Executive Summary

Thailand has been facing a surge of Chinese goods since the trade war 1.0 (2018–2020) after China’s exports to the US declined and China redirected its exports to other countries, particularly Thailand and ASEAN. Meanwhile, the worsening excess supply in China’s manufacturing sector following COVID-19 has pressured China to accelerate exports to global markets, further aggravating the influx of Chinese goods into the Thai market in recent years. Looking ahead, the renewed trade conflict between the US and China may intensify the ongoing pressure from the influx of Chinese goods.

Our analysis using the GTAP model found that in the worst-case scenario — where both sides impose tariffs exceeding 100% on each other — Chinese goods flowing into Thailand could increase by as much as 13.6% in the long term, which is significantly high compared to Thailand’s total import growth of only 1.1%. Furthermore, already weak manufacturing sectors are likely to continue contracting in the long run, including Rubber and Plastics, Textiles, Leather and Footwear, Machinery and Equipment, and even some industries that previously experienced growth, such as Food and Beverages, may turn to contraction.

Therefore, the government needs to implement comprehensive measures that go beyond negotiating trade deals with the US and include discussions with other trading partners, including China. At the same time, targeted financial assistance should be provided to affected businesses, industrial capabilities should be enhanced through technology, and premium products under the “Thai brand” should be promoted. Efforts to find new markets should also be accelerated, which will, in turn, help reduce Thailand’s dependence on China and provide the country with greater flexibility to implement anti-dumping measures within the WTO framework if necessary.

Looking Back at the Influx of Chinese Goods into Thailand in Recent Years

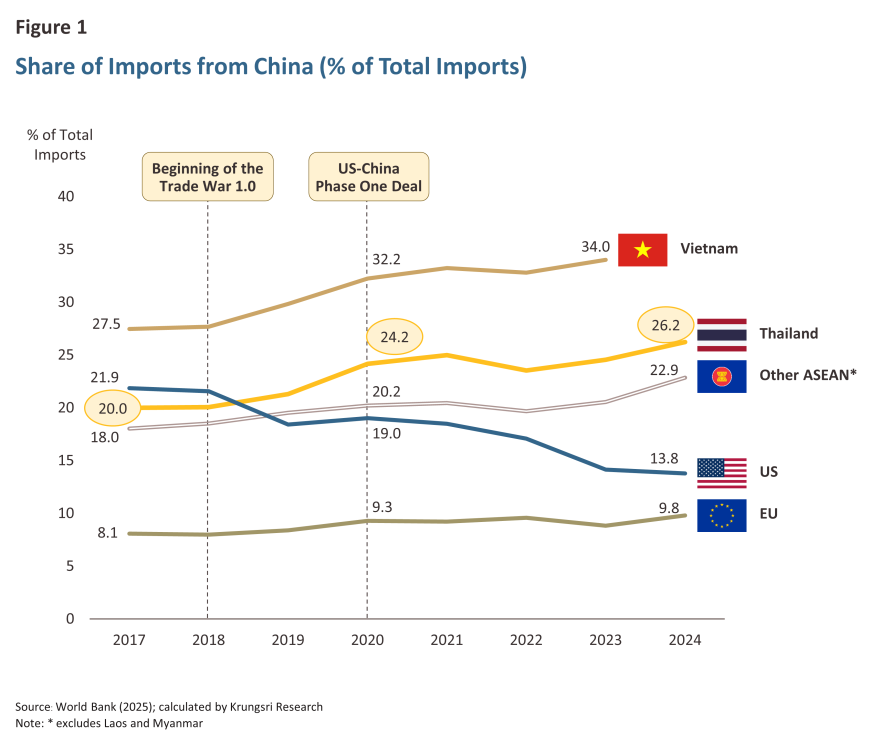

Since the trade war 1.0 (2018–2020), Thailand has experienced an influx of Chinese goods, as China increased its exports to Thailand and ASEAN to compensate for the decline in exports to the US following the imposition of US import tariffs. This situation led to a significant increase in imports from China into Thailand and other countries in the region during that period (Figure 1). In addition, the excess supply in China’s manufacturing sector—which worsened significantly after the COVID-19 pandemic (Figure 2)—has further aggravated the influx of Chinese goods into both global and Thai markets in recent years. Recent data indicates that China still faces excess supply issues in several industries, with no clear signs of improvement. This factor is expected to continue driving China to accelerate its exports to global markets, including Thailand.

Trade War 2.0 May Worsen the Influx of Chinese Goods

Since the beginning of this year, trade tensions between the US and China have experienced a renewed escalation, with both countries imposing tariffs on each other exceeding 100%. This situation has raised concerns about the potential global economic impact. However, on May 12, 2025, both parties mutually agreed to temporarily reduce tariffs for 90 days. The US will lower its tariff on Chinese goods from 145% to 30%, while China will reduce its tariff on US goods from 125% to 10% (Leonard, 2025).

This renewed trade tension between the US and China is likely to significantly reduce China’s export share to the US in the long term. From a share of 16.1% in 2023, it may decline to nearly zero if both countries maintain tariffs exceeding 100% or decrease to approximately 7.3% if tariffs are reduced to 30% and 10%, respectively, in accordance with the recent agreement.

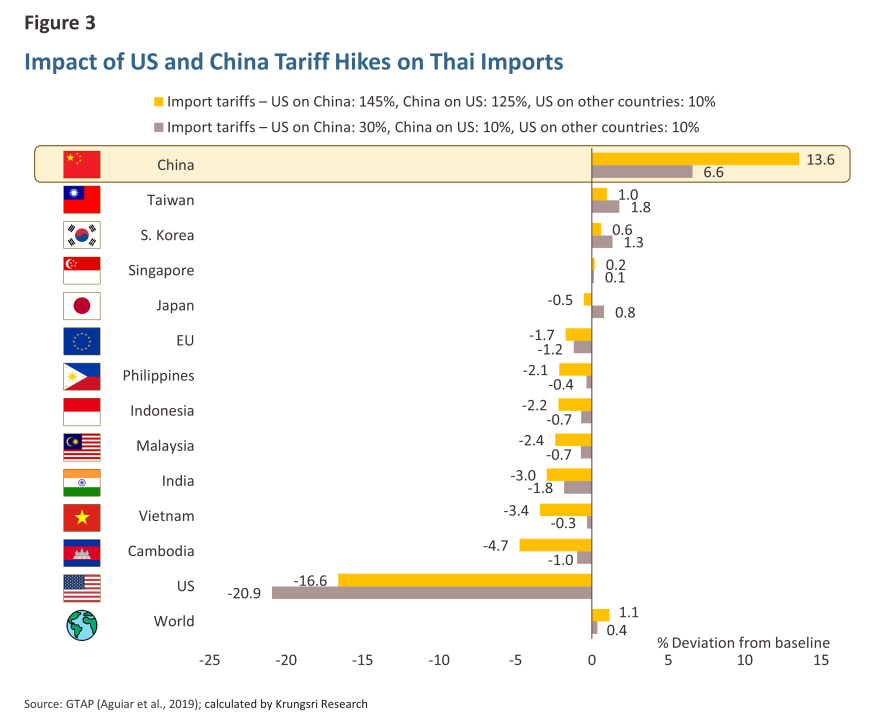

The key impact for Thailand is that the reduction of exports from China to the US will force China to diversify its exports to other trading partners, including Thailand. This will worsen the influx of Chinese goods in the Thai market, a situation Thailand has faced since the trade war 1.0. According to the GTAP model, in the worst-case scenario—where both sides impose tariffs exceeding 100%—Thailand’s import from China could increase by as much as 13.6%, which is substantial compared to Thailand’s overall import growth of only 1.1% (Figure 3).

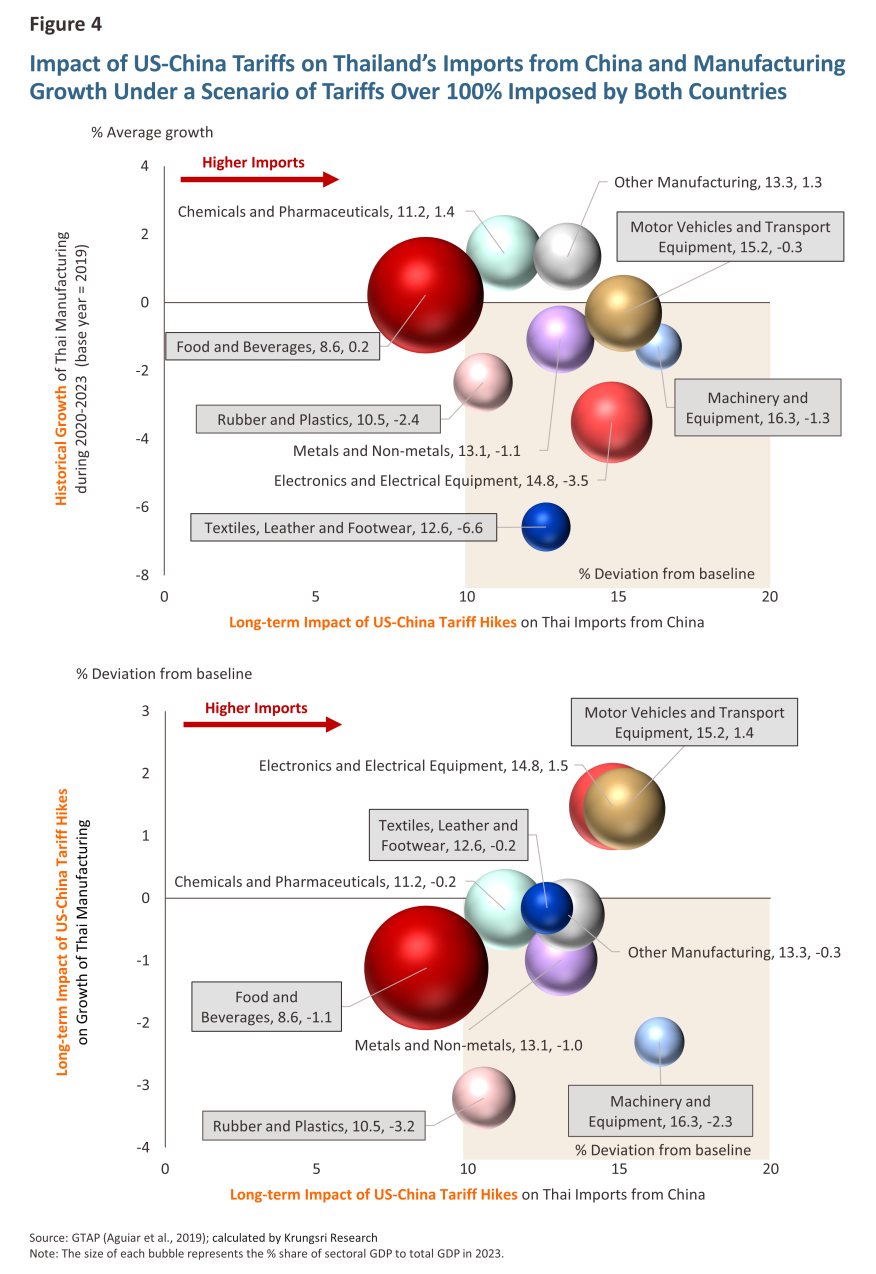

By industry, the influx of Chinese goods caused by US tariff hikes and China’s retaliatory tariffs (horizontal axis in Figure 4, top and bottom) is expected to further weaken struggling manufacturing sectors. These sectors—characterized by low or negative average growth in the post-COVID period (vertical axis in Figure 4, top)—are likely to continue contracting in the long run (vertical axis in Figure 4, bottom). Examples of these sectors include Rubber and Plastics, Textiles, Leather and Footwear, and Machinery and Equipment. In addition, some industries that previously experienced growth, such as Food and Beverages, may turn to contraction.

At the same time, some sectors may benefit in the long term—such as Motor Vehicles and Transport Equipment—through export substitution of US and Chinese goods whose prices have risen relatively, as well as through expanded investment and investment relocation. However, the positive impact on Thai businesses may be limited, partly because China uses Thailand for trade circumvention, which may result in limited value added within the Thai economy. Furthermore, many companies in these sectors are predominantly foreign-owned, with foreign ownership accounting for 70–90%.1/

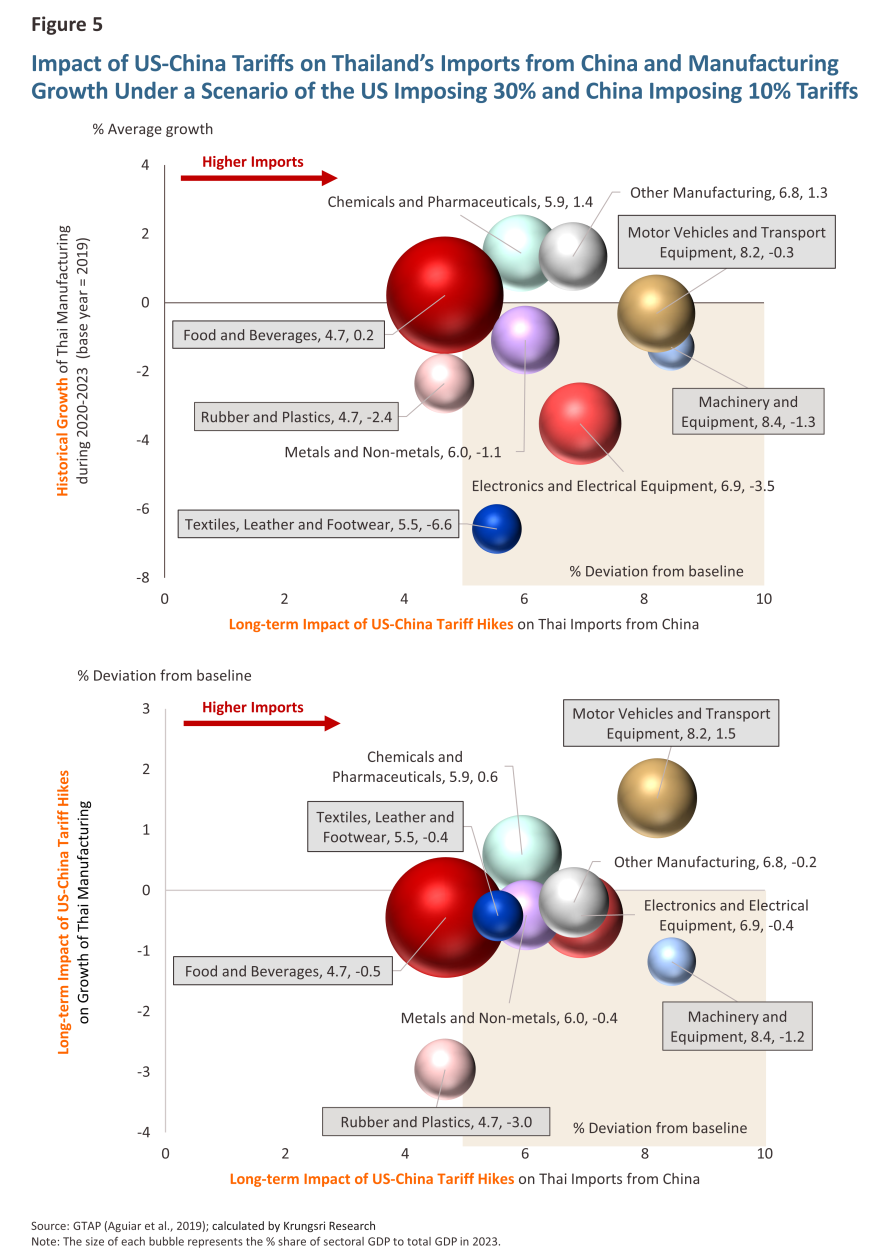

Even though the impact of the influx of Chinese goods on Thailand’s manufacturing sector may temporarily ease due to tariff reductions between the US and China (Figure 5, bottom), relative to the extreme scenario in which both sides impose tariffs exceeding 100% (Figure 4, bottom), Thai businesses are likely to continue facing risks from Chinese dumping—particularly in industries that are sensitive to price competition. In addition, the uncertainty surrounding US tariff policy could lead to future tariff adjustments, potentially resulting in a more severe impact than at present, though it may not reach the same extent as in the extreme case.

Krungsri Research View

Although import tariffs between the US and China have temporarily eased, Thai businesses are still likely to face pressure from an influx of Chinese goods and the uncertainty surrounding US trade policy. This concern is underscored by recent developments on May 16, 2025, when President Trump signaled that the US would no longer be able to negotiate with all countries but instead would impose tariffs unilaterally within the next 2–3 weeks. This shift may render Thailand’s previous proposals to the US ineffective in yielding tangible outcomes. (Dlouhy, 2025).

Moreover, Thailand’s prior trade proposals require careful consideration, particularly regarding the exchange of multiple trade-offs in return for tariff reductions—such as market access commitments—which could ultimately affect the domestic market and worsen the influx of Chinese goods into Thailand. Any trade negotiations need therefore to take into account both long-term impacts and a balanced distribution of benefits between the parties involved.

At present, Thailand is facing pressure from multiple fronts, including:

-

The US tariffs and China’s retaliatory tariffs cause an influx of Chinese goods into the Thai market, intensifying competition for Thai producers in the domestic market, especially in industries sensitive to price competition.

-

Thai exporters also face intensified competition in the global market due to China redirecting its exports to other markets globally instead of the US. This shift has heightened competition from Chinese products in Thailand’s key export markets.

-

Thailand risks facing high retaliatory tariffs from the US and may lose opportunities for export substitution of US and Chinese goods whose prices have risen relatively if Thailand fails to reach a trade agreement with the US or does so later than other countries. This will in turn, negatively affect Thailand’s competitiveness in the global market.

Given the situation, the Thai government needs to implement a comprehensive policy. This should go beyond trade negotiations with the US and include discussions with other trading partners, including China, especially regarding the issue of the influx of Chinese goods into Thailand. Crucially, urgent support measures for Thai producers are needed, which can be divided into short- and long-term strategies as follows:

-

Short term: The government should consider providing targeted financial support to businesses affected by the influx of Chinese goods, to help them adjust and keep operating.

-

Long term: Thailand needs to enhance its industrial capabilities through technology and promote the production of premium goods under the “Thai brand” to set itself apart from Chinese goods, which focus more on intensified price competition. Focusing on the quality and uniqueness of Thai products will help strengthen Thai manufacturing in the long run.

-

In terms of long-term structural strategy, Thailand should reduce its dependence on China by diversifying into new markets. This would not only help diversify risk but also give Thailand greater flexibility to apply anti-dumping measures within the WTO framework, if necessary.

In summary, the trade war 2.0 is posing serious challenges to the Thai economy, particularly in manufacturing sectors that are vulnerable to price competition. Although there has been a temporary reduction in tariffs between the two countries, uncertainty surrounding US trade policy remains a significant risk factor. Therefore, both the Thai government and the private sector must be well-prepared to navigate this landscape in a careful and comprehensive manner to mitigate short-term impacts and strengthen long-term resilience.

References

Aguiar, A., Chepeliev, M., Corong, E., McDougall, R., & van der Mensbrugghe, D. (2019). The GTAP Data Base: Version 10. Journal of Global Economic Analysis, 4(1), 1-27. Retrieved from https://www.jgea.org/ojs/index.php/jgea/article/view/77

Business Online Public Company Limited (BOL). (2025). ENLITE [Database]. Retrieved from https://enlite.bol.co.th/enlite/

Dlouhy, J. A. (2025). Trump says US to set tariff rates for other nations in weeks. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2025-05-16/trump-says-us-will-set-tariff-rates-for-other-nations-in-weeks?sref=s4Mndd0n

Leonard, J. (2025, May 12). US and China agree to major reductions in tariffs for 90 days. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2025-05-12/us-and-china-agree-to-major-reductions-in-tariffs-for-90-days

National Bureau of Statistics of China (NBS). (2025). Monthly Data [Database]. Retrieved from https://data.stats.gov.cn/english/easyquery.htm?cn=A01

World Bank. (2025). World Integrated Trade Solution [Database]. Retrieved from https://wits.worldbank.org/

1/Based on data from ENLITE (BOL, 2025), Motor Vehicles and Transport Equipment had an average foreign ownership share of approximately 73% in 2023.