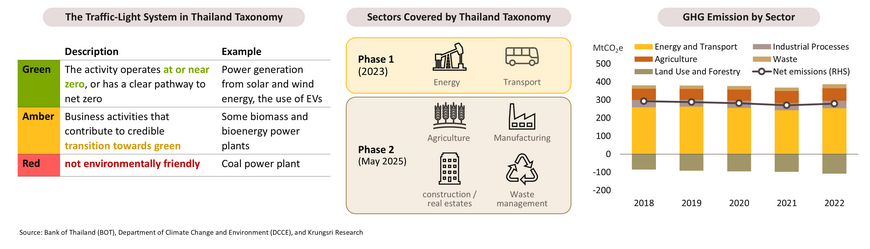

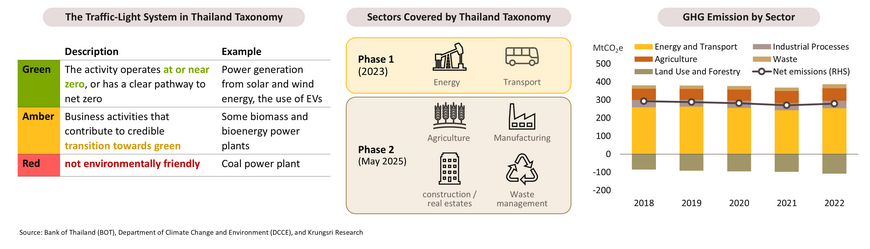

The authorities have launched the criteria for Taxonomy Phase II, which covers more industries than Phase I (energy and transport), including agriculture, construction and real estate, manufacturing, and waste management. Activities are categorized into green, amber, and red (traffic light) groups based on their substantial contribution to environmental objectives: climate change mitigation, climate change adaptation, water resource management, pollution reduction, circular economy, and biodiversity. In addition, sustainable activities must meet two conditions: (i) Do No Significant Harm (DNSH)—they must not negatively impact environmental objectives; and (ii) Minimum Social Safeguards (MSS)—they must align with international standards on human rights, labor rights, and good governance.

-

Although the application of the Thailand Taxonomy is currently voluntary, businesses aligned with the taxonomy will benefit in several ways, such as: (i) improved access to sustainable finance, including green bonds and loans; and (ii) enhanced business competitiveness and reputation, thereby attracting investors, partners, and sustainability-conscious consumers. However, businesses will face higher operating expenses from data collection and reporting—for example, disclosing the share of business activities, revenue, and expenditure classified under green, amber, and red categories—as well as costs related to transitioning from red- to green-listed activities. The energy and transport sectors are particularly affected, as they account for two-thirds of total GHG emissions.

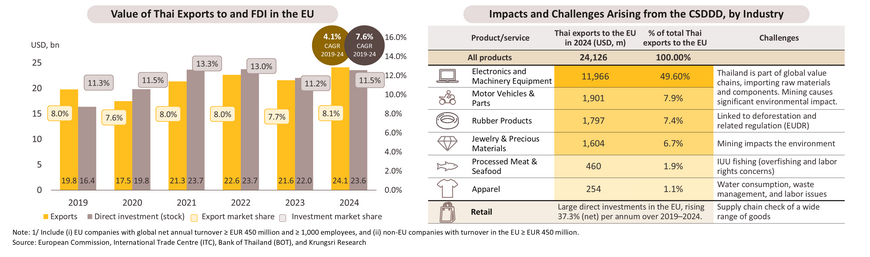

CSDDD: The EU’s stringent supply chain law will put pressure on Thai businesses to adapt quickly, especially in the electronics and machinery sectors.

-

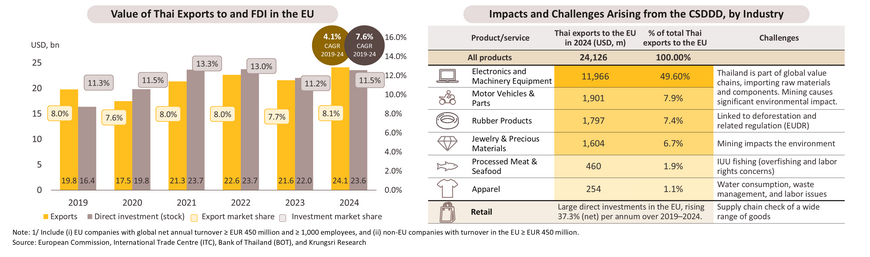

The EU’s Corporate Sustainability Due Diligence Directive (CSDDD) imposes two main requirements on large companies within the EU1/: (i) supply chain due diligence regarding environmental and human rights impacts. For example, an auto assembler must ensure that its suppliers—such as tire manufacturers and rubber growers—are not linked to deforestation or unfair labor practices; (ii) climate change mitigation, which includes drafting a transition plan that sets emissions reduction targets and implementing it as fully as possible. The CSDDD is currently in a transitional period since its entry into force on July 25, 2024. Actual enforcement is scheduled to begin on July 26, 2027, initially targeting the largest corporations. However, this may be postponed to 2028, following the European Commission’s proposed ‘omnibus package’ on February 26, 2025.

-

The CSDDD is expected to affect Thai businesses that invest in, export to, or are integrated into EU supply chains—primarily through: (i) increased costs, arising both from compliance with due diligence processes and from investments needed to meet sustainability standards; and (ii) shrinking market share, as businesses that fail to meet these new obligations may be excluded from EU supply chains. In 2024, the EU accounts for 8.1% of Thailand’s exports and 11.5% of its direct investment, ranking as the fourth- and third-largest market, respectively. Sectors likely to be most impacted include electronics and machinery, automotive, and rubber, which together account for two-thirds of Thailand’s exports to the EU. However, companies that successfully comply with CSDDD requirements and transition to more sustainable supply chains will benefit from improved access to and competitiveness in the EU market.

Back

.webp.aspx)