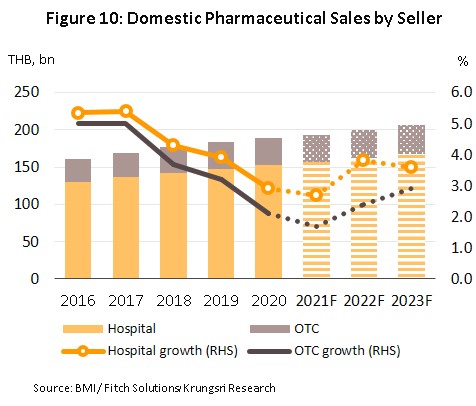

Growth in the value of the domestic market for pharmaceuticals is forecast to slip to just 2.5% in 2021. This is largely due to Thailand’s 3rd wave of Covid-19, which has caused a drop off in hospital visits for those seeking treatment for less serious conditions. However,

over 2022 and 2023, annual growth in the market should accelerate to 3.5% on: (i) a rising concern among Thais over personal health and wellness, itself partly a side-effect of the Covid-19 pandemic; (ii) the aging of Thai society, which is driving an increase in the number of individuals needing treatment for chronic non-communicable diseases; (iii) the broad coverage provided by the Universal Health Coverage scheme; and (iv) the return of foreign patients to Thai hospitals.

At the same time, competition within the pharmaceuticals industry is likely to stiffen as a result of: (i) greater imports of low cost products, especially from China and India; (ii) investment in Thailand-based production facilities by new overseas players that are aiming to produce generics for sale into both the Thai and export markets; (iii) increasing investment in the industry by domestic players from other businesses; and (iv) rising production costs, which will be pushed up by a combination of the additional overheads involved in meeting the GMP-PIC/S standards and the escalating price of imported precursor chemicals.

Overview

The pharmaceutical and medical supplies sector includes conventional medicines and chemicals which are used in the diagnosis and treatment of illnesses. Conventional pharmaceuticals can be split into two groups:

1) Original drugs or patented drugs are medicines that have gone through the lengthy research & development (R&D) process, and therefore would involve significant production cost. Manufacturers of original drugs are normally given a 20-year patent[1] protection and when the patent expires, other manufacturers are then allowed to produce those medicines

2) Generic drugs are copies of original drugs that are typically manufactured under a trademark or brand name but do not have patent protection. Generic drugs normally contain active ingredients that are identical to those found in original drugs for which patent protection has expired. Since the production of generic drugs does not usually require expensive inputs or costly R&D and clinical trials, production cost is typically lower than for original drugs.

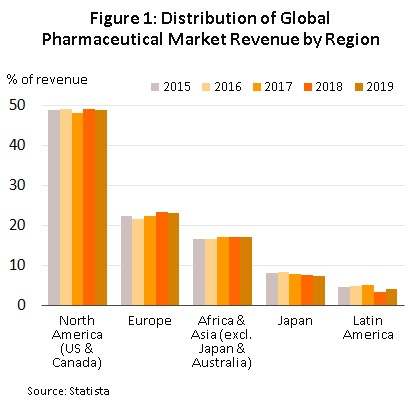

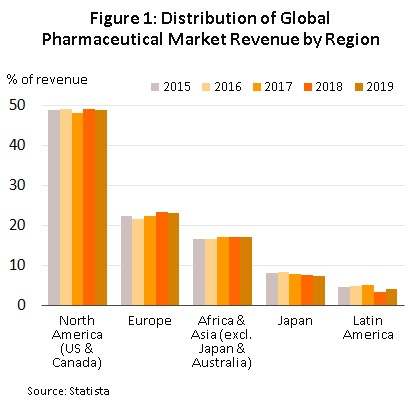

The continuous and costly R&D required in the development of new medicines and materials have prompted many global producers of pharmaceutical and medical supplies, especially original drugs, to cluster in developed economies such as the United States, Europe, and Japan, because of easy access to skilled professionals, expertise and manufacturing technology. These countries then export to meet global demand (Figure 1), while developing countries are left to play the role of importers of expensive patented medicines.

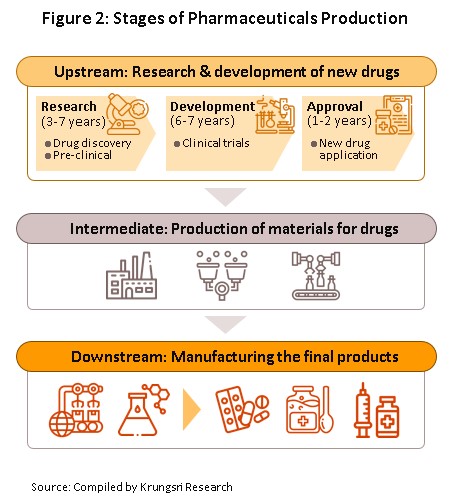

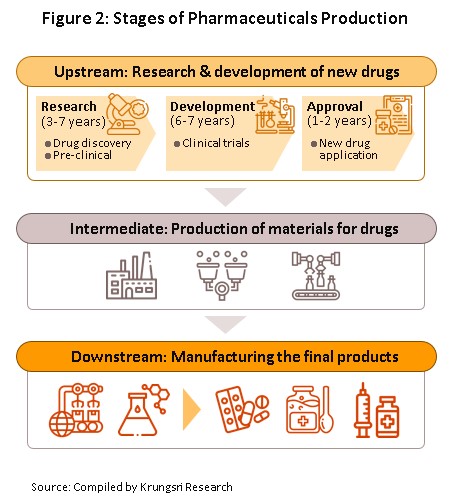

The conventional medicines production chain is split into three stages (Figure 2).

1) Primary: This involves R&D of new medicines.

2) Intermediate: This involves the production of ingredients to be combined to make the final product. These ingredients are either active or inert, and are normally added to speed up chemical reaction. The ingredients manufactured in this stage are normally already available in the market but require special processing techniques to produce the desired chemical reaction or to change the molecular structure of existing chemicals, which normally require advanced technology and a large investment.

3) Finished product (or chemical formula): The active ingredients are imported and mixed to produce a range of finished products including tablets, liquid medicines, capsules, creams, powders and injectable medicines.

The majority of Thai conventional medicine manufacturers are final-stage producers of finished generic drugs. The active ingredients are usually imported for domestic mixing and production into several forms for use in treatments. Thailand imports about 90% of all inputs used in the production of finished products. The highest value medicines are analgesics and medicines for treating fever.

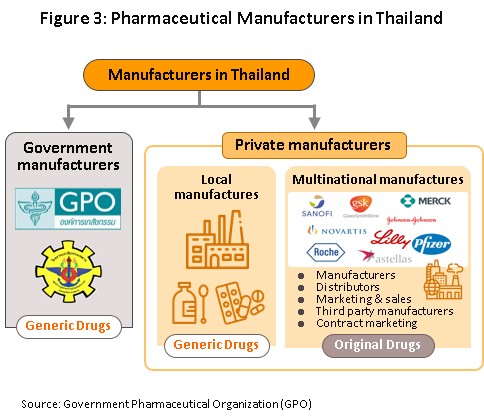

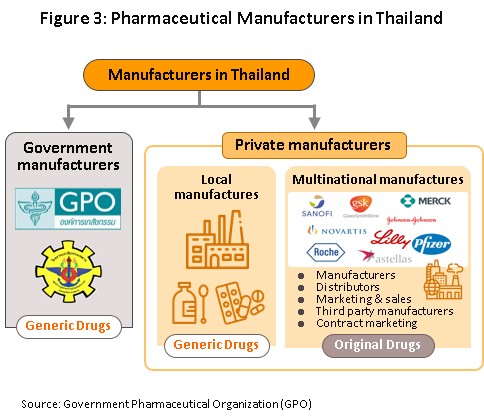

Data from the Food & Drug Administration show that as at August 2021, there were 148 domestic pharmaceuticals producers accredited with Good Manufacturing Practice (GMP) standard. But, not more than 5% have the ability to manufacture active ingredients (such as aluminum hydroxide, aspirin, sodium bicarbonate, or deferiprone) and they are largely for use in-house as inputs for finished products. In R&D, Thailand has been involved mainly in research into vaccines, for example against HIV, bird flu and influenza. Players in the medicines sector can be split into two groups (Figure 3).

Group 1 comprises state enterprises, such as the Government Pharmaceutical Organization (GPO) and the Defense Pharmaceutical Factory, which emphasize the production of generic drugs as alternatives to imported drugs. The Government Procurement and Supplies Management Act B.E.2560 has specified GPO as an entrepreneur similar to the private producer in the sector. Consequently, there is no engagement for government hospitals to purchase mainly from GPO. (Previously, government hospitals had to purchase their supplies principally from GPO not less than 60-80% of their budget). This effectively allowed government hospitals to purchase supplies from non-GPO suppliers. This created a level playing field for private enterprises and increased competition between the GPO and private sector players, including suppliers in India and China which export low-cost products.

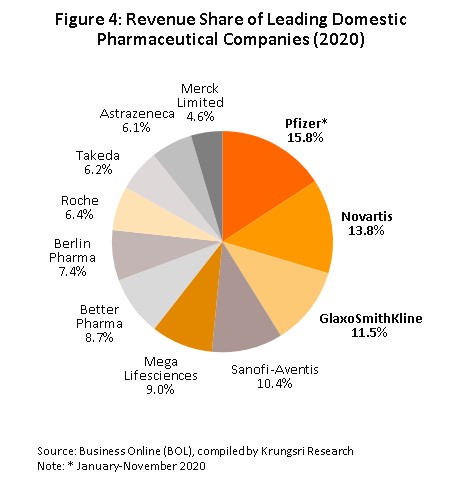

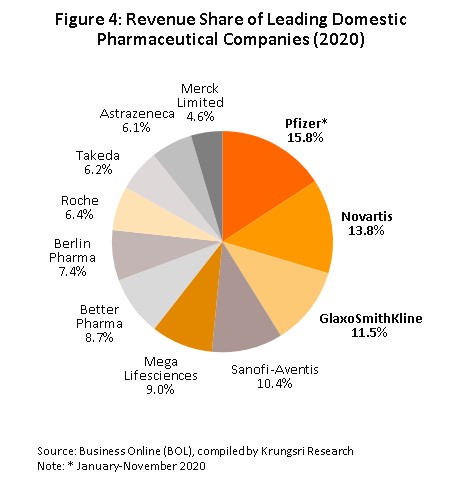

Group 2 comprises private sector producers. This can be divided into two sub-groups: (i) local manufacturers with Thai shareholders, which typically produce general-purpose low-cost generic drugs. Examples include Siam Pharmaceuticals, Berlin Pharmaceutical Industry, Thai Nakorn Patana, Biopharm Chemicals and Siam Pharmacy. Contract manufacturers such as Biolab, Mega Lifesciences and Olic (Thailand) also belong in this group; and (ii) multinationals (or MNCs) with foreign shareholders, which focus on original drugs and operate as agents to import pricier drugs for distribution in Thailand, though some have also established production facilities in the country. Operators in this group include Pfizer, Novartis, Roche, and Sanofi-Aventis (Figure 4).

Currently, two laws govern the manufacture of pharmaceuticals in Thailand. They are: (i) Patent Act B.E. 2522 (1979) and amendments, which grant patent-rights to discoverers and inventors (i.e. protects intellectual property rights), supervised by the Department of Intellectual Property; and (ii) Drug Act B.E. 2510 (1967) and amendments[2], which regulate the manufacture, import, sale and marketing of drugs in Thailand. In terms of regulatory bodies, the Food & Drug

Administration (FDA) is responsible for overseeing compliance in the sector. Its tasks include licensing operators and registering drugs for domestic distribution.

Private sector pharmaceuticals manufacturers typically face pressure from (i) Imports of cheap drugs from India and China, which have lower production costs than Thailand; (ii) The domestic private sector still has disadvantages relative to the GPO in terms of manufacturing and distribution; (iii) The Ministry of Public Health and the Comptroller General’s Department have set a list of reference prices for approved drugs, which is used as a tool to control expenses and set appropriate costs for the purchase of pharmaceuticals by public healthcare providers; and (iv) the private sector is also experiencing rising manufacturing costs following the implementation of the GMP-PIC/S standards[3].

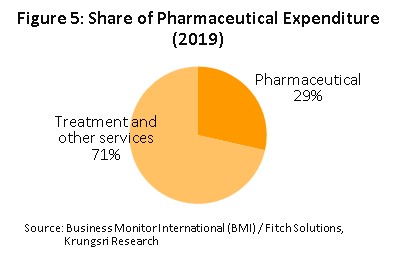

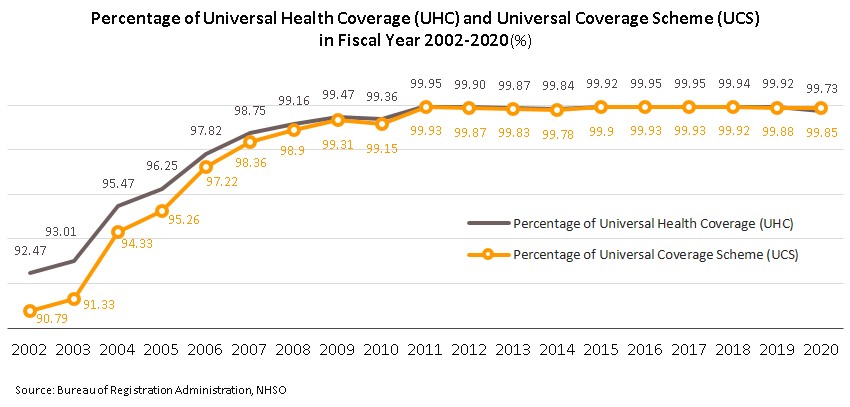

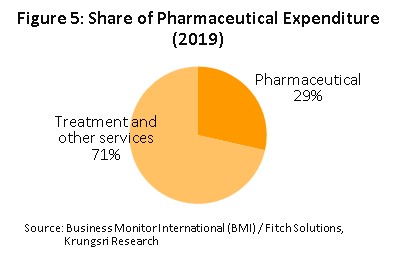

In distribution, approximately 90% of Thailand’s pharmaceuticals output is consumed by the domestic market. Drugs and medicines now account for a quarter of all domestic medical expenses (Figure 5).This was largely triggered by the expansion of national universal healthcare coverage (UHC), specifically the Universal Coverage Scheme (UCS) which now covers 99.85% of total eligible insured persons (Box 1) population. That has increased access to healthcare for most of the population nationwide, which naturally caused the consumption of medicines to jump.

BOX 1 The Thai public healthcare system

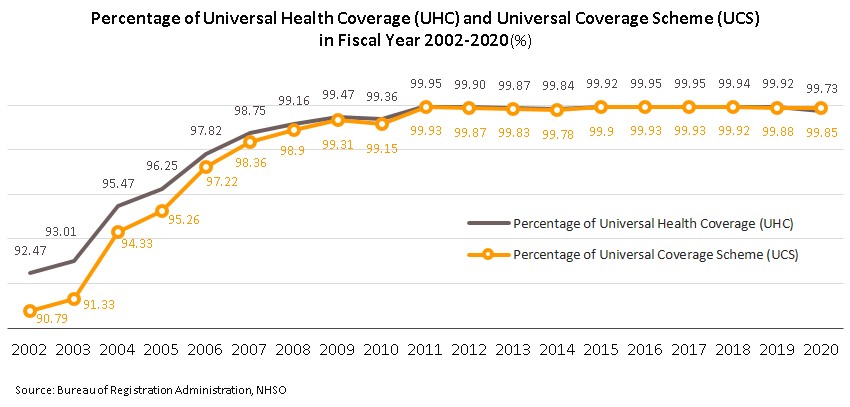

Thailand enacted its system of universal health coverage (UHC) in 2002 with the passing of the National Health Security Act. 99.73% of those eligible for the provisions of the act are now covered by the national healthcare system, and because of this and the fact that government agencies are now the most important buyers of pharmaceuticals in the country, the program plays a major role in determining how the domestic market develops. There are now 3 main channels by which Thai citizens gain access to public healthcare. These are:

- The Universal Coverage Scheme (UCS, though also called the Gold Card or the 30 Baht Healthcare Scheme) began operating in 2002 and is the largest of Thailand’s healthcare funds. The government is responsible for managing UCS healthcare through both state hospitals and private medical providers that are partners in the scheme. In 2020, 47.61 million Thais (71% of the population) were enrolled in the scheme. This figure represents 99.85% of those eligible and is an increase on the 90.79% covered in 2002.

- The Social Security Scheme (SSS) is a form of social welfare that was first rolled out in 1990. This is the second most important of the public healthcare funds and provides care for the ‘self-insured’. In 2020, 12.55 million people were covered by the scheme, or 18% of the population. Financing for the scheme comes from three sources: premiums paid by participants in the scheme, employers’ contributions, and government funding. Payments made by the fund may be used for treatment in both public and private facilities.

- The Civil Servant Medical Benefit Scheme (CSMBS) has been in operation since 1963. In 2020, the scheme covered 5.2 million people, or around 8% of the population. The CSMBS pays for the treatment of civil servants and their families, who have the benefit of receiving medical care in either state or private hospitals without having to make any contributions themselves.

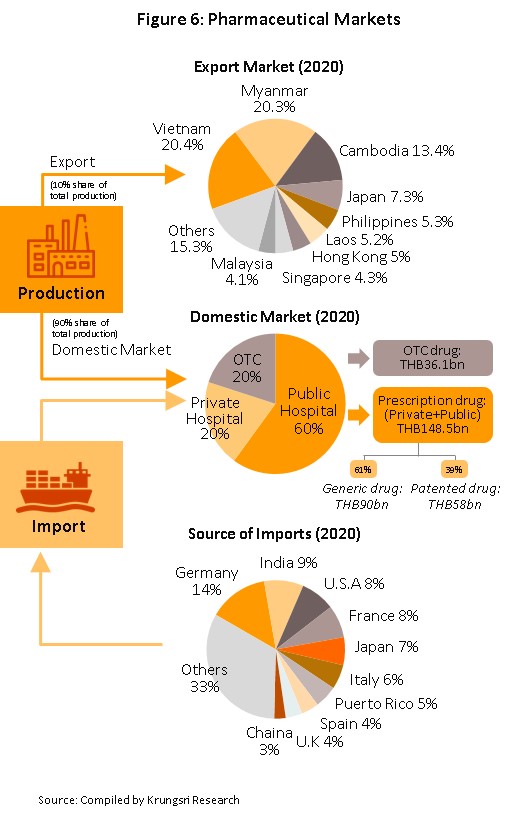

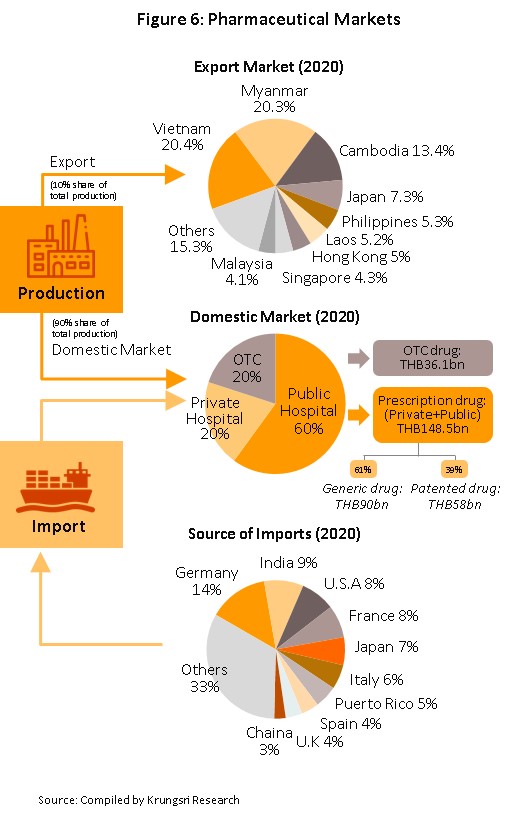

Medicines and pharmaceuticals are distributed through two main channels (Figure 6).

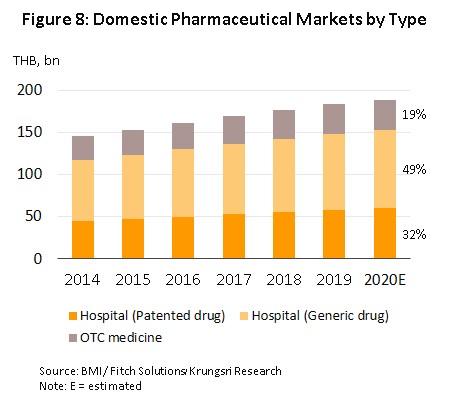

- Hospitals: Thailand’s public healthcare system is extensive, covering both civil servants and the majority of scheme claimants. By value, 80% of the total domestic market for medicines is distributed through hospitals, comprising 60% government hospitals and 20% private-sector operations. Medicines distributed through hospitals are generally prescription drugs, which can be further sub-divided into (i) generic drugs, which account for 61% of the value of medicines distributed via hospitals, and (ii) patented drugs, which make up the remaining 39%. But although this latter group has a smaller share, consumption of patented drugs is growing faster than the consumption of generic drugs, because they are mostly used to treat common chronic non-communicable conditions such as high blood pressure, diabetes, and heart disease.

- Over-the-Counter (OTC) medicines: Although the government health insurance scheme encourages individuals to increasingly seek medical care in hospitals instead of buying OTC medicines from pharmacies, the latter remain an important distribution channel for those with common minor ailments which can be treated with a quick trip to a pharmacy. Hence, the value of the OTC drugs market has been stable at 20% share of the total market for medicines. Nationwide, there are 20,516 registered pharmacies, 25% of which are in Bangkok and 75% in the provinces (source: FDA, August 2019). Pharmacies can be split into the two major groups: (i) stand-alone stores, mostly SMEs, which account for over 80% of pharmacy outlets in the country, and (ii) chain stores, which may either be run, centrally-funded, or organized for expansion through franchising, such as Fascino and Save Drug (a member of BDMS). Beyond this, modern trade outlets (including discount stores, supermarkets, convenience stores and specialist health stores) are turning over a part of their floor space to medicines and pharmaceuticals, and so are able to reach a wide range of customers.

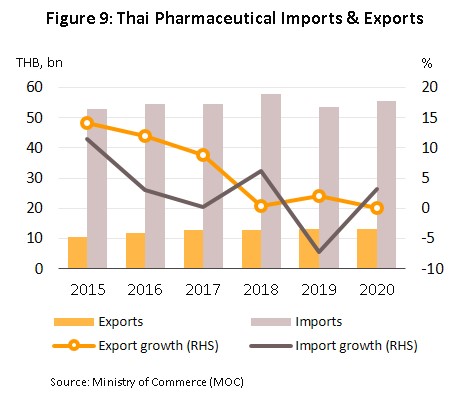

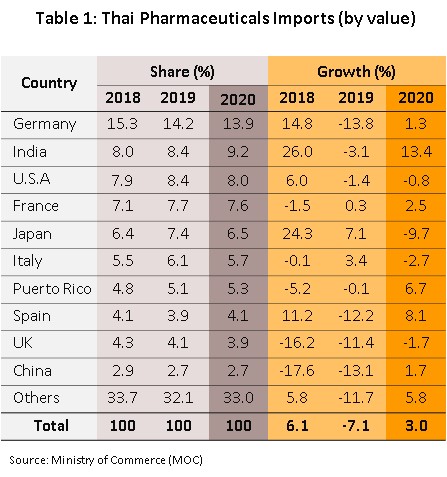

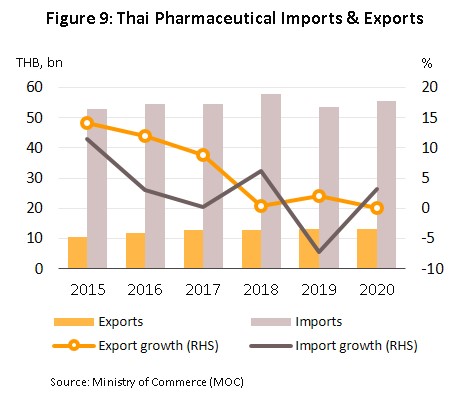

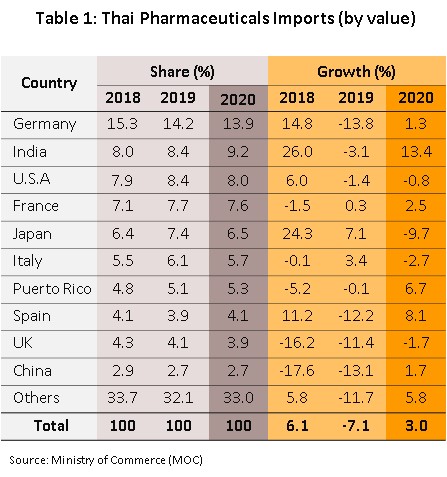

Between 2013 and 2019, exports of Thai pharmaceuticals grew by about 7.4% per year, but since these are low-value generics, they accounted for only 0.2% of the value of pharmaceuticals exports. A large share goes to neighboring, with Myanmar, Vietnam, Cambodia and Lao PDR taking 59% by value. Imports, on the other hand, are normally high-value products that the domestic sector is unable to produce. These include anti-anemia treatments, antibiotics, and cholesterol-lowering medications. The main exporters to Thailand are Germany, the United States, and France and because the exchange has been one-sided, there has long been an imbalance in the trade in pharmaceuticals. However, imports from India has been rising (account for 7.7% of total pharmaceuticals imports, from 5.9% in 2013). Most of these imports are cheap generics because India has benefited from open patents and a system of ‘compulsory licensing’ [4] that allows local manufacturers to override patent rights in some cases and enables them to manufacture generic versions of original drugs at much lower costs.

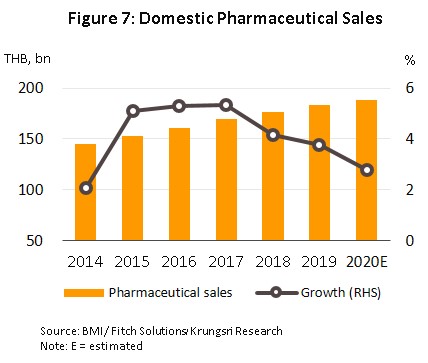

Situation

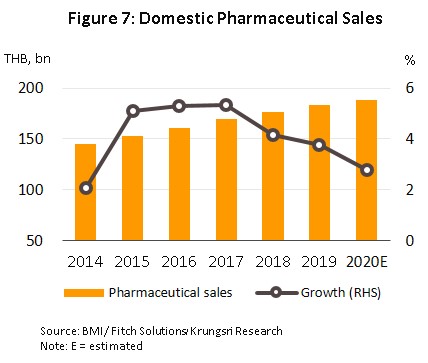

From 2014 to 2018, the Thai market for pharmaceuticals was the second largest in Southeast Asia (in terms of the value of goods distributed), beaten in size only by Indonesia, and through this period, the market sustained growth rates that averaged 4.6% per year. However, growth slowed to 3.7% in 2019 (Figure 7), when the government attempted to control spending on healthcare for civil servants, and the result of this has been that both state and private-sector hospitals have tended to switch to a greater reliance on locally manufactured generics.

The situation in the pharmaceuticals market in 2020 is summarized below.

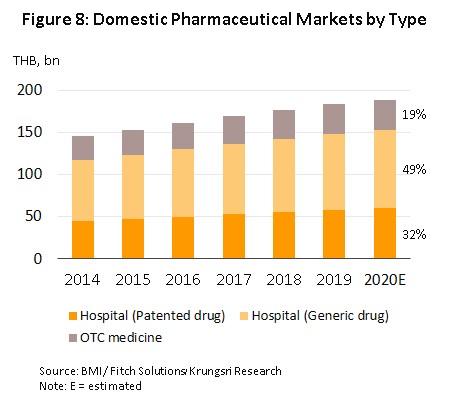

In 2020, growth in the domestic market for pharmaceuticals dropped to 2.8%, with annual sales generating income of THB 190 billion (Figure 7). The weakening of growth rates is explained by the decline in the number of patients (both Thai and overseas) seeking hospital treatment, which was itself a result of the 2020 Covid-19 pandemic and the strict social distancing measures that the government was forced to introduce in the first half of the year. However, the market picked up somewhat in the latter half of 2020, when the government relaxed restrictions on most economic activities, while demand was also given a boost by the need to treat seasonal illnesses, such as influenza and dengue fever, recurrent problems with open burning and air pollution, and the ongoing need for the treatment of non-communicable diseases (e.g., hypertension and diabetes). Overall, growth in the value of medicines distributed through hospitals (the primary distribution channel) thus slipped to 2.9% from 3.9% a year earlier. This was split between: (i) prescription medicines, itself divided between THB 92 billion for generic drugs (up 3.4%) and THB 60 billion for patented medicines (up 2.6%); and (ii) OTC sales, which had a value of THB 36 billion (up 2.1%) (Figure 8).

Total manufacturing output by the pharmaceutical sector[5] rose by 1.5% in 2020, though individual product categories fared differently through the year. Output of tablets (37.6% of all production) and capsules (9.1% of the total) rose by respectively 16.3% and 32.4% on greater demand for antipyretics, analgesics and anti-inflammatories, but production of solutions (accounts for 38.0% of output and is thus the industry’s most important product group) contracted by 0.8% on government move to restrict the sale of certain products that have intoxicating effects or that can be used in the manufacture of illegal drugs[6] (e.g., cough medicines that are made from diphenhydramine, promethazine or dextromethorphan). Less important product groups include powders (7.4% of the total), output of which declined 11.6%, and injectables (3.9%), for which production crashed 48.4%. Despite the relatively weak market, some major players increased production capacity in the year and so overall capacity utilization edged down to 71.9%.

The value of exports held steady in 2020, inching up just 0.1% from 2019 to a total of THB 13 billion (Figure 9). In the first half of 2020, the initial Covid-19 outbreak caused a slowdown in exports of some pharmaceuticals as these were diverted to the domestic market, and so while sales to the main market of the CLMV nations (59.3% of all exports by value) rose 3.8%, this was a sharp fall on 2019’s growth of 6.9%. Exports to Japan (7.3% of the total) fared better and rose 17.7%, but sales to Hong Kong, Malaysia, Indonesia, the Philippines, and Singapore all worsened in the year. As regards imports, these were up 3.0% to THB 55 billion (Figure 9), with most of this accounted for by purchases of original or patented drugs, especially those used in the treatment of hypertension and diabetes. The most important sources of imported pharmaceuticals are Germany, India and the US, which combined accounted for 31.1% of all imports by value. Purchases from these countries climbed 4.0% in 2020, though particularly noticeable were imports from India; these jumped 13.4% (Table 1) on strong price rises for active ingredients that came on the heels of the temporary closure of some Indian pharmaceutical production lines.

The situation for investments in pharmaceuticals was depressed through 2020, and only 10 submissions were made for investment support in the entire year. These had a combined value of THB 553.8 million, which represented a 82.6% drop on the 2019 total, though this can be explained by joint impacts of the debilitating effects of the Covid-19 pandemic on investment and the rush to submit applications in 2017-2018, when to encourage investment, 8-year corporate income tax exemptions were offered by the government (from 2019 onwards, this has been cut to a 5-year period). In the year, 5 projects (including those for research and development in biotechnology) that were approved for BOI support declined by 568.7% to a combined value of THB 535.8 million.

Krungsri Research’s assessment is that through the first half of 2021, domestic production and distribution of pharmaceuticals weakened relative to a year earlier. The emergence of the Covid-19 pandemic at the start of the year and the accompanying weakness in consumer spending power conspired to undercut the number of hospital visits and to weaken purchases of medicines at pharmacies, though in addition, a decline in some seasonal illnesses (e.g., influenza) also reduced overall demand. Thus, the value of tablets distributed domestically (47.8% of the total market value) fell back 15.8% YoY, while receipts from solutions (43.7% of the market) were down 1.9% YoY. Likewise, the value of exports dropped 5.2% YoY to THB 6.1 billion, with those to the CLMV market (contributing around 60.0% of the value of all exports) and Japan (6.2% of the value of all exports down by respectively 1.7% YoY and 14.0% YoY. Continuing the trend, 1H21 imports dropped 5.0% YoY to THB 26.1 billion, though those from Germany, France and India (combined 26.6% of the value of all imports) declined 8.8% YoY. Moving against the overall direction of the market, imports from India rose 5.9% YoY by value on stronger purchases of active ingredients and components.

Outlook

Growth in the value of medicines distributed to the domestic market is forecast to slow from 2020’s 2.8% to 2.5% in 2021. Across the year, the number of hospital visits for non-urgent treatment has been further weakened by the severity of Thailand’s 3rd wave of Covid-19, soft consumer spending power has undermined sales from pharmacies, and what was already a somewhat flat market has been further damaged by the likely failure of the government to reach its target of administering 110 million Covid-19 vaccines by the year end. Nevertheless, some tailwinds have helped to offset these problems, including strong demand for medicines for the treatment of Covid-19, which as of August 2020, had peaked at 23,418 new cases per day. The National Health Security Office now estimates that with a daily total of 20,000 new cases of Covid-19, monthly demand for Favipiravir will run to around 30 million tablets, and to this can be added additional sales of cough medicines and antipyretics.

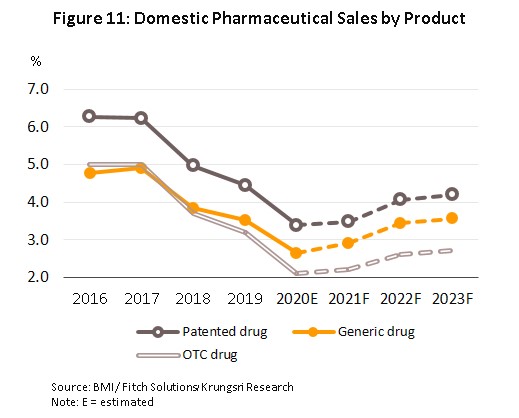

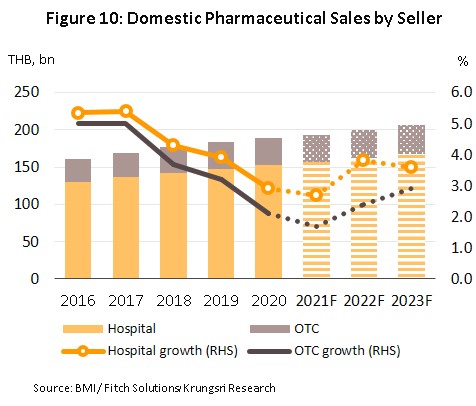

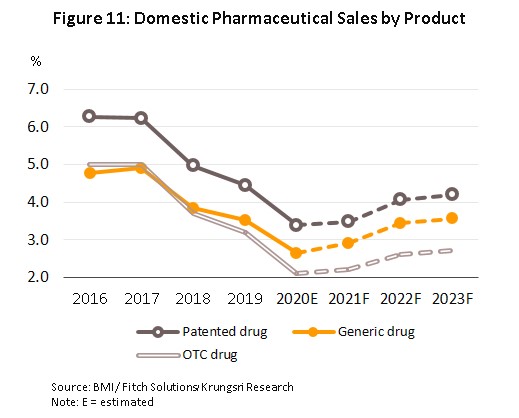

In 2022 and 2023, the forecast is for demand to strengthen in step with a better economic outlook and so growth is expected to rise to 3.5% annually (Figure 10). At the same time, the Covid-19 pandemic and a desire to avoid a serious infection has encouraged many people to take a greater interest in their overall health, and as such, distribution of patented and generic drugs is forecast to rise by 4.1% and 3.5% respectively in over the next two years, compared to 3.5% and 2.9% in 2021 (Figure 11). Factors supporting this outlook will include the following.

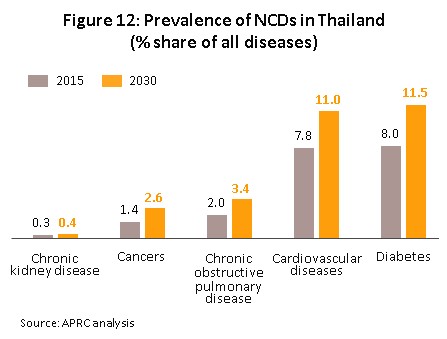

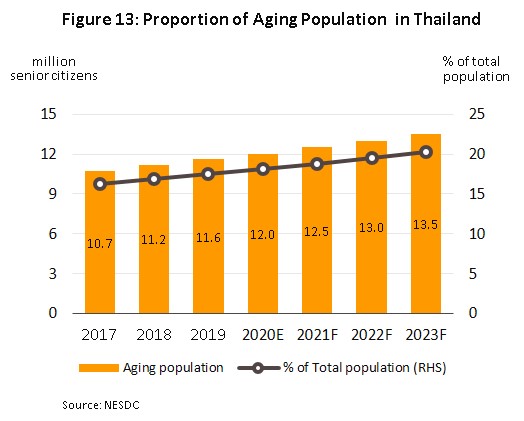

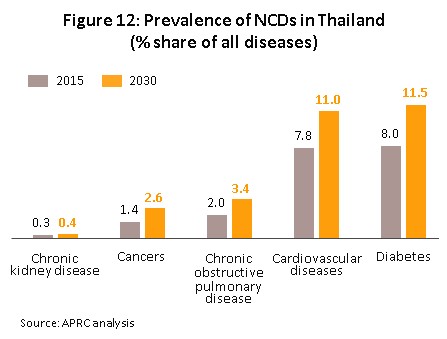

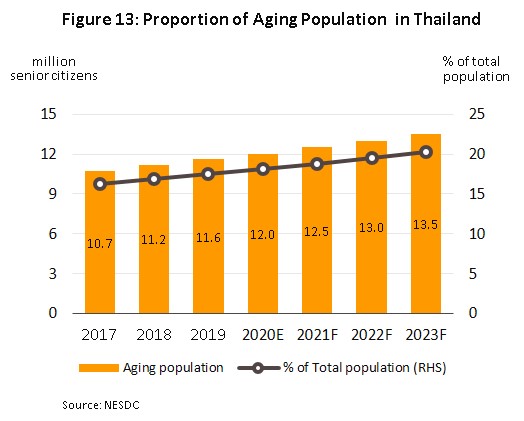

1) Rates of illness are tending to increase for both communicable and non-communicable diseases[7]. In Thailand, the most common communicable diseases are diarrhea, followed by pneumonia and dengue fever, while in order, the most frequently encountered serious non-communicable diseases (NCDs) are hypertension, diabetes, chronic obstructive pulmonary disease, heart disease and stroke (Figure 12). This is partly a consequence of demographic shifts that the Office of the National Economic and Social Development Council estimates will take the number of Thais over-60 years old from 12.5 million in 2021 to 13.5 million in 2023 (Figure 13). Unfortunately, large numbers of the elderly are affected by chronic NCDs, especially hypertension, which affects almost half of the aged in Thailand[8] and slightly less commonly, diabetes, heart disease, stroke and cancer. To meet these challenges, expenditure on healthcare for the elderly will rise and so this is forecast to climb to THB 228 billion in 2022 (2.8% of GDP) from THB 63 billion in 2010 (2.1% of GDP) (source: Thailand Twelfth National Economic and Social Development Plan, 2017-2021). Naturally, against this background, domestic consumption of pharmaceuticals is expected to increase, especially patented medicines that are used to treat more complicated conditions.

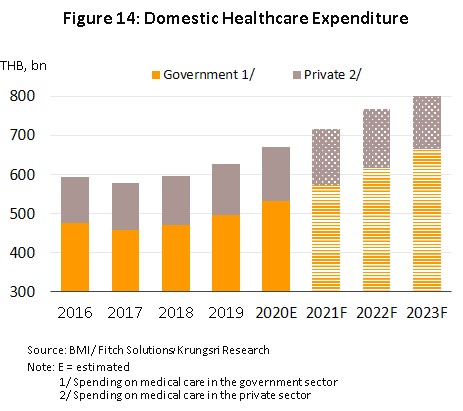

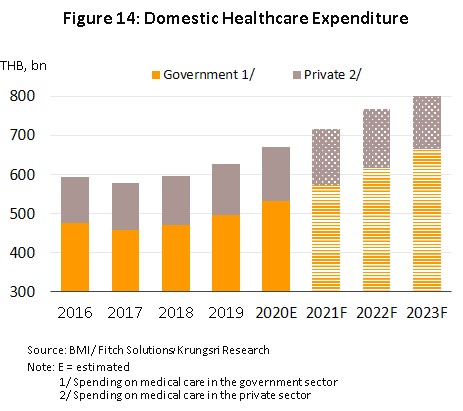

2) The extension of the government’s universal health coverage means that almost all Thais now have access to better quality healthcare, and in fact, over 99% of the population is now covered by some kind of health insurance. Over 75% of Thai citizens have a right to free healthcare under the so-called ‘Gold card’ scheme, 17% can access health services through their social security card, and 10% fall within the remit of the civil service healthcare scheme. Beyond this, private health insurance is becoming increasingly popular, as reflected in the 7.1% increase in enrollment in health insurance schemes in 2020, which was then followed by an additional 4.5% YoY increase in 1Q21. Because of this, in the period 2021-2023, expenditure on medical treatments (for both medicines and care) is expected to grow by 7.2% per year, up from 6.9% in 2020. This will be split between growth of 7.7% in public-sector spending and of 5.3% for the private sector, which would be an increase on 2020’s growth of respectively 7.4% and 5.2% (Figure 14).

3) The number of foreign patients seeking treatment in Thai hospitals will return to growth in the coming period, Krungsri Research estimates that overseas patient numbers will plummet 97% in 2021, the market will rebound in 2022 and 2023 as Thailand gradually reopens to tourism. Thus, although just 150,000 tourist arrivals are expected for 2021, this should rise to 2.5 million in 2022 and then 15.0 million in 2023, and since general and medical tourists comprise around 80% of all non-Thais treated in Thai hospitals, this points to an improvement in the situation for those serving this market. In addition, Thailand retains its advantages in terms of the superior quality of the healthcare and services that are on offer, which is also often cheaper than alternatives in countries such as Singapore and Malaysia. The number of non-Thais being treated in Thai hospitals can thus be expected to rise significantly in the near future, and this will help to support greater demand for pharmaceuticals.

4) Concerns over personal health are likely to rise post-Covid-19 and demand for consultations and treatments for even minor and insignificant conditions is therefore likely to rise, especially given fears over the emergence of new diseases.

Over 2022 and 2023, investment will tend to increase as a result of: (i) greater demand, which will be driven by the factors outlined above as well as by the spur to investment in healthcare industries that Covid-19 has created; (ii) the government’s pro-investment policies, which operate through BOI investment promotion schemes and include an 8-year corporate income tax waiver for approved manufacturers of active pharmaceutical ingredients and a 5-year corporate income tax waiver for those making modern medicines; and (iii) the fact that the pharmaceuticals industry is one of the government-designated ‘new S-curve’ industries, for which investment support is available for projects in the Eastern Economic Corridor (EEC). It is hoped that the latter will result in greater and more successful research and development and that this will then make production costs more competitive relative to imports, but to help push the industry in this direction, further incentives are on offer. Thus, manufacturers that use high-tech production processes will be eligible for further support through additional tax benefits and the provision of subsidies for research costs. In 2020, 4 projects were sought BOI investments privileges in biotech R&D and/or in biotech pharmaceuticals production, and these projects had a combined value of THB 355.1 million.

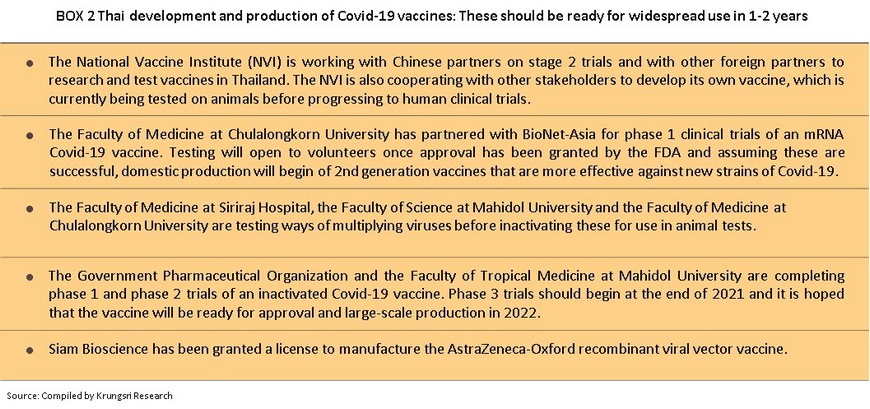

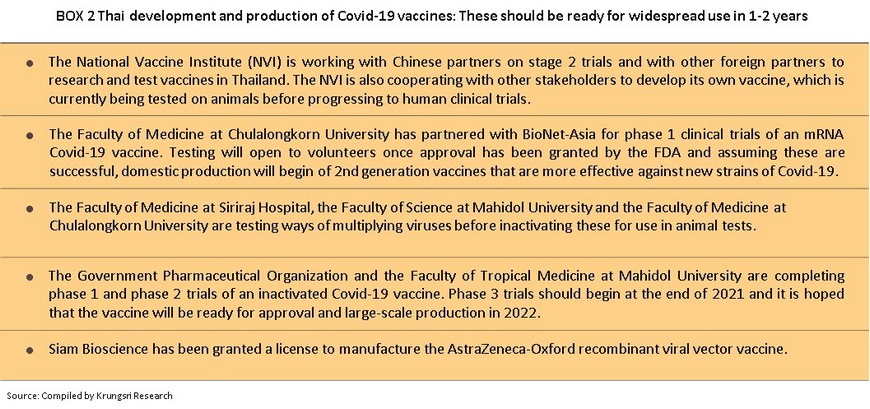

Opportunities exist for players to raise the efficiency of their production processes and so cut their reliance on imports. As part of this, the government is helping domestic manufacturers produce high-value original drugs and medicines for which copyright has expired (e.g., treatments for hypertension and diabetes, and antibiotics) as well as to develop biologics (e.g., anti-cancer treatments), for which demand is expected to increase in the future. The appeal of these products is such that Thai players that do not normally operate within the industry are now planning to move into the production of active pharmaceutical ingredients, these including PTT and the Government Pharmaceutical Organization, which are investing in new facilities that will produce three types of cancer treatment: (i) pill-based and injectable chemotherapy treatments, which are basic medicines used to combat cancer; (ii) pills and injectable biosimilar versions of monoclonal antibodies; and (iii) targeted treatments that will attack cancer cells directly. The production facilities for this project are located in the PTT-owned WEcoZi Wanarom Industrial Estate in Rayong, with construction scheduled for 2022 in the hope that products will be ready for commercial distribution in 2027. SCG Chemicals is also putting money into biologics and advanced vaccines (the company partnered with Siam Bioscience to produce AstraZeneca’s AZD1222 vaccine), while Medicpharma (part of the Bangkok Hospital group) plans to begin manufacturing pharmaceutical precursors. In addition to its other advantages, the Thai pharmaceuticals industry also benefits from: (i) the expertise Thai doctors and medical engineers have in medical research, especially in vaccines, including those for Covid-19 (Box 2); (ii) the ready access to a wide range of herbs and natural products[9] that can be used to produce extracts for use in biomedical or biopharma applications; and (iii) the extent of the country’s bioinformatics industry, which will then support the further research and development of pharmaceutical products. Beyond this, because it has dealt with outbreaks of disease for many years, from SARS and MERS, through to Ebola and now Covid-19, the domestic industry has the potential and the ability to develop effective vaccines at lower costs, and this will then help to reduce Thailand’s dependency on the import of expensive active ingredients and patented medicines.

However, competition is expected to increase within the industry as a result of: (i) greater imports of low-cost pharmaceuticals from India and China (over 2014-2020, imports from India rose by an average of 8.0% per year compared to 5.9% in 2013, while imports from China increased by an average of 3.6% annually over the same period); (ii) the entry into the sector of foreign corporations, which are setting up production facilities in Thailand to manufacture generics for export back to their home country or to penetrate other markets (for example, in 2019-2020, Japanese players submitted 10 applications for investment support in medicine-related industries with a total value of THB 557.4 million, up from 2 projects with a value of THB 347.8 million in 2018); (iii) the increasing interest in the sector coming from Thai corporations active in other businesses (e.g., from the chemicals and petrochemicals industry or from the energy sector); (iv) the increase in manufacturing costs, which will be inflated by a combination of the additional overheads arising from the need to meet the GMP-PIC/S standards and the escalating cost of imports; and (v) the coming into force of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which may affect the registration of drug patents[10] by potentially extending patent-holders’ rights to a 20-year monopoly, and this is thus increasing uncertainty about the future costs of some types of drugs.

Krungsri Research’s view

Income will tend to decline for manufacturers and distributors of pharmaceuticals in 2021 on the continuing effects of the Covid-19 pandemic, but would bounce back in 2022 and 2023 as the national vaccination program is completed and the benefits of this become clearer. Nevertheless, players will have to contend with the pressures of a more competitive environment, and this will tend to weigh on profits.

Manufacturers of pharmaceuticals: Income is likely to soften in 2021 with weaker purchasing power and the drop off in hospital visits that the latest outbreak of Covid-19 has caused. However, sales will be helped through the year by the widespread need for Covid-19 treatments.

However, the market is expected to bounce back in the following two years as economic activity returns to more normal levels and with this, income should grow. Sales will improve on both sides of the market, that is of patented medicines, for which demand from patients with chronic NCDs (such as high blood pressure, diabetes, heart disease, stroke and cancer) is persistent, and for sales of generics, for which demand is growing as a consequence of the extension of healthcare coverage to the entire population and increasing levels of infection with communicable diseases, including the various types of influenza, respiratory illnesses and allergies. On the downside, though, headwinds will come from: (i) worsening competition; (ii) the steadily rising cost of imported precursors; (iii) moves by the government to control the costs of medicines used in private hospitals and business, which may make it difficult for manufacturers to raise their prices; and (iv) the additional overheads imposed by the need to upgrade facilities to meet the GMP-PIC/S standards.

Distributors of pharmaceuticals (retailers and wholesalers): Income would steadily strengthen with more robust domestic demand but alongside this, competition will worsen and this will drag on growth in overall income across the industry, while stand-alone pharmacies will likely have to contend with a worsening threat from large chain stores. For example, Fascino (a chain of pharmacies) plans to extend its network from its current total of 105 branches (as of 2020) by opening another 200 franchises by 2023, while Save Drug (part of the Bangkok Hospital group) also hopes to expand its network. In addition, the range of retail sites from which pharmaceuticals are sold is broadening to include discount stores, supermarkets (of which at least 50 new branches open every year) and convenience stores (7/11 plans to open 700 new branches a year, with the goal of operating 13,000 branches by the end of 2021). Meanwhile, by exploiting their stronger purchasing position relative to stand-alone pharmacies,

wholesalers are increasingly moving into the market space currently occupied by retail operations.

[1]Under the WTO’s Agreement on Trade Related Aspects of Intellectual Property Rights

[2]The Drug Act has been enforced since 1967 and was amended. The Drug Act (No. 6) B.E. 2562 the has been completed and is enforced.

[3]The Pharmaceutical Inspection Co-operation Scheme (PIC/S) is a cooperative framework which was set up by GMP inspectors from a number of countries (but especially European ones) that wished to establish universal standards for assessing GMP in pharmaceuticals production. Thailand officially became its 49th member on 1st August 2016.

[4Compulsory licensing (CL) is employed to reduce the conditions of monopoly and to help other countries can apply CL to produce medicines for solving public health or treating

hazardous communicable disease their countries.

[5]Source: Office of Industrial Economics, produced liquid medicines, tablets, capsules, creams, powders and injectable medicines

[6]The Food and Drug Administration (FDA) has placed restrictions on the sale and distribution of these medicines. Pharmacists are also now required to maintain a register of sales of

these items to prevent people from doing the repurchase and misuse of drugs.

[7]Source: Ministry of Public Health, Fiscal Year 2020 (October 2019 – March 2020)

[8]The Ministry of Public Health states that of 9 million elderly, over 4 million have hypertension and over 2 million have diabetes.

[9]The National Master Plan on Thai Herbal Development 2017-2021 added a list of Thai herbs to the National List of Essential Medicines, and allowed hospitals to use herbal treatments to reduce reliance on expensive imported drugs.

[10]The Food and Drug Administration (FDA) is also responsible for checking whether generic drugs have a patent protection, in addition to checking for the quality and safety of the drugs that are requested for registration

.webp.aspx)