Executive Summary

Through the rest of 2022, the construction sector will struggle under the impact of the Russia-Ukraine war and the effects of this on global oil and commodity costs, which are feeding into significantly higher prices for fuel and building materials, in particular for steel and cement. However, over 2023 and 2024, growth will tend to move with forecast overall growth in investment in the construction sector of 4.5-5.5% per year.

One of the primary drivers of activity for the industry will be spending on government megaprojects, in particular on projects connected to the Eastern Economic Corridor (EEC), where work will need to be accelerated if it is to be completed according to phase 2 of the EEC transport infrastructure development plan for 2022-2026. The outlook for private sector investment in both residential and commercial projects will also gradually improve with progress on infrastructure projects and with broader economic recovery and the effects of this on consumer purchasing power. In addition, it will be possible for larger players to expand into markets in neighboring countries, where economic growth and ongoing investment in infrastructure is opening up new business opportunities.

Krungsri Research view

Contractors working on public-sector megaprojects should see their income grow steadily over 2022-2024 as spending on these ramps up. However, players working on private-sector projects will see conditions remain depressed in 2022 before they gradually improve in 2023 and 2024.

-

Construction contractors engaged on large civil engineering developments will enjoy a recovery in their income as the government accelerates the pace of work on infrastructure projects. Large and mid-sized players will benefit from their ability to bid on contracts and to project-manage effectively, and this will feed into a rise in incomes. These players will be able to work on ongoing public-sector projects (e.g., expansion of mass transit systems, and the double-track railway and motorway networks), megaprojects that connect to the EEC, and other infrastructure projects, for which the volume of work is likely to increase.

-

For companies working on private-sector accommodation, general construction, and high-rise and large buildings, income will tend to improve in 2023 and 2024, but for the rest of 2022, receipts will likely remain flat given the need to absorb the higher cost of fuel and construction materials. Large and medium-sized players will recover before that of smaller companies, though players involved in mixed-use projects will head the pack thanks to their increasing backlog of unfinished work. Large contractors will also have the opportunity of expanding into regional markets, especially for work on residential, commercial and industrial projects, for which investments are growing steadily with broader economic growth. However, the outlook for small businesses is less favorable and income growth may drag as work on smaller projects slows. In addition, smaller companies have greater difficulty managing their costs and are more exposed to labor shortages, and this will increase the risk of players in this group seeing their incomes fall and of becoming insolvent.

OVERVIEW

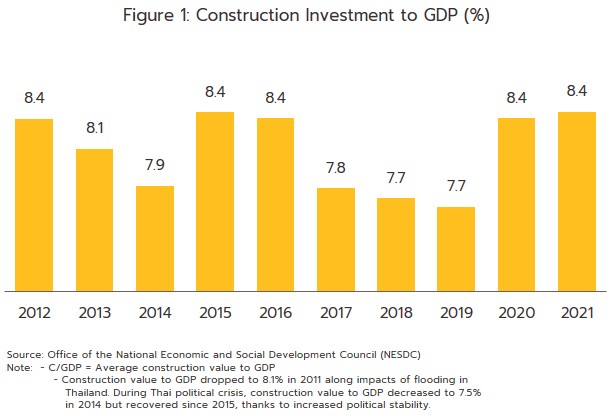

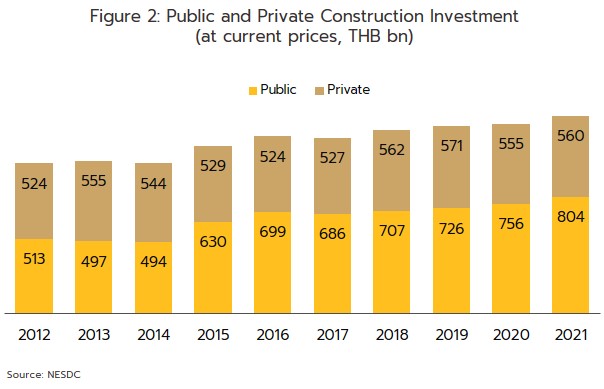

Over the years 2012 to 2021, the construction investment value averaged an 8.1% share of gross domestic product (Figure 1), most of which was attributable to the domestic market. The sector can be split into the two major segments of public and private construction, for which 2021 construction spending was split in the ratio 59:41 (Figure 2).

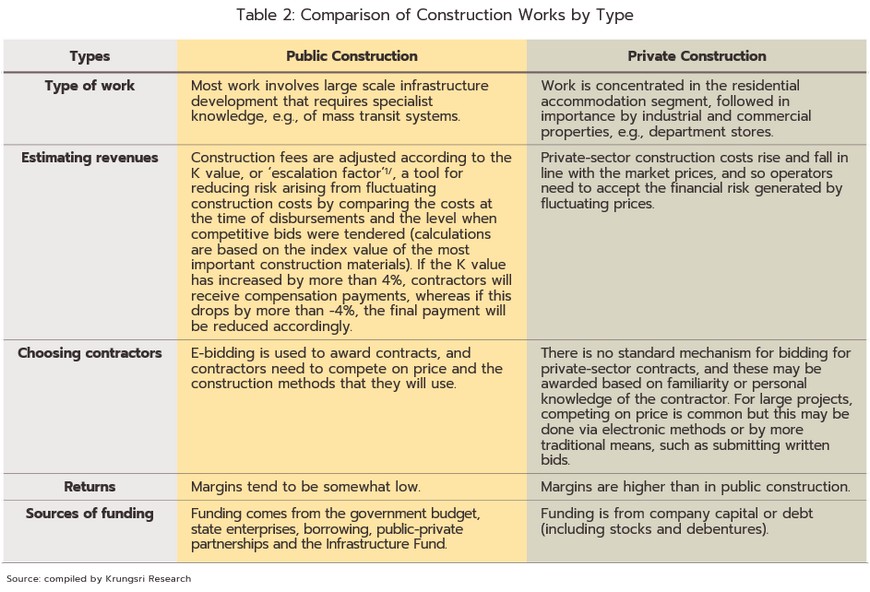

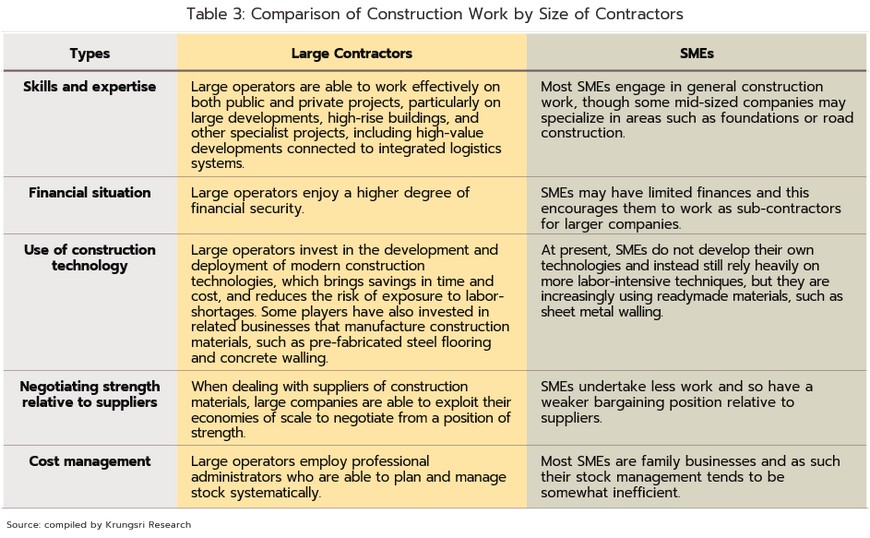

Public construction investment: The largest share of public-sector construction is accounted for by the build-out of infrastructure. This runs to around 82% of the segment’s total value, with the remainder being accounted for by the building of offices for government agencies (16%) and housing for civil servants (2%). Large companies typically enjoy advantages when contracting for government work, especially for infrastructure megaprojects, due to their experience, knowledge and expertise, financial security, and ability to utilize specialist techniques and technologies. SMEs thus tend to sub-contract for larger corporations when working on publicly-funded projects.

Private construction: Private construction work is mostly on residential accommodation, which contributes 52% of total private construction investment value. The remainder is split between industrial and commercial buildings (20%), and other developments (28%), a category that includes facilities such as hotels and hospitals (source: the Office of the National Economic and Social Development Council, correct as of 2020). Private construction tends to be affected by investor confidence, the overall state of the economy, the degree of political stability in the country, the extent of infrastructure spending, and government’s measures to stimulate investment.

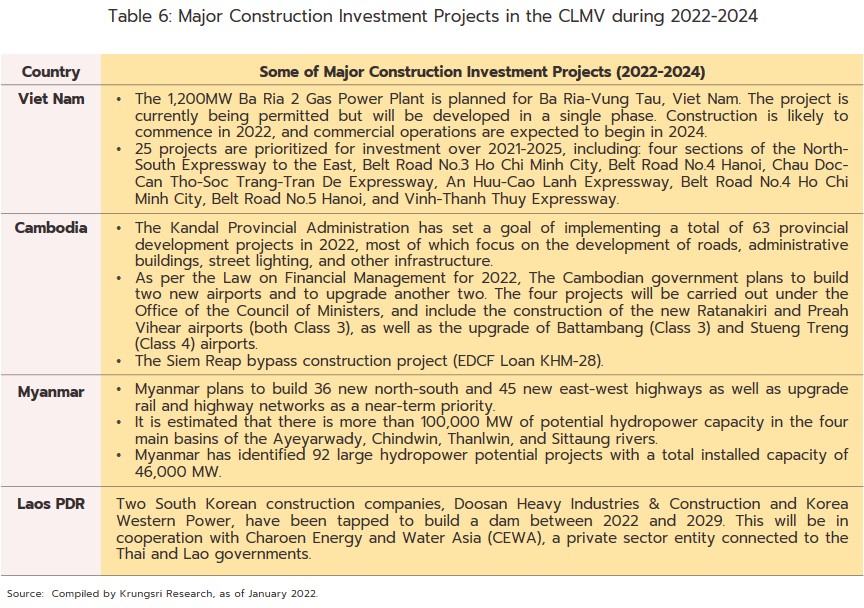

Thai construction companies, especially larger corporations, have also been expanding their customer base into overseas markets, in particular to the CLMV countries (Cambodia, Laos PDR, Myanmar and Vietnam), attracted by the high level of investment in infrastructure and utilities in these countries, for example, in road networks, rail links and power stations, as well as for the construction, repair and renovation of housing and other structures.

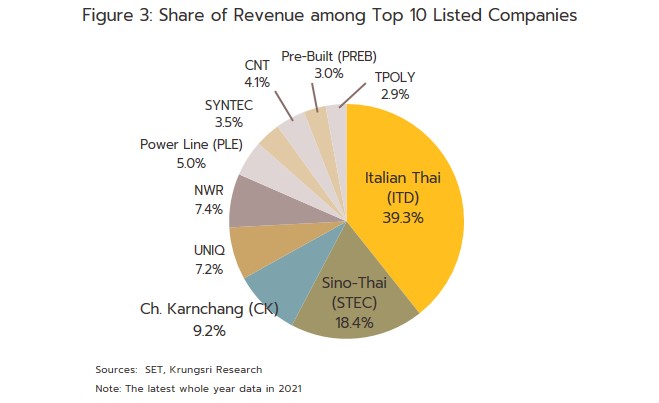

At present, there are some 100,000 construction companies registered in Thailand (source: Department of Business Development, 2020) but of these, only 691 (or 0.7%) qualify as large-scale operations. Nevertheless, by income, large players account for 82% of the market, mid-sized players 14%, and small companies 4%. Indeed, just the three largest players listed on the stock exchange, (Italian Thai Development, Sino-Thai Engineering and Construction, and Ch. Karnchang) hold a 17% share of the income of all large construction companies and a 67% share of the income of the 10 biggest construction companies traded on the Thai stock market (Figure 3, data as of 2021).

An evaluation of the state of the construction sector will need to consider the following:

1) The market. The possibility of generating income depends largely on the state of the economy, the political environment, plans for and progress with public- and private-sector investment, and the regulations governing investment in particular countries, which may either support or hinder the industry.

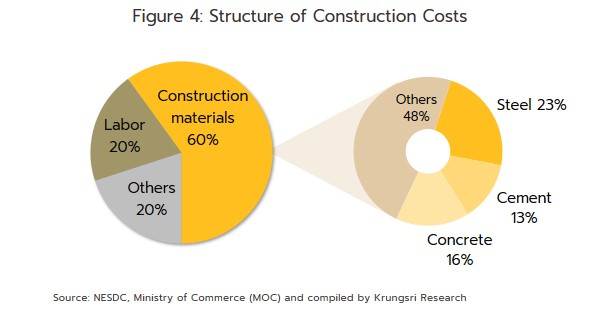

2) Costs: Of particular importance are changes in the costs of construction materials and of labor, and the effects of this on profits. (Currently, Thai players are struggling with a shortage of labor in terms of both quantity and quality and this has pushed wages above productivity.) For construction companies, costs are split approximately 60%, 20% and 20% between construction materials (construction steel, concrete, cement and other materials), labor and other costs respectively[2] (Figure 4).

SITUATION

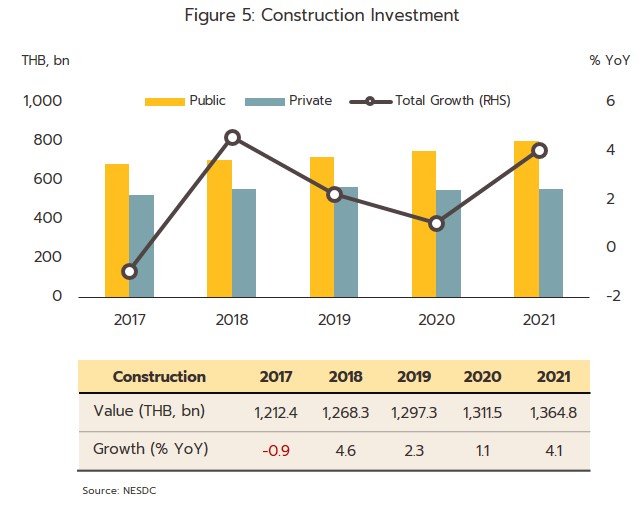

In 2021, construction contractors enjoyed a continuingly expanding market, as indicated by total investment that grew 4.1% YoY to a value of THB 1.37 trillion (Figure 5). The market was buoyed by the inflow of public-sector funds (59% of all spending on construction in the year), especially for infrastructure megaprojects, including phase 3 of the Map Ta Phut Industrial Port development and ongoing projects such as work on Bangkok’s Pink, Yellow and Orange MRT lines. However, the impact of the COVID-19 pandemic on the economy and subsequent sluggish conditions in the housing market led to a drop off in work on residential accommodation, and so despite an increase in work on non-housing projects, especially for factories on industrial estates, overall investment in construction by the private sector remained largely unchanged from a year earlier.

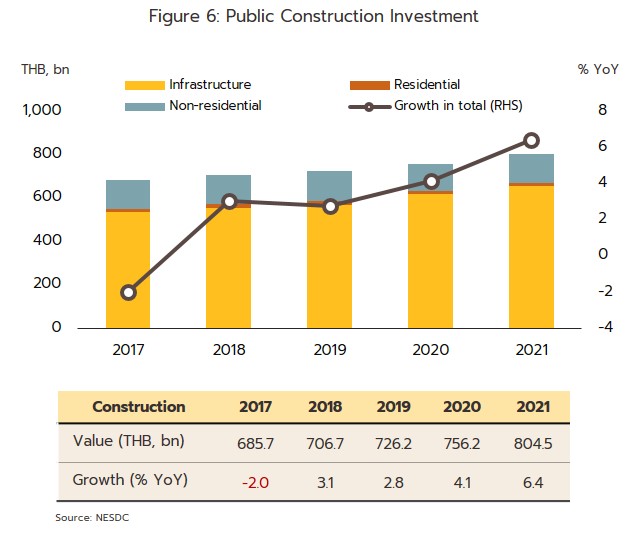

Public-sector construction investment expanded 6.4% to a total of THB 804.5 billion (Figure 6). The main driver of growth was spending on ongoing infrastructure megaprojects.

-

Infrastructure projects (81% of all public-sector spending on construction): Expenditure rose 5.8% in the year, with the most important projects being: (1) the 3 new MRT lines in Bangkok that are due to be opened in 2022, namely (i) the Orange Line from Thailand Cultural Center to Minburi (Suwinthawong), which is 89.5% complete, (ii) the Yellow Line from Lat Phrao to Samrong, which is 88.7% complete, and (iii) the Pink Line from Khae Rai to Minburi, which is 83.9% complete (information correct as of December 2021); and (2) phase 3 of the development of the Map Ta Phut Port in the EEC, for which ground was broken in July 2021.

-

Other construction projects: This category includes office buildings for government agencies (17% of the total) and residential accommodation for civil servants (2%), for which spending rose by respectively 8.4% and 14.3%, as efforts were made to meet completion targets that had been disrupted a year earlier by the outbreak of COVID-19. The majority of these projects were undertaken by SME contractors, many of which have been hit by cashflow problems and labor shortages.

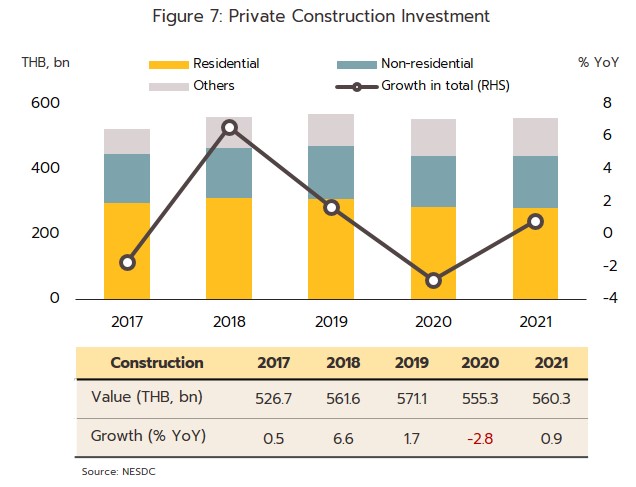

Private-sector construction investment expanded by just 0.9% in 2021, bringing the total to THB 560.3 billion (Figure 7), as the segment struggled against depressed conditions in the market for residential housing.

-

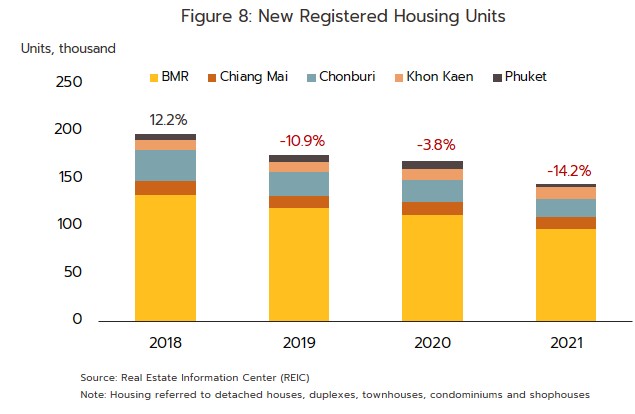

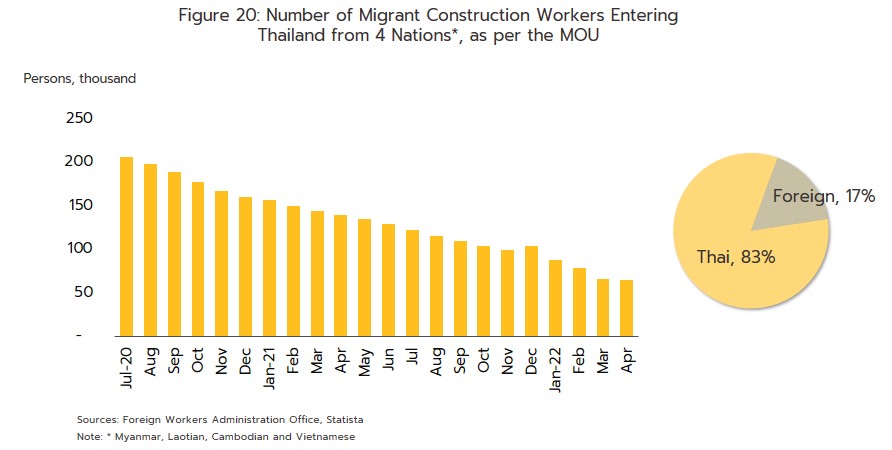

Residential accommodation (50% of all private-sector construction by value): Overall investment in the residential market slipped 1.8% in the year, while the number of new properties coming to market in the Bangkok Metropolitan Region and the 4 major provinces of Chiang Mai, Chonburi, Khon Kaen, and Phuket fell 14.2% in 2021 (Figure 8). This decline is explained by: (i) the move by property developers to switch from working on new projects (both low- and high-rise) to running down their existing stock of unsold properties as they tried to maintain liquidity and cashflow, by implementing strategies that included increasing price discounts, renting out units, and allowing 1-2 years’ free accommodation; (ii) the effect of the recession on consumer purchasing power and the decision by lenders to tighten the release of new credit, although interest rates remained extremely low; and (iii) the imposition of a state of emergency, which from June 28th to July 24th, 2021 forced the closure of construction sites and of laborers’ camps in the Bangkok Metropolitan Region. A portion of migrant workers from elsewhere in Thailand and from neighboring countries working in the construction sector then left the greater Bangkok region and numbers have yet to fully return to normal, thus delaying work on many projects.

-

Non-residential construction: Investment in this segment, which encompasses commercial and industrial property, factories, and buildings used for the provision of services and transport grew 3.8%. Growth was sustained by stronger spending on factories and offices on industrial estates, especially in the EEC, where businesses have benefitted from growth in manufacturing for export.

-

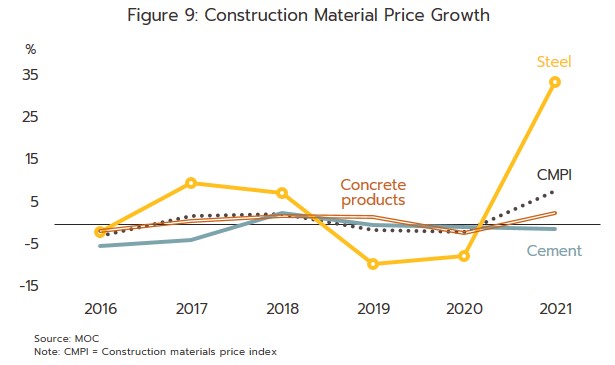

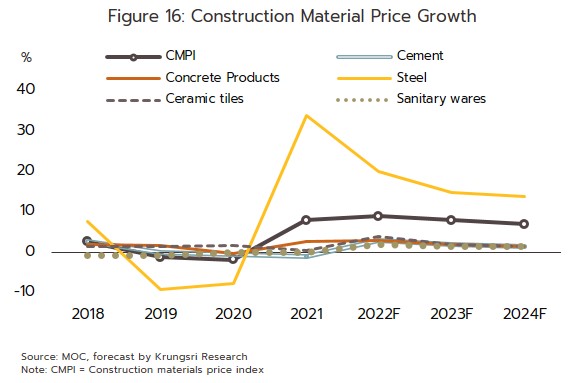

In 2021, the construction materials price index climbed 8.0%, having fallen back 1.8% in the previous year (Figure 9). Price rises were seen in almost all product categories, though these were highest for steel and related goods (23% of all construction material costs for the industry as a whole), which jumped 33.9% on a fall in output in China that then led to higher global prices for the scrap and billet that is imported to make construction steel. However, the cost of cement (13% of the total) declined 1.1% on a slowdown in work by the private sector as players waited for the economy to rebound (the private sector accounts for 60% of cement use).

-

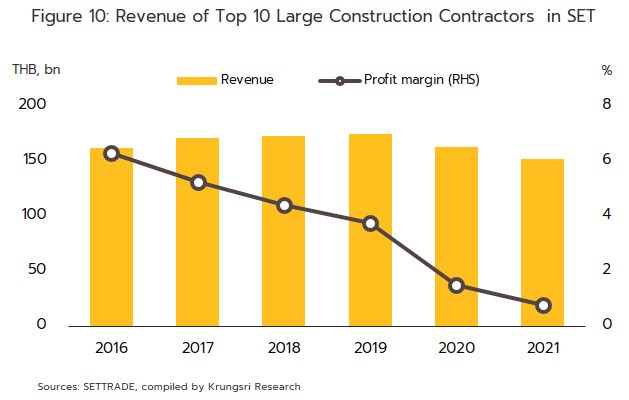

For 2021, overall income for the 10 largest construction companies listed on the stock exchange[3] fell 6.6%, while net profit margins dropped from 1.5% to 0.7%. Turnover and profits were hurt by the effects of slowing work on new projects and by the government’s temporary closure of construction sites as part of its COVID-19 control plan, which then delayed work on a number of projects (Figure 10).

Business conditions remained unfavorable into 1Q22 as rising costs continued to drag on the industry. The invasion of Ukraine by Russia at the end of February has added to the upward pressure on prices by tightening the supply of oil and construction materials, especially of some types of steel, which have now disappeared from the market. This has been particularly important because Russia is the world’s second biggest supplier of oil (as of 2020) and Russia and Ukraine combined account for 12% of the world’s supply of steel (a total of 47 million tonnes). Thai construction contractors have thus had to contend with a steep spike in the cost of both materials and transport, and so in 1Q22, prices for rebar jumped 25.3% YoY to THB 27,446/tonne, while the price of channel was up 37.5% YoY to THB 36,046/tonne. At the same time, prices for concrete and cement rose by respectively 5.7% and 4.8% (steel, concrete, and cement account for respectively 23%, 16% and 13% of average costs in the construction sector). Against this background, some developments have run into financial difficulties that have added to pre-existing problems related to COVID-19-induced labor shortages. As such, spending on these projects has had to be deferred and the net effect of this has been to pull down overall 1Q22 investment in construction by 3.7% YoY to around THB 340 billion, split between THB 210 billion from the public sector (down 2.1% YoY) and THB 130 billion from the private sector (down 6.1% YoY).

OUTLOOK

Krungsri Research sees the construction sector enjoying continuing growth over the period 2022 to 2024, with business conditions helped by expanding construction investment value. Business conditions will be lifted by work on infrastructure megaprojects, in particular those connected to the development of the EEC, and expansion of national communications networks, most notably of road and rail systems. With regard to the private sector, investment will tend to rise with economic growth, and this will be directed at both residential and commercial projects.

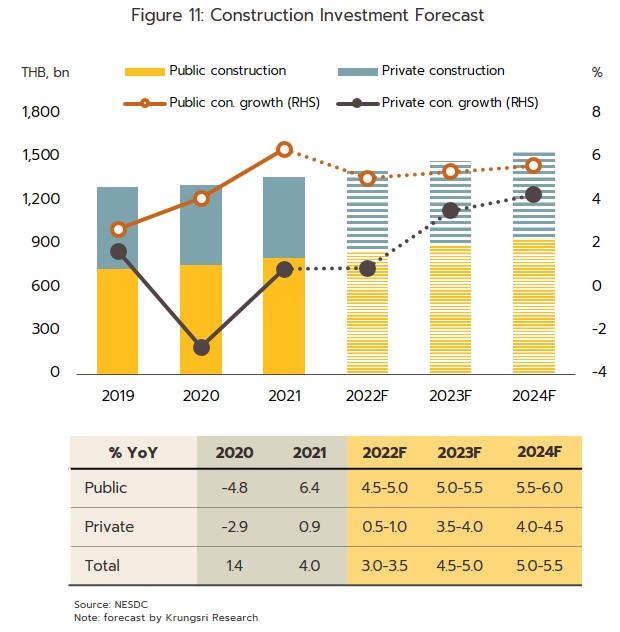

Nevertheless, through 2022, contractors will still have to contend with the spike in the price of oil and construction materials that the war in Ukraine has triggered. Because contractors will need to shoulder these additional costs themselves, some smaller operations will be at risk of becoming illiquid and so of having to cancel contracts. Moreover, many contractors have yet to receive compensation payments (i.e., the K value or escalation factor) for the higher cost of completing work on public-sector projects (source: Thai Contractors Association, Thansettakij, 2 April, 2022). Spending on construction is therefore expected to grow by 3.0-3.5% in 2022, though this will accelerate to 4.5-5.5% during 2023 and 2024 (Figure 11).

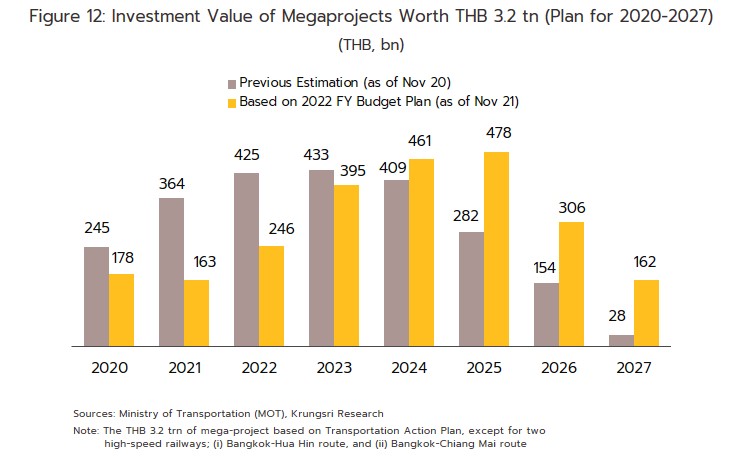

Public spending on construction is expected to grow by 5.0-6.0% annually over 2022-2024. Disbursements will be made for ongoing work on megaprojects as the authorities try to meet the deadlines set out in the 2019 Transportation Action Plan, itself part of the 20-year strategy for the development of Thailand’s communications system (Figure 12).

-

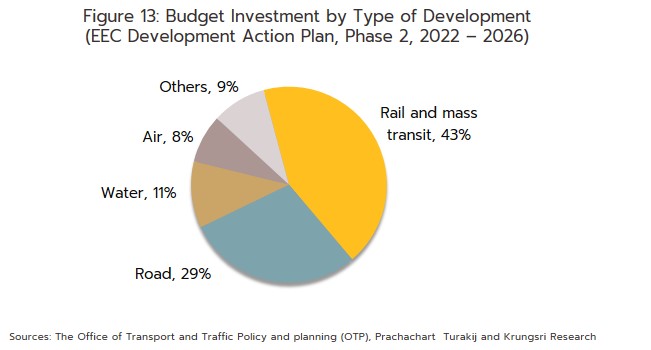

Work on road and rail megaprojects in the EEC related to phase 1 of the action plan for developing EEC transport and logistics infrastructure (2017-2021) should begin in earnest in 2022. This will include: (i) the high-speed rail-link connecting the area’s three airports (Don Muang-Suvarnabhumi-U Tapao), though work will begin with the Suvarnabhumi-U Tapao section; and (ii) phase 3 of the development of Laem Chabang Port. It is expected that phase 2 of the action plan (for 2022-2026) will help to cement Thailand’s place as a regional center of trade, investment, transport, and logistics, as well as providing support for the future development of the EEC. Initially, funding of THB 386.57 billion has been secured for 131 projects, of which 43% is for rail and mass transit systems (Figure 13).

-

Other major projects include Terminal 2 or the ‘north expansion’ of Suvarnabhumi passenger facilities, the southern extension of the Purple Line (Tao Poon-Rat Burana), and the Den Chai-Chiang Khong and Khon Kaen-Nong Khai double-track railway lines (Table 4).

Investment in construction by the private sector should steadily increase at an average rate of 3.0-4.0% annually over 2022-2024. This outlook is supported by the following.

-

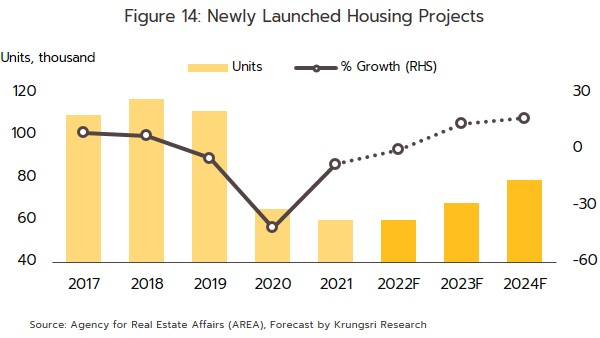

The residential segment will pick up and over 2022-2024, the number of new properties coming to market should increase by an average of 10.0% to around 70,000 units per year (Figure 14). Developers will tend to increase the share of low-rise properties in their portfolios, especially for developments in more suburban areas as they look to meet rising real demand for residence attracted to the market by extensions to motorways and mass transit systems that have reduced travel times between the suburbs and the city center. Work on condominiums will also pick up in certain areas, most notably in central districts and along some mass transit lines, though this will mostly benefit larger developers. However, in the short term (i.e., over 2022), construction work may slow with the greater cost of fuel and construction materials. Although developers have the option of responding to higher costs by putting up their own prices, weak consumer spending power limits the room for this. As such, the Thai Home Builders Association expects house prices to rise by 5-8% from April 2022.

-

Work on factories and industrial estates will benefit from an acceleration in spending on public-sector infrastructure projects, especially those in the EEC. Players in the industrial estates segment have plans to respond to expansion in the government’s targeted S-curve industries by investing in new projects for sale and development. Examples of these include the Nong Lalok Industrial Estate in Baan Khai in Rayong, which is expected to open within 2 years, and Apex Green Industrial Estate in Plaeng Yao in Chachoengsao (to be jointly operated with Industrial Estate Authority of Thailand, or IEAT). The latter should begin operations in 2023.

-

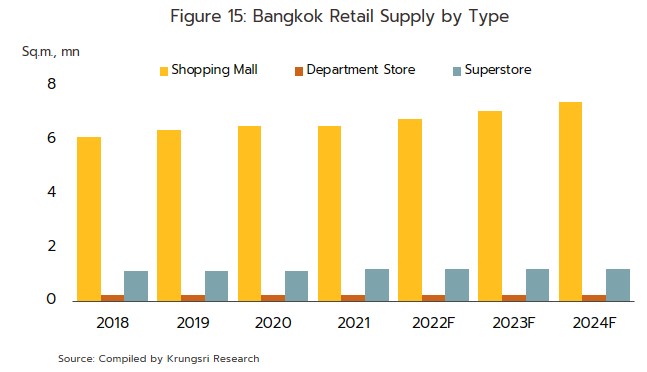

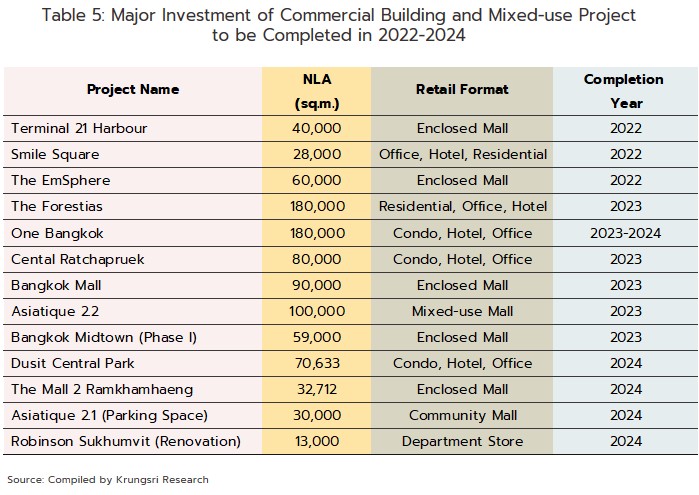

Commercial developments are split between (i) retail space, which will grow in line with developers’ investment plans to meet the rebound in the tourism sector and in private-sector consumption (Figure 15), and (ii) office buildings, for which growth will be determined by expansion in business investment. In addition, mixed-use developments that respond to modern urban lifestyles are becoming increasingly popular, and over 2022-2024, work will be carried out on a total of around 1 million sq.m. of these developments (Table 5).

-

Over 2023 and 2024, the cost of construction materials should fall from the peaks seen in 2022, though prices will remain high (Figure 16). The market will be affected by a number of factors. (i) More expensive energy will impact manufacturing and transport costs, but while investment and the economy are still in a period of restrained recovery, large players will be able to use their advantageous market position to negotiate favorable terms with manufacturers and distributors of construction materials, and this will help to restrain price rises for these. (ii) Higher global prices have influenced the cost of imports of the scrap and billet used in the construction sector, while problems with a supply glut caused by over production in China are now clearing. (iii) Recovery in the construction sector will support stronger demand for building materials, especially for cement and steel. (iv) Prices will also be affected by the government’s “Made in Thailand” policy, which promotes the use of Thai-made construction materials.

Responses by construction contractors to changing market conditions

-

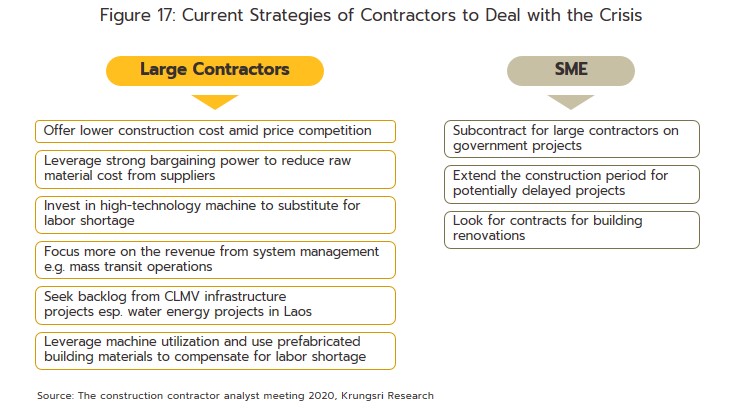

Large players will rely on their superior negotiating position relative to manufacturers and distributors of construction materials to manage the cost of inputs. They will also try to preserve their income and profits by moving into new markets, for example by managing mass transit systems, while investment will tend to be directed to high-tech machinery that reduces risks arising from labor shortages, cuts construction time, and improves the quality of finished work. This includes BIM (building information modeling) software and the use of prefabricated building components (Figure 17).

-

SMEs are mostly family-run businesses that have limited access to capital and so they negotiate with suppliers from a much weaker position. Many work as subcontractors for large players, especially on public-sector megaprojects, although some are also looking for additional sources of income from renovation and repair work.

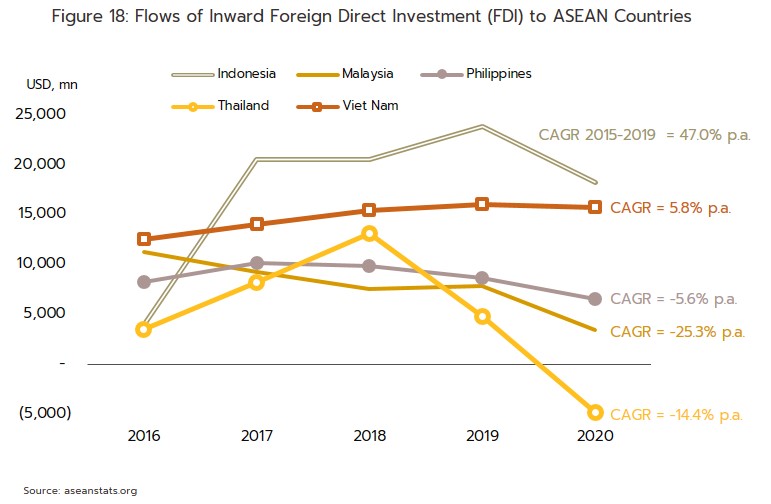

Overseas construction markets represent an additional possibility for Thai players, in particular in the CLMV countries, where investment in infrastructure has been growing in response to economic growth and continuing urbanization. The market is also growing for work on industrial, office and residential buildings, especially in Viet Nam where construction of infrastructure and industrial estates is expanding rapidly to meet strong inflows of foreign direct investment (Figure 18), most notably from China. However, these opportunities will tend to be restricted to larger players since only these have the requisite financial strength, technological know-how, and local business connections in overseas markets.

Unfortunately, the flip side of these new possibilities is that when competing for contracts in the CLMV countries, Thai contractors may encounter risks arising from employment regulations that fall short of international standards, contracts that contain conditions that elevate business uncertainty, the possibility of losses arising from political instability, and stronger competition from players from other countries. To reduce the potential impacts of these issues, it will be necessary for Thai contractors to partner with players in local supply chains, most obviously local property developers or building contractors, although to avoid the risk of labor shortages, they should also work with a local labor agency.

Major headwinds that may limit growth and income for construction contractors over 2022 to 2024 will include the following.

-

The war in Ukraine will keep the cost of both fuel and construction materials high, and contractors will need to carry these costs themselves.

-

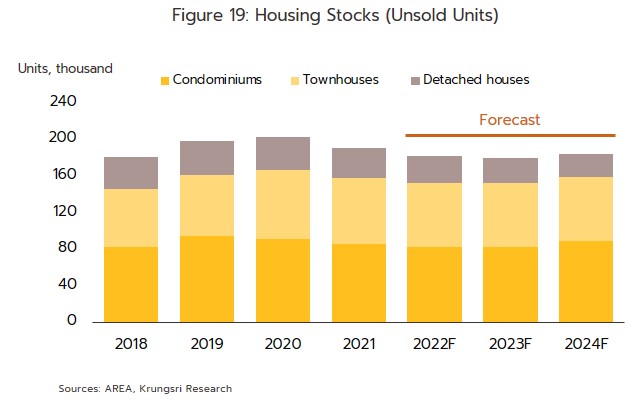

The stock of unsold properties remains high (Figure 19) but new supply continues to come to market and as a result, the value of investment in new properties will tend to be somewhat weak.

-

The COVID-19 pandemic triggered a shortage of labor and this will delay work on construction projects. The number of overseas migrant laborers working in the construction sector has yet to return to its pre-COVID-19 level, while Thai workers from upcountry have also not fully reentered construction labor markets in the Bangkok Metropolitan Region (Figure 20).

[1] The K value is an index that is used to evaluate the scale of changes in construction costs between the day on which tenders are submitted and the period when a stage of work is completed, and then to calculate the corresponding additions or reductions to payments to contractors. The K value thus works to lessen the impacts of changes in the cost of building materials on contractors’ payments (source: Office of Policy and Strategic Trade, Ministry of Commerce).

[2] Calculated from large operators’ costs and from the Office of the National Economic and Social Development Board (NESDC) input-output tables.

[3] Christiani & Nielsen (Thai) PLC. 2) Power Line Engineering PLC. 3) Pre-Built PLC. 4) Syntec Construction PLC. 5) Unique Engineering And Construction PLC. 6) Nawarat Patanakarn PLC. 7) Ch. Karnchang PLC. 8) Sino-thai Engineering And Construction PLC. 9) Italian-Thai Development PLC. 10) Thai Polycons PLC.