Global: Diverging growth prospects amid cyclical slowdown and structural challenges

Global growth loses momentum amid fading post-covid recovery tailwinds, tighter monetary policies, and less fiscal support

Slow global recovery with greater regional divergence, challenging to return to pre-covid output trends; policy tightening will ease inflation but bite growth

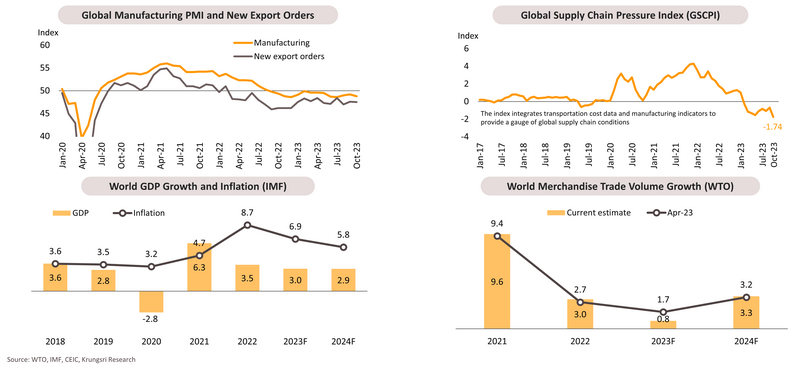

The IMF projects global economic growth will decelerate from 3.5% in 2022 to 3.0% in 2023 and 2.9% in 2024, below the historical average of 3.8% over 2000-2019. Growth in advanced economies is expected to slow from 2.6% in 2022 to 1.5% in 2023 and 1.4% in 2024. Growth in emerging markets and developing economies are projected to edge down from 4.1% in 2022 to 4.0% in both 2023 and 2024. Despite signs of resilience earlier this year, economic activity is still below the IMF’s pre-pandemic projections (in January 2020). Several forces are holding back recovery, including long-term consequences of the pandemic, the war in Ukraine, and increasing geo-economic fragmentation. Other forces are cyclical, including the effects of monetary policy tightening, withdrawal of fiscal support amid high debt levels, and extreme weather.

Global medium-term growth projections are the weakest since 1990 amid structural headwinds; EMDEs need longer period to half the income per capita gap with AEs

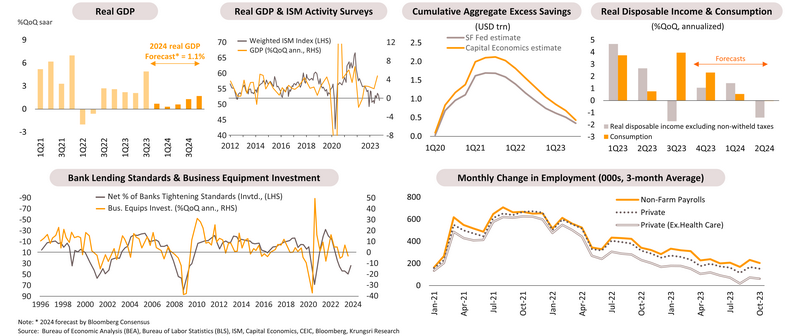

US: Preparing for a soft landing dragged by unusually tight credit conditions

Economic growth in the US rebounded to +5.2% QoQ saar in 3Q23 from 2.1% in 1Q23 and 2.1% in 2Q23. Looking ahead, US economic growth is projected to decelerate to only 1.5% in 2024 from 2.1% in 2023. The ISM Activity Survey suggests the economy would stagnate. Several factors, such as fading reopening benefits, fewer stimulus measures, and significantly higher interest rates, would have knock-on effects on financial markets, household wealth, consumer spending, and business investment. As a primary driver of the US economy, private consumption growth is anticipated to slow down due to a sharp drop in excess savings and slower income growth. Despite some signs of improvement, banks remain tight with lending, which could lead to a decline in investment growth. In the labor market, job growth is experiencing a cyclical slowdown though robust employment in the government and healthcare sectors might ease fears of a severe economic downturn.

Amid stronger signs of a cyclical slowdown and slower inflation, the Fed might start to unwind policy tightening in 2H24 or reduce real interest rates to prevent a hard landing

Eurozone: Absence of key growth drivers but low-base effect and softer inflation will support growth in 2H24

Sub-par growth and easing inflation might prompt Eurozone to cut rates in mid-2024

Japan: Fading reopening effects could dampen GDP growth in 2024 but improving real income and recovery in some export sectors would limit downside

Strong wage growth and rising consumption could prompt the BOJ to unwind ultra-loose monetary policy in 2024

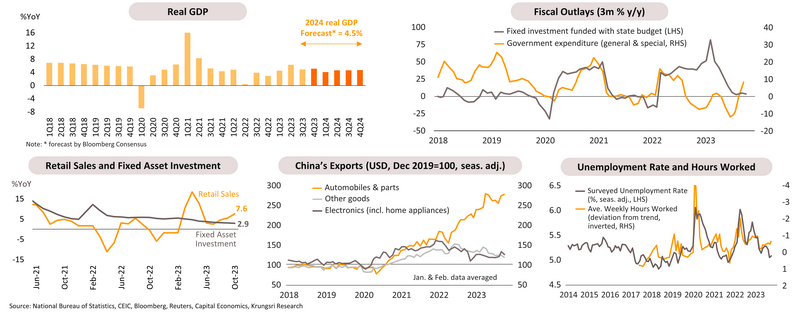

China: Economic stimulus meet structural headwinds; temporary rebound and partial recovery with additional policy supports

China's economy expanded faster-than-expected in 3Q23, by 4.9% YoY. On a quarter-by-quarter basis, GDP growth also accelerated to 1.3% in 3Q23 from 0.5% in 2Q23. Looking ahead, stimulus measures are likely to lead to a modest cyclical recovery in late-2023 or early-2024, but fading reopening tailwinds and structural headwinds are expected to cause economic growth to decelerate to 4.6% in 2024 from an estimated 5.4% in 2023. We expect China to experience a near-term rebound given the following: (i) government spending would start to rise again following the recent push to accelerate bond issuance, and (ii) improving consumer spending, as reflected by retail sales growth which accelerated to a 5-month high of 7.6% in October. However, key indicators still point to a fragile economy, and we see only a partial recovery due to the following: (i) sluggish real estate sector, reflected in the -0.38% drop in new house prices, the sharpest drop in 8 years; (ii) sluggish investment growth as, for the first 10 months of 2023, investment in fixed assets rose only 2.9%, investment in real estate tumbled 9.3%, and FDI inflows fell 9.4%; (iii) external demand remains weak with exports falling for the 6th month in October, by 6.4% despite a surge in exports of automobiles; and (iv) although unemployment is lower than before, shorter working hours suggest economic growth could slow down again in the periods ahead.

With fading reopening tailwinds, we see a structural slowdown amid the property crisis, high debt levels, US-China tension, and weak global demand

Thailand: Krungsri Research Forecast

Thailand: Lagged cyclical recovery with uneven and uncertain growth in 2024

3Q23 GDP growth slows to +1.5% YoY from +1.8% in 2Q, due to slower public spending, weak exports and stock depletion; we revised down economic growth projections

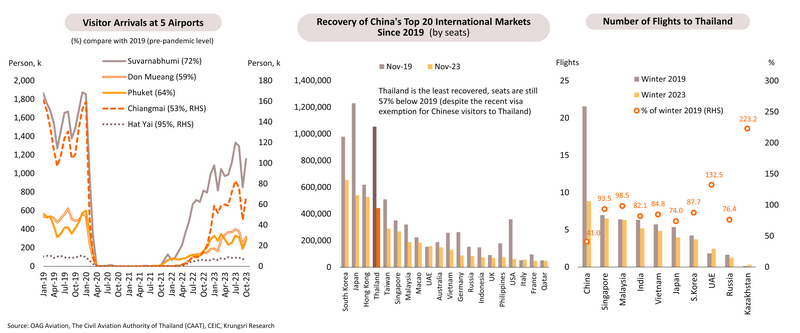

Tourism sector: On track to recovery facilitated by Visa-Free scheme and easing supply headwinds

In the first 10 months of 2023, tourist arrivals reached 22.2 mn (68% of pre-Covid level) and generated THB954 bn receipts (60% of pre-Covid level). Arrivals from Malaysia, Russia, South Korea and India reached 79-109% of pre-pandemic levels. Chinese tourists are returning slowly, at only 30% of pre-Covid level. Looking at the rest of this year and the first half of next year, we expect Thailand to expand the Visa-Free program to cover tourists from India and Taiwan, in addition to those from China and Kazakhstan, as well as extend visa-free stays for Russian tourists from 30 days to 90 days. Coupled with easing supply-side issues, we expect foreign tourist arrivals to reach 35.6 mn in 2024 from 27.7 mn in 2023.

Slow recovery in arrivals from China but data show more arrivals from other countries during peak season

The tourism sector has yet to return to pre-pandemic level. Passenger throughput at five of Thailand’s major airports are below pre-covid levels, including Suvarnabhumi Airport at 75% of pre-Covid level, Phuket at 64%, and Don Mueang at 59%. Chinese tourist arrivals is far below pre-pandemic level with airline seats from China to Thailand in November this year at only 57% of that in the same month in 2019. The number of flights from China to Thailand in the winter of 2023 (November 2023- February 2024) is 41% fewer than in the winter of 2019. However, arrivals from other countries are improving during the peak season.

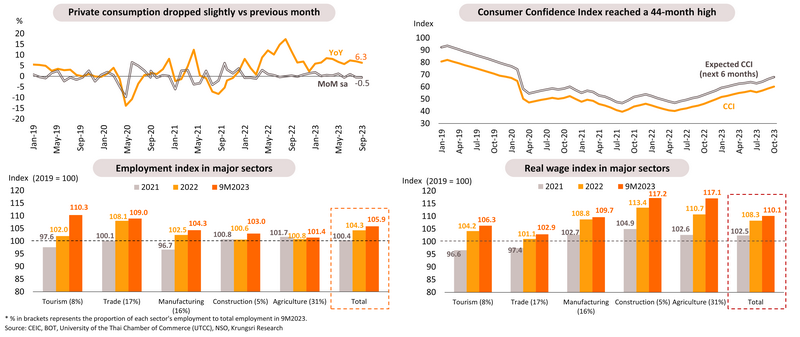

Private consumption will rise along with recovering services activity, employment, and real wage

Despite anticipating a slowdown after unusually strong growth in 2023 triggered by pent-up demand, private consumption should continue to grow in 2024 supported by (i) the continued recovery in tourism activity; (ii) rising confidence, with the Consumer Confidence Index (CCI) hitting a 44-month high in October (highest since March 2020), (iii) stronger labor market as employment in most sectors is higher than before the pandemic, led by the tourism sector (8% share of total employment and 10% above pre-covid level) and trade (17% share and 9% above pre-covid level). Real wage has also exceeded pre-pandemic level, both overall and in most sectors led by the construction sector (5% share of total employment) and agricultural sector (31%). In addition, consumption could be boosted by stimulus measures in 2024 such as E-Refund program and debt suspension for farmers.

However, consumption growth could be capped by drought, high debt level, and decade-high interest rates

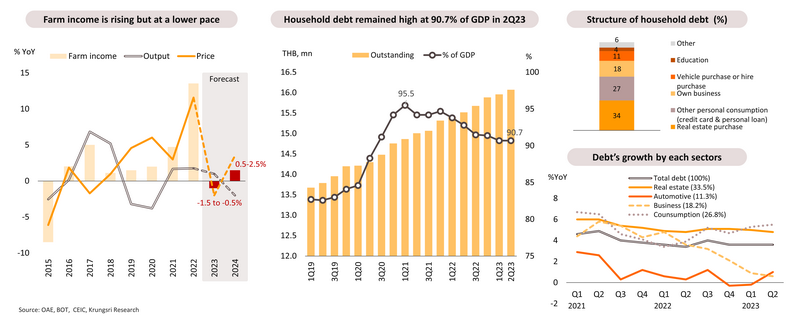

Farm income is expected to edge up by 0.5-2.5% in 2024 led by projected higher farm prices, driven by global demand for food security amid concerns over drought impact and geopolitical conflicts. Overall domestic farm output is expected to fall in 2024 as more severe drought conditions could reduce farmers’ income. Additionally, household debt remained high at 16.07 trillion baht at end-2Q23, rising 3.6% YoY. Household Debt-to-GDP ratio remained high at 90.7%, close to that in the previous quarter. We observed the rising household debt is led by personal and vehicle HP loans. Slow growth in farm income and elevated household debt levels, compounded by decade-high interest rates, could cap household consumption growth in 2024.

Private investment: Boost from stronger services activity and public spending, but constrained by external challenges and sluggish manufacturing growth

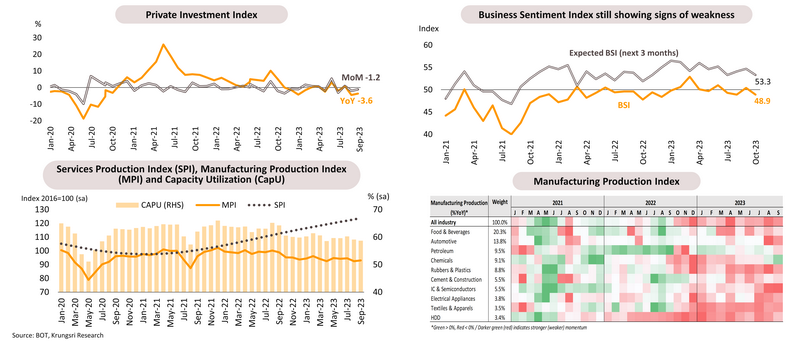

Private investment is projected to improve YoY in 2024, supported by (i) recovering tourism and domestic activities, reflected by rising Services Production Index (SPI); (ii) measures to boost investment in targeted industries, such as initiatives to enhance the EV (electric vehicle) industry in Phase II (EV 3.5) in 2024-2027; and (iii) accelerating infrastructure investment, covering both existing and new projects. Notably, the total value of public-private partnership (PPP) projects approved in fiscal year 2023 was THB98.8 bn, a whopping 112.7% increase from the previous year. However, some private investment is still being capped by weak business sentiment and sluggish industrial production influenced by slow growth in global manufacturing activity.

More applications for BOI incentives, could encourage investment in certain sectors

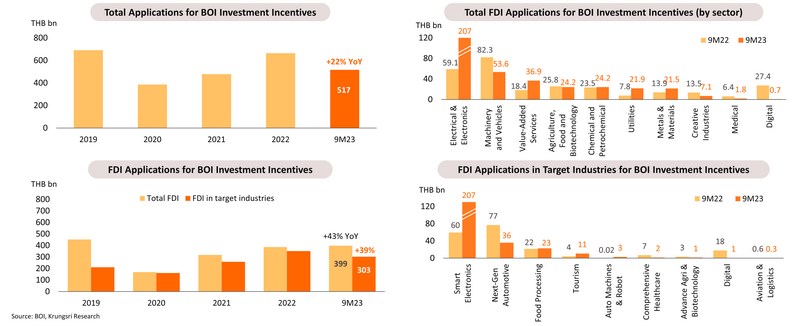

In the first nine months of 2023, the Board of Investment (BOI) received applications for investment incentives for 1,555 projects (+31% YoY) with a total investment value of THB516.80 bn (+22% YoY). The three industries with the highest investments were Electrical & Electronics, Agriculture and Food Processing, and Automotive & Parts. Foreign direct investment (FDI) applications for BOI incentives rose by 48% to 910 projects valued at THB399 bn (+43%), led by China, Singapore and Japan. The top industries which attracted FDI include Electrical & Electronics and Machinery & Vehicles. For FDI in targeted industries, there were 511 projects (+57%) with a total investment of THB303 bn (+39%). The industries with the highest investment value were Smart Electronics and Next-Generation Automotive. In the Eastern Economic Corridor (EEC), there were 522 projects (+54%) with a total investment of THB232bn (-4%), led by investments in Electrical & Electronics. There were FDI applications for 433 projects (+80%), with a total investment of THB217 bn (+31%). In terms of issuing investment incentive certificates, the BOI has approved 1,299 projects (+18% YoY) with a total investment value of THB 335 bn, close to 2022 level. This is a promising sign for domestic investment in key industrial sectors over the next 1-2 years, which should help to support economic recovery ahead.

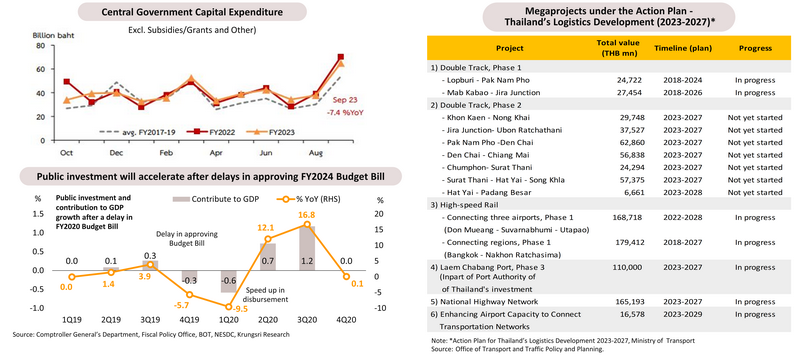

Public spending could rebound and push up GDP growth after FY2024 Budget Bill comes into effect in 2Q24

The delayed preparation and approval of the Budget Bill for FY2024 (October 2023-September 2024) would limit budget disbursements in the last quarter of 2023 and first quarter of 2024. However, once it is approved in about the second quarter of 2024, disbursements are likely to accelerate and lift GDP growth (similar to the disbursement pattern observed after 2019 general election). Additionally, the market expects investments in mega infrastructure projects – existing and new - to accelerate from 2Q24. Under the 2023-2027 action plan, the government would accelerate the double-track railway project (Phase 1 and 2) and EEC-related projects such as Laem Chabang Port Project Phase 3, and the high-speed rail project to connect three airports (construction is expected to start in 2024).

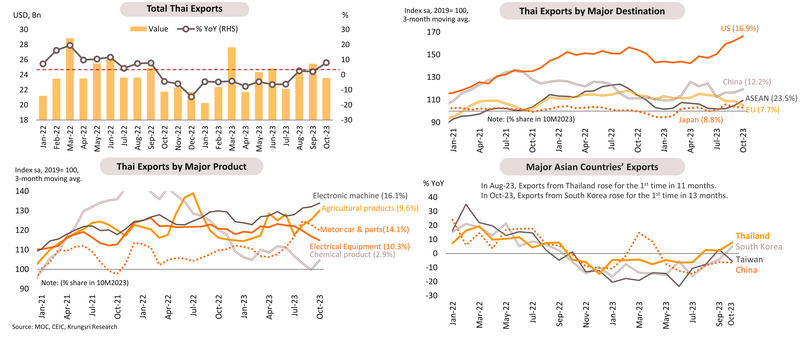

Exports: Technical rebound and diverging growth across sectors and countries; prospects dampened by sub-par global economic growth

Thai exports are expected to grow by a modest 2.5% in 2024, compared to -1.5% in 2023. There are more visible signs of exports improving in the latter half of 2023, surpassing growth in other major exporting countries in Asia. We expect the momentum to continue into 2024, in line with a pick-up in world trade volume and rising demand for Electrical & Electronic (E&E) products starting in the second half of 2023 supported by the growing importance of the digital world.

Exports to be driven by easing supply disruption, stable global growth, and low base

Although the global manufacturing sector and new export orders remain weak (index below-50), exports will be supported by easing supply chain disruptions. The Global Supply Chain Pressure Index (GSCPI) has dropped to a multi-year low of -1.74 in October from -0.70 in September. Furthermore, the International Monetary Fund (IMF) expects the global economy to continue to grow amid easing inflationary pressure in 2024. The World Trade Organization (WTO) also projects global trade volume would grow by 3.3% in 2024, compared to 3.2% in the previous forecast and 0.8% in 2023, supported by demand for machinery and consumer durables which should recover when economic growth stabilizes.

Inflation pressure capped by energy subsidy policies and limited demand-pull pressure; balanced risks as cost-push factors could be offset by extended energy subsidies

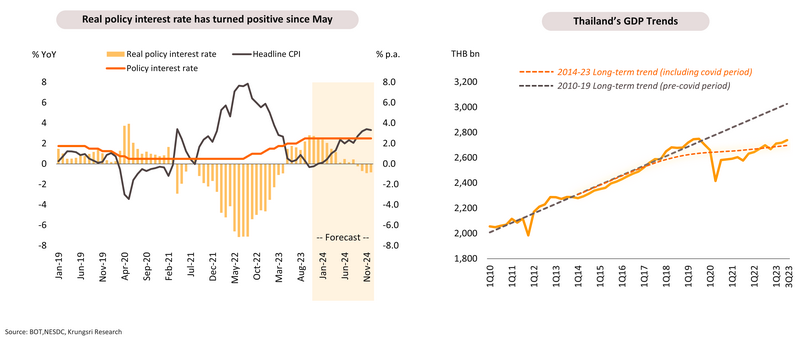

Expect MPC to keep policy rate at a 10-year high to address financial stability concerns while supporting economic growth

We expect the MPC to keep policy interest rate at 2.50% in 2024, premised on the following: (i) the MPC believes current interest rate is appropriate to support sustainable long-term growth; (ii) real policy rate has risen to positive territory; and (iii) the BOT expects Thailand’s economic growth to rebound in 2024. Economic activity is also gradually returning to long-term trend, supported by economic stimulus measures. Despite potential rate cuts by the world’s major central banks in 2H24, Thailand is unlikely to join the fray as headline inflation is expected to increase and remain within the BOT's target range in 2024, albeit possibly briefly exceeding its upper target range in late-2024 (due to the low base in 2023). We expect the MPC to keep policy interest rate at a decade-high to allow room to absorb uncertainties and risks in the foreseeable future.

Risks & Challenges

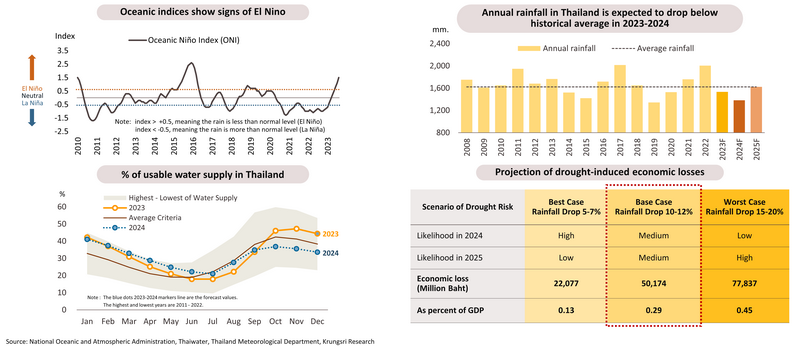

Expect drought to hurt farm output in 2H23, worsen in 2024

The emergence of El Niño conditions have started to affect the climate in Thailand, but the full effect will manifest in 2024 and 2025 as the country experiences higher temperatures. The delayed onset of seasonal rains would cause below-average precipitation across the country. In 2023, the effects would be most visible on output of crops that are sensitive to water shortage, such as off-season rice and cassava. In 2024 and 2025, the impact will expand to include other major crops, including sugarcane, corn, fruits, and forestry goods. In some cases, the effects could be worse for downstream industries than upstream suppliers. In our baseline case, overall drought-related losses are expected to reach THB 50 bn or 0.29% of GDP; it could reach THB 78 bn or 0.45% of GDP if the drought is more severe than expected in 2024 and 2025.

Digital wallet scheme can boost purchasing power of low-income households and stimulate the economy significantly, but the effects might last only a year

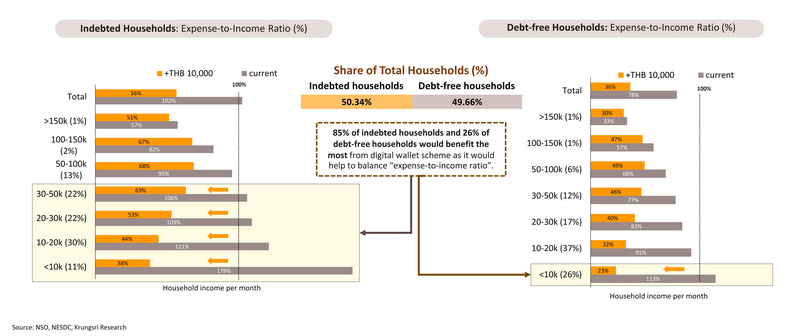

Digital wallet scheme can boost purchasing power of low-income households and stimulate the economy significantly, but the effects might last only a year

According to the NSO, data suggest indebted households with monthly income below THB50,000 and debt-free households with monthly income below THB10,000 have weak purchasing power as total expenses including debt repayments exceed their income. The THB10,000 digital cash wallet scheme which could be implemented in 2024, could boost household purchasing power significantly. It will benefit those under financial stress (85% of indebted households and 26% of debt-free households), by reducing expense-to-income ratio to below 100%. However, it would have minimal impact on households with high monthly income (more than THB50,000 for indebted households) and debt-free households (except those with monthly income below THB10,000) because these groups have very low marginal propensity to consume (MPC).

Digital Wallet supply-side analysis: Crop sector will be largest beneficiary but has low forward and backward linkages

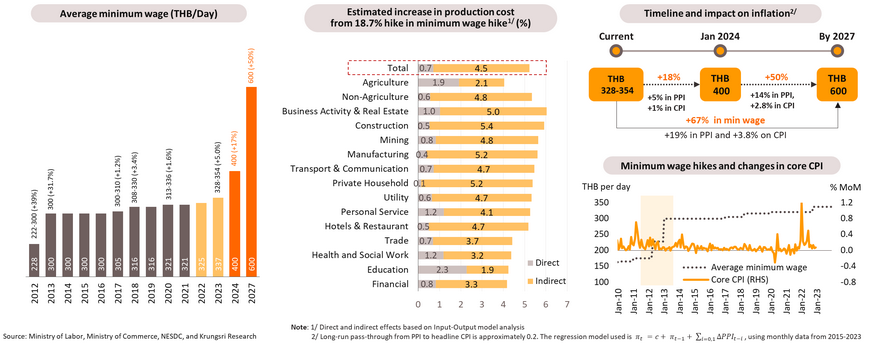

If Thailand hikes minimum wage by 18.7% to THB 400/day as proposed, that could lift inflation by about 1%; however, historical trends indicate a more muted effect

- If minimum wage is increased to THB 400 per day nationwide (from THB 337 currently) starting January 2024, the impact on production costs (PPI) would be +5.2%, comprising 0.7% direct effect and 4.5% indirect effect. Sectors that would be hurt most are business activity & real estate, construction, mining and manufacturing. Given the long-run pass-through from PPI to CPI, the total effect of a 18.7% hike in minimum wage hike on CPI would be around 1%. Looking ahead, the government plans to raise minimum wage to THB 600 per day by 2027. If implemented, there would be a significant impact on inflation.

- However, historical data suggest the actual impact might be smaller; the previous minimum wage hike (by 32% from THB 228 to THB 300 nationwide) had minimal impact on inflation. One of the reasons often cited is strong competition in the business sector in Thailand. The other factor that could mitigate the impact on inflation is a smaller share of labor earning minimum wage (from 25% in 2012 to 15% in 2022). The government also claimed the minimum wage hike might be rolled out in phases by region and/or skill level

Recession risk in the US: Data show, after the first rate cut, it usually takes 5-6 quarters to fall into an economic recession

Recession risk in Eurozone: After the first rate cut, it usually takes 1-2 quarters to fall into an economic recession or stagnation

After the first rate cuts, the US and Eurozone took more than 6 quarters to see an economic recovery

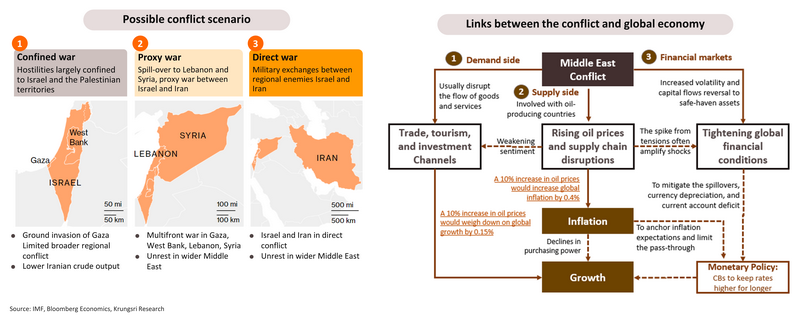

Israel-Hamas war could further weaken an already-slowing global economy

- The IMF has warned that the ongoing conflict will have repercussions on the Middle East and the world economy. Bloomberg Economics analyzed the conflict under three potential scenarios; a confined war, proxy war, and direct war. It sees low risk of a direct war, but it is a dangerous scenario. Soaring oil prices (to $150 a barrel) and a sharp drop in prices of risk assets would deal a substantial blow to growth and push inflation a notch higher. It could trigger a global recession with global GDP growth falling to 1.7% in 2024.

- Unrest in the Middle East could hurt economic activities through three primary channels: (i) demand side, resulting from disruptions to trade, tourism, and investment; (ii) supply side, where rising oil prices can lead to higher production costs, inflation, and a subsequent drop in purchasing power and investment. Indirectly, it will also weaken consumer and business sentiment. In the worst case, it could lead to global supply chain disruptions; (iii) financial markets, as rising tensions and uncertainties often amplify volatility, leading to risk-off sentiment.

- The impact on the Thai economy depends on the intensity and duration of the conflict. Given the current situation, the primary impact is on the supply side triggered by higher oil prices. The impact on financial markets are relatively limited, given Thailand's resilient external stability. In the worst-case scenario, tighter financial conditions could eventually affect monetary policy and the economy

In the near-term, Thai government’s energy subsidy measures could reduce impact on inflation

- The Bank of Thailand estimates a 10% increase in oil prices would push up Thai inflation by 0.5 ppt and reduce Thai GDP growth by 0.1 ppt. Based on our assumption that oil price would average $83/barrel in 2023, inflation could surge by 2.7 ppt and growth could drop by 0.5 ppt in the worst-case scenario

- Energy subsidy measures would only mitigate the impact on inflation in the near-term. Policies effective September to December 2023 include a reduction in electricity price and cutting diesel price. The government has agreed to reduce the price of benzene octane 91 by THB 2.5/liter for three months by lowering excise tax, similar to the approach to cut diesel price. If these policies are extended through to 2024, it could reduce inflation by 0.2-0.6 ppt.

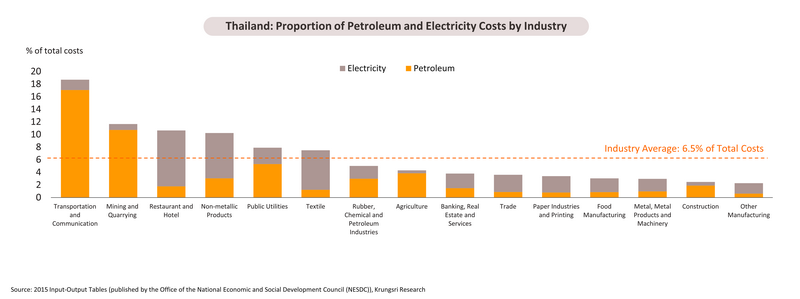

Duration of conflicts would determine the impact of higher oil prices on growth; transportation and mining sectors could be heavily affected.

- Duration of conflicts. Rapidly-fading oil price shocks do not necessarily affect growth. However, persistently-high oil prices will eventually pressure purchasing power and economic activities, even with energy subsidies in place. It could hurt Thailand indirectly, as weaker activity at trading partners’ economies triggered by rising oil prices would hurt Thailand's trade with those countries.

- Sector analysis. Downstream industries that would be hurt the most by rising oil prices are transportation and mining sectors, where petroleum costs account for 17% and 10.7% of total costs, respectively. Specifically, petroleum expenses in the rail, water, and air transportation segments exceed 25% of total costs. If oil prices lead to higher electricity costs, tourism and cement & concrete segments will be hurt more than other sectors because power costs account for 8.9% and 7.2% of total costs, respectively.

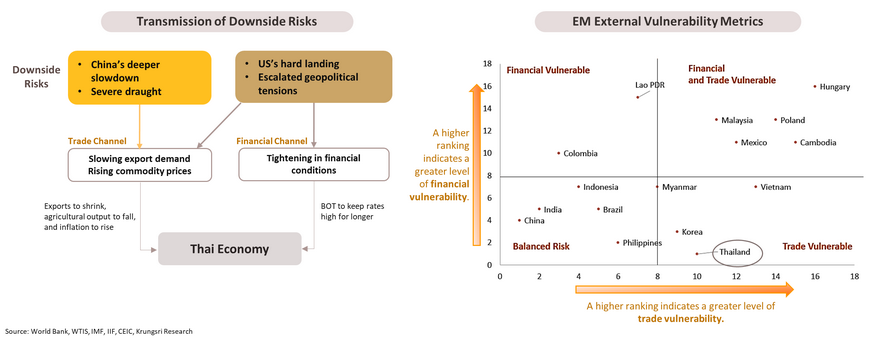

Vulnerability against external shocks: Hard landing and sharper slowdown at key trading partner countries, escalating geopolitical tensions, and severe drought

- External risks could hurt Thailand’s economy through both trade and financial channels. Risks transmitted through these channels include geopolitical tensions and a hard landing in the US, which could push up commodity prices, tighten financial conditions, and slow down exports. A sharper slowdown in China and severe drought could affect Thailand through the trade channel. A severe drought could cause prices of global key agricultural inputs to surge and reduce agricultural output in Thailand.

- According to EM external vulnerability metrics, Thailand is more resilient than other emerging and developing countries in terms of external financial stability, thanks to reasonably low twin deficits and share of short-term debt to total reserves, and ample reserves to cover imports. However, it has relatively high export exposure to the US and China (at 10% and 9% of GDP, respectively) and a high proportion of fuel imports (15% of total imports), which makes Thailand vulnerable to weaker-than-expected growth in these countries and volatile commodity prices.

Key factors in 2024: Stronger recovery of tourism activity and higher public spending to fuel growth in 2024, but impact could be capped by drought, debt, and external risks