Thai oil refining sector is expected to see continuing growth over the next three years on strong domestic demand for refined products that tends to expand by 2.0-2.5% annually, high utilization rate of 98-99%, and acceptable gross refinery margins around USD 5.2-6.0/barrel. However, players in the industry must be cautious on risks from stock losses in case of high volatility in crude oil prices.

Overview

Oil refining is a large-scale, technology-intensive industry which utilizes large amounts of capital to exploit economies of scale. Within the sector, returns on investment are made over an extended period of time and barriers to entry are thus high.

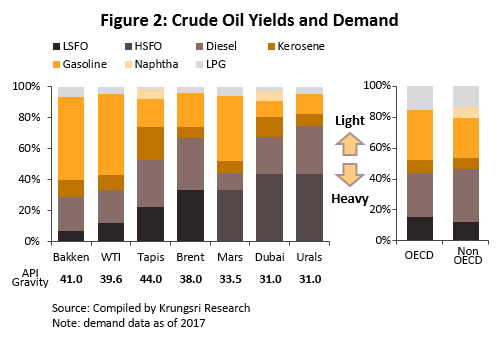

The refining process involves the fractionation or transformation of crude oil into a variety of petroleum products (Figure 1), including liquified petroleum gas (LPG), naphtha, gasoline, kerosene, diesel, bunker oil, and asphalt. These are used in different applications according to their qualities and properties, though the exact proportions of these different products in refinery output is dependent on the source of the crude oil used as an input.

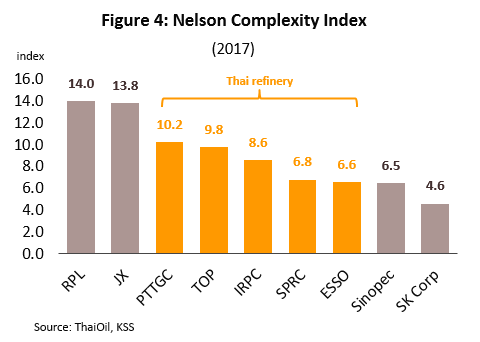

Refineries can be divided into the two broad categories of simple refineries, which distill or separate out a variety of oil products from the crude input according to the inherent properties of the crude, and complex refineries, which add so-called ‘cracking units’ to the process. Complex refineries are more expensive to build and to operator, but they have the additional ability of being able to transform heavy, low-value oil products into light, higher-value ones. This extent to which complex refineries are able to transform oil products varies and is measured by the Nelson Complexity Index (NCI). A high NCI indicates that a refinery is able to convert a wider range of products into high-value outputs and has a greater level of flexibility in the sources of crude which it can use as inputs. Refineries with a high NCI are therefore able to process crude from different sources.[1]

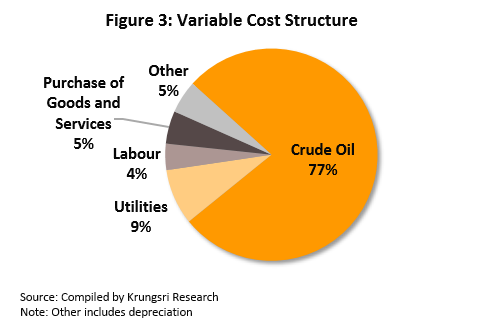

Although refinery is a highly capital-intensive industry, its fairly long lifespan of 30-50 years keeps fixed costs per unit low. More that 95% of total costs is variable costs. Some 75-80% of variable costs are attributable to inputs of crude oil, 10% to the costs of energy used in the refining process, and 10-15% to other costs, such as depreciation.

In addition to the price of crude, the price of petroleum products is also determined by the interaction of supply and demand, and the latter in turn depends on the level of economic activity since some 70% of all petroleum products are used as transport fuels. The difference between the price of petroleum products and the cost of crude (which is also called the ‘spread’) is therefore used to measure the profitability or margin of each refined product.

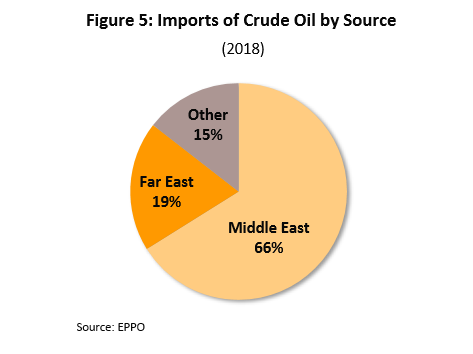

The profitability of a refinery can be assessed from an examination of its gross refinery margin (GRM), which is calculated per barrel by subtracting the total costs of refining from the combined value of the output of petroleum products. In detail, the following factors determine the GRM of a refinery. (i) The cost of crude oil. Changes in the cost of crude will increase the GRM in two situations. These are if increasing demand for petroleum products pushes up the price of crude, but refined products increase in price by a greater degree than does crude, or if the supply of crude oil expands and this helps to depress prices for crude and the effect of this is greater on the price of crude than on petroleum products. (ii) The price of petroleum products. (iii) Capacity utilization. If capacity utilization is high, the GRM will likewise be high, and generally, efficiently run refineries will operate with a capacity utilization of over 80%[2]. (iv) The extent to which a refinery is able to convert inputs into higher-value outputs. An examination of the NCIs of Thai refineries indicates that these are fairly high (Figure 4). (v) The ability to control costs and to source more desirable crude. Refineries which process heavier crude will usually have a lower GRM than those which are able to use lighter crude; around 66% of the crude processed by Thai refineries is heavy Middle Eastern crude and this means that output tends to be of heavier products, such as diesel and bunker oil.

In addition, the profitability of individual refineries also depends on: (i) the extension and connection of business operations from upstream through to downstream activities and out to related areas, which will help to reduce costs and improve production planning, and (ii) the physical location of the refinery, which will benefit from lower transportation costs and improved profitability if resources and/or markets are easily accessible.

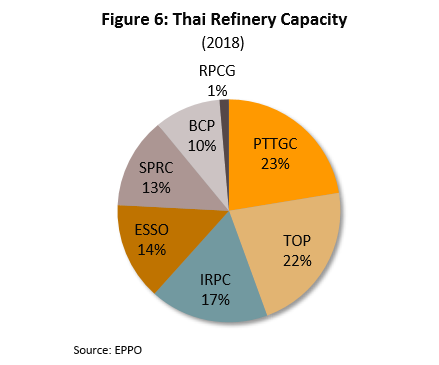

With a refining capacity of 1.235 million barrels per day, the Thai refining sector is, behind Singapore, the second largest in the ASEAN region. Seven operators are active in the sector, and all their operations use complex refineries. These seven players are: PTT Global Chemical (PTTGC), ThaiOil (TOP), IRPC Public Company Limited (IRPC), ESSO, Star Petroleum Refining Public Company (SPRC), Bangchak Petroleum (BCP), and RPCG. PTT is the largest of these since it is a major shareholder in PTTGC, TOP and IRPC.

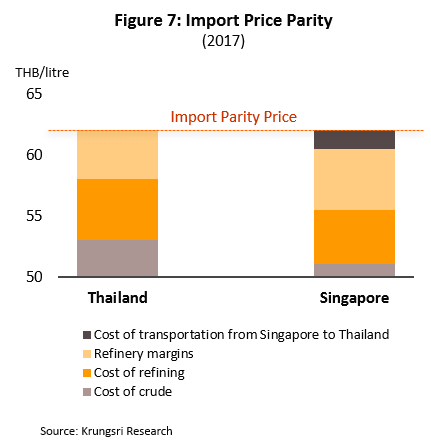

As their reference price, Thai ex-refinery prices use those on the Singapore exchange (SIMEX), specifically the Mean of Platts Singapore (MOPS) and the import price parity principle, which is calculated from the FOB Singapore prices together with transportation costs, is used to specify the ceiling for Thai ex-refinery prices. Clearly, therefore, Singaporean GRMs will have a heavy influence on those of Thai refiners.

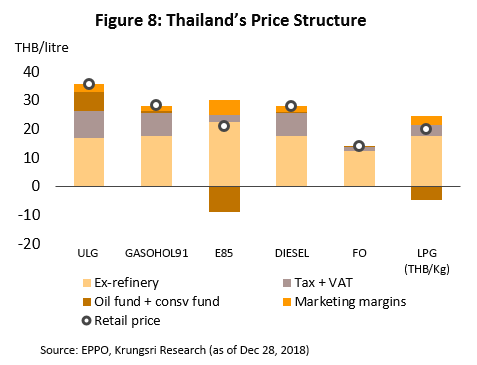

On the Thai market, the retail price of oil products is not determined simply by the refining and marketing margins and the cost of crude. Rather, the Thai government plays a significant role in determining the movement of prices through the collection of tax and contributions from distributors of oil products to the Oil Fund. The Oil Fund exists to reduce variability in the price of refined oil in Thailand during periods when prices on world oil markets are high or particularly volatile. The Oil Fund is also used as a tool by the government to support policies to promote particular fuels, such as E20 or E85.

About 80% of the refined oil produced by Thai refineries is consumed by the domestic market. Of this, 79% is used as transportation fuel (i.e. as gasoline, kerosene, or diesel), 11% is used as industrial fuels or in the production of electricity (i.e. as diesel or bunker fuel), 6% is used by the petrochemical industry (i.e. LPG and naphtha), and 3% (asphalt) is used in road construction. The 20% which is exported goes largely to the ASEAN zone, which takes approximately 75% of Thai refined products, and East Asia.

Situation

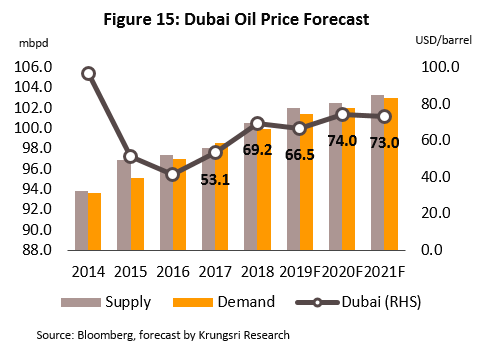

Dubai Crude price rose from an average of USD 53.1/barrel in 2017 to USD 69.3/barrel for 2018, which is an increase of 30.5%. This was caused by both supply and demand sides. Even though crude oil production in the US reached the highest level, decision by both OPEC and non-OPEC oil producers to limit oil production kept global oil supply increase only 0.76 million barrel a day in 2018. Meanwhile, demand for oil increased by 1.45 mbpd. It resulted in declining oil inventories to normal level. In addition, concerns over US sanction against Iran that might hurt Iran’s oil exports became another key reason for higher crude prices.

The higher cost of crude due to the concerns over oil supply led to the increasing prices of both gasoline and diesel rose on the Singapore market, but at a lower pace. Singapore prices for gasoline rose by 21.0% to USD 77.1/barrel, while those for diesel increased by 28.3% to USD 84.0/barrel. According to higher crude costs, the average GRM for the Singapore market declined from USD 6.2/barrel in 2017 to USD 5.7/barrel in 2018.

As regards the domestic refining sector, although slowing GRM pressured refining profits, continuing expansion in the consumption of oil has helped to keep capacity utilization at high levels. The state of the sector can be determined in more detail from the following indicators.

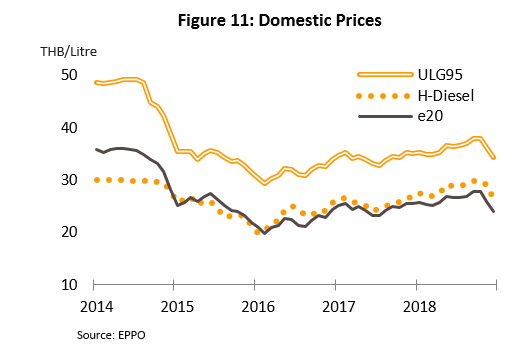

Domestic petroleum prices rose following rising crude costs

- Thai ex-refinery prices increased around 9-15% in 2018. However, the cost of crude increased by 30.5%. This causes ex-refinery prices to rise at a slower rate than crude prices. The Dubai- gasoline spread narrowed to THB 3.0/liter from THB 4.2/liter in the previous year, while the spread for diesel decrease to THB 4.0/liter from THB 4.4/liter .

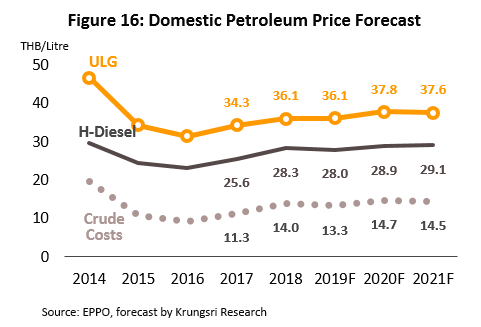

- The retail price of refined products rose in line with ex-refinery prices, while contributions to the Oil Fund and marketing margins remained stable. The price of gasoline rose by 5.3% to an average of THB 36.1/liter. The price of diesel also rose, increasing by 10.5% to an average of THB 28.3/liter.

Demand grew both domestically and in neighboring countries on improving overall economic activities

- Domestic consumption of refined products continued to rise. This was driven by prices which remained at acceptable levels, the expansion of the transport and tourism sectors, and the recovery of the overall economy and these combined to support an increase of 3.0% in the use of oil products in 2018. In detail: (i) demand from the transport sector for gasoline grew by 3.3% and that for gasohol rose by 10.0%; (ii) demand from industry for diesel and LPG grew by 1.5% and 4.4%, respectively; and (iii) growth of the number of flights that increased 6.5% drove a 5.2% increase in demand for jet fuel, and (iv) a consumption of bunker fuel returned to grow 4.2%.

- Exports of refined products increased by 6.9% for use in neighboring countries.

Petroleum production kept expanding on strong demand, resulting in high utilization rate

- Growing demand for refined products in 2017 supported an increase in output of 4.0% to 68.7 billion liters. Production of diesel rose by 2.9%, gasoline by 4.3% and jet fuels by 9.4%. This led to increasing capacity utilization from 86.2% in 2017 to 96% in 2018.

Gross refinery margins decreased on narrowing price spread, leading to slowing profit margins

- Gross refinery margins from USD 6.3/barrel declined to USD 5.6/barrel.

- For the five largest Thai refiners (PTTGC, TOP, IRPC, BCP and ESSO, which together account for 85% of Thai refining capacity), profits declined 20.3% in 2018. Over the same period net profits decreased from 6.4% to 6.2%.

Outlook

Normal level of oil inventories, continuing expansion in oil demand, and decision to freeze oil production by OPEC and non-OPEC are expected to be positive factors for crude prices for the next three years. However, as the costs of shale oil production have declined to USD 30-50/barrel from USD 50-80/barrel, it will encourage resumption in the exploitation of shale resources that tends to restrain increases in the price of oil. Krungsri Research thus estimates that for 2019, the price of Dubai Crude is expected to increase to USD 66.5/barrel and for 2020 and 2021, the price should remain at USD 74/barrel and USD 73/barrel.

Prices on the Singapore market for refined products will move in step with the rising costs of crude. Gasoline price for 2019-2021 is forecast to rise to USD 70/barrel, USD 80/barrel and USD 79/barrel, respectively, while the price per barrel of diesel will increase to USD 78, USD 83 and USD 84 in the same period. However, new refining capacity in the Asia-Pacific and Middle Eastern regions which is projected to come on stream over the next 3 years will likely hold back gross refinery margins and on the Singapore market, these are forecast to remain in the range of USD 5.2-5.8/barrel between 2019 and 2021.

The price of refined products in Thailand is likewise expected to move with the costs of oil on global markets so for 2019-2021 the forecast for the cost per liter of gasoline is THB 36.1, THB 37.8 and THB 37.6 and that for diesel is THB 28.0, THB 28.9 and THB 29.1, respectively. The spread between ex-refinery prices and Dubai Crude is likely to remain relatively steady and in the range THB 3.0-4.2/liter.

The relatively low level of increases in the price of refined oil products in Thailand that is forecast is likely to feed into strengthening domestic demand, especially for use in tourism and travel. The large national vehicle fleet is another factor which will tend to support increasing consumption of refined oil in Thailand and the expectation is therefore that domestic demand will expand by 2.0-2.5% per year over the next 3 years. Gasoline and jet fuels will be in particular demand, and consumption of these may thus rise at a higher rate.

This increase in domestic demand for oil will support growth in the output of refined products of 2.0-3.0% and this will tend to push up capacity utilization, which should rise to around 96-98% for 2019-2021. These high utilization rates may spur some operators to plan for business expansion and this will be especially likely for those such as ThaiOil and PTT Global Chemical which have the highest rates.

Eased concerns over global oil supply and solid oil demand will help gross refinery margins to stabilize. The GRM for Thai producers are forecast to stay USD 5.2/barrel in 2019, before lifting up to USD 5.8-6.0/barrel in 2020 and 2021. Higher GRM will push up refining revenues as well.

The Krungsri Research view:

Expanding domestic demand and rising prices will be positive factors affecting the refining sector and related businesses between 2019 and 2021.

Refineries: Refineries are expected to show good profit rates over the next three years. Expanding demand in the country, gross refinery margins which are stable and at a level to support refinery businesses’ profitability, and high capacity utilization rates together with a decline in price volatility and with it the risk of stock losses will all tend to support operators’ profitability.

Wholesalers of refinery products, oil and other liquid fuels: Players in this group will benefit from increasing demand for refined oil in Thailand and in neighboring countries. Most are also members of the same commercial networks as refineries so they face relatively low levels of market risk.

Petrol stations: Steadily increasing demand within Thailand for refined oil products will be a factor supporting a positive outlook for petrol stations but stiff competition and marketing margins which are at just THB 1-2/liter are also exposing businesses to management errors and risky business expansion. In addition, operators in this group are also increasingly under pressure to expand investment in business activities which are not connected directly to the sale of fuel, such as the rental of retail space in forecourts in order to increase competitiveness and build income.

[1] Crude oil is largely composed of hydrocarbons, specifically alkanes and cycloalkanes, along with small quantities of other chemical components, such as sulphur, nitrogen and metals, with oil from different regions having an individual chemical profile. For example, Bakken oil (from North Dakota) is over 60% light oil, whereas Urals oil (from Russia) is less than 30% light oil; light oil has a lower specific gravity due to its being composed of hydrocarbons which have a lower proportion of carbon atoms and thus lighter oils release more energy than heavier oils during combustion.

[2] Normally, refineries operate around the clock since the cost of stopping and starting operations is so high. Machinery will, however, be stopped for planned maintenance on an annual basis and this may be for as long as 1-2 months.