Following weak operations in 2020, hoteliers will continue to see depressed conditions through 2021. The first shoots of recovery will start to break through from the end of this year and throughout 2022 and 2023, but it could take at least 4 years for foreign tourist arrivals to return to pre-COVID level. Against this backdrop, domestic tourism will recover faster, partly thanks to ongoing policy efforts by the government to stimulate demand. By the latter half of 2021, the worldwide rollout of vaccination programs will start to translate into an uptick in foreign tourist arrivals, helped by a recovering global economy and long-term growth potential in the Thai tourism industry. However, in the post-pandemic environment, players in the tourism and hotel industries will need to move rapidly to overhaul their operations onto a more sustainable footing by accelerating the adoption of modern technology, placing greater emphasis on public health and hygiene, and developing their understanding of varied and diverse consumer needs and using this knowledge to offer customized travel experiences.

Overview

The hotel business (which here includes hotels, resorts and guesthouses) is directly connected to and an important part of the wider tourism sector. In terms of its contribution to the economy, in 2019, accommodation and food service activities together accounted for 6.1% of Thai gross domestic product (GDP), bringing in THB1.03trn.

The sector has a central role in the overall economy because Thailand is one of the world’s most popular tourist destinations. This is partly because the nation offers world-class tourist attractions throughout the country. Bangkok is a major and perennially popular tourist attraction, a fact underlined by the tourism awards that the city consistently wins[1]. There are also famous seaside and beach destinations in the South and East, and a range of eco-tourism travel options in the North. In addition,

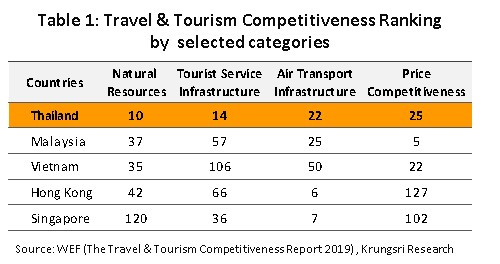

the country benefits from competitive pricing for accommodation and low cost of living, which offers better value-for-money than many other countries. Beyond this, the travel industry benefits from the country’s extensive, comprehensive transportation network, national infrastructure that is constantly being upgraded, and the increasing number of low-cost carriers serving the local market. These factors helped to give Thailand an edge over its competitors. Indeed, the 2019 Travel and Tourism Competitiveness Index, compiled by the World Economic Forum places Thailand in 31st place out of 140 countries surveyed (up from 34th in 2017) and 3rd in Southeast Asia, after only Singapore and Malaysia (Figure 1).

Within the Travel and Tourism rankings, relative to other countries in the Asia-Pacific region, Thailand scores particularly highly with regard to the quality of its natural resources (Table 1).

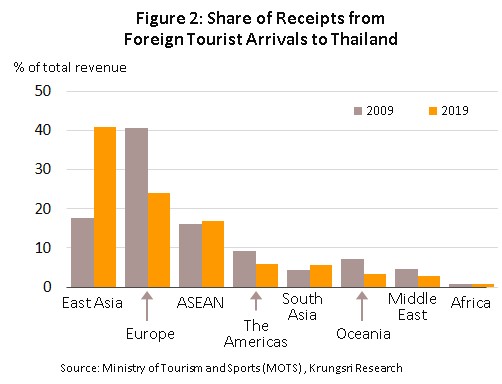

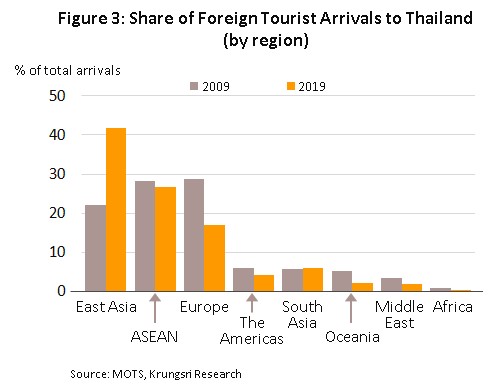

The travel industry generates considerable receipts. Foreign tourists are the most important group; they contribute around 65% of the sector’s revenue (2019 data), spend more per head, and stay for longer in tourist accommodation than domestic tourists. The largest tourist market comprise those from East Asia (China, Japan, South Korea, Hong Kong and Taiwan), who contribute 41% of total receipts from foreign arrivals (Figure 2) and account for 42% of total foreign arrivals (Figure 3). This is followed by Europe which generates 24% of foreign tourist receipts. The ASEAN zone is the second most important region in terms of number of foreign tourist arrivals (27% of total visitors).

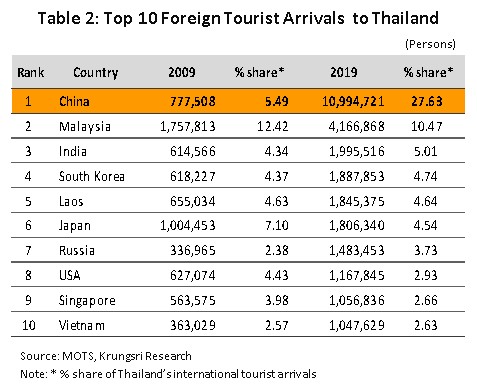

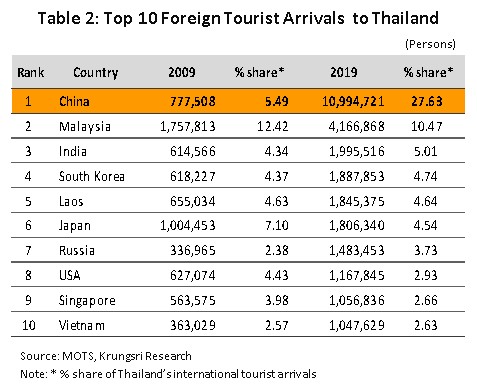

The most important tourist markets for Thai tourism are China, Malaysia, India and Russia.

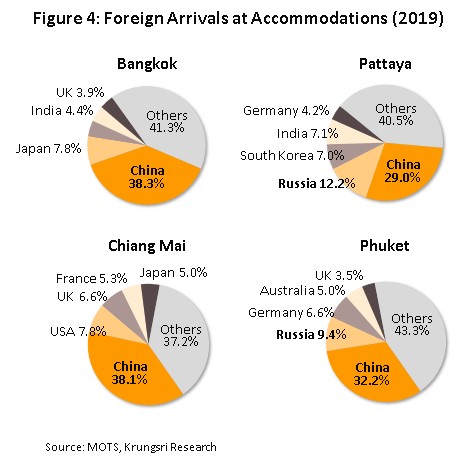

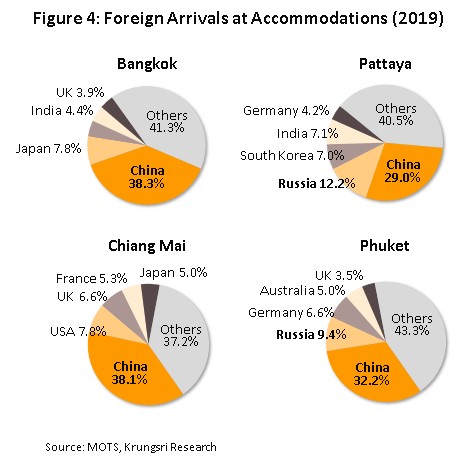

China: With 11 million Chinese tourists visiting Thailand in 2019 (27.6% of total foreign arrivals), China is Thailand’s most important market by a large margin. But this dominance is a recent development following explosive growth since 2007, when the Chinese market expanded more than 10-fold (Table 2). This growth was broad-based within the country with almost equal number of Chinese visitors at all of Thailand’s major tourist destinations (Figure 4). A combination of several ‘push’ factors has encouraged more Chinese visitors to visit Thailand, including the following: (i) China’s government has relaxed regulations on outbound tourism that had previously been restricted for Chinese citizens. Currently, Chinese tourists can visit up to 198 countries (source: Passport Index 2021)[2]. (ii) The rapid growth of the China’s economy has caused an equally rapid expansion of the Chinese middle-class population from 80 million in 2002 to 700 million in 2020 (source: Statista), and these individuals have greater ability and desire to travel abroad. (iii) The rising number of low-cost carriers as well as direct flights between Thailand and China. In addition, land links between the two countries have improved, especially the R3A (Thai-Laos-South China) connection.

![]()

Several ‘pull’ factors have also supported the market, including: (i) Thai government policies to promote tourism, for example waiving fees for visas issued on arrival (VOAs) for Chinese citizens; and (ii) ongoing marketing efforts by official organizations to attract Chinese tourists, such as road shows in Chinese cities and the presence of Tourism Authority of Thailand (TAT) offices in Beijing, Shanghai, Guangdong, Chengdu and Kunming.

![]()

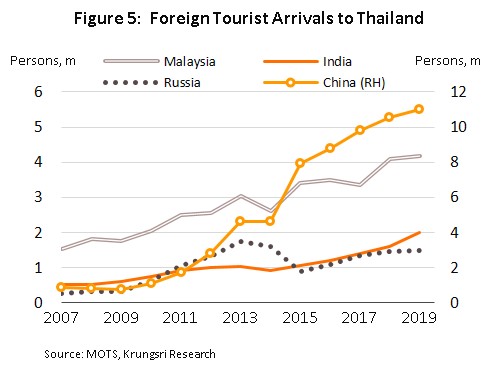

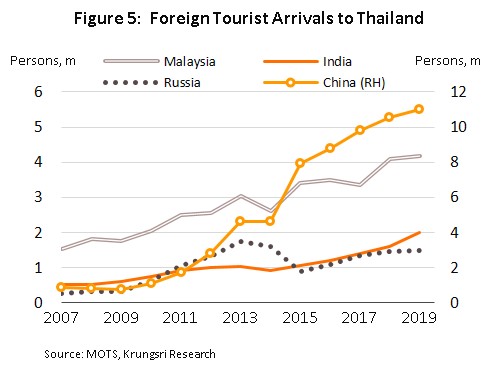

Malaysia: Malaysia is Thailand’s second most important tourist market (10.5% of all foreign arrivals in 2019). Compared to Thailand’s other immediate neighbors, Malaysia is also a major source of tourist receipts. In 2019, revenue from Malaysian tourists reached THB110bn compared to THB140bn from all CLMV tourists combined. Indeed, Malaysia was Thailand’s most important tourist market until 2012 when Chinese tourists started to dominate (Figure 5). With growth averaging 9.7% annually between 2010 and 2019, it remains in extremely good health helped by strong cross-border Thai-Malaysian trade. Malaysian tourists typically enter the country through the Sadao crossing (main entry point) or Betong and Sungaikolok. The launch of the Kuala Lumpur-Chiang Mai air route also lifted the number of Malaysian arrivals.

India: With a 5.0% share in 2019, India is Thailand’s 3rd biggest market. This segment is growing strongly; between 2015 and 2019, the market registered double-digit growth every year and generated an average of THB60bn receipts annually. Growth has been supported by several factors. (i) India’s economy has been performing well, and with this the middle class is expanding; India’s National Council of Applied Economic Research (NCAER) estimates that in 2016, 267 million Indians were middle-class and this would explode to 547 million by 2025-2026. (ii) Growth in this tourist market, especially tourists arriving from smaller Indian cities, has been helped by the rising number of routes by low-cost airlines flying between Thailand and second-tier Indian cities such as Ahmedabad, Kochi and Dehradun. In 2019, an extra 3,000 direct flights linked Thailand to major and minor Indian cities. (iii) Indian tourists (especially richer ones) have a preference for holding marriage ceremonies in Thailand, attracted by the cheaper accommodation and overall lower costs compared to India and other countries. (iv) With a flight time of only 4-5 hours from cities such as New Delhi, Mumbai, Chennai and Bangalore, travel to Thailand is relatively convenient. (v) For Indian tourists visiting Thailand, it takes only about 2 hours to apply for a visa on arrival, while the application process for a Thai visa in India is complicated and takes longer (logistic cost, verification procedures).

Russia: This market accounted for 3.7% of all foreign arrivals in 2019, making it the most important component of the European market. Thanks to several positive factors, the Russian market also has potential to continue to grow. (i) There is an increasing number of direct and charter flights between Russia and Thailand. (ii) Unrest in the Middle East is encouraging Russian tourists to switch from previously popular destinations such as Turkey and Egypt, to Thailand. This was especially the case between 2010 and 2013, when Russian arrivals jumped by an average of 46.1% per year, compared to annual growth of 22.5% between 2006 and 2009. (iii) The Thai government has been promoting Thailand as a tourist destination to Russians through TAT roadshows in Russia and signed reciprocal agreement with Russia to allow visa-free travel for tourism between the two countries for periods of up to 30 days, with effect from April 2007.

In domestic tourism, from 2010 to 2019, the number of trips grew by an average of 6% per year. Growth has been supported by: (i) ongoing efforts to encourage tourism, including the introduction of tax refunds for qualifying domestic tourism expenditure and the private sector promoting inbound tourism through annual travel fairs; (ii) expansion of low-cost airline services and the upgrade and development of provincial airports; and (iii) easier access to tourist sites for independent travelers, thanks to improvements in the transportation network, especially the road system.

However, because domestic tourists spend less per head and make shorter stays, domestic tourism accounts for only 35% of total tourism sector revenue (2019 data). Nevertheless, Thai tourists remain a major source of receipts for hotel operators and the general tourism sector. In addition to the major tourist areas of Bangkok, Chonburi (for Pattaya) and Phuket, domestic tourists are also important to the tourism and hotel industries in secondary tourist centers such as Chiang Mai, Prachuap Khiri Khan (for Hua Hin), Rayong, and Kanchanaburi, in regional centers such as Nakhon Ratchasima, Phitsanulok and Khon Kaen, and in other provinces including Buriram, Chiang Rai, Tak, Phetchabun, Nakhon Sawan, Sukhothai, Lampang, Mae Hong Son and Nan.

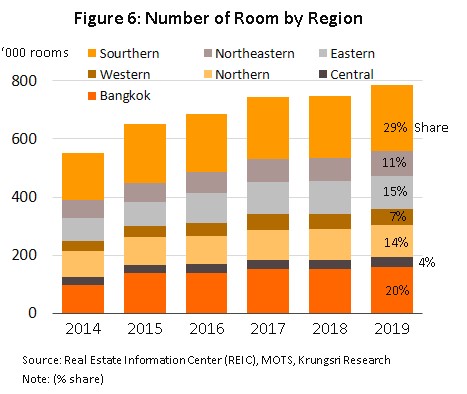

Looking at the supply side, the growth of the tourism sector has continued to feed into more hotels and room supply. Foreign tourists tend to be concentrated in Bangkok, which is both a center for tourism in its own right and the national travel hub, and the world-famous seaside resorts of Phuket and Pattaya (in Chonburi province). But in recent years, the official policy has been to develop tourism across the country (for example, in secondary tourist centers) and to improve the standards of regional airports and the national transportation networks. This has pulled in private-sector investment in hotels in regional centers and tourist areas such as Chiang Mai, Krabi and Koh Samui (in Suratthani province). The net effect of this is an increase national supply of hotel rooms from 540,088 in 2013 to 784,118 in 2019, or average annual growth of 6.5% (Figure 6) driven by both Thai and international hotel chains (Figure 7).

For hotel operators, their main source of revenue is room charges which account for 65-70% of total hotel revenue. Another 25% is generated from the sale of food and drinks, though the percentage varies with the type of hotel (four- and five-star hotels will typically derive a greater portion of revenue from food and drinks). Revenue from other sources, such as providing washing and ironing services and collecting rents from shops operating in hotel premises, usually contribute additional 5-10%.

Situation

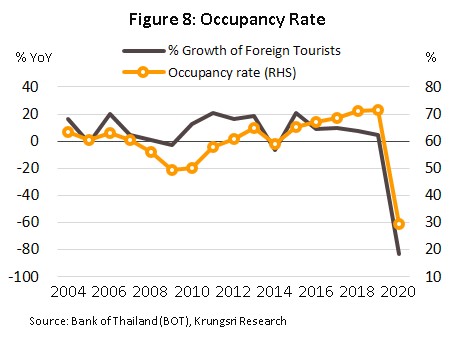

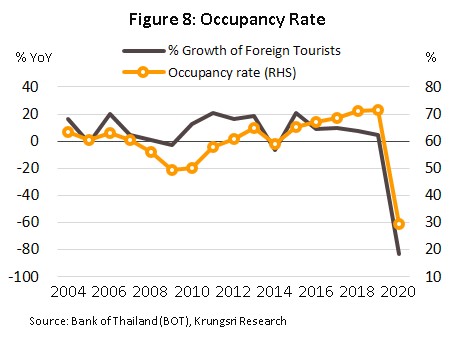

Between 2001 and 2007, Thailand’s international and domestic tourism sectors grew by 7.4% and 6.2% annually, respectively. But at the same time, continued investment in hotels and the resulting incremental supply kept occupancy rate at an average of 60.7% (Figure 8). Following this, from 2008 to 2014, average growth of the international tourism and domestic segments ran to 8.5% and 7.5% per year. But despite this, occupancy rate tumbled to an average of 56.8% as supply continued to grow, both hotel rooms (which increased by an average of 8.0% per year between 2008 and 2014, compared to +6.5% in 2001-2007) and the rising number of condominiums and apartments that offer daily rental. This has been pushing up competition in the sector.

![]()

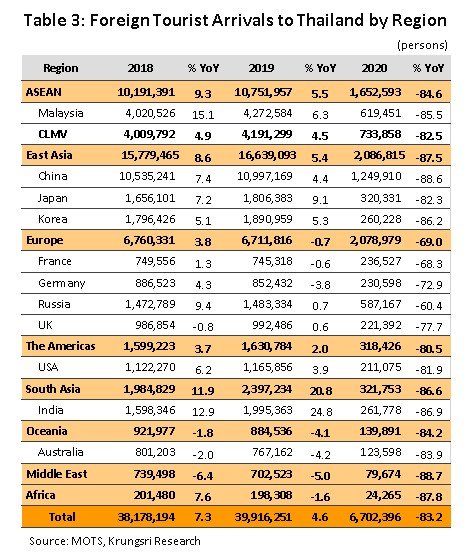

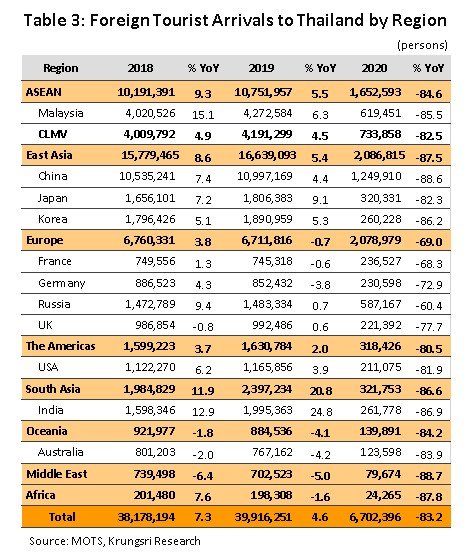

From 2015 to 2019, international and domestic tourism continued to grow and lifted the national occupancy rate to an average of 68.8%, which is considered satisfactory by hoteliers[3]. In 2019, foreign arrivals increased by 4.6%, adding to the 7.3% rise in 2018 (Table 3), taking arrivals to a historical high of 39.9 million. This had lifted occupancy rate to 71.4%, another record for Thailand. During this period, the tourism sector benefited from: (i) more direct and charter flights to Thailand, and the expansion of services offered by low-cost airlines; and (ii) official support for the tourism sector, e.g., waiving fees for VOAs for arrivals from 21 countries[4]. However, in 2019, the domestic tourism segment remained flat, and like in 2018, the population made 166 million domestic trips in the year. The muted growth can be explained by an increasing number of Thai outbound tourists, which recorded a new high of 10.4 million (up 4.8% from 2018) because of the strong baht and efforts by some governments (e.g., in Japan and Vietnam) to attract Thai tourists.

![]()

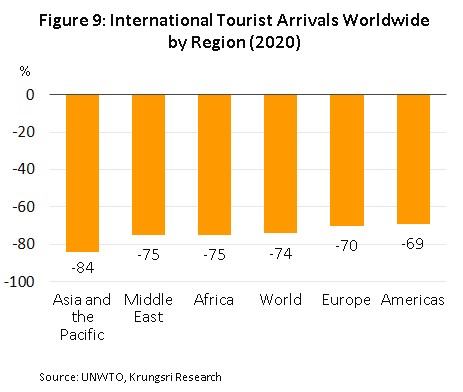

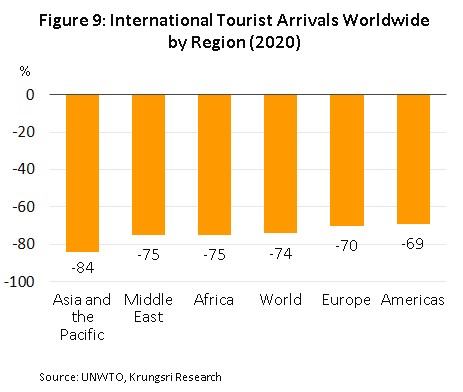

But following this period of sustained growth, in 2020, hotel and tourism industries worldwide suddenly had to endure the unprecedented and immediate disruption by the COVID-19 pandemic. To keep the pandemic under control, governments worldwide imposed strict lockdowns that severely restricted international travel. Global travel crashed by a record-breaking rate of 74% from 2019 level (Figure 9). The hardest-hit were the Asia-Pacific region (-84%), with severe drops in arrivals in Singapore (-85.1%), Thailand (-83.2%), South Korea (-85.6%) and Japan (almost -90%).

![]()

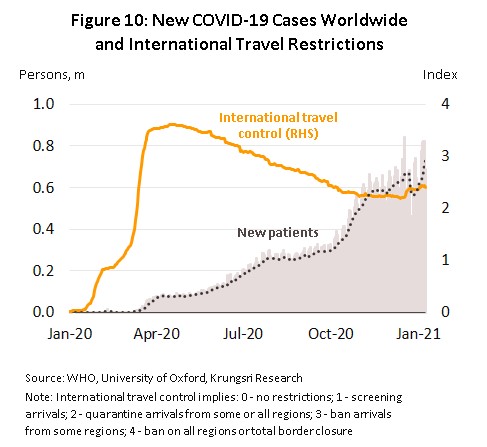

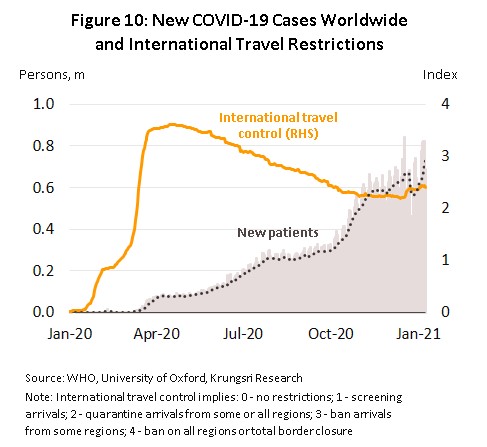

Currently, the global COVID-19 situation remains critical and many countries (including Thailand) have experienced fresh outbreaks. The number of new cases continues to rise steadily (Figure 10) and experts predict foreign tourist arrivals in Thailand will only recover to pre-pandemic level in 2024. This forecast is based on: (i) uncertainty over the rollout of vaccination programs and efficacy of the different vaccines; (ii) the World Health Organization’s (WHO) estimate that herd immunity will require 65-70% of the population to be vaccinated, and despite the commencement of vaccination programs in many countries, it will require large investment in time and money to achieve this; and (iii) the prediction by the University of California that tourist confidence in international travel will only recover 3-6 months after the pandemic is over. Beyond this, international travel remains a luxury and given the pressure on consumer spending power over the past year, demand will recover slowly and it will be uneven.

![]()

In Thailand, 2020 was a torrid year for the hotel and tourism industries. It was dominated by extremely depressed conditions, mirroring conditions worldwide. Hence, contribution from hotel accommodation and food services to GDP slumped 38.3% to THB635bn. Details of selected indicators are given below.

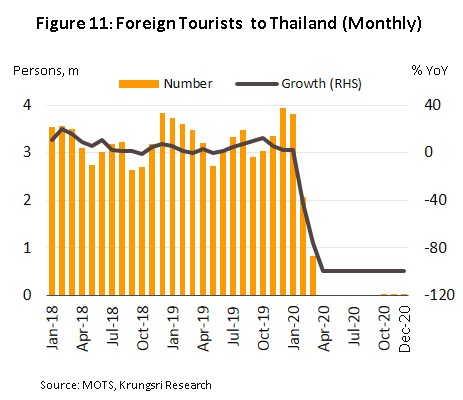

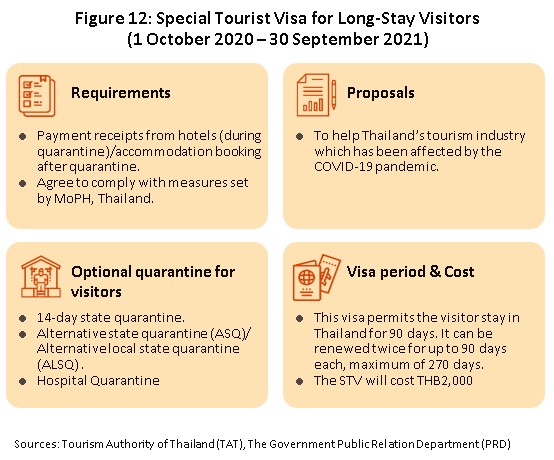

- In 2020, foreign arrivals reached only 6.7 million, tumbling 83.2% YoY. This was the direct consequence of worldwide lockdowns and cross-border travel restrictions. In Thailand, the government declared a state of emergency on 25 March and following this, Thai airspace was shut between 3 April and 30 September. Over this period, there were no tourist arrivals at all (Figure 11). The situation began to improve slightly in October, when Thailand started to allow tourists into the country under the Special Tourist Visa (STVs). The requirements include 14-day quarantine on arrival, health checks before and after travel, and proof of sufficient health insurance coverage (Figure 12). As a result of this, 10,822 tourists came to Thailand in Q4, and although this is only a fraction of the number under normal conditions, it was significantly above the government’s target of 3,600 arrivals (1,200 per month for each of the last 3 months of the year). Nevertheless, for the year as a whole, arrivals from all the main markets tumbled, including from China (-88.6%), India (-86.9%), South Korea (-86.2%) and Malaysia (-85.5%) (Figure 13).

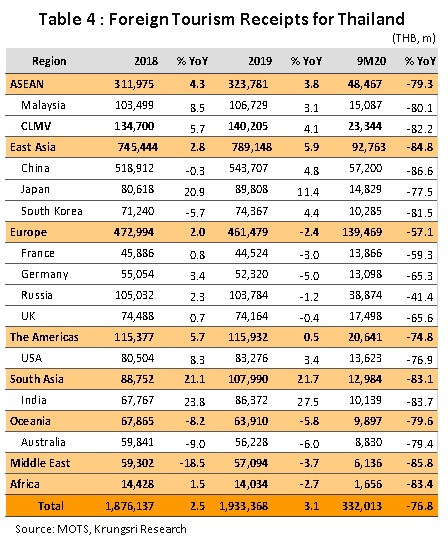

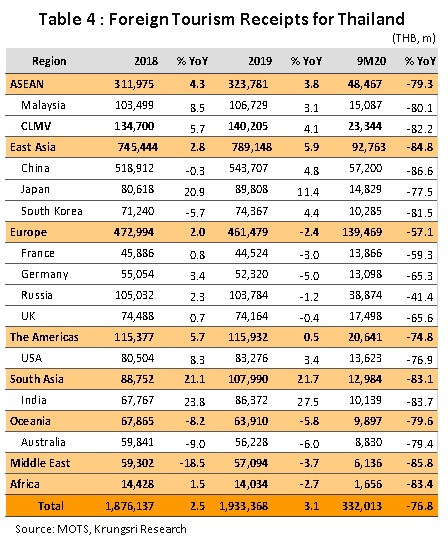

Receipts within the sector has naturally collapsed with the steep drop in arrivals. In 9M20, tourism receipts crashed 76.8% YoY to THB332bn. This drop was seen across the industry, with strong declines recorded from major markets of China (-86.6% YoY), India (-83.7%), South Korea (-81.5%), the United Kingdom (-65.6%) and Russia (-41.4%) (Table 4).

- At the same time, Thais made 90.5 million domestic trips (-47.6% YoY). During April and May last year, domestic tourism almost came to a halt because of the national lockdown. The economy slipped into a sharp recession, unemployment rose, and spending power flatlined. Domestic tourism started to return to life in June, and between then and December, total domestic trips fell by an average of 41.4% (Figure 14), aided by easing lockdown measures and continuous efforts by the government to breathe life back into the sector, notably through the ‘We Travel Together’ program which will run from 1 July 2020 to 30 April 2021.

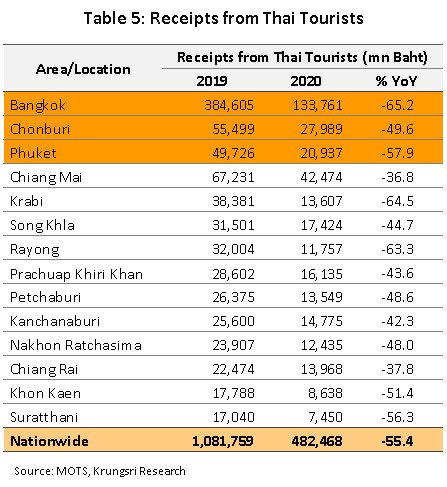

For full-year 2020, revenue from domestic tourism slumped 55.4% to THB482bn (Table 5). The 3 major tourist attractions – Bangkok, Chonburi and Phuket – accounted for 38% (THB160bn) of domestic tourism revenue in 2020.

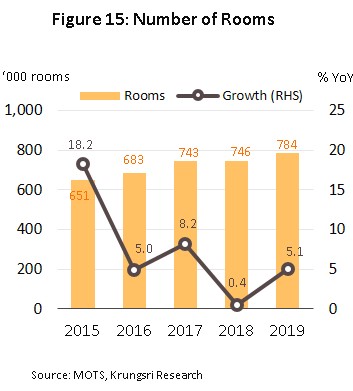

![]() At the end of 2019 (latest available data), the national market had 784,000 hotel rooms, up 5.1%

At the end of 2019 (latest available data), the national market had 784,000 hotel rooms, up 5.1% from 2018 (Figure 15). Supply was strongest in the South, which with 226,000 rooms (up 6.7%) was home to 29% of all hotel rooms in Thailand. Another 20% of hotel rooms were in Bangkok with 160,000 rooms (up 4.6%).

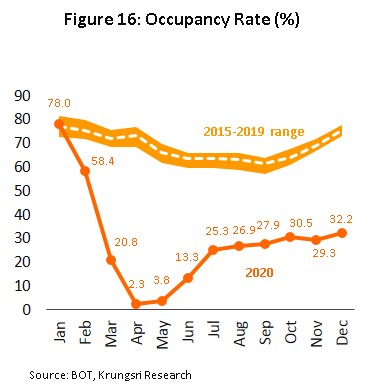

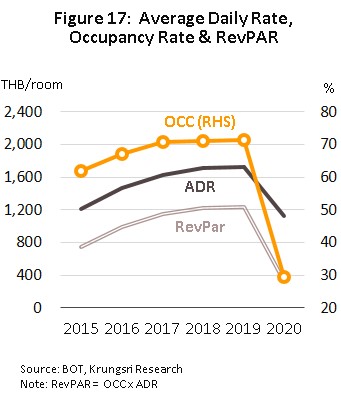

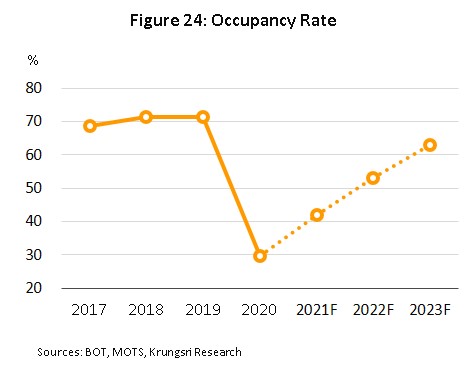

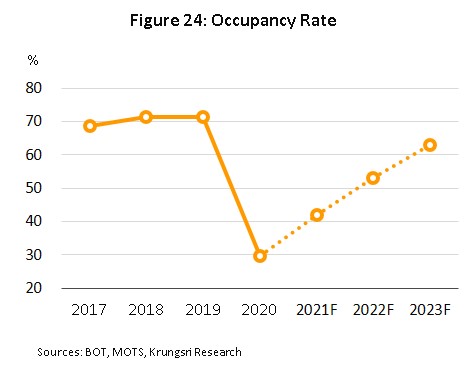

- With these declines in visitor numbers, the national average occupancy rate naturally plummeted. It slid from 71.4% in 2019 to 29.5% in 2020, and touched a historic low of just 2.3% in April (Figure 16). Average room rate also fell 34.9%. These two trends combined had reduced average room rate from THB1,229 in 2019 to only THB331 in 2020 (-73.1%) (Figure 17). This had a direct impact on industry revenues.

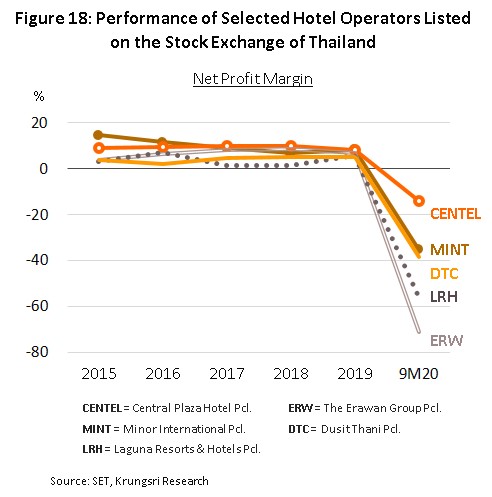

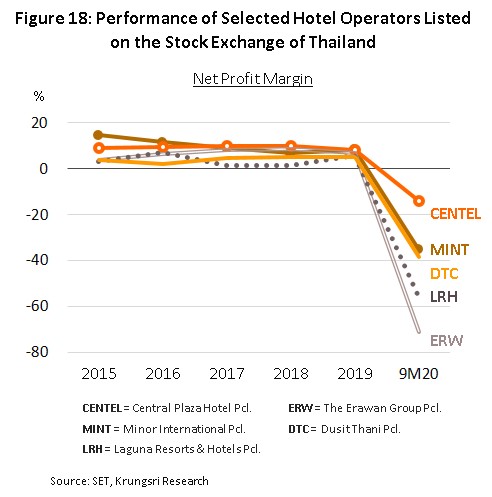

Given the above, the operating performance of major hoteliers worsened dramatically in 2020. For the five hoteliers listed on the stock exchange (Figure 18), overall net profit grew 6.9% in 2019, but contracted by 42.9% YoY in 9M20, though the decline varied with the degree of diversification. Some operators were able to generate more revenues from alternative sources (e.g., food services, distribution of fashion goods), which helped Central Plaza Hotel (CENTEL) and Minor International (MINT) to weather the worst disruption last year.

![]()

- Hoteliers have responded to this very different situation by overhauling their operations. For example, they had slashed room rates, change the range of services they offer, switched focus to domestic tourists, cut overheads, and sought alternative sources of revenue in related areas. Many hotels also offered ‘Work From Hotel’ programs to ride on the work-from-home policy, and joined mobile food delivery apps to improve utilization of their in-house food services (though this has been largely restricted to four- and four-star hotels). They also offered (sometimes in cooperation with hospitals and other healthcare providers) Alternative State Quarantine (ASQ) services in the Bangkok Metropolitan Region and Alternative Local State Quarantine (ALSQ) services in 10 provinces – Phuket, Suratthani (Koh Samui), Chonburi (Pattaya), Prachinburi, Buriram, Mukdahan, Chiang Mai, Phang-nga, Chiang Rai and Nakhon Nayok (correct as of 14 February 2021). ASQ and ALSQ services are available to foreign tourists arriving in Thailand who need to meet the 14 days quarantine requirement. However, while some hoteliers have been able to adapt to these changing circumstances, a large number of smaller and mid-size players have not been so lucky, and many have been forced to shutter their operations.

Outlook

Hoteliers will continue to face a severely depressed market in 2021 but the industry will start to recover in 2022 and 2023, though

it could take at least 4 years for tourist arrivals to return to pre-COVID level of 38-40 million. Domestic tourism should recover more rapidly partly thanks to ongoing government stimulus measures, but the slow recovery in tourist numbers and large operators’ ongoing investment plans (albeit they might be delayed) will weigh on occupancy rates, which are expected to average 40% in 2021, 50-53% in 2022, and 60-63% in 2023.

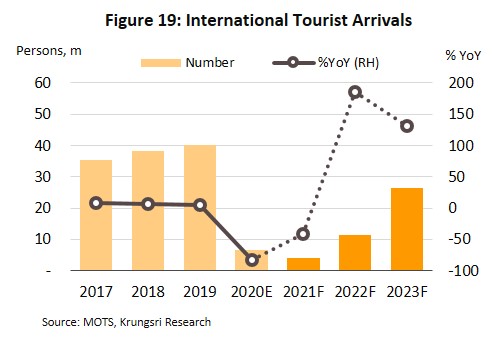

- Foreign tourists: Arrivals should increase steadily with the expansion of the STV scheme and Thailand possibly signing quarantine-free travel bubble programs with several countries (Box 1). By the second half of 2021, the accelerating vaccination programs worldwide will also help to boost foreign arrivals. Krungsri Research forecasts only 4.0 million foreign tourists arriving in Thailand in 2021, but this will rise to 11.4 million in 2022 and to 26.4 million in 2023 (compared to 40 million in 2019) (Figure 19). This is supported by the following factors:

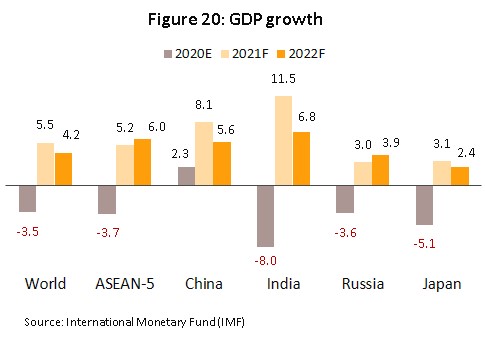

1) Recovering global economy: The International Monetary Fund (IMF) projects global GDP would grow by 5.5% in 2021 and by 4.2% in 2022 (Figure 20). In the case of Thailand, the IMF projects strong growth in Thailand’s main tourist markets of China (+8.1% in 2021 and +5.6% in 2022), India (+11.5% and +6.8%), and Russia (+3.0% and +3.9%).

2) Vaccination passport: Thailand might ease travel restrictions with the use of vaccination passports to allow quarantine-free travel for foreign arrivals who have been vaccinated. In mid-January, the Seychelles became the first country to accept vaccination passports. In addition, Thailand has been praised by the WHO for its handling of the COVID-19 crisis, and countless hotels across the country have been awarded the Amazing Thailand Safety and Health Administration (SHA) certification, confirming their adherence to recognized public health standards.

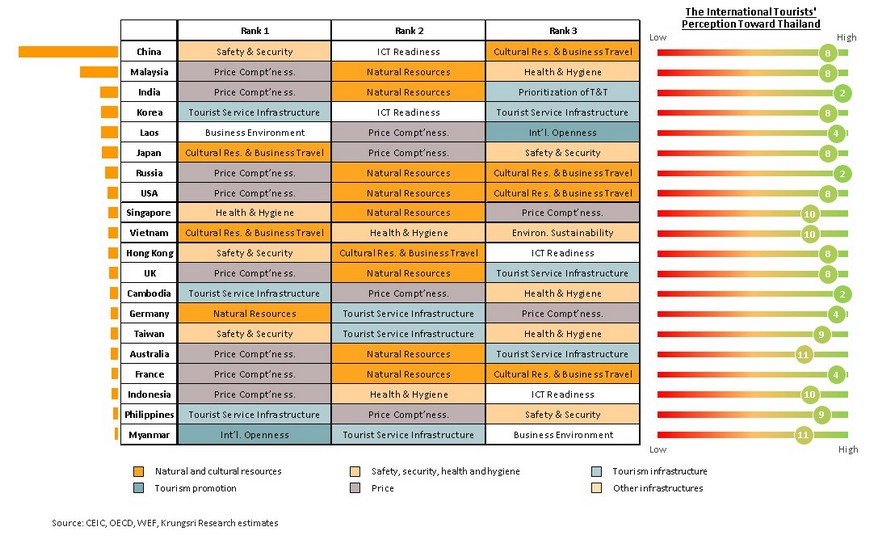

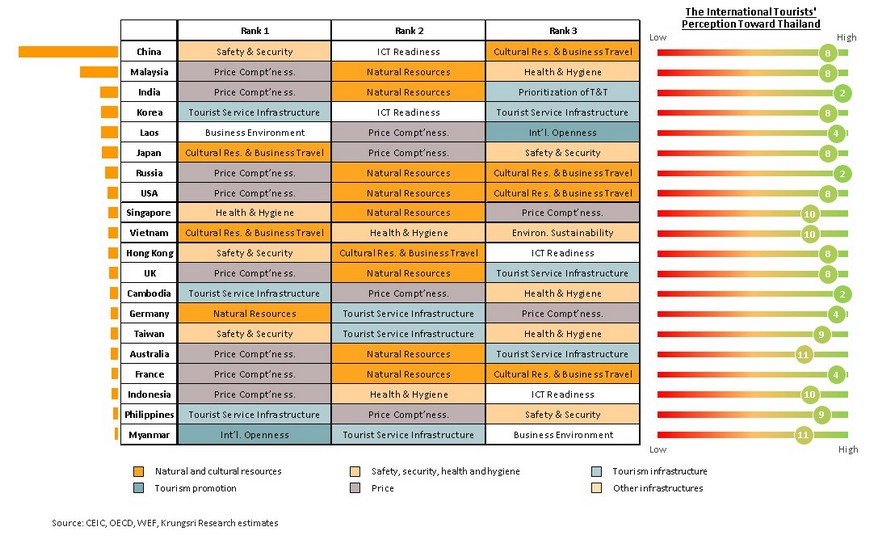

3) Long-term growth potential of the Thai tourism sector: Krungsri Research analyzed the preferences of travelers from 48 countries and concluded that Thailand remains a favored destination for tourists from many countries. Indeed, Thailand was ranked among the top 10 destinations for travelers from almost all countries surveyed (Box 2), with Indian, Russian and Cambodian travelers placing Thailand in 2nd place. Chinese and Malaysian tourists placed Thailand in 8th place. This supports the potential for Thailand’s tourism sector to meet consumer demand in the post- COVID world.

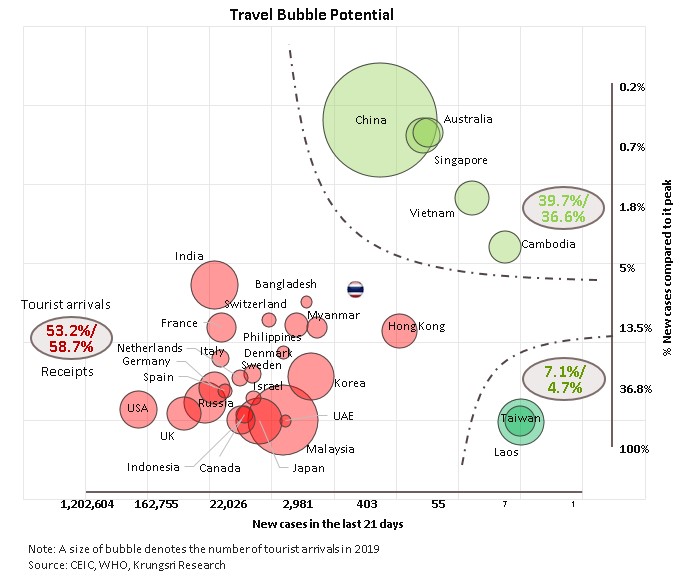

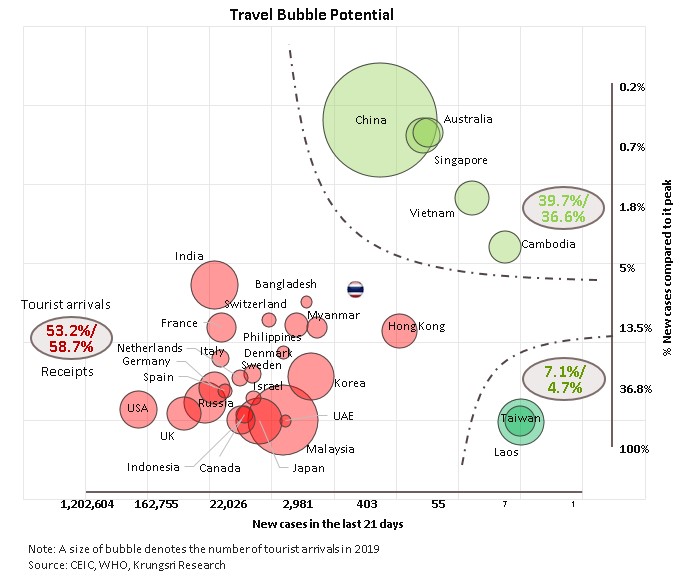

Box 1: Travel Bubbles

Travel bubbles involve bi-lateral agreements between governments to allow quarantine-free travel between participating countries. Thailand might initially form travel bubbles with countries which have successfully contained domestic COVID-19 transmission, and which were once Thailand’s major source of inbound tourism. This might include China, Singapore, Vietnam and Australia. However, if it does decide to go down this road, the government will remain vigilant and might partner with insurers and issue policy directives to detect and contain risks of a new outbreak.

Krungsri Research believes Thailand would enter into travel bubble agreements this year (2021). Initially, these would likely to be limited to designated geographical areas where arrivals can be easily screened, such as Phuket and Suratthani (for Koh Samui), and where the local economies are heavily reliant on foreign arrivals. Although the travel bubbles are unlikely to prompt a huge increase in arrivals initially, they would at least prepare the sector to return to growth in the future.

Box 2: Tourist Preference by nationality

Box 2: Tourist Preference by nationality

![]()

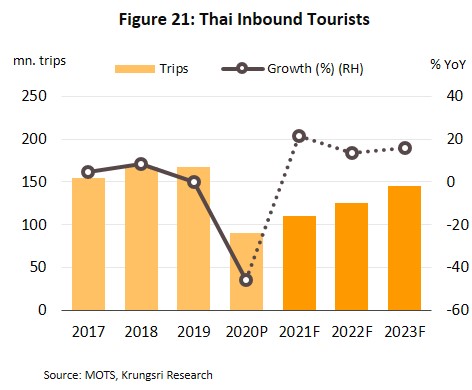

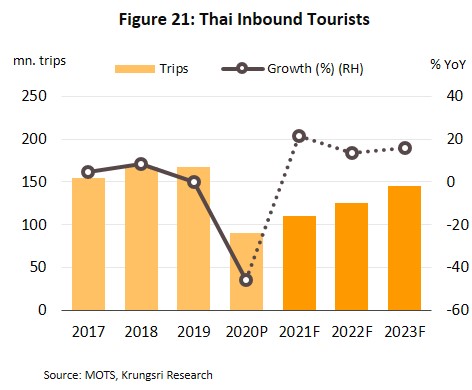

- Domestic tourists: Throughout 2021, the tourism and hotel industries will be heavily reliant on domestic tourism. However, given that many countries still have restrictions on foreign arrivals, this could encourage Thai tourists to travel more within Thailand. Krungsri Research estimates that Thai tourists will make 110 million domestic trips this year, 125 million in 2022, and 145 million in 2023 (Figure 21). This would be supported by the following.

![]() 1) Government measures to stimulate the tourism sector: These are expected to continue.

1) Government measures to stimulate the tourism sector: These are expected to continue. They include:

(i) the ‘We Travel Together’ program which is likely to be extended at least to the end of 2021. In addition to fostering tourism activity and broader economic growth, it has helped players in the hotel, tourism and related industries to stay afloat;

(ii) additional holidays to encourage the public to travel more within the country; and

(iii) tax refund for qualifying travel-related expenditure. While foreign tourists are largely unable to enter Thailand, these and other similar programs will remain extremely important for players in the tourism and hotel industries.

2) Low oil prices: This will encourage domestic tourists to travel by private vehicles. This will remain important as long as vaccinations in Thailand remain slow and the COVID-19 situation remains uncertain, which would discourage tourists from traveling on public transport.

3) Infrastructure development: The buildout and upgrade of national infrastructure will help to support stronger domestic tourism. They include upgrades and extensions to airports in the provinces, extension of air networks across the country, as well as the development of the rail and motorway systems which hould encourage more visits to secondary provinces.

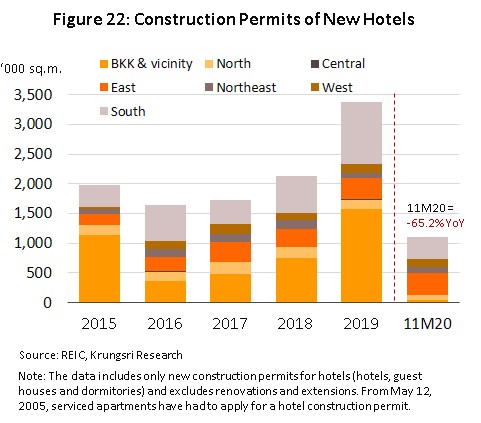

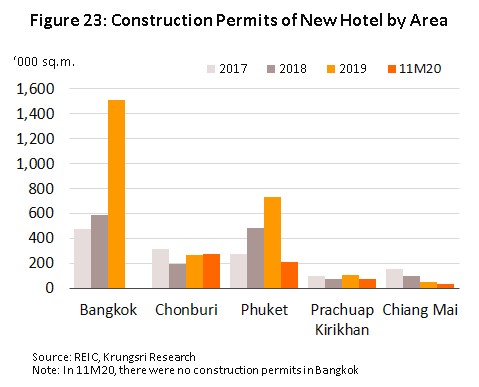

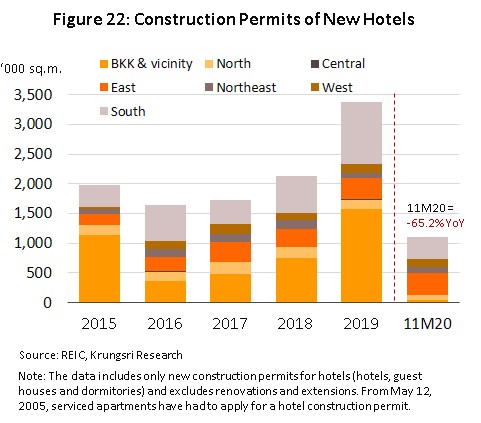

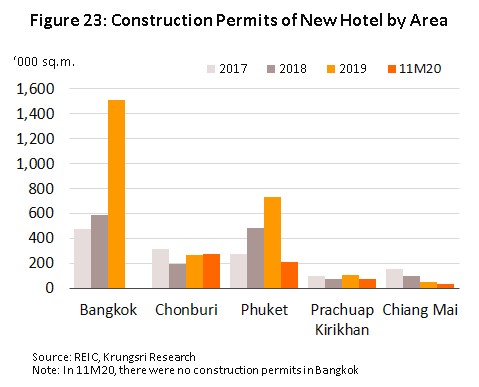

- Overall outlook for hotel business: Slow growth of new hotel room supply nationwide. This is reflected in the number of applications for construction permit submitted in the first 11 months of 2020 (strong indicator of supply growth 1-2 years out), which fell 65.2% YoY to 1.11 million sq.m. (Figure 22). 35% of these applications were for hotels in the south of the country, making it the fastest expanding geographical segment, followed by the east (32% of new applications). By province, investors in new hotels are most interested in Chonburi, where new applications reached 280,000 sq.m. of hotel space (up 18.6% YoY) (Figure 23). This sharp increase in future local supply is partly attributed to the development of the Eastern Economic Corridor (EEC) and anticipated increase in demand for tourism and business travel.

![]()

Large operators are investing mostly in mid-range (i.e., three- and four-star establishments) and budget hotels in regional centers, tourist areas and border regions that are linked economically to neighboring countries. These include new supply under the Hop Inn chain (run by Erawan Group), Fortune D chain (operated by CP Land), and the COSI chain (Central Plaza Hotel). Thai and international 5-star hotels (both under joint-ventures and management-contract basis) are also investing in new sites in tourist areas. And although many of these may be postponed in light of the current situation (Table 6), the willingness to make heavy investment in current times reflect the operators’ continued confidence in the long-term potential of the Thai tourism sector.

![]()

- Occupancy rate: This will remain low at about 40% in 2021 before improving in 2022 and 2023 (Figure 24). However, due to the anticipated slow recovery in foreign arrivals and worldwide efforts to boost domestic tourism, rates will not recover to pre-pandemic level of 70-80%, even in the major tourist areas.

![]()

Competition will intensify within the hotel industry, coming from two separate sources. (i) Competition from other hotels will intensify due to continuing investment in the major tourist areas and regional centers. This would come from both hotel operators and those who will appoint a third-party hotel management team to operate the hotel (normally large players that are part of extended commercial groups or that have their own chains). (ii) Although it is illegal under the 2004 Hotel Act, hotels also have to face growing competition from alternative accommodation such as regular and serviced apartments and condominiums that are rented out by the day, generally at lower rates than hotels. Given this, overall occupancy rates will remain low, and because players will need to employ more aggressive pricing strategies to attract guests, this will drag revenues especially for SME operators.

More positively for hoteliers, the COVID-19 crisis has hit the alternative accommodation industry as hard as it has the hotel industry. So, while prior to 2020, Airbnb enjoyed rapid growth and was considered a genuine threat to the hotel industry because of the low prices and wide range of choices, its star has faded as travelers place greater emphasis on health and hygiene standards. Hence, while many Thai hotels have been awarded SHA certification, there is on similar certification scheme within the sharing economy. In addition, hoteliers may also experience less competition from unregistered hotels (there are many in Thailand) because these would likely have severe financial hardship in the past year. Because they are unregistered, it would be difficult for the operators to secure financing from commercial banks, causing many to become insolvent and go out of business. Thus, despite rising competition, the problems associated with oversupply of hotel rooms and other accommodation facilities would be at least partially alleviated.

Krungsri Research projects the hotel industry would remain depressed in the next 2-3 years, and recover slowly thereafter, though within the ‘new normal’ of social distancing and reduced physical interactions. Because of this, it is not sufficient for players to simply return to how they operated previously, after the pandemic eases. To effectively meet changing consumer needs, operators in the tourism and hotel industries need to consider moving their business onto a more sustainable footing by making the following changes.

1) Greater adoption of modern technology would help to build consumer confidence in the sector and retain competitiveness. In addition, modern technology can also be a means to develop the tourism value chain. The value chains within the tourism sector are complex and involve many players from different sub-segments, including hotels, tour agencies, transportation companies, food industry, retailers, suppliers of raw materials, and local businesses. But, by skillfully linking these disparate groups through one or more platforms, players will be much better able to respond to consumer needs that are increasingly varied and diverse.

2) Operators need to analyze the varied consumer needs in the market. This will put them in a better position to respond to individual needs, whether individual’s travel plans, preferred activities or budget. To this end, players are now able to exploit recent technological advances that make collecting and analyzing data much easier and more efficient. And by taking advantage of these new opportunities, hoteliers will be able to customize marketing programs, for example by conducting public relations and marketing activities that target specific age groups, or by attracting guests who are beneficiaries of government measures to stimulate domestic tourism.

3 ) Operators need to pay greater attention to health and hygiene standards, which will be more important within the tourism and hotel industries. Indeed, in the few years before the pandemic, there was already a significant uptick in interest in personal health and wellness, as reflected in the growing trend for health and sports tourism (e.g., bicycle tours, marathons) and the steady rise in the number of people who exercise regularly. However, in the post-COVID world, travelers will likely show greater interest in hygiene and public-health standards when selecting travel destinations. At the same time, to avoid enclosed and crowded spaces, outdoor activities would be increasingly popular. Hence, operators need to work with local communities to develop the local area and to keep it safe, clean and free from the risk of infection.

Krungsri Research view

The COVID-19 pandemic in 2020 and the mandatory closure of a large number of hotels and other businesses in the tourism sector led to an unprecedented wave of redundancies. These depressed conditions will persist for hoteliers in 2021.

However, as the situation starts to improve, visitor numbers should slowly pick up again in 2022 and 2023. Krungsri Research believes the groundwork for this will be set in the latter half of 2021, when worldwide vaccination programs will help to rebuild confidence among Thai and overseas travelers. The domestic tourism segment is expected to rebound ahead of the recovery in international arrivals, thanks to government measures to boost domestic tourism. The recovery of foreign arrivals will be delayed by similar efforts by other countries to boost domestic tourism. In this challenging environment, large players will generally retain their ability to pursue investment and expansion plans, though these might be delayed. But SME operators will face rising competition, and for individual operators, there will be high risk of insolvency.

- Hotels in the major tourist areas of Bangkok, Pattaya and Phuket: The low number of foreign arrivals will keep occupancy rates low throughout 2021. However, the situation will improve in 2022 and 2023. Operators’ revenues will recover along with the overall recovery of the tourism sector over the next 2-3 years, but the industry will remain relatively weak compared to the pre-COVID-19 era and average occupancy rate will hover at 50-55%.

- Hotels in regional centers and other popular tourist areas[5]: These hotels will experience an uneven recovery. Because most of these establishments serve the domestic market, they will benefit from government policies to stimulate domestic tourism. But despite this, domestic tourism is not expected to return to pre-pandemic levels within the next three years, and hence, any rebound in revenue in this segment will be limited.

- Hotels in other provinces: For other hotels, government efforts to support the tourism sector will be unable to prevent a slide in revenue because travelers in these provinces are often on their way to provincial centers or other tourism sites. Given this, occupancy rates will be lower than for either of the two groups described above.

Meanwhile, in all parts of the country, the hotel industry will face rising competition from oversupply of hotel rooms and other types of daily accommodation. This will be worsened by the slow recovery in demand, which means it will be difficult for operators to raise room rates, especially in tourist areas that are dependent on foreign arrivals.

[1] For example, the 2019 ‘Favorite Leisure City in the World’ award, presented at the 2019 Business Traveller China Awards Ceremony and Travel & Leisure Magazine’s ‘World’s Best Award’, which Bangkok won in 2008, 2010, 2011, 2012 and 2013.

[2] In November 1983, the Chinese government first allowed Chinese citizens to travel to Hong Kong and Macau in order to visit family members. The process of travel liberalization was accelerated by China’s entry to the WTO in 2001, and the requirement that China operate under WTO regulations regarding tourism. The result of this has then been to increase the number of Chinese tourists traveling abroad (Bank of Thailand, June 2014).

[3] Interviews with hoteliers and an evaluation of data by the Bank of Thailand indicates that an occupancy rate of 65-70% is considered satisfactory by operators.

[4] The waiving of fees for visas on arrival ran from 15 November 2018 to 31 October 2019 and applied to tourists from the following countries: Andorra, Bulgaria, Bhutan, China, Cyprus, Ethiopia, Fiji, India, Kazakhstan, Latvia, Lithuania, Malta, Mauritius, Papua New Guinea, Romania, San Marino, Saudi Arabia, Taiwan, Ukraine and Uzbekistan.

[5] Chiang Mai, Chiang Rai, Phitsanulok, Kanchanaburi, Chonburi, Rayong, Chachoengsao, Nakhon Ratchasima, Khon Kaen, Udon Thani, Ubon Ratchathani, Phetchaburi, Prachuap Kiri khan, Songkhla, Krabi, Phang-gna and Suratthani (Koh Samui).

.webp.aspx)