Hotel business in downtown Bangkok continues to grow through the period 2019-2021 in line with growth in the number of visitors to the capital, especially to the city center. It is forecast that in these three years, the number of foreign and domestic tourists staying in hotels in Bangkok will rise by 4% and 7% per year, respectively, and this will then help to lift the occupancy rate for hotel accommodation in downtown Bangkok to 79-80%, compared to a national occupancy rate of 71.5-72.5%.

At the same time, competition will tend to increase and this will come not only from other hotels but also from players in similar though non-hotel businesses. This will then tend to encourage operators to use pricing strategies to attract customers and the effect of this will be to limit the possibility of raising room rates, while the over-reliance on particular segments (and especially on the Chinese market) may expose hoteliers to a higher risk of fluctuation in demand.

Overview

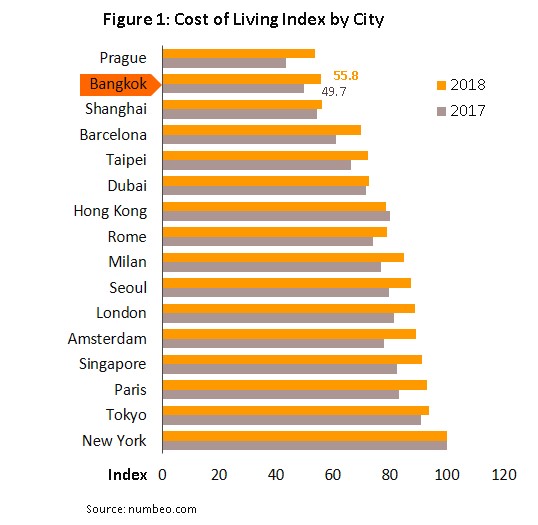

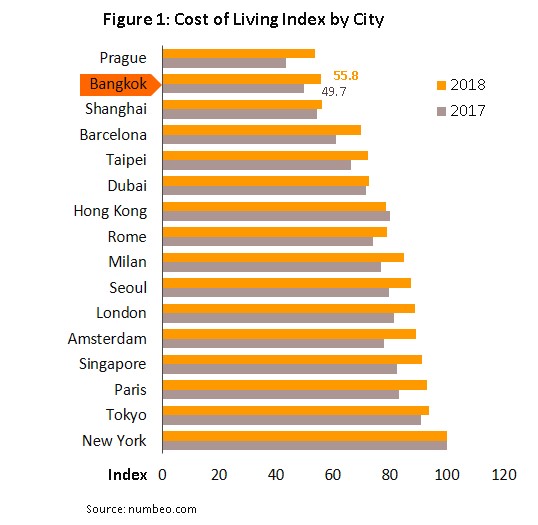

Bangkok is one of the world’s foremost travel destinations and a number of factors help to explain its enduring appeal to world travelers. (i) Bangkok is a major global travel hub. (ii) Bangkok’s cost of living is relatively low compared to other world-class travel destinations and in 2018, the Cost of Living Index for Bangkok stood at 55.8, compared to over 80 for other famous travel destinations, such as New York, Tokyo, Paris, and Seoul (Figure 1), and in the eyes of many tourists, travel to Bangkok therefore gives considerable value for money. (iii) The city is also well served by communications networks. This includes Bangkok’s two international airports serving the tourist market, although Suvarnabhumi Airport is clearly the more important of the two, being the country’s main airport and having won 5th place in the 2014 Skytrax awards for airports that serve 40-50 million passengers per year. In addition, the opening and then extension of the metro system in the central business district (CBD) has also helped to improve travel within the city. (iv) Faster and more convenient travel between Bangkok and the rest of Asia has been helped by the increasing number of direct and charter flights, especially those operated by low cost airlines. (v) Bangkok is also home to a wide range of tourist attractions, from sites of historical interest to the most modern and up-to-date shopping centers, as well as hosting a huge range of easily accessible restaurants.

These factors have helped Bangkok to stand alongside other world-class cities, and this competitiveness is reflected in the international awards that have been given to Bangkok. MasterCard’s Global Destination Cities Index, which measures the number of overnight international visitors in 20 world cities (Table 1) revealed that in 2017, which is the most recent data available, for the third year running, Bangkok was in 1st place and so for the year the city had over 10 million more international tourists staying overnight than did any other Thai city (Phuket and Pattaya were in 12th and 18th place, respectively).

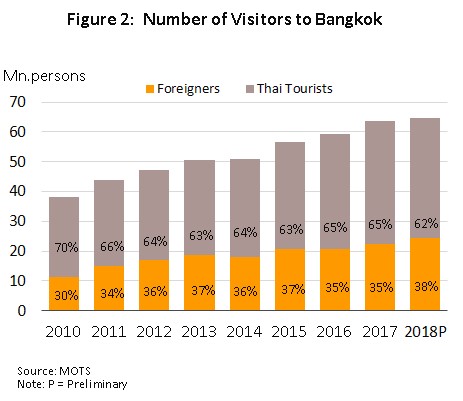

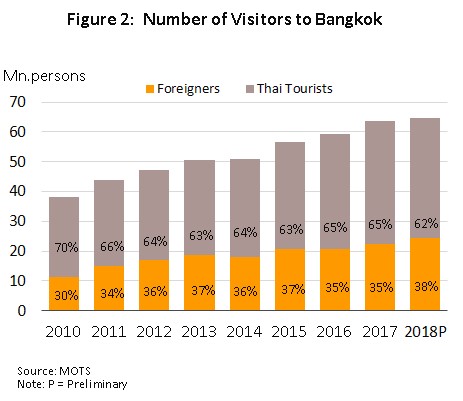

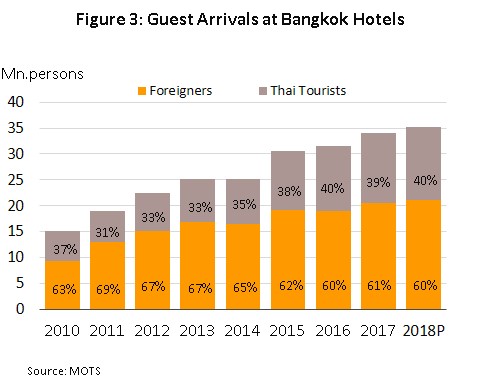

In terms of the make-up of visitors to the capital, including both overnight visitors and those who travel for the day, in 2018, these were split 38% international travelers and 62% Thais (Figure 2) and with the exception of 2008 and 2009, when the global financial crisis and domestic political trouble combined to cause a decline, visitor numbers have increased steadily year on year. However,

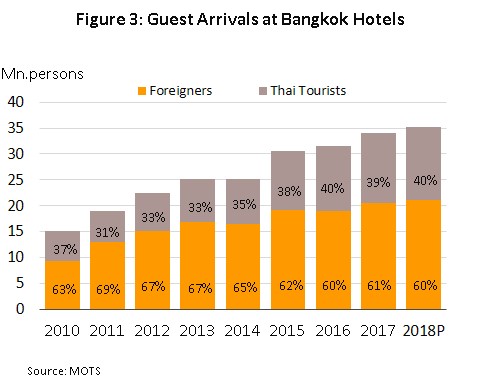

data for 2018 shows that foreign tourists comprised 60% of hotel guests and so constitute the main market for hoteliers (Figure 3) and because of this, any change to the number of foreign arrivals in Thailand tends to have a direct and somewhat significant impact on Bangkok hotels. Looking at the Thai hotel business over the last ten years, though, the number of foreign guest arrivals in Bangkok hotels considered as a proportion of all guest arrivals in hotels in Thailand has tended to decline as a result of the rising number of direct international flights to other Thai cities (e.g. Phuket, Chiang Mai, Krabi, etc.) and the subsequent reduction in the need for travelers to stay overnight in the city before going on to their final destination.

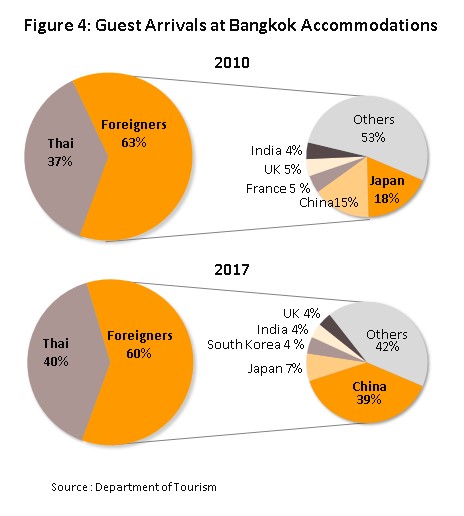

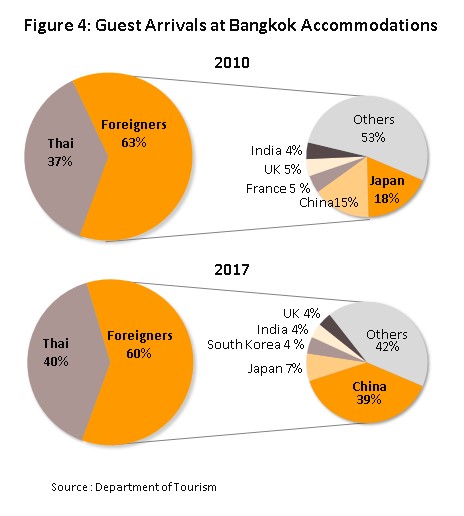

In 2017, 39% of all foreign tourists staying in Bangkok hotels were Chinese, the most important market segment (Figure 4), followed by the Japanese (7%) and the South Korean (4%). However, the proportion of Chinese visitors increased significantly compared to 2007, the Chinese were in second place with a 15% market share, behind the Japanese, with 18%.

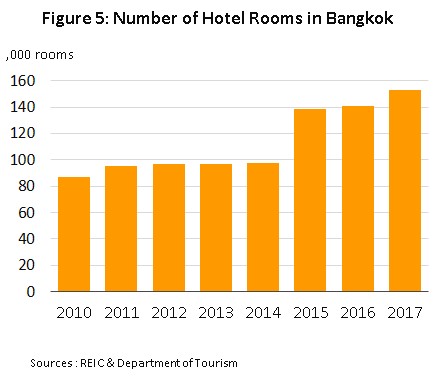

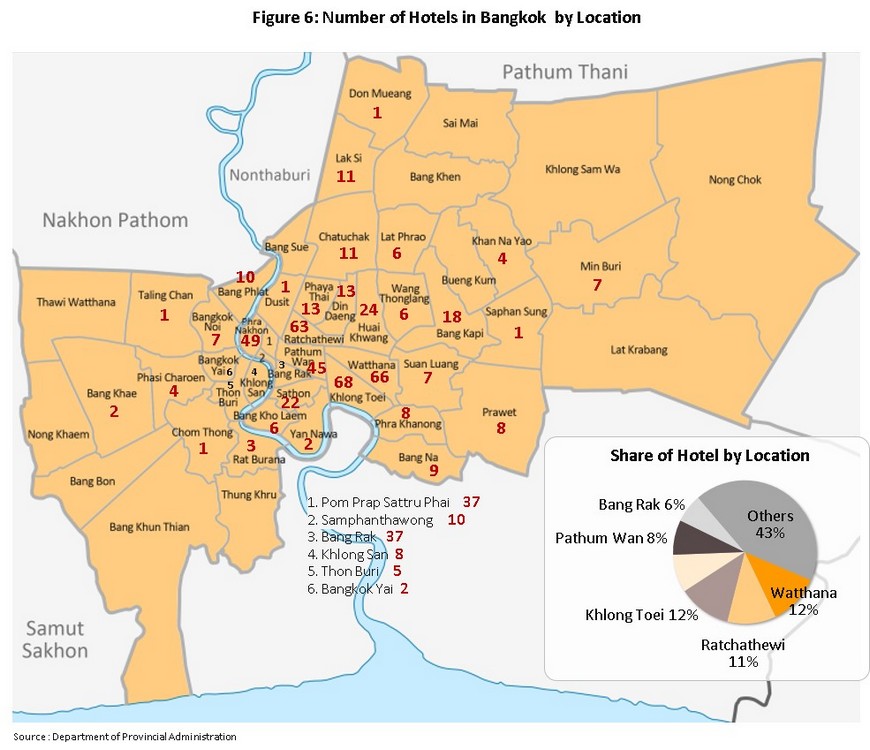

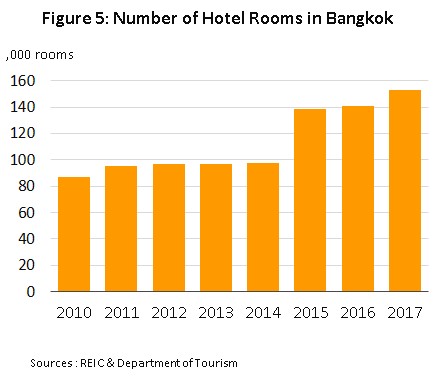

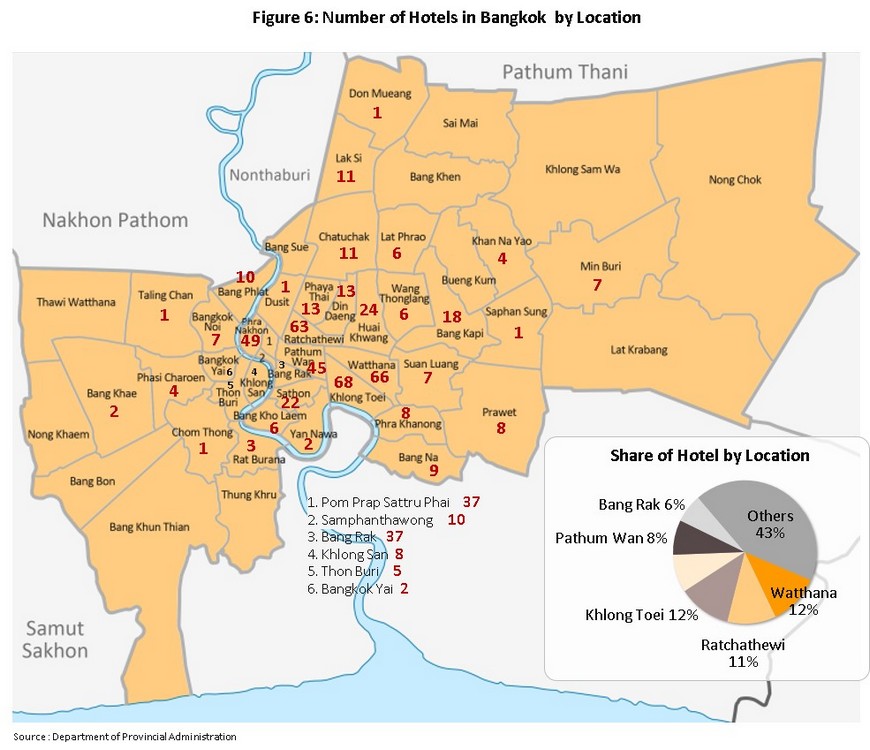

The rapid growth of the tourism sector has led to a substantial expansion in the supply of hotel rooms in Bangkok, both those run by Thai hoteliers and those that are part of international chains; the number of rooms jumped from 90,000 in 2010 to 150,000 in 2017 (Figure 5). Bangkok’s hotels tend to be clustered in Watthana district (Ploenchit and Sukhumvit), Ratchathewi district (areas around the CBD) and Khlong Toei, and together these are 35% of the total 570 hotels in Bangkok (Figure 6). (This information is correct as of May 2017, and is for hotels registered according to the 2004 Hotel Act with the Department of Provincial Administration.)

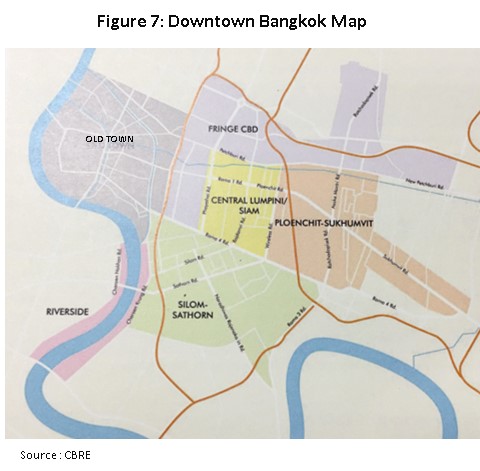

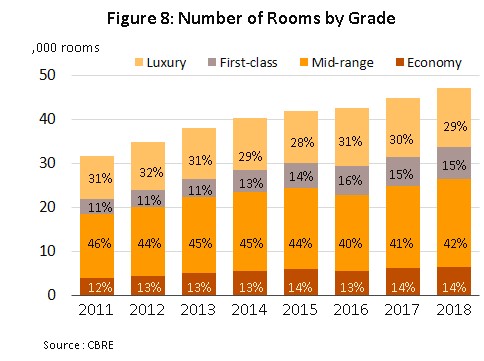

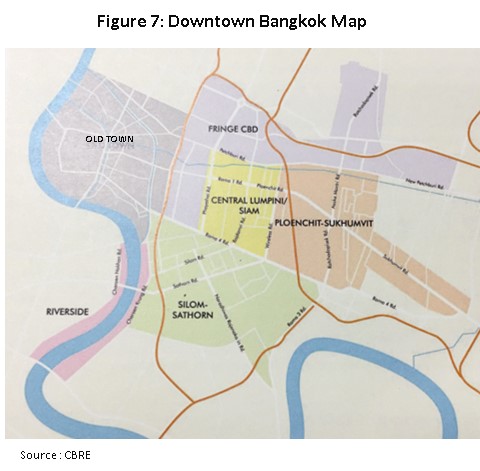

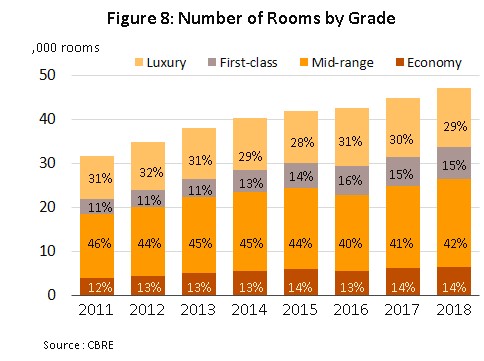

In terms of hotel rooms in downtown Bangkok[1] (Figure7), the supply has increased at the rate of 6% per year from 31,628 rooms in 2011 to 47,091 in 2018 (Figure 8) and at present, central Bangkok contains about 30% of the total supply of hotel rooms in all of Bangkok. Hotels in the central zone include those that are part of chains operated by major Thai players, including Centara, Dusit Thani, Amari, and those that are foreign-owned, such as Accor (Sofitel, Pullman, Mercure and Ibis hotels), InterContinental (Holiday Inn and Crown Plaza hotels) and Starwood (Sheraton, St. Regis and Le Méridien hotels).

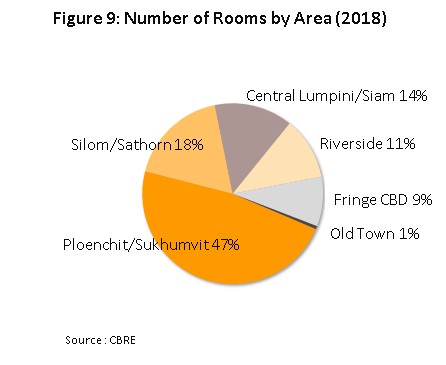

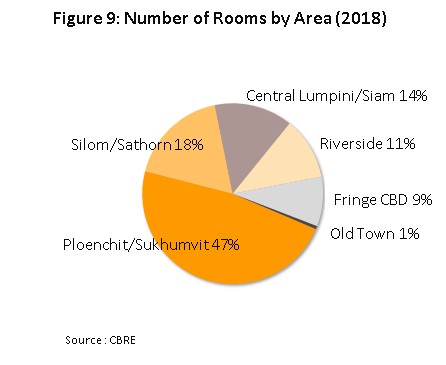

Considered in terms of their average daily rate (ADR) the largest group of hotels in downtown Bangkok are mid-range establishments, defined as hotels with an ADR of THB 1,500-2,500. These account for over 40% of all downtown Bangkok’s hotels, followed in order by luxury hotels, which have an ADR of over THB 3,500, first-class hotels (an ADR of THB 2,500-3,500) and economy hotels (an ADR of THB 700-1,500) (Figure 8) but the dominance of this category is falling and has slipped from 46% of supply in 2011 to 42% in 2019. Over the same period of time, the proportion of first-class hotels has moved in the opposite direction, increasing from 11% to 15% as the rising cost of land in downtown Bangkok has forced operators to focus on developing hotels with higher room rates in order to get the best return on their investments. In terms of location, in 2018, the Ploenchit/Sukhumvit area was the most popular for hotel owners, and was home to 22,417 hotel rooms, or 47% of the rooms in downtown Bangkok (Figure 9); this area is one of Bangkok’s business districts, it is the location for a number of leading shopping centers and it is well-served by the BTS and MRT metro systems. The area’s major hotels include Centara Grand at CentralWorld, Grand Hyatt Erawan, Plaza Athenee, and Renaissance Bangkok. The Ploenchit/Sukhumvit area is followed in importance by Silom/Sathorn, which has 8,400 hotel rooms (18% of the total) and this area is favored by tourists and especially by overseas business travelers because the Ploenchit/Sukhumvit business district is easily accessible. Here, major hotels include Holiday Inn Bangkok Silom, Bangkok Marriott Hotel the Surawongse, Le Méridien Bangkok, and Eastin Grand Hotel Sathorn.

Situation

Between 2008 and 2010, hotel operators in Bangkok faced worsening business conditions. First, the sub-prime crisis led to a dramatic slowing of the global economy, and then domestic political conflicts erupted and these combined to trigger a sharp downturn in the number of foreign and domestic tourists traveling to Bangkok. With this, average occupancy rates in Bangkok plummeted, especially for luxury hotels, many of which were in the parts of Bangkok affected by disturbances (most notably Ploenchit). Thus, compared to average rates of 70% in the previous 3- 4 years,

occupancy rates for luxury hotels in Bangkok fell to respectively 63%, 50% and then 47% in each of the years 2008, 2009 and 2010.

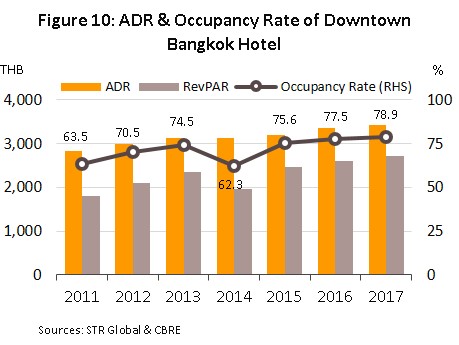

Following this period, rates rebounded, and with the exception of 2014, when the last coup was staged, from 2011 to 2017 average occupancy rates steadily rose again for hotels at all levels of the market (Figure 10).

However, in the same period, although average daily room rates for hotels in downtown Bangkok rose, they did so at only the relatively low average rate of 3% per year (Figure 10) pressured by a rapid increase in the supply of rooms, especially in the first-class category, for which the supply of rooms rose by 12% annually. This then naturally led to increased competition and it became increasingly difficult for operators to raise their prices. The average Bangkok room rates are very low compared to those of other tourist cities, especially those in the rest of Asia (Table 2). More positively, though, this has also been a major factor in helping to maintain the competitiveness of Bangkok hotels when competing against operators in those same cities.

For 2018, tourism and hotel business situation in downtown Bangkok continued to grow serving the rising number of the tourists, while the supply of hotel rooms increased only slightly. Details for the year are given below.

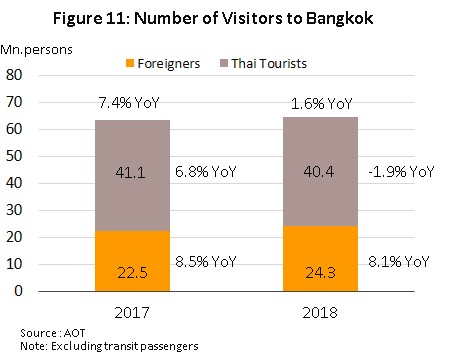

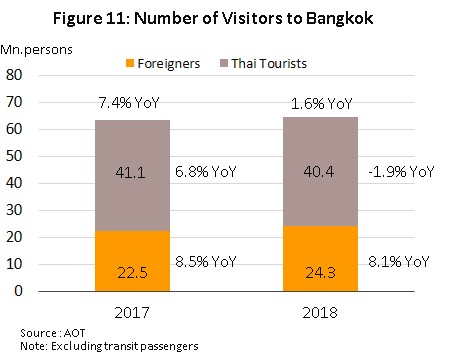

- The number of visitors to Bangkok rose 1.6% YoY to 63.6 million (Figure 11). By origin, the number of foreign visitors rose by 8.1% YoY (a total of 24.3 million tourists), while the number of Thai visitors moved in the opposite direction and shrank by 1.9% YoY to 40.4 million people. The latter fall was in part caused by government measures to encourage Thais to visit other tourist and secondary cities.

- In 2018, the number of visitors staying in hotels in Bangkok rose 3.9% YoY to 35.3 million guests, split between 21.2 million foreign tourists (up 2.8% YoY) and 14.1 million Thai visitors (up 5.5% YoY). The data, which is from the first half of 2018, thus demonstrates that with a 66% share, foreign guests remain the most important group. By country of origin, China was easily the largest market segment (41% of all foreign guests), followed by South Korea (5% of the market) and India (4%), while in terms of annual growth, these three segments increased in size by 13.3% YoY, 1.8% YoY and 7.8% YoY, respectively.

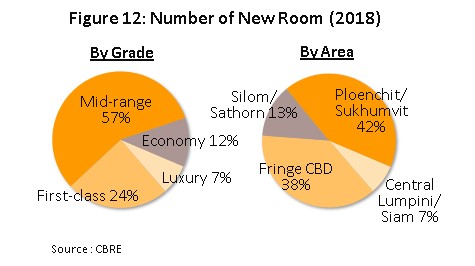

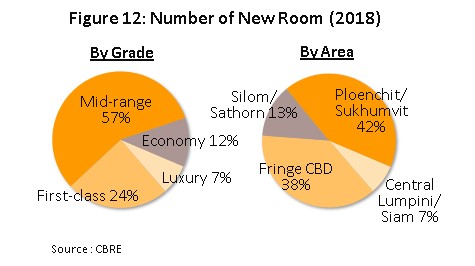

- The supply of new hotel rooms in downtown Bangkok rose by 5.3% (or 2,359 rooms) from the total at the end of 2017 and this pushed the total supply in the area to 47,091 rooms at the end of 2018. The majority of this expansion was in the mid-range segment, which grew by 1,338 rooms (57% of all new rooms), followed by first-class hotels, with 576 new rooms (24% of the total), economy hotels, (274 new rooms, or 12% of the total), and finally, with 171 rooms (7%), luxury hotels. However, in terms of the rate of expansion of each segment, the supply of rooms in the first-class segment, which rose 8.7% YoY, was the most rapid. By area, Ploenchit/Sukhumvit remained the most attractive to investors and 999 new rooms were built there. With 886 new rooms, the area on the fringes of the CBD was in second place, followed by Silom/Sathorn (303 rooms) and central Lumpini/Siam (171 rooms) (Figure 12). In the year, no new supply was added in the riverside and Old Town areas.

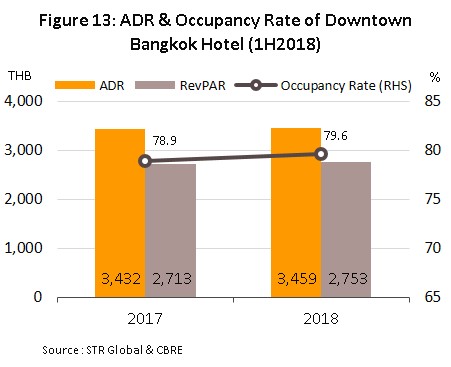

- In the year, business performance indicators improved slightly relative to those for 2017 (Figure 13). Thus, the average occupancy rate for 2018 stood at 79.6%, up slightly from the previous year’s figure of 78.9%, while increases in average room rates were held back by stiff competition to a rise of just 0.8% YoY, bringing the ADR to THB 3,459. This then restricted growth in the average revenue per available room (RevPAR) to 1.5% YoY, or THB 2,753.

Outlook

Between 2019 and 2021, business conditions for hotels in downtown Bangkok will improve in line with the expansion of the city’s tourism sector and it is forecast that overall, guest arrivals in Bangkok hotels will increase by 5.5% per year, compared to annual growth across the country of 4-5%. This will be split between yearly growth of 4% for foreign tourists and 7% for Thai visitors and this will then keep the average occupancy rate in central Bangkok at the high rate of 79-80% (compared to 71.5-72.5% nationwide).

In addition to Thailand’s other advantages, government policy will also help to support growth in the sector, including upgrades and improvements to Suvarnabhumi and Don Muang airports, the extension of road and rail networks, and the introduction of measures to support tourism directly, which are expected to run through the whole of this period. The outlook for different markets is given below.

- Foreign arrivals will remain the main driver of the market for hotels in downtown Bangkok, especially tourists from the most important market of East Asia (China, Japan and South Korea). However, the Indian market is becoming increasingly important, partly thanks to the growing number of direct flights by low-cost carriers that now link Indian cities and Bangkok, and the rapid growth in the number of Indian tourists coming to Bangkok that this is causing will help to offset the weakening of the Chinese market somewhat. Indeed, the Association of Thai Travel Agents (ATTA) estimates that by 2029, the number of arrivals from India may be close to the number of Chinese arrivals.

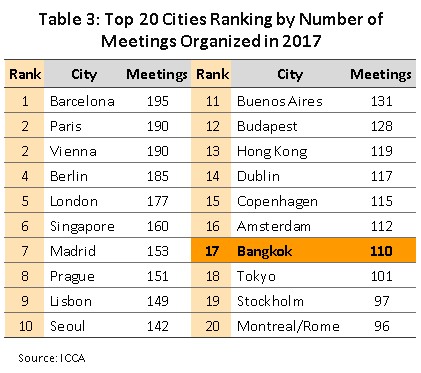

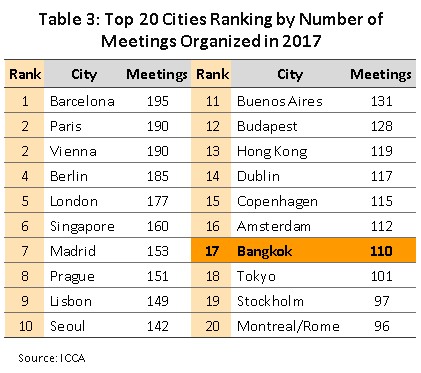

- MICE visitors (Meetings, Incentives, Conventions and Exhibitions) will play an increasingly important role in the market. Thus, the Thailand Convention and Exhibition Bureau (TCEB) forecasts that the number of MICE visitors will grow by 6-10% in 2019 (at present, MICE travelers represent 3% of all foreign arrivals in Thailand), and rankings issued by The International Congress and Convention Association (ICCA) in 2017 show that Bangkok is in the world’s top twenty cities for the number of meetings and seminars held there (Table 3). Hotels in Bangkok that will benefit from growth in the MICE market will largely be in CBD and in the luxury or first-class categories because these have a sufficient supply of rooms and are usually equipped with a full range of facilities, such as conference rooms that have the capacity to host large-scale meetings and seminars.

- The number of Thai visitors coming to Bangkok will also rise steadily, boosted by the initiation of or increase in flights by low-cost carriers between provincial airports and the capital, as well as by improvements to land transport networks that are making travel into Bangkok quicker and more convenient.

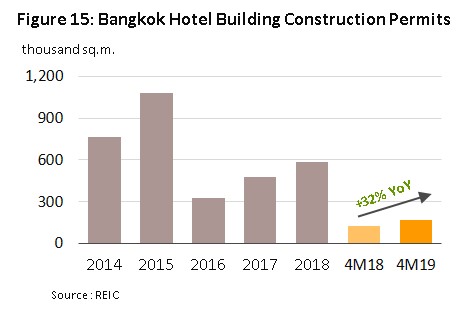

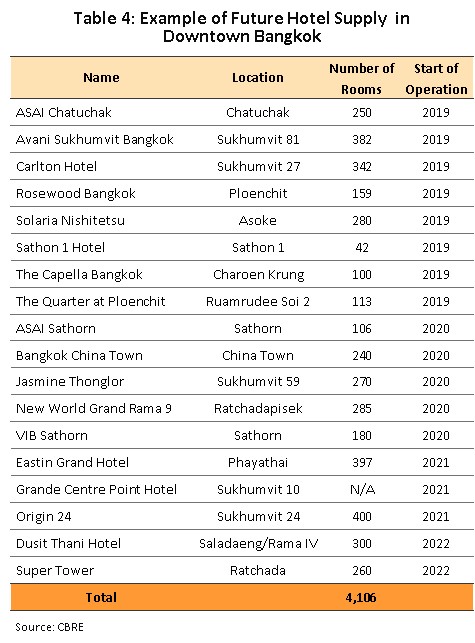

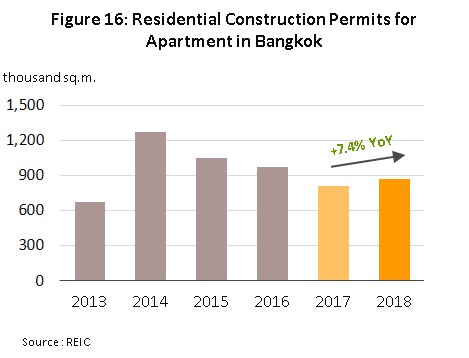

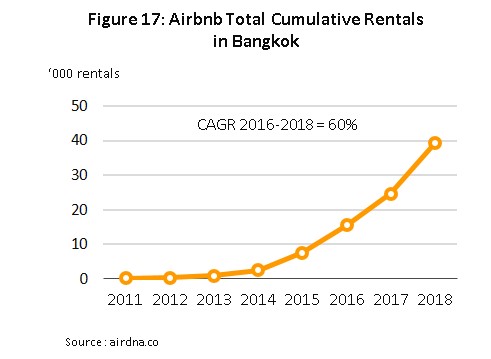

The number of hotels in Bangkok will tend to increase in the coming period, as is reflected in the total footprint of applications for permits to build hotels in the city (a reliable indicator of supply 1-2 years out), which ran to 170,000 sq. m., in 4M19, a rise of 32.0% YoY (Figure 15) and 30% of all applications for hotel construction made nationwide. Although the ongoing investment in Bangkok hotels reflects the city’s continuing appeal to travelers, it will also feed rising competition, which will come from several different sources. (i) Competition between hotels will rise, especially in the city center, where a substantial number of new hotels targeted at business travelers are going up alongside new metro lines. These include several luxury hotels, such as the Eastin Grand Phayathai Bangkok (due to open in 2019) and the One Bangkok project, which includes a five-star hotel that is scheduled to open in 2021. (ii) As increased applications for construction permits indicate, competition will also come from suppliers of alternative accommodation, such as flats, serviced apartments and condominiums which will enter the market over the next few years (Figure 16). This will include accommodation marketed through booking platforms such as Airbnb, which are typically priced at a point below that of hotels and which present customers with a wide range of choices, from individual rooms in a shared house to whole condominiums. As of October 2018, according to data from airdna.co, there are 12,000 properties available on Airbnb in the Bangkok area alone and although at present, there is no legislation governing these types of rentals, this segment is growing rapidly and between 2016 and 2018, the number of properties rented through Airbnb increased by 60% per year (Figure 17). The consequence of this increase in competition will likely be to limit the extent to which average room rates rise.

Krungsri Research view

Generally, the outlook for hotels in downtown Bangkok is positive and growth will be seen in line with the number of tourists staying in the city. This is expected to rise by an annual average of 5.5%, with growth in the Thai and foreign markets forecast to run to 7% and 4% per year, respectively. Hotel operators will benefit from Bangkok’s advantages as home to a wide range of tourist attractions, as well as from its being a major business center. In addition, the capital is the nation’s primary travel hub, connecting to other tourist centers such as Phuket, Pattaya and Chiang Mai, while the government’s ongoing efforts to develop the city’s transport infrastructure is helping to support growth in tourism by domestic and international visitors. Overall, increases in the supply of hotel accommodation that are expected to keep pace with the increase in guest arrivals will maintain high and stable occupancy rates, and these should sit at around 79-80%.

However, risks still exist for operators and two potential problems in particular may have negative consequences for the tourism sector and for hoteliers in downtown Bangkok, and these should be closely monitored. (i) The over reliance on individual customer groups, and especially on Chinese tourists exposes operators to the risk of a weakening of the market in these segments. (ii) The steady increase in the supply of accommodation, both from hotels and from similar but non-hotel operators is forcing players to use pricing strategies to attract customers, and this is limiting the space for increases in room rates.

[1]Downtown Bangkok consists of: (1)Ploenchit/Sukhumvit - covering areas along Langsuan, Wireless, Ploenchit, and Sukhumvit (soi 1-39 and 2-26) roads and the sois in between; (2)Silom and Sathorn - covering areas along Silom, Sathorn and Surawong roads, the sois in between, and the early part of Rama IV road from Samyan to the Sathorn-Rama IV intersection, including the sois in between; (3)Central Lumpini/Siam Area - covering areas along and Rama I, Phayathai, and Rajdamri roads including the sois in between; (4)Riverside - covering the areas along Rama III road from the Taksin Bridge to the Rama IX Bridge, and Charoen Krung road from the Taksin Bridge to the end of Silom road; along with Charoen Nakorn road on the opposite bank of the river; (5)Fringe CBD - covering the intersection of Rama IV and Ratchadapisek up to the Huay Kwang area. Newer Pratunam, Phayathai and Ratchathewi hotels are also included in the area; Old Town - covering the areas along Rama VI towards Chao Phraya river including the sois in between

.webp.aspx)