In 2021, the housing market in the Bangkok Metropolitan Region (BMR) will remain flat or see only mild growth, premised on: (i) the ongoing spread of COVID-19 and the effects of this on economic recovery, and (ii) steadily rising household debt that is undercutting consumer purchasing power and encouraging lenders to be more careful about the release of new credit. However, in 2022 and 2023, the outlook for the market should improve thanks to: (i) growth in the Thai economy that is forecast to reach 3.0-4.0% per year; (ii) greater investment in infrastructure megaprojects; (iii) government stimulus measures targeted at the real estate sector; and (iv) stronger demand for accommodation from overseas buyers investing and working in Thailand.

In 2021-2023, the number of new housing coming to market is expected to rise by 4.7% annually, with this split approximately equally between condominium and low-rise developments. Supply of the latter will steadily rise as developers look to meet growing real demand, while investors will also tend to work on a more diverse range of project types that will include mixed-use developments, wellness residences, housing for the elderly, smart homes and leasehold properties.

Overview

The real estate sector contributed 8% of Thailand’s GDP in 2020, which is significant to the national economy. A large amount of capital circulates within the economic system and supports rising employment and income. The sector is also has a large influence on the direction of related businesses such as construction, building materials, consumer electronics, furnishings/ decoration and finance.

The property sector consists of three principal segments: residential, commercial, and industrial. In Thailand, two-thirds of the property market (by value) is derived from residential transactions (source: World Bank). Developers of residential properties normally focus on Thai customers because Thai law stipulates that non-Thais may legally own only condominiums and only up to 49% of total salable area in any project. For detached housing and townhouses (also called rowhouses or shophouses), the ownership regulations for non-Thais are more onerous.

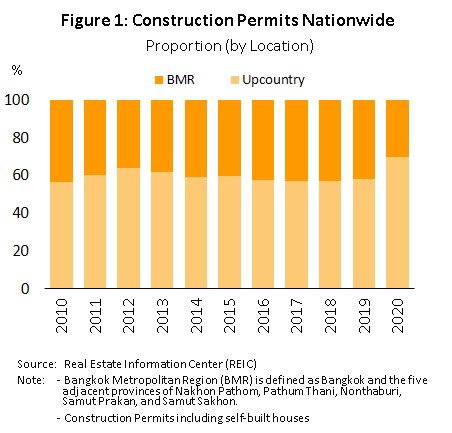

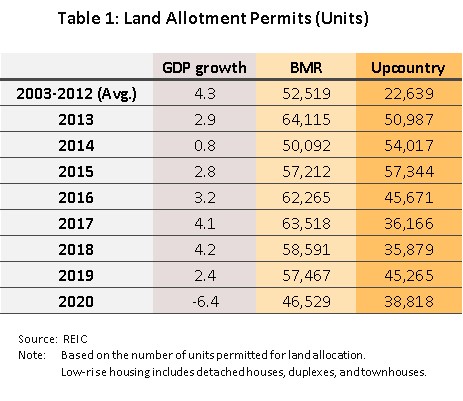

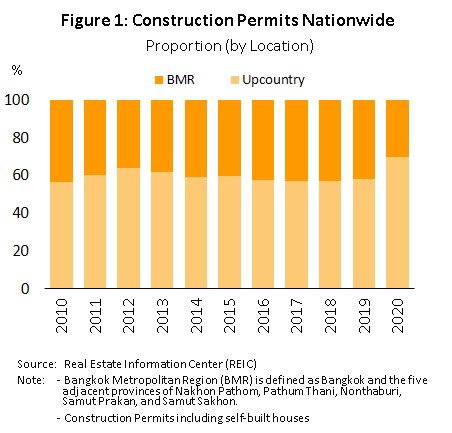

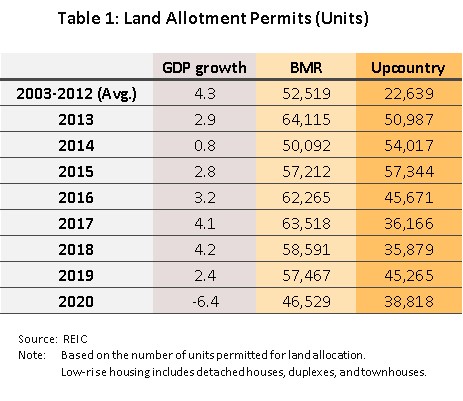

The housing market is split between self-built housing and housing projects. 40% of nationwide construction permits in the past 5 years are located in BMR (Fig. 1). This market had an annual value of around THB480bn but since 2012, developers have started to look beyond the Bangkok region. The shift in focus followed the major flooding in BMR and central region near the end of 2011 and the decision by the government in 2012 to increase spending on infrastructure in provinces. This prompted developers to place greater emphasis on investing in housing projects in provincial centers, the majority being low-rise housing due to far fewer constraints on access to land for development upcountry and land there is relatively cheaper. However, revenue growth has been limited due to volatile consumer purchasing power, which has translated into different impact on the market (Table 1), and this caused developers to switch their attention back to projects in the BMR.

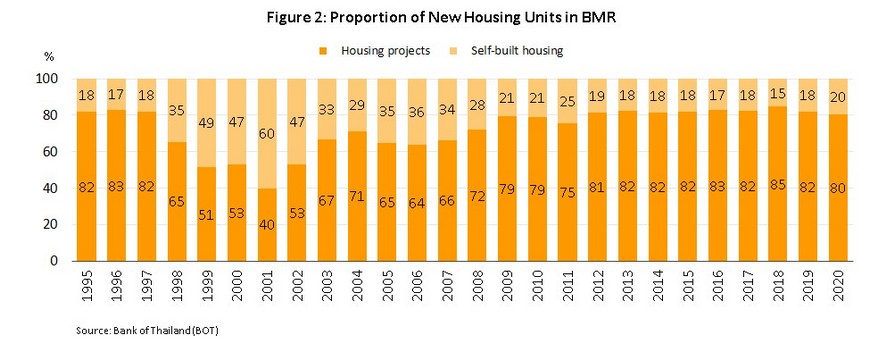

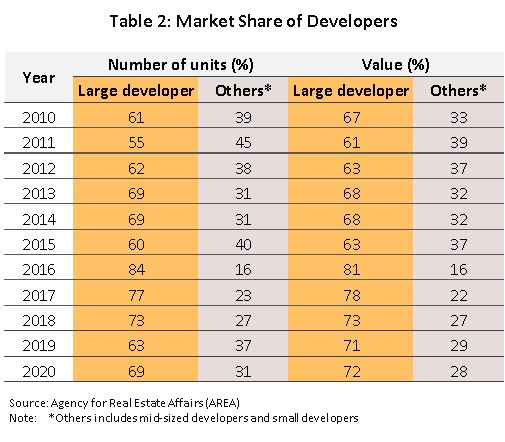

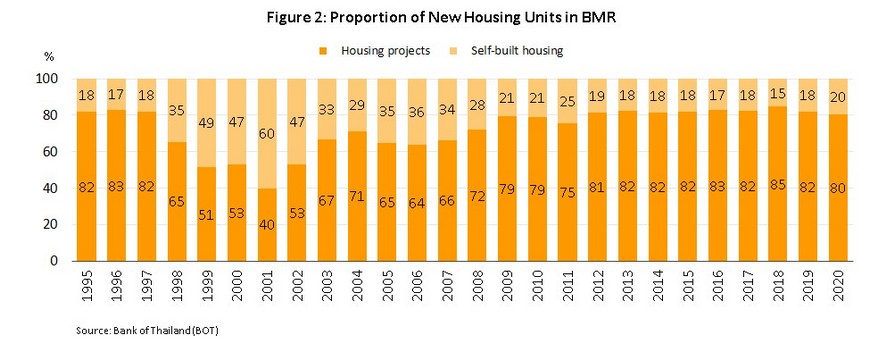

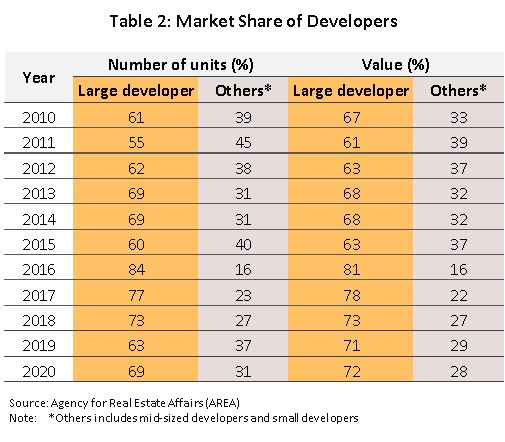

Currently, over 80% of new housing units in the BMR are in projects developed by commercial housing developers (Figure 2). Large developers (those listed on the SET and their subsidiaries) control 60-70% of the market by volume and value in 2020 (Table 2). Because large companies are able to manage costs more effectively than their smaller peers, they are also in a position to buy larger land bank which would reduce project development cost. They can also undertake several projects simultaneously which improves economies of scale. Beyond this, they benefit from stronger branding and marketing networks.

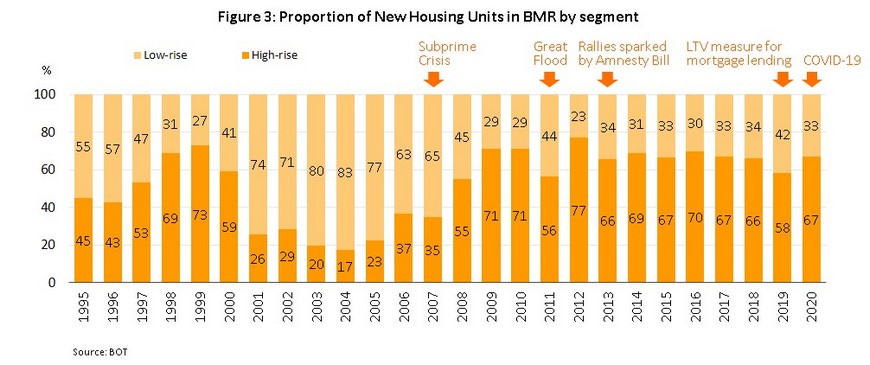

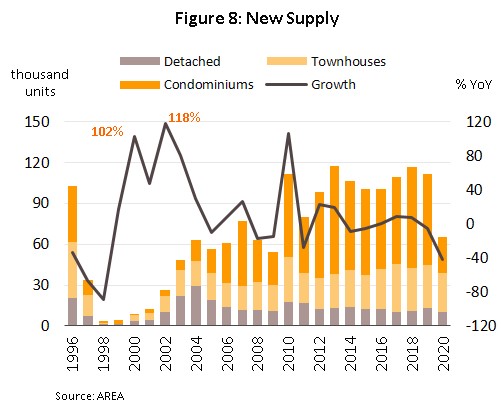

Since 2008, high-rise residential buildings have represented a larger share of new projects than low-rise segment. An average of 70% of new housing units in the market have been condominium units (Figure 3) due to the declining availability of land, and consequently, higher prices for development land. The extension of rapid mass transit lines (MRT and BTS) has also led to housing projects springing up along new routes and near stations. These led to the increasing popularity of high-rise residential developments.

Situation

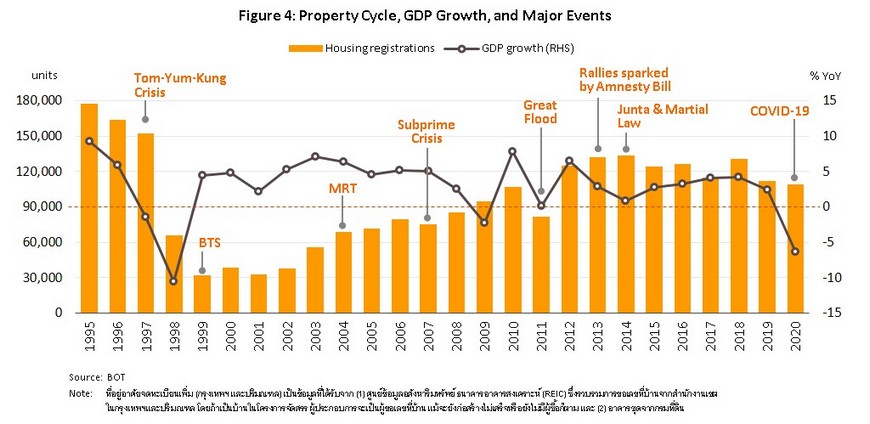

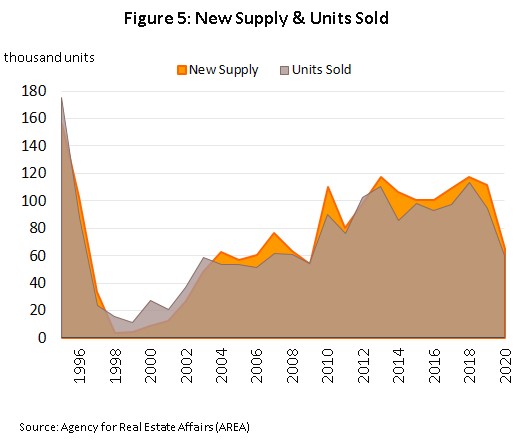

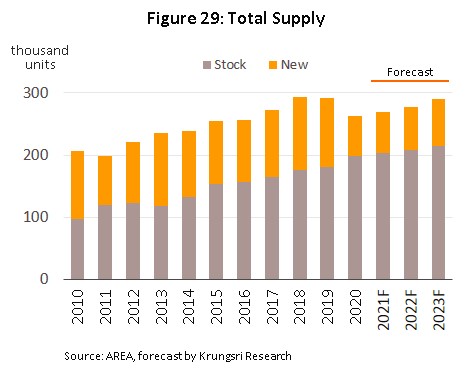

2010-2017: The BMR saw an average of 105,000 new units each year but only about 96,000 were sold annually (Figure 5)

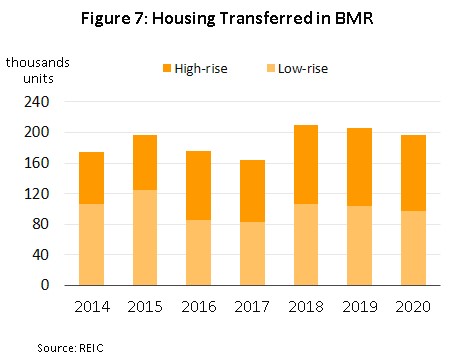

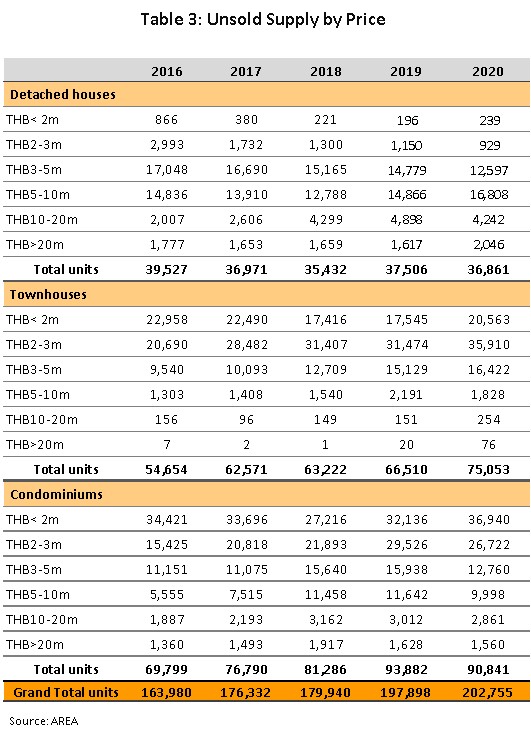

, which pushed up housing inventory. This supply-demand imbalance was partly caused by the private sector’s response to the government’s incentive for first-time house buyers in 2011 and 2012. It led to record-breaking investments in condominium projects in 2012-2013. In addition, domestic political conflicts and a weak Thai economy in 2013-2017 also suppressed demand for housing. This is reflected in the lower absorption rate (Figure 6) and number of property transfers (Figure 7). Consequently, there was 176,000 unsold housing units in the BMR. Of these, more than 60% were units priced below THB3m (Table 3).

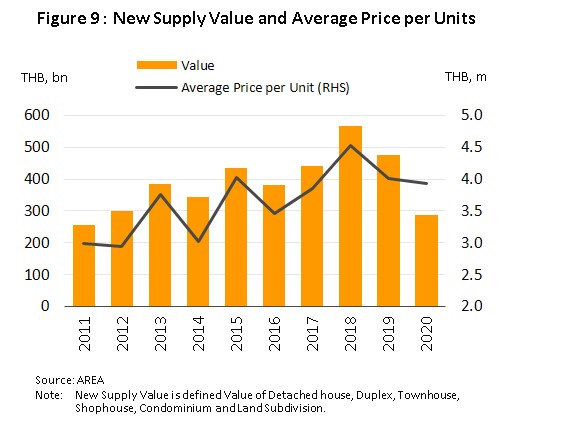

In 2018, Thailand economy grew by 4.1%. This boosted spending power and consumer confidence, and subsequently, residential property transactions (units) by 16.4%, the largest increase in 5 years. This is led by the sale of mid- to high-priced properties; most of these buyers were looking to buy a second home (generally condominiums priced at more than THB3m). Demand from the expat market was also strong, especially from the Chinese, for condominiums. Buyers from China and Hong Kong accounted for 43% of all transfers of title deeds among non-Thai nationals. On the supply side,

developers had increased investments in condominium projects near new or extended metro lines and increased the share of high-end projects in their portfolios; the latter pushed up average house price to THB4.5m per unit in 2018 (+17.2% from 2017 average). This prompted

the Bank of Thailand to tighten rules governing housing loans[1]

at the end of 2018, when officials moved to reduce speculative pressure in the housing market. However, buyers had rushed to complete transfers of housing units before the new rules came into effect on 1 April 2019. Therefore, in the last quarter of 2018, housing transfers jumped 17% YoY.

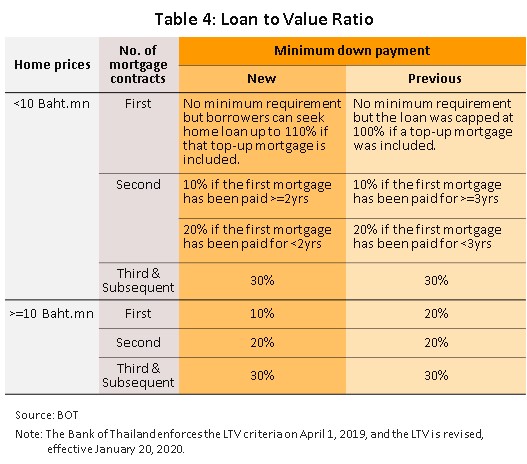

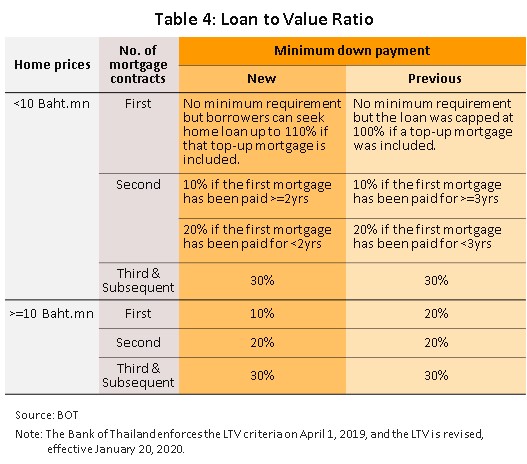

The housing market was in a depressed state in 2019 due to economic growth of just 2.4% that fed into weaker consumer spending. In addition, changes to LTV ratios has resulted in a delayed purchasing decisions given higher down payment. The slowing global economy and the strengthening of the baht undercut demand from overseas buyers investing in the Thai property market. However, the government responded by stimulating demand to pare down the excess housing stock. These measures included cutting tax for first-time buyers for properties priced at not more than THB5m[2], reducing transfer and mortgage registration fees to 0.01% of property value[3], and introducing the Baan Dee Mee Down program[4]. Unfortunately, these programs only had a limited impact on housing sales and for 2019 overall, sales slipped 16.8% from a year earlier.

In 2020, the housing market worsened dramatically with the outbreak of COVID-19. The slowdown in economic activity that the pandemic precipitated across the Thai and global economies resulted in a further erosion of consumer spending power among both domestic and foreign buyers. Beyond this, a slowing of work on government infrastructure projects and the severe drought in the first half of 2020 combined to result in Thai GDP falling 6.1%, the sharpest recession in 22 years. Developers reacted to this sudden worsening of business conditions by holding back the release of new supply. On the demand side, despite the Bank of Thailand’s relaxation of the LTV rules for first-home buyers (Table 4), Thai and overseas buyers postponed or cancelled purchases and transfers of ownership as their incomes shrank and confidence evaporated. Details of the housing market are given below.

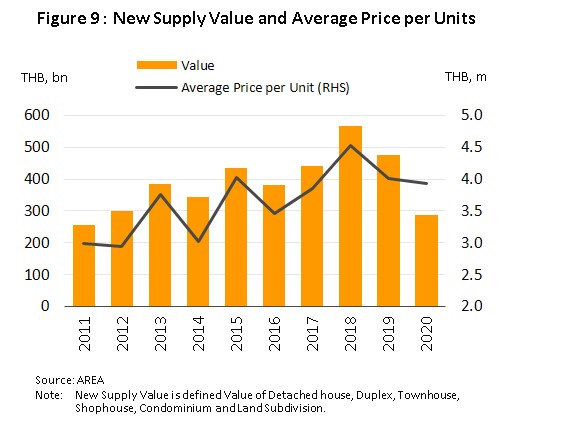

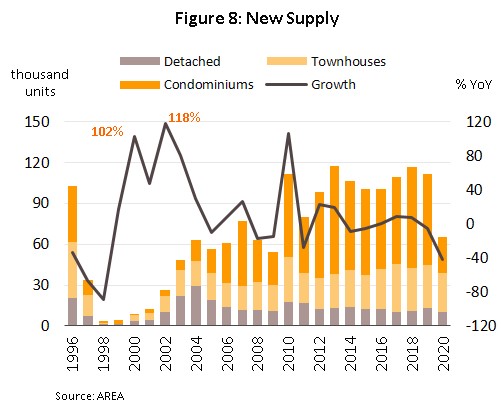

- New housing units coming to market in 2020 crashed 41.6% to just 65,051 units (Figure 8), falling in value by 39.8% to an 8-year low of THB287bn (Figure 9). Condominiums were particularly hard hit, and the number of new units plummeted 61.0%, which then brought the ratio of high- to low-rise developments down to 40:60, the first time in a decade that the number of new condominiums was beneath that of low-rise developments. This situation is partly explained by the significant supply of unsold housing stock that developers were sitting on and by the move by lenders to tighten the release of new credit in reaction to the onset of the recession and rising household debt. But in response, developers used a range of different strategies to try to stimulate sales. These included switching to work on smaller projects, giving away free gifts and cutting prices (to better meet real demand from owner-occupiers) and increasing their focus on the higher end of the market, which has been less severely affected by the year’s turbulent economic conditions. As such, average per-unit prices for properties sold in 2020 edged down by 1.9% to THB3.9m.

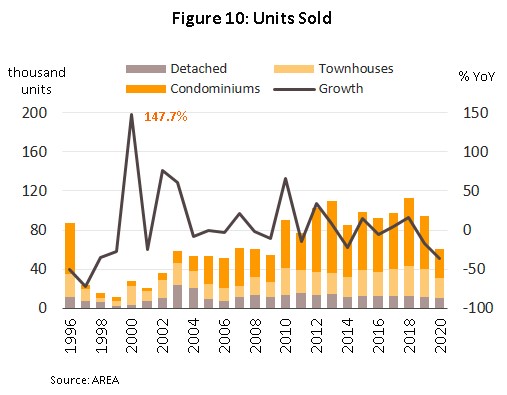

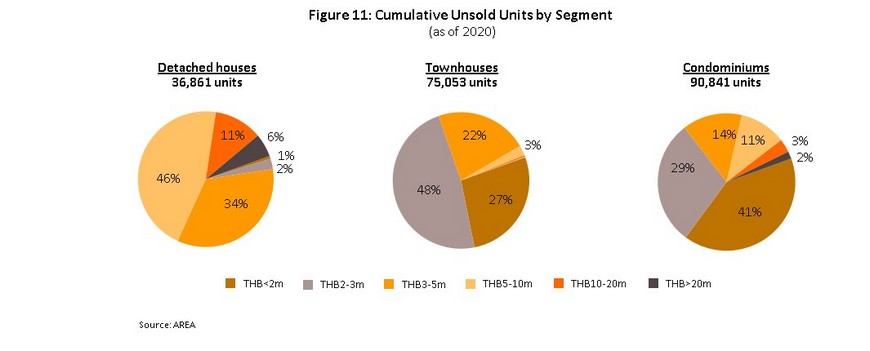

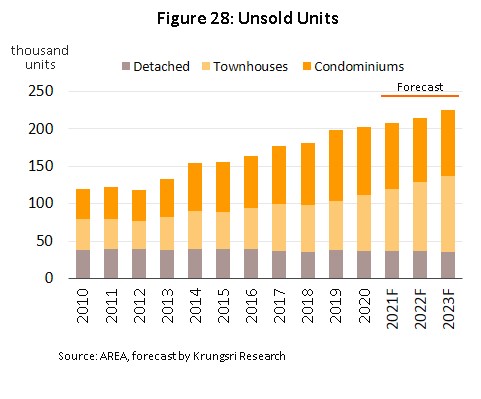

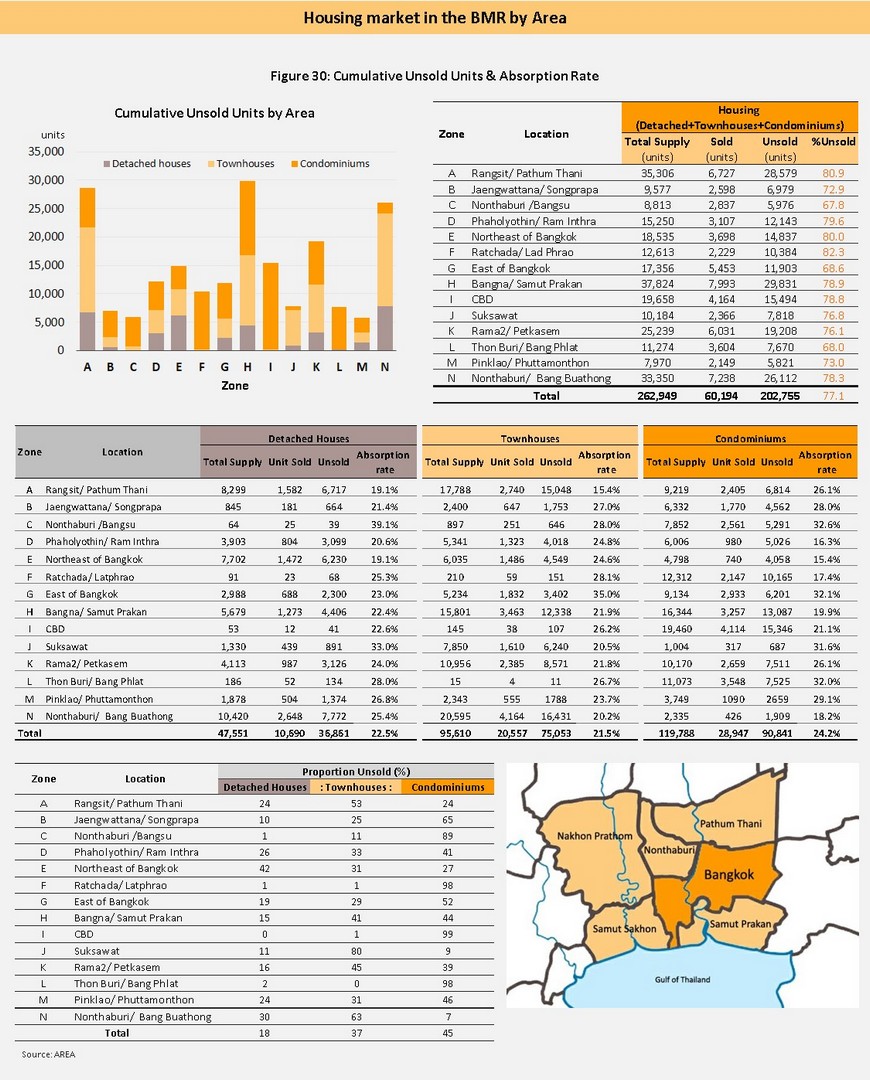

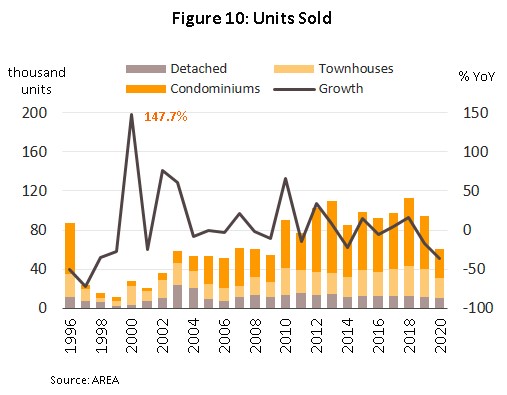

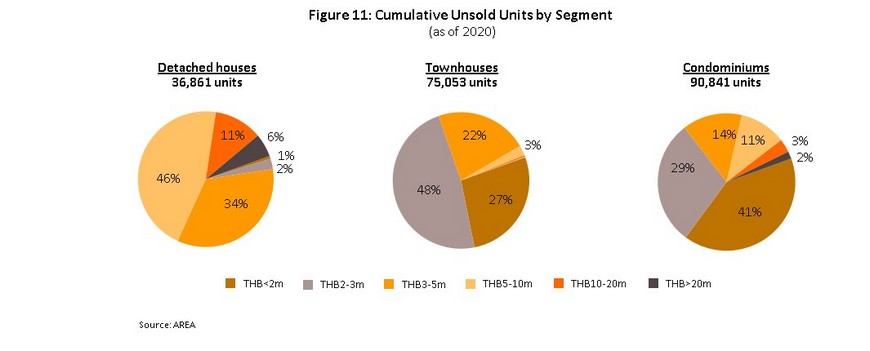

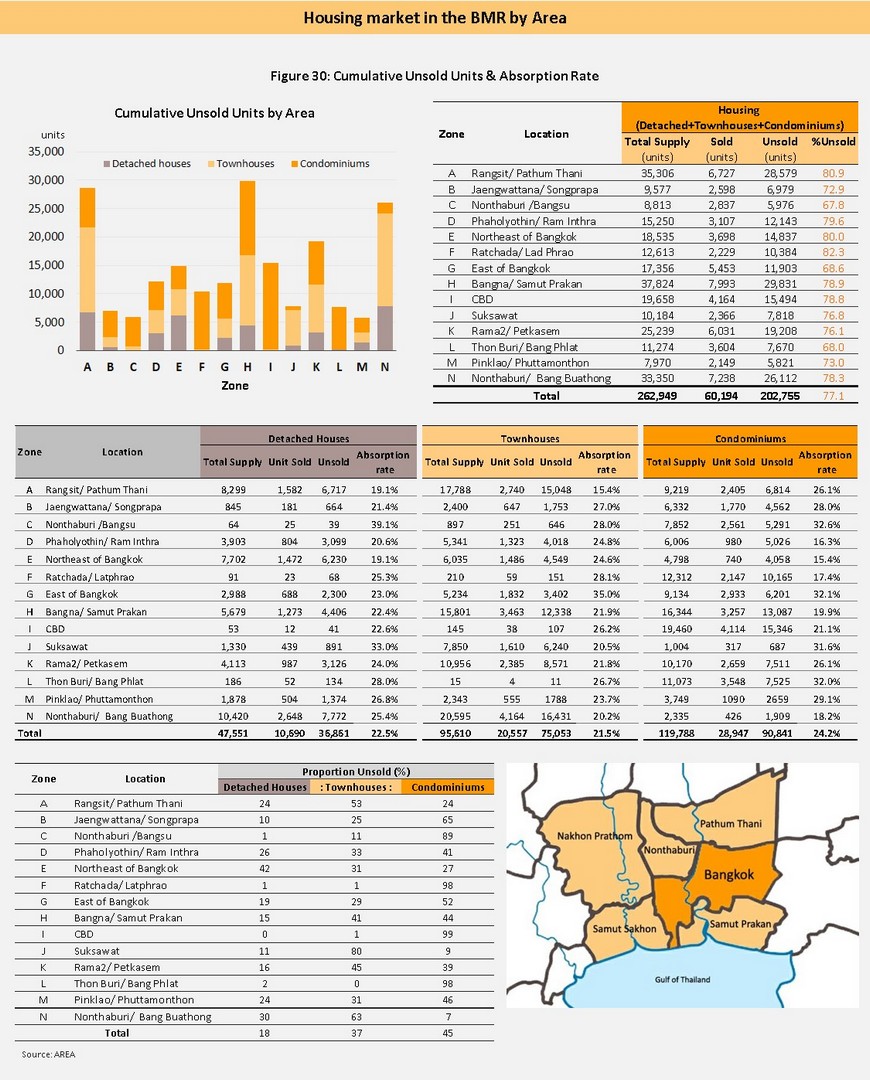

- Sales slumped 36.0% to 60,194 units, the sharpest decline in the market for 10 years (Figure 10). Sales were badly affected by the jump in household debt to an 18-year high of 86.6% of GDP (in 3Q20) and by the increasing unwillingness of lenders to authorize new loans. This then helped to boost the cumulative total of unsold properties by another 2.5% from the figure at the end of 2019 to a 24-year high of 202,755 units. Cheaper properties comprised the majority of this unsold stock, with over 60% of the total consisting of units priced at under THB3m (Figure 11).

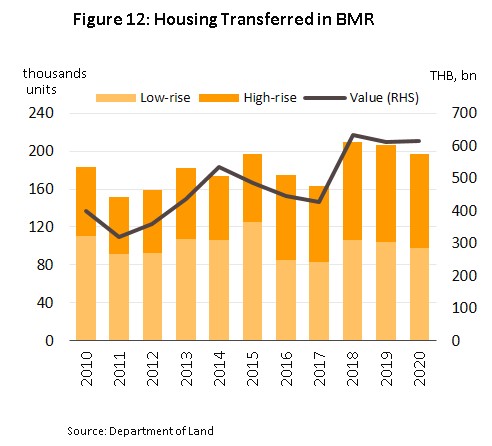

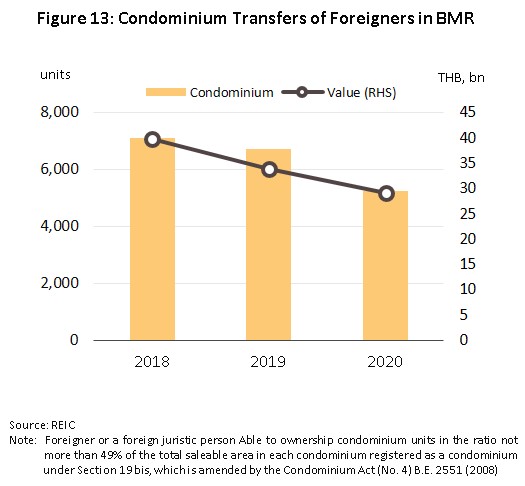

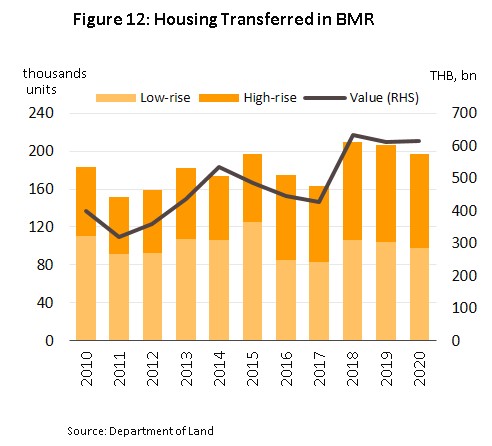

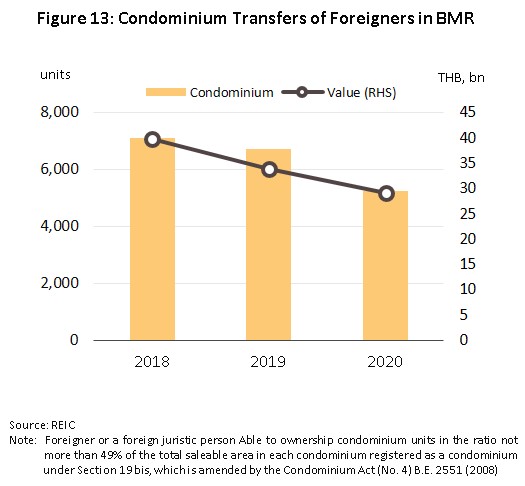

- Transfers of house ownership dropped 4.7% in the year to 196,639 units (Figure 12). Condominiums accounted for 50% of this total, with ownership transferred on 98,698 units (-3.3%), followed in importance by townhouses (28% of the total), of which 55,234 were transferred (-8.1%), detached houses (14% of the total), of which 27,670 were transferred (-1.0%) and ‘other’ properties (the remaining 8% of the total). The latter includes semi-detached and shophouses, and in total, ownership was transferred on 15,037 of these (-7.0%). As one would expect, the outbreak of COVID-19, the slowdown in the economy and the weakening of consumer purchasing power all played a part in undercutting the market and as fears over future income snowballed, domestic buyers delayed or cancelled planned transfers of ownership. A large number of foreign buyers also postponed or cancelled their plans to purchase properties in Thailand, and in 2020, transfers for condominiums made by non-Thais dropped 22.1% by number to 5,248 units and 14.4% by value to THB29.03bn (Figure 13).

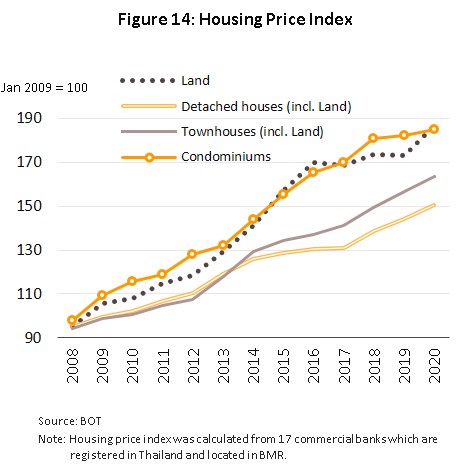

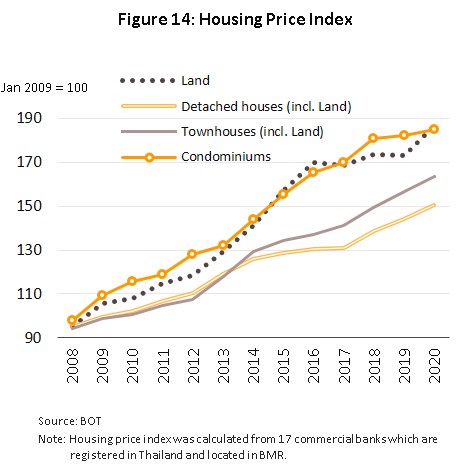

- Property prices rose across the board in 2020 (Figure 14). Increases were strongest for low-rise properties, and partly because developers concentrated their attention on meeting demand from upper-mid to upper income-earners, prices for town- and detached houses strengthened by respectively 4.5% and 4.4% following increases of 4.7% and 4.0% in 2019. Prices for condominiums also rose, though at the lower rate of 1.4% , slightly improving from +0.8% in 2019, as developers used aggressive pricing strategies to stimulate sales and run down the significant supply of unsold properties.

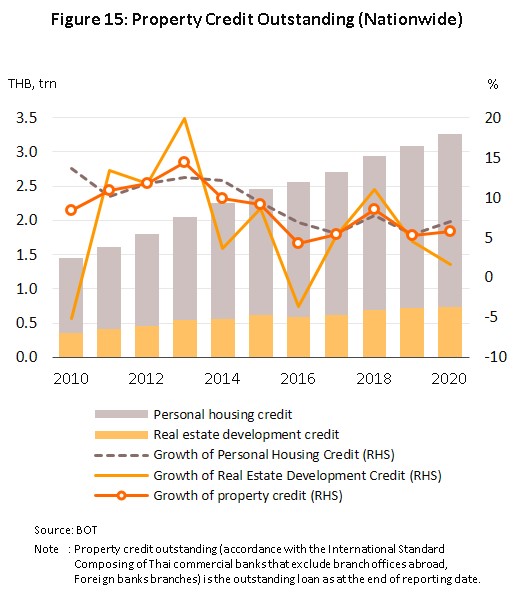

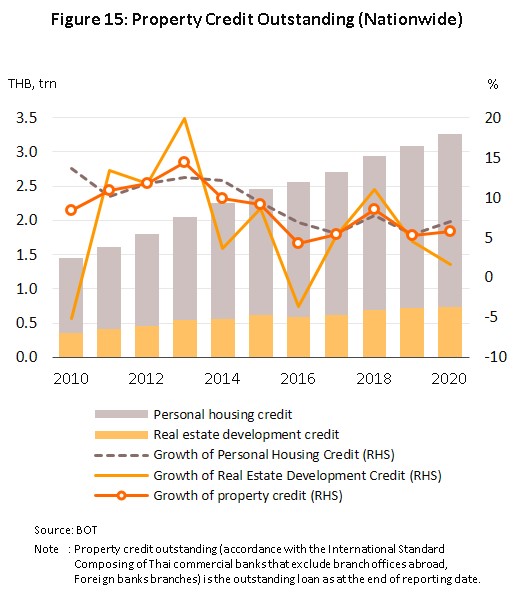

- Growth of housing loans by the commercial banking slowed sharply to 5.7% in 2020, compared to 8.8% average between 2010 and 2019. (Figure 15). This was split between the following:

- The value of pre-finance loans for developers rose 1.6%, down from 4.5% in 2019. Developers postponed new projects and instead adopted a wait-and-see approach to the market. At the same time, banks had tightened the release of new credit. However, pre-finance loans were still required for new developments, boosted by the extension of new mass-transit lines.

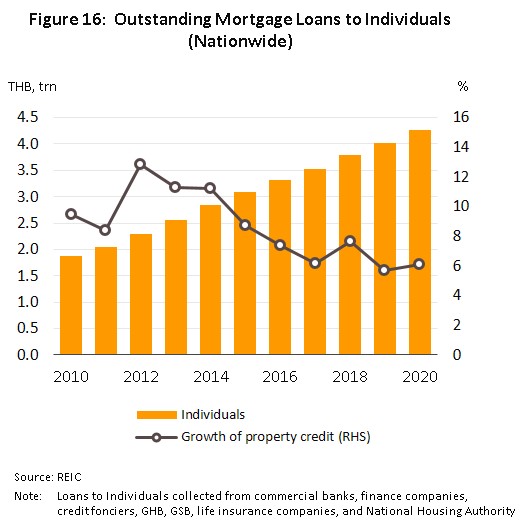

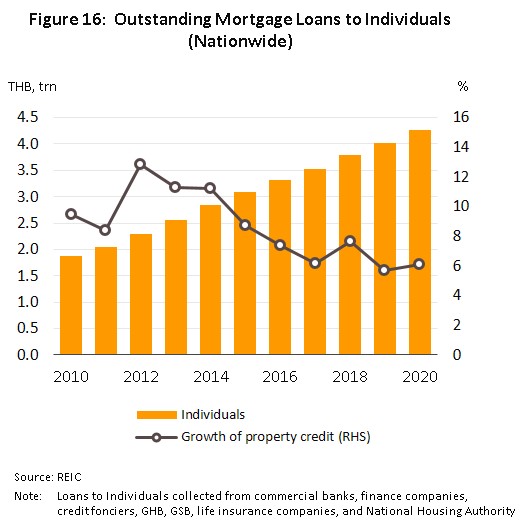

- The value of personal post-finance loans expanded by 7.0% in 2020. Demand for credit was supported by developers’ efforts to run down inventories by offering steeper-than-normal discounts and 1-2 years of payment-free accommodation. Beyond this, adjustments to the LTV rules that eased regulation of purchases of first homes made it easier for these buyers to access credit. In line with this, the value of personal mortgage loans by the financial sector{5} rose 6.1% (Figure 16).

- Detached housing

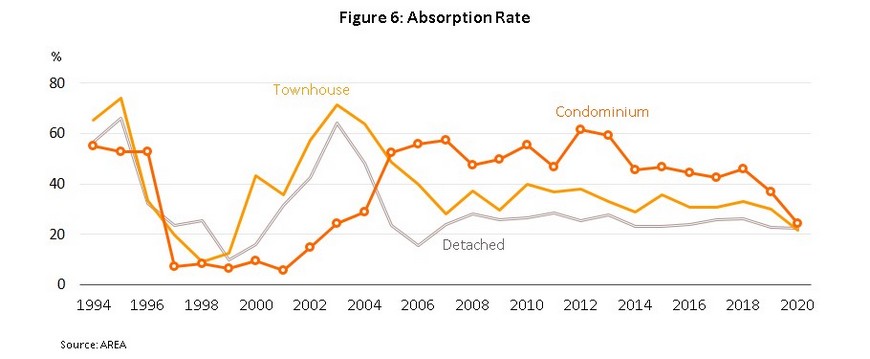

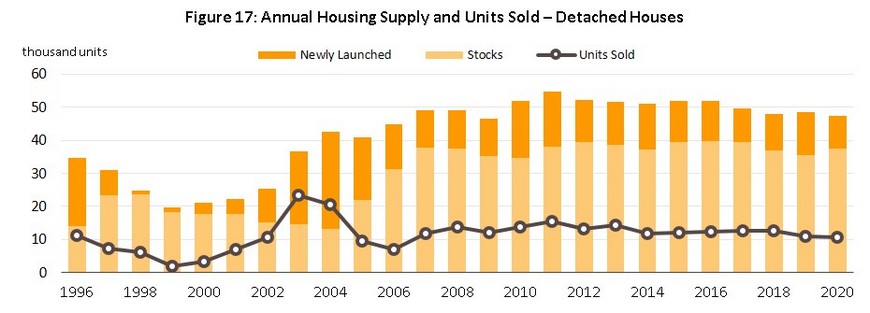

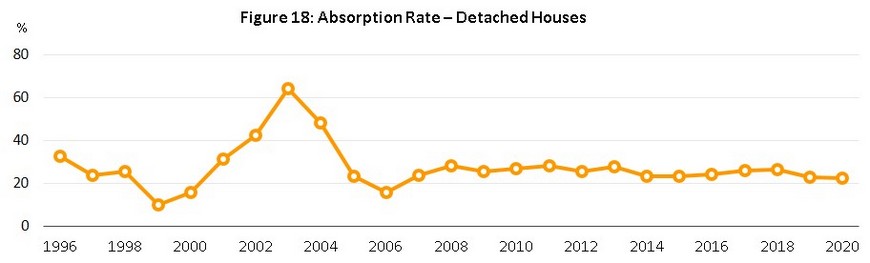

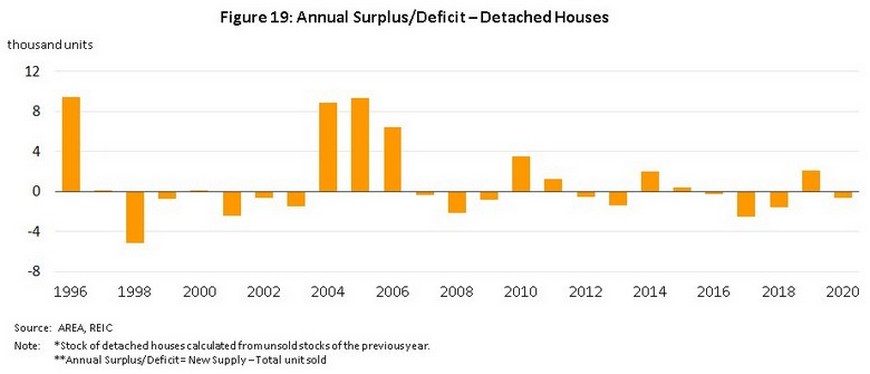

- Several years ago, the market for detached housing saw a steady increase in demand as major transport routes were extended into the suburbs and new roads were constructed. But new supply outpaced demand. As a result, cumulative unsold detached housing continued to rise, and in 2020 the figure accounted for 18% of total unsold housing stock in the BMR. Meanwhile, the absorption rate has remained at 25% since 2005, compared to a high of 64% during the property boom in 2003.

- In 2020, the number of new detached houses plunged 23.2% to 10,045 units (15% of all new housing supply). Developers shifted their attention more strongly to buyers with higher purchasing power and so for the year, 21% of all new detached houses carried a price tag of more than THB10m, and this then helped to pull the average price of new houses up by 14.5% to THB9.2m (compared to THB8.0m in 2019). At the same time, sales of detached houses weakened 2.9% to 10,690 units, most of which were in the THB 5-10m price band, and because growth in the release of new properties fell behind sales, the supply of unsold houses declined 1.7% to 36,861 units.

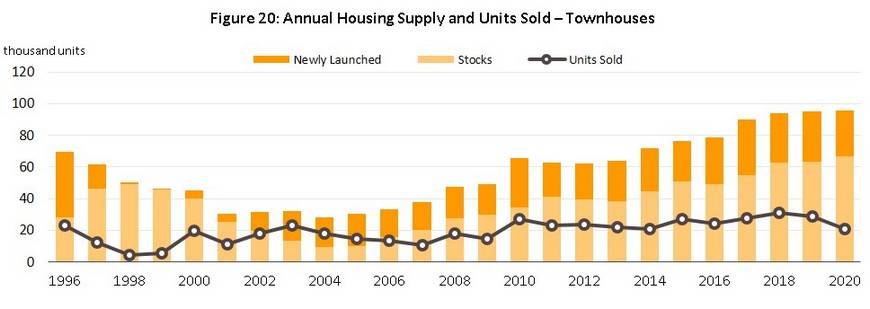

- Townhouses

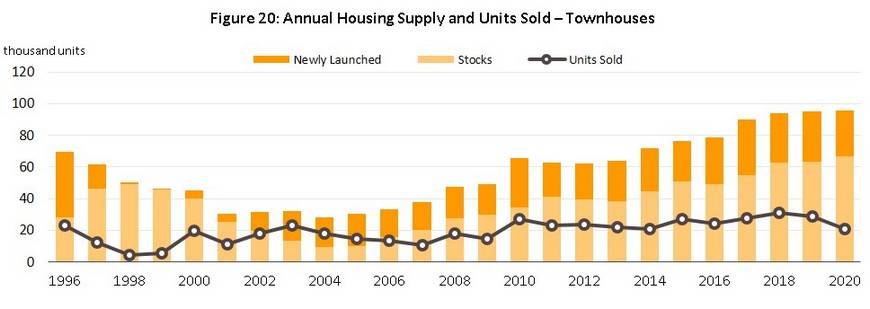

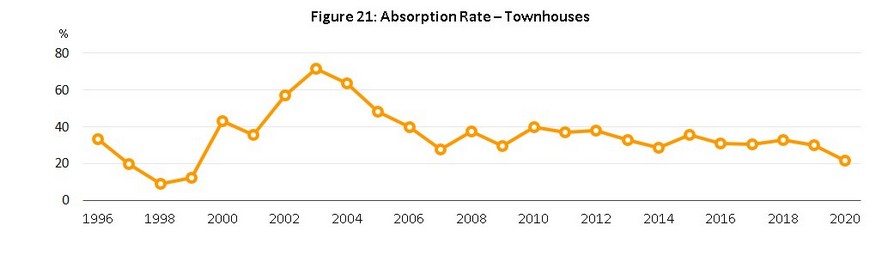

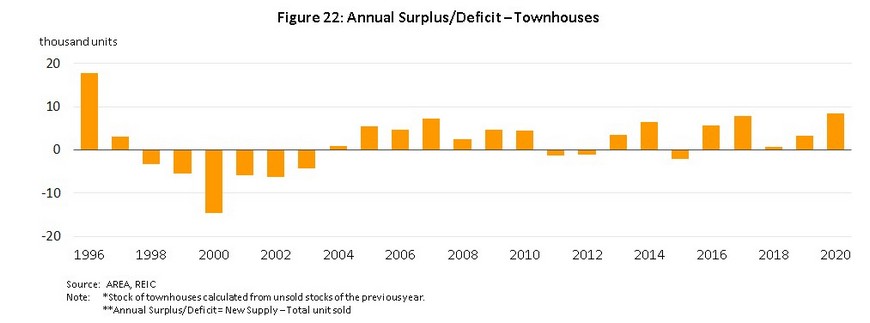

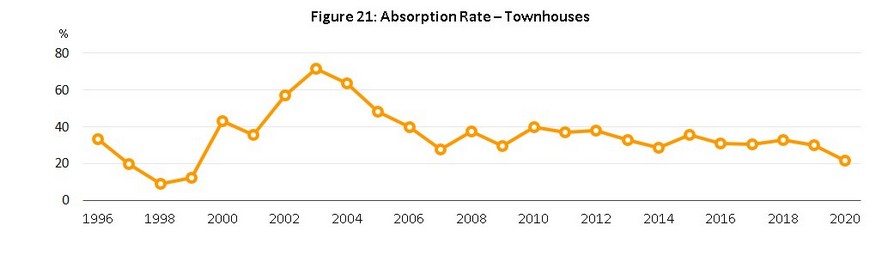

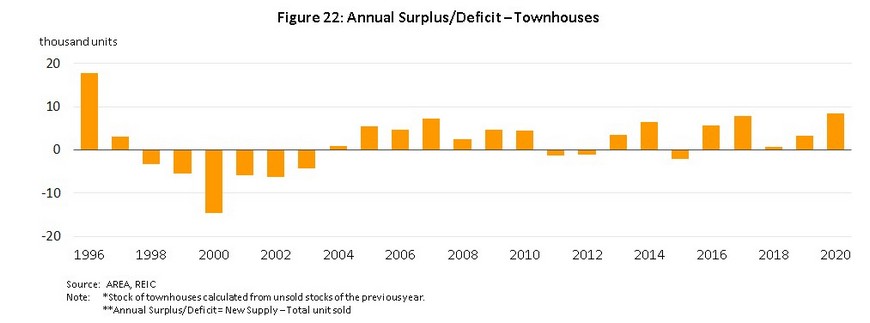

- Rising land prices spurred demand for townhouses as alternatives to more expensive detached housing. However, like other market segments, supply had risen at a faster pace than demand, and consequently, the number of unsold townhouse units had been rising steadily. In addition, there was falling interest in townhouses in favor of condominiums located near BTS lines (referred to as ‘city condos’), with the latter having advantages in terms of pricing and easy access (via mass rapid transportation) to the city center. These shifts in the market reduced absorption rate for townhouses to an average of 34% from 56% during the townhouse boom period of 2002-2006. Despite this, since 2014, developers had been developing expensive townhouses priced over THB10m per unit. These townhouses typically have three or more floors, are located on the fringe of Bangkok city center, and are relatively close to BTS stations, such as Rama 3, Sathu Pradit, Yannawa, and Lat Phrao. Beyond this, developers also invested in townhouses located in smaller alleyways that connect to mass transit systems, priced at THB2-3m each to target mid-to-low income earners.

- The number of new townhouses for sale in 2020 contracted by 9.0% to 29,100 units (45% of all new housing supply). The average price of these remained unchanged at THB2.9m. Total sales contracted 28.4% to 20,557 units as the slowing economy weakened demand, especially from middle- and low- income earners which normally go for properties priced under THB3m each. This segment comprised the largest group of unsold townhouses. As of end-2020, cumulative unsold units for all townhouses by 12.8% to 75,053 units.

- Condominiums

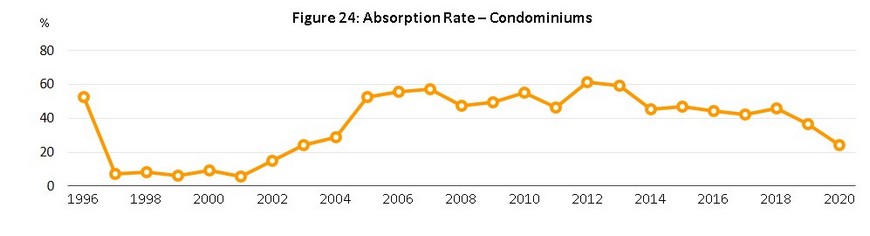

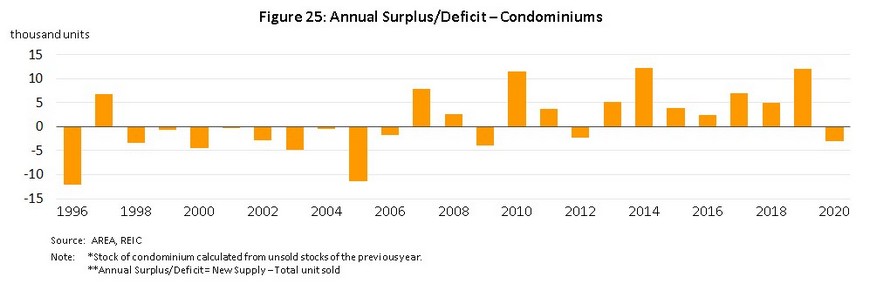

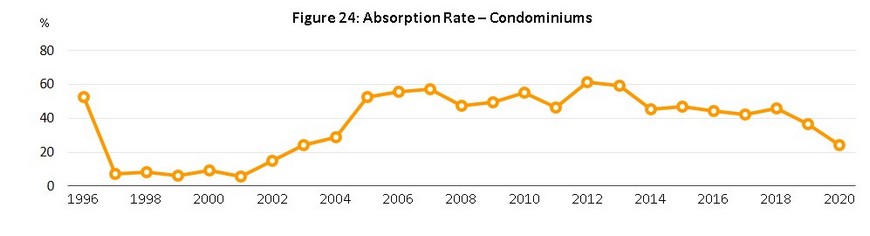

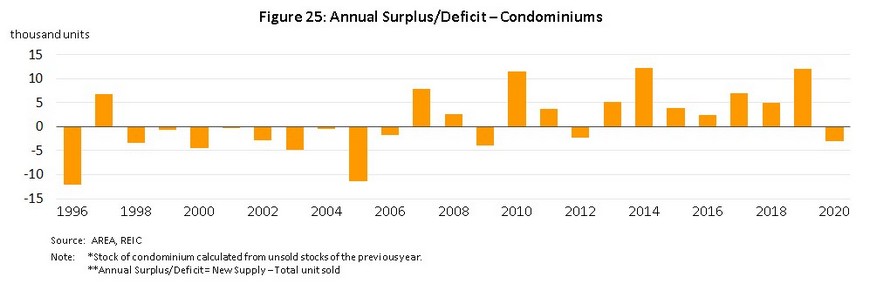

- Condominiums have been popular with a rising number of new projects since 2007 due to: (i) the extension of mass rapid transit lines and better connection within the communications network, which makes public transportation more convenient; (ii) changing consumer behavior driven by a desire to save money and to reduce commuting time, leading to a switch in preferences from low-rise housing in suburbs to high-rise accommodation in the city center; (iii) changing social structures in Thailand, with more people living in smaller units and nuclear families; and (iv) the declining availability of development land and rising land prices. The combination of these factors prompted developers to build condominiums to meet demand for housing with over 50,000 new units available annually. Buyers of these condominium units can be split into two distinct groups: (i) real demand accounts for around 60% of the market; and (ii) those who buy for investment, which can itself be split into those who buy to rent out 25-30% of the market and those who buy for speculation the remaining 10-15%. Thai law specifies that non-Thais may own condominium units subject to a maximum of 49% of the total floor-space in the project; this also led to condominium projects registering higher absorption rates than low-rise buildings. Between 2009 and 2019, the absorption rate for condominiums averaged 50% compared to only 25% for detached houses 34% for townhouses.

- However, the condominium market slowed down from 2014 to 2019, especially demand for mid- to low-end units (i.e. priced below THB3m each), due to high debt levels and a sluggish economy. As a result, buyers in this property segment were forced to be careful about spending and had delayed purchases. But in the top end of the market, units continued to sell and remained popular among high-income earners and foreigners.

- In 2020, the number of new condominiums contracted 61.0% to 25,906 units (40% of all new housing supply). Average prices dropped 25.2% to a 5-year low of THB2.8m. The majority of new projects released to the market were lower-priced developments in outer parts of Bangkok that were undertaken by SMEs, while only a few projects carried out by large developers materialized in 2020; these players instead concentrated on maintaining liquidity by selling off their unsold stock. Overall, sales were very weak in 2020, contracting by 46.7% to just 28,947 units, the worst performance in 10 years. As elsewhere in the market, this was caused by the poor economic environment, though this was amplified by the recent changes to the LTV rules for buyers of second homes, which helped to further undercut demand for investment and speculation. Meanwhile, the supply of unsold condominiums dropped 3.2% to 90,841 units. The absorption rate fell to 24%, its weakest in 16 years, and on current figures, it will take 2 years and 4 months for the current supply glut to dissipate.

Industry Outlook

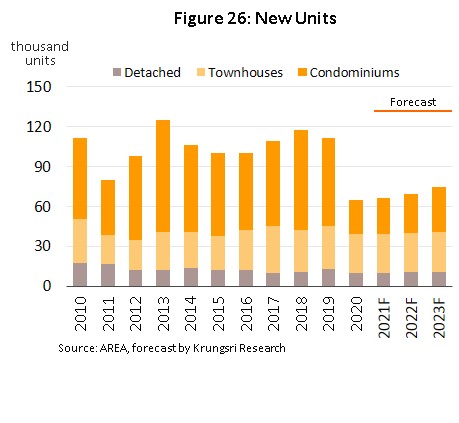

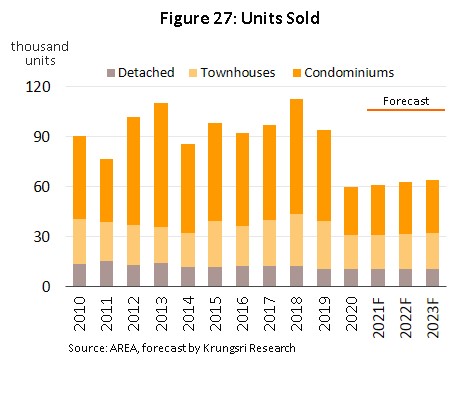

- Krungsri Research expects the pandemic to continue to hurt the economy, and thus, housing market in the BMR will remain flat or strengthen only slightly. This year, economic growth is expected to reach just 2.2% and household debt would continue to trend up, which would reduce affordability and simultaneously lead to tighter credit conditions. At 200,000 units, the glut of unsold housing stock is also substantial, and so the number of new properties coming up for sale will likely be close to that of 2020 (Figure 26). Following a 36.0% crash last year, pre-sales should strengthen by 1.2% (Figure 27), helped by the relatively resilient spending power of richer buyers, government measures that aim to stimulate the domestic market by, for example, cutting the fees for registering mortgages and transferring ownership[6], and low interest rates and cheap financing. However, the number of housing transferred this year is forecast to shrink by 1.5-2.0%; non-Thai buyers continue to face considerable barriers to entering the country, and so for the time being, the market will be sustained by domestic purchasers.

- The housing market should improve in 2022 and 2023 on stronger demand and rising investor confidence that will be driven by: (i) forecast economic growth of 3.0-4.0% per year (following a contraction of 6.1% in 2020); (ii) an acceleration of work on infrastructure megaprojects; (iii) government stimulus measures targeted at the real estate sector; and (iv) higher demand from non-Thai buyers investing or working in Thailand.

- Over the period 2021-2023, the number of new housing coming to market is forecast to rise by an annual average of 4.7%. This is expected to be approximately evenly split between condominiums and low-rise housing, with the share of the latter increasing in importance as a result of stronger real demand. The latter is in turn being boosted by the adoption of a ‘new normal’ that is encouraging buyers to place a greater value on having additional usable space or multifunction rooms that can be used when working from home. Thanks to this, low-rise developments in suburban locations are now becoming more popular. The economic crisis of 2020 has also weakened operators’ balance sheet. And this has then tended to encourage them to develop low-rise projects on the outskirts of Bangkok where land is significantly cheaper than it is in the city center, and they can be built and sold in phases. This differs from high-rise projects, which must be fully completed before ownership of individual units can be transferred. In addition, developing projects on high-value, high-potential land exposes developers to elevated levels of financial risk. Although the supply of new condominiums slowed substantially in 2020, the condominium segment continues to be more seriously affected by an oversupply of stock than does the market for low-rise.

- Players will continue to seek overseas partners. This will remain an important business strategy since foreign investors are still a solid and identifiable source of capital. However, the developments targeted by these investors will likely change, and in place of high-rise projects, investors will increasingly favor working on low-rise developments. This move is partly being driven by changing consumer preferences and the greater importance that buyers are placing on access to usable space that allows owners to work from home, and partly on ongoing urban development that is bringing much-improved train and road links and better shopping possibilities to more suburban areas. In 2021, joint investments in property projects will be increasingly carried out by Thai investors with a track record in this area, and these players will be involved in more projects. For instance, Sena Development is working with Japanese developer Hankyu Hanshin Properties on a project, THB900m low-rise development in Thepharak. Property Perfect is working with three foreign partners on three different projects with a combined value of THB4bn: Hongkong Land Holdings (development of detached houses in Chaeng Wattana and Bang Na-Suvarnabhumi), Sumitomo Forestry (condominium projects in Thong Lor) and Sekisui Chemicals (existing projects in three areas but investment has increased).

- In the coming period, competition is likely to stiffen, but purchasing power of buyers will recover only slowly. Thus, developers will look to reduce the risk of an over dependency on any one source of demand by broadening the range of market segments that they try to service.

- Work on mixed-use projects[7] will mostly be undertaken as joint ventures that exploit the particular strengths of the partners to increase the development’s competitiveness and sales potential. Against the backdrop of a market that remains sluggish, these developments will allow players to generate recurring revenue from rents and service fees.

- Developing health-conscious residential housing is a trend that is gathering strength across demographic groups, regardless of both gender and age. More immediately, the outbreak of COVID-19 has further strengthened consumer interest in personal health and self care. In response to these social movements, developers have been increasing their involvement in a range of different types of ‘wellness residence’, including increasing the provision of on-site health and wellness facilities. In some cases, investors have also adapted to the fact that Thailand will officially become an ‘aged society'[8] in 2021 by ensuring that new residential projects are built with the elderly in mind, both in the design of communal areas and of individual units, and by refitting condominiums project as nursing homes.

- New technology will be used in the construction of smart homes, with smart electronics devices built directly into the house. This will allow internet-enabled sensors and controllers to be accessed from a user’s smartphone, thus permitting an individual to safely and remotely manage the house and its water and electricity supplies and home entertainment systems.

- Long-term leaseholds are becoming increasingly popular, especially in prime areas such as Rajadamri and Lang Suan. These have the advantage of allowing foreigners to occupy properties without restriction and of carrying a price tag that is some 30-40% lower than equivalent freeholds in the same area.

- Important policy shifts that may have a significant impact on the housing market include a proposal to encourage greater investment in Thai real estate by overhauling the law on ownership of land by non-Thais[9]. At present, non-Thais may legally own only condominiums and only up to 49% of total salable area in any project, but it is proposed that this be raised to 70-80%. In addition, the government is also considering allowing foreigners to buy low-rise houses.

- Headwinds will blow against the market over 2021-2023. These originate from: (i) only slow recovery of the economy, which will make it more difficult for developers to market their properties; (ii) the tendency for household debt to rise and the reduced willingness of lenders to release new credit; and (iii) the limited rebound in demand for housing, most of which will be real demand. The extensive oversupply of housing (especially of condominiums) and the new LTV rules and their impact on buyers of second (or more) properties will also tend to depress demand for investment and speculation. At the same time, demand from overseas buyers will remain weak given the continuing heavy restrictions on international travel. As such, players will need to make extensive use of pricing strategies to encourage sales and to reduce their backlog of unsold stock, though this will then naturally tend to negatively impact players’ profits.

Krungsri Research’s view

Between 2021 and 2023, housing markets in BMR will gradually recover with a steady rebound in consumer purchasing power in line with the economic conditions. However, the continuing threat of COVID-19 will weigh on growth, especially in the condominium segment. While sales will remain depressed, developers will need to spend on marketing to stimulate sales, which would add to their overheads. For large developers, this will be less problematic and established operators will be able to sustain business growth. However, SME developers will have to contend with rising competition alongside growing business costs for, for example, land in high-potential areas. Developers will therefore tend to build competitiveness by expanding their access to capital, and a favored way of doing this will be to look for other companies (both Thai and international) with which to form joint partnerships or to merge. As such, the real estate market will likely undergo structural change as operators consolidate and the number of large players grows, and in this environment, small operators that have only limited access to financing may become insolvent and be forced out of business.

- Low-rise housing developers (in BMR): Large players will see their revenue rise thanks to a combination of their adaptability and lower costs of financing (a result of being able to raise funds on the stock exchange and on bond markets). However, SMEs will have to contend with a more challenging environment and as such, their market share may shrink. Players that lack established business partners or that are not part of an extensive commercial group will find conditions especially difficult, and those that are on a weaker financial footing or that have trouble accessing credit may become insolvent.

- High-rise housing developers (in BMR): Developers of condominiums in the central business district and along mass transit lines, the majority of these players are large corporations that are skilled in project management, marketing and securing sources of working capital. But despite this, competition will tend to stiffen and this may place a limit on how far profits may rise. At the same time, SME developers will tend to concentrate on projects that have a maximum height of 8-storeys and that are located in more distant, suburban areas that are comparatively less attractive. In these districts, high-rise developments are also often less appealing to buyers than are town- and detached houses and so players will likely see only low levels of profitability, though some will also be at risk of becoming loss-making.

[1] The new rules came into force in April 2019 and cover property loans, specifically loan to value ratios (LTVs) for new loans. - For purchasers of first properties with a value of less than THB10m, there is no change to the regulations. - For purchasers of second homes, if repayments on the first home are made on a schedule of 3 years or over, the deposit must be at least 10% of the loan value. If repayments on the first home are made on a schedule of less than 3 years, or if the value of the property against which the loan is made is over THB10m, the deposit must be at least 20% of the loan value. - For purchasers of a third (or subsequent) house, if the buyer has outstanding mortgages, whatever the value of the loan, the deposit must be at least 30% of the loan value. - Top-up loans are loans that are made against the same collateral as a housing loan or another loan (such as a ‘home for cash’ remortgaging-type arrangement) but which provide additional funds to the borrower. This excludes (i) loans made against accident and life insurance and (ii) loans made to SMEs.

[2] The cuts in tax for first-time home buyers provided for reductions in personal income tax (calculated according to the cost of purchases) up to a value of THB 200,000 for those buying houses and land together or apartments with a value of not more than THB 5m. These measures ran from April 30 to December 31, 2019.

[3] Charges for the housing transfer and for registering mortgages have been cut from respectively 2% and 1% of the estimated value of the property to only 0.01% of its value. This reduction applies to (i) purchases of property with a value of not more than THB 1m made between June 24, 2019 and May 31, 2020 and (ii) those with a value of not more than THB3m made between November 1, 2019 and December 24, 2020.

[4] The ‘baan dee mee down’ program was run by the Ministry of Finance, and under this, a contribution of THB 50,000 was made by the government to the down-payments of those purchasing new properties. The program was limited to 100,000 applicants, who had to have an annual income of not more than THB 1.2m. The scheme ran from December 11, 2019 to March 31, 2020.

[5] The financial sector comprises commercial banks, the Government Housing Bank, the Government Savings Bank, the Islamic Bank of Thailand, the Bank for Agriculture and Agricultural Cooperatives, finance companies, credit fonciers, life insurance companies and the National Housing Authority.

[6] Charges for the housing transfer and for registering mortgages have been cut from respectively 2% and 1% of the estimated value of the property to only 0.01% of its value, for purchases of property with a value of not more than THB3m has been extended for 1year to December 31, 2021.

[7] Mixed-use real estate developments include both commercial and residential uses. Mixed-use developments may thus contain retail units, office space and residential accommodation within the same project.

[8] An ‘aged society’ is defined as one in which at least 20% of a society (or a country) is over 60 years old or at least 14% is over 65.

[9] Proposed changes to the relevant sections of the Condominium Act, the Hire of Immovable Property for Commerce and Industry Act, and the Land Code are as follows: - Purchases of real estate: (i) For condominiums, it is proposed that the ceiling on foreign purchases should be raised to 70-80% of the total area for sale in individual developments (at present, this is limited to 49%). (ii) It is also proposed that non-Thais be allowed to buy detached houses but with the provision that this is only permitted on housing developments/estates, that this only apply to houses priced at THB 10-15m and over, and that it should not be possible for non-Thais to own more than 49% of the total area for sale in any given housing estate. (At present, ownership of houses is limited to those investing at least THB 40m in Thailand. These individuals may own up to 1 rai of land, but this is only with the express permission of the relevant minister.) - Rentals/leases of real estate: The Hire of Immovable Property for Commerce and Industry Act allows foreign investors to negotiate 30-year leases but it is proposed that to attract foreign investors and to allow them to take up long-term residence in Thailand, the law be amended to allow this to be extended by 50 and then another 40 years.

.webp.aspx)