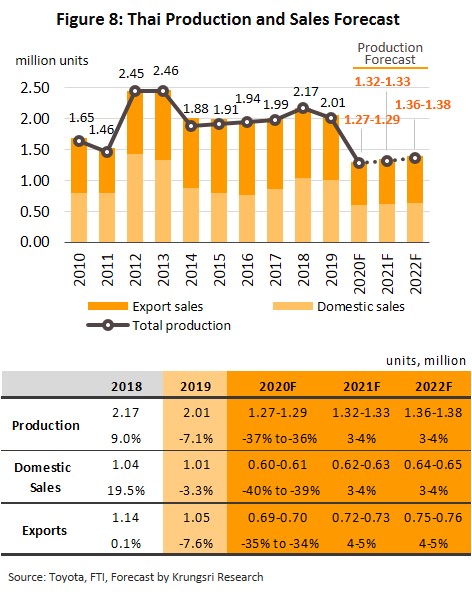

In 2020, disruption to supply chains and the sharp drop in consumer purchasing power in Thailand and abroad – triggered by the Covid-19 pandemic - will reduce demand for new vehicles. But we expect output and unit sales to recover in 2021 and 2022, driven by a rebound in spending power in tandem with the projected recovery of the economy. The brighter outlook will also be supported by: (i) residual replacement demand from those who had bought vehicles under the first-car buyer scheme; (ii) ongoing government investment and growth in online retail and logistics, which will create greater demand for commercial vehicles; (iii) plans by automakers to stimulate demand with the release of new models (including both internal combustion engine and electric vehicles); and (iv) more liberal trade arrangements under prevailing ASEAN Free Trade Area agreement which would allow Thailand to export more vehicles to the rest of the region.

Overview

The automobile sector has long been identified as a crucial pillar of the Thai economy, and as such, has been receiving strong government support. In 1961-1970, the support was to encourage production for import substitution. The Thai government introduced several measures to attract investment into the industry, including: (i) offering tax breaks; (ii) reducing import duties for auto parts for use in completely knocked-down (CKD) units that are assembled in-country; and (iii) restricting imports of completely built-up (CBU) units by raising import duties on these.

In 1971, the government switched its policy to developing and strengthening the automotive industry by encouraging domestic production of vehicle parts. They achieved this by: (i) raising import duties on CKD parts and CBU units; (ii) imposing local content requirement from January 1, 1975, which was gradually raised to increase the use of more locally-produced parts; and (iii) employing policies to attract foreign investment and encourage technology transfer from multinational operators to domestic businesses. These policies led to the steady growth in investment in auto parts production, which in turn, helped to develop and strengthen the supply chain for the domestic automotive sector. This has proven to be successful as currently, over 80% of parts used in the manufacture of vehicles are now sourced domestically.

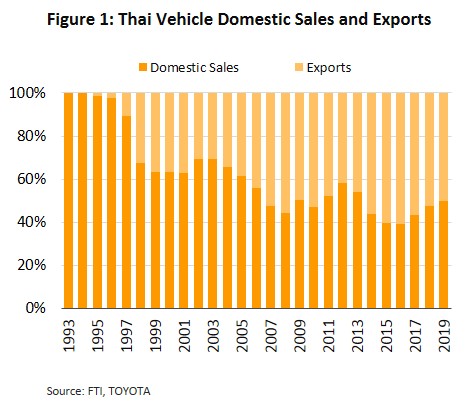

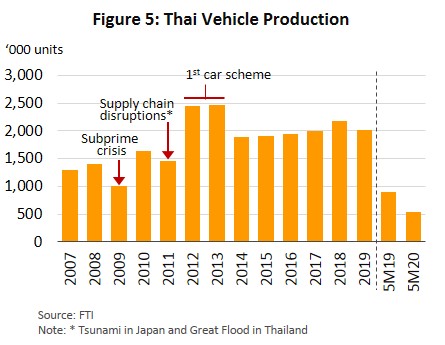

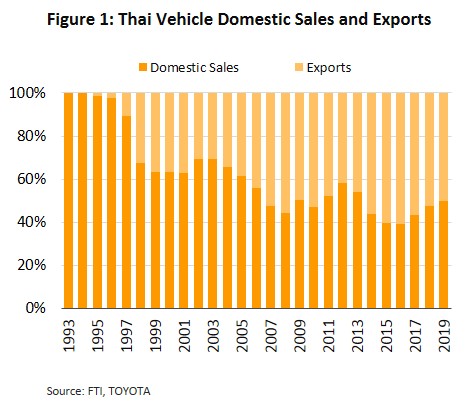

Multinational automakers (especially those from Japan) had rushed to invest in Thailand following the 1987 Plaza Accord. Prior to the Accord, the Yen had strengthened, posing a significant risk to Japanese automobile manufacturers, and rendered cars from Japan less competitive price-wise. This had encouraged Japanese players to invest in manufacturing facilities overseas. In addition, following the 1997 Asian Financial Crisis, the Thai government had relaxed rules for non-Thai entities which hold stakes in Thai companies while concurrently rolling out plans to develop the automotive sector into the ‘Detroit of Asia’. This led to two decades of growth and annual production rose from 0.36 million vehicles in 1997 to 2.01 million in 2019, or a compounded annual growth rate of 8.6%. At the same time, the automotive sector switched to focus on the export market, and that has been a priority since 2008, with the exception of 2012 and 2013 when the government introduced the first-car buyer scheme.

Beyond this general overview, the government had introduced a series of investment promotion policies that had different effects on the type of vehicles produced in Thailand.

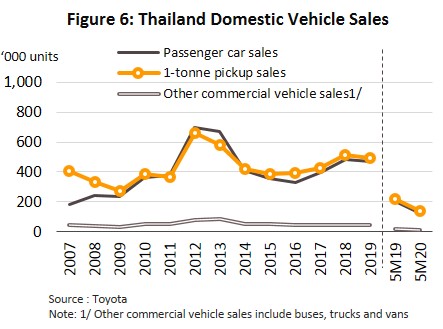

- In 1997-2008, the government encouraged the production of 1-tonne pickups, a class of commercial vehicle which is typically diesel-powered. The policies to encourage large global manufacturers to establish pickup production facilities in Thailand made this class of vehicle a ‘product champion’ in the country. The government also introduced measures to stimulate domestic demand for pickups, for example by using the oil fund to keep diesel price low relative to gasoline and cutting duty on pickups to 3% compared to 30-50% for passenger vehicles. As a result, sales of 1-tonne pickups grew substantially and commercial vehicles accounted for over 70% of Thai auto production.

- Since 2009 however, the government has been promoting passenger cars, and that has now become the product champion, instead of 1-tonne pickups. This move helped to encourage investment in the manufacture of cars, and production of this class of vehicle had risen from 28% of total output in 2007 to 47% in 2019. The series of policies to support the sector include the following:

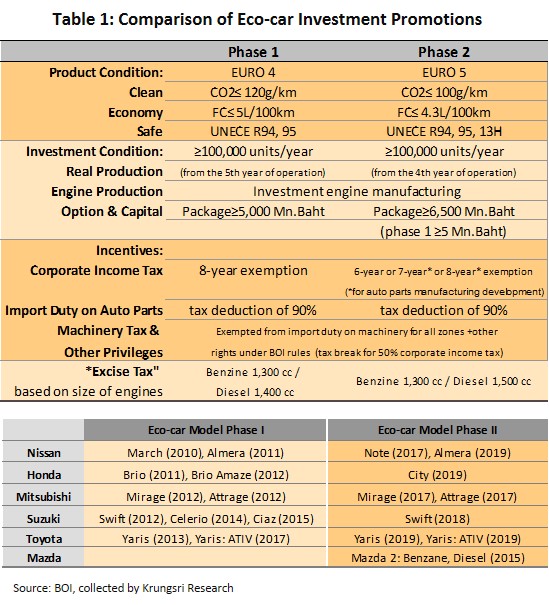

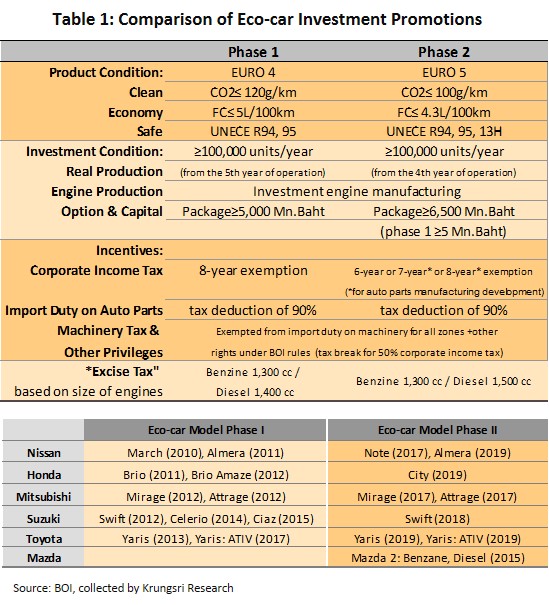

- Measures to encourage domestic production of small, economical cars (called eco-cars) included designating this category as the country’s second ‘product champion’ in 2009-2015. To encourage investment by the major automakers, the government introduced a series of tax incentives subject to them meeting a set of export targets. These incentives came in the form of ‘Eco car Phase I’ (with effect from 2009) and ‘Eco car Phase II’ (with effect from 2015) (see Table 1). There were also other factors that helped to extend the domestic market for eco cars: (i) improvements in gasoline engine technology to allow the use of ethanol-based fuels (or ‘gasohol’); (ii) a decision by the Thai government to support domestic consumption of biofuels by using the oil fund to keep prices of gasohol relatively low; (iii) including eco cars under the 2012-2013 first-car buyer scheme which temporarily allowed buyers to claim duty paid for these items[1]; and (iv) a reform of the vehicle duty structure in 2016, to calculate duty based on CO2 emission and engine size. This generally caused larger vehicles to be more expensive. At the same time, the government stimulated demand for small automobiles by lowering import duty, especially for eco cars (which meet the Board of Investment’s requirement for (low) CO2 emission). Duty for this vehicle category was cut from 17% to 12-15%.

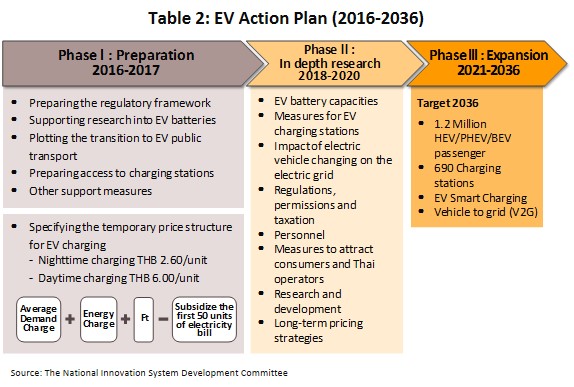

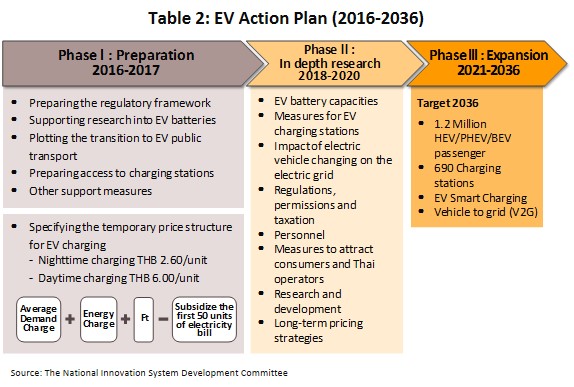

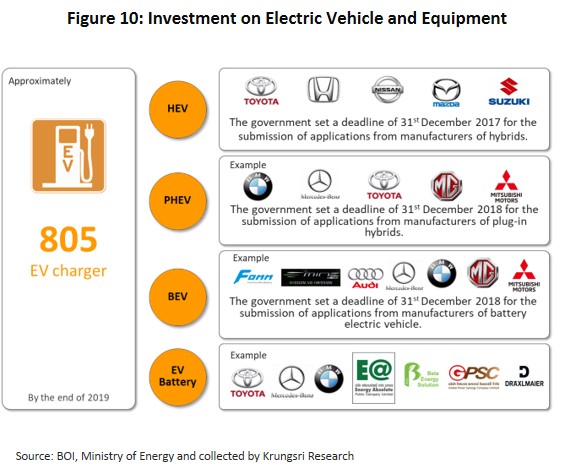

- For electric vehicles (EV), government is supporting the development of three vehicle categories: hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and battery electric vehicles (BEVs). In addition to declaring EV Thailand’s third ‘product champion’ for 2016-2036, the government has offered further support: (i) amending the application process for investment support under the Eco car Phase I and Eco car Phase II schemes to allow manufacturers to include EVs in the total count. Although, it should be noted these two schemes have not been as successful as hoped and to date, production has yet to meet the level required by the Board of Investment (BOI).(ii) In May 2019, to encourage production of EVs, the government announced that manufacturers would also be eligible to apply for BOI investment support for BEV if they manufacture HEVs (for applications submitted by December 31, 2019) on the condition they start HEV production within 3 years from the date which the investment support was granted, and that production of BEVs has to commence not later than 3 years after HEV production starts. (iii) The government has also attempted to stimulate domestic market for EVs by encouraging state and private organizations to expand the number of vehicle charging stations throughout the country, and by placing EVs in the low-duty category (after reforming the vehicle duty structure). The government’s EV Action Plan is summarized in Table 2.

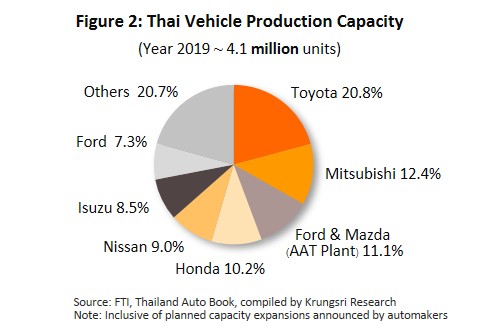

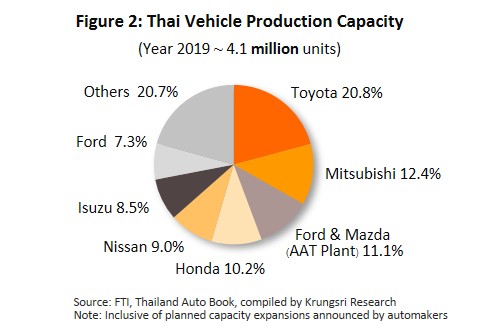

In 2019, Thailand’s annual production capacity for all vehicle types reached 4.1 million units[2], split almost equally between passenger and commercial vehicles. For the latter, over 90% of capacity is for 1-tonne pickups. Japanese manufacturers dominate the market with 80% of national production capacity (Figure 2).

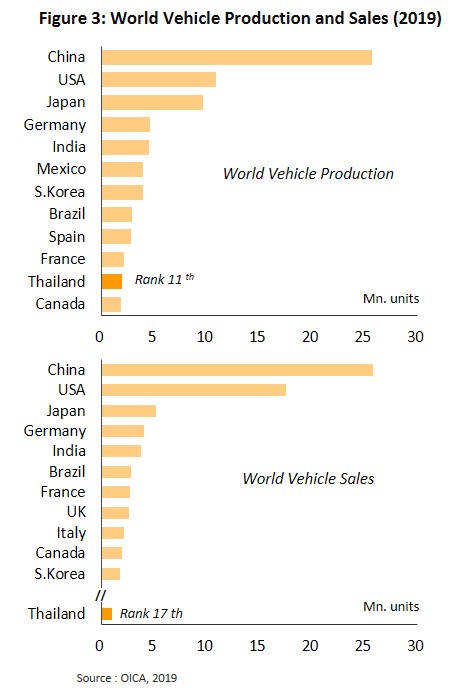

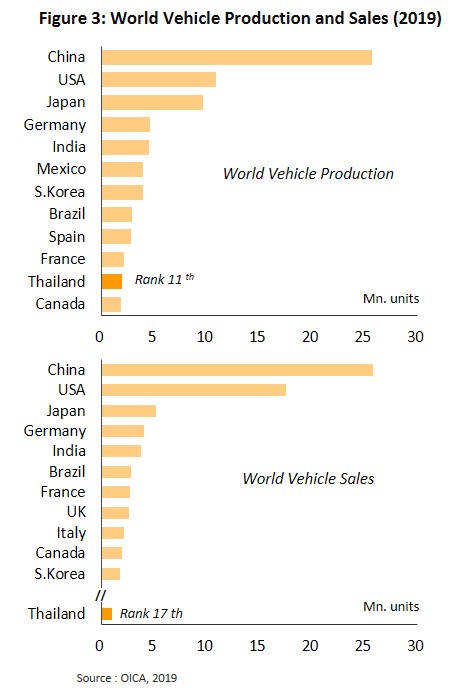

In 2019, Thailand’s total auto output made the country the 11th largest producer worldwide, 5th in Asia, and 1st in the ASEAN zone. But in terms of unit sales, Thailand is 17th largest in the world, 6th in Asia, and 2nd in the ASEAN zone (Figure 3). The market is split between the following vehicle types:

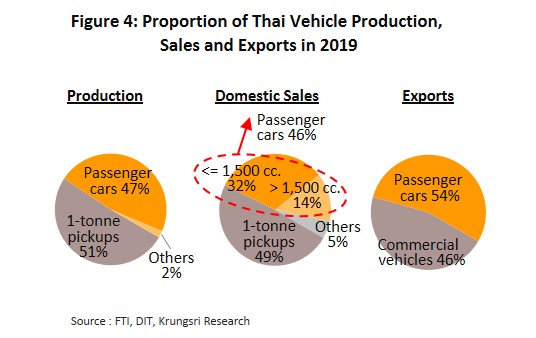

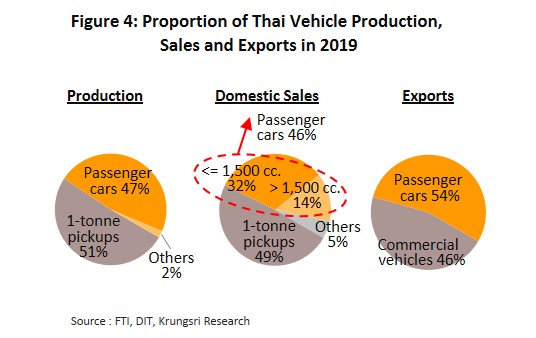

- Passenger vehicles: These account for 46% of all vehicles distributed domestically, with 32% of all vehicles in the sub-1,500cc group of passenger vehicles (which includes eco cars) and 14% with engine size over 1,501cc. Passenger vehicles also accounted for 54% of total vehicles exported, and exports made up 50-60% of all passenger vehicles produced in the country. The major export markets for passenger vehicles are ASEAN, Australia, the Middle East and Europe.

- Commercial vehicles: 54% of the vehicles distributed to the domestic market are in this category (49% are 1-tonne pickups and 5% are other commercial vehicles including trucks, busses and vans). Commercial vehicles made up 46% of total exports (Figure 4), mostly 1-tonne pickups (which accounted for 50-60% of all 1-tonne pickups assembled in Thailand). The most important export markets are ASEAN, Australia and New Zealand. For other commercial vehicles, exports account for 10-15% of total output for each segment.

Situation

Between 2012 and 2019, auto manufacturers had been exporting more eco cars to meet BOI requirements for investment support. The total number of eco cars exported in that period breached 1 million vehicles. In contrast, distribution to the domestic market had been considerably affected by the first-car buyer scheme which started at end-2011. This had pulled forward demand for new automobiles from the following few years. As a result, units sales had jumped to 1.4 million vehicles in 2012 and then to 1.3 million in 2013, compare with an average of 0.7-0.8 million unit sales per year during 2007-2011. Following the expiry of the scheme, between 2014 and 2017, the number of vehicles distributed to the domestic market slipped back to 0.7-0.9 million units annually. This caused output to drop to around 2 million vehicles per year, much less than the record high of 2.4 million per year recorded during the first-car buyer scheme.

In 2012-2013,

the first-car buyer scheme had encouraged auto manufacturers to expand production capacity to meet the sudden surge in demand created by the scheme. This subsequently resulted in a supply glut that had dragged the Thai auto market. The front-heavy demand created by the scheme also led to a substantial mismatch between supply and demand when the program expired. This was evident in 2014 when the market also had to contend with a slower economy and weaker spending power’ Unit sales crashed and dealers were left to bear the cost of keeping large inventories. Industry players responded by stepping up marketing activity and employing aggressive pricing strategies, but that effectively suppressed earning for both manufacturers and dealers for several years.

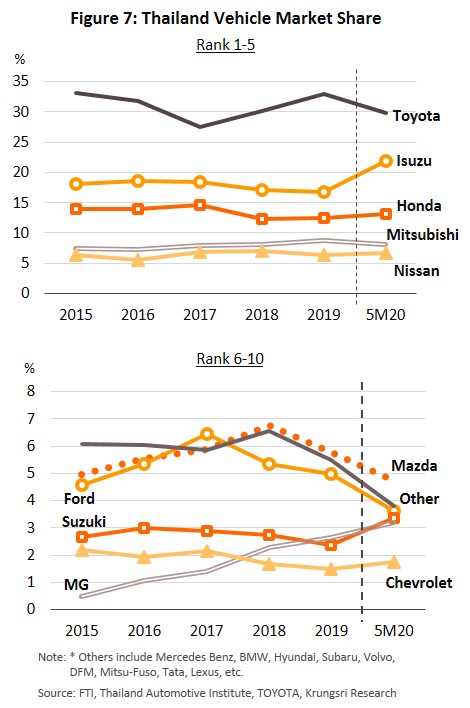

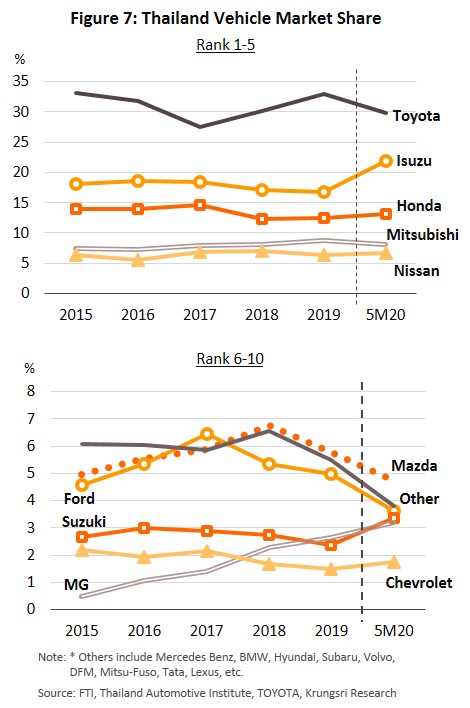

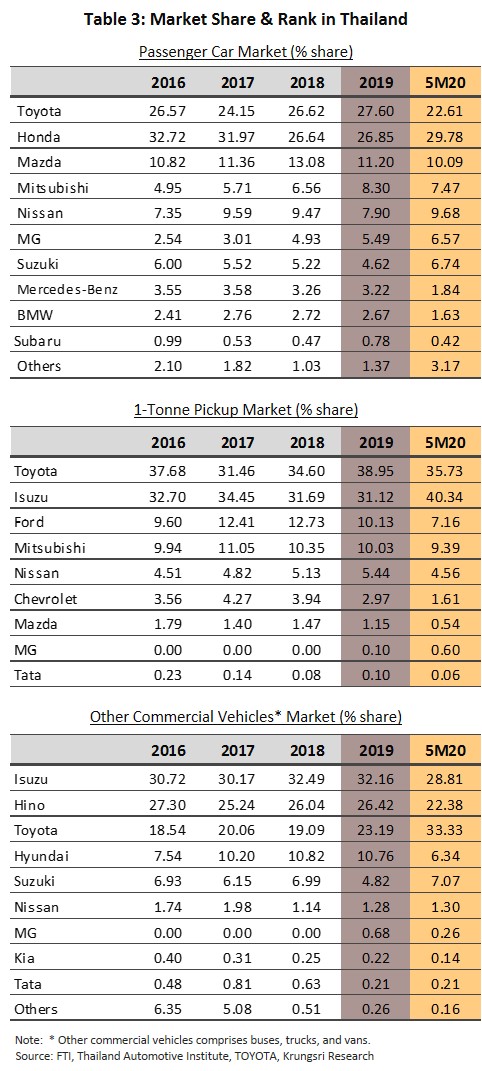

The situation turned around in 2017 when unit sales registered growth for the first time in 5 years. In 2018, annual sales of new vehicles broke the 1 million mark, which had not happened since the first-car buyer scheme expired (delivery of new cars bought under the scheme continued until 2013). This improvement was driven by: (i) 4.1% GDP growth in Thailand in 2018, its best in 6 years; (ii) replacement demand from buyers under the first-car scheme as well as the end of the 5-year moratorium; and (iii) strong competition arising from aggressive marketing activity, which helped to boost demand. Some dealers offered cash-back deals for buyers of new vehicles[3], and Toyota and MG had released new models, including EVs, which succeeded in attracting sufficient interest to noticeably expand their market shares (Figure 7).

In 2019, conditions worsened again for auto manufacturers as the US-China trade conflict dragged the global economy and pulled down Thailand’s economic growth to just +2.4%. As such, total domestic output fell by 7.1% from 2018 level to 2.0 million vehicles, comprising 0.95 million passenger vehicles (-10.4%), 1.03 million 1-tonne pickups (-4.0%), and 0.04 million other commercial vehicles (0.6%). Details of the volume distributed to the domestic and international markets are below.

Domestic unit sales reached 1.01 million vehicles, falling 3.3%. Besides the high base the year before, commercial lenders had moved to tighten loan conditions after the Bank of Thailand warned automakers to tone down the price competition that was raging in the market. Vehicle manufacturers and dealers had been offering promotions that included price cuts and cashback deals. At the same time, the worsening economic outlook had encouraged consumers to exercise greater caution over their spending.

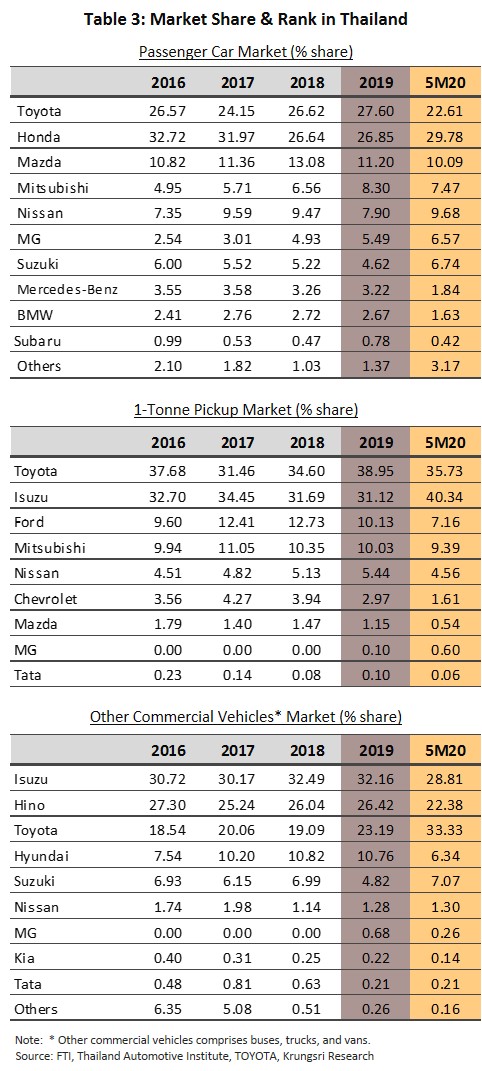

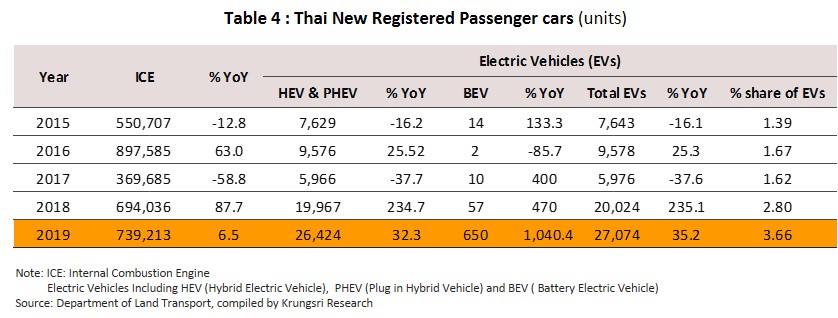

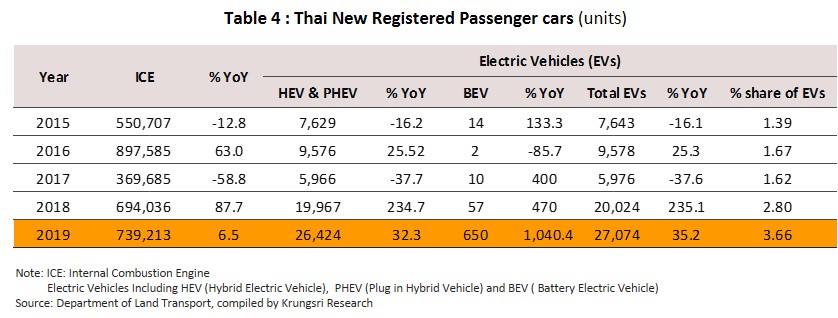

- Passenger vehicles: Unit sales shrank by 2.7% to 470,000 in 2019. Unit sales of vehicles with engines below 1,500cc (including eco cars which accounted for 69% of passenger vehicle sales) fell by 1.8%, while sale of vehicles with larger engine sizes fell by 5.7%. Despite this, the major manufacturers (notably Toyota and Honda) released new models in the market, including eco cars (per the requirements for investment support under the Eco car Phase II project) and SUVs, which were popular with consumers. Vehicles with smaller but still-powerful engines that are cheaper and more economical also proved to be a hit with buyers. These included the Honda City with DOHC VTEC 1,000cc turbo engine, and the Mazda 2 which came with a Skyactiv 1,300cc engine. Based on new vehicle registrations, sales of electric vehicles[4] jumped 35.2% to 27,074 vehicles or 3.7% of all new passenger vehicle registrations, up from 1.4% in 2015 (Table 4). Given BOI support, sales of battery-powered EVs surged 10-fold in 2019 following the release of the MG eZS and FOMM One, although they were also helped by imported Nissan Leaf, Hyundai IONIQ Electric and Kona Electric, the Audi e-tron 55 Quattro and the Jaguar I-Pace. Sales of hybrids and plug-in hybrids also surged by 32.3% with the release of the Toyota C-HR, Camry and Corolla Altis Hybrid models, the Mercedes-Benz C300e, and the BMW X5 plug-in hybrid. But despite the impressive growth, EVs are still at the introductory stage of the product lifecycle, and hence, they have a small market share and remain a niche product for wealthier buyers.

- 1-tonne pickups: Sales slipped 3.8% to 490,000 units amid weaker spending power in the agricultural sector and after extensive flooding in northeast Thailand in 3Q19 which had hurt purchasing power in the affected regions. But there was support from (i) the release of MG Extender and Isuzu D-Max, and (ii) strong growth of the e-commerce sector which has raised demand for pickups for use by delivery companies.

- Other commercial vehicles: Sales reached 40,000 vehicles (+0.6% from 2018 level) driven by (i) higher demand from the expanding tourism sector for passenger transport vehicles, and (ii) rising demand for trucks following higher government spending on infrastructure projects and the growth of the logistics sector.

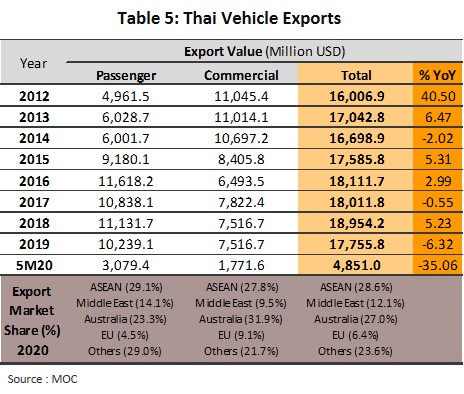

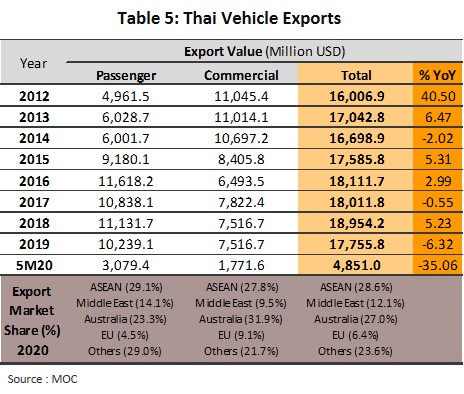

Auto exports performed badly in 2019, with unit export sales falling by 7.6% to 1.1 million vehicles, and export value by 6.3% to THB1.8bn (Table 5). This was largely a result of the global economy recording its slowest growth in a decade (only +2.9%) and the impact of the US-China trade war on Thai export markets, although this also presented an opportunity for Thai players to ramp up exports of certain types of vehicles. The current situation for exports is described below:

- Passenger vehicles: 2019 export value reached USD10.2bn, down 8.0% from 2018 level. By category, sales of eco cars, PPVs (pickup passenger vehicles) and ‘others’ (SUVs and larger-engine size vehicles) shrank by 7.2%, 24.8% and 6.5%, respectively. Exports sales (by value) to the major export markets also fell. Australia accounted for 24% of vehicle exports from Thailand, making it Thailand’s most important export market. But after the state governments there raised duties on luxury vehicles5/ and introduced measures to promote greater use of EVs (2,400 new EVs were sold in Australia 2018, government is targeting 1 million EVs on the road by 2030), exports from Thailand dropped by 17.5%, the steepest decline in 5 years. The Philippines is Thailand’s third largest vehicle export market (9% market share) but sales crashed by 41.8% there to an 18-year low following the overhaul of the auto and fuel excise duty regime, which raised excise duty on vehicles powered by internal combustion engines, halved the duty for hybrids, and removed it entirely for BEVs. But they increased excise duty on oil-based fuels from 2018. However, exports to some market grew: in Vietnam (Thailand’s second largest export market with 10% share), exports jumped 56% after the government relaxed rules for imports from Thailand[6], and in China (Thailand’s fourth biggest market with 7% share), the US-China trade war had encouraged Mercedes-Benz and BMW to export some models from Thailand instead of from the US, which boosted Thai exports by 183%.

- Commercial vehicles: By value, exports fell by 3.9% to USD7.5bn. Exports of 1-tonne pickups (98.4% of export value of all commercial vehicles exported) fell 2.8% to USD7.4bn. Accounting for 32% of the value of all exports of pickups, Australia is Thailand’s most valuable export market. But in that year, exports fell by 19.3% due to a slower economy, weaker real estate market, and widespread drought. However, thanks to growing economies and the ASEAN Free Trade Area agreement, exports to the ASEAN zone (19% of total) rose by 14.4%. For other types of commercial vehicles (trucks, busses and vans), exports crashed by 43.8% to USD119m.

For the first 5 months of 2020, output tumbled 40.2% YoY to 0.53 million units due to Covid-19 impact. This drastically weakened the domestic and export markets, as supply chains ground to a halt and local and global economies slid into a recession. The drought also dampened spending power in the agricultural sector. The industry’s performance in 5M20 is summarized below.

- Domestic unit sales contracted by 38.2% to 0.27 million vehicles in 5M20. This was due to a combination of reasons: (i) customers cutting back on unnecessary spending in response to the Covid-19 pandemic; (ii) sharp drop in purchasing due to the lockdown; (iii) drought had hurt income in upcountry; and (iv) tightening credit criteria imposed by lenders. In addition, the Bangkok International Motor Show was repeatedly postponed to July 15-26, from March 25-April 5 originally. And most manufacturers have postponed the launch of new models, reducing the extent to which the market is being stimulated. Against this bleak outlook, some manufacturers have been running online campaigns. Following its decision to cease production of the Chevrolet brand in Thailand this year, General Motors (GM) is offering attractive discounts to sell inventory units, which also helped to support auto sales. Overall, in 5M20, unit sales reached 119,216 passenger vehicles (-40.7% YoY), 136,833 pickups (-37.2% YoY), and 14,535 ‘other’ commercial vehicles (buses, trucks and vans; -22.6% YoY).

- Exports also fell by 35.0% YoY to 0.3 million vehicles, valued at USD4.9bn (-35.1% YoY). The latter comprised USD3.1bn for passenger vehicles (-26.8% YoY) and USD1.8bn for commercial vehicles (-45.7% YoY). Like the rest of the world, the Covid-19 pandemic had a large impact on Thailand’s export markets. Shipments to Australia (which accounts for 25.8% of total vehicle export value) fell by 44.7%, and fell by 33.7% to the Philippines (9.3% of exports) and Vietnam by 55.4% (6.3% of exports). But exports to some countries bucked the trend. Thai exports to China (6.9% of exports) exploded by 793% because Mercedes-Benz and BMW had switched to sourcing some of their luxury models from Thailand (instead of the US). Some Thai-based Japanese manufacturers also started to ship a greater portion of their output back to their home country, increasing exports by 32.1% and lifting Japan’s share of Thailand’s total export market from 1.9% to 3.9%.

Outlook

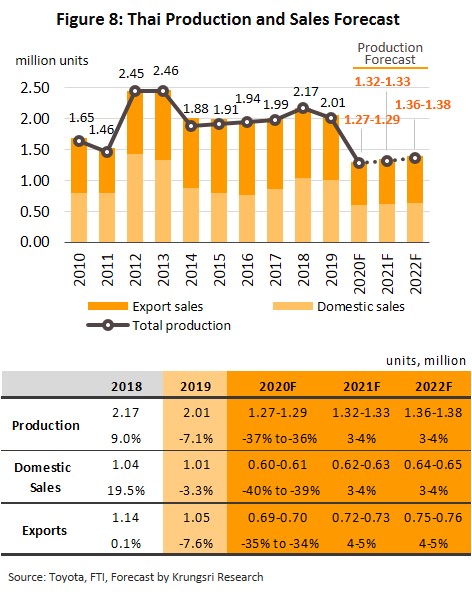

In 2020, the Covid-19 pandemic and subsequent crash in spending power and disruption to supply chains, and projected 10% contraction of the Thai economy (as of July), are expected to significantly reduce the number of vehicles distributed to the domestic and international markets. The ongoing impact of the drought on purchasing power upcountry will worsen the situation and prompt a severe drop in output. In addition, in attempts to reduce the risk of infection, most manufacturers had completely shut down production lines in the second quarter of the year. They are currently also cutting back production capacity to reduce inventory. Hence, output is now expected to shrink by 36-37% in 2020 to 1.27-1.29 million units. However, in 2021 and 2022, as Covid-19 is brought under control and economies recover, we expect output to grow by 3.0-4.0% per year to 1.32-1.33 million and 1.36-1.38 million vehicles, respectively.

- The number of vehicles distributed to the domestic market in 2020 is projected to tumble 39.0-40.0% to 0.60-0.61 million units, the lowest since 1999. This will be due to more cautious spending on durable goods such as cars ( which are also considered a luxury) and taking on long-term debt obligations.

Krungsri Research’s projects demand would recover in in the following two years, with unit sales rising by an annual average of 3.0-4.0% p.a. in Thailand to 0.62-0.63 million in 2021 and 0.64-0.65 million in 2022. Recovery would be driven by several factors.

(i) Replacement demand from individuals who had bought vehicles under the first-car buyer scheme. This is estimated to translate into demand for 0.2-0.3 million new cars in each of 2020-2022[7].

(ii) Between 2020 and 2022, manufacturers plan to stimulate sales with the release of over 20 new models. Many of these would be EVs or models that are already popular with the masses[8]. MG has announced it would try to market a self-driving vehicle in 2021[9].

(iii) Greater investment in infrastructure construction by the government will benefit the construction sector, which will in turn, boost demand for commercial vehicles to transport bulk construction supplies.

(iv) Development of the road network within Thailand as well as road links to neighboring countries, coupled with the steady growth in online shopping and the logistics sector, will increase demand for small and mid-size commercial vehicles.

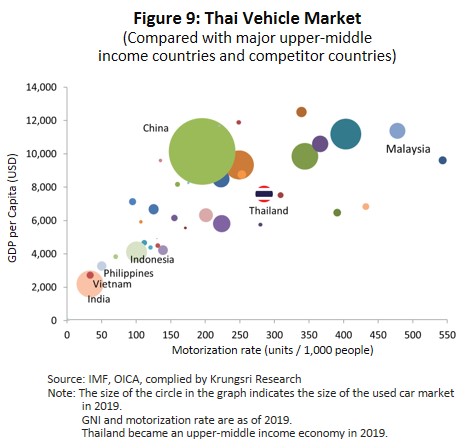

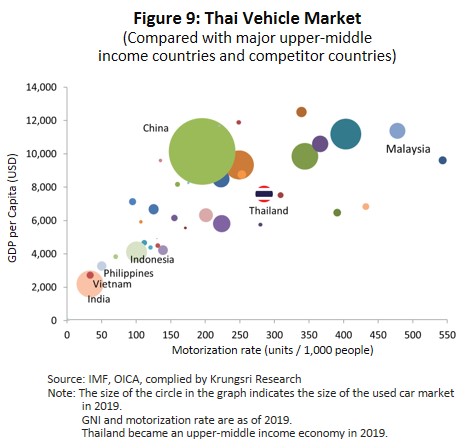

(v) Motorization rate in Thailand is only 285 vehicles per 1,000 population, lower than the average for upper-middle income countries such as Malaysia where it is 478 vehicles per 1,000 population. This suggests opportunity for future growth (Figure 9).

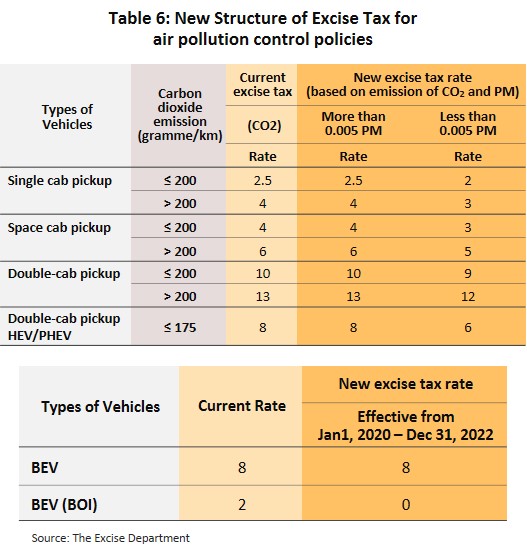

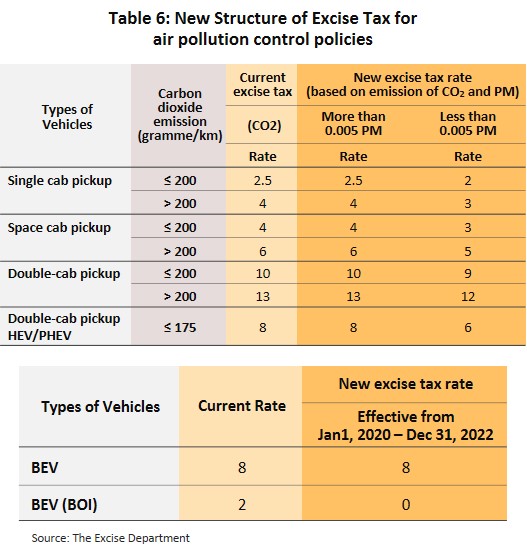

But overall, the market for internal combustion engine vehicles will be pressured by government legislations to control particulate emissions from new vehicles. (i) Currently, all new vehicles need to meet Euro 4 emission standards. But from 2021, this will be replaced with the Euro 5 standards, and Euro 6 standards the year after. This would likely raise production costs because manufacturers need to develop more efficient engines. (ii) Effective 2019, excise duty will be reduced by 1-2% for regular and 4-door pickups that are able to run on B20 or that release less than 0.005 grams of particulate emissions per kilometer traveled. (iii) Between January 1, 2020 and December 31, 2022, excise duty will be zero-rated (from earlier rate of 2%) for battery electric vehicles (BEVs) produced by manufacturers which have received BOI investment support (Table 6). These measures will make B20-fuelled pickups and qualifying BEVs cheaper, and increase the appeal of environmental-friendly vehicles.

- In 2020, auto exports are projected to tumble by 34.0-35.0% to 0.69-0.70 million units as the world economy registers the first slowdown since the 2009 global financial crisis. But in 2021-2022, exports should return to annual average growth of around 4.0-5.0% p.a. to 0.72-0.73 million in 2021 and 0.75-0.76 million in 2022. This is supported by the following: (i) Requirements for the BOI’s Eco car (Phase II) project. Toyota and Nissan are required to meet agreed export targets (EVs will count towards these targets but they are not expected to have substantial influence on the final export number). (ii) Exports within the ASEAN Free Trade Area will benefit from (a) zero-rating for imports within the ASEAN zone, and (b) finalizing of the ASEAN Mutual Recognition Agreement on Type Approval for Automotive Products, which ensures that the individual country’s vehicle safety standards and checks are accepted across the ASEAN region[10] to remove the need for repeat testing. (iii) Thailand should be able to expand exports to some neighboring countries, including the Philippines, where Honda’s decision to cease production of the BR-V and City models in March (and reducing annual production capacity by 7,200 vehicles) has paved the way for more imports from Thailand. In Vietnam, the government is easing import restrictions[11], and the recently-agreed EU-Vietnam Free Trade Agreement (EVFTA) specifies that import duties on goods originating from the signatories should be reduced progressively between 2002 and 2029, but that would have limited impact on Thailand’s vehicle exports because the EU generally imports more expensive, luxury models, and the number is low.

Over the next 3 years, there are several risks to the auto industry: (i) delayed recovery from the COVID-19 pandemic would lead to slow improvement in consumer purchasing power; (ii) uncertainty over the direction of the US-China trade conflict and potential impact on the economic outlook for Thai export markets; and (iii) Philippines may hike import duties on Thai vehicles after Thailand lost the case against the Philippines (WTO dispute) where Thailand claimed the Philippines was under-declaring the value of cigarettes exported to Thailand.

General Motors (GM) and Great Wall Motors (GWM)

General Motors, or GM, is the manufacturer of the Chevrolet brand. Until earlier this year, its Thai plant had an annual production capacity of 50,000 vehicles. The company recently announced it will cease the Thai operation and pull its investments out of the country. It will continue to offer after-sales service until 2030. Naturally, this would affect the GM supply chain, with the manufacturers of GM engines (GM powertrain) having to shutter operations alongside their parent company, suppliers of parts to GM would be forced to either move into OEM production for other car makers or focus on the REM market, and authorized dealers going out of business altogether if they are unable to change their strategy. The used car market for Chevrolets will also be affected by this because the large discounts (up to 50%) offered by GM for new cars (to reduce inventory) had also resulted in losses for used-car dealers. The situation is likely to be worsened by concerns over future access to service centers and spare parts.

Great Wall Motors, or GWM, is a Chinese auto manufacturer. They produce SUVs under the Haval brand, luxury cars, SUVs, BEVs, and PHEVs under the Wey brand, BEVs under the Ora brand, and pickups under the GWM brand. The company recently moved into the Thai market after buying the GM and GM Powertrain plants, and has announced they would invest THB 10bn to expand production capacity to 100,000 vehicles per year (GWM will takeover the GM premises in 2021 and start to distribute vehicles in 1Q22). GWM has its own research & development team and operates 9 factories in China and 7 factories in Ecuador, Tunisia, Bulgaria, Malaysia, Russia, India (it bought Chevrolet’s facilities in 2019), and now Thailand. In Thailand, the company will produce pickups, SUVs, BEVs and PHEVs for distribution to the domestic market and for export to the ASEAN zone and Australia.

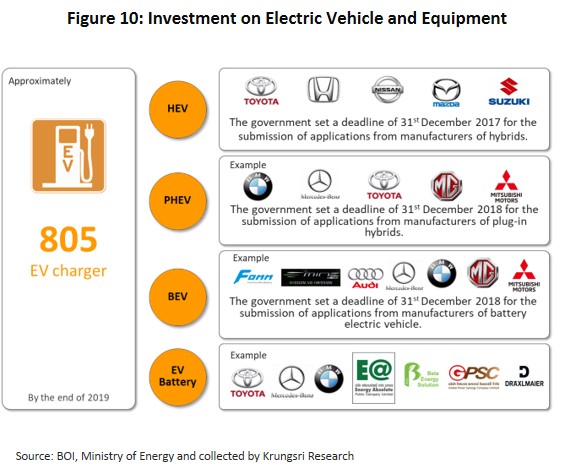

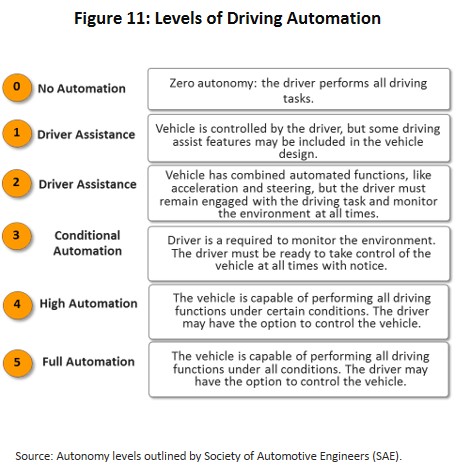

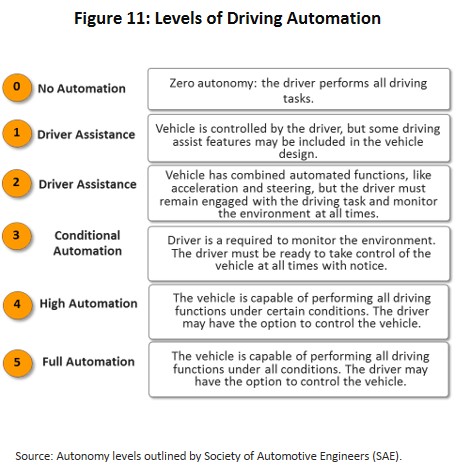

Over the long-term, the domestic automotive sector will be shaped by changing policies for the sector, a shift to prioritize the development of electric vehicles, and ambitions to turn Thailand into a regional hub for the assembly of electric vehicles. Krungsri Research also believes that over the next 4-6 years, domestic demand for EVs will surge. This would be helped by the following: (i) improvements in lithium-ion batteries coupled with the steady decline in price[12] from an average of USD 1,200/kWh in 2010 to USD 156 in 2019. By 2022, the price of BEVs and ICE-powered vehicles should be almost similar[13]; (ii) manufacturers plan to step up investments in EVs and the production of auto batteries, which will help to expand supply (Figure 10); and (iii) the government is targeting for EVs to comprise 30% of Thai vehicle production (including both autos and motorcycles) by 2030. In addition, the deployment of 5G technology may occur faster than anticipated (auction for 5G bandwidth was held on 16 February, and commercial 5G services could start in 3Q20)[14], which is significant because 5G technology and networks are required to support autonomous driving. In the future, this is expected to have a more important role in Thailand’s automotive sector, although currently, the development of self-driving vehicles in Thailand is still in its infancy and has yet to move beyond stages 0-2 (Figure 11). Worldwide, the most advanced self-driving projects, such as Waymo (a subsidiary of Google) and Uber’s self-driving cars are at stage 4 trials, while Tesla’s ‘Auto Pilot’ and Audi’s Autonomous A8 are at stage 3. To develop this segment, the government needs to help manufacturers develop supporting infrastructure for EVs such as a nationwide network of charging stations, and the new, more efficient, smart grid and smart meters[15] that are required for services such as vehicle-to-home (V2H) systems.

Krungsri Research view:

The COVID-19 impact has had, and will have a significant impact on auto manufacturers and related industries. Business conditions will worsen in 2020. But in 2021 and 2022, as the economy starts to recover, auto manufacturers’ earnings will start to rise again. It will be the same for dealers of new vehicles.

- Auto manufacturers: Earnings will crash in 2020, but domestic and export markets will start to recover in 2021-2022.

- Manufacturers of passenger vehicles and 1-tonne pickups: For these players, the temporary disruption to supply chains in 1H20 and the sudden weakening of consumer spending power worldwide will severely affect unit sales in both Thailand and overseas market. However, earnings should improve in the following two years, along with the economy. In addition, the growth of online shopping will boost demand for pickups for use by delivery companies, and the release of new models (especially EVs) will stir greater consumer interest. Exports would also return to growth, especially multi-purpose vehicles (PPVs and SUVs) and large passenger vehicles, which remain a consumer favorite.

- Manufacturers of trucks, trailers and semi-trailers: These players will benefit from the government’s ongoing infrastructure construction plans, as well as growth in the logistics sector (which will induce demand for trucks) and more opportunities to export to neighboring countries which economies are growing and plan to accelerate spending on infrastructure.

- Manufacturers of buses: This segment will see a recovery when the tourism and transportation industries start to improve in 2021 and 2022. Recovery will also be supported by rising demand for public transportation, for example from the Bangkok Mass Transit Authority. Demand will also be boosted by recent government orders to transition from using vans to microbuses, a change that is gradually working its way through the nation’s transport system. Exports will also rise, especially to markets in the ASEAN zone.

- Dealers of new vehicles (passenger vehicles and pickups) and authorized importers: These businesses will likely see limited earning growth. Although there will continue to be demand for servicing & repairs depending on the age and mileage of the vehicles, there is a risk of vehicle owners switching to cheaper general garages, especially for the 1.1 million vehicles bought under the first-car buyer scheme which would be 7-8 years old now. In addition, manufacturers also require dealers to invest in upgrading showrooms and service centers, which would increase operating costs.

- Dealers of trucks and other heavy vehicles: We project a sharp drop in earning in 2020, and a recovery in 2021 and 2022. This is premised on progress in government-backed build-out of new infrastructure and rising demand for the transportation of goods triggered by the development of the national road network and road links to neighboring countries. Growth of the online retail and logistics industries will also support additional demand for trucks, especially for two-tonne and six-wheel vehicles. Most players in this segment also offer a comprehensive range of services, including supplying spare parts, servicing & repairs, selling used vehicles, and providing hire-purchase arrangements. These will all help to build additional revenue streams in the coming period. Independent importers (or gray market importers): The business environment will be more challenging for these operators. Competition will intensify for both authorized and independent importers. The government is imposing stronger measures to control gray imports, normally by pushing up costs to levels where players can no longer compete on price with authorized dealers. In addition the COVID-19 pandemic has forced gray importers to adjust operations to reduce risk of making losses, for example by scaling back operations, cutting costs by distributing only cheaper vehicles, and reducing selling prices to run down their stock. Players with potential may also invest in their own service centers to build up customer confidence and diversify revenue base, and increase revenues from after-sales services and the sale of spare parts.

- Used-car dealers: Revenue will contract sharply this year and recover in the following two years. However, players will continue to be pressured by strong competition, oversupply of used cars for sale (which is expected to increase in 2020-2022), a sluggish economy, and price competition from both dealers of new vehicles and the increasing number of new entrants in the used-car industry (especially overseas players, companies that are part of an auto maker’s commercial network, and online platforms to sell/buy used cars). All these factors will cap profitability in this sector.

[1] The first-car buyer scheme involved refunding vehicle duty (up to a value of THB 100,000) to individuals buying their first automobile, provided that they kept possession of that vehicle for the next 5 years. The scheme ran from September 16, 2011 to December 31, 2012 and covered vehicles with a value of up to THB 1m, including passenger vehicles with engines not over 1,500 cc, regular pickups and pickups with double cabs (the government did not specify the timeframe for car delivery.)

[2] Compiled from announcements of investment plans made by Thailand-based auto manufacturers

[3] With these promotions, dealers will set two prices, the actual sale price and a higher price that is used for the loan application. Buyers will then be able to pocket the difference between the two as the ‘cashback’ promotion.

[4] Almost all EVs distributed to the domestic market are passenger vehicles.

[5] In 2018, Queensland and Victoria imposed a luxury tax on cars with a list price of more than AUD 100,000, with this set at an additional 2% and 7-9%, respectively. Excise rates were also set at 33% for regular vehicles with a price over AUD 67,525 and for fuel-efficient vehicles priced over AUD 75,526 (although these were zero-rated for low-emission vehicles and those used by farmers). Source: Department of International Trade Promotion.

[6] Exports of autos to Vietnam slowed after January 1, 2018, when Vietnamese authorities changed their policy on checking Thai imports for their emissions and safety records. In the past, only the first lot of imports were inspected but from 2018, all imports had to be checked, significantly slowing the passage of goods through customs and pushing manufacturers to cut their exports but in 2019, the Thai and Vietnamese authorities negotiated a relaxation of this policy.

[7] Estimated by Krungsri Research from newspaper interviews given by representatives of auto manufacturers and the tendency of consumers to change their cars after 5-7 years.

[8] Manufacturers’ plans for the release of new models between 2020 and 2022 include Toyota’s Hilux REVO, Honda’s HR-V, Isuzu’s MU-X, Mitsubishi’s Expander Cross, Mazda’s Mazda 2, CX-30 and BT-50, Ford’s Ranger and Everest, Nissan’s N-Trak Warrior and Kick, Great Wall’s new pickup, Peugeot’s new pickup, Mercedes-Benz’s GLA, GLB 200, CLA-Class, and AMG 35 4MATIC A-Class, and BMW’s 320d, M-Sport, X6 and M8. In terms of EVs, consumers can look forward to the Honda City (HEV), Mazda 2 (mild hybrid) Mitsubishi Outlander (PHEV), Volvo T8 (PHEV), BMW 320e (PHEV), BMW iX3 (BEV), BMW i4 (BEV), BMW iNEXT (BEV), Mine Mobility SPA1 (BEV) and the Mini Electric (BEV).

[9] MG has worked with Bosch to develop a semi-automated intelligent driving system for use with the MG Pilot L2+, which includes a Traffic Congestion Assistance system (TCA) to help with low-speed travel in congested areas and Integrated Cruise Assistance (ICA) for long-distance driving. This uses cameras and a radar to provide real-time information on the road conditions, traffic situation and weather, which is used to calculate the optimum distance to maintain from other vehicles and to automatically keep a steady speed relative to the rest of the traffic. In addition, the car comes equipped with systems to automatically adjust the vehicle’s speed, to check for and to avoid collisions with pedestrians and cyclists, to keep the vehicle inside its lane and to alert the driver when leaving this, to inform the driver about blind spots, to automatically adjust the headlights, and to automatically process information on traffic signs when these are in the Euro NCAP format (designed for use in Europe with the new generation of vehicles).

[10] At the 51st meeting of the ASEAN Economic Ministers (AEM) in September 2019, attendees agreed to the ASEAN Mutual Recognition Agreement on Type Approval for Automotive Products. This agreement specifies that autos and parts that have passed the safety tests of one ASEAN member state may be imported into another member state without the need for further testing, thus speeding up distribution and cutting business costs. The agreement covers brakes, safety belts, seats, tires, exhaust systems, steering systems, speedometers, emissions and windshield safety glass.

[11] From February 2020, decree 17]2020 has been enforced in Vietnam, relaxing safety checks on imported vehicles to the first lot of imports and replacing the earlier policy of checking all imports. The decree also stipulated that auto manufacturers producing for export need to receive ‘conformity of production’ (CoP) clearance from the Vietnam Register in place of the earlier Vehicle Type Approval Certificate (VTA) that was issued in the exporting country. The results of checks will be valid for 36 months but because Vietnam has agreed to the ASEAN automotive MRA, further government checks will now not be necessary.

[12] With a budget allocation of THB 180m coming from funds for promoting energy conservation, the Ministry of Energy and the Vidyasirimedhi Institute of Science and Technology (VISTEC) are jointly developing batteries for use in electric vehicles and looking for ways of storing energy generated from solar power. As part of this work, the partnership has patented a lithium-sulfur battery that has a capacity 3-5 times that of lithium-ion batteries but which is also lighter and can propel a car for up to 800 kilometers on a single charge, compared to 400-500 kilometers for a lithium-ion battery. Given that lithium is about 200 times more expensive than sulfur, the VISTEC battery is also cheaper but unfortunately, it has a lifespan of only 2-3 years, compared to an average of 10 years for a lithium-ion battery. VISTEC hopes to begin commercial production of their new batteries in 2021-2022.

[13] Bloomberg’s evaluation of the situation is that battery electric vehicles will be priced at a similar level to ICE-powered vehicles when the cost of lithium-ion batteries falls to USD 125]kWh.

[14] In November 2019, The National Broadcasting and Telecommunication Commission set out the timetable for auctions of 5G bandwidth at the 700 MHz, 1,800 MHz, 2,600 MHz and 26 GHz frequencies. Public hearings on the terms and conditions of the auction were held between November 13 and December 12, 2019 and the auction details were then announced in the Royal Gazette on December 17, 2019. Bids were invited from January 2, 2020 and the bidding was completed on February 16. It is hoped that 5G services will begin during 3Q20.

[15] The plan for developing a smart grid involves the build-out of an electricity network that uses communications and information technology to manage the production, transmission and distribution of electricity and that can connect to distributed energy resources (DERs), such as independent producers of alternative energy, through the use of smart meters. This would thus allow for the more efficient use of energy resources.

.webp.aspx)