Global: Small steps towards normalization

As major countries wind down crisis stimulus programs and pent-up demand drop, global growth will decelerate but remain above-trend

Global activities have recovered past pre-COVID levels led by major countries; services sector will play a greater role in boosting growth

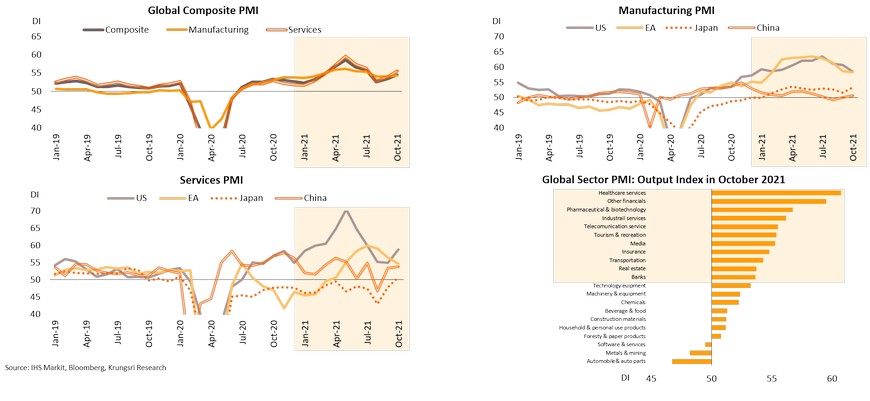

Global manufacturing and services activities have improved compared to end-2020 and end-2019. Growth in the US and Eurozone has slowed down due to supply-side problems and fading reopening effects, but activities remain above pre-COVID-19 levels. China and Japan also saw signs of picking up in late 2021. Global Sector PMI data indicate output in most sectors are still in expansion territory (PMI above-50). The top 10 fastest-growing industries are in the services sectors. Looking ahead, rising vaccination rates, easing of lockdown measures, and resumption of economic activities in most countries, will be tailwinds to support further expansion of global economic activities.

Economic growth could slow on unwinding stimulus and fading reopening effects but rely more on real demand of private sector

The world’s major countries are unwinding their crisis stimulus programs in response to signs of economic recovery. They will continue to narrow their fiscal deficits and gradually normalize their monetary stimulus programs but with still-accommodative policies. Private sector will play a greater role in driving economic growth. Improving labor market will hold up private consumption and rising capacity utilization will encourage an expansion in business investment. Even though the global economic recovery could enter a slower and more difficult course, the next recovery phase should be firmer than the past few years.

US: Consumer demand and services sector to drive growth

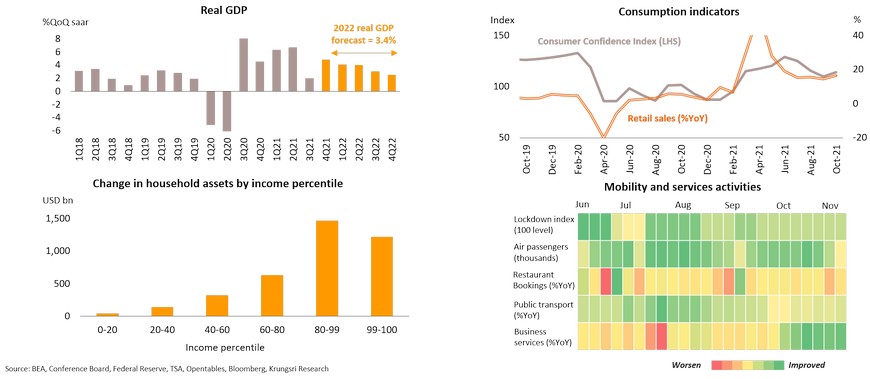

The US economic growth is projected to moderate in 2022 to 3.4% due to waning government stimulus and reopening effects. However, strong demand for goods and services suggests consumers could spur growth by digging into savings. Consumption has continued to recover with retail sales registering double-digit growth, at 16.3% YoY in October supported by both offline and online channels. Consumer Confidence Index is returning to pre-pandemic level following easing concerns over the delta variant. The USD3.8trn increase in household assets during the pandemic could strengthen purchasing power in 2022. Recovery will shift to the services sector as health concerns ease. Americans appear to be ready to spend on services. Lifting domestic restrictions have allowed people to spend more on hotel, restaurant and leisure activities, while relaxing international travel restrictions would improve airline and tourism activities in the US. Premised on easing restrictions, job market developments and improving purchasing power, we expect the US economy to be driven by consumption and rising spending in the services sector.

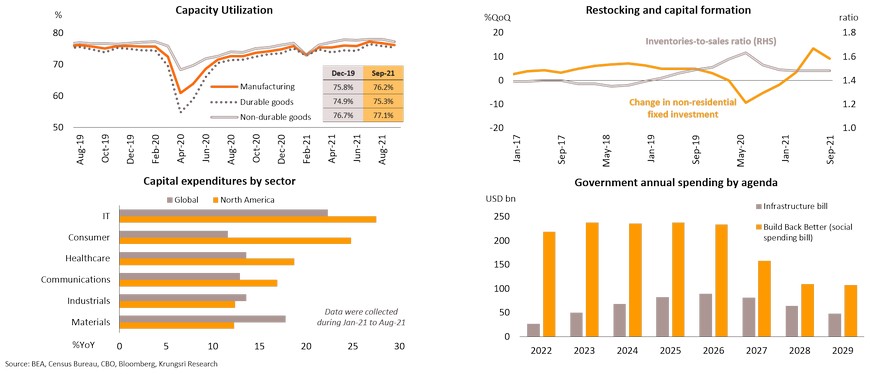

Businesses and government are entering next investment cycle

Private and public investments would also play important roles to support growth in 2022. Solid consumer demand and low interest rates would encourage business to invest when the pandemic impact fades. Supply bottlenecks triggered by COVID-19 suggests businesses will accelerate investment. Manufacturers will ramp-up production to pre-crisis levels by increasing capital utilization, while retailers are restocking as inventory-to-sales ratio have dropped. Corporate capital expenditures also show rising investment in IT equipment and software, consumer-related sectors, and healthcare. These are the critical sectors to improve productivity and drive economic activities. Similarly, the US government has passed the USD1.2trn infrastructure bill to refresh transportation, utility and broadband. Disbursements would start in 2022 and peak in the next 4 years. That would generate millions of jobs and lift sentiment, especially in the industrial sector. Furthermore, Congress would approve the USD 1.75trn social safety and climate policy bill which might spur a wave of investment in environmental-friendly and alternative energy sectors.

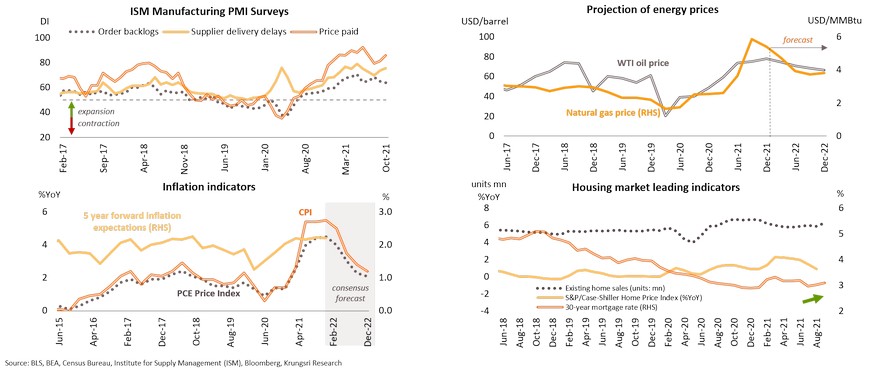

US will continue to experience supply constraints and rising inflation in 2022 but they will dissipate

Strong consumer demand in the US suggests supply constraints in the US would take time to resolve. Despite falling order backlogs, latest PMI sub-indices indicate lingering supply bottlenecks with longer delivery delays and prices continuing to escalate. Energy prices could continue to push up inflation to around 6% YoY in 1Q22 before easing, following softer oil and natural gas prices. Moreover, resumption of production and fewer COVID-19 cases could lead supply to catch up with demand, mitigate the material shortage and logistic problems. This is expected to pull-down inflation to the central bank’s target by year-end. Despite a shortage of homes for sale, we suspect house prices will cool down from recent highs in late-2021 as a tightening environment could push up mortgage rates in 2022. Looking ahead, the supply disruption could extend into 2022 but is unlikely to hit the economy as hard as in 2021, and could start to soften by the middle of 2022.

Despite ongoing labor shortage, employment will meet target by end-2022

Maximum employment and largely-transitory inflation point to tightening monetary policy soon

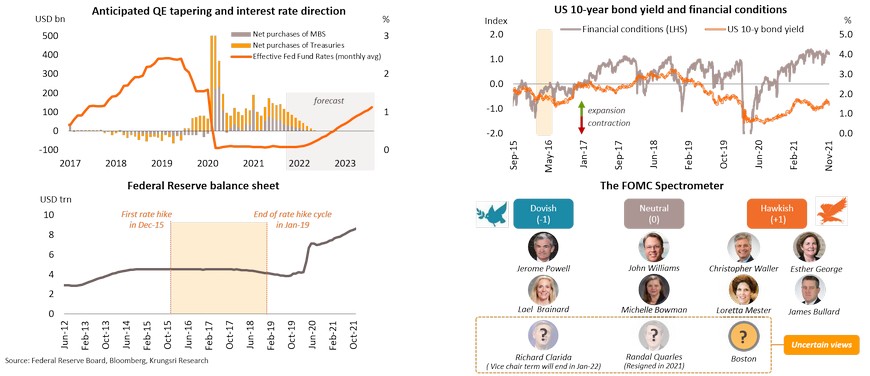

The Federal Reserve have reduced Treasury and MBS purchases by USD15bn per month since November but left the door open for adjustments depending on the direction of the economy. High inflation in early-2022 could force the Fed to reduce bond purchases faster to pave the way for rising interest rates. We expect the first-rate hike in 2H22, at least 25 bps, sooner than half of FOMC members’ expectations for 2023, due to price pressures and a recovering labor market. As the Fed near a rate hike decision, concerns over tightening financial conditions and liquidity would pile up. Historical data show that financial conditions near rate hikes tighten in the early stages but would finally return to expansion territory. Meanwhile, the Fed’s balance sheet is unchanged, reflecting the central bank’s efforts to maintain sufficient liquidity in the economy. The resignation of Randal Quarles and the end of Clarida’s Vice Chair term in January could give Biden two potential slots to fill. However, the FOMC spectrometer points to a more hawkish tone than in 2021, which could support a rate hike in 2022.

Current government will try to secure majority seats and influence developing economies

Europe: Private consumption and tourism sector will propel economic growth in 2022

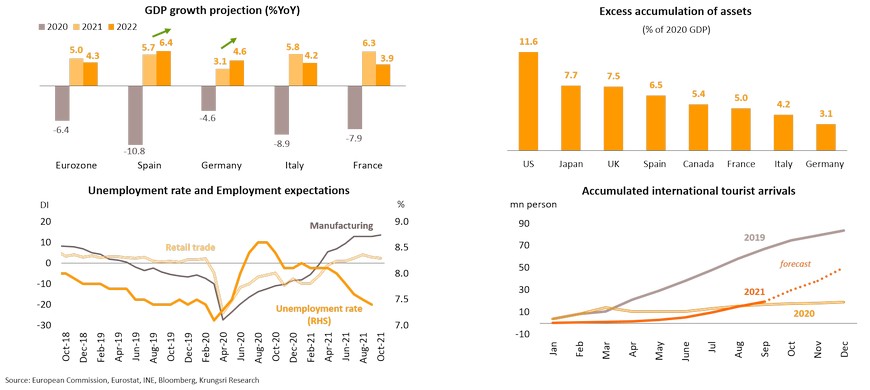

The Eurozone economy is projected to expand by 4.3% in 2022, a notch slower than 5.0% registered in the previous year, led by Spain and Germany. The key driver of the recovery would be private consumption as demand for goods and services could accelerate along with waning pandemic impact. Savings could also drive economic growth, especially in the UK and Spain. Despite labor shortage, the labor market has recovered to near pre-pandemic levels. After the furlough program ended, companies reported workers have started to return to work, suggesting purchasing power will improve. The tourism sector is heating up driven by country reopening while inbound tourism has been gathering momentum in recent months. The Spanish government forecasts tourism would recover to more than 60% of pre-crisis level in 1Q22. Hence, we expect the eurozone economy to deliver another year of sound economic growth.

Strong business sentiment suggests improving investment ahead, Recovery Fund will boost growth

The improving business sentiment indicates firms are optimistic of investing in the period ahead. Business Confidence Index rose to 118.6 in October, exceeding pre-pandemic level of 104. Despite a blip in Manufacturing and Non-Manufacturing PMI data, the indices remain above pre-crisis level and in expansion territory (above-50). Looking at new investment, gross capital formation has ramped up since 1Q21 while profits have also risen. Moreover, authorities plan to utilize grants and loans from the Recovery & Resilient Facility worth a total of EUR723.8bn during 2021-2026. The major countries - Spain, Italy and France,- have received up to 10% of the total allocation in 2021, so they will start to disburse and include these funds in national investment plans. Besides, the EU is deploying the Global Gateway strategy to encourage domestic investment and improve global connectivity. The projects would differ by area but will focus on transportation, digital and green initiatives. The imminent fund inflows could support the bloc’s economic growth and the EU’s role on the global stage.

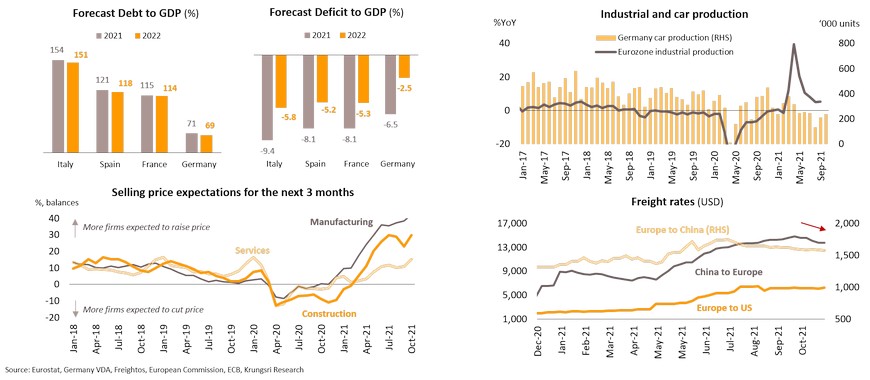

Not time to consider fiscal rules; chip shortage and transportation delays will be less severe in 2H22

Premised on higher level of investments in the medium term, European governments will continue to run deficit plans and have less concerns over public debt. The fiscal rules would not be a critical issue in 2022, but the end of the flexible era in 2023 might force some countries to reconsider their fiscal stance. Major headwinds in 2022 include supply disruptions which have been hurting production in the Eurozone since 2021, especially in Germany. Car makers will continue to struggle with parts and labor shortage. These problems could extend into 2022 as chipmakers are still catching up with demand induced by the pandemic. Hence, we expect more firms to raise selling prices in early-2022 to partly offset rising input costs. Meanwhile, there is improvement in transportation cost, reflected by declining freight rates since October 2021. Looking ahead, we expect the shortage problems, transportation delays, and high input costs, to become less severe in 2H22 premised larger manufacturing capacity and relaxation of pandemic restrictions at ports.

Despite rising inflation, ECB will not rush to implement tightening monetary policy

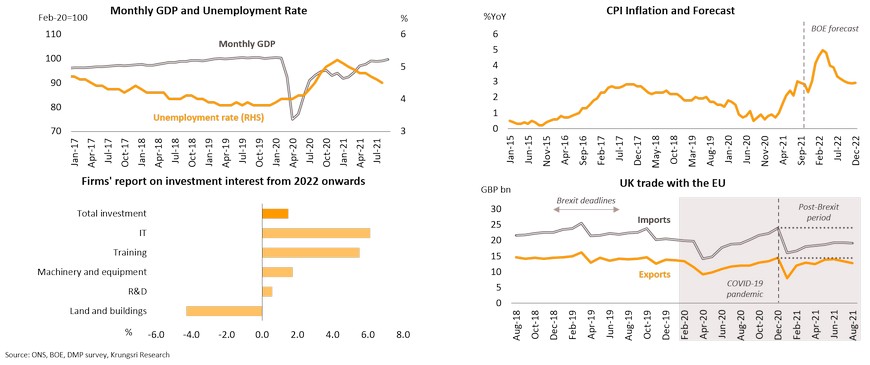

UK: Economy will lean on domestic factors; inflation concerns could force central bank to act

The UK economy registered a slow recovery in late-2021 because of waning reopening effects and withdrawal of fiscal measures. However, the strong rebound in 1H21 and further recovery could push the economy to reach pre-pandemic level by 1Q22. Solid demand for goods and services has caused inflation to surge since September 2021. This prompted the central bank to take a more hawkish stance. The BOE could lead major central banks in terms of hiking interest rates, as the expiry of furlough programs have been less disruptive than expected and there is growing concerns over inflation. The inflation rate is now expected to peak at around 5% in April 2022 and dissipate as energy price effects fade and supply & demand rebalances. UK businesses are now focusing on investing in the IT sector instead of land and buildings, and total investment could rise from 2022 onwards. This could support technology adoption and economic growth. On the international front, trade with EU countries has been declining since the end of the transition period. We expect bilateral trade to remain below pre-Brexit level and the risks could increase if the labor shortage is unresolved, suggesting economic growth in 2022 would be influenced by domestic factors.

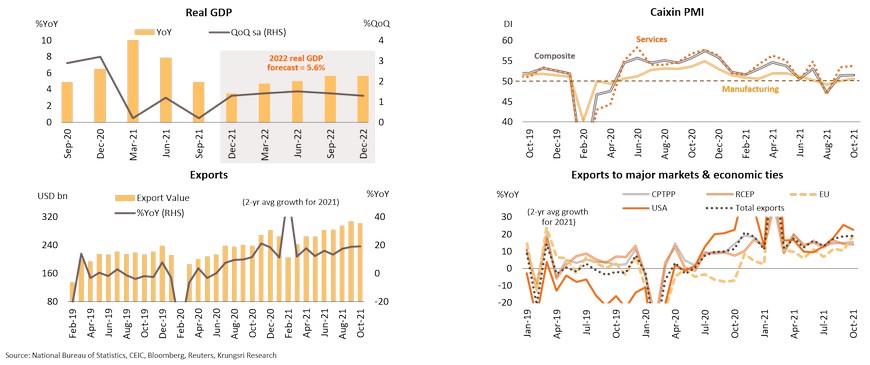

China: Pursuing slower economic expansion in return for better quality growth; export sector remains a key growth driver

The Chinese economy has continued to slow down partly because authorities are now focusing on long-term “quality growth” instead of high-growth. The deceleration in GDP growth to +0.2% QoQ in 3Q21 is attributed to regulatory crackdown to mitigate speculation and promote fair competition, as well as temporary factors including energy shortage and sporadic outbreaks. In 2022, the economy is expected to grow by 5.6%, slower than estimated 8.0% in 2021. However, it is expected that Chinese economy would unlikely experience a sharp slowdown given the recent improvement in economic activity. October’s Caixin Manufacturing and Services PMI data have picked up as China ramps-up electricity generation and managed to contain the epidemic, which softened the temporary disruption. In addition, export growth (2-year average growth to remove base-effect) reached an 8-month high in October. The export sector would remain a key growth driver in 2022 premised on a further recovery of the global economy and stronger economic ties with many countries, including through the RCEP (contribute 24.3% of Chinese exports) which will come into force in January 2022.

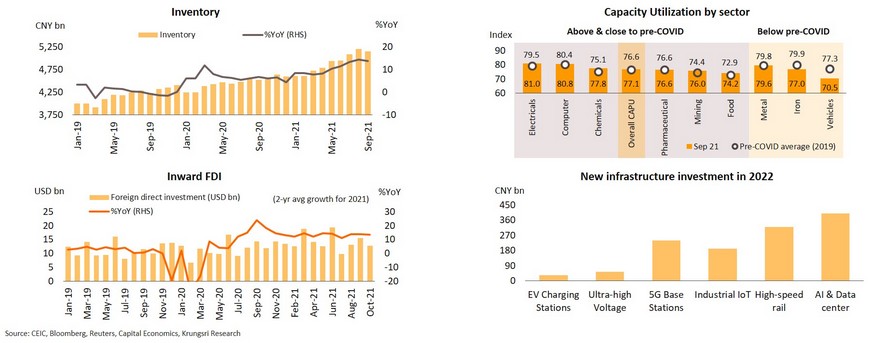

High inventory and slow property market will cap investment, but high CAPU, FDI, and new infrastructure projects will limit impact

Private investment growth in China since the pandemic has been affected by weak domestic demand, oversupply in old industries, and a slow property market. Manufacturers’ inventories hit record high in August. Liquidity issues in real estate developer Evergrande amid regulatory clampdowns to curb speculation could also limit new investment in property and related sectors. Evergrande’s problem has triggered fears of default risks (including CNY15.2bn interest payment due in 2022) but authorities have stepped up to help individuals & homebuyers, curb financial risks, and prevent a systemic collapse. Looking ahead, despite high inventory and a slow property market, there are several positive factors that would ease the impact on private investment growth. First, overall production capacity utilization rate (CAPU) has risen to its highest since the data was firstly published in 2013, at 78.4 in 2Q21. In several sectors, including electronics, computer and chemicals, September CAPU rates had exceeded 2019 (pre-pandemic) average. Second, foreign direct investment (FDI) has continued to rise. In the first 10 months of 2021, the 2-year average FDI growth was 13.3%, overtaking the 2019 (pre-COVID) average. Being the top destination for foreign investors would also support a recovery in private investment ahead. Third, the government is promoting new infrastructure investment worth CNY1.24trn in 2022 (2.3% of GDP) to develop/deploy cutting-edge technology, especially 5G, artificial intelligence, and big data, to enhance self-reliance and reinforce China’s competitiveness.

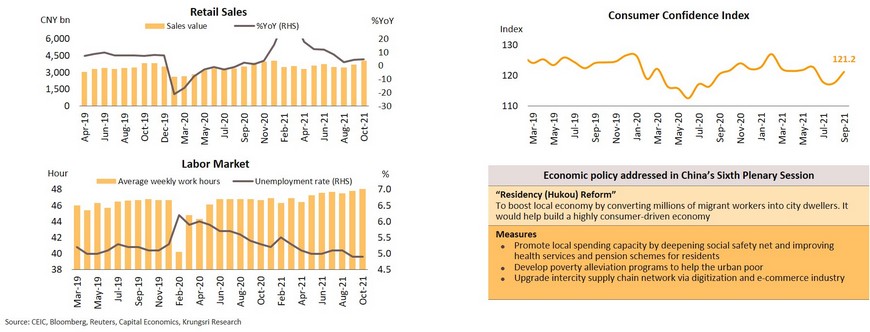

Household spending would expand at a moderate pace with fiscal supports that focus on inclusive growth

We project limited growth in private investment, but private spending could help to drive economic recovery going forward. Several indicators have showed signs of a stronger recovery. October retail sales reached a 10-month high and has been expanding since September 2020. Consumer confidence has also improved after temporary negative factors, especially electricity shortage and Delta-driven outbreak, unravel. In addition, the labor market has strengthened, with China reporting the lowest unemployment rate since December 2018 and average weekly working hours reaching a 4-year high in October. On fiscal supports, the government announced the “residency (Hukou) reform” at the 6th Plenary Session of Communist Party Central Committee in November 2021, to reduce expenses on healthcare services and pension contribution, which would in turn boost domestic demand and the local economy. This stimulus scheme underscores China’s effort to achieve its “common prosperity” goal. Given these positive signs and fiscal supports, household spending would continue to expand, albeit at a moderate pace. In addition, there will be both risk and opportunities for consumption. The COVID-zero stalwart may delay reopening and sporadic outbreaks could disrupt some economic activities. But recently, the National Health Commission revealed the government will allow mRNA vaccine from Cansino (a homegrown vaccine producer) and a vaccine jointly-developed by Fosun Pharma and Pfizer BioNTech as booster shots. The use of mRNA vaccines as a booster shot would increase vaccine efficacy and could be a turning point for the government to ease stringent containment measures, which would encourage domestic spending and allow China to reopen to international arrivals soon.

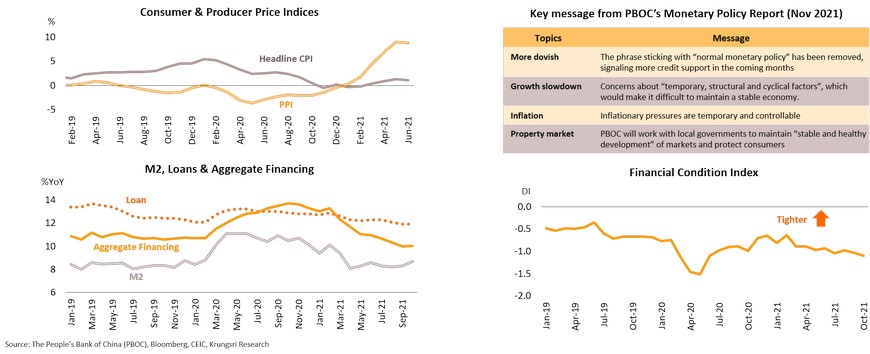

Limited inflation pressure would allow PBOC to employ targeted monetary easing to support growth, maintain cross-cyclical policy

COVID-19 and regulatory crackdowns have had adverse impacts on economic growth. This suggests the People’s Bank of China (PBOC) should keep its accommodative policy stance with targeted monetary easing, despite higher inflation. Headline and factory-gate inflation rates have passed their peaks and the broad-based impact of factory-gate inflation on consumer prices would be limited because downstream producers and retailers would help to absorb the pass-through effect. Authorities also employed measures to soften commodity price hikes. Limited inflationary pressure would also allow the PBOC to pursue monetary easing to support domestic demand going forward. The PBOC has recently signaled a more dovish tone by removing the phrase “normal monetary policy” and hinted at more credit support sooner. In response to a slower growth trajectory, the central bank will continue to employ the “cross-cyclical” approach through targeted monetary easing rather than “pro-cyclical” approach via broad-based monetary easing. M2 and Aggregate Financing have picked up in October, indicating more liquidity has been injected into the economy. Hence, financial conditions have eased. Looking ahead, the PBOC could employ more targeted monetary easing to avert a sharp economic slowdown, with the ongoing objective to achieve sustainable long-term economic growth.

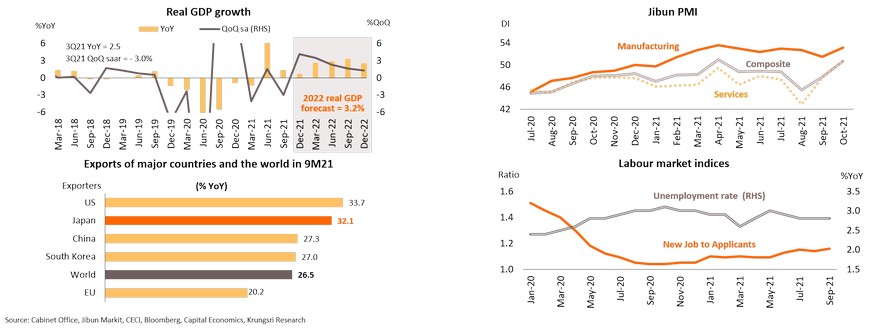

Japan: Growth to improve along with vaccination rate and global recovery, but still need policy supports to overcome hurdles

The economy was hit hard by the latest outbreak. 3Q21 GDP contracted 3.0% QoQ saar but it has started to show signs of recovery in 4Q21. In 2022, GDP is projected to grow by 3.2% compared an estimated 2.4% in 2021 and faster than 1.2% p.a. average growth in the past decade. GDP is expected to reach pre-pandemic level in 1Q22. Supporting factors are: (i) Progress in vaccination with 75.9% of the population fully-vaccinated, which would allow the country to ease containment measures and reopen to foreign tourists by 2Q22. Plans to relaunch “Go to Travel” scheme (expected February 2022) would also boost the services sector. In October, Services PMI reached expansion territory for the first time since January 2020. (ii) Easing supply constraints in ASEAN would improve manufacturing operations; Manufacturing PMI has risen to a 6-month high. (iii) Exports would continue to drive the economy given the global cyclical recovery. In the first 3 quarters of 2021, Japan’s export growth (+32.1%) outpaced that in other major countries and the global average. (iv) Recovering labor market, with jobs-to-applications ratio rising to a 17-month high. However, Japan's economy is in the early phase of recovery and still needs policy supports to ensure a sustainable recovery, given the following: (i) Japan could reopen to foreign tourists later than other major countries, which will continue to hurt Japan’s tourism and related-sectors; (ii) global supply constraints will not ease until at least mid-2022 which would cap manufacturing sector activity; and (iii) despite signs of improvement, the labor market is still weaker than pre-pandemic level, which would continue to cap purchasing power and consumer spending.

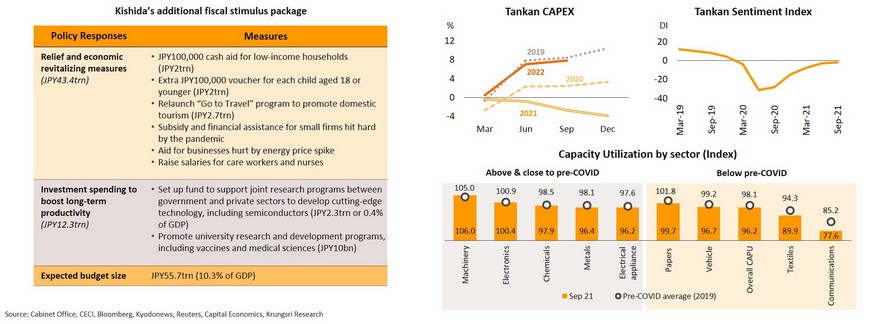

Additional stimulus measures would boost consumption in the near-term; business investment is picking up slowly

To ease the pandemic impact and drive the economy back on the path to recovery, the government has launched a new stimulus package. The JPY55.7trn package (10.3% of GDP) is larger than the previous pandemic stimulus package. Most of the measures are targeted at the middle- and low-income groups as well as small businesses, in response to the “new capitalism approach” proposed by the new government to reduce income inequality. Nonetheless, it is likely to include loans and recycle unspent funds from previous supplementary budgets, implying the fresh injection would be smaller than reported. Most of the budget will likely be allocated for short-term measures, at JPY43.4trn or 78% of the total package. The rest would be used to boost longer-term productivity. In the business sector, private investment is picking up. 3Q21 Tankan survey, which looks at proposed investment in the next year, reveals the business sector is poised to increase 2022 capital expenditure (CAPEX) budget to beyond 2020-2021 levels, and more importantly, to close to pre-pandemic (2019) level. Meanwhile, 3Q21 business sentiment index is at its highest since 4Q19. Capacity utilization rates in several sectors have exceeded or are close to their pre-pandemic levels, led by machinery, electronics and chemicals. Capacity utilization rates in other sectors are below pre-COVID levels as they continue to struggle with supply shortage and weak demand. Despite the uneven improvement, business investment is picking up and would be another growth driver to support recovery in 2022.

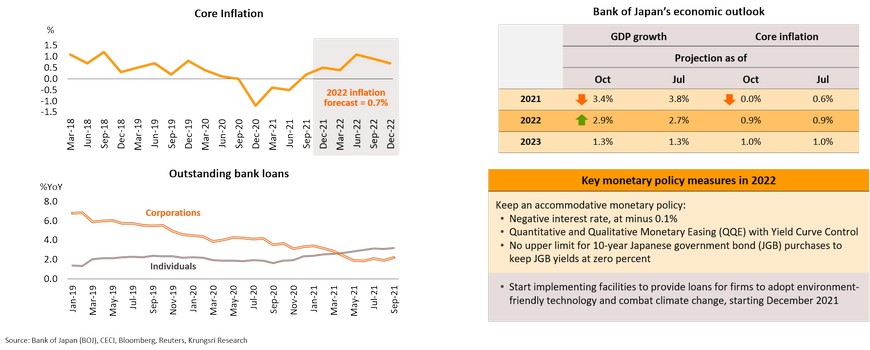

Inflation still below target; expect BOJ to keep accommodative stance

Japan’s economy is entering the recovery phase with higher inflation and several advanced economies have started to normalize monetary stimulus. However, Bank of Japan (BOJ) is likely to keep an accommodative monetary policy for the following reasons. First, inflation has picked up but remains low, with core inflation still below the BOJ’s 2% target. This suggests the economy still lacks sufficient demand-driven forces to pull up inflationary pressure. Market expectations are for core inflation to average +0.7% in 2022 compared to estimated -0.5% in 2021. Also, the possible easing of supply constraints and decline in global oil prices would soften inflation in 2H22. Second, the recent rebound in bank loans for the hardest-hit businesses and individuals suggest there is demand for more liquidity to ease the impact of the latest wave of infections and to support further recovery. Third, the BOJ is more dovish on growth and inflation prospects. At its latest meeting, it had revised down 2021 GDP growth projection to +3.4% from +3.8% at the July meeting. It also reduced core inflation forecast to 0.0% from +0.6%. The BOJ projects GDP growth will decelerate to +2.9% in 2022 and to only +1.3% in 2023. Core inflation will rise but is projected to reach only +1.0% in 2023, far below target. Premised on these factors, we expect the BOJ to keep the negative interest rate policy throughout 2022 and possibly in 2023, to support economic recovery in Japan, which continues to trail recovery in other advanced economies.

Thailand Economic Outlook 2021-2022

Thailand: First steps on the path to recovery

- Key drivers would be recovering household spending, further export expansion, emerging investment cycle, improving tourism sector, and still-accommodative policies.

- Consumption is recovering unevenly with easing restrictions and stimulus measures; rising income is key to sustainable spending.

- Exports would grow further following global economic recovery and regionalization; growth could be above-trend.

- Improving economic activity, rising exports, rising FDI, and accelerating infrastructure projects, would lead to a new investment cycle.

- Tourism shows signs of nascent recovery; will take several years to return to pre-pandemic level.

- Temporary rise in inflation and still-fragile economic recovery suggest BOT will not hike rates in 2022.

- Risks & Challenges: COVID-19 pandemic, domestic political risks, US policy normalization, global supply-side constraints, and geopolitical risks

2022 Outlook: Economic activity to return to pre-pandemic level in the second half

Consumption is recovering unevenly with easing restrictions and stimulus measures; rising income is key to sustainable spending

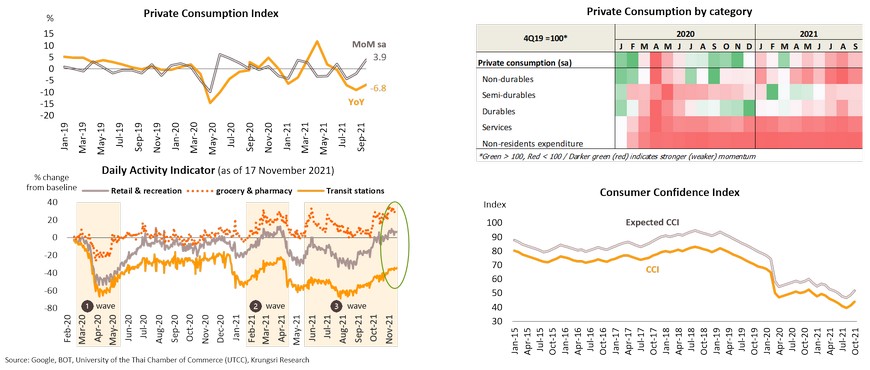

There are signs of improvement in private consumption. The Private Consumption Index (PCI) rose MoM for the first time in 3 months in September, albeit it was still weak with year-on-year contraction in spending on all items. High frequency data from Google Mobility Index indicate economic activity has improved following lockdown easing. In addition, the Consumer Confidence Index (CCI) rose for the second straight month to a 5-month high of 43.9 in October from 41.4 in September, but is still weak compared to 2019 (pre-pandemic) average of 75.5. Looking ahead, government measures to lift consumer purchasing power and stimulate domestic tourism will help to support consumption recovery in the near-term. Other supportive factors are relaxing containment measures and rising pent-up demand. Following improving economic activity, rising employment and income would be the key drivers of sustainable consumption recovery in the next period.

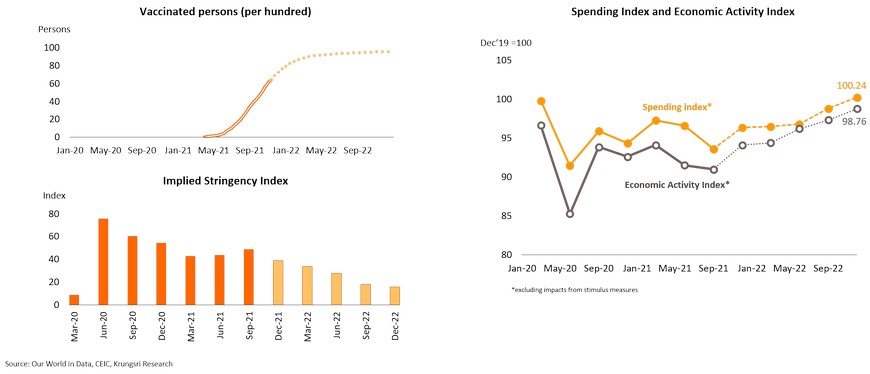

Mass vaccination and easing social-distancing limits will release pent-up demand; spending to reach pre-COVID level in 2H22

Mass vaccination and fewer new COVID-19 cases will allow Thailand to ease restrictions, including on public gatherings, and reopen borders. We estimate 90% of Thailand’s population would have received at least one dose of vaccine before the end of March 2022. Hence, there will be less stringent measures to control the COVID epidemic. Our model suggests the Implied Stringency Index would fall below 20 in the second half of 2022. Easing restrictions would encourage economic activities to resume, especially domestic activities and consumption. We developed the Household Spending Index and Economic Activity Index based on the Implied COVID Stringency Index and Google’s search trends. Both are aimed to reflect Thailand’s activity. Our conclusion is that in 2022, household spending would reach pre-pandemic level in the last quarter of 2022.

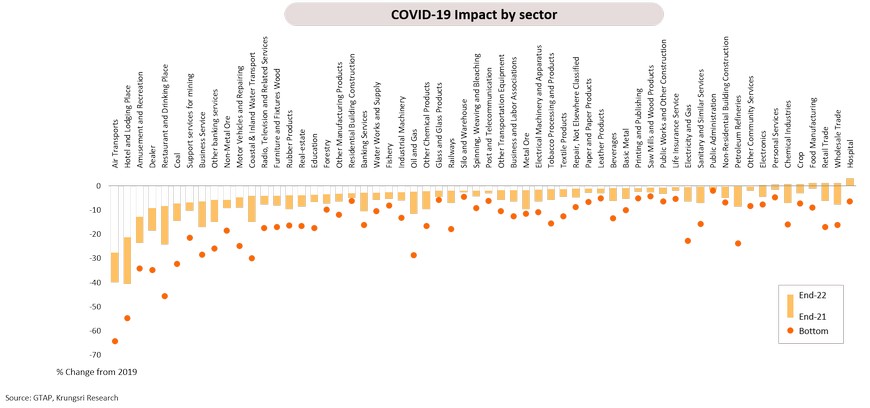

Easing restrictions to improve sector performance; wages would rise by 5% in 2022 but remain 2.9% below pre-Covid level

Krungsri Research’s study concludes that the hardest-hit sectors - air transportation, hotel & lodging places, and recreation – will see a sharp recovery in 2022. However, most sectors are likely to improve noticeably with the removal of most restrictions. Hospital, wholesale & retail trade, food manufacturing, crop, chemicals, personal services, and electronics sectors would recover to pre-COVID levels in 2022. As a result, overall wages would increase by an average of 5.0% YoY in 2022 but remain 2.9% below pre-pandemic level (2019).

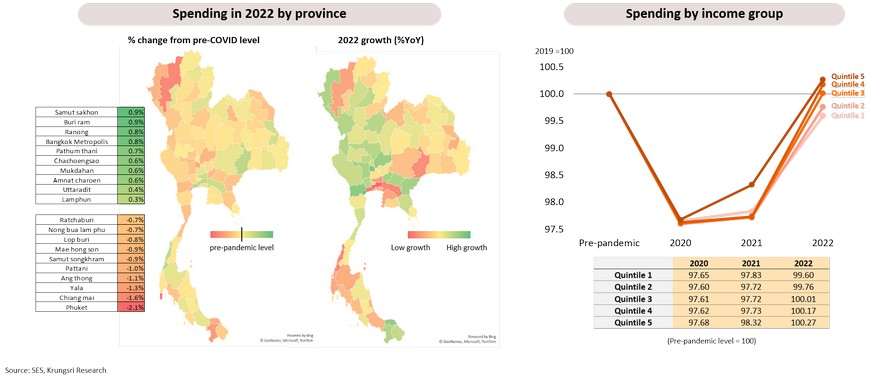

Uneven recovery in consumption by region and income level

We expect overall household spending to exceed pre-pandemic level in 2022 but there is visibly uneven recovery in consumption. The latter is attributed to different wages by sector, different pace of vaccination, and the number of new COVID-10 cases in each province. Overall income will improve in 2022 but remain 2.9% below 2019 level and would differ by sector. By area, household spending in many provinces would recover to their pre-pandemic levels in 2022, led by Bangkok, Samut Sakorn, Pathum Thani, Buriram, and Ranong. However, spending in several provinces would remain weaker than their pre-COVID levels, especially Phuket, Chiangmai and Yala. By income class, all income groups have been hit hard by the latest COVID-19 outbreak. Household spending is estimated to drop by 2.5% at the height of the crisis. However, wealthier groups will recover faster. In 2022, spending by the top three wealthiest groups is expected to exceed pre-pandemic levels. Consumption by the poorest group would be 0.4% below normal levels.

Exports would grow further following global economic recovery and regionalization; growth could be above-trend

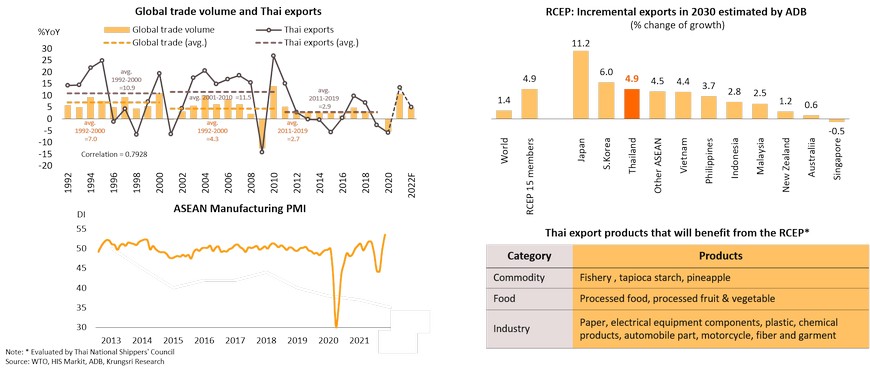

The World Trade Organization (WTO) predicts global trade volume would grow by 4.7% in 2022, slowing from 10.8% in 2021, but well above 2001-2019 average of 2.7%. In addition, strong correlation (0.8) between global trade and Thailand’s exports implies that Thai exports would continue to expand well. We project 2022 Thai export growth at 4.5% (based on MOC data) and 5.0% (based on BOT data), higher than average of 2.9% during 2001-2019 (pre-pandemic). Also, supply disruption in ASEAN countries has dissipated gradually, reflected in the ASEAN Manufacturing PMI which reached a new high in October. Moreover, Thailand’s exports would be supported by regionalization, including the Regional Comprehensive Economic Partnership (RCEP) which will take effect in early 2022. The ADB estimates that, given benefits from the RCEP, Thailand would see incremental exports of 4.9% by 2030 following gains in Japan (+11.2%) and South Korea (+6.0%), and would register larger gains than other ASEAN countries (+4.5% and lower).

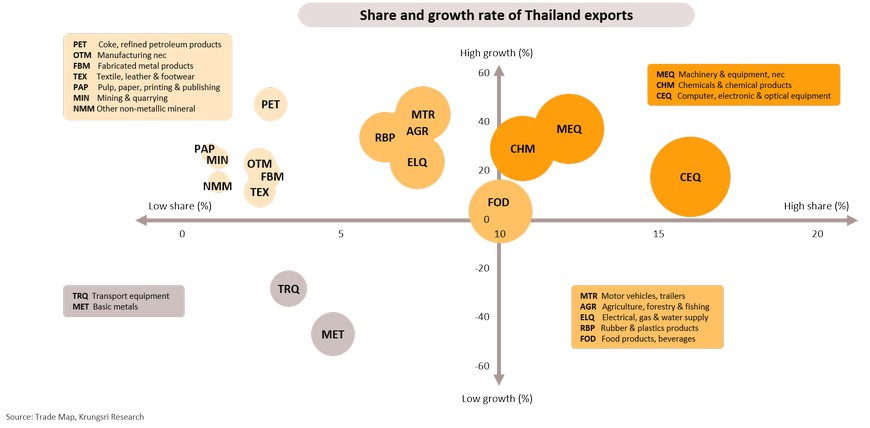

Recovering global economy lifted exports in most product categories

In the first 8 months of 2021, merchandise exports surged supported by positive growth in most product categories. The largest contributors (>10% of Thailand’s total exports) which posted strong growth included machinery & equipment (MEQ), chemical & chemical products (CHM), and computer & electronic equipment (CEQ). Products which contribute 5-10% of total exports which recorded positive growth were motor vehicles (MTR), agriculture products (AGR), electrical, gas & water supply (ELQ), rubber and plastic products (RBP), and food & beverage (FOD). Those which account for less than 5% of exports and booked positive growth were petroleum products (PET), pulp & paper, and printing & publishing (PEP). Product categories which saw negative growth were basic metal (MET) and transport equipment (TRQ), both of which account for a small share of total exports.

Growth in several sectors helped to diversify export revenues to medium and large businesses, and to Thai and foreign companies

The three largest export contributors - MEQ, CHM, CEQ – comprise mostly large companies (covering 71-92% share of export revenue in each industry) and the majority of shares are held by foreigners. Sectors which account for medium share of exports and posted positive export growth (MTR, AGR, ELQ, RBP, FOD) are mostly medium-to-large-size companies and be owned by both Thai or foreign shareholders. These implies the growth in exports of several product categories would help to diversify revenues to several businesses by company size and ownership.

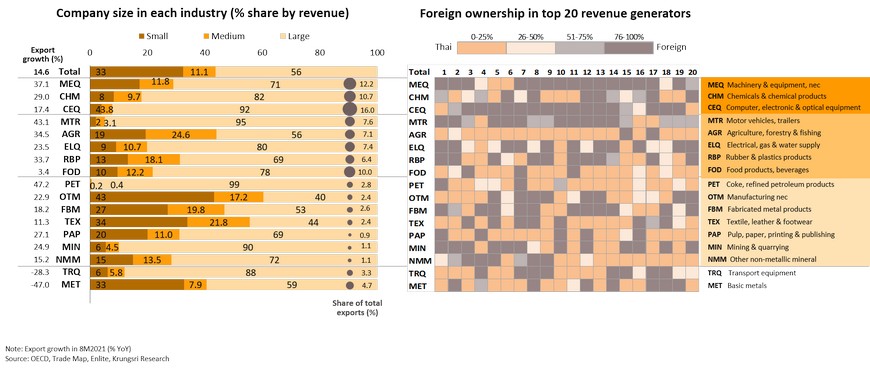

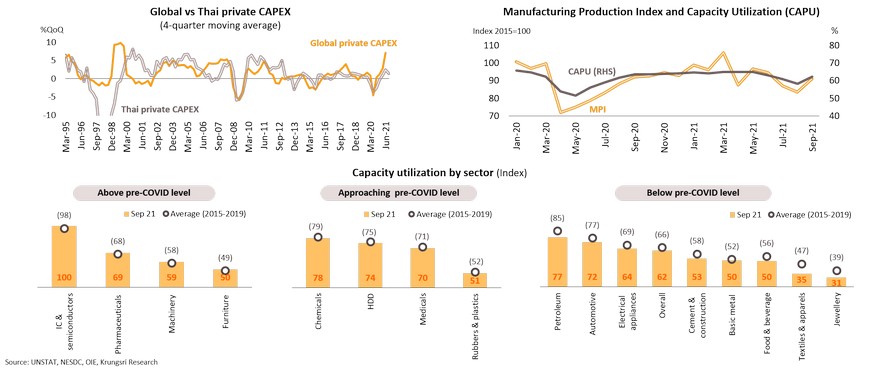

Business investment cycle kicks off in the global economy, evidenced by a turnaround in capital expenditure and FDI

Global capital expenditure (CAPEX) has been rising alongside the recovery in global Industrial Production Index to above pre-pandemic level. Based on S&P estimates, global CAPEX would grow by 13.3% in 2021, led by electronics, home appliance and healthcare sectors which demand is spurred by the outbreak and digital disruption. In addition, supply chain diversification to avoid disruption also encouraged firms to invest in new production facilities. Global foreign direct investment (FDI) has surged. Noticeably, Asia was the only region where FDI expanded in 2020. In 1H21, Asia remained a key destination for FDI, especially Southeast Asia (+43%). Looking ahead, global investment would gain momentum from a cyclical economic recovery, pandemic-induced industries and industrial transformation which adopt new technology to create opportunities for sustainable growth.

Thailand is experiencing a new investment cycle driven by recovering global and Thai economies

.

Capital expenditure in Thailand has also been rising in line with global investments. This new investment cycle would be driven by a recovery in external and domestic demand. Following the improving pandemic situation, Thai Manufacturing Production Index (MPI) and Capacity Utilization had rebounded in September. National capacity utilization has yet to reach pre-pandemic level but several key industries are operating at above pre-pandemic levels, especially IC & semiconductors, pharmaceutical, machinery and furniture. Production in some industries are approaching their pre-pandemic levels, including chemicals, HDD, medical, and rubber & plastics. A further recovery of the global and domestic economies would lift capacity utilization and kick-start a new investment cycle.

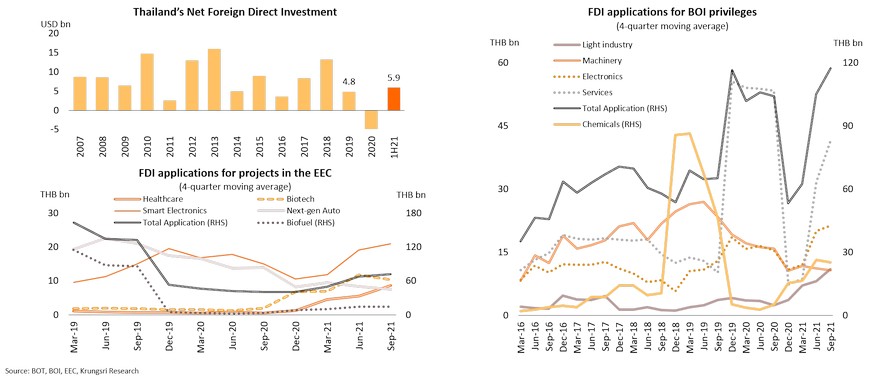

Apart from economic recovery, rising FDI would also support a new investment cycle

Economic recovery, coupled with expansion in pandemic-induced sectors and industry transformation, will push forward investments in Thailand. Net FDI into Thailand in the first half of 2021 has exceeded that for the whole of 2019, the pre-pandemic year. The value of FDI applications for BOI privileges in the first 9 months of 2021 reached THB372bn, exceeding its 5-year average. Specifically, FDI applications under the scheme for light industry (such as rubber gloves, pandemic-related industry) and electronics (driven by pandemic and industry transformation) have risen past their pre-pandemic levels in 2019. Likewise, FDI applications to invest in the EEC (Eastern Economic Corridor) also improved, led by smart electronics, biotech, healthcare and biofuel; applications have exceeded pre-COVID records. The need to spend to sustain long-term business growth would keep Thai investments on an expansion path.

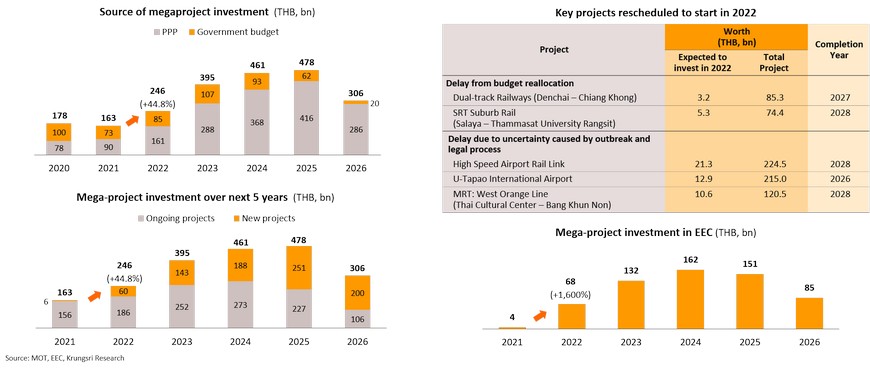

Infrastructure projects will accelerate and induce more private investment

In addition to economic recovery and rising FDI, accelerating mega-infrastructure projects would also stimulate a new wave of investment. The government has allocated a budget to mitigate the COVID-19 impact since 2019. That includes reshuffling funding for mega-projects to public-private partnership (PPP) agreements. Over 80% of spending in mega-projects over the next five years (2022-2026) would be mostly driven by PPP projects. In addition, uncertainties over lockdown restrictions and legal matters have delayed some key projects which contracts have been signed. However, these mega-projects, which were originally scheduled to start in 2021, have been rescheduled to start construction in 2022, including the double-track railway project and the high-speed rail link connected to the EEC. In the next few years, the government will accelerate construction of mega-projects and completion of ongoing projects (accounting for 61.3% of total spending over the next 2 years). Progress in megaprojects is expected to inject more liquidity into the system, which would encourage the new investment cycle and lead to crowding-in effect in the overall economy.

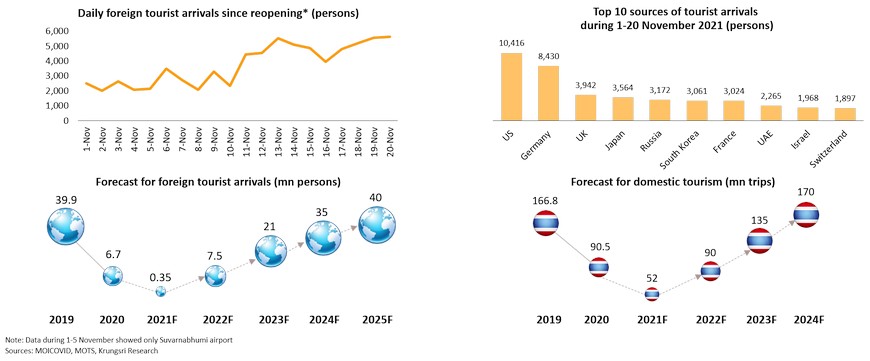

Tourism shows signs of nascent recovery; will take several years to return to pre-pandemic level

Thailand has allowed quarantine-free entry to vaccinated visitors from low-risk countries since 1 November, 2021. From then up to 20 November, international arrivals have reached 80,017 (daily average 4,000), compared to 15,000 arrivals per month registered under the Phuket Sandbox scheme. However, the number is still far below pre-pandemic average of 3.3 million per month. In November, the number of international flights arriving at Suvarnabhumi Airport averaged 104 per day, much lower than 800 per day in November 2019. Looking ahead, mass vaccination programs and improving COVID-19 situation in many countries, and reopening effects, will boost the inbound tourism sector. However, lingering pandemic uncertainties suggest there will still be travel restrictions. Krungsri Research expects foreign tourist arrivals to increase from an estimated 350,000 in 2021 to 7.5 million in 2022, but that would still be far below 40 million registered in 2019. Domestic tourism is expected to improve to 90 million trips in 2022 from 52 million in 2021, supported by the nationwide vaccination program, easing containment measures, measures to boost domestic tourism, and pent-up demand. Domestic tourism is expected to reach pre-pandemic level in 2024, one year sooner than the inbound tourism sector.

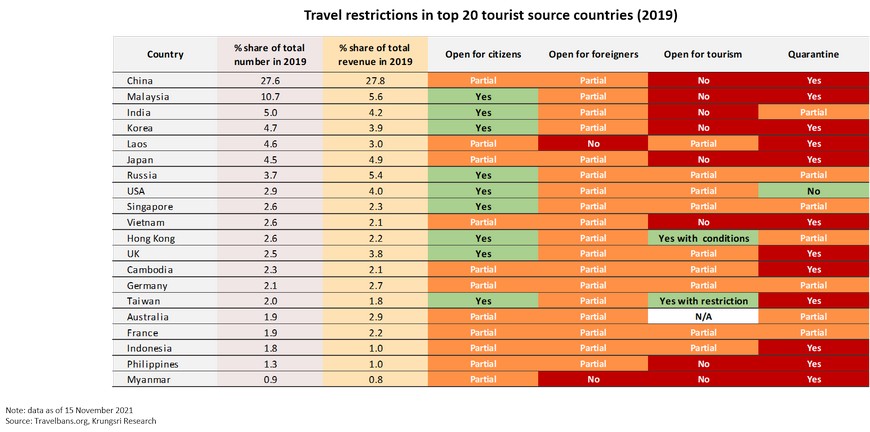

Travel restrictions (especially quarantine) in departure countries could disrupt the recovery in inbound tourism

The COVID-19 pandemic remains a concern worldwide. Many countries still have travel restrictions for both outbound and inbound travelers, especially quarantine requirements when returning to the home country. Among the 20 countries which account for the largest source of inbound tourism in Thailand in 2019, only the US does not impose quarantine requirements. All these 20 countries are on the list of 63 under Thailand’s quarantine-free entry list for vaccinated visitors.

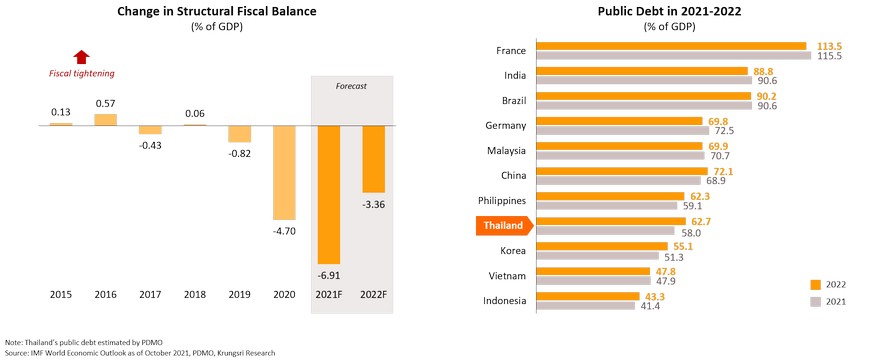

Fiscal stimulus will remain larger than pre-COVID level despite a narrower deficit; public debt will rise but remain manageable

In line with global trends to wind down crisis stimulus programs, Thailand will reduce its fiscal deficit although 2022 deficit will remain larger than pre-COVID level of less than 1% of GDP. The IMF projects Thailand’s fiscal deficit will narrow from 6.9% of GDP in 2021 to 3.4% in 2022. This suggests there will still be large fiscal supports to ease the pandemic impact and support the still-fragile economic recovery. The PDMO estimates public debt would increase from 58% of GDP in 2021 to 62.7% in 2022, still lower than in most countries. Recently, the government extended the public debt ceiling from 60% to 70% to create room for further economic stimulus, if necessary.

Government’s regular & extra-budget and state enterprise investments still play crucial roles in supporting economic recovery

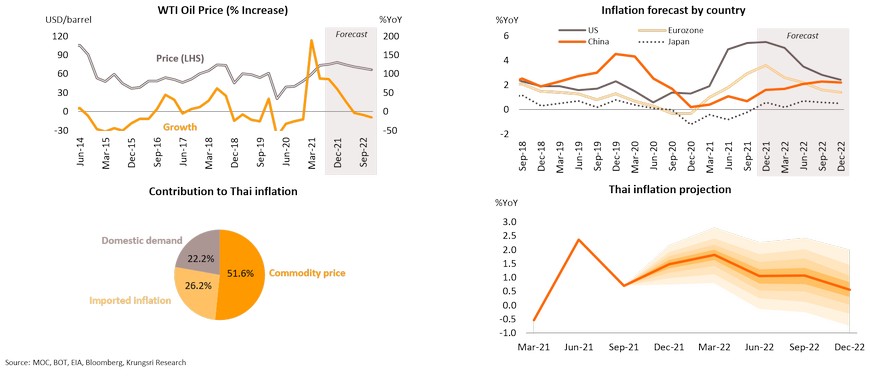

Inflation to peak in 1Q22 driven by low base and cost pass-through effects, but the impact would be temporary

Headline inflation surged in 4Q21 following the expiry of government subsidies for power and water bills, coupled with higher oil prices. However, inflation would subside in 2022 as oil prices would peak in 4Q21 and gradually decline later. Moreover, inflation rates in major economies are expected to slow down in 2022 as they unwind crisis stimulus and pent-up demand start to fade. Krungsri Research opines that Thailand’s inflation is mainly influenced by external factors such as commodity prices (51.6%) and imported inflation (26.2%), followed by domestic demand (22.2%). Hence, declining oil prices and global inflation would eventually pull down Thai inflation. According to a fan chart, headline inflation would peak in 1Q22 at 2.8%, possibly hit 3% in some months because of the low-base effect. However, the spike would be temporary and inflation would soften from 2Q22 onwards. Average inflation rate in 2H22 could return to close to the lower end of the inflation target, at 1%, suggesting a moderate impact on consumption.

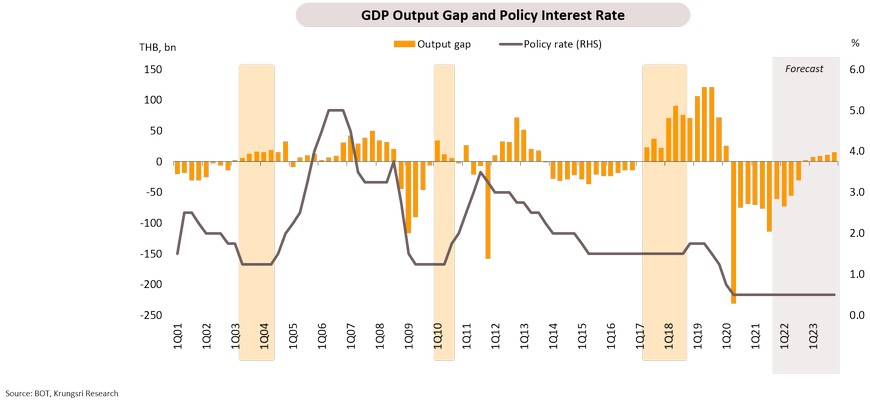

MPC: Temporary spike in inflation and fragile economic recovery suggest MPC would hold policy rate in 2022

Despite lower risk to growth and risk of higher inflation, as well as major economies’ plans to wind down monetary stimulus measures, the Thai MPC is in no hurry to raise policy rate for the following reasons. First, although headline inflation might rise in the near-term, possibly hitting 3% in some months in 1Q22, this would be partly due the low-base effect in 2021. We also expect inflation to ease throughout 2022 premised on lower global energy prices. This view is echoed by the BOT which sees excess supply of crude oil from 2Q22 onwards. Second, Thailand’s economic recovery remains fragile, especially in the tourism sector where activity is still far below pre-pandemic levels. Third, historical data suggests the first policy rate hike could occur after the output gap turns positive for average of four consecutive quarters. We project that the output gap would turn positive for the first time in the last quarter of 2022. So, to nurture the fragile economic recovery, policy rate should be kept at a record low throughout 2022.

Risks & Challenges

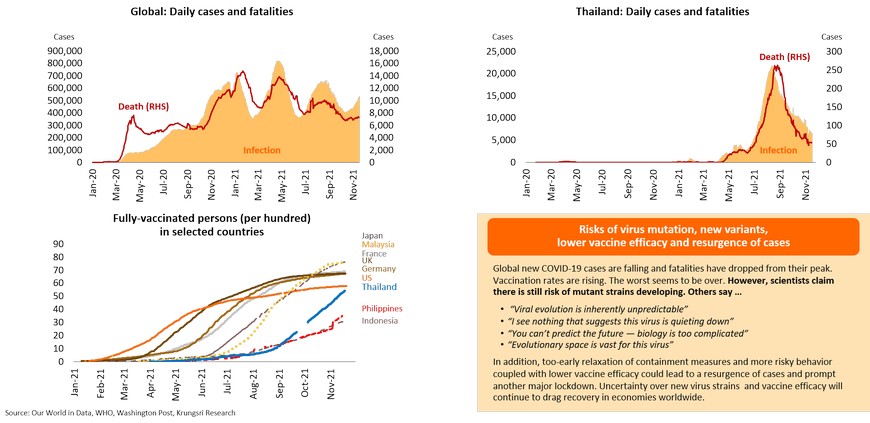

COVID-19 situation is improving as vaccination rate rise, but there are still concerns over mutant strains and vaccine efficacy

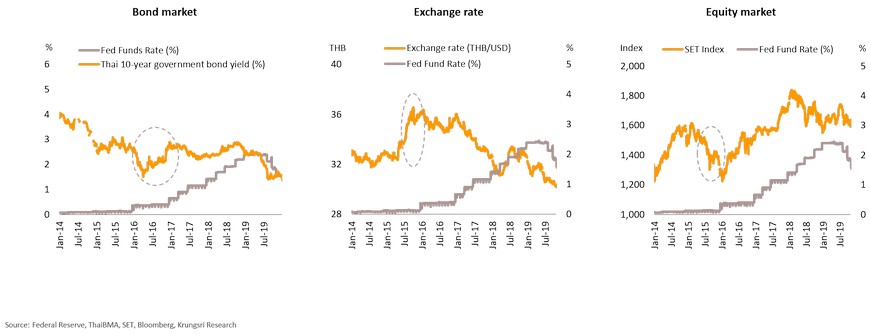

US unwinding monetary stimulus – impact will be transmitted through financial markets: bond, equity and FX

There are three principal channels by which the impact of changes in US monetary policy might be transmitted to emerging markets and Thailand. They are bond market, equity market and exchange rates. If the US raises interest rates, the wider interest rate gap between advanced economies and emerging markets could encourage investors to seek higher returns and rebalance their portfolios, accelerate a sell-off in bonds, and further fuel yield spikes in emerging markets. The first rate hike after the recession in 2015 pushed up 10-year bond yields in both the US and Thailand, which led to a depreciation of the Thai baht against the US dollar. However, the overall impact on the Thai economy was smaller than in other emerging countries, thanks to Thailand’s safe-haven status at that time because of relatively sound external stability. Rising interest rates have raised fears of liquidity shortage in the domestic equity market but the impact on Thailand was temporary due to smaller exposure to foreign investors.

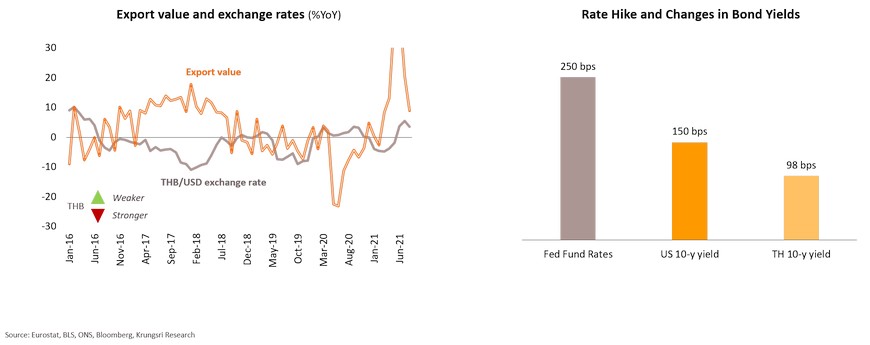

Weaker baht is unlikely to support exports but rising bond yields could hurt the economy via higher funding costs

Krungsri Research analyzed the bond and exchange rate market transmission channels by looking at quarterly data from 2000 to 1Q21. The conclusion is that tightening policy would put downward pressure on the baht. However, the weaker baht is unlikely to support stronger exports. In contrast, US monetary tightening normally has negative impact in Thailand through the bond market because a 100-bp increase in policy rate by the Fed would lead to a 60 bps rise in 10-year US Treasury yield. This would then feed through to a 39-bp rise in 10-year Thai government bond yield. Assuming US policy rate would rise to 2.5% over the long-term (per the Fed’s September Dot Plot), this mean yields of 10-year US and Thai government bonds would rise by 150 bps and 98 bps, respectively. This would push up cost of funds, which would hurt business investment decisions and future expansion.

If there is no policy support, higher Thai bond yields would reduce private investment by 3.2%, and long-term GDP by 0.4%

Krungsri Research’s analysis concludes an increase in 10-year Thai government bond yield would push up cost of funds and hurt private sector investment in the country. It would take about five quarters to play out but economic growth would start to slow down in the next period. The VAR model suggests a 1% increase in bond yield would reduce private sector investment by 3.2%; the latter would hurt major components of GDP, from imports of machinery to industrial output to labor market, which then would reduce consumption and generate a negative feedback loop. The analysis suggests a 3.2% decline in private investment would ultimately reduce long-term economic growth by 0.4%.

Global supply-side problems will linger in 2022, but the worst is over given rising investment and improving COVID situation

The extended COVID-19 pandemic, strict containment measures, lack of investment in the last few years, coupled the recent recovery in demand for goods and services, have disrupted the global supply chain. This could cap global economic growth. Although transportation costs, energy prices and chip prices soared in 2021, they have showed signs of softening recently. Rising business investment should increase supply of materials and equipment, while the improving COVID-19 situation and fewer restrictions could increase labor supply. Easing containment measures and adapting to the new normal could ease bottlenecks in the logistics and production sectors.

Geopolitical risks: Middle powers could face risks & challenges from a new global geopolitical order

Domestic political risk: Deepening political conflict could heighten risks to government stability and delay economic policy implementation

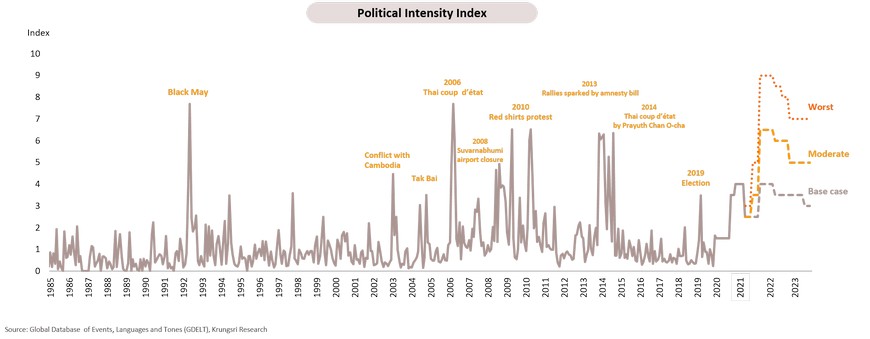

Political Intensity Index indicates severity of political tensions and risks

The Political Intensity Index was constructed by collecting and tracking news about political uncertainty. This captures political instability followed by mass civil protests. Political risk and uncertainty could affect economic confidence and performance. The impact is influenced by the intensity of protests. To assess the risk and severity of political unrest based on historical data, even in the base case, we assumed higher intensity of political risk in 2022 premised on continued protests to call for greater democracy and tensions would rise but remain controllable. In the Moderate case, rising uncertainty and concerns over election results under the new constitution could increase political tension, so we assumed the Political Intensity Index would rise further in 2022. In the Worst case, the Index would hit a new high if violent confrontations trigger public disorder.

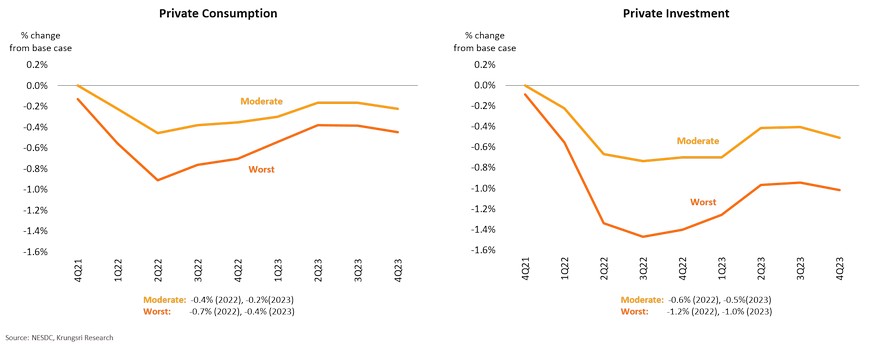

Rising political risks could hurt consumption immediately; larger and longer impact on private investment

Due to adverse impacts of rising political risks, in 2022, private consumption could be immediately reduced by 0.4% from baseline under the Moderate case (House is dissolved, early election) and by 0.7% under the Worst case (political and social unrest). Private investment could be affected later, but the impact would be larger and longer. It could drop by 0.6% and 1.2% from baseline under the Moderate and Worst case scenarios, respectively.

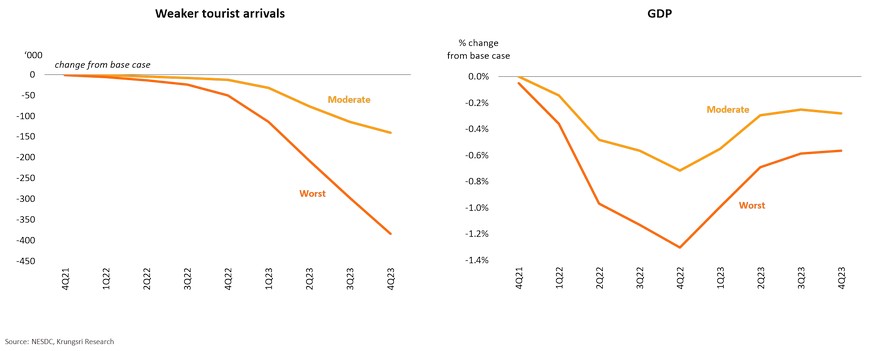

Political risks and turmoil could freeze tourism sector recovery; Thai GDP could contract by 0.5-0.9% in 2022 and see long-term impact

In the Worst case scenario, rising political uncertainties or political turmoil next year could halt the fragile recovery in the tourism sector. In 2022, foreign tourist arrivals would fall by 30,000-90,000 from baseline assumption. In 2023, tourist arrivals would continue to drop by 360,000-1,000,000 from baseline. Political risks and unrests would delay the fragile recovery in the tourism sector by several years. Thai GDP would be reduced by 0.5%-0.9% from baseline. More worryingly, Thailand’s economic recovery could be delayed. It could take one to three quarters longer than base case scenario, for economic activity (or GDP) to reach pre-pandemic level. This suggests headwinds from rising political tensions would continue to pressure the nascent economic recovery in the years ahead.