Global: Economic growth decelerates amid deglobalization

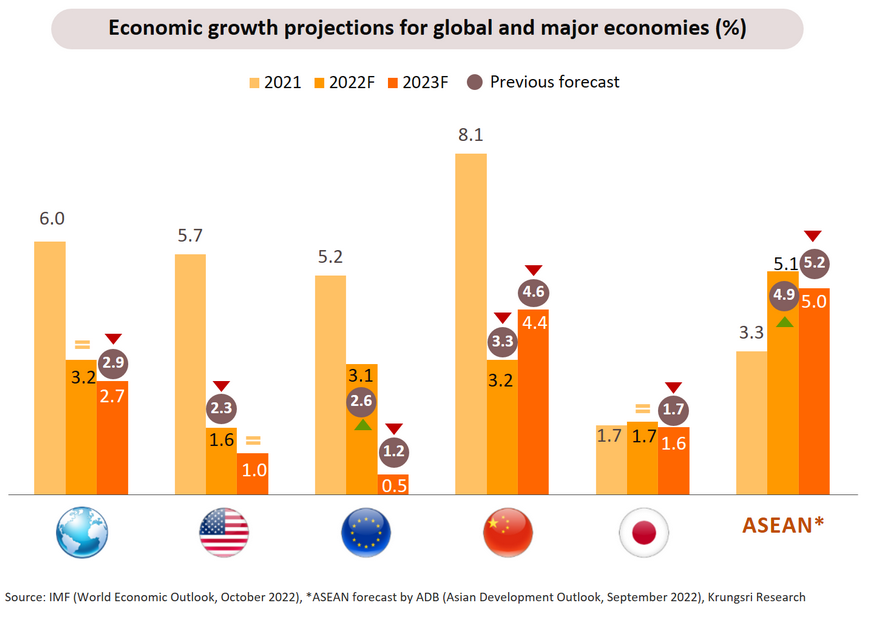

Economic growth in major countries is expected to slow down with higher risk of recession; IMF indicates global growth could be weaker than projected

Global economic growth will slow down from 3.2% in 2022 to 2.7% in 2023 (0.2 percentage point below July forecast), according to the projection by the International Monetary Fund (IMF) in October. There is a 25% probability that 2023 growth could fall below 2%. More than a third of the global economy will contract this year or next. Downside risks remain elevated. In November, the IMF added that the global economic outlook is even gloomier than projected in October, citing the impact of tightening monetary policy triggered by persistently high and broad-based inflation, weak growth momentum in China, and ongoing supply disruptions and food insecurity as a result of Russia’s invasion of Ukraine..

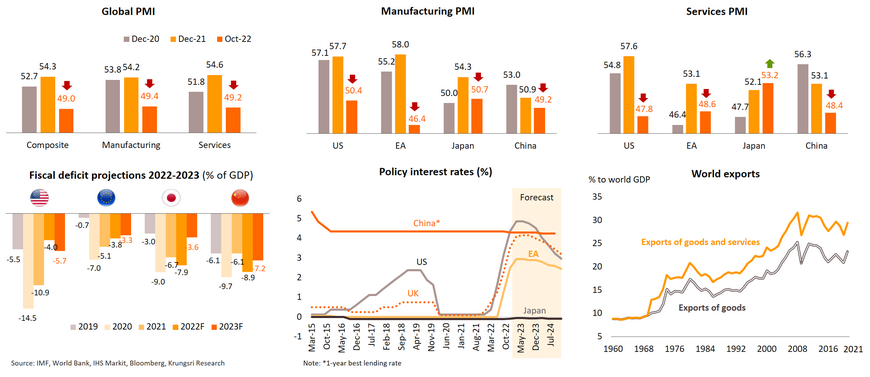

Signs of economic growth decelerating amid unwinding stimulus and tightening monetary policies; deglobalization is imminent given lingering geopolitical conflicts

Global economic activities in both manufacturing and services sectors have slowed down substantially. Easing supply disruption and relaxation of covid containment measures would help to improve activity in some countries but it is unlikely to boost overall global growth. Looking ahead, pent-up demand in advanced economies is fading. Also, global demand and production would be pressured by spillover effects of the extended Russia-Ukraine war, energy crisis, unwinding covid stimulus, and higher interest rates worldwide. Deglobalization is imminent given the physical war, sanctions, tech war, and intensifying geopolitical tension, including risk of US-China decoupling.

Conflicts between the US and China are fragmented through several channels, heightening risks to trade, inflation, economic growth and financial markets

US: Clearer signs of economic slowdown with risk of recession and debt ceiling standoff in 2023; tight labor market could put upward pressure on wages and prices

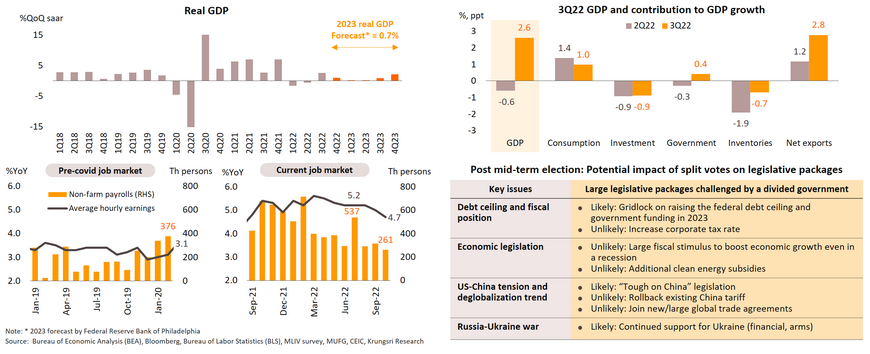

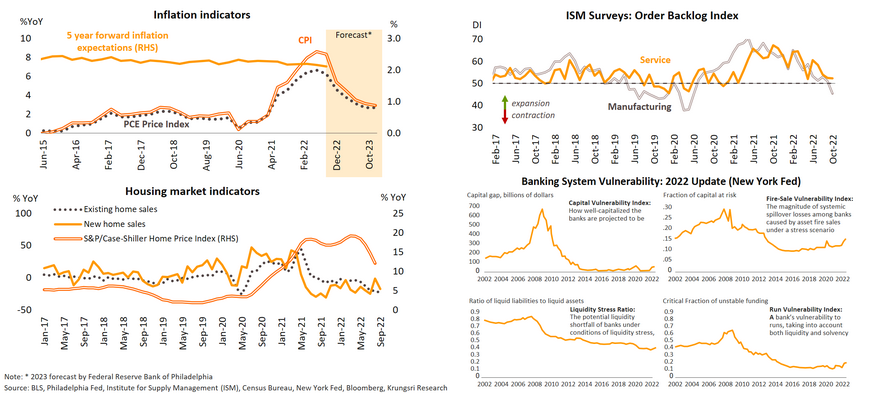

US economic growth rebounded to +2.6% QoQ saar in 3Q22 after two quarters of modest contraction, but it was mainly boosted by large contribution from net exports, which is not sustainable. More importantly, in 3Q, consumer spending posted the second-lowest growth during the pandemic recovery period and business investment contracted amid rising interest rates. Looking ahead, US economic growth is projected to decelerate to only 0.7% in 2023 from 1.9% in 2022, with higher risk of recession in 2H23. In addition to fading reopening effects and waning stimulus measures, the sharply higher and high interest rates in 2023 would have knock-on effects on financial markets, wealth, consumer spending and business investment. Slowing global growth would also weigh on US exports. After the mid-term election, given a split Congress, the biggest risk is a debt ceiling standoff, said the MLIV survey. 63% of retail investors and a still-large 48% of professional investors think a debt standoff will be as bad or worse than the one in 2011, according to Bloomberg. For the labor market, job growth has started to slow and could turn negative in 2023 due to a weaker outlook for economic conditions and a correction in the housing market. However, the labor market remains tight, which could put upward pressure on wages and prices in the near future.

Expect Fed to continue to hike rates but at a slower pace; interest rates should remain high throughout 2023 but the US is unlikely to experience a deep recession

Upward pressure on wage and prices amid economic expansion and rising domestic spending would prompt the US FOMC to raise interest rates further to prevent entrenched inflation. We expect the Fed funds rate to rise to around 5% by end-1Q23 and to stay at that level the rest of 2023. Pace of rate hikes is likely to be less aggressive from now on given signs of recession and easing inflation. Headline inflation is expected to drop below 4% in 2Q23 but it is unlikely to reach the Fed’s 2% target by end-2023. On recession risks, there are more negative signs such as a drop in the Order Backlog Index to contraction zone and a sharp fall in both new and existing home sales, which could have negative spillover effects on other sectors. However, there is minimal risk of a deep recession in the US because: (i) consumption remains robust with steady real wage growth despite higher inflation as consumer prices had risen by 15% from pre-pandemic level but wages have increased by 14% in the same period, almost matching inflation. Wages of non-supervisory workers (over 80% of labor force) also rose by 16%. (ii) Household net wealth is 30% higher than pre-pandemic level; and (iii) banking sector remains resilient, indicated by Banking System Vulnerability index, which showed the low vulnerability of the banking system despite the recent increase. Overall, although it is difficult to avoid a recession, those factors could be a cushion against shocks.

Eurozone: Risk of deep recession as indicators suggest downturn will worsen in early 2023 and price cap measure would exacerbate the situation

Core inflation is projected to stay above the ECB’s target in 2023 and could prompt the central bank to keep hiking rates despite rising risk of recession

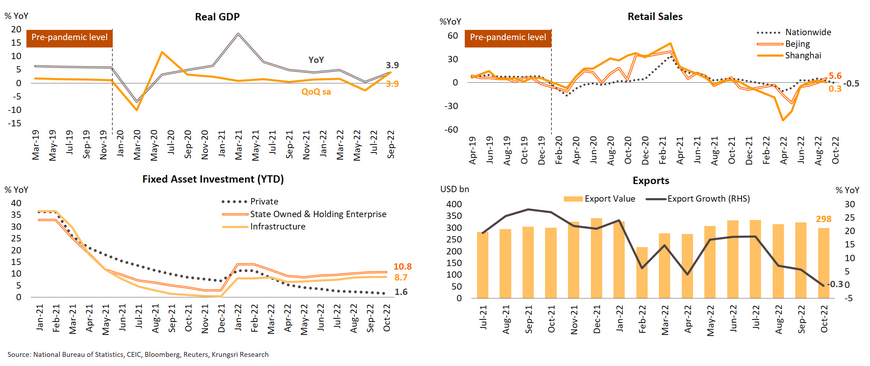

China: Sporadic surge in Covid-19 cases will hamper economic recovery; growth trajectory will depend on a significant shift in its Zero-Covid policy and government spending

The Chinese economy grew faster than expected in Q3, thanks to a rebound in consumer spending and a steady increase in public investment. However, this positive trend might not be sustainable as new Covid-19 cases has been rising since October to a 6-month high in November. The lockdown in major cities had reduced retail sales by 0.5% YoY in October. Other major economic engines show no apparent signs of improvement: (i) private investment has been growing at a slower pace since March and is likely to remain weak in 2023 given the struggling property sector; (ii) exports fell 0.3% YoY in October, and we project sluggish growth in 2023 premised on weakening global demand. We still expect China to relax its Zero-Covid policy by spring (2Q23), implying there would not be a sustainable recovery in household consumption until 2H23. The government recently signaled a gradual shift by refining its Covid-19 rules, including shorter quarantine period for the close-contact group, limiting the number of people affected by stringent mobility restrictions, and suspending daily mass testing in many districts. In addition, there are plans to increase infrastructure spending in the next few years, especially in crucial areas such as renewable energy, transportation, and data centers. Therefore, economic growth will improve in 2H23 and be fueled primarily by domestic consumption and public investment, albeit slower than pre-pandemic levels.

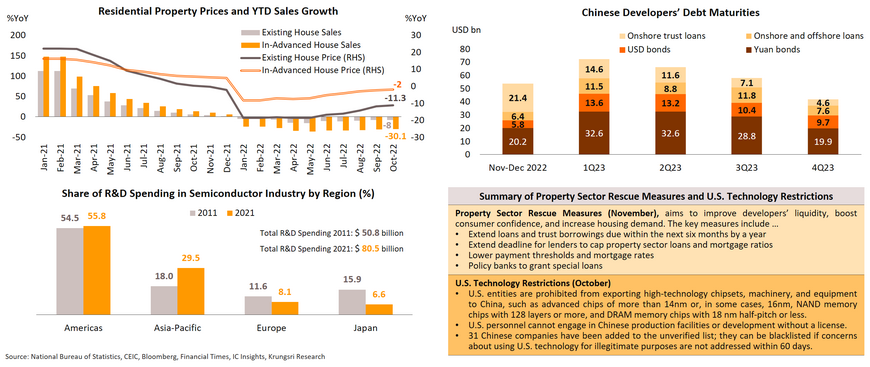

However, medium-term economic growth will be constrained by a fragile real estate sector and high-technology restrictions

Even with the easing Zero-Covid policy, economic growth in the next few years will not match pre-pandemic level because of the property slump and high-technology restrictions. In the property sector, housing sales and prices have been falling since January. With declining revenues and a $238 billion debt maturing next year, developers’ ability to repay remain constrained. Thus, new rescue packages are recently issued to improve their liquidity. We expect these measures to delay a property sector meltdown in the short term, but the medium-term impact on economic growth remains worrying. Furthermore, the Chinese semiconductor industry still relies heavily on U.S. high technology. In 2021, U.S. firms dominated 46.3% of the global and 49.9% of the Chinese semiconductor market. R&D spending by American firms also remain by far the highest in the world at 55.8%. Thus, U.S. restrictions on high-technology exports will harm China’s competitiveness in this industry. In the short term, we expect sales of U.S. and Chinese high-technology companies to drop significantly while domestic sales of chip-making machines would rise temporarily. However, according to Bernstein, domestic suppliers can only meet 15% of Chinese chipmakers demand this year. In the medium term, Chinese companies will find it increasingly challenging to achieve a technological breakthrough. We also expect a slowdown in investments in chip-making tools due to a lack of some irreplaceable U.S. tools and domestic suppliers’ technology lagging behind their U.S. counterparts. According to Jefferies, China will invest $18 billion in chip-making equipment in 2024, down from the $26 billion previous forecast. Overall, Barclays estimated the restrictions could cost up to 0.6% of China’s GDP and will rise to 3% if lower-end semiconductors and other countries’ supplies are entangled.

Japan: Expect moderate growth but larger downside risk due to worsening global economic condition, but healthy consumption should prevent a deep downturn

2023 projection: No policy shift as inflation would slow down again because of rising risk of a global recession

Thailand: Krungsri Research Forecasts for 2022-2023

Thailand: Recovery is underway but there are hurdles

- Key drivers would be recovering tourism, growing household spending, rising investment, and improving employment. Rising external headwinds, tighter financial conditions, and unwinding policy supports will limit growth of economic activity.

- Tourism is the key engine to drive economic growth and continues to recover, albeit still weaker than pre-pandemic level

- Overall consumption could grow modestly following improving employment; spending by low-income earners is still weak

- Business investment would be lifted by the recovery in domestic activity and FDI inflows despite pressure from slower exports

- Thai exports would decelerate along with the global economic slowdown but the impact could be less than peers

- MPC will raise policy rate gradually given early phase of economic recovery and easing of inflationary pressure

- Risks & Challenges: Extended Russia-Ukraine crisis, tighter-than-expected financial conditions, uncertainty over Covid-19 policy and property crisis in China, risk of tech war amid rising geopolitical tension, and domestic political risk

2023 Outlook: Economic activity is likely to exceed pre-pandemic level in 2023 but recovery is still in the early phase

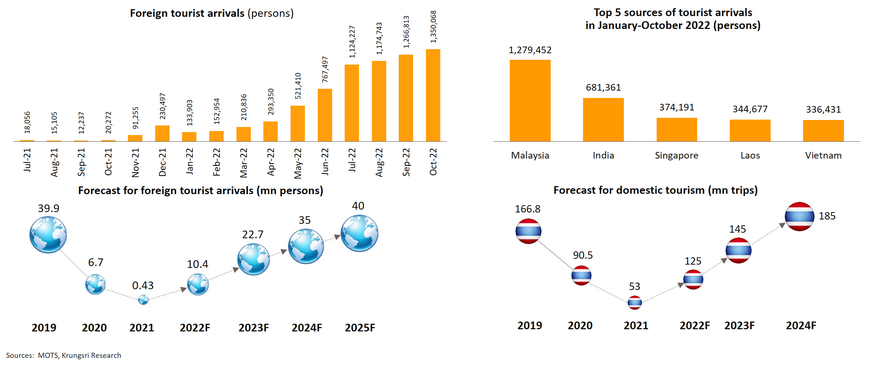

Tourism: Key economic growth engine continues to recover but is still below pre-pandemic level

Tourism sector has been gaining momentum. Foreign tourist arrivals had reached 46,000 per day by late October and reached 1.35 mn in the month. In the first 10 months of this year, it reached 7.04 mn and generated THB254 bn in tourism receipts vs THB1.9 trn in 2019 (pre-pandemic). This was led by tourists from Malaysia, India, Singapore, Laos, and Vietnam. For the rest of this year, foreign tourist arrivals is expected to continue to rise driven by the peak tourist season. It is projected to rise to 10.4 mn this year and to 22.7 mn in 2023, bolstered by reopening of most countries and pent-up demand for tourism after almost 3-year lockdown. The strongest improvements would be seen in short-haul destinations in Asian countries. Chinese tourists would start to return from mid-2023. Within Thailand, domestic tourism activity will continue to improve to reach 125 mn trips in 2022 and 145 mn trips in 2023. It is projected to exceed pre-pandemic level in 2024, a year before inbound tourism.

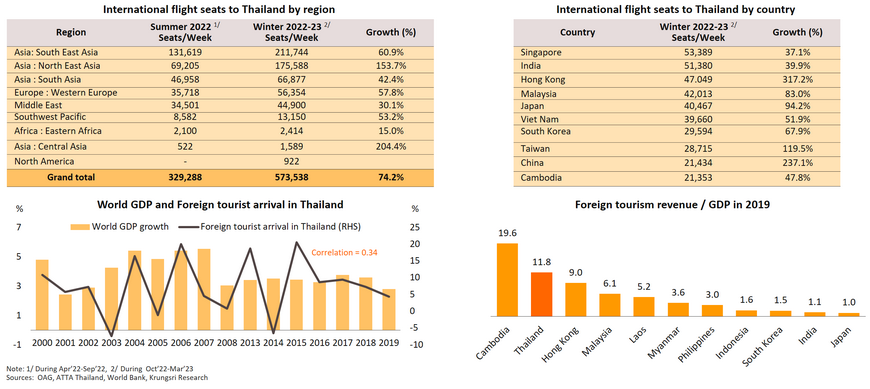

Higher flight capacity to Thailand suggests more foreign tourists ahead, bucking the slowing global growth trend

Data from the OAG projects weekly average flight seats to Thailand during winter 2022-2023 (Oct 2022-Mar 2023) would be 70% higher than during summer 2022 (Apr-Sep 2022). Most passengers would be from Asian countries. Departure flights from Singapore and India marked the biggest seat capacity. In addition, historical data show low correlation (0.34) between global economic growth and foreign tourist arrivals, suggesting slower economic growth in 2023 would have only a small impact on foreign tourist arrivals in Thailand. In 2019 (pre-pandemic), foreign tourist receipts reached almost 12% of GDP; which is high in Asia and suggests the Thai economy would benefit more than other Asian countries from a recovery in tourism.

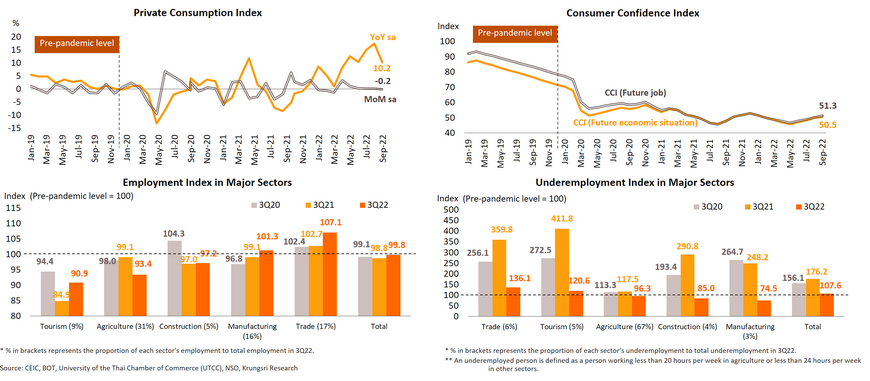

Consumption is projected to rise as employment in major sectors continue to recover

Private consumption is showing signs of improvement. The Private Consumption Index (PCI) has increased sharply year-on-year since the beginning of this year, though the month-on-month change has been relatively small, averaging only 0.25%. The Consumer Confidence Index (CCI) has risen for four months in a row, reflecting rising optimism about the economy and job market despite both being far below pre-pandemic levels. Most major sectors are registering more hiring, noticeably in wholesale/retail trade and manufacturing. The underemployment indices in 3Q22 are 2 to 4 times below their peaks during the height of the pandemic, suggesting income will improve. Given the country's full reopening since July this year, we project a further recovery in the labor market, especially in tourism and related sectors, which will be the key driver of consumption growth next year.

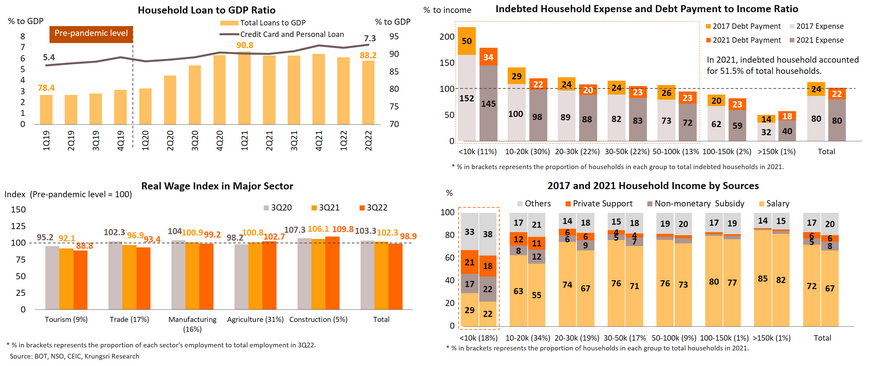

However, consumption by low-income households will be capped by high debt burden, rising interest rates, declining real wages, and reduced government support

Since the first wave of COVID-19 outbreaks in 2Q20, household debt to GDP ratio has surged to a high of 90.8% in 1Q21. Credit card and personal loans to GDP ratio has also risen, reaching 7.3% in 2Q22 compared to pre-pandemic average of 5.7%. Indebted households earning below 50,000 baht per month will find it difficult to repay debts as their expenses plus debt repayment would exceed their income, and interest rates have been rising with more rate hikes expected next year. Furthermore, real wage in most major sectors has dropped below pre-pandemic level in 3Q22. Poor households also rely more on non-monetary government subsidies (e.g., the 50-50 co-payment scheme, subsidies for water and electricity bills) than during the pre-COVID-19 period. Therefore, the anticipated reductions in government assistance will limit spending by low-income households, especially those earning less than 10,000 baht per month.

Investment is projected to rise driven by improving tourism and economic activities, but could be pressured by a slowdown in the export sector

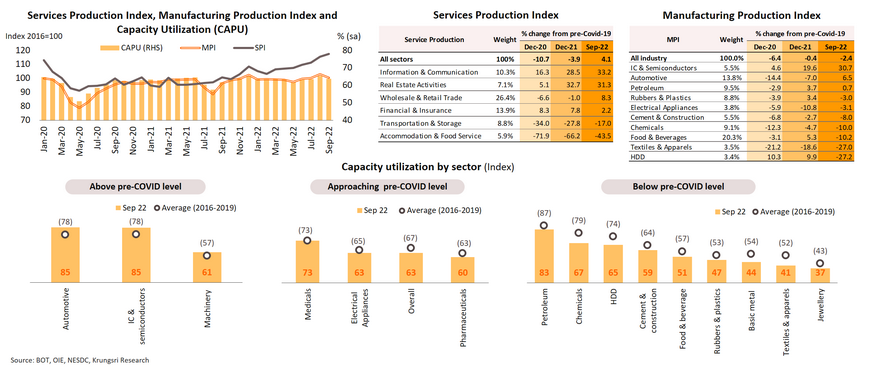

In the coming period, investment would be boosted by a recovery in tourism and domestic economic activities. September Service Production Index is 4.1% above 2019 (pre-Covid) level led by information and communication industries, real estate activities, and wholesale & retail trade. September Manufacturing Production Index (MPI) is 2.4% below pre-Covid level, but some industries such as IC & semiconductor producers and automakers, have continued to recover. Likewise, production capacity utilization rate has improved; that in automotive, IC & semiconductor, and machinery industries have exceeded pre-Covid levels. Capacity utilization in the medical, electrical appliance, and pharmaceutical industries have recovered to near pre-pandemic levels. Likewise, firmer domestic demand and recovering tourism activity will boost capacity utilization further and increase investment in these industries and business sectors. Nevertheless, slowing export growth attributed to trading partners’ weak economies and rising financial costs weigh on private investment growth.

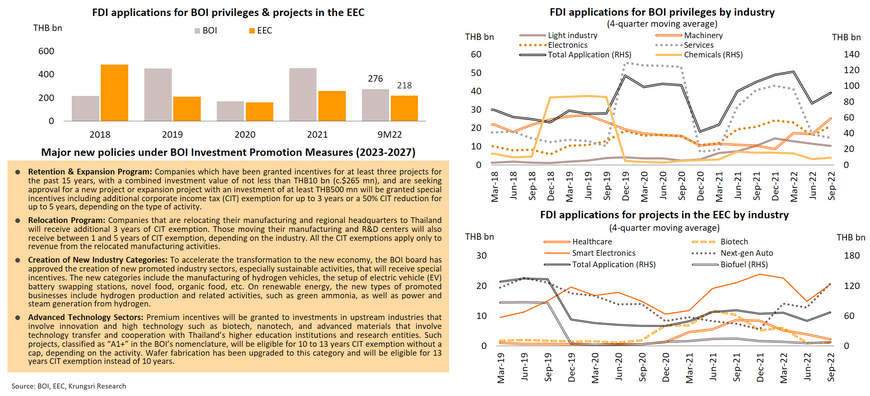

FDI inflow into target industries in the EEC is picking up, notably in next-gen automotive and smart electronics industries

A growing post-pandemic economy and industrial technology transformation will help to attract more investment into Thailand. In 9M22, FDI applications for BOI incentives reached THB 275.7bn; this contracted 24.7% YoY but the figure for Q3 is above the 5-year average. In the period, the biggest investors in Thailand were China (THB 45.0bn), Taiwan (THB 39.3bn), and Japan (THB 37.6bn). Most of the investments from China and Taiwan went to the manufacture of EVs, electrical appliances, and electronics. Within the EEC, FDI applications reached THB 218bn, up 4.9%, with the strongest growth seen in smart electronics and next-generation automotive industries. The BOI has announced a new 5-year investment promotion scheme for 2023-2027 that will include existing measures and new incentives to attract more foreign investment into Thailand.

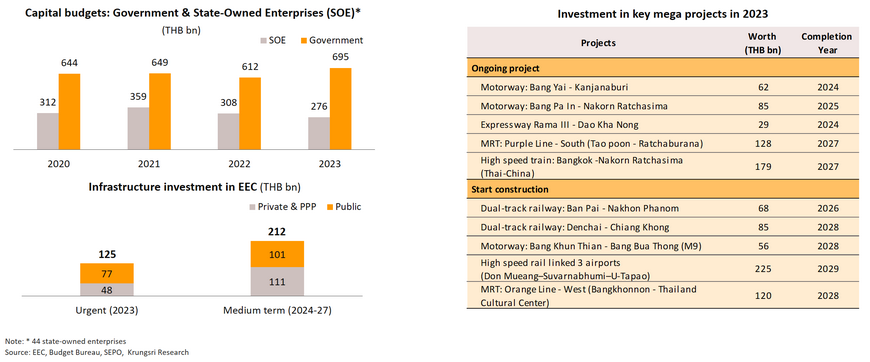

Ongoing public-sector spending on infrastructure will also help to power the economy but progress in many projects remain uncertain

For 2023, central government’s allocation for infrastructure spending will rise by 13.6% to THB 695bn. Although investment by state enterprises will drop 10.2% to THB 276bn, overall investment by the public sector will be 5.6% higher from a year earlier. In addition, the urgent action plan for the construction of infrastructure and utilities in the EEC (start in 2023) aims to speed up economic development in the area by allocating THB 125bn for work on 29 projects. Of this,7 private or private-public partnership (PPP) projects carry a total bill of THB 48bn. Over the medium term (2024-2027), work will be undertaken on additional 48 projects with a total value of THB 212bn, of which 9 are private or PPP projects worth THB 111bn. Public and Private investments are expected to rise in 2023 for ongoing major infrastructure projects, including the high-speed railway (Bangkok-Nakhon Ratchasima), Bang Pa-In-Nakhon Ratchasima and Bang Yai-Kanchanaburi motorways, and the Rama III-Dao Khanong Expressway. In addition, work will begin on some megaprojects in 2023 but initial expenditures on these new projects will be low, mainly for making compulsory purchase orders and preparing the sites. It also remains to be seen how political developments after the 2023 election will affect the business environment; the new government might change it’s the infrastructure spending policy.

Exports: Recovery in domestic activity is gaining traction but more pronounced slowdown in the global economy could rein in Thai exports

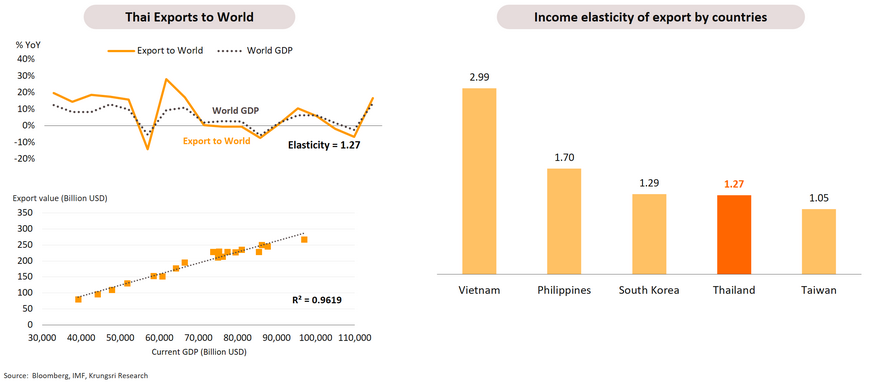

Thai export growth is projected to decelerate along with an expected slowdown in global economy and trade; Thai exports is less sensitive to global growth than peers

With the income elasticity of demand for Thai exports at 1.27, that means a 1% drop in global GDP would reduce Thailand's exports by 1.27%. The income elasticity of demand for Thailand’s exports is lower than for several of other countries in the region such as Vietnam (2.99), Philippines (1.70), and South Korea (1.29).

Thai exports to major advance economies, especially the US and Eurozone, will slow down further; growth opportunity has shifted to ASEAN market

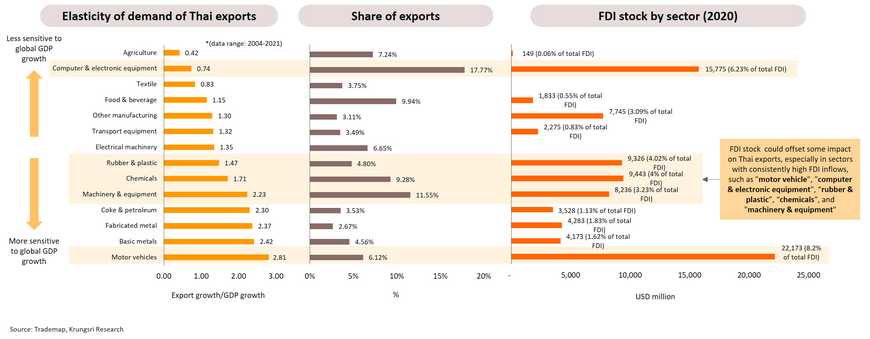

Exports by some key sectors less sensitive to global slowdown due to low elasticity and substitution effect; downside risk to exports in some sectors could be limited by FDI

Thai exports of "motor vehicles“, "basic metals", fabricated metal", “coke & petroleum", and "machinery & equipment" register the highest elasticity (more than 2) to global GDP. 2023 would be a difficult year for these sectors amid worsening economic conditions in major export markets, especially the U.S. and Europe. On the other hand, exports of "agriculture“ and "computer & electronic equipment“ are less sensitive to global GDP growth given relatively low elasticity index of less than 1; this mean a global slowdown would have smaller impact on these sectors. Some of these products could be substitutes for products blocked by Russia's war. In addition, the negative impact of a global slowdown on Thai exports could be mitigated by Foreign Direct Investment (FDI), especially into “motor vehicles" and “computer & electronic equipment”.

Fiscal stimulus: Smaller stimulus but still conducive to support economic recovery

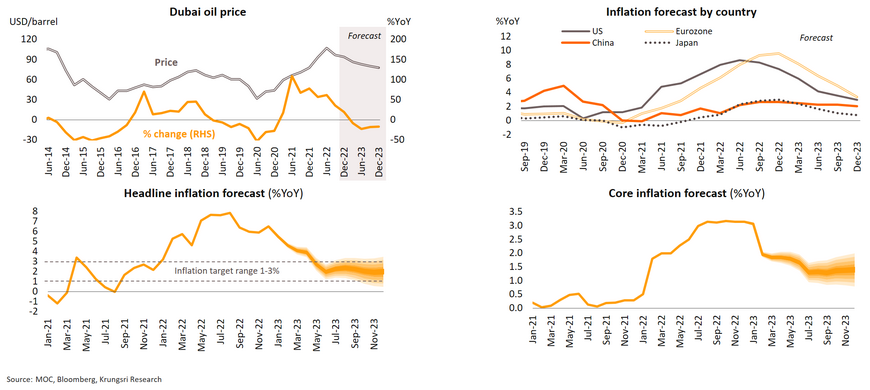

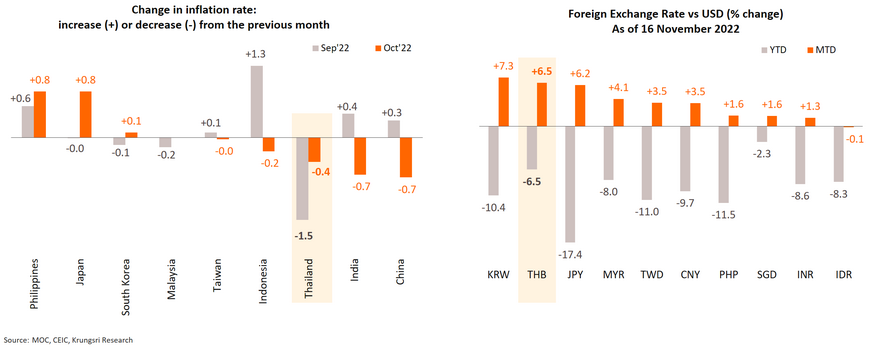

Headline inflation would ease to official target range by mid-2023 and possibly drop below 2% by 4Q23

Headline inflation is expected to ease from an estimated 6% in 2022 to an average of 2.5% in 2023, premised an expectations of a year-on-year drop in global crude oil and other commodity prices triggered by a global economic slowdown as advanced economies’ (particularly the US and Eurozone) tighten monetary policies to contain skyrocketing inflation. Bloomberg forecasts inflation in the US and Eurozone would remain high at 4.2% and 5.7%, respectively, in 2023, exceeding their central banks’ 2% inflation targets. Unlike advanced economies, inflation in Thailand is expected to return to the 1-3% official target range by mid-2023 and stay close to the median inflation target range in 2H23 given softening commodity prices, weak demand-pull pressure, and limited wage pressure. However, headline inflation might not drop much as gains from lower global crude prices would be used to finance the mounting debt in the state Oil Fuel Fund created by a huge subsidy to control domestic fuel prices. So in 2023, domestic fuel prices would drop slower than global crude prices. Given recovering domestic activity, core inflation is expected to stay above 3% in 4Q22 and fall gradually to below 3% from 2Q23 onwards as cost-push pressures ease.

Pace of policy rate hikes likely to be milder than peers given Thai economic recovery is still in the early phase and inflation pressure is easing

Krungsri Research expects the Thai Monetary Policy Committee (MPC) to normalize monetary policy by gradually raising policy rate as economic activity recovers from the Covid-19 crisis. Nonetheless, the implementation of monetary policy to contain inflation is likely to be milder than peers for the following reasons: (i) Thai inflation had passed its peak in 3Q22 and is showing signs of slowing since 4Q22. In addition, it is projected to return to the official inflation target range of 1-3% by mid-2023. Meanwhile, the depreciating local currency is having less pressure on inflation as the US dollar had weakened in November on expectations of slower rate hikes by the US Fed; (ii) Thailand’s tourism sector will take time before recovering to pre-pandemic level; (iii) the Thai economy is in the early phase of post-pandemic recovery; and (iv) external headwinds could heighten in 2023 as the global economy is projected to slow down and advanced economies face recession risks. For these reasons, we expect the MPC to raise policy interest rate gradually, by 25bps each, at the next few meetings to reach 1.75% by end-1Q23 and keep it there throughout the rest of 2023.

Risks & Challenges

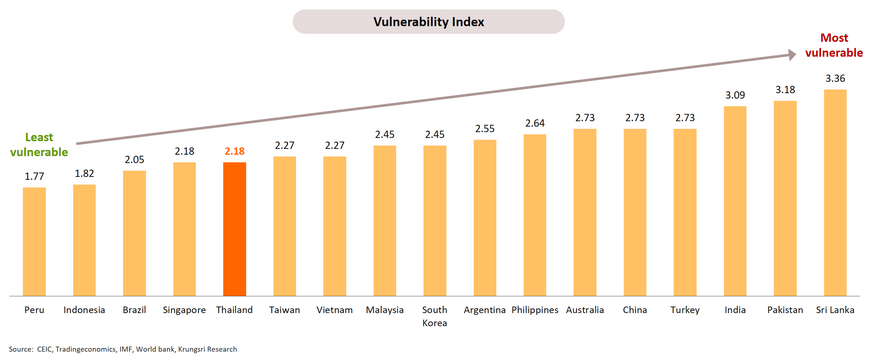

Vulnerability heat-map score: Most of the selected Asia economies are relatively resilient to new shocks than other EMs, due to less severe inflation and high FX reserves

Vulnerability index: Other EMs are highly vulnerable to external shocks because of high debt and severe inflation

To gauge the vulnerability of selected Asia economies to external shocks, we analyzed several economic indicators, including “FX reserves to GDP”, “FX reserves to short-term debt”, “Current account to GDP”, “Public debt to GDP”, “Budget balance to GDP”, “Trade in service to GDP”, “FDI to GDP”, “FPI to GDP”, “Banks’ capital adequacy ratio”, “Real policy rate ”, and “short-term yield spread to the US”. The aggregate scores will determine the vulnerability of each country. Our analysis shows Indonesia, Singapore, Thailand, Taiwan, Vietnam, Malaysia and South Korea are less vulnerable than Argentina, Philippines, Australia and China. The most vulnerable are countries stuck with high debt, huge outflows and severe inflation such as Sri Lanka, Pakistan, India and Turkey.

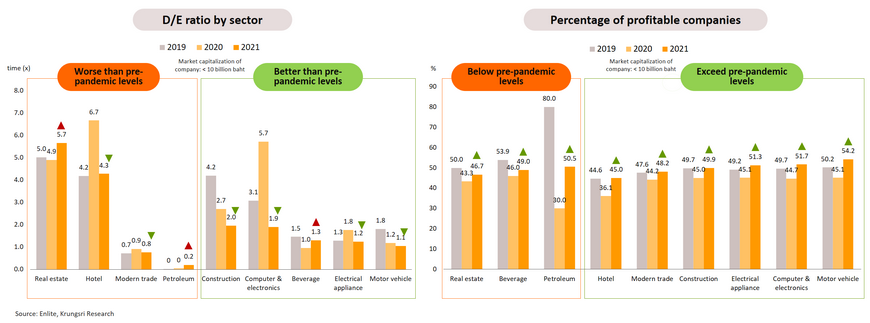

Financial stability of Thai SMEs: Activity in most sectors have improved but several continue to struggle to recover; companies with high gearing are exposed to interest rate risk

Our analysis shows Thai SMEs in Hotel, Modern Trade, Construction, Computer & Electronics, Electrical Appliance, and Motor Vehicle sectors which size is below 10 billion baht, are showing healthier balance sheets (lower D/E ratio) and a larger share of them are profitable. However, almost half of them are still struggling to recover to pre-pandemic level. Meanwhile, sectors that are clear laggards in both measures are Real Estate and Petroleum. In conclusion, Motor Vehicle, Computer & Electronics, Electrical Appliance and Construction sectors would be able to weather new shocks and high borrowing cost in 2023 better than Hotel and Modern Trade sectors. The Real Estate sector is the most fragile as they continue to lag in both indicators.

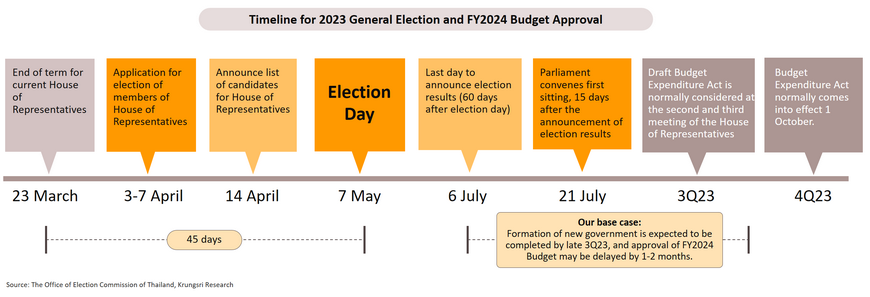

Thailand political uncertainty: Delays in forming government and economic policy implementation could lead to weaker-than-expected economic growth

Thailand is scheduled to hold a general election in 2023 but the political situation is uncertain and might affect economic growth. The Election Commission (EC) has set the next general election to be held on May 7, 2023. Our base case assumption is the current government will remain in office until its term ends on March 23, 2023. However, there are concerns political conflict could delay the formation of a new government, and consequently, delay the implementation of economic policies and approval of the fiscal budget for FY2024 (normally scheduled to be completed by August and to start budget disbursement in October) by up to two months. As soon as the House of Representatives is dissolved, the EC must hold a general election within 60 days but not less than 45 days after the executive decree endorsing the dissolution. However, if political conflict intensifies and delays the formation of a government, it could undermine confidence. In this case, Thailand’s economic growth would be slower than expected.